Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 06, 2019

Hedging the corporate profit cycle

Research Signals - February 2019

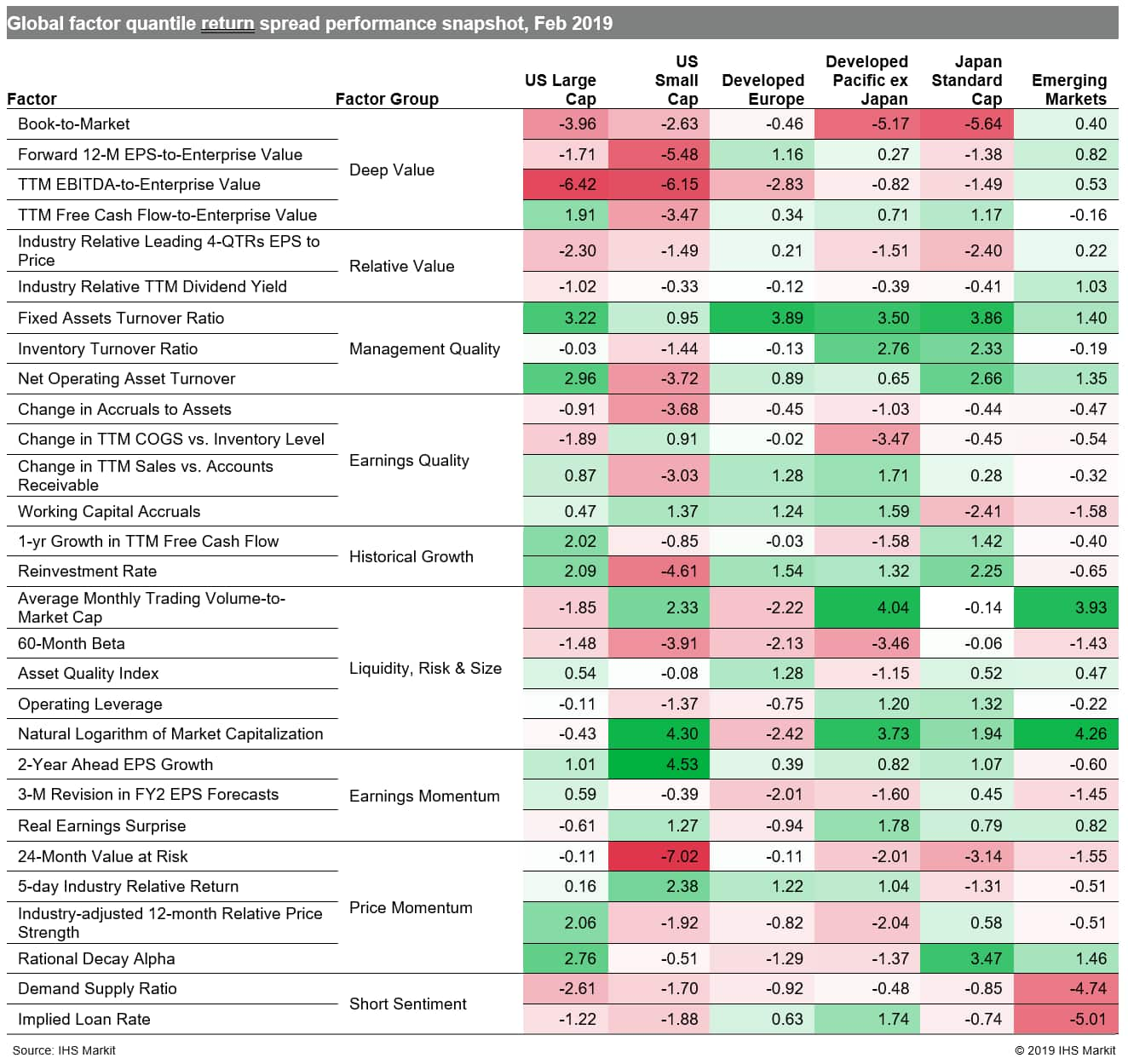

The global manufacturing sector eased to a 32-month low, according to the February J.P.Morgan Global Manufacturing PMI, with major economies including the US, the euro area and Japan all slowing. However, partially offsetting the global slowdown was China, whose Shanghai Composite moved from being the worst performer last year to the best at the start of this year. In turn, while high beta stocks initially led the market rebound off December's low, high quality took over as a much more prominent theme in February (Table 1), perhaps as investors postured for a maturing business cycle and as major markets showed signs of having already priced in optimism toward the end of February.

- US: High quality names were juxtaposed with high momentum stocks to lead large caps higher in February, as captured by factors including Net Operating Asset Turnover Ratio and Rational Decay Alpha, respectively

- Developed Europe: Strong corporate fundamentals were rewarded, with factors such as Fixed Assets Turnover Ratio and Reinvestment Rate among the top performers

- Developed Pacific: High momentum (e.g., Rational Decay Alpha) and high quality (e.g., Fixed Assets Turnover Ratio) stocks outperformed, while the Book-to-Market factor struggled in Japan

- Emerging markets: Small cap stocks gauged by Natural Logarithm of Market Capitalization led markets higher, along with undervalued names measured by Forward 12-M EPS-to-Enterprise Value

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhedging-the-corporate-profit-cycle.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhedging-the-corporate-profit-cycle.html&text=Hedging+the+corporate+profit+cycle++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhedging-the-corporate-profit-cycle.html","enabled":true},{"name":"email","url":"?subject=Hedging the corporate profit cycle | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhedging-the-corporate-profit-cycle.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Hedging+the+corporate+profit+cycle++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhedging-the-corporate-profit-cycle.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}