Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 06, 2020

Daily Global Market Summary - 6 August 2020

Gold prices broke above a new record (again) and yields on the long end of the AAA tax-exempt municipal bond curve breached the lowest yields on record. US and European benchmark government bonds also closed higher on the day, while iTraxx and CDX indices were close-to-flat across IG and high yield. Most US equity markets closed higher, while APAC was mixed and Europe was lower across the region. US initial claims for unemployment insurance declined versus last week, which provides some additional insight on the US employment situation ahead of tomorrow's 8:30am EST release of the US non-farm payrolls report.

Americas

- US equity markets closed higher except for Russell 2000 -0.1%; Nasdaq +1.0%, DJIA +0.7%, and S&P 500 +0.6%.

- 10yr US govt bonds closed -2bps/0.54% yield.

- CDX-NAIG closed -1bp/64bps and CDX-NAHY -3bps/390bps.

- Gold futures closed +1.0%/$2,069 per ounce and reached a new record intraday high of $2,081 per ounce at 9:40am EST.

- The oldest gauge of municipal yields, the Bond Buyer index of those on 20-year general-obligation bonds, now stands at 2.09%, the lowest since 1952. (Bloomberg)

- Yields closed 4bps lower today across the IHS Markit AAA

Municipal Analytics Curve for tax-exempt maturities of 5yrs or

longer.

- Crude oil closed -0.6%/$41.95 per barrel.

- Seasonally adjusted US initial claims for unemployment

insurance, at 1,186,000 in the week ended 1 August, remained at

historically high levels, although well below the all-time high of

6,867,000 in the week ended 28 March. Since the initial spike in

mid-March, initial claims have remained at levels unprecedented

before the COVID-19 pandemic, averaging 1.406 million per week over

the last nine weeks. (IHS Markit Economist Akshat Goel)

- The seasonally adjusted number of continuing claims (in regular state programs), which lags initial claims by a week, fell by 844,000 to 16,107,000 in the week ended 25 July. The insured unemployment rate in the week ended 25 July fell 0.6 percentage point to 11.0%.

- There were 655,707 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 1 August. In the week ended 18 July, continuing claims for PUA fell by 70,075 to 12,956,478.

- In the week ended 18 July, 1,144,429 individuals were receiving Pandemic Emergency Unemployment Compensation (PEUC) benefits.

- The Department of Labor provides the total number of people claiming benefits under all its programs with a two-week lag. In the week ended 18 July, the unadjusted total rose by 492,816 to 31,308,678. Of this total, 53% are from regular state programs and 41% from the PUA program.

- US employers announced 262,649 planned layoffs in July,

according to Challenger, Gray & Christmas—up 54% from

June's 170,219. In terms of record months, April of this year

remains steadfastly in first place, followed by May and then July

in terms of announced job cuts. Prior to the COVID-19 pandemic, the

highest monthly total of job cuts was 186,350 in February 2009.

(IHS Markit Economist Rebecca Mitchell)

- July was the fifth month to report job-cut announcements specifically because of the COVID-19 pandemic. However, just as in the prior months of this pandemic, the number does not include the furloughed workers.

- Year to date, 1,847,696 job cuts have been announced, 212% higher than the same period in 2019. The current year-to-date total is also only about 100,000 away from the 2001 total, which was the highest annual total on record. This year will almost certainly surpass 2001.

- Of the total job cuts announced so far this year, over a million were because of COVID-19, according to employers.

- According to Andrew Challenger, senior VP of Challenger, Gray & Christmas, "the lapse in extended unemployment benefits for millions of Americans will significantly impact the economy, as we see more employers announce they are cutting jobs permanently. The downturn is far from over, especially as COVID cases rise around the country. Consumers are buying fewer goods and services, businesses are closing, and bankruptcies are rising."

- Unsurprisingly, the hardest-hit sector and recipient of the lion's share of the coronavirus-related cuts continues to be the entertainment/leisure sector, which encompasses bars, restaurants, hotels, and amusement parks. Year to date, companies in the entertainment/leisure sector have announced 781,780 cuts, 8,309% higher than during the same period in 2019.

- Rounding out the top five most adversely affected sectors year to date were retail (163,112 job cuts), services (121,741 job cuts), transportation (105,026 job cuts), and automotive (83,853 job cuts).

- According to Challenger tracking, the number of hiring announcements (246,507) in July almost equaled the number of job cuts as the economy continues to be reshaped by COVID-19. The bulk of the hiring announcements were in warehousing (100, 340) as more Americans turn to online shopping, followed by government (22,024), and services (33,485).

- Offshore drilling contractor Noble Corporation reported a net

loss of USD42 million on total revenues of USD238 million for the

second quarter of 2020, compared to a loss of USD1.1 billion on

revenues of USD281 million in the first quarter of the year. (IHS

Markit Upstream Costs and Technology's Matthew Donovan)

- Results for the second quarter included net after tax favorable items totaling USD47 million. Excluding these items, Noble would have reported a net loss of USD89 million for the quarter.

- Contract drilling services revenues for the second quarter totaled USD220 million, compared to USD267 million in the first quarter, decreasing largely due to a decline in total fleet operating days.

- Noble entered into a restructuring support agreement (RSA) with two groups of the largest holders of its outstanding bond debt. This will be implemented through a voluntary Chapter 11 process. Noble expects to emerge from Chapter 11 before the end of 2020 and will continue to operate as usual during the bankruptcy.

- The RSA calls for all of the company's bond debt, currently over USD3.4 billion, to be converted into equity of the reorganized company. In addition, Noble's major bond holders have agreed to invest USD200 million of new capital in the form of new second lien notes. At emergence, liquidity is expected to be further enhanced by a new USD675 million secured revolving credit facility.

- General Motors (GM) and charging station company EVgo have announced a new partnership to increase the number of electric vehicle (EV) fast-charging plugs by 2,700 across the United States over the next five years. According to a joint statement, this partnership will triple the size of the EVgo fast-charging network. This program is aimed at cities and suburbs, including creating increased charging access for drivers who live in multi-unit homes, rental homes, or homes where a charger cannot be installed, or who might not have access to workplace charging. Under the partnership, fast charging stations will be located where people typically spend 15 to 30 minutes at a time; for example, so customers can charge their EV while doing errands. Locations of stations will include grocery stores, retail outlets, entertainment centers, and other high-traffic locations. EVgo currently has a network of 800 station locations across the US. The program will see the first stations available in early 2021, and the partners say that most stations will be able to charge up to four vehicles at one time. Some will incorporate new charging technology for supporting 100 to 350 kW charging capabilities. In addition, the companies say these new fast chargers will be powered by 100% renewable energy, which EVgo began contracting for in 2019. GM plans to have all its US plants running on renewable energy by 2030 and all its plants globally by 2040. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Electric vehicle (EV) startup Nikola, which has begun trading

on the NASDAQ stock exchange, has reported its financial results

for the second quarter. The company reported disruptions to its

supply chain as a result of the COVID-19 pandemic, stating that

mitigation efforts are under way. Nikola reported an USD86-million

loss in the second quarter, up from a USD17-million loss in the

second quarter of 2019. (IHS Markit AutoIntelligence's Stephanie

Brinley)

- The company also reported achieving several operational milestones during the second quarter, including having begun test unit production of the Nikola Tre in Ulm, Germany, scheduled to be completed in the fourth quarter.

- Nikola also confirmed that, once completed, the facility will have a production capacity of up to 10,000 vehicles per year; the first vehicles will be delivered to US customers.

- Once construction of Nikola's plant in Arizona, United States, is completed, the Ulm facility will supply the European market only.

- Phase one of construction of the company's Arizona plant began in July, and Nikola expects that phase to be completed by the fourth quarter of 2021.

- The startup confirmed as well that once its US plant is completed, it will be capable of producing 35,000 trucks per year at full capacity on two shifts.

- Nikola also stated it has hired a head of global manufacturing, Mark Ducheshne, to oversee the buildout of the plant.

- Nikola has also hired a new president of Nikola Energy, Pablo Koziner, to oversee the company's hydrogen fueling and battery charging activities.

- Nikola has not begun production and sales of its new vehicles, so losses are to be expected. The company took advantage of the required briefing on its financial results to summarize a variety of planned actions as it moves towards beginning production.

- BorgWarner has reported net sales of USD1.46 billion in the

second quarter, down 44% year on year (y/y) amid the COVID-19

pandemic. Excluding the impact of foreign currencies and the net

impact of acquisitions and divestitures, net sales were down 43%

y/y. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The supplier posted a net loss of USD84 million in the second quarter, compared with net income of USD172 million in the second quarter of 2019.

- BorgWarner's operating loss was USD78 million in the second quarter, or 5.5% of net sales.

- The supplier's net sales in the engine segment stood at USD826 million in the second quarter, compared with USD1.57 billion in the corresponding period a year earlier.

- The supplier's net sales in the drivetrain segment stood at USD607 million in the second quarter, compared with USD998 million in the corresponding quarter of 2019.

- BorgWarner's adjusted EBIT were USD29 million in the engine segment and USD1 million in the drivetrain segment in the second quarter, compared with USD249 million and USD102 million, respectively, in the second quarter of 2019.

- In the first quarter of 2020, BorgWarner implemented cost-containment measures. Additionally, on 5 August, BorgWarner announced that it is supplying components for the upcoming Ford Mustang Mach-E electric sport utility vehicle (SUV), specifically the supplier's integrated drive module (IDM) for both rear- and all-wheel-drive (AWD) configurations, as well as the secondary drive unit to power the front wheels on the AWD GT version.

- Delphi reported that its net revenues declined 44% year on year

(y/y) to USD628 million in the second quarter of 2020 as OEM

production was halted for weeks early in the quarter, in reaction

to the COVID-19 virus pandemic. Delphi also noted the impact of a

downward trend in passenger car diesel fuel-injection systems in

Europe, partially offset by growth in advanced gasoline (petrol)

direct-injection fuel systems. (IHS Markit AutoIntelligence's

Stephanie Brinley)

- There was a net loss attributable to Delphi of USD60 million in the second quarter, down from income of USD56 million in the same period of 2019.

- Adjusted operating loss for the quarter was USD43 million, versus USD81 million adjusted operating income in the second quarter of 2019.

- Delphi reports four segments: fuel-injection systems, powertrain products, electrification and electronics, and aftermarket. All four posted declines in the first quarter.

- Fuel-injection systems is the largest division with sales of USD238 million in the second quarter, followed by powertrain products at USD142 million.

- Electrification and electronics posted sales of USD155 million, while the aftermarket division recorded sales of USD128 million.

- Fuel injection systems and electrification and electronics recorded adjusted operating losses of USD29 and USD5 million, respectively, powertrain products and aftermarket saw adjusted operating income of USD7 and USD6 million, respectively.

- Argentine authorities announced on 4 August the postponement of

the deadline to join a debt-restructuring agreement to 24 August

2020. One of the main bondholder committees, Ad Hoc, confirms the

intent to sign on the latest debt-restructuring agreement. (IHS

Markit Economist Paula Diosquez-Rice)

- Argentine authorities have announced the main points of the latest version of the proposed agreement that includes, among others, an estimated new nominal value of nearly USD55 per USD100 of nominal debt, a change in the payment dates (to 9 January and 9 July), and a change in the maturity for the bonds to be issued as compensation for accrued interests and for additional consents to July 2029.

- Argentina's Ministry of Economy's official statement asserts that the country will adjust certain aspects of the collective action clause in the new/replacement bonds, requested by the bondholder committees, but only if there is evidence of a general support from the general international community. The government emphasized the sustainability of the agreement's debt-service schedule as the hefty payment load moves to 2028-30.

- Meanwhile, more than half of the Argentine provinces are also negotiating a debt restructuring; although already in non-payment status, the governor of the Buenos Aires province extended the deadline to reach an agreement with bondholders to 14 August.

- If the agreement stands, Argentina should formalize its ninth external debt default in history on 4 September and effectively push the hefty financial load to the next government. This implies that the country needs to achieve stellar economic growth in the next four years or significantly reduce the fiscal deficit in order to avoid further accumulation of debt and the eventual default.

Europe/Middle East/ Africa

- European equity markets closed lower across the region; Italy -1.3%, Spain -1.2%, UK -1.3%, France -1.0%, and Germany -0.5%.

- 10yr European govt bonds closed higher across the region; Italy/Spain -4bps, France/Germany -3bps, and UK -2bps.

- iTraxx-Europe closed flat/56bps and iTraxx-Xover +4bps/347bps.

- Brent crude closed -0.2%/$45.09 per barrel.

- The Bank of England's Monetary Policy Committee (MPC) voted

unanimously to maintain the Bank Rate at 0.1% at its meeting ending

on 4 August. The MPC also voted unanimously for the Bank to

continue with its existing programs of UK government bond and

sterling non-financial investment-grade corporate bond purchases,

financed by the issuance of central bank reserves, maintaining the

target for the total stock of these purchases at GBP745 billion

(USD981 billion) by the latter stages of this year. (IHS Markit

Economist Raj Badiani)

- As of 4 August, the total stock of the Asset Purchase Facility was GBP662 billion, representing a rise of GBP217 billion as part of the programs of asset purchases announced on 19 March and 18 June.

- The Bank, as expected, overhauled its May growth projections. A less negative assessment of the second quarter implies that the Bank expects the economy to contract by 9.5% in 2020 as opposed to the 14% figure published in May. It argues that the recovery has occurred "earlier" and has been "more rapid" than it had assumed in May, reflecting a faster easing of lockdown restrictions and a return to pre-COVID-19 virus levels for spending on clothing and household furnishings. However, the Bank acknowledges that leisure spending and business investment remain subdued, which will weigh down on the recovery.

- The Bank had expected the economy to grow by 15% in 2021 and to return to its pre-virus peak by the middle of next year, and then expand by 3.0% in 2022. It now projects the economy to expand by 9% in 2021 and 3.5% in 2022, with the economy forecast to return to its pre-COVID-19 level by the end of 2021. The Bank accepts that the outlook for growth is now "unusually uncertain", and the projections are "indicative" or "a less informative guide than usual".

- The Bank's less positive outlook for 2021 reflects entrenched concerns about labor market developments. The Bank reports falling employment since the COVID-19 outbreak but acknowledges that job losses have been curtailed "by the extensive take-up of support from temporary government schemes". However, it worries that employment prospects could be increasingly negative once the support schemes are withdrawn completely, which could push the unemployment rate to around 7.5% by the end of 2020.

- UK registrations of light commercial vehicles (LCVs) with a

gross vehicle weight of less than 3.5 tons have grown during July,

according to data published by the Society of Motor Manufacturers

and Traders (SMMT). (IHS Markit AutoIntelligence's Ian Fletcher)

- LCV demand increased by 7.1% y/y to 27,701 units in the United Kingdom in July. Sales in nearly all categories improved last month. This included the popular category of vans with a GVW of 2.5-3.5 tons, registrations in which increased by 5.4% y/y to 17,566 units.

- An even bigger improvement was seen for vans with a GVW of 2.0-2.5 tons, registrations of which grew by 12% y/y to 4,083 units, although registrations of vans with a GVW of less than 2 tons decreased 22% y/y to 1,468 units.

- Pick-up registrations saw an improvement of 24.9% y/y to 3,893 units, while registrations in the low-selling commercial 4x4 category jumped by 78.1% y/y to 203 units.

- Despite the market improvement last month, registrations of vans with a GVW of less than 3.5 tons were down by 38.6% y/y to 136,577 units during the first seven months of this year.

- Registrations of the bigger rigid LCVs with a GVW of 3.5-6 tons increased by 15.9% y/y to 634 units in July. In the year to date (YTD), registrations in this segment are down by 27.2% y/y to 3,190 units.

- Uber has agreed to acquire UK-based company Autocab, which sells booking and dispatch software to private hire firms, reports Bloomberg. This deal will help Uber to expand its reach in the UK, as it will allow riders to connect to local drivers in areas where it does not currently operate. According to the report, Uber will expand its operations from 40 locations to about 170; and this integration will be only rolled out in the market where Uber is not available. Jamie Heywood, Uber's Northern and Eastern European head, said, "Autocab has worked successfully with taxi and private hire operators around the world for more than thirty years and Uber has a lot to learn from their experience". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Petrofac has signed a memorandum of understanding (MOU) with Storegga Geotechnologies, an independent clean energy company. The MOU builds new energy capability and capacity in the UK and represents a significant strategic step in Petrofac's continued expansion into new and renewable energy. The agreement supports Petrofac and Storegga to collaborate on potential business development and project initiatives in carbon capture and storage, hydrogen and other low carbon projects. With an initial focus on the UK and north west Europe, the MOU also includes scope for the parties to work together internationally. Petrofac was recently awarded a project management office support contract for the Acorn project with Pale Blue Dot, of which Storegga is the holding company. (IHS Markit Upstream Costs and Technology's William Cunningham)

- According to a string of data releases by Ireland's Central

Statistics Office (CSO) for June and July, activity has picked up

sharply after COVID-19 virus-related restrictions were eased from

mid-May. Ireland is currently in the third phase (out of five) of

its reopening strategy. (IHS Markit Economist Daniel Kral)

- The CSO has reported that overall retail sales were up by 38.4% month on month (m/m) in June, surpassing the level in January by 2.3%. Retail sales of food were flat m/m in June, but were up by 13.1% compared with January, and non-food retail sales excluding motor trades and bars were up by 51.3% m/m, and 4.5% since January.

- Among the main sub-categories, the largest increases were recorded in textiles, clothing, and footwear (+284.2%), motor trades and automotive fuel (+90.4%), and household equipment (+55.5%).

- Despite the extremely high growth rate in the first of these categories, sales levels were still 16.9% below January levels. Retail sales in bars, which can only serve takeaway food, were still down by more than 80% compared with January.

- The share of turnover generated by online sales declined from its peak of 15.3% in April to 6.8% in June, although the June figure is likely to be adjusted. However, this still represents more than double the average for 2019, when online sales accounted for just 3.3% of turnover.

- In a separate release, the CSO has reported that the adjusted unemployment rate in July dropped to 16.7% from its peak of almost 29% in April. The adjusted unemployment rate includes recipients of the Pandemic Unemployment Payment (PUP), who are excluded from the standard definition.

- The unemployment rate among men is slightly lower than among women, at 16.5% versus 16.9%, respectively, although the difference has narrowed since April. The unemployment rate among 15-to-24-year-olds stood at 41% in July, down from 62% in May.

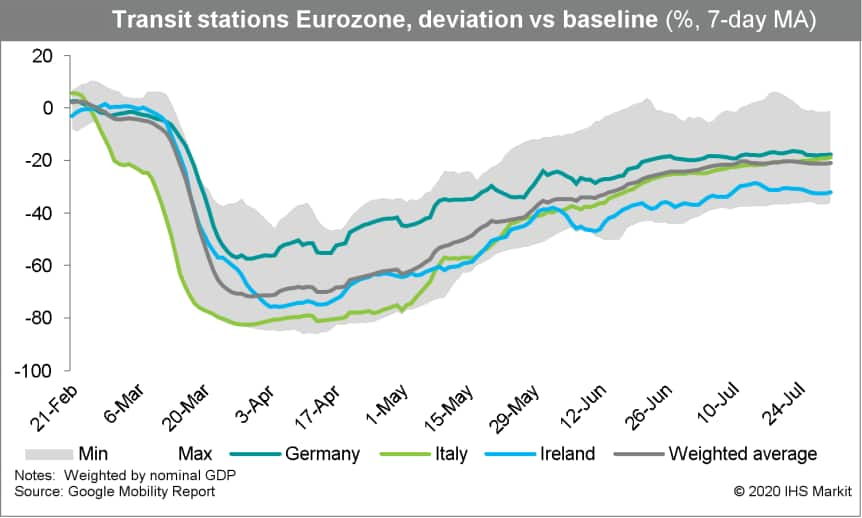

- According to Google's mobility data, the recovery in retail

footfall in Ireland continued in July but remained the lowest in

the eurozone, due to the slow easing of restrictions in Ireland.

The recovery in traffic at transit stations has levelled off across

the eurozone and Ireland and remains significantly below

pre-pandemic levels, indicating continued widespread working from

home.

- Ireland's passenger car market has retreated by 14.1% year on

year (y/y) during July, according to the latest data released by

the Society of the Irish Motor Industry (SIMI) and published by

beepbeep.ie. (IHS Markit AutoIntelligence's Ian Fletcher)

- Demand last month dropped to 21,213 units, from 24,681 units in the year-before period. Leading the market last month was Volkswagen (VW), which registered 2,654 units, a decline of 5.3% y/y.

- Behind VW was Toyota with 2,406 units, as its registrations contracted by 23.6% y/y.

- However, Ford, in third place, saw an improvement of 14.5% y/y to 1,946 units, boosted by the latest-generation Kuga and Focus.

- Furthermore, the very steep declines in registrations as a result of the COVID-19 virus outbreak in earlier months of 2020 are still in evidence in the year-to-date (YTD) figures.

- In the first seven months of the year, Ireland's passenger car registrations fell by 29.8% y/y to 74,069 units.

- Registrations in Ireland's light commercial vehicle (LCV) market also decreased last month, by 5.5% y/y to 4,438 units.

- In the YTD, LCV registrations are down by 25% y/y to 15,009 units.

- The medium and heavy commercial vehicle (MHCV) category recorded an improvement of 2.8% y/y to 258 units in July, although earlier declines during 2020 mean that MHCV registrations are down by 28.8% y/y at 1,461 units in the YTD.

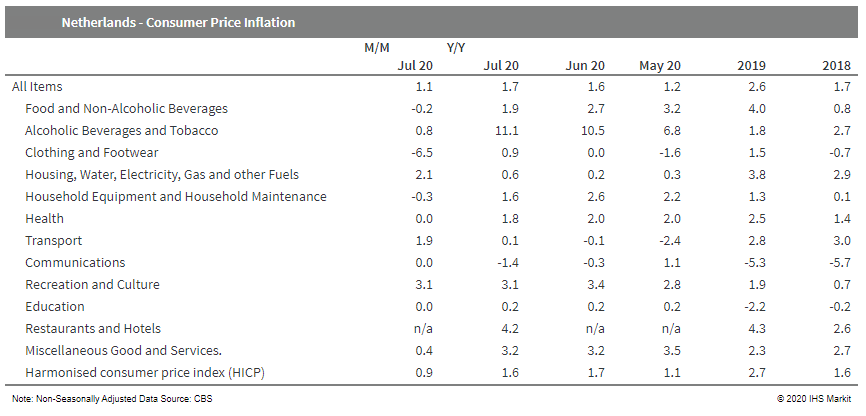

- Dutch consumer prices increased by 1.7% year on year (y/y) and

1.1% month on month (m/m) in July, according to the national

consumer price index (CPI) measure, and by 1.6% y/y and 0.9% m/m

according to the EU-harmonized measure. This means that the large

positive differential in headline and core inflation versus the

eurozone, present through 2019, remains wide but has narrowed a

little. (IHS Markit Economist Daniel Kral)

- Among the biggest drivers of the increase in July were prices of alcohol and tobacco, which increased by 11.1% y/y, after a similar rise in June, following a rise in excise duties from 1 April and the sale of old stocks (see table below).

- The statistics office (CBS) also notes that prices for stays in bungalow parks and rents have contributed to headline inflation in July. The former rose by 1.8% and the latter by 2.9% y/y. Final results on developments in rent prices will be published on 7 September.

- Core inflation remained at 2.6% y/y in July, the same as in

June. This was among the highest rates in the eurozone, linked to a

still historically tight labor market due to limited employment

losses thanks to government support measures.

- A majority stake of Spanish vegetable canner Alsur - Sola de Antequera S.A - was recently acquired by Washington private equity investment firm ACON investments, it was announced on August 3, 2020. Terms of the transaction were not disclosed. Founded in Spain by the Jimenez Family of Antequera in 1988, Alsur has developed production and processing facilities in Spain (Antequera) and Peru (Arequipa and Cusco) to supply the US market under the Alsur brand, while securing long-standing relationships with retailers and wholesalers across Spain and the US. This transaction will integrate the various subsidiaries of the company, which previously operated independently, into one multinational holding company, according to ACON: "The future strategy will focus on expanding Alsur's geographic footprint within Spain while continuing to drive sales into the US, where demand has continued to grow over the recent years," a noted read. Meantime, the Jiménez family, together with the company's business partner in Peru Mario Mustafá Aguinaga, will retain a significant minority stake in Alsur. In Spain, the company's portfolio includes canned baby broad beans, canned artichokes, canned asparagus and canned peppers. In Peru, Alsur is one of the leading exporters of artichokes, "with an opportunity to develop new product lines using its existing land bank and processing facilities," the Washington-based firm noted. (IHS Markit Food and Agricultural Commodities' Estela Cuesta)

- The Monetary Policy Committee (MPC) of the National Bank of

Georgia (NBG) in its 5 August meeting opted to cut its refinancing

interest rate by 25 basis points, taking the policy rate to 8.0%. A

similar decision had been taken at the previous meeting in late

June, while a 50-basis-point cut had been enacted in April. (IHS

Markit Economist Venla Sipilä)

- The decision follows continued easing of inflation; the latest data from the National Statistics Office of Georgia (GeoStat) show that consumer prices in July increased by 5.7% year on year (y/y), in what presents the third consecutive month of deceleration of the still-high inflation rate.

- Price gains in the category of food and non-alcoholic beverages contributed 3.6 percentage points to the overall inflation rate, while inflation in all other key categories was much more modest, and prices of transport services contracted. Prices fell by 0.5% from June.

- The NBG expects inflation to continue moderating over the rest of 2020, falling below the target (3%) during the first half of 2021, then starting to climb back towards it. The key reason for soft inflation pressures is the expected weakness of aggregate demand.

- The NBG has revised its GDP forecast downwards, now expecting economic contraction of 5% in 2020, as the negative impact from the COVID-19 virus crisis on global economic activity and external demand is proving more pronounced than expected earlier.

- Indeed, the latest "Rapid estimate of economic growth" from GeoStat suggest economic contraction of 12.6% y/y in the second quarter, and a decrease of 5.8% y/y for the first half of 2020.

- However, the NBG also reiterates its concern over high risks associated with inflation expectations in conditions were inflation remains above target for a prolonged period. These are all the more relevant given that monthly dynamics of the output indicator point to some recovery in domestic demand, aided by fiscal stimulus and stronger-than-expected credit developments and remittances.

- The Turkish lira is ₺7.21/USD as of 3:36pm EST and reached a new record low versus the US dollar of ₺7.31/USD at 11:10am EST.

- The Turkish new light-vehicle market increased by 387.5% year

on year (y/y) in July to 87,401 units, according to data released

by the Automotive Distributors' Association (Otomotiv

Distribütörleri Derneği: ODD). (IHS Markit AutoIntelligence's Tarun

Thakur)

- Of this total, passenger vehicle sales were up by 350.9% y/y to 69,427 units during the month, while light commercial vehicle (LCV) sales stood at 17,954 units, up 610.7% y/y.

- The country's light-vehicle market has now posted a year-to-date (YTD) increase of 60.3% y/y to 341,469 units, comprising 273,022 passenger vehicles, up 58.9% y/y, and 68,447 LCVs, up 65.8% y/y.

- In the YTD, C-segment vehicles account for 62.1% of total passenger vehicle sales in Turkey, with sedans being the most preferred vehicle type, accounting for 44.4%.

- In the LCV segment, vans account for 76% of total sales in the YTD, followed by light trucks with 11.1%.

Asia-Pacific

- APAC equity markets closed mixed; South Korea +1.3%, India +1.0%, Australia +0.7%, China +0.3%, Japan -0.4%, and Hong Kong -0.7%.

- Toyota today (6 August) released its financial results for the

first quarter (April-June 2020) of fiscal year (FY) 2020/21. The

automaker's operating income plunged by 98.1% during the period to

JPY13.9 billion (USD131 million) on net sales of JPY4.6 trillion,

down by 40.4% year on year (y/y). (IHS Markit AutoIntelligence's

Abby Chun Tu)

- Its net income declined by 76.3% y/y to JPY149.4 billion. Toyota's consolidated vehicle sales in the quarter were severely affected by the spread of the COVID-19 virus.

- The automaker reported consolidated sales of 1.158 million units during the period, marking a decrease of 50% from the same quarter last FY.

- Combined sales for Toyota and Lexus vehicles were reported at 1.71 million units during the period, down by 51% y/y.

- Sales declined in Japan, North America, and Europe to 385,000 units (down by 30.7% y/y), 285,000 units (down by 61.7% y/y), and 141,000 units (down by 49.4% y/y), respectively.

- In Asia, Toyota's sales declined by 55.6% y/y to 182,000 units.

- Sales volumes contracted by 49.8% y/y to 166,000 units in other regions.

- Toyota also provided its financial forecast for FY 2020/21. It expects to report consolidated global sales of 7.2 million units during the FY, revised upwards from 7.0 million units projected in May. Among its key sales regions, North America is forecast to remain Toyota's top sales region with a volume of 2.33 million units.

- Daimler announced on 5 August that Mercedes-Benz and Contemporary Amperex Technology Co Limited (CATL) will deepen their partnership to advance the development of new-generation batteries for Mercedes-Benz's future electric models. The agreement covers the full range of battery technologies, from cells across modules for Mercedes-Benz passenger cars to entire battery systems for Mercedes-Benz Vans. This also includes the CATL cell-to-pack (CTP) design, which eliminates conventional modules and integrates the cells directly into the battery, according to a company statement. The upcoming Mercedes-Benz EQS will also be equipped with CATL cell modules. The electric premium sedan is said to have a range of 700km under WLTP. Under the enhanced partnership, the German automaker will also be sourcing from CATL's Thuringia (Germany) plant when it begins production. Under the new deal, Daimler will work more closely with CATL to jointly develop battery solutions for Mercedes-Benz's next-generation electric vehicles (EVs). The partnership will allow CATL to play an increasingly important role in Daimler's electrification plan as the scope of their collaboration will include the development of entire battery systems as well as research and development activities. (IHS Markit AutoIntelligence's Abby Chun Tu)

- South Korean battery manufacturer SK Innovation has partnered with Nobel Laureate Professor John Goodenough to develop next-generation battery technologies, according to a company press release. Professor Goodenough will work with SK Innovation on a new battery that provides higher energy density and better safety at a competitive cost. "We are delighted to announce that SK innovation and Professor Goodenough's group are jointly preparing for the next-generation battery era. SK Innovation believes this will be a meaningful step on our journey to deliver an innovative lithium-metal battery that is safe and cost-competitive," said SK Innovation CTO Dr Seongjun Lee. According to the press release, the new battery will have a newly developed gel-polymer electrolyte system, which will evenly transport lithium-ion (Li-ion) while filtering undesired ions from travelling and ultimately suppressing dendrite growth. This is expected to shorten the time to market for an all-solid lithium-metal battery. The goal is to develop a microporous polymer matrix with a weakly co-ordinating-anion system that can be applied to larger, more powerful cells. SK Innovation said that despite Li-ion batteries being the most effective system for electric vehicles (EVs), they have limited abilities to increase their energy density, which is necessary to extend the driving ranges of EVs between charges as well as create smaller, lighter batteries. In fact, with the current Li-ion chemistry, it is not likely to overcome 800 Wh/L energy density. A lithium metal anode and solid-state electrolyte are viewed as a promising solution to deliver a battery with 1,000 Wh/L energy density. (IHS Markit AutoIntelligence's Jamal Amir)

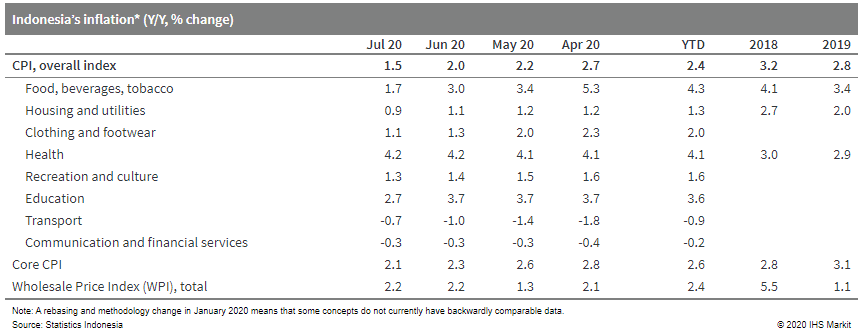

- The Indonesian economy was hit from all sides by the COVID-19

virus pandemic in the second quarter, with real GDP contracting by

a stronger-than-expected 5.32% year on year, the first contraction

since the Asian Crisis. With consumer prices hitting a two-decade

low in July, indicating sustained weakness in demand, IHS Markit

forecasts that a meaningful recovery in the economy may not arise

until late 2021 even if GDP growth returns to positive territory by

early 2021. (IHS Markit Economist Bree Neff)

- Private consumption expenditures collapsed because of the patchwork of containment measures implemented to mitigate the spread of COVID-19 infections during the quarter, which triggered the 15.3% y/y and 16.5% y/y contractions for real expenditures by households on transportation and communication as well as restaurant and hotel services.

- The only areas in which consumers increased their spending were on health and education services and dwellings and utilities, both of which rose just over 2.0% y/y in real terms.

- Spending on non-restaurant food and beverages contracted 0.7% y/y, which is surprising considering the stockpiling of foodstuffs seen in other economies because of the pandemic.

- During the second quarter of 2020, real fixed investment plunged at the fastest pace since the third quarter of 1999. Building activity, which is the largest component of real fixed investment, plunged 5.3% y/y in real terms because of containment measures and the government changing gears on its spending plans.

- The biggest surprise in the data was the magnitude of the plunge in government consumption activity to -6.90% Y/Y from +3.75% Y/Y in Q1 stemming from issues with government capacity and red tape, and resulted in complaints about slow delivery of promised stimulus funds. Following the GDP release, Minister of Finance Sri Mulyani Indrawati indicated firmly that the government plans to be more aggressive in spending for the second half of 2020 to avoid further weakening of the economy.

- Indrawati also indicated last week that the government hopes to expand its planned fiscal deficit for the 2021 budget to 5.2% of GDP, up from the previously announced 4.2-4.7% of GDP, to help with recovery efforts. However, details of where the additional spending will be allocated have not been announced, but should start to be revealed in the coming month.

- Imports in real, inflation-adjusted terms were dragged down by a 41.4% y/y collapse in services imports as travel and tourism services collapsed with containment measures domestically and globally. In addition, restricted travel domestically on top of slowing activity caused a 26.2% y/y plunge in oil and gas imports, while non-oil and gas imports fell by a relatively more modest 10.3% y/y.

- Real exports were dragged down during the second quarter by a 52.7% y/y plunge in services exports as tourism came to a halt. In real terms, oil and gas exports were up 3.8% y/y, but that was coming off a very weak base in 2019. Non-oil and gas exports fell 7.5% y/y during the June-quarter.

- Statistics Indonesia on 3 August released consumer price

inflation data for July, which showed headline inflation easing

below the 2.0% y/y mark during that month, the weakest reading

since the Asian Crisis. Food prices slipped below 2.0% y/y, a fresh

record-low for this series, because of falling prices of garlic,

shallots, and chicken meat.

- Proton's sales surged by 45.7% year on year (y/y) to 13,216

units during July, according to data released by the company. This

is the highest monthly sales volume for the automaker since June

2012. (IHS Markit AutoIntelligence's Jamal Amir)

- Proton claimed that four of its models led their respective segments. The Saga was the best-selling A-segment sedan during the month with 5,421 units sold - the highest for the nameplate since April 2014 (6,307 units).

- The X70 sport utility vehicle (SUV) remained the best-selling C-SUV segment in Malaysia with sales of 3,087 units last month - the highest sales since February 2019 (2,896 units).

- The Persona sedan continued to be the most popular B-segment sedan with 3,043 units sold, and the Exora multi-purpose vehicle (MPV) topped the C-MPV market with 792 units sold.

- The Iriz hatchback stood at the third position in the B-hatchback segment with sales of 873 units last month. In the year to date (YTD), the automaker's sales declined by 4.2% y/y to 50,294 units.

- It is estimated to have captured 21.8% of the Malaysian new vehicle market, which the automaker said is a 6.7% increase over July 2019.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-august-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-august-2020.html&text=Daily+Global+Market+Summary+-+6+August+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-august-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 6 August 2020 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-august-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+6+August+2020+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-august-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}