Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 08, 2021

Dredging industry builds smaller vessels

The COVID-19 pandemic presents challenges also to the dredging and marine civil engineering industry, with uncertainty over new contracts for big capital projects and thus, the need for powerful and large vessels.

This is reflected in the types and number of orders made in 2020. Five vessels have been ordered - all trailing suction hopper dredgers (TSHD) - signalling a decrease in orders for 2020 compared to previous years, according to the newly published International Dredging Directory (IDD), available for download here.

Current orders

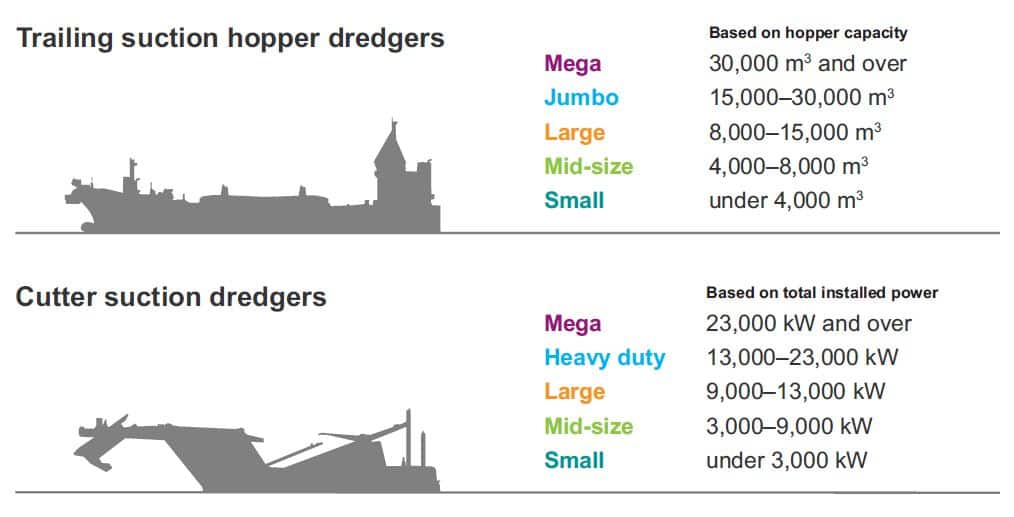

In terms of size, the TSHDs range from small to mid-sized vessels based on IDD-criteria, which means no vessel was ordered with a hopper capacity over 8,000m3.

Taking additional orders from before 2020 into account, 30 dredgers with IMO numbers are under construction in total, which includes statuses on order, keel laid, and launched. Of those, 21 are TSHDs, seven cutter suction dredgers (CSD), and two water injection dredgers. Only one of those TSHDs has a hopper capacity over 15,000m3, again confirming the trend that fewer large vessels will enter the fleet in upcoming years.

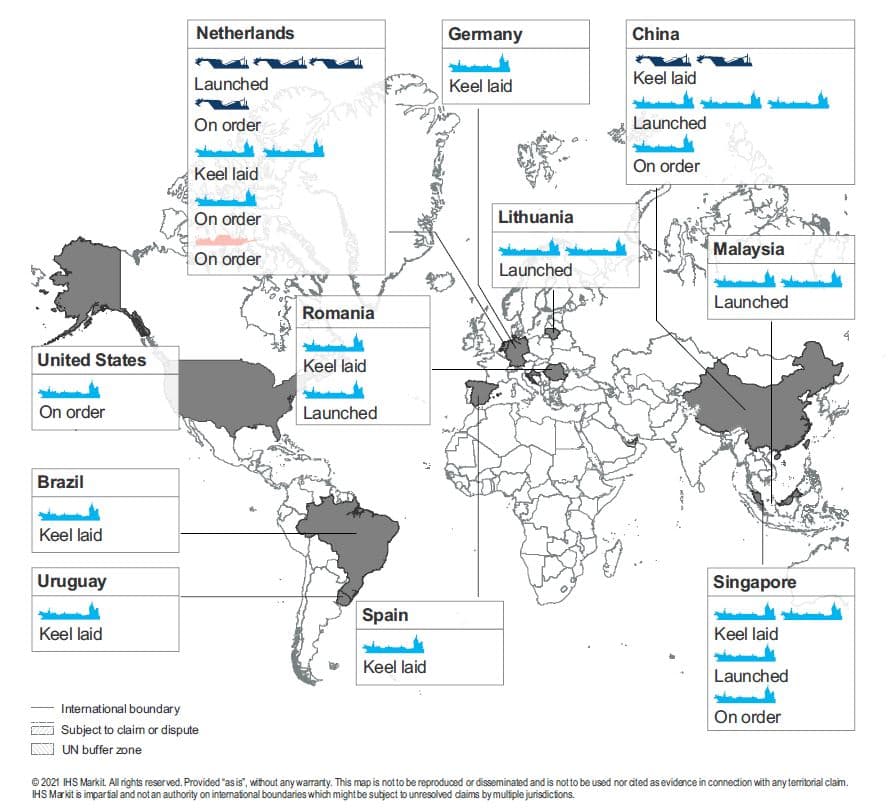

As we've seen in previous years, there is again a race underway between the Netherlands and China in terms of securing contracts to build vessels. Currently, nine vessels are under construction in the Netherlands and eight in China.

Other popular ship building countries such as Romania, Lithuania, and Singapore also currently work on several newbuilds. In each Brazil, Germany, Spain, US, Croatia, and Uruguay, one vessel is under construction.

2021 deliveries and outlook

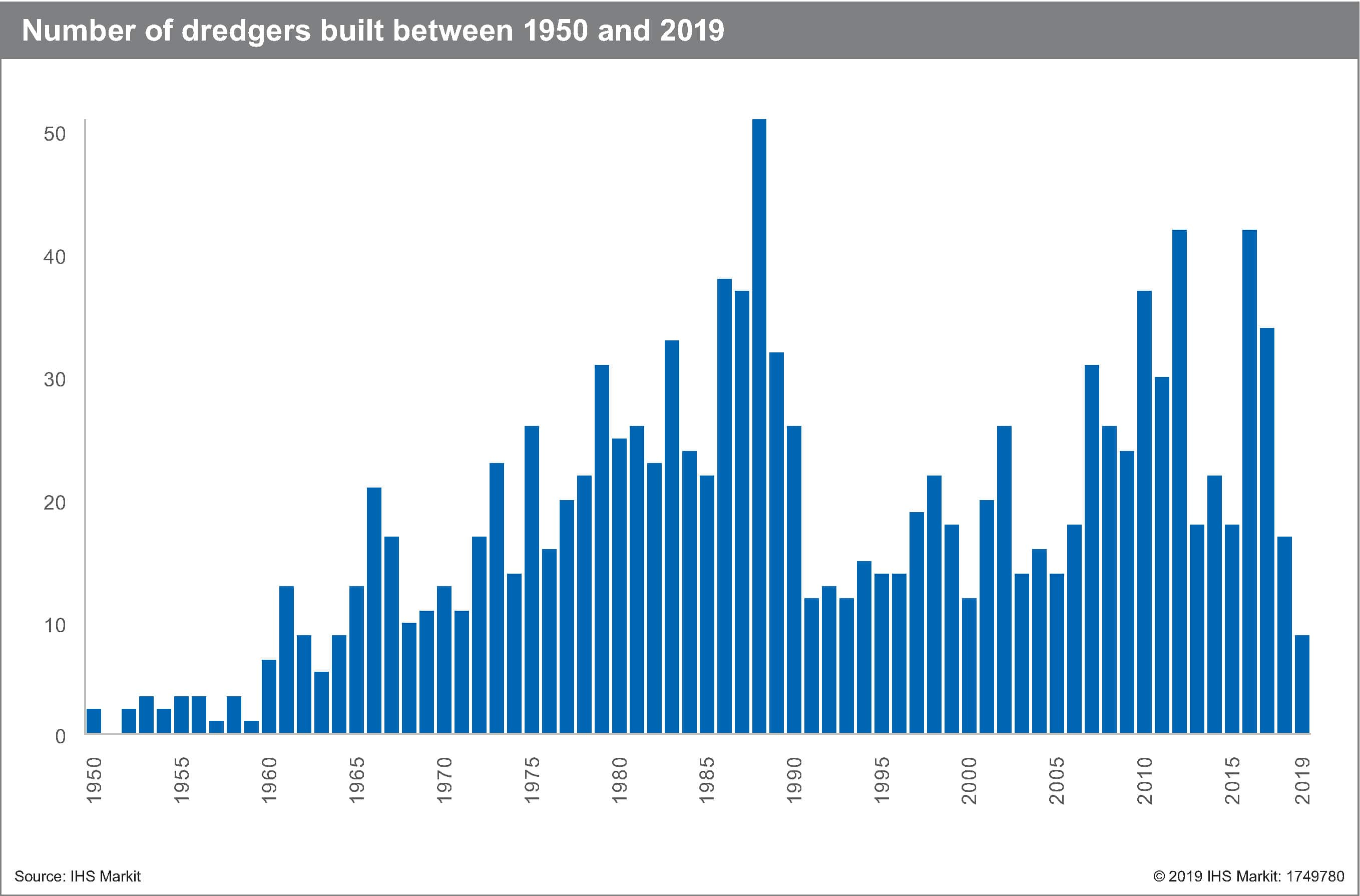

Looking at upcoming deliveries, 20 dredgers are expected to join the global fleet in 2021, which signifies a peak compared to 2022 and 2023 with currently one delivery each. This mirrors previous developments, where every five years, we see a spike in vessel deliveries, going back to 2006.

One of them is DEME's hugely-anticipated Spartacus, which will start dredging in Egypt. The other is Jan de Nul's Willem van Rubroeck. Its delivery has been delayed due to the bankruptcy of the original builder Uljanik, Croatia.

Both CSDs are in the mega-IDD-class for cutters with a total installed power of plus 23,000 kW and thus will create competition in the market. These upcoming deliveries might also serve as explanation for the lack of new cutter suction dredger orders made in 2020. The uncertainty over new projects and the saturation of the market might have led to owners shying away from additional cutter orders.

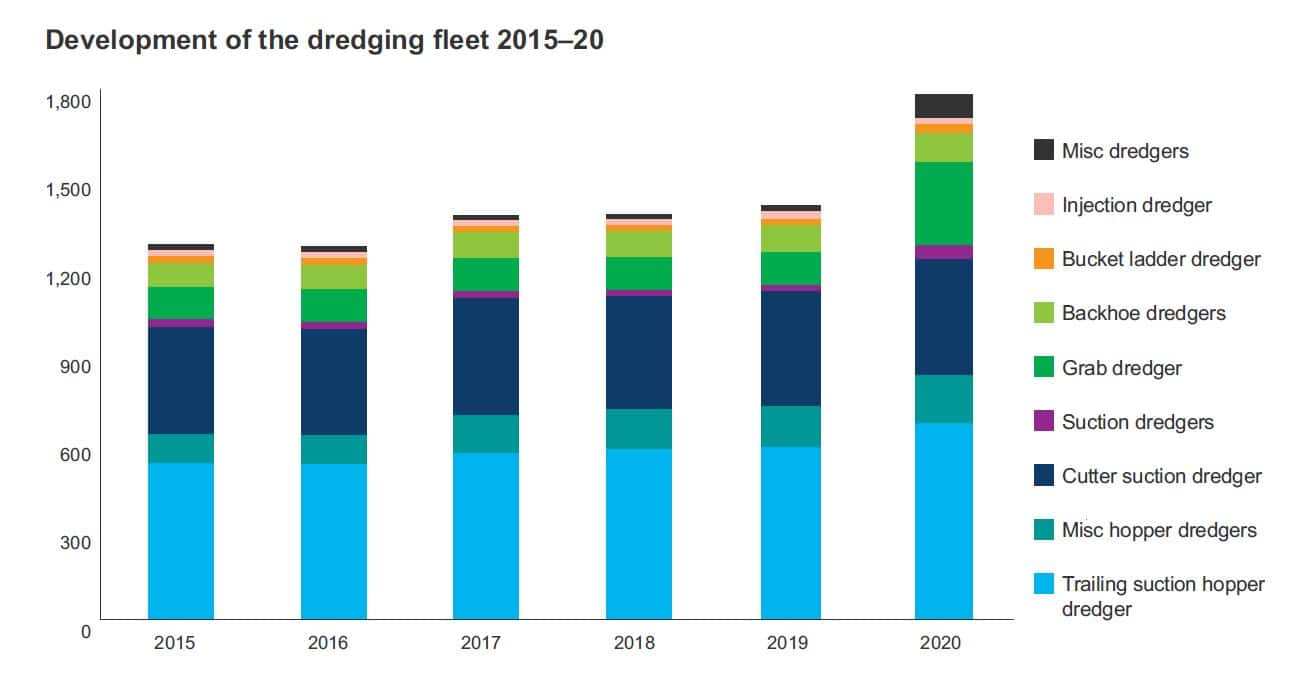

Diving into more of the data, in total, 1,785 dredgers that have an IMO number are currently in service.

The biggest share of the fleet is made of TSHDs, which has been

the case for the past years, too. The other two main types of

dredgers remain CSDs and grab dredgers.

We have seen an overall increase of vessel numbers, from 1,406 in

2019 to 1,785 as mentioned above, which is due to an IHS Markit

database upgrade done in late 2019 rather than newbuild vessels

entering into service.

Just in time for this edition, IHS Markit has audited the dredging sector data it holds and designated more vessels with a distinct type, which previously have been classed as miscellaneous dredgers. This audit also resulted in the inclusion of especially more grab dredgers that have, in previous years, been left out of the IDD.

In addition, the dredging companies have been thoroughly vetted to include the most up-to-date contact information.

All the above and other data were turned into handy visualisations to give an overview average capacities of different dredger types as well as the average age of the fleet. You can find the infographics on pages 28-31.

Distributed with the January 2021 issue of the International Association of Ports & Harbors member magazine Ports & Harbors, and available here for download, the 2020 IDD is a landmark annual publication that is retained across the dredging and civil engineering sector as a key reference guide.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdredging-industry-builds-smaller-vessels.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdredging-industry-builds-smaller-vessels.html&text=Dredging+industry+builds+smaller+vessels+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdredging-industry-builds-smaller-vessels.html","enabled":true},{"name":"email","url":"?subject=Dredging industry builds smaller vessels | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdredging-industry-builds-smaller-vessels.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dredging+industry+builds+smaller+vessels+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdredging-industry-builds-smaller-vessels.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}