Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 09, 2021

Daily Global Market Summary - 9 June 2021

Major US equity indices closed lower, while European and APAC markets were mixed. US and benchmark government bonds were sharply higher for a second consecutive day. European iTraxx closed slightly tighter across IG and high yield while CDX-NA was flat on the day. The US dollar, silver, and gold closed higher, Brent and natural gas were flat, and WTI and copper were lower on the day. All eyes will be on tomorrow (Thursday) morning's US CPI and weekly unemployment insurance claims reports being released simultaneously at 8:30am ET.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed lower; Nasdaq -0.1%, S&P 500 -0.2%, DJIA -0.4%, and Russell 2000 -0.7%.

- 10yr US govt bonds closed -6bps/1.49% yield and 30yr bonds -5bps/2.17% yield, which is 25bps and 31bps below this year's highest closing yields reported in early-March, respectively.

- CDX-NAIG closed flat/50bps and CDX-NAHY flat/283bps.

- DXY US dollar index closed flat/90.12.

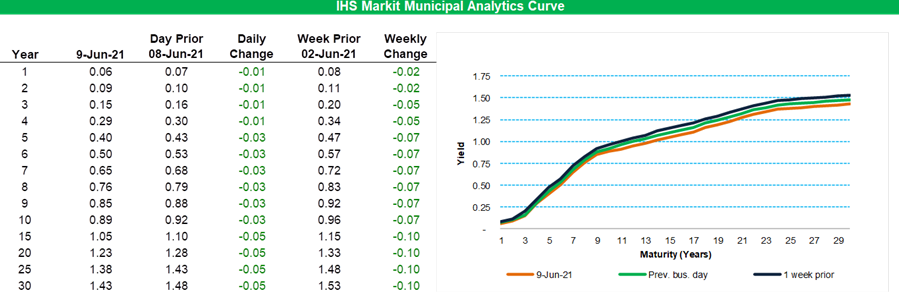

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

rallied 3bps across 5-10 year maturities and 5bps for 15yr and

greater maturities.

- Gold closed +0.1%/$1,896 per troy oz, silver +1.0%/$28.00 per troy oz, and copper -0.5%/$4.53 per pound.

- Crude oil closed -0.1%/$69.96 per barrel and natural gas closed 0%/$3.13 per mmbtu.

- In a press release, ExxonMobil Corporation announced a new hydrocarbon discovery at the Longtail-3 well on the Starbroek Block offshore Guyana, bringing the total numbers of discoveries on the Stabroek Block to 20. The well, located approximately 2 miles (3.5 kilometers) south of the Longtail-1 discovery, encountered 239 feet (70 meters) of net hydrocarbon pay in 6,100 feet (1,860 meters) of water, the company said. In April 2021, ExxonMobil and partners announced a new oil discovery at the Uaru-2 well on the Starbroek Block offshore Guyana. ExxonMobil (45% interest) is the operator of Starbroek Block, with partners Hess (30%), and CNOOC Limited (25%). (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- Private equity firms ought to tap more into the investment opportunities offered by clean energy and low-carbon technology as the global energy transition gathers pace, a report released 8 June recommends. Penned by Ceres, a nonprofit sustainable network of institutional investors, and SustainAbility Institute by ERM, the report, Changing Climate for Private Equity, said private equity firms remain an untapped source for clean energy investment that could help the world reach net-zero goals by midcentury. Private equity firms invest directly into companies and assets, generally with a longer-term horizon, deploying capital on behalf of limited partner investors, the organizations said. The level of investment in clean energy projects or climate solutions by private equity is growing, though not at the same rate as investment by publicly held companies. The report cites a lack of universally adopted and mandated frameworks and standards to guide climate-related disclosure of financial risk as a key barrier to greater adoption. (IHS Markit Climate and Sustainability News' Amena Saiyid)

- A letter sent by Pfizer (US) to US hospitals has reportedly warned of likely disruption to the supply of four of its products, given that resources have instead been diverted towards the manufacture of vaccines to protect against COVID-19. According to the Financial Times, the four products facing disruption include an antibiotic, a steroid, and two types of testosterone. These products are manufactured using some of the same ingredients and manufacturing facilities as the COVID-19 vaccine co-developed by Pfizer and BioNTech (Germany). (IHS Markit Life Sciences' Milena Izmirlieva)

- Tyson Foods says it plans to achieve net-zero greenhouse gas emissions across its global operations and supply chain by 2050, a move the company contends shows its commitment to "help combat the urgency of the growing climate change crisis." The new initiative expands on the meat industry giant's prior commitment to achieve a 30% reduction in emissions by 2030 and is intended to align with the goal of the Paris Agreement to limit global temperature rise to 1.5 degrees Celsius. Tyson, which has 239 facilities and 139,000 employees worldwide, says it will look at emissions tied to direct global operations, energy sources and throughout its supply chain. The largest meat processor in the US, Tyson says it will update its baseline for emissions in line with the goal of the Paris Agreement by 2023 and will prioritize "establishing a pathway' to using 50% renewable energy across its domestic operations by 2030. (IHS Markit Food and Agricultural Policy's Richard Morrison)

- Lordstown Motors has disclosed a "going concern" warning to the US Securities and Exchange Commission (SEC) in its 10-Q quarterly filing, noting that its current cash levels are not sufficient for commercial production. The SEC filing included the statement, "The Company had cash and cash equivalents of approximately $587.0 million and an accumulated deficit of $259.7 million at March 31, 2021 and a net loss of $125.2 million for the quarter ended March 31, 2021. Since inception, the Company has been developing its flagship vehicle, the Endurance, an electric full-size pickup truck. The Company's ability to continue as a going concern is dependent on its ability to complete the development of its electric vehicles, obtain regulatory approval, begin commercial scale production and launch the sale of such vehicles. The Company believes that its current level of cash and cash equivalents are not sufficient to fund commercial scale production and the launch of sale of such vehicles. These conditions raise substantial doubt regarding our ability to continue as a going concern for a period of at least one year from the date of issuance of these unaudited condensed consolidated financial statements." (IHS Markit AutoIntelligence's Stephanie Brinley)

- As expected, the Bank of Canada kept interest rates unchanged.

The Bank continues to provide extraordinary forward guidance and

its targeted large-scale asset purchases of $3 billion per week.

(IHS Markit Economist Arlene

Kish)

- The domestic and global growth outlooks have mostly improved, yet there are downside risks to the economic outlook.

- Canada's rapid upswing in vaccinations, coupled with specific planned provincial easing of containment measures, solidifies a stronger rebound in the second half of the year.

- The Bank of Canada's inflation profile is little changed as it will keep the overnight rate at 0.25% until the inflation rate hits 2% on a sustainable basis, which is expected in the second half of 2022.

- Canada-based startup NuPort Robotics has selected NVIDIA Drive platform to develop autonomous systems for middle-mile short-haul routes, according to a company statement. The platform, which is scalable to Level 4 autonomy, can process a wide array of deep neural networks (DNNs) necessary for autonomous truck operations. NuPort plans to build upcoming generations of its autonomous trucking platform on NVIDIA Drive Orin, which is capable of 254 trillion operations per second. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Newly established Canada-based autonomous vehicle (AV) startup Waabi has raised USD83.5 million in a Series A funding round led by Khosla Ventures, according to a company statement. Additional investors participating in the round include Uber, Radical Ventures, 8VC, OMERS Ventures, BDC Capital's Women in Technology Venture Fund (WIT), Aurora Innovation Inc., AI luminaries Geoffrey Hinton, Fei-Fei Li, Pieter Abbeel, Sanja Fidler, and others. Waabi uses artificial intelligence (AI) technology to build software that automates driving on commercial delivery routes. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- European equity indices closed mixed; France +0.2%, Spain 0%, UK -0.2%, Italy -0.3%, and Germany -0.4%.

- 10yr European govt bonds closed sharply higher for a second consecutive day; Italy/Spain/UK -4bps, France -3bps, and Germany -2bps.

- iTraxx-Europe closed -1bp/48bps and iTraxx-Xover -3bps/240bps.

- Brent crude closed 0%/$72.22 per barrel.

- Germany's Federal Statistical Office (FSO) external trade data

for April (customs methodology, seasonally and calendar adjusted,

nominal) reveal broadly flat exports month on month (m/m; up 0.3%)

and a setback for imports (-1.7%). Huge base effects from the

pandemic-related initial slump in April 2020 led to year-on-year

(y/y) rates of 47.9% and 33.2%, respectively. (IHS Markit Economist

Timo

Klein)

- The seasonally adjusted trade surplus, which had narrowed from an interim peak of EUR21.3 billion (USD26.0 billion) in January to EUR14.0 billion in March, corrected only moderately to EUR15.9 billion in April. This compares with monthly averages of EUR18.9 billion in 2019 and EUR14.8 billion in 2020.

- April's regional breakdown reinforces the recent picture of

outperforming EU trade relative to trade with the non-EU world. In

part, this reflects the particularly pronounced slump in the

European Union a year ago, whereas trade with China had already

started to recover in April 2020.

- Exports to China increased by "only" 16.0% y/y this April and imports by 13.3% y/y.

- Trade with the United States was particularly lopsided in April, as an export surge of 59.9% contrasted with a mere 2.2% increase in German imports from that country.

- The same pattern applied to the United Kingdom, given an export increase of 64.1% and essentially unchanged imports (-0.6%). This demonstrates that the post-Brexit disruption is not hampering German exports to the UK unduly, while many importers have either diverted supply chains away from the UK or at least stocked up on inventories in late 2020.

- Volkswagen (VW) Passenger Cars board member Klaus Zellmer has said that the company is considering offering an autonomous vehicle (AV) on a pay-per-use basis, reports Reuters. He estimates that the hourly rate will be around EUR7.00 (USD8.50), and the AV will be accessible to the public. Zellmer added, "Regarding autonomous driving we can imagine to offer it on an hourly basis. We assume a price of around seven euros per hour. So if you do not want to drive yourself for three hours you can pay 21 euros to get it done." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Renault has announced testing of the new Mégane E-Tech Electric, releasing photos and confirming up to 450 km on the WLTP cycle. According to the press statement, the new vehicle will also be called "MéganE". The company is testing a fleet of 30 pre-production cars in the coming months. The pre-production units will continue to wear camouflage until their full reveal, which Renault calls "a tailor-made pattern from Renault Design. Consisting in a play of lines and patterns from our new and iconic logo, this design creates a dazzle-like camouflage." The vehicle is based on the CMF-EV platform and gets a 217-hp e-motor and a 60kWh battery pack. (IHS Markit AutoIntelligence's Stephanie Brinley)

- EEW Special Pipe Constructions (EEW SPC) has been awarded by Saipem a contract to manufacture 64 monopile foundations for the Courselles-sur-Mer (Calvados) project in France. EEW SPC will begin work in the third quarter of 2021. Each monopile is estimated to weigh around 780 metric tons. The 450 MW Calvados offshore wind farm, situated 10 kilometers off the coast of Normandy, is developed by consortium Eolien Maritime France, which comprises EDR Renewables, wpd, and EIH Sarl, a subsidiary of Enbridge and CPP Investments. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Ride-hailing app Cabify has launched a pilot multi-modal subscription service, "Cabify Go!", in Madrid (Spain), reports TechCrunch. Cabify will test three monthly subscription models, which encompass the company's different mobility offerings. The first plan, "Everything in one", costs EUR6.95 (USD8.47) per month, which includes a 10% discount on all car services and a 30% discount on parcels. Subscribers also get two free cancellations each month and are exempt from the additional fee incurred due to high demand. The second plan, "On two wheels", costs EUR19.95 (USD24.31) per month and this allows 10 trips on an electric scooter or motorcycle for trips of no more than EUR6.00 (USD7.31). Finally, the "Pedal" plan, costing EUR49.95 (USD60.87) per month, allows users to rent electric bikes for long periods. It also includes servicing and maintenance as well as a 10% discount on ride-hailing trips. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Norwegian offshore wind developer Wind Catching Systems and its collaborators Aibel, and the Institute for Energy Technology (IFE) have introduced a novel concept for floating offshore wind. The concept consists of a vertical floating array of turbines of 1 MW each arranged into a large "sail". The company has claimed that each sail is five times as efficient as a conventional offshore wind turbine, and can bring down the costs of electricity production for floaters to the level of bottom-fixed solutions. Wind Catching is targeting a lifespan of 50 years for the design. The company is planning to complete technical verification in 2021 and believes that it can accelerate the target cost reductions developers have set for 2030-2035 and to bring them forward to 2022-2023. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- South Africa's real GDP surprised on the upside and accelerated

by 1.1% q/q and 4.6% at a seasonally adjusted annualized rate

during the first quarter. The largest contributions to the growth

rebound came from the finance, trade, and mining industries. (IHS

Markit Economist Thea

Fourie)

- The finance, real estate, and business services industry rebounded by 7.4% at a q/q annualized rate, contributing 1.5 percentage points to the overall growth performance. This was followed by the mining industry, up by 18.1% q/q annualized, contributing 1.2 percentage points, and the trade sector, up by 6.2% q/q annualized, contributing 0.8 percentage point. The agriculture, forestry and fishing, and the electricity and water sectors were the only sectors in the South African economy that slowed on a quarterly basis.

- Demand-side GDP shows that household spending combined with a build-up in inventories were primarily responsible for South Africa's growth performance during the first quarter. A change in inventories made an 8.0 percentage point contribution to overall GDP followed by household consumer spending, which accelerated by 4.7% q/q annualized, making a 3.0 percentage point contribution. Household spending in all sub-categories accelerated on a q/q basis, with the strongest gains made in clothing and footwear, furnishing, household equipment and maintenance, health, and recreation spending. The catch-up in household spending has been impressive, with most consumer categories closing in on pre-COVID-19 levels, with the exception of spending at restaurants and hotels.

Asia-Pacific

- Most major APAC equity markets closed lower except for Mainland China +0.3%; Hong Kong -0.1%, Australia -0.3%, Japan -0.4%, India -0.6%, and South Korea -1.0%.

- Mainland China's Consumer Price Index (CPI) increased by 1.3%

year on year (y/y) in May, up 0.4 percentage point from the April

reading, according to the National Bureau of Statistics (NBS).

Month-on-month (m/m) CPI deflation further narrowed to 0.2% in May,

owing to the smaller month-on-month decline in food prices. (IHS

Markit Economist Lei Yi)

- The five-day-long Labor Day holiday in mainland China, together with an accelerated COVID-19 vaccine rollout, underpinned sustained recovery in consumer demand in May. Prices of consumer goods rose by 1.6% y/y, the highest rate since September 2020, while services prices rose 0.9% y/y, the highest increase since last May.

- Transportation and communication continued to lead year-on-year price gains across sub-categories, as fuel prices registered a larger increase of 21.3% y/y, and air ticket prices rose 32.3% y/y in May. Excluding the volatile food and energy components, core CPI inflation reached 0.9% y/y in May, a rate last seen in June 2020.

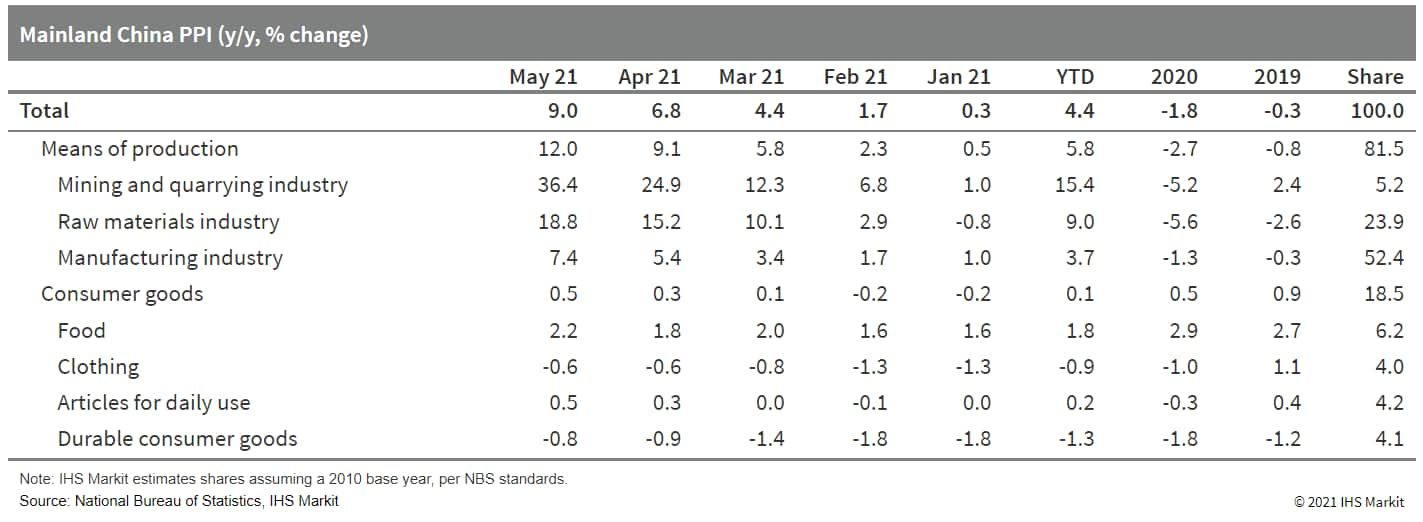

- The Producer Price Index (PPI) surged by 9.0% y/y in May, the largest increase since September 2008 and near the historical high of 10.1% y/y logged in August 2008. Month-on-month PPI inflation ticked up to 1.6% in May from the April reading of 0.9% m/m, driven by the soaring commodity prices.

- Oil-related sectors, including petroleum and natural gas

extraction and fuel processing, reported month-on-month price gains

driven by rising crude oil price in May. Increases in the cost of

iron ore, aluminum, and copper widened month-on-month price gains

for ferrous and non-ferrous metal smelting and processing.

Meanwhile, the approaching summer season raised coal demand from

power stations, thus driving up prices in the coal mining and

dressing sector.

- Autonomous vehicles (AVs) are deployed in South China's city Guangzhou to transport supplies to residents, reports Caixin Global. Communities in the city's Liwan district, home to around 180,000 people, are subjected to COVID-19 virus-related stay-at-home orders issued by the city government. This move is expected to decrease the risk of COVID-19 virus transmission as it will help people reduce physical contact. AVs are increasingly being deployed to deliver medical and food supplies in regions affected by the COVID-19 virus. Last year, Neolix.ai experienced a rise in orders for its autonomous delivery vans during the COVID-19 virus outbreak in China. Neolix's autonomous vans were deployed to deliver medical supplies in hospitals, help disinfect streets, and deliver food to people. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Apple is reportedly in talks with Chinese battery suppliers CATL and BYD for the supply of batteries for its planned electric vehicle (EV) model, according to Shanghai Daily, citing four unnamed people with knowledge of the matter. Apple, which is in favor of using lithium iron phosphate batteries owing to the low-cost factor, has also asked that the potential battery supplier build manufacturing facilities in the United States. However, CATL is reluctant to set up a plant in the US because of political tensions between the US and China. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Mainland Chinese shipyard Wison Offshore and Marine has delivered the country's first floating wind foundation. The semisubmersible structure was built at Wison's Zhoushan facility in Zhejiang province and has been mounted with MingYang Smart Energy's MySE5.5 MW typhoon resistant floating wind turbine. The prototype was assembled at MingYang's Yangjiang manufacturing facility. The floating unit will be headed for the China Three Gorges' (CTG) 400MW Yangxi Shapa III offshore wind farm off the coast of Yangjiang City in Guangdong Province. The semisubmersible will will be hooked up using a single 35kV dynamic power cable, provided by Ningbo Orient Cable, to an adjacent fixed-bottom turbine. MingYang is supplying 31 fixed-bottom MySE6.45-180 MW offshore wind turbines to the same project, and will be demonstrating the viability of it's the floating unit concurrently. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Japan's current-account surplus for April rose by 540.2% year

on year (y/y) to JPY1.3 trillion (USD12.1 billion) on a

non-seasonally adjusted basis, but fell by 8.5% month on month

(m/m) to JPY1.6 trillion on a seasonally adjusted basis. (IHS

Markit Economist Harumi

Taguchi)

- The y/y increase was largely due to a trade surplus of JPY289.5 billion, which rose from a deficit of JPY983.1 billion and offset a wider service balance deficit and a decrease in secondary income.

- The improvement in the trade balance reflected a solid rise in exports (up 38.0% y/y), which outpaced imports (up 11.3% y/y), thanks to solid external demand and also partially due to low base effects. That said, the m/m decline in the current-account surplus was largely due to a narrower trade surplus, reflecting a 11.3% m/m rise in imports. The wider service balance deficit was due to increased payments for business services and intellectual property usage. An increase in primary income reflected increased income from direct investment.

- LG Energy Solution, the wholly owned subsidiary of LG Chem Ltd, has submitted the application to bourse operator Korea Exchange, as it seeks an initial public offering (IPO) within this year, reports the Yonhap News Agency. Earlier this year, the company picked KB Securities and Morgan Stanley as the lead managers for its IPO. It is expected that LG Energy Solution may be able to raise around KRW10 trillion (USD8.9 billion) through the share sale. Its market value is estimated at up to KRW100 trillion. LG Energy Solution plans to use IPO proceeds to expand a facility investment to meet growing demand for batteries for EVs. (IHS Markit AutoIntelligence's Jamal Amir)

- Singapore-based autonomous vehicle (AV) startup MooVita has secured an undisclosed amount of investment funding from SMRT Ventures and Malaysia-listed energy infrastructure and technology firm Yinson Holdings, reports the Straits Times. This investment, which is part of MooVita's Series A funding round, is expected to accelerate the development and commercialization of the company's driverless solutions. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Australian government has awarded the first A$50 million (approximately US$38.7 million) to six companies from its Carbon Capture, Use and Storage (CCUS) Development Fund, it announced on 8 June. The program was launched 1 March. At the time of launch, Minister for Energy and Emissions Reduction Angus Taylor said: "Australia has the potential to be a world leader in geosequestration. We have the right geology and storage basins." The government's investment leveraged commitments from each of the companies as well, yielding a total investment of A$412 million (US$319 million). (IHS Markit Climate and Sustainability News' Kevin Adler)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-june-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-june-2021.html&text=Daily+Global+Market+Summary+-+9+June+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-june-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 9 June 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-june-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+9+June+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-june-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}