Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 13, 2021

Municipal Calendar Week of 09/13/2021

Calendar Week of 09/13/2021

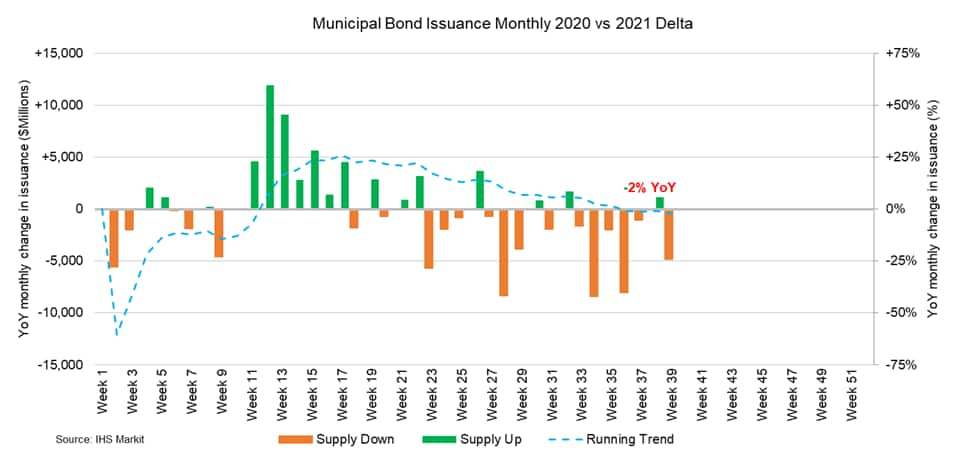

Primary market activity is slated to pick up steam this week pending volume returning to double digit levels as investors navigate evolving economic conditions paired with persistent demand for new issue paper. Muni benchmarks displayed mixed performance over the course of last week with a 1bp cut in the short and long end of curve following last Friday's producer price index report which posted .7% for the month of August, highlighting extended inflationary pressures realized across the nation. Lingering inflation has been a major focal point on behalf of market participants as underlying supply chain bottlenecks, lackluster labor improvements and fluctuating COVID cases appear to hinder accelerated economic growth. While the FOMC remains confident in the transitory nature of current inflation levels, participants continue to holistically analyze evolving economic indicators as the market prepares for the expected tapering of central bank asset repurchases. Fluctuations in economic cycles have played a major factor behind state and local governments financing objectives, as issuers remain highly focused on reducing debt service expenditures while issuing new money bonds to finance a host of development activities. Despite the current uptick in macro market volatility, demand for muni bond paper continues to remain robust as various institutional accounts seek to deploy cash across safe haven fixed income investments posting a historical track record of nominal default rates. Persistent demand from investors has resulted in sustained muni mutual fund inflows which have remained positive for over six months as money managers seek greater investment returns. Portfolio managers have directed focus towards longer dated maturities as well as sub-investment grade credits, catering to funds seeking a greater risk tolerance and corresponding larger beta. As the fall season swiftly approaches, new issue activity is forecasted to expand throughout the remainder of the year as issuers address financing needs while taking advantage of opportunistic borrowing levels, boosting supply figures across the muni arena with MTD % levels forecasted to climb for the remainder of the month.

New issue activity is set to return above the 2021 weekly average level of ($9.2Bn) after last week's holiday-shortened calendar resulted in subdued issuance given the $7.8Bn priced and the majority of volume supported by several $500mm+ deals across California, Virginia and Texas. The California Community Choice Financing Authority led last week's negotiated calendar supplying a combined $1.2Bn of clean energy project revenue bonds with a corresponding green ESG status. Demand for the green bond offering was pronounced after the 2021B-1 series witnessed heavy investor demand resulting in bumps across the scale of 5-10bps, with the greatest tightening registered in the intermediate range. The City of Grand Forks, ND also faced robust order flow with proceeds designated towards the Altru Health System with bumps of 8-17bps across all maturities, effectively driving down the finalized true interest cost to the issuer. This week's calendar is primed to offer $12.5Bn spanning across 257 new issues with a strong presence of California paper representing $3.3Bn or 26% of the total weekly calendar. The State of California (Aa2/AA-/AA) will lead this week's negotiated calendar, supplying a hefty $2.1Bn of general obligation bonds across two series with maturities ranging 10/2022-10/2051 and the majority of ($) par size housed in 2041. The Black Belt Energy Gas District is also slated to come to market on Wednesday, supplying $805mm gas project revenue bonds within a single series, senior managed by Goldman Sachs. This week's competitive calendar will span 146 issues for a total of $2.6Bn led by the Massachusetts School Building Authority auctioning $344mm subordinated dedicated sales tax refunding bonds on Tuesday 09/14.

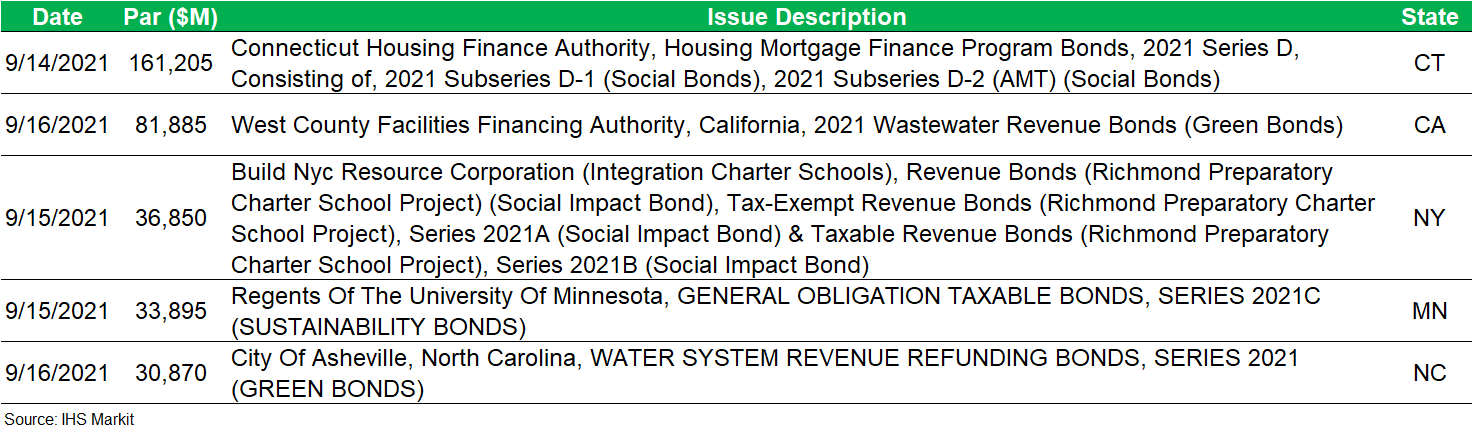

Negotiated ESG Offerings Week of 09/13/2021:

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-09132021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-09132021.html&text=Municipal+Calendar+Week+of+09%2f13%2f2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-09132021.html","enabled":true},{"name":"email","url":"?subject=Municipal Calendar Week of 09/13/2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-09132021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Municipal+Calendar+Week+of+09%2f13%2f2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-calendar-week-of-09132021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}