Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 06, 2021

Daily Global Market Summary - 6 October 2021

Most major US equity indices closed higher, and all major APAC and European market were lower. US government bonds closed higher with the curve flatter on the day, while most benchmark European bonds were lower on the day. European iTraxx closed wider across IG and high yield and CDX-NA was flat on the day. The US dollar and gold closed higher, while natural gas, oil, copper and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher, except for Russell 2000 -0.6%; Nasdaq +0.5%, S&P 500 +0.4%, and DJIA +0.3%.

- 10yr US govt bonds closed flat/1.53% yield and 30yr bonds -2bps/2.08% yield.

- CDX-NAIG closed flat/54bps and CDX-NAHY flat/305bps.

- DXY US dollar index closed +0.3%/94.27.

- Gold closed +0.1%/$1,762 per troy oz, silver -0.3%/$22.53 per troy oz, and copper -1.1%/$4.15 per pound.

- Gas markets swung sharply on Wednesday after Russia's president Vladimir Putin said his country was prepared to stabilize the soaring global energy prices that are threatening to curb industrial activity and sharply raise inflation. UK and European natural gas prices shot higher early in the day to trade at close to 10 times their level from the beginning of the year. But prices abruptly reversed course hours later when Putin hinted that Russia's state-backed monopoly pipeline exporter, Gazprom, may increase supplies to help Europe avoid a full-blown energy crisis. (FT)

- Henry Hub natural gas reached a new almost 13-year intraday high of $6.45 per mmbtu, before dropping precipitously to close -10.1%/$5.68 <span/>per mmbtu.

- Crude oil closed -1.9%/$77.43 per barrel.

- Companies shook off worries over the COVID delta variant and hired at a faster-than-expected pace in September, according to a report Wednesday from payroll processing firm ADP. Private jobs rose by 568,000 for the month, better than the Dow Jones estimate from economists of 425,000 and ahead of the downwardly revised 340,000 reading in August. The initial August report showed growth of 374,000. (CNBC)

- The Federal Reserve Bank of New York (NY Federal Reserve) for

the first time has linked the indirect risks that climate change

poses to the banking sector. The staff of the regional reserve bank

examined the impact on banks with loans to the oil and gas sector

by using a stress test approach that was developed in response to

the 2008 global subprime mortgage crisis. (IHS Markit Net-Zero

Business Daily's Amena

Saiyid)

- In a recently released report, Hyeyoon Jung, Robert Engle, and Richard Berner of the NY Federal Reserve found that the exposure for some of these banks arising from indirect climate risk to be "economically substantial."

- "This report shows that this risk is so concentrated in the equity of the world's largest banks that it could threaten their ability to retain prudential capital reserves, and in turn limit their ability to withstand financial shocks that could threaten global financial stability as a whole," IHS Markit CleanTech and Climate Executive Director Peter Gardett told Net-Zero Business Daily.

- The staff reached this conclusion after measuring climate risk in 27 large global banks in the UK, US, Canada, Japan, and France that together hold more than 80% of the syndicated loans made to the oil and gas industry.

- Their report, however, stopped short of recommending any course of action for the US Federal Reserve Board, which plans to include climate change risk as part of its framework to assess the financial stability of banks that it oversees, and is in the throes of completing a study.

- Dow announced several developments related to circular plastics

production during its 2021 Investor Day on 6 October. Each of the

moves concerns the supply of pyrolysis oil, a naphtha-like

steam-cracker feedstock derived from plastic waste. (IHS Markit

Chemical Advisory)

- In Europe, Dow has expanded on an initial 2019 agreement with Fuenix Ecogy Group to build a second plant in Weert, Netherlands, with the capacity to process 20,000 metric tons/year of waste plastics. The resulting pyrolysis oil will be used to produce circular plastics at Dow's Terneuzen site in the Netherlands.

- Dow has also finalized an agreement with Gunvor Petroleum Rotterdam, a refinery located in the Port of Rotterdam, Netherlands, to purify pyrolysis oil. Gunvor will supply the cracker-ready feedstock to Dow beginning this year. Dow is separately fast-tracking the design, engineering, and construction of a market development-scale pyrolysis oil purification unit in Terneuzen.

- In the US, Dow has established a multiyear agreement with New Hope Energy (Tyler, Texas) to supply pyrolysis oil. New Hope Energy in May announced a pyrolysis oil supply agreement with CPChem.

- Dow says it has received or is on track to receive International Sustainability & Carbon Certification (ISCC) for each of its major European and US sites. The certification, which must be renewed annually, allows Dow to guarantee the circularity of plastics supplied to customers.

- In April, Dow announced a partnership with Mura Technology to support the rapid scaling of Mura's new Hydrothermal Plastic Recycling Solution (HydroPRS) advanced recycling process. The world's first HydroPRS plant is in development in Teesside, UK, with the first 20,000-metric tons/year line expected to begin supplying feedstock to Dow in 2023.

- California will be tightening the requirements for using the

"chasing arrows" recycling symbol and when claims regarding

recyclability can be made, just one of a package of bills signed by

Gov. Gavin Newsom (D) this week. The new recycling law is likely to

affect hundreds of companies that will need to change their

labeling practices—especially those made with resins

#3-7—and opponents warn it could send more materials to

landfills. (IHS Markit Food and Agricultural Policy's Joan Murphy)

- Newsom said the bills he approved will raise consumer awareness and industry accountability and complement the $270 million investment to modernize recycling systems as part of his proposed $15 billion climate package.

- Under the legislation, products will be prohibited from showing the chasing arrows symbol unless they meet "recyclable" goals spelled out in the California Truth in Labeling for Recyclable Material legislation.

- Under current practices, the vast majority of single-use items are used once and then landfilled, incinerated or dumped into the environment, according to advocates, who say only 15% of single-use plastic is recycled.

- Newsom hailed new bills he signed the same day to limit exposure to perfluoroalkyl and polyfluoroalkyl substances (PFAS). Newsom signed AB 1200 that prohibits disposable food packaging from containing intentionally added PFAS by January 1, 2023 and requires cookware manufacturers to disclose the presence of hazardous chemicals such as PFASs on product labels and online by January 1, 2024.

- The US Department of Justice (DOJ) has announced that Taro (US), Novartis (Switzerland)'s Sandoz unit, and Apotex (Canada) have agreed to pay a total of USD447.2 million to resolve allegations of price-fixing for various generic drugs. Within this total, Taro has agreed to pay USD213.2 million, Sandoz USD185 million, and Apotex USD49 million, with these civil settlement payments being in addition to criminal payments previously paid by the companies. As part of the settlement, each of the companies has also entered into a five-year corporate integrity agreement (CIA) with the Department of Health and Human Services' Office of the Inspector General (OIG), with these CIAs including internal monitoring and price transparency provisions as well as other compliance measures. The DOJ settlement relates to allegations by the government that, between 2013 and 2015, all three companies paid and received compensation prohibited by the Anti-Kickback Statute through arrangements on price, supply, and allocation of customers with other pharmaceutical manufacturers for certain generic drugs manufactured by the companies. (IHS Markit Life Sciences' Milena Izmirlieva)

- Ouster has agreed to acquire solid-state LiDAR startup Sense Photonics in an all-stock deal, according to a company statement. Ouster says that it will buy 100% of the capital stock and property of Sense Photonics for 9.5 million Ouster shares. Once the acquisition has been completed, Ouster will establish a new business division, Ouster Automotive, which will be headed by Sense Photonics CEO Shauna McIntyre and will focus on mass-market adoption of digital LiDAR in consumer and commercial vehicle industry verticals. The new business will integrate Sense Photonics' 200-metre-range solid-state LiDAR into Ouster's multi-sensor LiDAR suite. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Prysmian Group announced that it obtained the notice to proceed with the USD 220 million contract to supply the subsea power cable system for the Vineyard Wind 1 project. The contract had been awarded in 2019. Prysmian's scope covers the design, manufacture, installation and commissioning of an HVAC cable system composed of two 220 kV three-core cables. A total of 134 km (83 mi) of power cables will be supplied. Offshore installation will be performed by Prysmian's cable lay vessels Cable Enterprise and Ulisse. The company says delivery and commissioning of Vineyard Wind 1 is scheduled for the fourth quarter 2023. The offshore wind farm will consist of 62 wind turbines that will generate 800 MW. It will be located 15 miles south of Martha's Vineyard, an island in Massachusetts. Water depth in the area ranges from 37 to 49 m (121 to 161 ft). (IHS Markit Upstream Costs and Technology's Amey Khanzode)

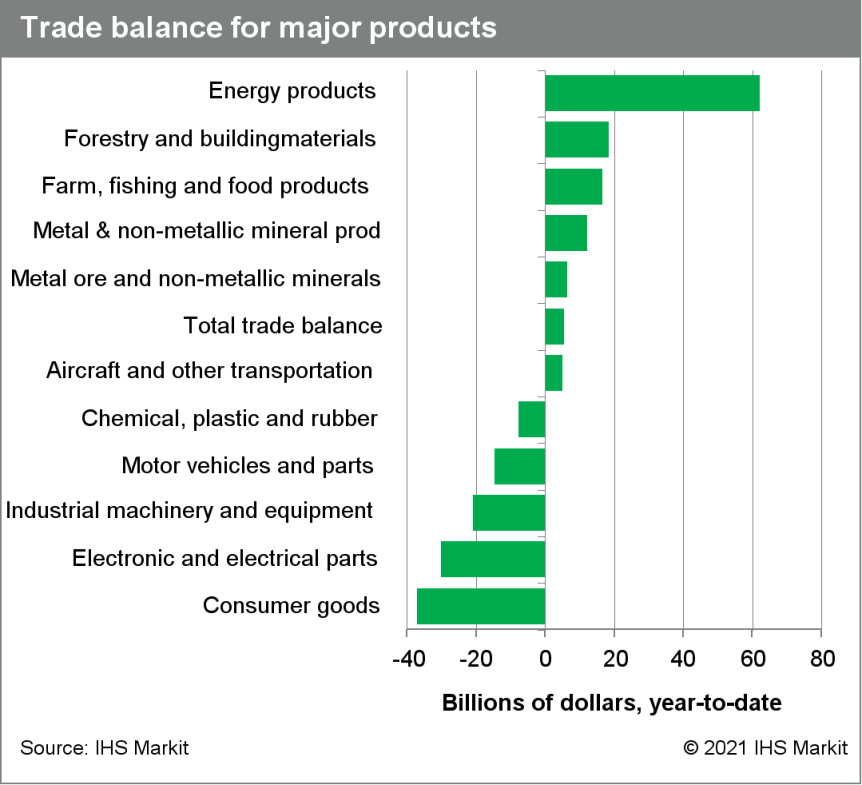

- Canada's merchandise trade balance has registered three

consecutive—and six total—surpluses in 2021 so far, after

consistent deficits since late 2014.This month's export gain was

supported by higher levels of natural gas, crude oil, and coal

pushing energy product exports up 5.1% m/m. (IHS Markit Economist

Evan Andrade)

- The merchandise trade balance reached a surplus of $1.9 billion in August, after posting a surplus of $778 million the month prior.

- Nominal exports grew 0.8% month on month (m/m) to $54.4 billion—advancing for a third consecutive month—while imports declined 1.4% m/m to $52.5 billion.

- On a volume basis, real exports advanced a further 2.3% m/m while imports fell 2.5% m/m.

- Automotive trade took a bite out of both sides of the trade

ledger, as exports fell 7.3% m/m and imports fell a further 11.1%

m/m, driven almost entirely by lower volumes.

- Dow plans to build the industry's first net-zero carbon

emissions ethylene and derivatives complex at the company's Fort

Saskatchewan, Alberta, Canada, site by 2030. The project includes a

new world-scale, 1.8-million metric tons/year (MMt/y) "net-zero

carbon emissions" steam cracker, scheduled for start-up by 2027,

according to a Dow official. That would be followed by a retrofit

of existing assets to get the entire site to net-zero Scope 1 and

Scope 2 carbon dioxide (CO2) emissions. The Fort Saskatchewan

investment includes an autothermal reformer (ATR) to convert

cracker off-gas into "circular hydrogen" for fuel in the process,

replacing natural gas or other fossil fuels. CO2 from the ATR would

be captured and transported to The Alberta Carbon Trunk Line

(ACTL). (IHS Markit Chemical Advisory)

- The project would decarbonize 20% of Dow's worldwide ethylene capacity, and downstream investment at Fort Saskatchewan would grow polyethylene (PE) supply by 15%, the company says. The project would more than triple Dow's ethylene and PE capacity from its Fort Saskatchewan site.

- Dow announced the project at its 6 October investor day, where it also set a target to generate $3.0 billion/year of additional EBITDA over the next decade while keeping capital expenditures at or below depreciation and amortization levels of roughly $2.9 billion/year across the cycle. Roughly $1 billion of the EBITDA growth would come from the Fort Saskatchewan investment. Dow also announced broader carbon-reduction actions today, including additional renewable energy agreements in the Americas and Europe, and plans to provide initial supply of fully circular polymers to customers starting in 2022. The Fort Saskatchewan investment is subject to final approval by Dow's board and various regulatory agencies.

- Mexico's President Andrés Manuel López Obrador (AMLO) sent a

constitutional amendment draft law to Congress on 1 October that

seeks to strengthen the state's role in the power, lithium, and

hydrocarbon sectors. The president has said that he would pursue

implementation even if the amendment fails to be approved in

Congress, but is likely to first pressure opposition lawmakers by

accusing them of wrongdoing and subjecting them to personal public

pressure in efforts to secure the required two-thirds majority.

(IHS Markit Country Risk's Jose Enrique Sevilla-Macip)

- The amendment reinforces a policy that is already under implementation. The bill's key objective is to ensure that the state--owned utility company, the Federal Electricity Commission (Comisión Federal de Electricidad: CFE), controls at least a 54% share of the generation market (by reference to government-assessed generating capabilities), with the remainder to be held by private sector firms. According to government figures, 62% of total national demand is currently covered by private generators while the CFE provides 38%. Within the proposed adjustment, the CFE would assume the functions of the National Centre of Energy Control (Centro Nacional de Control de Energía: CENACE), which is currently the independent organization responsible for operating the country's power grid.

- A ban on private-sector lithium mining is likely to slow development in the three-year outlook. AMLO's proposal includes a ban on private exploitation of lithium, reflecting the importance that his government assigns to the mineral in its energy transition policy. However, lithium-mining concessions already granted to the private sector would be respected if companies provide evidence that exploration work is under way. As of February, there were 36 private lithium-mining projects registered with Mexico's Ministry of the Economy (Secretaría de Economía: SE), but only three companies were active: Canada's Organimax and One World Lithium and British-Chinese owned Bacanora Lithium.

- The failure to approve the amendment by 2022 would encourage AMLO to develop an increasingly radical stance ahead of a potential presidential recall referendum. If MORENA is unable to gain approval for the bill by 2022, the issue is likely to become key in the campaign for a referendum over presidential recall, legally scheduled for April 2022 but dependent on obtaining sufficient public backing (by way of signatories seeking recall).

Europe/Middle East/Africa

- All major European equity indices closed lower; UK -1.2%, France -1.3%, Italy -1.4%, Germany -1.5%, and Spain -1.7%.

- Most 10yr European govt bonds closed lower except for UK -1bp; Germany/France/Spain +1bp and Italy +3bps.

- iTraxx-Europe closed +1bp/52bps and iTraxx-Xover +8bps/266bps.

- Brent crude closed -1.8%/$81.08 per barrel.

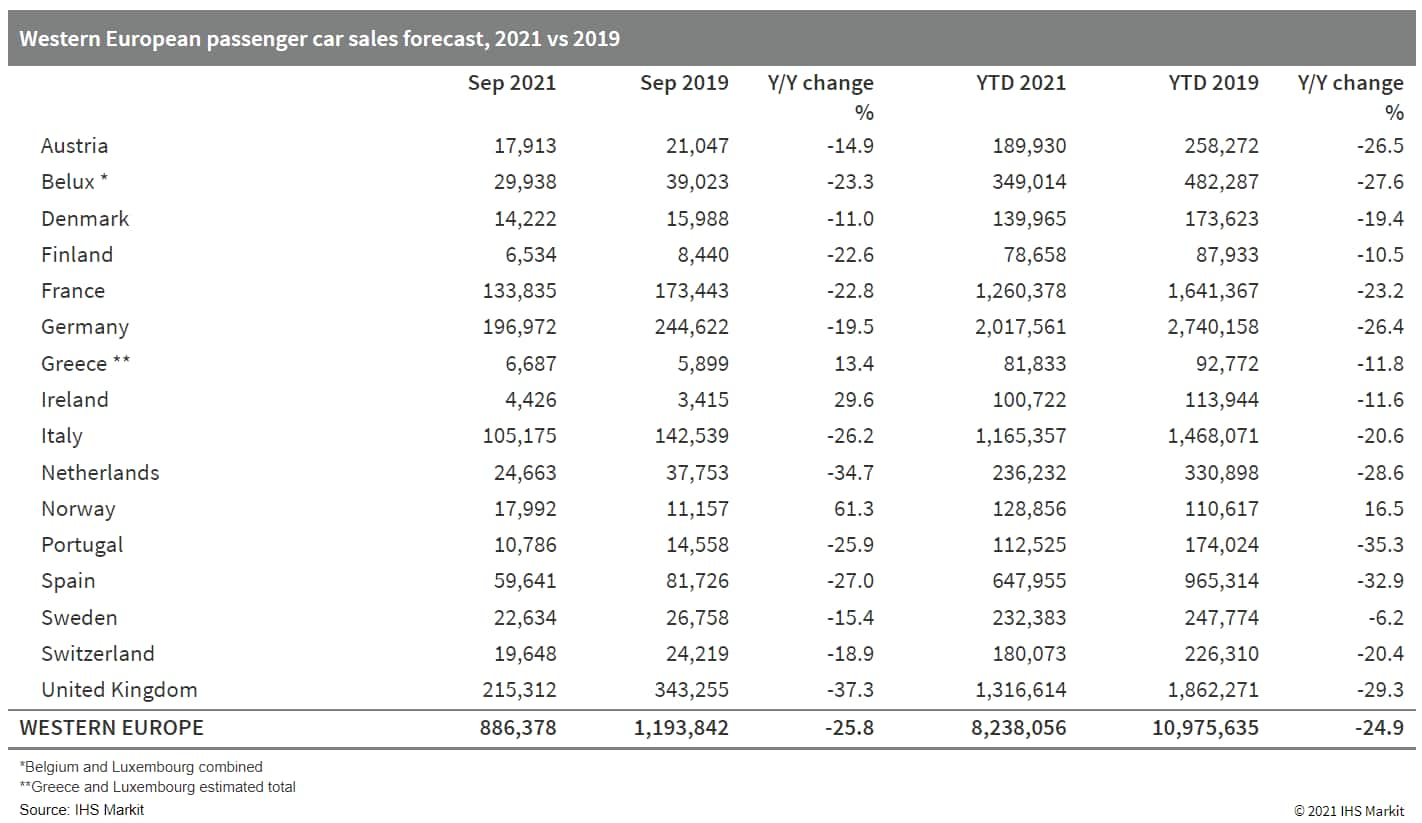

- Western European passenger car registrations fell back further

during September. According to our latest forecast, registrations

in the region declined by 26% year on year (y/y) last month to

886,378 units. Nevertheless, earlier substantial gains have helped

to keep volumes in positive territory in the year to date (YTD).

For the first three quarters of 2021, registrations are up 6.5% y/y

at around 8.238 million units. The further downswing in the market

during September has led to the seasonally adjusted annual rate

(SAAR; D11) falling back to 9.643 million units, while the final

trend cycle (D12) figure sits at 9.830 million units. We have also

published a comparison with 2019 data that underlines the continued

weakness of the market compared with pre-COVID-19 pandemic levels,

showing a 25.8% decline last month compared with September 2019 and

a 24.9% retreat when comparing the YTD 2021 and 2019 figures. Last

month was yet another weak one for Western Europe following a

relatively flat September 2020. One of the big factors dragging

down the performance last month was a lack of supply of vehicles

due to the ongoing semiconductor shortage, which has been hitting

output around the world and is continuing to do so. Besides the

direct impact on the supply of vehicles to customers from

factories, the duration of the shortage has depleted inventories to

much lower levels than usual as OEMs have been unable to restock.

(IHS Markit AutoIntelligence's Ian Fletcher)

- Denmark hopes to become a leader in sustainable farming by setting a goal to reduce greenhouse gas emissions in agriculture by at least 55%. On 4 October, the Danish government announced the new 2030 target after agreeing a green farming strategy with a majority of the country's political parties. The strategy outlines different measures the government will support to achieve the needed 7.4 million tons of carbon dioxide-equivalents (CO2e) reduction by 2030. It sees the greatest potential in the country's large livestock sector, with a four million ton decrease of CO2e possible through biorefineries, better management of manure and feed additives. It hopes another one million tons of CO2e can be reduced through doubling the country's organic area and rewetting around 100,000 hectares of low-lying land. The remaining reduction would be met through other measures including the promotion of protein-rich crops, afforestation and extensification of existing farms while there is another target to reduce nitrogen emissions by 10,800 tons by 2027.The government said farmers must be incentivized to switch to more sustainable production and it will spend around 3.8 billion Danish kroner (€383 million) to help food producers adapt to this transition. (IHS Markit Food and Agricultural Policy's Steve Gillman)

- According to the preliminary monthly GDP data published by

Statistics Sweden (SCB), Sweden's GDP decreased by 3.8% month on

month (m/m) in August. In annual terms, however, the economic

output was still higher than a year ago by 2.4%. (IHS Markit

Economist Marie-Louise Deshaires)

- Exports of goods were the main contributor to this downturn. In August, Swedish exports of goods amounted to SEK115.0 billion, while imports of goods amounted to SEK125.3 billion. As a result, the net trade balance was -SEK10.3 billion. The bulk of the deficit came from trade of goods with EU countries. Trade of goods with countries outside the European Union resulted in a surplus of SEK6.4 billion, while EU trade resulted in a deficit of SEK16.7 billion. While the EU trade deficit moderately widened compared with July (SEK13.7 billion), the non-EU trade surplus narrowed significantly by almost SEK14 billion, mainly driven by a SEK9-billion contraction in the exports of goods to non-EU trading partners.

- Household consumption also decreased in August, for the second consecutive month, dropping by 1.1% compared with July. On an annual basis, household consumption increased by 4.6%. The main annual positive contribution came from spending on recreation and culture and goods, while the largest negative impact resulted from a drop in the consumption of other goods and services.

- According to the latest monthly production value index (PVI) published by the SCB, calendar-adjusted private-sector output in August decreased by 4.7% m/m. On an annual basis, private-sector production still rose by 3.4% year on year (y/y), driven by a 5.3% y/y increase in service production. Among private service fields, the information and communications industry contributed the most to private-sector production, growing by 13.1% y/y. Motor vehicle sales, in contrast, contributed negatively to services production, decreasing by 4.4% y/y.

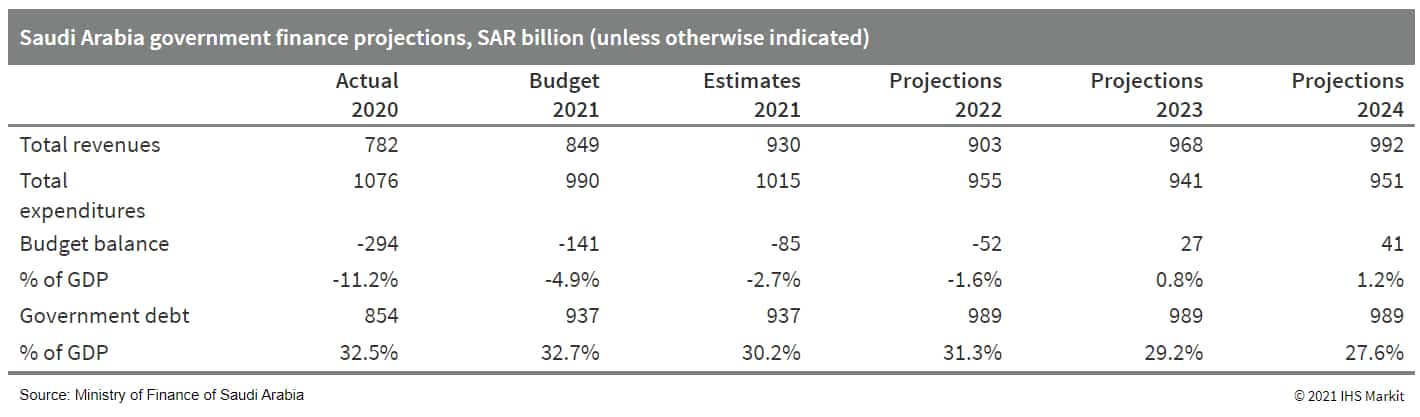

- The Saudi Ministry of Finance has published a pre-budget

statement for the year 2022 including updated annual fiscal

projections until 2024. Compared to the previous budget statement

from December 2020, the revenue projection for 2021 has been lifted

considerably, which is mainly due to the higher oil price level.

The latter had been projected at USD50 per barrel for 2021, but the

recovery of the price in the first half of the year allowed the

ministry to increase the projections to an average annual level of

USD67 per barrel for 2021 and lift the revenue outlook as a result.

(IHS Markit Economist Ralf

Wiegert)

- The revenue outlook for 2022 through 2024 has been increased, too, although the nominal revenues for 2022 (SAR903 billion or USD241 billion) are actually lower compared to the estimated revenues for 2021 (SAR930 billion). Given that the outlook for GDP growth has been lifted strongly for 2022 to a rate of 7.5% (from 3.4% as published previously), the only plausible reasons for why revenues should decline in 2022 is either a markedly lower oil price assumption or a reduction of the value-added tax (VAT) rate and, hence, non-oil revenues. The latter seems more likely given that Crown Prince Mohamed bin Salman had signaled that the VAT rate would be dialed back as soon as the budget balance had been restored.

- The spending outlook has been confirmed, although expenditure

estimates for 2021 were raised from SAR990 billion in the previous

budget statement to SAR1,015 billion in the update. This means that

spending is still expected to decline in 2022 and 2023; spending

will edge up slightly only from 2024 onwards. IHS Markit remains

cautious about these conservative spending projections and we

continue to assume a slightly higher expenditure path.

- After contracting 26% y/y in the second quarter of 2020 on the

back of strict COVID-19 pandemic-related restriction measures

introduced in April 2020, Botswana's real GDP expanded by 36% y/y

during the second quarter of 2021. The record growth rate largely

reflects low base effects and a gradual resumption of economic

activities postponed or restricted due to measures taken by the

government to curb the spread of the COVID-19 virus. On a quarterly

basis, Botswana's real GDP growth decelerated to 0.2% in the second

quarter, from 5% in the first quarter. (IHS Markit Economist Archbold

Macheka)

- Economic growth in the second quarter was broad-based, with activity in all industries expanding, except agriculture, forestry and fishing, which contracted 8.4% y/y as real value added of livestock farming shrank 17.2% y/y because fewer cattle were marketed during the quarter under review. The public administration and defence sector, which remained the major contributor to GDP, accounting for 18.5%, grew 5.6% y/y in the second quarter of 2021, compared with 1.3% y/y in the second quarter of 2020.

- Mining and quarrying accounted for 14.2% of total GDP by growing 153% y/y in the second quarter of 2021, after declining 60.8% y/y in the corresponding quarter in 2020. The sharp rebound was driven mainly by a significant increase in the diamond industry's real value added of 172.2% y/y. This increase was thanks to diamond production in carats, which surged by 202.8% y/y as rough diamond demand gradually picked up.

- Although still not functioning at full capacity, Botswana's economy is not far off its pre-pandemic growth pace, but various hurdles to maintaining this growth path persist. The country's COVID-19 vaccine rollout has been slow, with only 234,777 people, representing 9.8% of the total population, fully vaccinated as of 4 October. Botswana is securing its vaccines under the World Health Organization-backed COVAX scheme and has signed up for 940,800 doses, but has so far received less than 10% of the total order. Additional agreements to supply vaccines have been reached with mainland China and US pharmaceutical company Moderna, while donations have since come in from India and mainland China.

Asia-Pacific

- All major APAC equity markets closed lower; Hong Kong -0.6%, Australia -0.6%, India -0.9%, Japan -1.1%, and South Korea -1.8%.

- LG Electronics has said that its advanced driver assistance systems (ADAS) front camera will be deployed in the Mercedes-Benz C-Class, reports the Yonhap News Agency. The camera, which is co-developed by LG Electronics and Daimler, enables vehicle assist functions such as automatic emergency braking (AEB), lane keeping assist, lane departure warning (LKA), and traffic sign recognition. It said that the camera is powered by algorithms developed by its vehicle components solutions (VS) business unit, incorporating technologies of telecommunications, telematics, and image recognition, as well as artificial intelligence (AI) and deep learning. It has obtained ISO 26262 certification from independent inspection body TÜV SÜD. LG Electronics is expanding its presence in the future mobility sector with three focus areas: infotainment, powertrain, and auto lighting systems. The VS division reported sales of KRW5.80 trillion in 2020, up by 6.1% from 2019. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- US-based wireless charging technology company WiTricity has announced that its patented electric vehicle (EV) charging technology is all set to debut in the South Korean market soon. The wireless EV charging technology will be first made available as factory-installed equipment in Hyundai's Genesis GV60 electric utility vehicle, the first dedicated EV under the Genesis brand (see South Korea: 30 September 2021: Genesis unveils its first dedicated EV, the GV60). The GV60 will initially be available for sale in South Korea. Notably, the Hyundai Motor Group had previously demonstrated WiTricity's wireless charging technology at the 2018 Geneva Motor Show. According to WiTricity, the concept of wireless charging also has the potential to provide vehicle-to-grid (V2G) power and dynamic charging to power vehicles in motion in the future. (IHS Markit AutoIntelligence's Jamal Amir)

- Ola has acquired geo-analytics technology platform GeoSpoc for

an undisclosed amount, reports Livemint. This acquisition will

enable Ola to build next-generation mapping technology by

converting satellite imagery into real-time maps as well as 3D,

high-definition (HD), and vector maps. la, which operates in over

100 cities in India, has expanded to several international markets,

including Australia, New Zealand, and the United Kingdom. Enhanced

geo-spatial services will provide Ola with improved urban planning,

including road networks, better public transportation, and to

pre-empt congestion spots. (IHS Markit Automotive Mobility's

Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-october-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-october-2021.html&text=Daily+Global+Market+Summary+-+6+October+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-october-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 6 October 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-october-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+6+October+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-october-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}