Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 22, 2020

Changes in trade routes and consumption for jet fuel

Significance

The UAE, Saudi Arabia and India have dominated jet fuel flows to Europe, accounting for almost half of the volumes shipped to Europe. The seasonality patterns with Q2 and Q3 volumes supported by typically stronger demand in the continent have not been followed this year. The COVID-19 pandemic has sharply affected demand and flows in Europe.

Implications

Jet fuel demand has been severely affected once most flights in Europe were grounded since April. Meanwhile the strong imports till the end of April due to the contango in the forward curve lead to increased volumes kept on floating storage in North Western Europe and the Mediterranean, with similar increases observed onshore. The recent heavy refinery maintenance in the Middle East Gulf refineries resulted in lower jet fuel output and exports from the Middle East Gulf to Europe. Exporters turned their interest to Asia-Pacific.

Outlook

Flows of jet fuel to South East Asia have been supported by low prices, which recently allowed the fuel to be used as a blending component for shipping fuel. Jet fuel components were used for blending in April and May in Singapore and the switching is picking up again due to the recently weaker price of aviation fuel. The destruction of demand for aviation fuels might last as the globe seems to be entering a second wave of the COVID-19 pandemic.

.......................

Jet fuel trade flows has been one of the hottest topics to discuss during the last couple of months, with all eyes on how its much lower price has been shaping its three major trade routes, from the Middle East to Europe, from Asia-Pacific to the USWC, and then from the US Gulf to South America.

European refineries which have been feeling the pressure of fresh competition in emerging regions, with rationalisation of their operations left as their only option, have been typically not producing enough volumes for the continent's demand. As a result, Europe has been one of the major importers of jet fuel, with large portions of its requirements sourced from producers east of Suez. Europe imported more than 22 million tonnes of jet fuel last year, according to data by IHS Markit Commodities at Sea, with the UK, France, Netherlands and Italy having absorbed more than 68% of the total flows to the continent.

Among major suppliers of jet fuel to Europe, the UAE, Saudi Arabia, and India have dominated the market, accounting for almost half of the volumes shipped to Europe. Other producers in the Middle East together with Russia and South Korea are among major suppliers. Another interesting aspect of jet fuel flows to Europe that we need to highlight refer to the seasonality patterns typically observed, with Q2 and Q3 volumes supported by typically stronger demand in the continent. 2020 seems to have been a rather different year so far, with COVID-19 having sharply affected demand and flows in Europe.

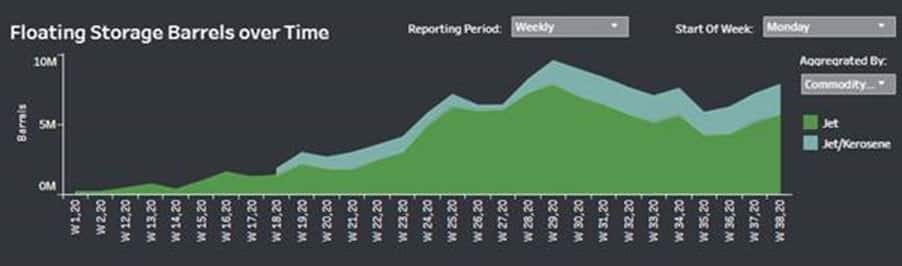

Since the pandemic started, we hadn't really observed any dramatic change compared to volumes carried during the last two year, but once most flights in Europe were grounded since April, jet fuel demand has been severely affected. Meanwhile the strong imports till the end of April due to the contango in the forward curve lead to increased volumes kept on floating storage in North Western Europe and the Mediterranean, with similar increases observed onshore. Inventories at the ARA ports reached new high levels, as demand remained weak and could simply not absorb all flows to the continent.

Jet fuel floating storage in North Western Europe and the Mediterranean

Source: IHS Markit Commodities at Sea

Focusing on suppliers of jet fuel to Europe, producers across the Middle East Gulf underwent a heavy refinery maintenance when the COVID-19 outbreak commenced, which was already scheduled for late Q1/ early Q2 2020. This has resulted in lower jet fuel output during that period. This caused jet fuel exports from the Middle East Gulf to drop. But since, several refineries of the region have returned from maintenance. These refineries started shipping much more jet fuel to Europe in May, with several barrels remaining in storage as demand weakened. This resulted in much weaker flows to Europe in July and August, with exporters turning their interest to Asia-Pacific, where prices have been much healthier.

Flows of jet fuel to South East Asia have been supported by low prices, which recently allowed the fuel to be used as a blending component for shipping fuel. This has been a rather unthinkable shift, as the strong demand from the aviation industry typically kept prices at much higher levels. Jet fuel components were used for blending in April and May in Singapore and the switching is picking up again due to the recently weaker price of aviation fuel. The destruction of demand for aviation fuels might last as the globe seems to be entering a second wave of the COVID-19 pandemic.

For more insight subscribe to our complimentary quarterly commodity analytics newsletter

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjet-fuel-changes-in-trade-routes-and-consumption.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjet-fuel-changes-in-trade-routes-and-consumption.html&text=Changes+in+trade+routes+and+consumption+for+jet+fuel+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjet-fuel-changes-in-trade-routes-and-consumption.html","enabled":true},{"name":"email","url":"?subject=Changes in trade routes and consumption for jet fuel | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjet-fuel-changes-in-trade-routes-and-consumption.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Changes+in+trade+routes+and+consumption+for+jet+fuel+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjet-fuel-changes-in-trade-routes-and-consumption.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}