Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 05, 2021

Daily Global Market Summary - 5 August 2021

All major US and most European equity indices closed higher, while APAC mas mixed. US government bonds closed lower and benchmark European bonds closed mixed. European iTraxx closed slightly tighter across IG and high yield, CDX-NAHY was sharply tighter, and CDX-NAIG was unchanged on the day. Oil and copper closed higher, the US dollar was flat, and gold, silver, and natural gas were lower on the day. All eyes will be on tomorrow's US non-farm payroll report at 8:30am ET.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +1.8%, DJIA/Nasdaq +0.8%, and S&P 500 +0.6%.

- 10yr US govt bonds closed +4bps/1.22% yield and 30yr bonds +3bps/1.87% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY -7bps/289bps.

- DXY US dollar index closed flat/92.24.

- Gold closed -0.3%/$1,809 per troy oz, silver -0.7%/$25.29 per troy oz, and copper +0.3%/$4.35 per pound.

- Crude oil closed +1.4%/$69.09 per barrel and natural gas closed -0.4%/$4.14 per mmbtu.

- The shortage of truck drivers across the US has become so acute that logistic operators are trying to recruit foreign drivers, according to the American Journal of Transportation. Filling stations are facing fuel outages and airports are short on jet fuel. The country was short of about 60,000 drivers in 2019, according to the American Trucking Associations. This number is expected to rise to 100,000 by 2023. There are several contributing factors to the situation. Demand for shipped goods is soaring while early retirement surged during the pandemic. Lockdowns have also made it harder for new drivers to access commercial-trucking schools and get licensed. Carrier rates are continuing to rise, incentivizing drivers to accept local loads and forgo the necessary national moves to get fresh produce to the destination. This has impacted the distribution of fresh fruits and vegetables grown in different parts of the country. Demand for Visa Solutions' services from the trucking industry has more than doubled since the pandemic started. "This is 100% because of the driver shortage," according to Jose Gomez-Urquiza, the chief executive officer of Visa Solutions. The industry is seeking to lower the minimum age to 18 from 21 for interstate drivers and adding trucking to the list of industries that can bypass some of the US Department of Labor's immigration certification process. Some companies are increasingly turning to drivers from South Africa and Canada. Companies have also offered higher wages, signing bonuses and increased benefits to attract and retain drivers. However, more efforts need to be made to attract domestic workers to the industry. (IHS Markit Food and Agricultural Commodities' Hope Lee)

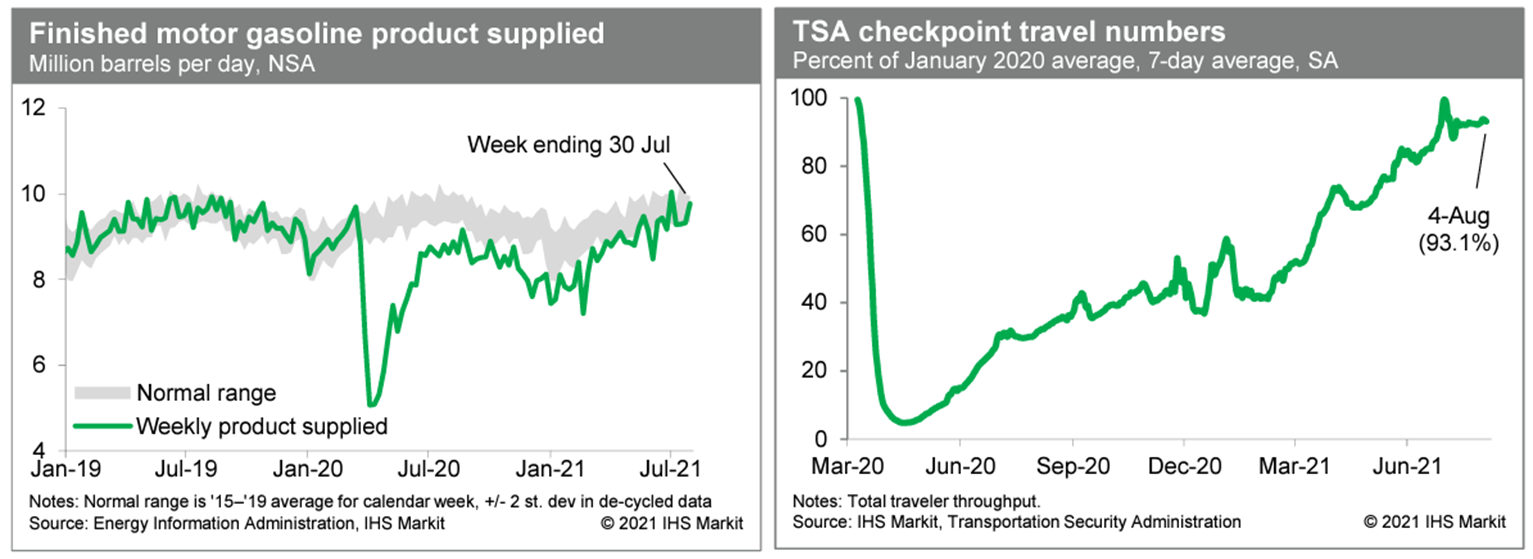

- Consumption of gasoline rose last week and is within a range

consistent with normal internal mobility. Meanwhile, averaged over

the last week, passenger throughput at US airports (after seasonal

adjustment) was about 93% of the January 2020 level. This is close

to readings dating back several weeks, indicating nearly a full

recovery in air travel. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- US seasonally adjusted (SA) initial claims for unemployment

insurance fell by 14,000 to 385,000 in the week ended 31 July.

While the level of initial claims is trending down and is far below

the pandemic-era high, the last time initial claims were

consistently above the current level was in late 2011 when the

economy was still limping out of the Great Recession. Initial

claims closer to 200,000 would suggest a normal level of "churn"

for an economy in its prime. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 366,000 to 2,930,000 in the week ended 24 July, hitting its lowest since 14 March 2020. The insured unemployment rate decreased by 0.3 percentage point to 2.1%.

- In the week ended 17 July, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) rose by 12,324 to 4,246,207.

- In the week ended 17 July, continuing claims for Pandemic Unemployment Assistance (PUA) fell by 89,180 to 5,156,982.

- In the week ended 17 July, the unadjusted total of continuing claims for benefits in all programs fell by 181,251 to 12,975,015.

- Despite only 26 states still accepting claims for pandemic-related federal unemployment benefits, the share of these benefits in all programs remains high; continuing claims under PUA and PEUC accounted for 72% of the claims under all programs.

- US employers announced 18,942 planned layoffs in July 2021,

according to Challenger, Gray & Christmas—down 7.5% from

June's 20,476. July's total is the lowest monthly reading since

June 2000 and is 93% lower than the July 2020 reading, when the

pandemic was still the main factor influencing job-cut decisions.

(IHS Markit Economist Juan

Turcios)

- For the year to date (YTD), 231,603 job cuts have been announced, down 87% from the 1,847,696 job cuts announced over the same period in 2020 and the lowest January-July total on record (Challenger began tracking job-cut announcements in January 1993).

- According to Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, "In a healthy economy, there's a good amount of churn. Right now, things appear to be stalling. There are over 9.2 million job openings and 9.5 million unemployed. The positions and workers are not connecting."

- So far this year, employers have cited COVID-19 as a reason for 7,950 planned job cuts. Employers have cited other reasons including market conditions (48,047), demand downturn (44,033), restructuring (40,864), closing (39,689), and acquisition/merger (10,252) more frequently than COVID-19 as causes of job-cut announcements this year.

- Last year, 2,304,755 job cuts were announced, the highest yearly total on record. COVID-19 was the leading reason cited for job-cut announcements last year but was cited less frequently toward the end of the year. As of July, COVID-19 is the eighth-leading reason for job-cut announcements in 2021 and has been trending downward. The recent surge in cases due to the Delta variant could make COVID-19 a bigger factor in job-cut decisions going forward but the July announcements do not yet show an effect.

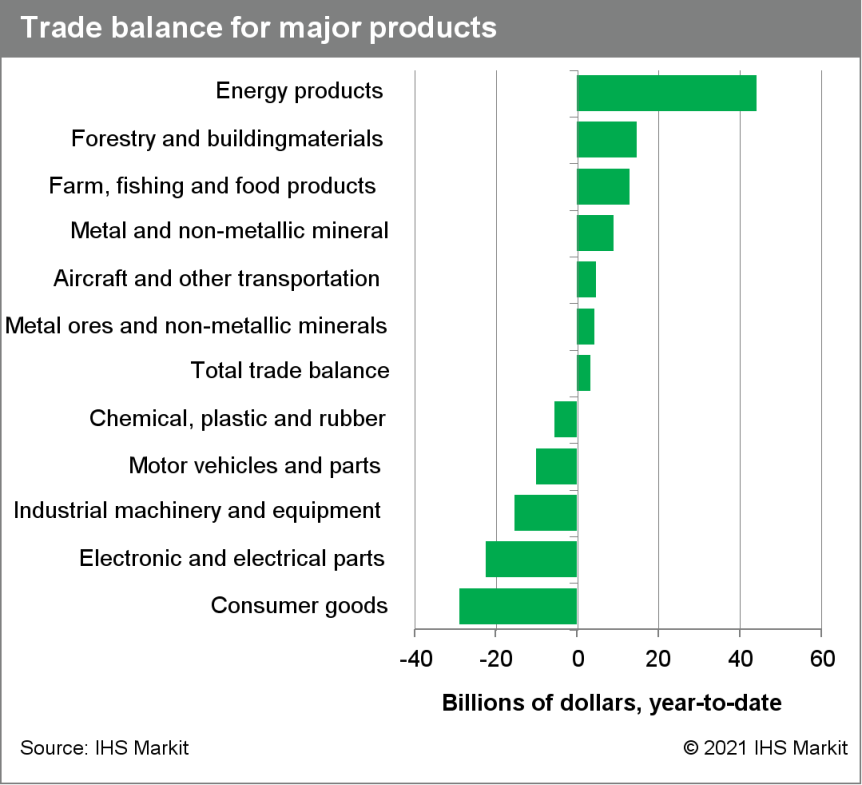

- In nominal dollars, the following set record highs in June: the

trade deficit, the goods deficit, the nonpetroleum deficit,

exports, goods exports, imports, and goods imports. The real goods

deficit widened to its second-highest level on record. (IHS Markit

Economist Patrick

Newport)

- Real goods import growth slowed to a 3.4% annual rate in the second quarter following three quarters of double-digit growth. At the end of the quarter, real auto and consumer goods imports were dropping, and capital goods imports were leveling. Real imports were 9% higher than in the fourth quarter of 2019, the last pre-pandemic quarter.

- Real goods exports—nearly back to pre-pandemic levels—increased at a 5.8% annual rate in the second quarter on strong gains from consumer and capital goods.

- The petroleum deficit, which has been bouncing about the zero line since February, turned positive in June as nominal petroleum exports—benefiting from higher oil prices—set a record high.

- The surplus in services has dwindled from $22.4 billion in January 2020 to $17.4 billion in June 2021. Imports and exports of travel and transport collapsed last year when the pandemic struck; these categories remain in a deep hole.

- The goods deficit was about $1.0 billion higher than reported in the advance report trade report that came out last week; imports were higher and goods exports were lower.

- Offshore wind installation vessel market entrant Eneti has announced that it will acquire wind turbine installation vessel (WTIV) contractor Seajacks from its shareholders: Marubeni, INCJ and Mitsui OSK Lines. Eneti will acquire 100% of Atlantis Investorco Limited, the parent of Seajacks International Limited, for consideration of approximately 8.13 million shares, USD299 million of assumed net debt, USD74 million of newly-issued redeemable notes, and USD12 million of cash. The transaction has been approved by the boards of directors of Eneti and Seajacks' selling shareholders, and is expected to close by the middle of the third quarter of 2021. Upon closing, existing Eneti shareholders will own 58% of Eneti; Marubeni, INCJ and Mitsui OSK Lines will own 42%. As a result of the transaction, Mr. Hiroshi Tachigami of Marubeni and Mr. Peter Niklai of INCJ will join the Eneti Board of Directors. Seajacks was founded in 2006 and is based in Great Yarmouth, UK. It owns five self-propelled jackups, and has a track record of installing wind turbines and foundations dating back to 2009. Its flagship, NG14000X design Seajacks Scylla, was delivered from Samsung Heavy Industries in 2015, and it is currently employed in the Asia Pacific market. NG5500C design Seajacks Zaratan is currently operating in the Japanese market under the Japanese flag. Three NG2500X specification jackups are employed in the North Sea market. The acquisition will give Eneti a strong foothold in the Asia Pacific and North Sea offshore wind markets, and allow the company to quickly develop its track record as a wind farm installation contractor. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Uber recorded a quarterly net income for the first time as a

public company in the second quarter of 2021. Net income of USD1.1

billion during the period was largely driven by unrealized gains

from the revaluation of Uber's equity investments in Chinese

ride-hailing firm Didi Chuxing and autonomous technology startup

Aurora. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The company's revenue rose to USD3.9 billion in the second quarter, an increase of 105% year on year (y/y).

- The rise in revenues was the result of growth in the number of monthly active users across rides, bike shares, and food deliveries, to 101 million, up from 55 million a year earlier.

- Gross bookings, a number used to track customer demand, increased 114% y/y to USD21.9 billion.

- Uber's core business, ride hailing, posted an increase in its revenues of 106% y/y to USD1.6 billion during the quarter. Meanwhile, revenues at its delivery business rose 122% y/y to USD1.9 billion. Uber's freight revenue during the period was USD348 million, up 65% y/y.

- Automotive LiDAR startup Cepton Technologies is reportedly planning to go public via a reverse merger deal with Growth Capital Acquisition Corporation, a special-purpose acquisition company (SPAC). The deal is expected to value the combined entity at USD1.5 billion, reports Bloomberg. However, a final agreement has not been reached. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Canada's June merchandise trade balance returned to a surplus

of $3.2 billion, the largest monthly surplus since September 2008.

(IHS Markit Economist Evan Andrade)

- In nominal terms, exports advanced 8.7% month on month (m/m) to $53.8 billion—the largest monthly increase on record excluding pandemic distortions in 2020—while imports fell 1.0% m/m to $50.5 billion.

- Exports were strong in volume terms as well, rising 6.5% m/m, while import volumes fell 2.2% m/m.

- The service trade deficit widened to $740 million, driven by a

higher import of commercial and travel services.

- Colombia's Ministry of Finance announced on 27 July its

framework for planned Green Bond issuance. (IHS Markit Economist Brian

Lawson)

- It has identified 27 projects eligible to be financed from future issuance, which span water resources, transportation, ecosystems and biodiversity, renewable energy, the circular economy, and sustainable agriculture.

- The program has enjoyed technical support from IADB and the World Bank.

- César Arias, Director of Public Credit, flagged that the planned issuance, projected in the third quarter, would be the first sovereign Green Bond issuance in the region denominated in local currency (and the second overall behind Chile). He claimed the process should strengthen Colombia's domestic capital market. Treasury Minister José Manuel Restrepo described the deal as establishing "a new alternative to finance investment projects".

- The deal comes against a background of deterioration in Colombia's credit ratings to junk levels and a widening in its dollar spreads: its EMBI+ index reached 293 basis points over comparable US Treasury bonds 0n 28 July, its widest level in the last year, reflecting the ongoing difficulties in agreeing measures to trim the country's growing debt burdens.

Europe/Middle East/Africa

- Most major European equity indices closed higher except UK -0.1%; Italy +0.7%, France +0.5%, Spain +0.5%, and Germany +0.3%.

- 10yr European govt bonds closed mixed; Spain -4bps, Italy -3bps, France -1bp, Germany flat, and UK +1bp.

- iTraxx-Europe closed -1bp/46bps and iTraxx-Xover -2bps/234bps.

- Brent crude closed +1.3%/$71.29 per barrel.

- Hyundai Motor UK has launched an all-in-one monthly subscription service called Mocean for its line-up of hybrid, plug-in hybrid, and fully electric models, according to a company statement. A subscription to Mocean starts from GBP339 (USD472) per month, which covers nearly all major motoring costs including insurance, roadside assistance, road tax, and maintenance and repairs at authorized Hyundai dealers. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hyundai will invest in Germany's hydrogen fueling station operator H2 Mobility through its German unit, reports Reuters. A partner in the project since 2017, Hyundai's German subsidiary will become a seventh shareholder shortly, it said, having received approval from Germany's cartel office. Other investors include France's Total SA, Royal Dutch Shell, OMV, Linde, Air Liquide and Daimler. Hyundai did not disclose financial details. "In Germany, a lot of money is flowing into the topic of hydrogen through the European Union Green Deal and national funding, and we believe that we are at the forefront," said Ronald Grasman, vice-president of fuel cell business development at Hyundai. (IHS Markit AutoIntelligence's Jamal Amir)

- Daimler's Mercedes-Benz has stated that it will increase its co-operation with German company Grob-Werke in the area of battery cell manufacturing technology, according to a company statement. Mercedes-Benz is planning to ramp up its own cell production capabilities massively in the coming years to achieve its plan to become an all-battery electric vehicle (BEV) manufacturer by 2030, while reducing its dependence on complex international supply chains. Grob-Werke is a world market leader in highly innovative battery production and automation systems and has been a long-standing partner of Mercedes-Benz. (IHS Markit AutoIntelligence's Tim Urquhart)

- Siemens Gamesa has assembled its first offshore wind turbine nacelle outside Europe at its Taichung facility in Taiwan. The nacelles are for Ørsted's 900 MW Greater Changhua 1 and 2a projects. Construction of the nacelle assembly facility was started in March 2020 over a land area of over 30,000 square meters. The factory has officially started production by strengthening its manufacturers local footprint in the fast-growing Asia-Pacific market. The first large-scale and far-shore offshore wind farms in Taiwan―Greater Changhua 1 and 2a are located 35 to 50 kilometers off the coast of Changhua County. With a combined capacity of 900 MW, the two projects will feature a total of 111 SG 8.0-167 DD turbines installed on jacket foundations. The offshore construction at these sites will be carried out during 2021 and 2022, with the project expected to be finalized in 2022. The wind turbine installation is slated for 2022. Other projects in the region that Siemens Gamesa have secured turbine deals for include the two further phases of the 1,044 MW Hai Long offshore wind farm, and the Hai Long 2B (232 MW) and Hai Long 3 (512MW) projects. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- The national statistical office (INE) reports that Spain's

EU-harmonised rate of consumer price inflation rose for the fifth

consecutive month to reach a 71-month high of 2.9% in July.

Meanwhile, according to the national definition, the inflation rate

was also 2.9% in July. (IHS Markit Economist Raj

Badiani)

- This is a "flash" estimate of just the headline rate, with no additional information on the goods and services in the CPI basket.

- The main lever appeared to be the impact of higher global crude oil prices, which increased by 73.3% year on year (y/y) to average USD74.9 per barrel in July. Therefore, we expect transport and housing and utility prices rose notably when compared to a year ago.

- Underlying inflation (all items excluding energy and unprocessed food and the national definition) increased from 0.2% in June to 0.6% in July.

Asia-Pacific

- Major APAC equity markets closed mixed; Japan +0.5%, India +0.2%, Australia +0.1%, South Korea -0.1%, Mainland China -0.3%, and Hong Kong -0.8%.

- Preliminary Hong Kong SAR data show that real GDP climbed 7.5%

year on year (y/y) in the second quarter of 2021, after jumping

8.0% y/y in the first quarter, which marked the fastest expansion

since the first quarter of 2006. For the first half of 2021, real

GDP climbed 7.8% y/y, following six straight quarters of

contractions that began in mid-2019. (IHS Markit Economist Ling-Wei

Chung)

- In seasonally adjusted quarter-on-quarter (q/q) terms, the economy contracted 1% from the previous quarter, reversing a strong 5.5% expansion posted in the first quarter. It followed three quarters of q/q expansions.

- Domestic demand continued to improve as the stabilized local outbreak has enabled the government to gradually relax social distancing measures since mid-February. Domestic demand contributed 10.5 percentage points to second-quarter growth as private consumption added 4.5 percentage points and fixed investment contributed 3.9 percentage points. On the other hand, net exports turned negative in the second quarter as the pickup in domestic demand bolstered import growth, which outpaced export expansions.

- Although merchandise exports remained strong, the rate of gains moderated in the second quarter. Exports of goods jumped 20.3% y/y, albeit decelerating from a sharp 30.1% y/y surge in the first quarter. Exports to all major markets continued to surge at the double-digit pace in the second quarter, except Japan. In June, merchandise exports soared 33% y/y, after expanding at 24% y/y in April-May.

- Accounting for around 60% of total exports, a 36.6% y/y surge in shipments to mainland China continued to drive the rebound in Hong Kong's export demand in June. The revivals in the regional economies also provided strong support, led by a 64.1% y/y surge in exports to South Korea and a 46.1% y/y jump in shipments to Taiwan. Shipments to the US climbed 19.2% y/y. Shipments to Europe also turned stronger, led by a 87.9% y/y surge in those to the UK.

- Exports of services resumed growth for the first time in two years, rising 2.6% y/y in the second quarter, reversing a 7.3% y/y drop in the first quarter and after slumping 36.1% in 2020 as a whole. Despite the pickup in the second quarter of 2021, it came mainly on the back of a very-low comparison base as the tourism sector has remained at a standstill. Prolonged travel restrictions have continued to disrupt inbound tourism and resulted in prolonged doldrums in exports of travel services.

- Total tourist arrivals have remained below 7,000 per month, compared with 3-6 million every month before the pandemic. Caused by fears over the spread of the virus and the resulting tightening social distancing measures and travel restrictions, tourist arrivals started to plunge in February 2020 by more than 96% y/y since then. Visitor arrivals dropped again in May by 34.8% y/y and further by 57.6% y/y in June, after resuming growth in April for the first time since June 2019, up 38.3% y/y, although the gain was mainly on the back of a low comparison base.

- Nissan has teamed up with Chinese battery manufacturer Envision AESC to set up a battery plant in Japan, reports Electrive. According to the report, the new plant is to be built in Ibaraki prefecture north of Tokyo and involve an investment of JPY50 billion (USD456 million). Reportedly, the plant is to have an annual production capacity of six gigawatt-hours in 2023. The new battery-manufacturing plant in Japan will be the second facility set up by Envision to supply batteries to Nissan for electric vehicle (EV) models. Last week, Envision AESC submitted plans for an EV battery plant to supply Nissan's Sunderland (United Kingdom) facility. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Japanese automakers Nissan and Honda have reported double-digit percentage declines in Chinese sales during July. According to a company press statement, Nissan witnessed a 20.8% year-on-year (y/y) decline in sales to 95,783 units in China during July. In the year to date (YTD), Nissan posted a sales increase of 11.8% y/y to 802,133 units. Sales of Nissan's passenger vehicle joint venture (JV) with Dongfeng, which includes the Nissan and Venucia brands, decreased 20.3% y/y to 79,328 units in July and increased 11.3% y/y to 648,747 units in the YTD. Sales of Nissan's light commercial vehicles (LCVs), including those of Dongfeng Automobile Co Ltd (DFAC) and Zhengzhou Nissan Automobile (ZNA), dropped 17.7% y/y to 15,364 units in July and rose 22.6% y/y to 146,073 units in the YTD. Sales in the Chinese market were impacted by the floods in several parts of the country, along with a shortage of semiconductor chips. For Nissan, the major drivers of sales were the Qashqai sport utility vehicle (SUV; 11,839 units), the Sylphy series (40,124 units), and the Altima sedan (11,044 units). Meanwhile, Honda's sales were driven by the Civic, Accord, Breeze, Vezel, and XR-V. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- LiDAR startup Innoviz Technologies has partnered with autonomous mobility firm SpringCloud to expand its presence in South Korea. Under this partnership, SpringCloud is allowed to distribute Innoviz products in South Korea across multiple sectors and industrial applications. This partnership builds on Innoviz's strong associations in South Korea with Naver, Samsung, and SK as its investors. Innoviz, which recently went public via a special-purpose acquisition company (SPAC) merger deal, offers a range of hardware products including InnovizOne, a solid-state LiDAR sensor specifically designed for automakers and robotaxis. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Indian car rental firm Zoomcar has announced the launch of operations in international markets as it expands to Southeast Asia and the Middle East. In addition, Zoomcar has announced the appointment of Hany Olama and Gene Angelo Ferrer as country heads in Egypt and the Philippines, respectively, to help the company scale up its business. Zoomcar introduced car-sharing services in India in 2013 and currently has over 10,000 cars in its fleet, with around 4.8 million users. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- New Zealand's seasonally adjusted unemployment rate was 4.0%

for the June quarter of 2021, according to Statistics New Zealand

(SNZ), dropping 0.6 percentage point quarter on quarter (q/q), with

the total number of unemployed people falling by 12.4% - the

largest quarterly drop on record. This continued fall from the peak

recorded during the September 2020 quarter has brought the

unemployment rate back to roughly pre-pandemic levels for the first

time in almost a year and a half. (IHS Economist Andrew Vogel)

- The sharp improvement in the unemployment rate was supported by further growth in employment (up 0.5% q/q) on top of last quarter's gains - helped by the low working-age population growth caused by reduced inward migration since the start of the pandemic, although the total number of filled jobs has also improved by 2.4% year on year (y/y). The total number of people employed increased 1.7% y/y, helped by large growth in part-time and temporary employment (up 4.0% and 21.5%, respectively).

- The labor-force participation rate registered another slight improvement, increasing by 0.1 percentage point to 70.5%. Perhaps more importantly, labor underutilization (defined by SNZ as "those who work less than 30 hours a week, but would like to work more hours and have the availability to do so"; or all underemployed, unemployed, and unavailable and potential jobseekers) fell sharply to 10.5% - down an almost unprecedented 1.6 percentage points q/q - while the total number of underutilized people fell a record 13.3% q/q.

- Wage growth rose to 2.1% y/y, improving over the previous quarter and marking the second straight quarter that annual wage inflation has increased. However, this is still lower than the 3.3% annual rise in consumer price inflation (CPI) in the same period. That said, average weekly earnings saw dramatic improvement of 9.2% y/y, driven by both the increase in hourly wages and an even larger jump in paid hours (up 7.8% y/y, the largest increase on record).

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-august-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-august-2021.html&text=Daily+Global+Market+Summary+-+5+August+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-august-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 5 August 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-august-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+5+August+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-august-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}