Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 25, 2021

New global trade forecast by IHS Markit GTA Forecasting

Positive outlook for 2021 and stronger revival already in Q4 of 2020 for East Asia & Europe, uncertainty still high.

Main Observations

- The incorporation of the most recent historical data for the third and fourth quarter of 2020 has significantly affected our estimates of trade decline in 2020 and forecasts for 2021-2022. The recovery started much faster in China and East and Southeast Asia and proved to be stronger than expected. The last quarter of 2020 proved to be positive for the EU as well

- We predict a year-on-year increase in the real value of global trade of 6.5% in 2021 and 4.3% in 2022. This accommodates the forecasted recovery in global GDP in 2021 and a particularly strong growth impulse expected in Q2 2021

- The predicted CAGR for the period 2021-2030 is now estimated at 3.2%

- We estimate a contraction of global trade in 2020 to 13.7 billion metric tons in 2020 or by -5.4% year-on-year

- We predict the volume of global trade to reach 14.5 billion metric tons in 2021 and 15 billion metric tons in 2022

- We estimate a shallower contraction in the global trade volume of -5.4% in 2020 in comparison to -9.5% by the World Bank, -9.2% by the WTO, and -8.0% by IMF

- As to the growth in 2021, we forecast it now at 6.0% (and +3.7% in 2022). WTO forecasts it at 7.2%. IMF decreased its forecasts from +8.3% to +6.0% while the baseline scenario of the World Bank predicts it at +5.1% (+5.1% in 2022)

- Our forecasts for 2021 are close to the most recent predictions of the IMF, a bit more optimistic than the predictions of the World Bank in its baseline scenario & below of the predictions of the WTO

The new release of the GTA Forecasting model accommodates the most recent macroeconomic forecasts from the IHS Markit Global Link Model, the actual historical data for the first three quarters of 2020 from the Global Trade Atlas (GTA) for all monthly reporting states, and updated COVID-response factors.

The estimated contraction in 2020

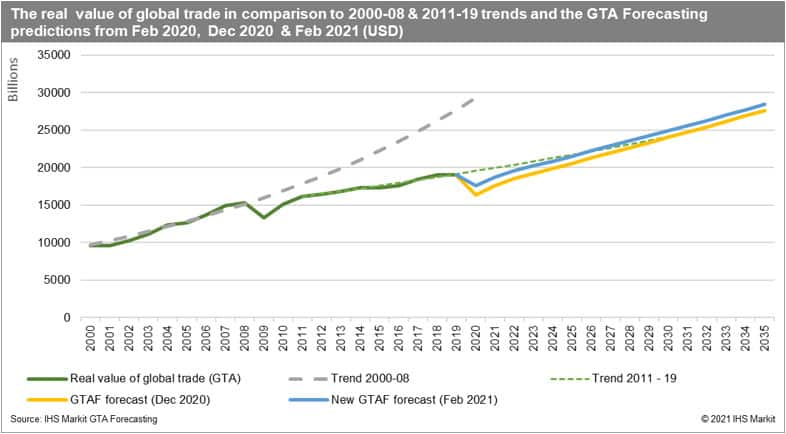

The GTA Forecasting model estimates a contraction in the real value of global merchandise trade in 2020 to USD 17,647 billion or -7.6% year-on-year (yoy) (it represents a significant upward adjustment from the December 2020 release of the model which estimated it at USD 16,382 billion or -13.5% year-on-year).

The now estimated contraction in global trade in 2020 is close to the results reported by the OECD and IMF and now significantly better than the estimated "optimistic scenario" of the WTO from April 2020.

The adjustment is mostly due to better than the priorly expected revival of economic activity in Q3 and Q4 of 2020 with the significant upward adjustment of quarterly real GDP estimates in the GLM model for 2020.

The shallower than initially expected contraction in trade is supported by the incoming data reported by monthly reporting states.

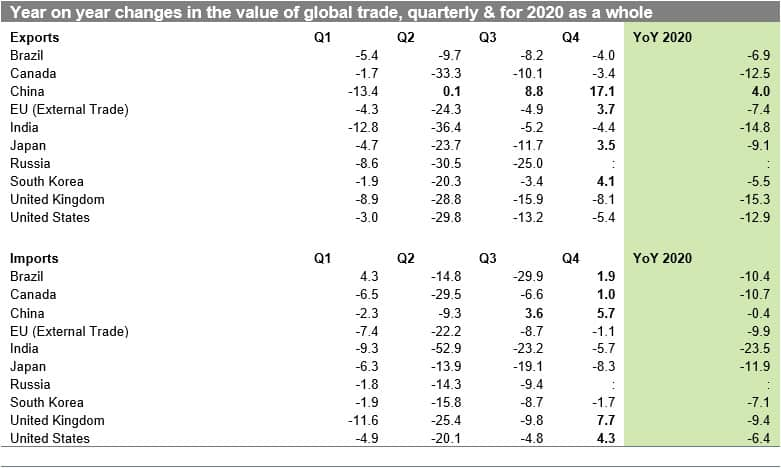

Among the top ten economies of the world, responsible for three quarters of global trade value, only Chinese exports have increased in 2020 by 4% year-on-year - the contraction was present only in Q1 (-13.4% yoy) followed by a steady recovery - +0.1% in Q2, +8.8% in Q3, and +17.1% in Q4. All other top ten economies suffered a contraction in exports in 2020 which varied from -5.4% for South Korea, -6.9% for Brazil, -7.4% for the EU, -9.1% in Japan, -12.5% in Canada, -12.9% in the case of the U.S., - 14.8% for India & -15.3% for the UK. Q2 2020 was the worst quarter for global trade on record.

It is worth noting that exports were growing in value in the last quarter of 2020 for both Japan (+3.5%), South Korea (+4.2%), China (+17.1%), and the European Union (+3.7%). The upturn in exports is also clear from the incoming 2021 data for Brazil, Canada, China (+60.2% yoy in February 2021), Japan & South Korea. India showed an increase in exports of 0.2% yoy in December and EU both in November (+5.5%) and December (+11.4%). Two out of the top ten stand out that's the U.S. (-1.1% yoy in January 2021) and the UK (-25.4% in January 2021).

At the same time, in most of the top ten economies the contraction in imports in 2020 (apart from the U.S. and Canada), was deeper than the contraction in exports; all the economies that have already reported the full data for 2020, suffered a decline in 2020 ranging from -0.4% yoy for China, -6.4% in the U.S., -7.1% in South Korea, -9.4% in the UK, -9.9% in the EU, -10.4% in Brazil, -10.7% in Canada, -11.9% in Japan to a massive decrease of -23.5% in India.

All top ten economies reported contraction in imports in Q1 and Q2 of 2020 with the second quarter once again the worst on record; in Q3 imports were growing only in the case of China; in Q4 2020 imports were above of 2019 level in a much larger number of states: China (+5.7%), the U.S. (+4.3%), the UK (+7.7%), Brazil (+1.9%) and Canada (+0.8%).

Source: IHS Markit Global Trade Atlas

Predictions for 2021-2035

We predict a year-on-year increase in the real value of global trade of 6.5% in 2021 and 4.3% in 2022 (we priorly forecasted 7.6% in 2021 and 5.2% in 2022). This accommodates the forecasted recovery in global GDP in 2021 and a particularly strong growth impulse expected in Q2 2021.

The predicted CAGR for the period 2021-2030 is now estimated to be 3.2% (in comparison to 3.5% in the last release).

We thus predict a smaller than priorly forecasted contraction in trade in 2020 thus less sharp recovery in 2021 and a lower overall growth rate of trade value in the mid to long-run. Nonetheless, the value of trade is going to reach the pre-COVID-19 level already in 2022 and to reach the levels set by the pre-COVID-19 (2011-19) trend around 2025/2026.

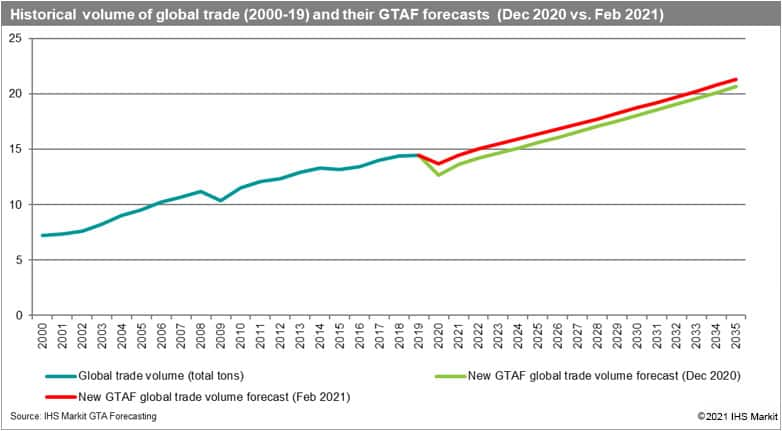

In terms of volumes, we estimate a contraction of global trade in 2020 to 13.7 billion metric tons in 2020 or by -5.4% year-on-year (priorly we forecasted contraction to 12.7 billion metric tons or by 11.2% year-on-year).

According to the latest release of our forecasting model, we predict the volume of global trade to reach 14.5 billion metric tons in 2021 and 15 billion metric tons in 2022. We thus predict growth rates of 6.0% in 2021 and 3.7% in 2022 (a downward correction from the priorly predicted 7.5% in 2021 and 4.1% in 2022).

This will allow the global economy and in particular transport, community to regain momentum and to recoup some of the losses from the trade collapse of 2020. Global trade volume should already reach the pre-COVID-19 level in 2021 (one year faster on prior prediction). At the same time, the forecasted CAGR for global trade volume is now predicted to reach 2.9% over the period 2021-30 (it was forecasted to reach 3.2% in the last release).

CAGR for global trade volume averaged 3.6% in the period 2000-19 and an impressive 5.6% in the period 2000-2008 preceding the global financial crisis. In the period 2011-2019 (post-financial-crisis, pre-COVID-19) it stood at 2.1%.

The last two quarters of 2020 were better than expected (at least for the most important monthly reporting states) and thus we have to verify our prior statements.

The estimated contraction in global trade volume in 2020 (-5.4%) is significant but lower than the contraction observed in the global financial crisis of 2008-09 (-7.7%).

The forecasted average growth rate for the period 2021-2030 is nonetheless above the average for the period 2011-2019 but significantly below the growth path of global trade volume preceding the global financial crisis.

A less severe downturn in 2020 as well as the speed of estimated recovery can be strong enough to bring trade close to its pre-pandemic trend (2011-2019) already around 2023 (and not 2029).

Summary and comparison to forecasts by other organisations

The incorporation of the most recent historical data for the third and fourth quarter of 2020 has significantly affected our estimates of trade decline in 2020 and forecasts for 2021-2022. The recovery started much faster in China and East and Southeast Asia in particular, and proved to be stronger than expected. The last quarter of 2020 proved to be positive for the EU as well.

The new release of the GTA Forecasting model shows that the contraction in 2020 from an annual perspective was shallower than we predicted in the last three releases (nonetheless Q2 2020 still was the worst quarter for global trade on record). As of now, in comparison to other projections, we estimate a shallower contraction in the global trade volume in merchandise trade of -5.4% in 2020 in comparison to -9.5% by the World Bank, -9.2% by the WTO, and -8.0% by IMF.

As to the growth in 2021, we forecast it now at 6.0% (and +3.7 in 2022). WTO forecasts it at 7.2%. IMF decreased its forecasts from +8.3% to +6.0% while the baseline scenario of the World Bank predicts it at +5.1% (+5.1% in 2022).

Thus, our forecasts for 2021 are in line with the most recent predictions of the IMF, a bit more optimistic than the predictions of the World Bank in its baseline scenario and below the predictions of the WTO.

The four scenarios of the World Bank presented in the Global Economic Prospects 2021 Report indicate that the evolution of the global economic system both in 2021 and onwards is still uncertain. Therefore, for obvious reasons (significant unpredictability of the pandemic and the questions about the efficiency of mass vaccination programs both in advanced, emerging and developing states) the forecasts should be treated with a large degree of caution.

This column is based on data from IHS Markit Maritime & Trade Global Trade Atlas (GTA) & GTA Forecasting.

The full version of this article is available on the Connect platform for IHS Markit clients with a subscription to GTA/GTA Forecasting.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-global-trade-forecast-by-ihs-markit-gta-forecasting.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-global-trade-forecast-by-ihs-markit-gta-forecasting.html&text=New+global+trade+forecast+by+S%26P+Global+GTA+Forecasting+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-global-trade-forecast-by-ihs-markit-gta-forecasting.html","enabled":true},{"name":"email","url":"?subject=New global trade forecast by S&P Global GTA Forecasting | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-global-trade-forecast-by-ihs-markit-gta-forecasting.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+global+trade+forecast+by+S%26P+Global+GTA+Forecasting+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-global-trade-forecast-by-ihs-markit-gta-forecasting.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}