Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 05, 2020

Daily Global Market Summary - 5 August 2020

US and European equity markets closed higher today, while APAC markets were mixed. The US dollar and US government bonds ended the day lower alongside the Treasury's announcement of a record quarterly refunding, with European government bonds also closing lower on the day. Credit indices ended the day tighter across IG and high yield, with CDX-NAHY tightening significantly on the day. All eyes will be on tomorrow's US claims for unemployment insurance and Friday's US non-farm payroll reports, as the early read from today's ADP employment report came in well below consensus.

Americas

- US equity markets closed higher; Russell 2000 +1.9%, DJIA +1.4%, S&P 500 +0.6%, and Nasdaq +0.5%.

- 10yr US govt bonds closed +5bps/0.56% yield and 30yr bonds +3bps/1.22% yield.

- The US Treasury expanded its plans for borrowing at longer maturities in the coming months, saying today it will sell a record $112 billion of securities at next week's quarterly refunding of maturing Treasuries. Over the three months through October, it will boost its offering of notes and bonds by a total of $132 billion compared with the previous quarter, and rely more heavily on securities due in seven to 30 years. (Bloomberg)

- The DXY US dollar index was -0.5%/92.89 as of 4:02pm EST, but was as low as 92.57 and was only 0.01 away from last Tuesday's multi-year low:

- Gold reached another record intraday high of $2,069 per ounce today and is +1.5%/$2,052 per ounce as of 4:13pm EST.

- The ADP US private employment report came in much lower than expected at +167K vs 1.0 million jobs expected (based on the WSJ consensus).

- Crude oil closed +1.2%/$42.19 per barrel.

- CDX-NAIG closed -2bps/65bps and CDX-NAHY -36bps/395bps. Today was the best close for CDX-NAHY since 4 March.

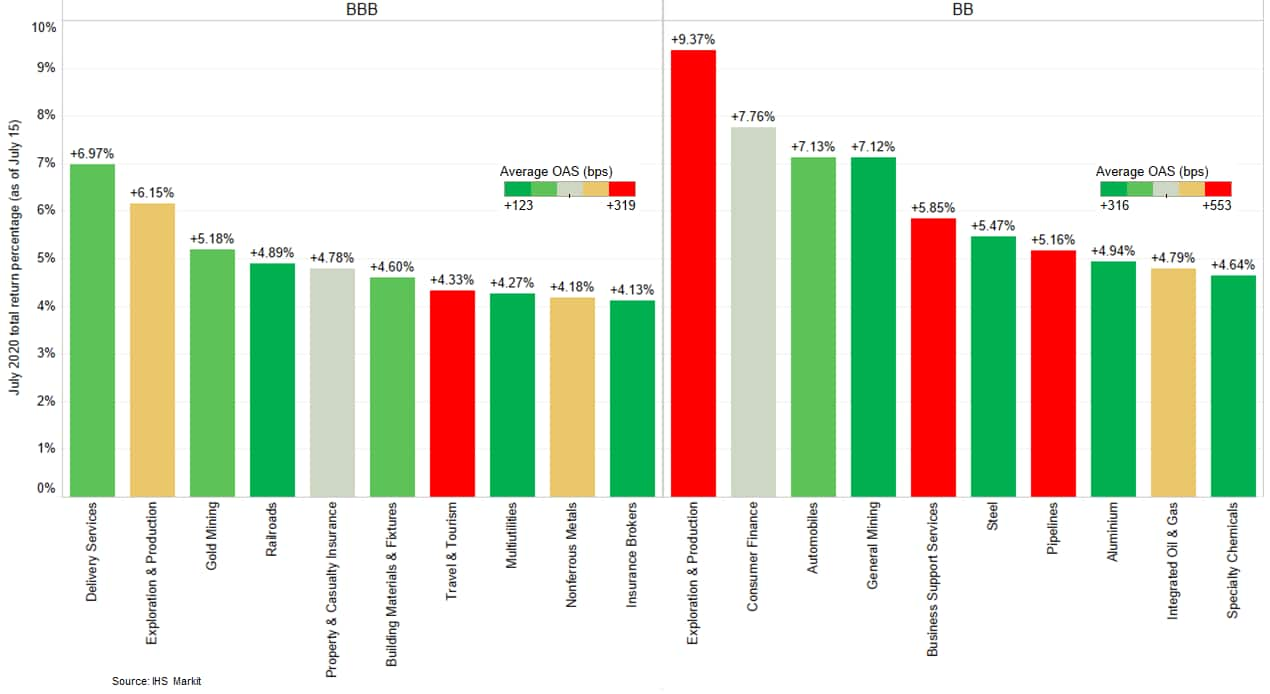

- The below charts show the top 10 best performing sectors by

July's average monthly total returns and the average OAS credit

spreads for the BBB rated segment of the IHS Markit iBoxx USD

Investment Grade Index (left) and the BB rated segment of the IHS

Markit iBoxx USD High Yield Index (right). Delivery services at

+6.97% was the best performer in the BBB category and exploration

& production +9.37% in the BB group.

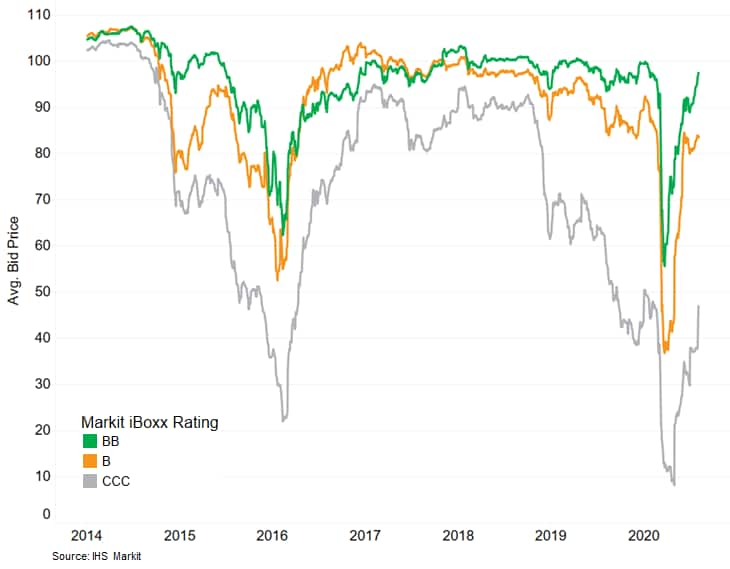

- The chart below shows the average bond prices for each main

rating category across the exploration & production

constituents in the IHS Markit iBoxx USD High Yield Index have all

increased significantly from this year's lows. As of 31 July, CCC

rated average bond prices have increased 363%, B rated 128%, and BB

rated 73% from the 2020 lows (please note that the pool of bonds

changes to some degree at the beginning of each month as a result

of the index rebalancing process).

- The seasonally adjusted final IHS Markit US Services PMI

Business Activity Index registered 50.0 at the start of the third

quarter, up from 47.9 in June and improving on the 'flash' estimate

of 49.6, to signal a stabilization in service sector business

activity. The latest data brought to an end a five-month sequence

of contraction, with the Business Activity index rising for a third

successive month from April's record low (26.7). (IHS Markit

Economist Chris Williamson)

- New business continued to decrease in July. Service providers registered a marginal rate of decline which was slightly greater than seen in June.

- Input costs at service providers rose for the second month running in July, with the rate of inflation accelerating to the sharpest since October 2018. The increase in cost burdens was commonly associated with supplier price hikes, with some highlighting greater costs for sanitizing and PPE products especially.

- The US nominal trade deficit narrowed in June by $4.1 billion

to $50.7 billion, close to expectations. Underlying the headline

number, nominal exports rose 9.4% and nominal imports rose 4.7% in

June. This was the first increase in exports since February 2020

and the first in imports since December 2019. (IHS Markit Economist

Kathleen Navin)

- In response to this morning's report on trade, we lowered our estimate of second-quarter GDP growth 0.1 percentage point to a 33.0% annualized rate of decline and left unchanged our forecast for a 20.4% annualized increase in GDP the third quarter.

- The trade balance through June was about as the Bureau of Economic Analysis (BEA) had assumed in the advance estimate of the second-quarter National Income and Product Accounts (NIPA), but with somewhat fewer net imports of capital goods. This lowered our estimate of second-quarter equipment spending.

- Relative to our previous estimates, the data on trade through June suggested stronger growth of both exports and imports of services in the third quarter. On balance, this left our forecast for the change in net exports unrevised in the third quarter; we look for net exports to rise $38 billion in the third quarter, adding 1.2 percentage points to third-quarter GDP growth.

- In the details of today's report, trade in transport and travel services combined began to turn up in June. This area of trade has been hit particularly hard by the global pandemic as air travel was all but shut down for much of March and April and as the recovery remains slow. We look for trade in these sectors to gradually improve over the coming months.

- Merck Animal Health has continued to expand its digital technology portfolio with the acquisition of IdentiGEN. According to Merck, IdentiGEN is a leader in DNA-based animal traceability solutions for livestock and aquaculture. IdentiGEN's DNA TraceBack technology combines DNA and data analytics to accurately and precisely trace beef, seafood, pork and poultry from farm-to-table. IdentiGEN claims DNA TraceBack helps safeguard and strengthen supply chain integrity. The firm said its technology enables products to be reliably traced back through production to the farm, parent or individual animal from which they originated. IdentiGEN was founded in 1996 and has operational sites in Ireland, the UK, North America, central Europe and Switzerland. MML Growth Capital Partners Ireland - an Irish-focused private equity investment firm - acquired a majority stake in IdentiGEN in 2015. Merck confirmed to IHS Markit Animal Health it has fully acquired IndentiGEN, although specific terms of the agreement have not been disclosed. The company stated: "Food producers, processors and retailers are looking for accurate and complete animal traceability solutions that provide full accountability, as well as greater transparency, quality and sustainability of food sources for consumers. (IHS Markit Animal Health's Sian Lazell)

- Offshore drilling contractor Diamond Offshore reported a net loss of USD144.8 million for the second quarter of 2020, compared to a loss of USD113.9 million for the second quarter of 2019. Losses for the first half of 2020 totaled USD1.007 billion, largely from losses on impairment of assets, compared to a loss of USD187.3 million in the first half of 2019. The company's revenues for the second quarter of 2020 were USD198.2 million, down from USD216.7 million in the second quarter of 2019. Diamond Offshore and certain subsidiaries filed voluntary petitions for relief under Chapter 11 in the US Bankruptcy Court for the Southern District of Texas in late April 2020. As of June 30, 2020, the company had not emerged from bankruptcy and no plan of reorganization or restructuring support agreement had been filed with the Bankruptcy Court. Negotiations between the various parties to the Chapter 11 cases are ongoing. (IHS Markit Upstream Costs and Technology's Matthew Donovan)

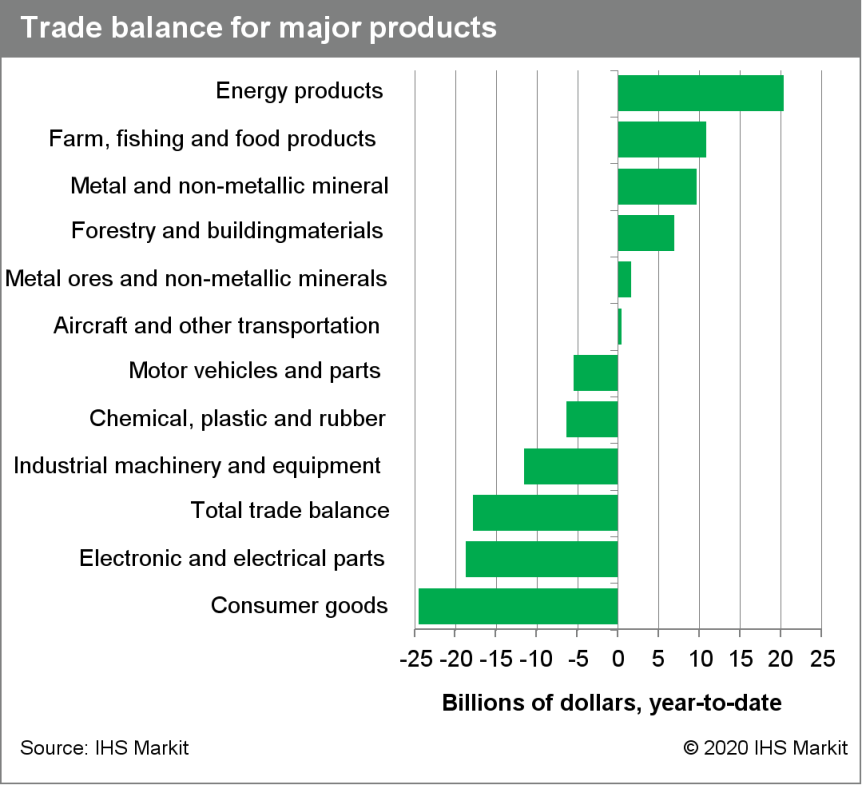

- Canada's nominal exports skyrocketed 17.1% month on month

(m/m), as auto production picked up; real exports climbed 16.2%

m/m. Motor vehicles and parts accounted for 72% of the increase in

exports, which remained 18% below February's $48.4 billion level,

despite the June surge. Farm, fishing, and intermediate food

products and industrial machinery, equipment, and parts posted

small declines while metal ores and non-metallic minerals and metal

and non-metallic mineral products made double-digit advances. (IHS

Markit Economist Patrick Newport)

- Nominal imports jumped 21.8% m/m on soaring imports of autos and aircraft; real imports soared 23.2% m/m. Imports rebounded sharply but remained 14% below February's $50.1-billion pre-pandemic level. Autos accounted for 47% of the rebound, with passenger cars and light trucks rising $1.7 billion and engines and parts increasing $1.6 billion.

- Canada's trade surplus with the United States narrowed by $0.8 billion to $1.1 billion. The trade deficit with the rest of the world increased by $1.0 billion to $4.3 billion as imports increased more than exports.

- This report is largely one about economic activity picking up across the world following a massive collapse, with autos driving the rebound. For the first time since February, auto assembly plants in North America were operating throughout the month, resulting in an export and import surge. Productive capacity at these plants remains below pre-pandemic levels, however.

- Trade with the United Stated rebounded, but from diminished

levels. Imports from the United States increased 28.0% to $26.4

billion (19.3% below February's level). Exports to the United

States jumped 21.8% to $27.5 billion (23.9% below February's

level).

- US electric vehicle (EV) startup Lordstown Motors is planning

to go public through a merger with special purpose acquisition

company DiamondPeak Holdings. Lordstown Motors said it has signed

"a definitive agreement for a business combination" that will

result in the company being listed on the NASDAQ stock exchange.

(IHS Markit AutoIntelligence's Stephanie Brinley)

- The planned move of merging with publicly traded special acquisition company is similar to one used recently by Nikola and one that Fisker is working on.

- Once the merger between Lordstown and DiamondPeak is closed, the resulting company will be called Lordstown Motors Corporation and is expected to be listed on NASDAQ under the new ticker symbol, "RIDE".

- Funds from the merger will be used for development and commercialization of the Lordstown Endurance pick-up.

- Lordstown expects USD675 million in gross proceeds from the deal, which will fund production of the Endurance.

- The deal includes USD500 million private investment in public equity (PIPE) from General Motors (USD75 million) as well as institutional investors.

- The merged company's board of directors will include Steve Burns, founder and CEO of Lordstown, and David Hamamoto, chairman and CEO of DiamondPeak.

- Brazilian light-vehicle registrations decreased 29.8% year on

year (y/y) in July, according to initial data from the National

Federation of Motor Vehicle Distributors (Federação Nacional da

Distribuição de Veiculos Automotores: Fenabrave). (IHS Markit

AutoIntelligence's Tarun Thakur)

- The federation reported registrations of 163,083 light vehicles last month, compared with 232,203 in July 2019.

- Registrations of medium and heavy commercial vehicles (MHCVs) and buses increased by 0.2% y/y last month; 11,415 MHCVs were sold, compared with 11,396 units in the same month a year earlier.

- The best-selling automaker in the Brazilian light-vehicle market, Volkswagen (VW), had a market share of 19.3% in July.

- General Motors (GM) and Fiat Chrysler Automobiles (FCA) claimed second and third places with shares of 17.2% and 15.2% respectively.

- Fenabrave reported that the VW T-Cross was the best-selling passenger car in Brazil last month, with 10,211 units registered. The Fiat Strada pick-up was the best-selling commercial vehicle, with 6,564 units registered in July.

- IHS Markit assesses that risks to the outlook for Brazil's light-vehicle and MHCV markets in 2020 are primarily political, as the government will try to implement tax reforms.

Europe/Middle East/ Africa

- European equity markets closed modestly higher across the region; UK +1.1%, France +0.9%, Italy +0.6%, Germany +0.5%, and Spain +0.3%.

- 10yr European govt bonds closed lower across the region; UK +6bps, Germany +5bps, France/Spain +3bps, and Italy +2bps.

- iTraxx-Europe closed -2bps/56bps and iTraxx-Xover -13bps/343bps.

- Brent crude closed +1.7%/$45.17 per barrel and was as high as $46.18 per barrel at 7:50am EST, which is its highest intraday level since 6 March.

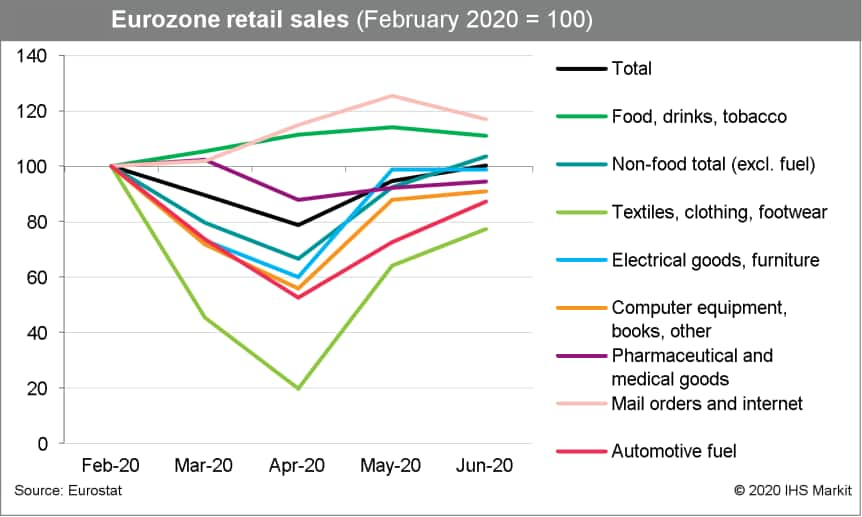

- Despite the overall level of retail sales matching pre-pandemic

levels, recovery among different sub-components and eurozone member

states varies widely. According to real-time activity indicators,

growth in retail footfall in July stalled, while some European

countries have recently paused or reversed the planned easing of

COVID-19 virus-related restrictions. (IHS Markit Economist Daniel

Kral)

- Based on the latest data from Eurostat, eurozone retail sales continued their recovery in June, growing by 5.7% month on month (m/m).

- Growth in May was revised up from 17.8% m/m to 20.3% m/m, resulting in the overall volume of retail sales in June being 0.2% higher than in February, before the impact of the COVID-19 virus pandemic.

- On an annual basis, retail sales in June were up by 1.3%.

- Growth in June was driven by non-food products (except automobile fuel), which were up by 12.1% m/m, after a 38.7% increase in May.

- Food, drinks, and tobacco were down by 2.7% m/m, after increasing by 2.5% in May. Sales of both food and non-food products surpassed February's levels, while total retail sales were dragged down slightly by sales of automotive fuel.

- Among the main sub-components of non-food products, the textiles, clothing, and footwear category was up by 20.4% m/m, while May's increase was revised up to 224.1%.

- Owing to the extremely deep contraction in March-April (down by 80% on a cumulative basis), the level of sales in June was still almost 23% below February's level.

- Strong growth in June was also recorded in computer equipment, books, and other, up by 3.6% m/m, and pharmaceutical and medical goods, up by 2.5% m/m. However, both categories were below February's levels, by 9.1% and 5.5%, respectively.

- After growing strongly in February-May, mail orders and internet sales in June were down by 6.8% m/m. However, this category is the clear outperformer in 2020, highlighting an accelerated trend towards online shopping during the pandemic.

- Among member states for which there are available data, the highest monthly increases in June were recorded in Ireland (21.9%), Spain (+16.5%), and Italy (+13.8%). Small decreases were reported in Austria (-2.5%) and Germany (-1.6%).

- Among the largest member states, the volume of retail sales in

June exceeded February's levels in Germany, France, and the

Netherlands, but not in Italy and Spain

- Sweden fared significantly better than the eurozone, despite

its record drop in GDP the second quarter. High-frequency and

real-time activity data indicate that a recovery is under way after

the bottom was reached in April-May. (IHS Markit Economist Daniel

Kral)

- Statistics Sweden (SCB) has published a 'flash' estimate of Sweden's GDP for the second quarter. It shows that the Swedish economy contracted by 8.6% quarter on quarter (q/q) and by 7.8% year on year (y/y).

- There is no breakdown available accompanying the release, but it represents a much better performance compared with the eurozone, which contracted by 12.1% q/q and 15.0% y/y in the second quarter. However, it is weaker than our projection of a 7.5% q/q drop, with the contraction larger than indicated by leading confidence indicators, which are historically strongly correlated with GDP.

- Although there is no detailed breakdown of the drivers, the statistics office stated that the drop is in "large parts driven by falling exports and household consumption expenditure". This is consistent with our view that the export-led growth from the first quarter would not be sustained.

- Sweden's approach to containing the spread of the COVID-19 virus has differed from most European countries. In IHS Markit's analysis tracking the severity of containment measures, Sweden has been the most lax in the European Union, with the country never imposing a lockdown. However, high-frequency indicators were pointing to a large drop in the second quarter.

- In a separate release, the SCB stated that private-sector production increased by 0.7% month on month (m/m) in June, after monthly declines in February-May. On an annual basis, private-sector production was 8.4% lower in June.

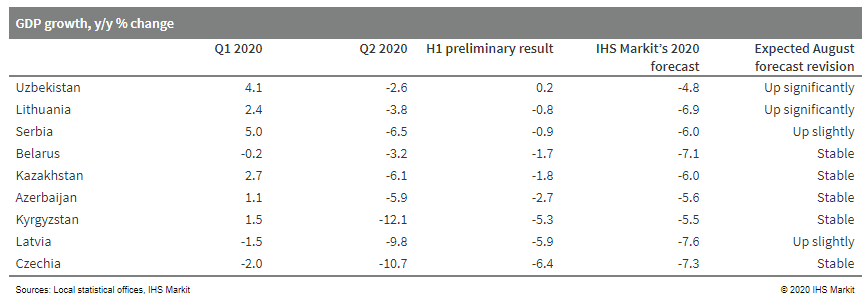

- Preliminary second-quarter GDP data have been published for

nine countries from across Emerging Europe. Although early results

have generally been encouraging, we are hesitant about upgrading

our 2020 forecasts. (IHS Markit Economist Sharon Fisher)

- Nine countries have released preliminary second-quarter GDP estimates, including three EU member states (Czechia, Lithuania, Latvia), one Western Balkan country (Serbia), and five Commonwealth of Independent States (CIS) countries (Belarus, Uzbekistan, Kazakhstan, Azerbaijan, and Kyrgyzstan). Although IHS Markit does not publish quarterly forecasts for three of the nine countries (Belarus, Uzbekistan, and Kyrgyzstan), the second-quarter results were significantly better than anticipated throughout the region.

- Across Emerging Europe, the range of recent outcomes has been broad as the region struggles with the impact of the coronavirus disease 2019 (COVID-19) virus pandemic. For the first half of the year, Uzbekistan managed to eke out growth of 0.2% year on year (y/y), while Czechia reported the steepest decline (down by 6.4% y/y).

- In the second quarter alone, Kyrgyzstan and Czechia appear to have suffered the most (with double-digit y/y declines), while both Uzbekistan and Belarus reported a comparatively modest drop.

- Quarter-on-quarter (q/q) results, which are currently available only for the three EU countries, were most negative for Czechia (down by 8.4%), while Lithuania's GDP fell a more modest 5.1%. In all three cases, the declines were less steep than anticipated, particularly in the case of Lithuania.

- Although GDP results for the first half of 2020 were generally

better than expected, IHS Markit will be cautious about upgrading

its forecasts in the August round. One country that will be

upgraded significantly is Lithuania while Uzbekistan is another

candidate for an upward revision.

- In July, Turkish annual inflation cooled slightly as compared

to June, the deceleration built on lira stability against the US

dollar. However, at the end of July, the lira slipped from its

recent level against the dollar. A fresh round of sharp

depreciation would send inflationary pressures back upwards. Even

without a fresh round of depreciation, the central bank's end-year

target is far too optimistic. (IHS Markit Economist Andrew Birch)

- Annual consumer price inflation decelerated from June to July in Turkey, although it remained elevated, at 11.8%. IHS Markit had anticipated a deceleration of inflation in July in the face of the stabilization of the lira against the US dollar since mid-May.

- With the lira largely unchanged since mid-May against the dollar, imported price pressures lessened in June and July. Seasonal fluctuations contributed to the fall of food and beverage prices in July, fueling the deceleration of inflation. Imported energy prices also helped to alleviate both transport and housing and utility annual inflation from June to July.

- The lira stability on which the deceleration of inflation in July was reliant faltered at the end of last month, with the lira dropping from the TRY6.85/USD1 rate it had been at since mid-May to TRY6.94/USD1 over the last two days of July. The lira had long been depreciating badly against the euro, having depreciated from TRY7.44/EUR1 as of end-May to TRY8.07/EUR1 as of 28 July. However, with the lira drop against the dollar at the end of July fueled the downturn against the euro as well, to TRY8.15/EUR1 as of end-July.

- The course of inflation over the final five months of the year depends greatly on whether or not the end-July lira depreciation was a one-off lurch or if it is the beginning of another period of sharp losses against the dollar and/or euro.

- The Turkish lira was a low as ₺7.06/USD today, which is the first time it breached ₺7.00/USD since 12 May.

- Volvo Cars has announced that its global retail sales grew by

14.2% year on year (y/y) during July. According to data released by

the company, its sales increased from 54,546 units to 62,291 units.

(IHS Markit AutoIntelligence's Ian Fletcher)

- The automaker saw growth from all its regions. Its largest single market, China, recorded an increase of 14% y/y to 14,410 units, while in the United States it has gained by 10.3% y/y to 9,697 units.

- Its important European market has risen by 12.5% y/y in July to 28,700 units, while in its 'Other' region it has grown by 24.9% y/y to 9,484 units.

- Nevertheless, the automaker remains well down during the first seven months of 2020 as a result of COVID-19 virus-related measures during the first half, with global sales standing at 332,253 units, a decline of 16% y/y.

Asia-Pacific

- APAC equity markets closed mixed; South Korea +1.4%, Hong Kong +0.6%, China +0.2%, India -0.1%, Japan -0.3%, and Australia -0.6%.

- BAIC BJEV, the new energy vehicle (NEV) subsidiary of BAIC Motor, plans to raise up to CNY5.5 billion (USD787 million) through a private offering to support research-and-development (R&D) activities on several key projects. According to a company statement, the automaker plans to allocate around CNY2.6 billion of the funds raised for the development of new models under its premium brand, Arcfox. The rest will be used to support battery-swapping technology development and programs related to connectivity system development. Three new models are planned for the Arcfox brand, including a C-segment electric sport utility vehicle (SUV), a D-segment SUV, and a coupe-style SUV. The Chinese electric vehicle (EV) maker also said it plans to build 83 new battery-swapping stations in China, which it believes will facilitate the rolling out of EVs featuring swappable battery packs. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The China Association of Automobile Manufacturers (CAAM) on 4

August released estimates of new vehicle sales in China in July

prior to its monthly briefing. According to CAAM, new vehicle sales

in China are expected to reach 2.08 million units in July, up by

14.9% year on year (y/y) and down 9.6% month on month. (IHS Markit

AutoIntelligence's Abby Chun Tu)

- Breaking down the figures by vehicle type, passenger vehicle (PV) sales are expected to grow 5.3% y/y, while commercial vehicle (CV) sales are expected to rise 59.6% y/y.

- During January-July, new vehicle sales in China are expected to reach around 12.34 million units, down by 12.7% y/y. IHS Markit expects more details to be released by CAAM in the coming week.

- Honda reported its sales results for July in the Chinese market

on 5 August. The Japanese automaker experienced strong sales growth

of 17.8% year on year (y/y) to 136,646 units during July in China,

setting a new record of July sales in the market. (IHS Markit

AutoIntelligence's Abby Chun Tu)

- In the year to date (YTD; January to July), Honda's Chinese sales were down 13.1% y/y to 748,653 units.

- Sales of the Guangqi Honda joint venture (JV) stood at 69,187 units during July, up 24.5% y/y, and 384,219 units in the YTD, down 11.9% y/y.

- Sales of the Dongfeng Honda joint venture (JV) were 67,459 units in July, up 11.7% y/y, and 364,434 units during the YTD, down 14.3% y/y.

- Honda's hybrid models are gaining traction in the Chinese market. The combined sales of Honda's hybrid vehicles were 17,822 units in China in July, accounting for 13% of its total sales in the market.

- Yantai North Andre Juice Co Ltd (Andre) was approved (July 30) by the China Securities Regulatory Commission for its first application and will be listed on the Shanghai Stock Exchange. The company is hoping to raise CNY175 million (USD25 mln) for expansion of a variety of juice concentrate production lines. Consumers demand more varieties and flavors. North Andre's core products are apple and pear juice concentrates. It is the juice concentrate supplier for Nongfu Spring, Coca-Cola, PepsiCo, Uni-President, Master Kong, Wahaha and Yili, and also exports 75% of its juice concentrate to key export destinations including the US, Russia, Japan, Australia, Canada and South Africa. It has production plants based in Shandong, Shaanxi, Jiangsu, Liaoning and Shanxi. Andre can process 1.8 mln tons of fruits, for an annual capacity of 280,000 tons of juice concentrates. The company benefits from its own circular industrial chain of apple cultivation, juice processing and pomace utilization. (IHS Markit Food and Agricultural Commodities' Hope Lee)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-august-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-august-2020.html&text=Daily+Global+Market+Summary+-+5+August+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-august-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 5 August 2020 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-august-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+5+August+2020+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-august-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}