Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 21, 2022

Palm Oil Protectionism – Cooking up a storm

Introduction

The global palm oil market was dealt a blow recently following the announcement that the world's largest exporter Indonesia would ban exports on April 28th in a step to protect domestic consumption. The ban promptly ended on May 23rd but was long enough to pile more pressure on edible oil producers and consumers facing rising prices as palm oil is a key component in many foodstuffs, notably cooking oil. While this latest export ban seems to have been short lived, it represents the latest in a series of food-related disruptions affecting global food manufacturing and supply. Here we more closely examine the implications of the recent embargo using a combination of international trade tools. We explore the unique characteristics of the global supply of this commodity and the possible downstream implications of additional supply disruption for major importers.

Supply and Demand Dynamics

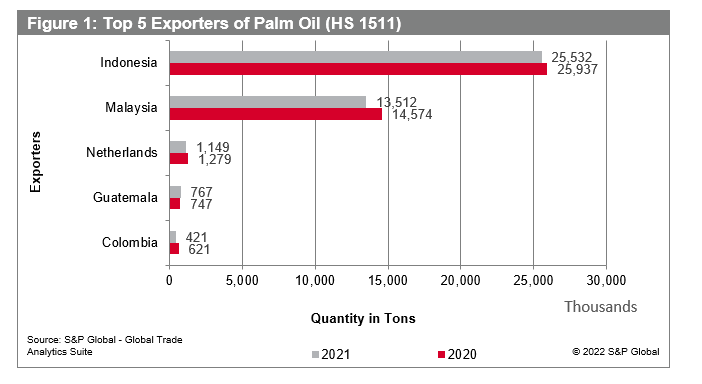

Indonesia is the world's largest producer of palm oil, accounting for 58% of global export volume as recorded by S&P Global's Global Trade Analytics Suite (GTAS) for HS Code 1511, Palm oil and its fractions, in 2021 (see figure 1). This output is a position and percentage share Indonesia has held since 2019. Whilst production levels have remained constant post Covid, the value of Indonesia's global palm oil exports has risen markedly year on year, from $17.3B in 2020 to $26.7B in 2021

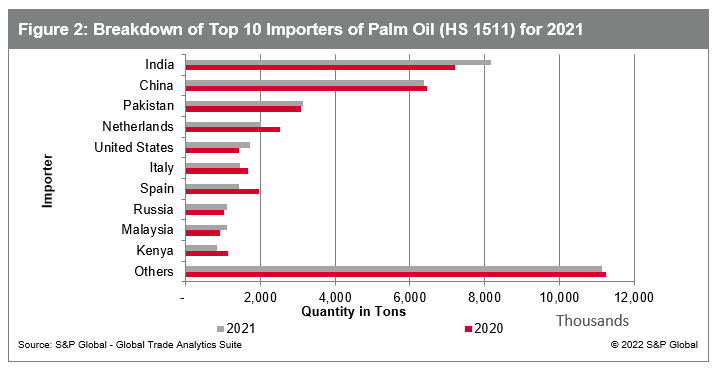

GTAS statistical data provides clear evidence that Indonesia's palm oil exports are critical for global supply. Considering major importers of Palm Oil (see figure 2), Indonesian supply alone accounted for approximately 88% of all Pakistan palm oil demand in 2021, 74% of mainland China imports and 42% of Indian imports.

Global Impact

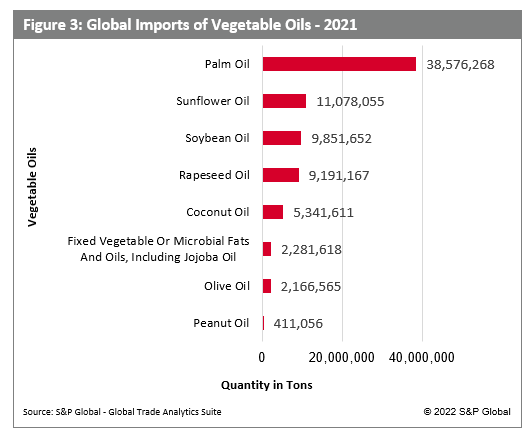

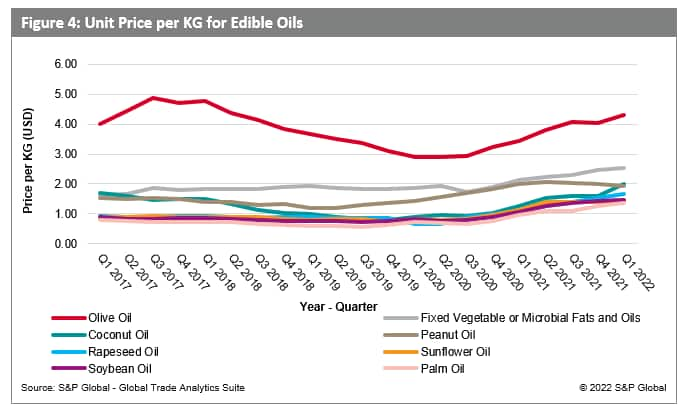

The importance of palm oil across the edible oil market is significant. As figure 3 shows, palm oil volumes accounted for 56% of global edible oil imports by metric tonnage in 2021, and it remains one of the most affordable edible oil types (see figure 4). The reliance on and demand for palm oil has been growing post Covid and will likely continue to grow against a backdrop of events impacting the supply of other edible oils.

Considering soybean oil and rapeseed oil production, droughts in key producing countries like Argentina and Brazil have had analysts slashing output forecasts. GTAS data shows Argentinian exports were at 693k tons in Q1 2022, roughly half the 1.2m tons recorded in Q1 2021, bearing out concerns that 2021/22 could be the lowest harvest for three years.

It has been well documented that the ongoing war in Ukraine has hit sunflower oil production and exports particularly hard as Ukraine and Russia account for 60% of global production. Sunflower oil prices had remained relatively flat in 2H of 2021 but since the Russian invasion prices have risen sharply. GTAS unit price data shows an increase of 7% in March 2022 vs 3% in January 2022. While Ukrainian sunflower oil exports haven't come to a complete stop since the war began, the degree to which Ukrainian oil can be consistently harvested and exported remains to be seen.

Assessing these factors, it is no surprise that unit prices of all edible oils have been rising steadily globally and that this is starting to impact consumer prices and food preparation industries. In 2021, palm oil unit prices per kilogram were already rising YoY by 55% and soybean oil by 60% according to unit price data provided by GTAS.

Even prior to the Indonesia ban, the tightening of the edible oil supply had already prompted retailers in the UK to ration cooking oil for consumers.

India - Impact, Prices and Diversification

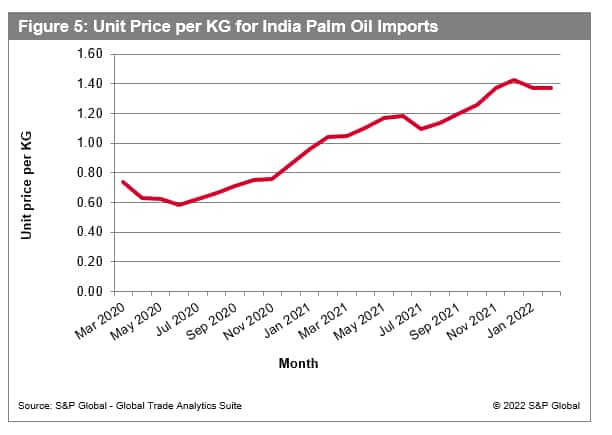

As seen in figure 2, India is the world's largest importer of Palm Oil and the 2nd largest importer of Indonesian palm oil. Also the largest importer of Argentinian soybean oil, India is the fourth largest edible oils market globally after Brazil, US, and mainland China. According to India's Department of Food & Public Distribution, as much as 56% of India's domestic demand for edible oils are met through imports, of which 54% are palm oil imports (source: India Department of Food & Public Distribution). Since the Covid outbreak in March 2020, rising prices of edible oils have already impacted India considerably, with palm oil prices into India having risen as much as 64% as shown in Figure 5.

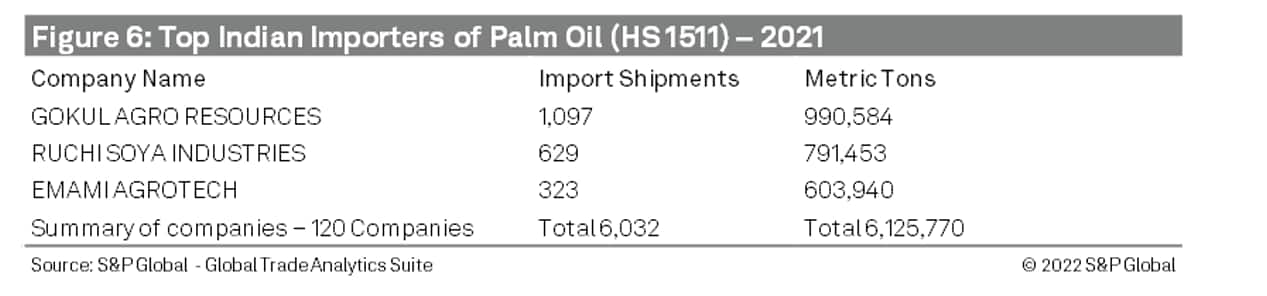

This has impacted domestic manufacturers and suppliers of foodstuffs, the effects of which are hitting consumers, particularly low-income families, relying on palm oil as an affordable cooking oil. In 2021, GTAS bill of lading data identified 120 domestic companies in India importing a total of 6,032 shipments of palm oil from Indonesia. Investigating the top 3 companies showed they accounted for 33% of all Indian imports (metric tons) as shown below in Figure 6. A review of these businesses indicates palm oil is used/distributed as cooking oil and specialty fats for foodstuffs.

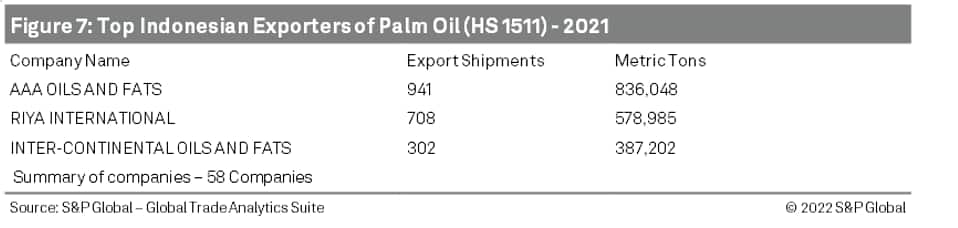

In 2020, Indonesian palm oil exports to India were valued at approximately $2.98B, rising markedly to $3.28B, a 9.93% increase year on year. In 2021, GTAS bill of lading data recorded 58 exporting companies linked to 6,032 shipments and over 6m tons. Between January 1,2022 and the start of the ban on April 28, bill of lading data identified 38 Indonesian exporting companies linked to approximately 890k tons with an approximate value of $750M

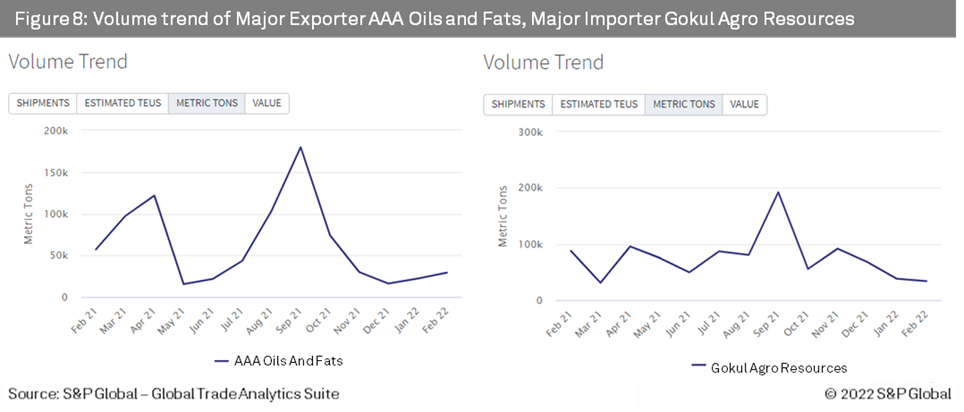

India's businesses have been grappling with rising prices since 2020 and new supply shortages resulting from the temporary ban have only exacerbated the issue. Considering the volume trends of both metric tons and shipments for India's largest producers of edible and non-edible oils, and Indonesia's leading global edible oils processors respectively, had the ban not been so quickly reversed, the effects may have been far greater for any embargoes affecting flows during the peak season in September. It is unlikely that Malaysia or other producing nations would have been able to cover such a major shortfall.

Now that the ban has ended, Indonesian producers and the transportation industry are no doubt reviewing the effects for them and their trade partners with a degree of concern. Even before the temporary ban, the Indian government had already been actively taking steps to reduce its reliance on palm oil imports against the backdrop of rising prices. In November 2021, it announced the establishment of the National Mission on Oilseeds and Palm Oil, an initiative specifically aimed at increasing domestic crude palm oil production with the aim to reduce the import burden.

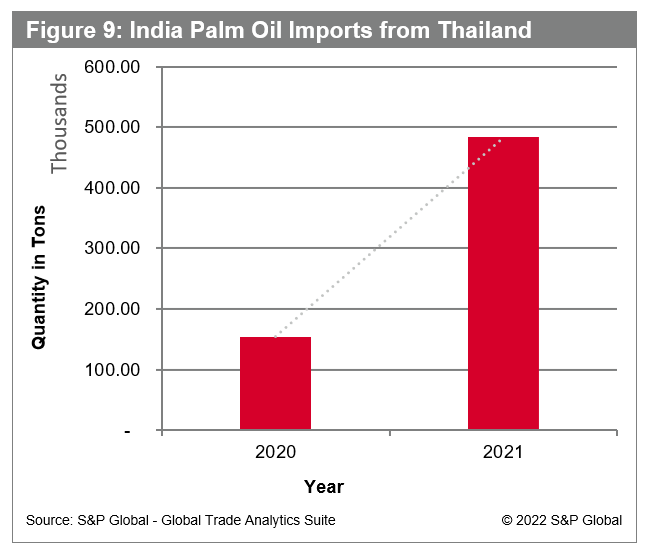

Furthermore, the Indian government had also started diversifying its sources, notably with a significant increase in palm oil trade with Thailand as GTAS data affirms in 2021:

With the demand for edible oils growing and prices rising, it seems likely that Indonesia's recent actions will only continue to influence India's domestic policy and diversification efforts, and perhaps cause others to follow.

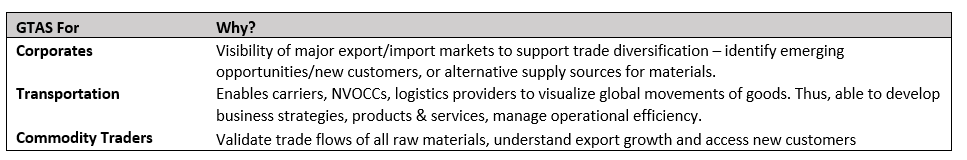

Track the edible oils story as it evolves with GTAS

GTAS data enables governments to understand markets, monitor trade flows, formulate policies and track trends. We help users manage business development, risk and supply chain resilience.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpalm-oil-protectionism-cooking-up-a-storm.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpalm-oil-protectionism-cooking-up-a-storm.html&text=Palm+Oil+Protectionism+%e2%80%93+Cooking+up+a+storm+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpalm-oil-protectionism-cooking-up-a-storm.html","enabled":true},{"name":"email","url":"?subject=Palm Oil Protectionism – Cooking up a storm | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpalm-oil-protectionism-cooking-up-a-storm.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Palm+Oil+Protectionism+%e2%80%93+Cooking+up+a+storm+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpalm-oil-protectionism-cooking-up-a-storm.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}