Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 08, 2021

Daily Global Market Summary - 8 April 2021

All major US and most APAC and European equity indices closed higher. US and benchmark European government bonds closed higher. European iTraxx and CDX-NA closed modestly tighter across IG and high yield. The US dollar and WTI closed lower, while Brent, gold, silver, copper, and natural gas closed higher on the day.

Americas

- US equity indices closed higher; Nasdaq +1.0%, Russell 2000 +0.9%, S&P 500 +0.4%, and DJIA +0.2%.

- 10yr US govt bonds closed -4bps/1.63% yield and 30yr bonds -5bps/2.31% yield.

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -3bps/291bps.

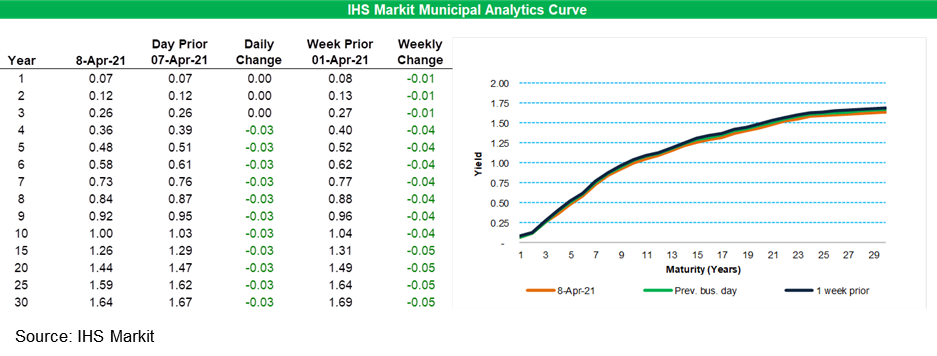

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

rallied 3bps for 4-year and longer paper, with maturities 15-years

and longer 5bps better week-over-week.

- DXY US dollar index closed -0.4%/92.06.

- Gold closed +1.0%/$1,758 per troy oz, silver +1.3%/$25.59 per troy oz, and copper +1.0%/$4.10 per pound.

- Crude oil closed -0.3%/$59.60 per barrel and natural gas closed +0.1%/$2.52 per mmbtu.

- US seasonally adjusted (SA) initial claims for unemployment

insurance rose by 16,000 to 744,000 in the week ended 3 April. The

previous week's level was revised up by 9,000 from 719,000 to

728,000. A year ago, initial claims were at an all-time high of

6.15 million as the strict pandemic lockdown effectively put the

economy into hibernation. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 16,000 to 3,734,000 in the week ended 27 March. The insured unemployment rate was unchanged at 2.6%.

- In the week ended 20 March, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) rose by 117,108 to 5,633,595.

- There were 151,752 unadjusted initial claims for PUA in the week ended 3 April. In the week ended 20 March, continuing claims for Pandemic Unemployment Assistance (PUA) rose by 203,289 to 7,553,628.

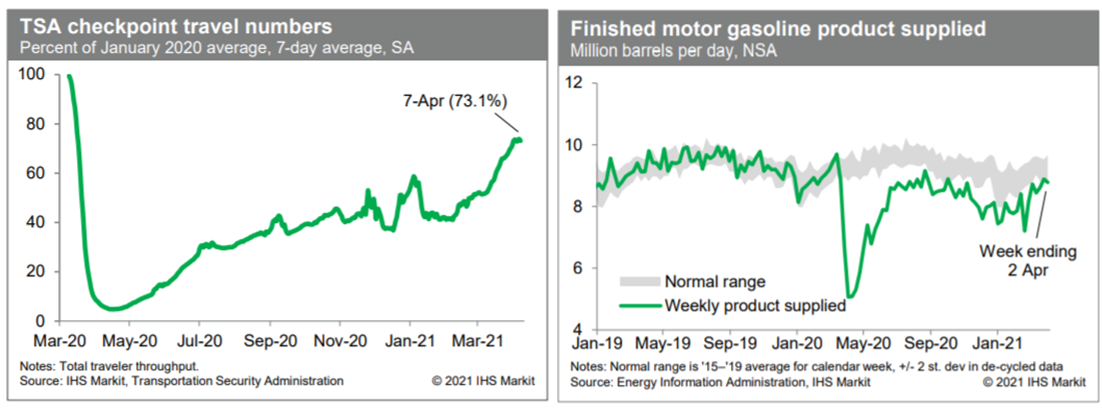

- Seasonally adjusted passenger throughput at US airports

averaged over the last seven days was about 73% of the January 2020

level, according to our estimate based on daily data from the TSA.

The recovery in air travel since early February (when passenger

traffic was roughly 40% of the January 2020 level) has been swift

and is indicative of a broad re-engagement in travel-related

activity. Meanwhile, consumption of gasoline last week, as reported

by the Energy Information Administration, was down slightly from

the prior week and at the lower end of what we estimate to be a

normal range. This is the second consecutive week that gasoline

consumption was at the lower end of normal. Continued readings at

such a level would indicate the early stages of convergence of

internal mobility to normal. (IHS Markit Economists Ben Herzon and

Joel Prakken)

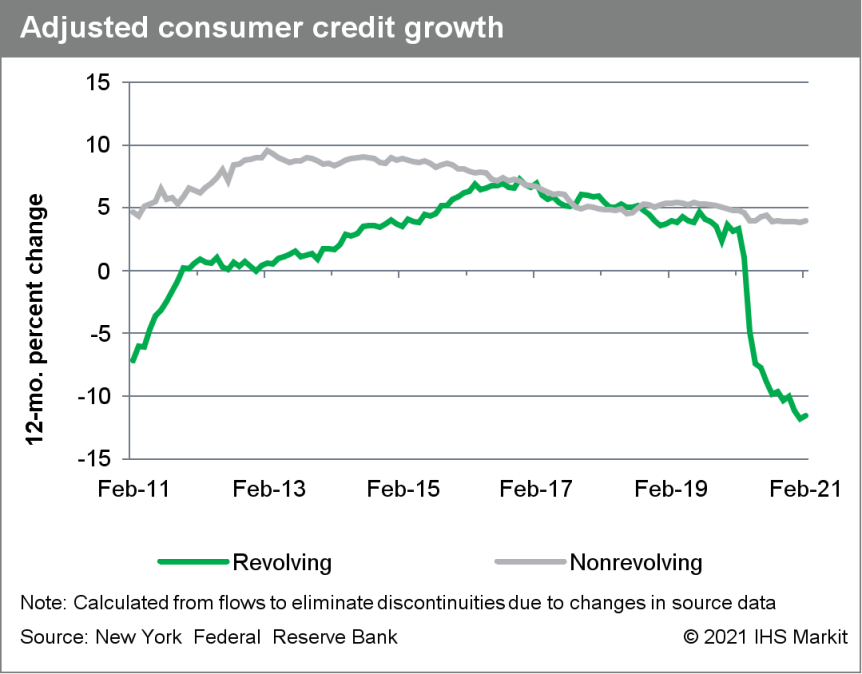

- Outstanding US nonmortgage consumer credit rose $28 billion to

$4.21 trillion in February after a flat January. (IHS Markit

Economist David Deull)

- The 12-month change in outstanding consumer credit rose 0.2 percentage point to a flat reading (0.0%.) Revolving credit increased somewhat, but the main driver of the gain was the nonrevolving category.

- Revolving (mostly credit-card) consumer credit rose $8 billion, which slightly moderated its 12-month change to -11.2% after a record low in January.

- Nonrevolving credit rose $19 billion in February and its 12-month growth rate ticked up 0.2 percentage point to 4.0%. This category includes student and auto loans, and the growth of these types of obligations has remained steady.

- The ratio of nonmortgage consumer credit to disposable personal

income jumped 2.0 percentage points to 23.8% as the one-time nature

of stimulus checks issued in January resulted in a month-on-month

decrease in personal income in February.

- Autonomous truck startup TuSimple is targeting a valuation of more than USD8 billion for its initial public offering (IPO) in the US, reports Reuters. The company is considering raising about USD1.3 billion in funding by selling around 34 million shares at a price range between USD35 and USD39 apiece. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Apple CEO Tim Cook dropped a few hints about the company's autonomous car project in an interview released by the New York Times. Cook said that autonomous technology in cars is an ideal match for the company. He added that Apple is planning to build an autonomous platform that can be used by automakers. Cook said, "An autonomous car is a robot and so there are lots of things you can do with autonomy; we will see what Apple does. We love to integrate hardware, software and services, and find the intersection points of those because we think that's where the magic occurs." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The California Air Resources Board (CARB) has issued a draft rule that would require ride-hailing fleets to shift to 100% zero-emission vehicles by 2030. Meanwhile, Uber and Lyft are reportedly paying drivers more to increase participation in services, although Uber says the pay will drop back once more drivers are participating. Although these two issues are not directly related, they both underscore the current reliance of ride-hailing businesses on drivers, who own their own vehicles and are not direct employees. The Californian proposal also clearly puts the onus on electrifying the TNC fleet on the TNC company, expecting that the company will resolve how or whether to incentive drivers to opt for ZEVs. Relative to the pay issue, many areas of the US are opening up and use of ride-hailing services is expected to increase. Uber and Lyft also expect that the number of drivers will increase as the number of passengers increases, and Uber states that, over time, driver earnings will return to pre-COVID-19-pandemic levels. (IHS Markit AutoIntelligence's Stephanie Brinley)

- RPM International today reported fiscal third-quarter net

income of $38.2, compared with $11.9 million in the year-ago

quarter. Net sales were up 8.1% year on year (YOY), to $1.27

billion. Adjusted earnings totaled 38 cents/share, up 65.2% YOY and

beating analysts' consensus estimate of 29 cents/share, as reported

by Refinitiv (New York, New York). Organic sales grew 4.9% YOY

during the quarter, and restructuring efforts boosted the company's

bottom line, RPM says. (IHS Markit Chemical Advisory)

- Consumer group segment sales increased 19.8% YOY, to $477.7 million, while segment EBIT grew 43.3%, to $42.8 million. "Our consumer group continued to leverage its broad distribution and market leadership in caulks, sealants, cleaners, abrasives and small-project paints to capitalize on the positive DIY home improvement trend," Sullivan says.

- Construction products segment sales rose 6.4% YOY, to $396.0 million, while segment EBIT totaled $16.5 million, compared with $1.7 million in the year-ago quarter.

- Performance coatings segment sales declined 11.4% YOY, to $226.5 million, while segment EBIT fell 45.4%, to $12.1 million. "Challenging market trends persisted for our performance coatings group during the quarter, including weak energy demand that impacted industrial coatings and COVID-19 protocols that restricted access to facilities for flooring system installations," Sullivan said.

- Specialty products segment sales rose 14.4% YOY, to $169.2 million, while segment EBIT grew 89.9%, to $24.6 million.

- In a press release, Hess Corporation announced the signing of an agreement to sell its Bakken Shale assets to Enerplus Corporation for a total cash consideration of $312 million. The transaction is expected to close by the end of May 2021. The assets are located in the Little Knife and Murphy Creek areas of North Dakota. Hess holds 78,700 net acres (77% operated) in Dunn County, largely contiguous to Enerplus' core Bakken position. The transaction also includes 110 net core undrilled locations (77% operated) and 120 net upside locations focused in the Middle Bakken formation. The acquired acreage has very limited exposure to federal land (less than 3% of the total net acreage), Enerplus said. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

Europe/Middle East/Africa

- Most European equity indices closed higher except for Italy -0.7%; UK +0.8%, France +0.6%, Spain +0.5%, and Germany +0.2%.

- 10yr European govt bonds closed higher across the region; Italy -4bps, UK -3bps, and Spain/France/Germany -1bp.

- iTraxx-Europe closed -1bp/50bps and iTraxx-Xover -4bps/244bps.

- The account of the European Central Bank's (ECB) most recent

policy meeting, which concluded on 11 March, reinforces the key

point from the press conference that followed the meeting. (IHS

Markit Economist Ken Wattret)

- A sharp rise in bond yields threatened to deliver an unwarranted and premature tightening of financing conditions in the eurozone, necessitating a scaling-up of the pace of asset purchases under the Pandemic Emergency Purchase Programme (PEPP).

- The meeting account notes that in December 2020, the ECB's Governing Council had pledged to preserve favorable financing conditions over the pandemic period and to prevent any tightening that could counter the projected increase in inflation over the medium term.

- Differences of opinion were expressed, however, about the appropriate size of the increase in the pace of purchases. It was proposed by the ECB's chief economist Philip Lane that, to give a clear message to markets regarding the Governing Council's "reaction function", the purchase volume should be increased significantly.

- The ECB's next policy meeting and press conference will take place on 22 April. The assessments of economic growth, inflation, and policy prospects are unlikely to change materially compared with those communicated in March

- The year-on-year (y/y) rate of increase in the eurozone

producer price index (PPI) accelerated in February for the eighth

month in the past nine, to 1.5%, its highest level since May 2019.

(IHS Markit Economist Ken Wattret)

- This was marginally above the market consensus expectation (of 1.4%), with January's PPI inflation rate also revised upwards by 0.4 percentage point (from zero to 0.4%).

- Energy prices have been primarily responsible for the marked acceleration (see first chart below). The y/y rate of change in the energy sub-index jumped by almost three percentage points in February, to 2.3%, the first positive inflation rate in almost two years.

- France's current-account deficit widened from EUR2.0 billion

(USD2.4 billion) in January to EUR2.6 billion in February,

according to seasonally adjusted figures released by the Bank of

France. The deficit totaled EUR4.7 billion during the first two

months of the year, below EUR6.8 billion during the same period in

2020. (IHS Markit Economist Diego Iscaro)

- The increase in the overall deficit resulted from a combination of a lower surplus on the service balance and a higher merchandise trade deficit.

- The surplus on services declined from EUR1.2 billion to EUR1.0 billion, as an improving transport balance as not enough to offset modest deteriorations in the travel and professional services accounts.

- Worsening terms of trade resulting from higher international commodity prices (which France is a net importer) played a key role in the widening of the current-account balance in February.

- Porsche is looking to increase its ties with high-end automotive battery technology specialists amid concerns that the company's specific needs may not be met by mainstream suppliers, according to a Bloomberg report. The company has set up discussions with specialist cell makers with a view to collaborating and supplying batteries to build upon the impressive start that Porsche has made to life as a battery electric vehicle (BEV) manufacturer with the Taycan. In a statement, Porsche said it was entering into collaboration with Germany's Custom Cells GmbH, which is a specialist high-performance cell manufacturer. (IHS Markit AutoIntelligence's Tim Urquhart)

- Zurich-based FiveT Capital launched a fund 8 April to finance and build commercial scale "clean hydrogen" projects, just as IHS Markit projects global investment in hydrogen could reach $265 billion by 2030. Starting with an initial investment of €290 million ($345.07 million), the FiveT Hydrogen fund hopes to raise $1 billion from a combination of financial and industrial investors. However, the prospects for green hydrogen from renewable energy sources are largely dependent on the price of the electricity, with the cost currently in the $4-$5/kg range rather than the $1-$2/kg required to be economic, according to energy experts speaking at CERAWeek by IHS Markit panel discussions in early March. (IHS Markit Climate and Sustainability News' Amena Saiyid)

- Belgium-based biotechnology companies OncoDNA and myNEO entered a collaboration agreement on 7 April in the immuno-oncology therapeutic space. The deal will focus on the development of mRNA technologies in the potential production of personalized vaccines that hypothetically could selectively boost a patient's immune system against certain types of cancer. The technology is intended to recognize and eliminate tumor-specific molecules produced by the malignant cells - in theory immunizing patients against difficult-to-treat individual cancer types. The potential setting would be late-line, once a patient has exhausted other treatment options. Research and development (R&D) in this area is promising and has piqued pharmaceutical-sector interest in the wake of the development of COVID-19 mRNA vaccines. (IHS Markit Life Sciences Eóin Ryan)

- Europcar Mobility Group has partnered with Stellantis's mobility brand Free2Move to accelerate the roll-out of its connected vehicles program. Under this partnership, Europcar Mobility will have access to telemetry data from Peugeot, Citroën, Opel, Vauxhall, and DS vehicles. The data will include information about the vehicle's geolocation, fuel level, mileage, and maintenance alerts. Brigitte Courtehoux, CEO of Free2Move, said, "Free2Move, as a Data Service provider, brings not only the best, connected services for our Business Customers to help them reduce their costs, but also offers complementary value-added services for their own clients. We are happy to support Europcar Mobility Group in the project of having its fleet 100% connected in 2023." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- International interest in Spain's solar photovoltaic (PV) market is accelerating, with 3.4 GW of solar projects set to be backed by the investment manager of Canada's public pension scheme. Spanish PV developer Benbros Solar has agreed a development joint venture with UK-based investment platform Renewable Power Capital, which was established by Canada's Pension Plan Investment Board (CPP Investments) in 2020 to invest in renewables in Europe. So far, it has invested in onshore wind in Finland. The partners will develop or acquire 14 projects in the Spanish regions of Andalucía, Extremadura, Castilla la Mancha, Aragon, and Murcia, according to a 29 March statement. (IHS Markit Climate and Sustainability News' Cristina Brooks)

- While EU exporters are trying to secure their businesses with

the UK, British importers are busy making more direct trade with

suppliers outside the EU. This has created some opportunities for

nearby non-EU growers. A few countries will benefit from the slight

reshuffled supply lines for fresh fruits and vegetables: Morocco,

Egypt, Peru, Chile, Colombia, Central America and South Africa.

Morocco noted very strong growth in exports to the UK in January

2021. For HS code 08 of fruits and nuts, Morocco shipments to the

UK reached 25,000 tons in January, up 110% from the same time last

year. Fresh strawberries deliveries were over 1,000 tons from

2020's 200 tons. (IHS Markit Food and Agricultural Commodities'

Hope Lee)

- The Statistical Centre of Iran released the consumer price

index (CPI) report for the month of Esfand of year 1399, which

corresponds to the last month of the year that just ended (21 March

2020-20 March 2021). The statistical release shows that price

pressures remain elevated in Iran, with the national point-to-point

rate of inflation, referring to the consumer price index change in

Esfand 1399 relative to Esfand 1398, reaching 48.7%. This compares

to a previous reading of 48.2% in the previous month (Bahman 1399,

ending 20 February 2021). (IHS Markit Economist Jamil Naayem)

- The annual inflation rate, reflecting the average year-on-year (y/y) percentage change in the price index in the year ending 20 March 2021, reached 36.4%.

- The monthly inflation rate stood at 1.8% in the month ending 20 March, slightly lower than the 2.5% headline figure registered in the month before.

- The most important inflation drivers on a monthly basis proved to be the index's heavyweights, i.e. the food and non-alcoholic beverages category and the housing, water, electricity, gas and other fuels category.

Asia-Pacific

- Most APAC equity markets were closed higher except for Japan -0.1%; Hong Kong +1.2%, Australia +1.0%, South Korea +0.2%, India +0.2%, and Mainland China +0.1%.

- BYD announced yesterday (7 April) that its 2021-model-year models, the Tang electric vehicle (EV), Song Plus EV, Qin Plus EV, and e2 EV, will all feature its Blade batteries, replacing the lithium-ion (Li-ion) batteries used in the outgoing models. The Blade battery, which was first introduced in BYD's flagship Han EV, is said to be safer and more cost effective than Li-ion batteries. Of the four new models, the Qin Plus EV offers the longest range performance. The Qin Plus EV Long Range version promises to deliver a range of 600 km using a 71.7-kWh battery pack. The Song Plus EV with a standard 71.7-kWh battery pack can deliver a range of 500 km. The latter model's starting price has been lowered by CNY50,000 (USD7,633) compared with the MY 2019 Song Pro EV thanks to the use of the less expensive Blade batteries. With regard to the Tang EV, BYD's flagship sport utility vehicle, the automaker has introduced a four-wheel-drive dual-motor variant to the 2021 MY line-up. The top-of-the-line vehicle can provide a driving range of 505 km and can accelerate from zero to 100 km/h in less than five seconds. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Japan's current-account surplus fell by 4.7% year on year (y/y)

to JPY2.2 trillion (USD26.6 billion) on a non-seasonally adjusted

basis in February, but rose by 19.9% month on month (m/m) to JPY1.7

trillion on a seasonally adjusted basis. (IHS Markit Economist

Harumi Taguchi)

- The first y/y decline in seven months was driven by a decrease in the trade surplus (down JPY839.3 billion to JPY524.2 billion), offsetting an increase in primary income (up JPY527.0 billion to JPY2.6 trillion) and an improvement in the services balance (up JPY194.2 billion to a deficit of JPY75.7 billion).

- The weak trade balance reflected a 4.0% y/y decline in exports, while imports rose for the first time in 22 months (up 11.8% y/y). The weakness for exports was largely driven by the downside from the Lunar New Year holiday of Japan's Asian trade partners.

- Ride-hailing firm Grab is going public via a merger deal with Altimeter Capital Management, a special purpose acquisition company (SPAC), reports the Financial Times (FT). Grab will finalize its merger agreement this week with Altimeter Growth 1, one of Altimeter Capital's two SPACs. This potential deal will involve Grab raising about USD2.5 billion through private investment in public equity and almost USD1.2 billion from Altimeter, valuing the company at USD35 billion. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Thai-based Energy Absolute plans to start producing batteries for electric vehicles (EVs) at its factory in Chachoengsao (Thailand) in June, reports Bangkok Post. Production at the THB6-billion (USD191.1-million) facility will begin with a trial run of its machinery. "The move signals significant progress in the EV supply chain in Thailand because batteries are a major component of EVs," said Energy Absolute deputy chief executive Amorn Sapthaweekul. Energy Absolute is also developing an EV assembly factory in Chachoengsao at a cost of THB1.8 billion, scheduled to begin operation around the middle of this year. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-april-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-april-2021.html&text=Daily+Global+Market+Summary+-+8+April+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-april-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 8 April 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-april-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+8+April+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-april-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}