Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

COMMENTARY

Mar 24, 2020

IHS Markit predict global dividend lockdown

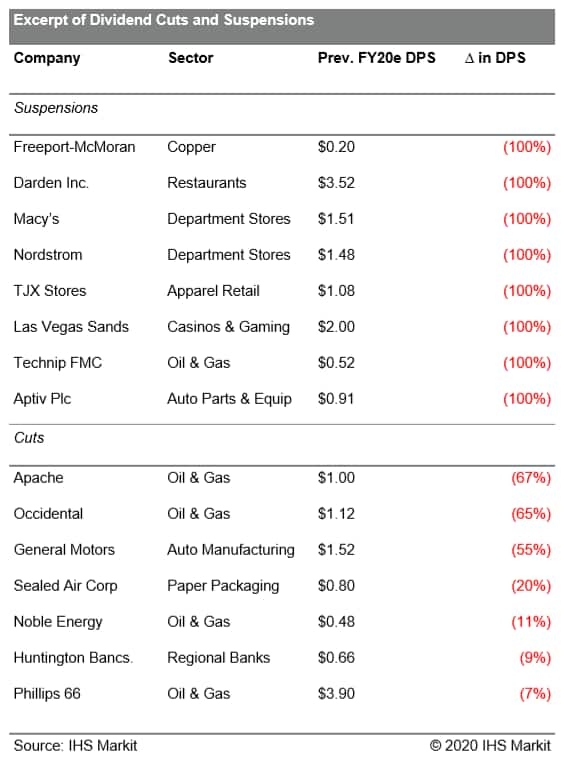

In response to the anticipated economic impact of COVID-19 we have been reducing our forecasts for dividend payouts across a wide range of sectors and markets.

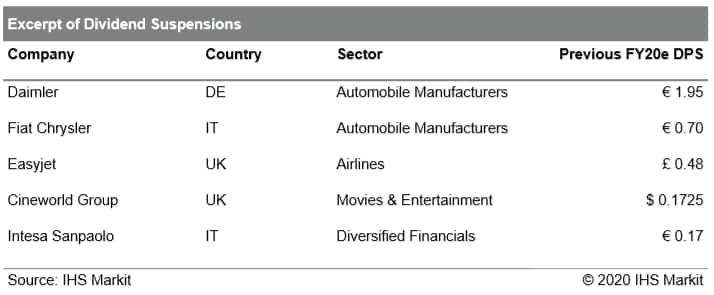

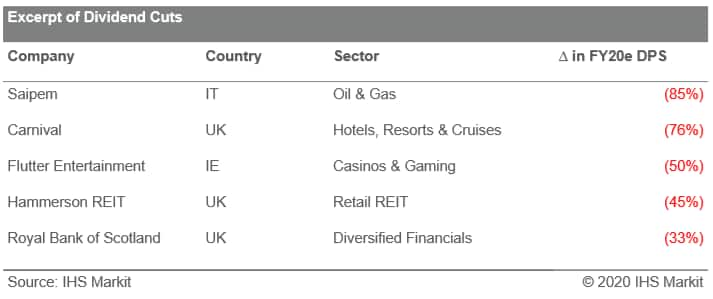

So far, we have projected dividend suspensions for 230 companies out of the biggest 1800 global payers and have lowered our FY20 estimates by more than 10% on a further 800 companies from the list.

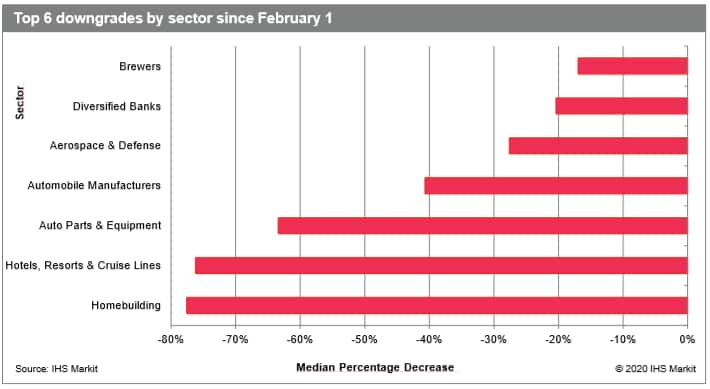

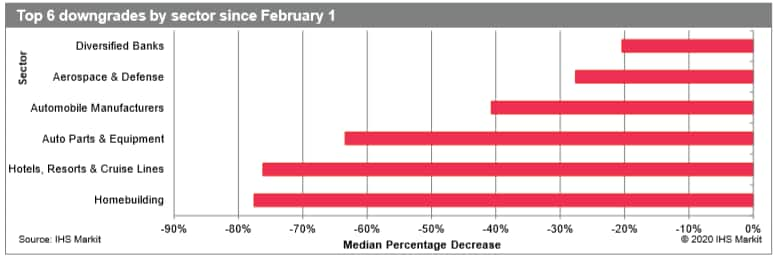

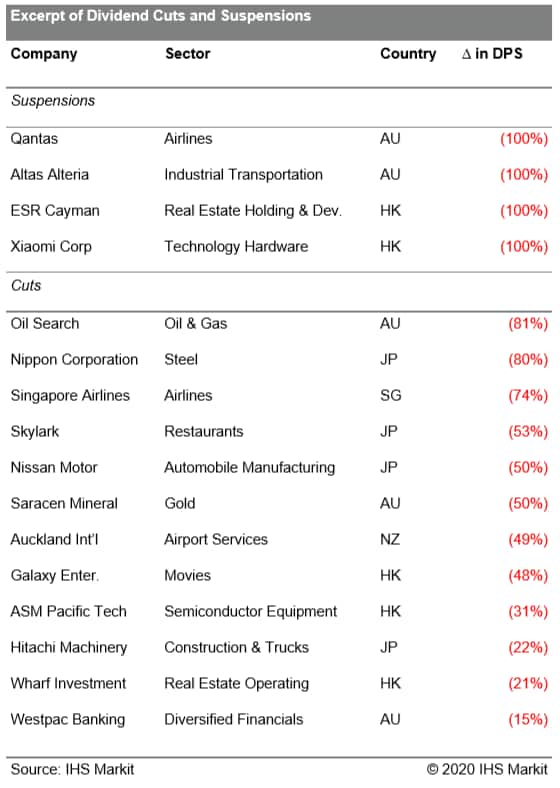

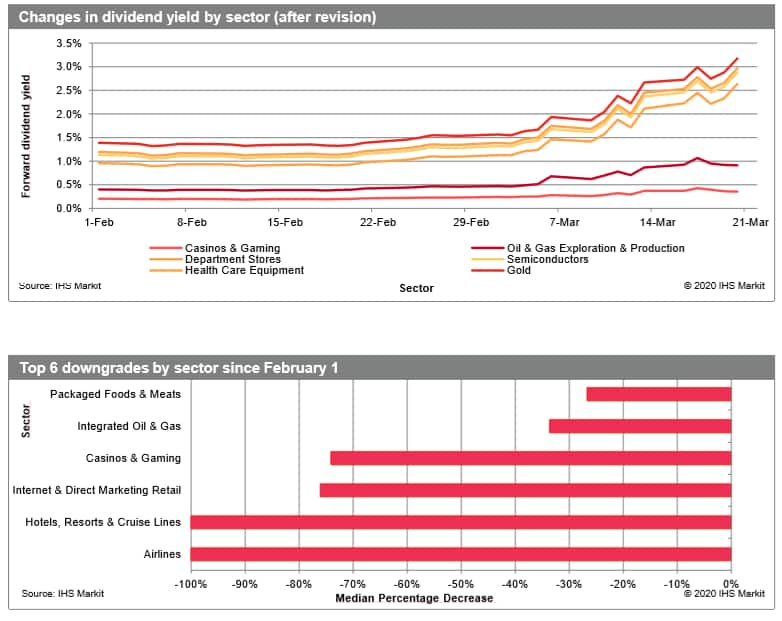

The sectors the most impacted by those downgrades are Travel & Leisure, Housebuilders, Automakers, Oil & Gas and Banks. Below we outline some notable revisions from each region.

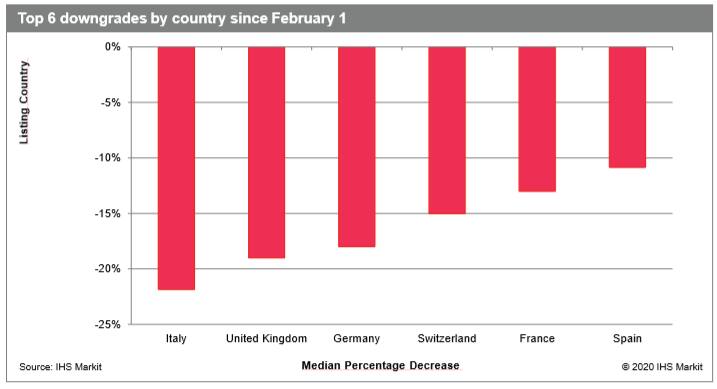

In Europe, within the Stoxx Europe 600 index, we have already downgraded our FY20 dividend estimates by over 10% for 200 companies. Within that number are 86 predicted payout suspensions.

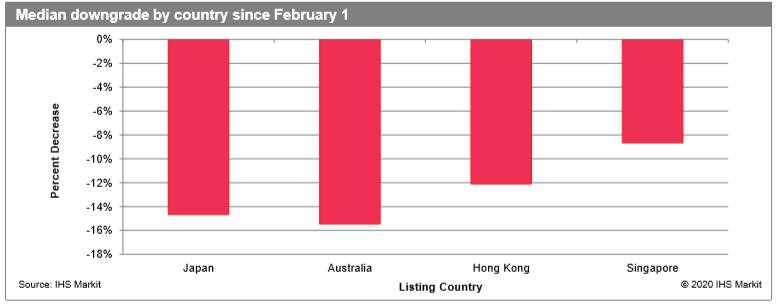

In the APAC region, within the Stoxx 600 Asia/Pacific index, we have downgraded our FY20 dividend estimates by at least 10% for 370 companies. Among them we project 125 complete suspensions.

In the US, within the S&P 500 index, we have downgraded our FY20 dividend estimates by more than 10% for 190 companies. So far we estimate 15 suspensions of dividend payments.

To find out more information, get in touch with our experts at dividendsupport@ihsmarkit.com.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-predict-global-dividend-lockdown-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-predict-global-dividend-lockdown-.html&text=S%26P+Global+predict+global+dividend+lockdown++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-predict-global-dividend-lockdown-.html","enabled":true},{"name":"email","url":"?subject=S&P Global predict global dividend lockdown | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-predict-global-dividend-lockdown-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+predict+global+dividend+lockdown++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-predict-global-dividend-lockdown-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}