Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Jul 05, 2022

Defensive Strategies for the Asian USD High Yield Credit Market

Market Overview (2021-Present)

International investors have long viewed the Asian USD high yield credit bond market as an alternative investment universe to the traditional U.S. high yield market. As a result, the junk bond market has undergone considerable growth, with the total issuance increasing almost sixfold between 2012 and 2020.

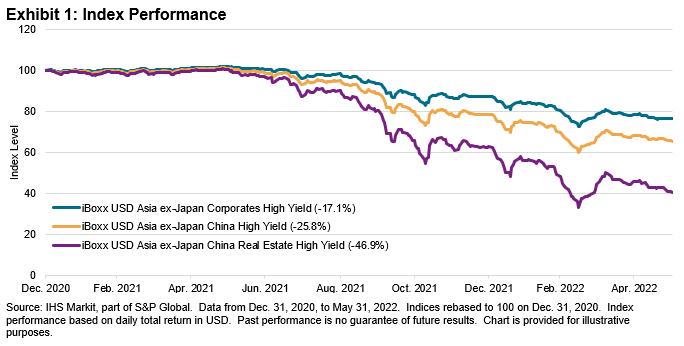

However, the market has seen some turbulence in the past 12 to 18 months, largely due to its high exposure to the Chinese real estate market. In the past decade, Chinese real estate companies have issued large amounts of debt at a low borrowing cost to fund their operations. This changed when Chinese regulators imposed new rules to deleverage the financial system. Meanwhile, companies were unable to turn over their inventory effectively for cash, and a liquidity crisis in the sector began to emerge.

In September 2021, China Evergrande Group, the second-largest property developer in China by sales, missed coupon payments on its U.S. debt obligation. Since then, there has been a growing list of prominent names involved in the Chinese real estate sector crisis. The top five issuers by market value as of April 2021 in the iBoxx USD Asia ex-Japan China High Yield Real Estate have defaulted on their USD debt obligations in the past 12 months.

As of May 31, 2022, more than 12 distinct Chinese property issuers in the iBoxx USD Asia ex-Japan Corporates High Yield had missed payments on their U.S. debt, and the total amount of issuance removed from the index exceeded USD 35 billion.

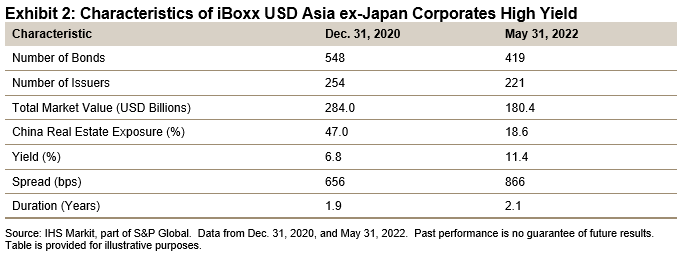

Once dominating the Asian USD high yield credit bond market, the Chinese property sector has shrunk significantly after the spate of defaults and sell-offs. On Dec. 31, 2020, China's real estate issuance accounted for 47.0% of the iBoxx USD Asia ex-Japan Corporates High Yield. By the end of May 2022, its share had dwindled to 18.6%. As expected, the index characteristics between the two dates are also significantly different, as illustrated in Exhibit 2.

The widespread media coverage of the China real estate crisis likely brought the Asian USD high yield credit asset class to the attention of many investors, including value investors who may perceive price level (and yield) to be attractive at this juncture. However, many might be sitting on the fence due to the ongoing volatility in the market.

In the full report, we discuss two indexing strategies that seek to retain the benefits of Asian USD high yield corporate bonds, while offering potential protection against defaults and high volatility in the associated underlying market.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefensive-strategies-for-the-asian-usd-high-yield-credit-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefensive-strategies-for-the-asian-usd-high-yield-credit-market.html&text=Defensive+Strategies+for+the+Asian+USD+High+Yield+Credit+Market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefensive-strategies-for-the-asian-usd-high-yield-credit-market.html","enabled":true},{"name":"email","url":"?subject=Defensive Strategies for the Asian USD High Yield Credit Market | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefensive-strategies-for-the-asian-usd-high-yield-credit-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Defensive+Strategies+for+the+Asian+USD+High+Yield+Credit+Market+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefensive-strategies-for-the-asian-usd-high-yield-credit-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}