Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 27, 2022

Insight Congestion in Shanghai (CJK) - Freight Signal Monitor

Port congestion in mainland China continued to remain high with extended lockdown measures

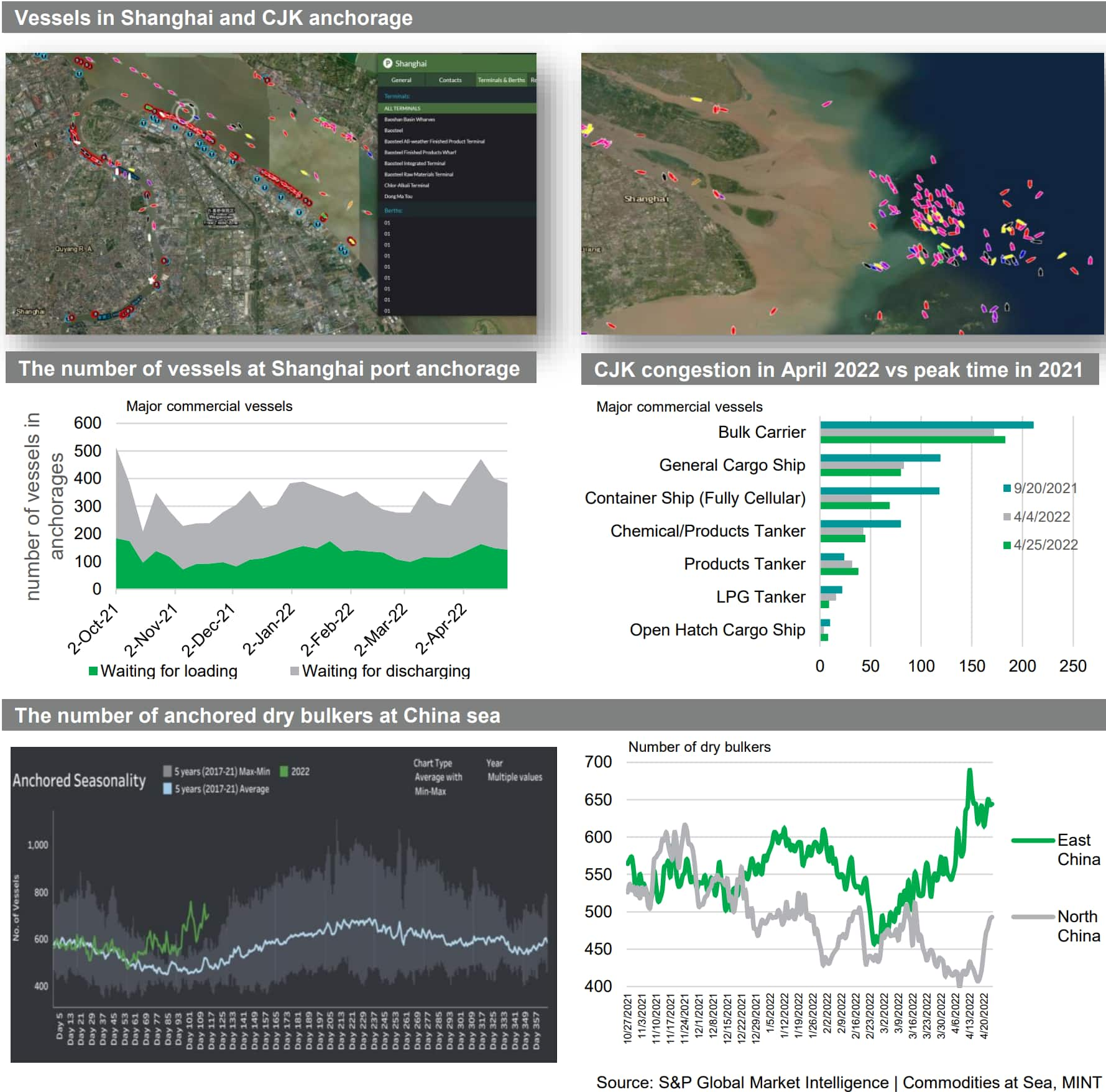

As COVID-19 lockdown measures were extended from Shanghai to more Chinese cities including parts of Beijing, port congestion rebounded in northern Chinese ports. Moreover, many vessels are trying to find alternative ports since social restrictions in major cities in east China including Shanghai are expected to continue into early May. This will likely increase congestion in southern ports as well.

According to S&P Global Commodities at Sea, total congestion levels at Shanghai's port has increased by about 30-40% since the start of March 2022, but it is still lower than the peak of last year over the third quarter. Since the manufacturing sector in mainland China has also been affected because of the lockdowns and labor shortage, Chinese import and export growth has been reduced from levels a year-ago. According to S&P Global Market intelligence AIS data, vessel capacity arrivals into Chinese ports to load or discharge cargo have decreased by 11% to about 1.15 billion deadweight in the first quarter of 2022 from about 1.28 billion deadweight from the first quarter 2021.

Since mainland China is exporting less container-related cargo with lockdown measures, freight rates for containers and small bulkers have been softening. High demand for exports in mainland China, along with tight container capacity was affecting general bulk cargo flow with de-containerized trends. Some general cargo that was typically shipped in container box including steel, aluminum, fertilizer, bagged cargo etc. have been shipped on general cargo ships and small geared bulk vessels.

Also, lesser export volume from mainland China eased congestion on discharging ports including U.S. container ports. However, once COVID-19-related lockdown is lifted in mainland China along with seasonal recovery of shipments, the impact may pose another upside risk on port congestion and the discharging ports side over the coming peak season.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finsight-congestion-in-shanghai-cjk-freight-signal-monitor.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finsight-congestion-in-shanghai-cjk-freight-signal-monitor.html&text=Insight+Congestion+in+Shanghai+(CJK)+-+Freight+Signal+Monitor+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finsight-congestion-in-shanghai-cjk-freight-signal-monitor.html","enabled":true},{"name":"email","url":"?subject=Insight Congestion in Shanghai (CJK) - Freight Signal Monitor | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finsight-congestion-in-shanghai-cjk-freight-signal-monitor.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Insight+Congestion+in+Shanghai+(CJK)+-+Freight+Signal+Monitor+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finsight-congestion-in-shanghai-cjk-freight-signal-monitor.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}