Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 10, 2020

LIBOR Transition: Market volatility and PAI alignment

COVID-19 and LIBOR transition plans, will there be delays?

After an eventful Q4-2019 and early Q1-2020, the pace of the LIBOR transition is challenged by the recent market turmoil. The risk-reward profile of bringing new RFR liquidity to a market in distress is less attractive and we expect dealers will refocus on critical tasks before they can resume transitioning away from LIBOR.

There have been some rumors that key deadlines could potentially be pushed but nothing has been confirmed to date. At time of writing, the upcoming PAI alignments at LCH and CME are still scheduled for June 2020 (EUR ESTR) and October 2020 (USD SOFR). The UK FCA has confirmed that the 31 December 2021 deadline for the end of mandatory LIBOR submissions still holds: "The central assumption that firms cannot rely on LIBOR being published after the end of 2021 has not changed and should remain the target date for all firms to meet." -Communication from the FCA on 25-Mar-2020.

This is not to say that there won't be delays…

Recently, a few interim milestones and key consultations have been pushed to give market participants more time to adapt and respond. The consultations from ISDA on pre-cessation triggers and from the ARRC on potential spread adjustments for cash products referencing USD LIBOR have been extended by a few weeks. The FHFA also extended the deadline for the FHLBs to cease entering LIBOR based instruments that mature beyond end of 2021 by 3 months to June 30, 2020.

However, by and large, we do not expect major LIBOR transition milestones will be pushed unless the current market situation persists longer than expected.

RFRs and market volatility, a show of strength or weakness?

The current market volatility has given SOFR and other RFRs a stress period that the industry will be able to scrutinize in order to better understand the behavior of those new benchmarks in distressed times.

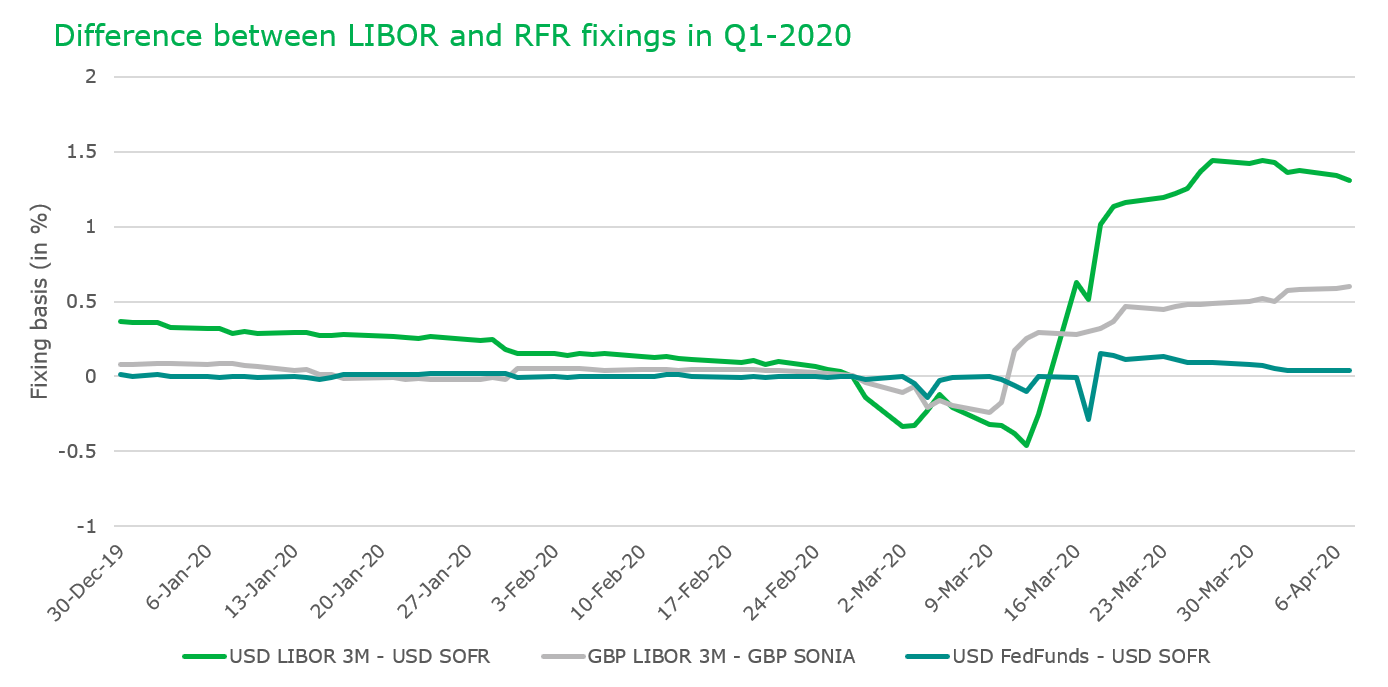

Through March 2020, LIBOR to RFR spreads have widened significantly across all major currencies. We won't go into the details of the actions that central banks took that resulted in those moves as this has already received a lot of press recently. We will however look at the evolution of the LIBOR to RFR spreads in GBP and USD and the consequences on the LIBOR transition roadmap.

Source: IHS Markit OTC Derivatives Data

As shown on the graph above, the LIBOR 3m v RFR fixing spreads in USD and GBP have significantly widened in March with RFR rates contracting - e.g. SOFR was published at 0.01% between March 24 and April 7 - and LIBOR rates expanding. This difference in behavior between RFRs and LIBORs is not coming as a surprise and has been one of the key discussion points in all LIBOR transition working groups in 2019.

In the US, it looks likely that the concept of a credit spread adjustment will again take center stage post COVID-19 as SOFR has contracted significantly and has certainly proven that it won't behave as LIBOR in a credit stressed environment. Depending on where you sit, you may see SOFR as a very appropriate replacement for LIBOR as it tracks base rate expectations accurately or on the contrary you may see SOFR as a benchmark unfit for purpose as it lacks credit sensitivity.

Similarly, ISDA derivatives fallbacks and spread adjustments are also challenged with the current market volatility. The preferred approach of a median 5-year historical window will smooth out periods of high volatility, but assuming LIBOR v. RFR spreads remain elevated through 2020, the likelihood of a wider spread adjustment at LIBOR cessation is increasing.

Ultimately, this is what it is. We are in motion and it is extremely unlikely that LIBOR will be there after 2021, and even if it is, this won't be forever. Market participants must get used to the behavior of RFRs and find ways to use those across all industry segments. Forward-looking term rates and potential credit adjustments will also facilitate the transition for the remainder of the industry that is currently stuck with LIBOR.

LCH ESTR PAI switch, value transfer and the challenge with EUR swaptions

The current market volatility should not distract us too much as an important transition deadline is looming on the horizon. On June 22, 2020, LCH intends to switch PAI from EONIA to ESTR for all cleared EUR interest rate swaps. Although this is expected to be less disruptive than the SOFR PAI switch on October 17, 2020 (a.k.a. "The Big Bang"), it will nonetheless require careful review from all market participants involved in those transactions. In this context, it is worth noting that the EONIA curve is linked to the ESTR curve via a 8.5bps spread applied equally to all tenors. This simple relationship should facilitate the calculation of compensations required for the PAI switch at LCH and minimize unforeseen value transfer.

There is however some uncertainty with EUR swaptions physically settled into a cleared swap as those are not part of the prescribed compensation mechanism although they will undoubtedly be impacted by the PAI switch. ISDA recently consulted the industry and published Supplement 64 to the ISDA 2006 Definitions which addresses this issue and how market participants should handle CCP discounting changes on swaptions.

Many have questioned the timing of the LCH ESTR PAI switch given current market conditions. At time of writing, LCH have communicated that they still intend to go ahead with the switch on June 22, 2020. Although things could change, we believe this date will be confirmed as many market participants have been trading EUR swaptions with the underlying assumption that the switch would happen in June 2020. If this was to be delayed, many will be very annoyed, and this could greatly jeopardize the LIBOR transition plans at the CCPs.

Is 2020 still going to be the year of RFRs?

Is it still possible that 2020 will see a large uptick in RFR trading? It is too early to say really…

Assuming the markets can resume working semi-normally in the next few months and market volatility reduces, we should still see a significant increase in RFR-linked trading activity. Some industry segments still have a long way to go with the implementation of strong fallbacks and a clear set of definitions before new liquidity can come (e.g. loans, FRNs) but compared to early 2019, the industry overcame many hurdles.

Just a couple of months ago we saw the first USD SOFR swaptions traded in the US, the SONIA FRN market was growing steadily and there was not a day without a new development in the LIBOR transition space. COVID-19 will surely push some interim deadlines, but this should not completely prevent the industry from moving away from LIBOR and embrace RFRs. If we collectively find a way to rebuild the economy post COVID-19, we should surely be able to figure out how to use RFRs and eventually move away from LIBOR, right?

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flibor-transition-market-volatility-and-pai-alignment.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flibor-transition-market-volatility-and-pai-alignment.html&text=LIBOR+Transition%3a+Market+volatility+and+PAI+alignment+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flibor-transition-market-volatility-and-pai-alignment.html","enabled":true},{"name":"email","url":"?subject=LIBOR Transition: Market volatility and PAI alignment | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flibor-transition-market-volatility-and-pai-alignment.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=LIBOR+Transition%3a+Market+volatility+and+PAI+alignment+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flibor-transition-market-volatility-and-pai-alignment.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}