Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 27, 2022

Outlier momentum events in down markets

Research Signals - October 2022

Since the US stock market peak in late 2021, investors have been searching for the market bottom, with many fits and starts along the way. Likewise, from a factor style perspective, while Valuation has been the winning strategy during the current market downturn, Price Momentum has benefited from occasional bursts of investor enthusiasm, including in recent months. However, does the overall direction of the market affect how high momentum stocks come out of the initial bounce? With this question in mind, we perform an event study of price momentum factor performance during prior periods of downward trending markets.

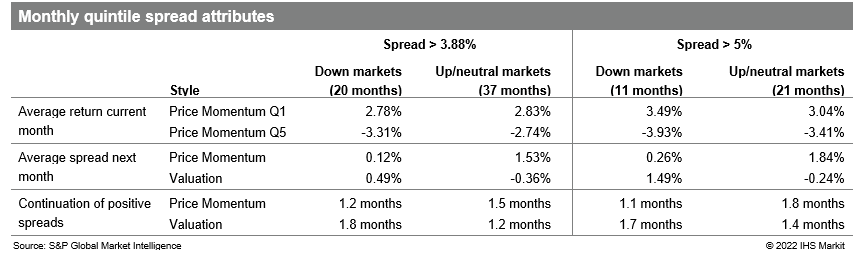

- The Price Momentum style has been a positive signal throughout our factor history, with an average monthly quintile spread of 0.62% and standard deviation of 3.26%

- When Price Momentum performance exceeded the one standard deviation band around the mean, positive spreads carried over to the subsequent month on average well above the level in up/neutral markets (1.53%) compared with down markets (0.12%), with a slightly wider difference (1.84% and 0.26%, respectively) when spreads topped 5%

- The reverse was seen with performance of the Valuation style, with negative average spreads (-0.36%) in the months following spikes in Price Momentum during up/neutral markets, compared with positive spreads (0.49%) on average during down markets

Table 1

IHS Markit provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foutlier-momentum-events-in-down-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foutlier-momentum-events-in-down-markets.html&text=Outlier+momentum+events+in+down+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foutlier-momentum-events-in-down-markets.html","enabled":true},{"name":"email","url":"?subject=Outlier momentum events in down markets | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foutlier-momentum-events-in-down-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Outlier+momentum+events+in+down+markets+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foutlier-momentum-events-in-down-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}