Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 03, 2022

Daily Global Market Summary - 3 February 2022

Most major APAC and all major US and European equity indices closed lower. US and benchmark European government bonds closed lower, with the latter selling off significantly post-ECB meeting. CDX-NA and European iTraxx widened sharply across IG and high yield. Oil closed higher, while the US dollar, natural gas, gold, silver, and copper were all lower on the day. All eyes will be on tomorrow's 8:30am ET US non-farm payroll report for indications of how much pressure the omicron variant had put on the US labor market last month.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -1.5%, Russell 2000 -1.9%, S&P 500 -2.4%, and Nasdaq -3.7%.

- 10yr US govt bonds closed +6bps/1.83% yield and 30yr bonds +4bps/2.16% yield.

- CDX-NAIG closed +3bps/63bps and CDX-NAHY +15bps/350bps.

- DXY US dollar index closed -0.6%/95.38.

- Gold closed -0.3%/$1,804 per troy oz, silver -1.5%/$22.38 per troy oz, and copper -0.6%/$4.47 per pound.

- Crude oil closed +2.3%/$90.27 per barrel and natural gas closed -11.1%/$4.89 per mmbtu.

- Amazon.com Inc. said profit nearly doubled in the critical holiday period, as the company managed to control labor and supply costs better than expected and saw gains in its cloud-computing and advertising businesses. The company saw a huge boost in the quarter from its investment in electric-vehicle maker Rivian Automotive, Inc., adding nearly $12 billion to its operating income in the period on gains from that company's initial public offering in November last year. That accounted for the most of Amazon's profit. (WSJ)

- On February 2, the US Department of Energy (DOE) joined the US

Departments of Homeland Security (DHS) and Housing and Urban

Development (HUD), plus the Commonwealth of Puerto Rico, to launch

a new effort to accelerate work to strengthen the island's power

grid and advance new initiatives to enhance Puerto Rico's energy

future. (IHS Markit PointLogic's Barry Cassell)

- The parties executed a memorandum of understanding that enhances collaboration among federal agencies and the Commonwealth, and kickstarts the PR100 Study. This study is a community-driven and locally-tailored roadmap to help Puerto Rico meet its target of 100% renewable electricity, improve power sector resiliency, and increase access to more affordable energy and cleaner air.

- Dozens of grid modernization projects will start construction this year, and the government-owned Puerto Rico Electric Power Authority will sign contracts for at least 2 GW of renewable energy and 1 GW of energy storage projects.

- "The Biden-Harris Administration is helping Puerto Rico strengthen the island's resilience, and in the process unlock its potential for cheap and abundant renewable energy," said US Secretary of Energy Jennifer Granholm. "Today's commitments and the launch of the PR100 Study show that 2022 will be a year of action to modernize Puerto Rico's grid and increase energy resilience as we accelerate our work with Puerto Rico to execute data-driven, community-tailored pathways towards 100% clean electricity."

- FEMA Permanent Work Projects Will Begin Construction - FEMA, the Central Office for Recovery, Reconstruction and Resilience (COR3), the Puerto Rico Electric Power Authority (PREPA), and PREPA's contracted system manager, LUMA Energy, have established working groups and collaboration processes to reconstruct the island's electric grid. It is expected that at least 138 projects will be under construction bidding or have begun initial construction activities, including island-wide substation repairs, the replacement of thousands of streetlights across five municipalities, and the creation of an early warning system to improve dam safety.

- Clean Energy Projects Will Move Forward - Puerto Rico is procuring 3,750 MW of renewable energy and 1,500 MW of energy storage, enough clean energy to power over 1 million homes. Over the last year, DOE has provided technical assistance to the Government of Puerto Rico to align the procurement process with global best practices and ensure access to capital to ultimately lower electricity costs for ratepayers who currently pay twice the national average. PREPA is currently in final negotiations of the first tranche of proposed projects: 844 MW of renewable energy, 220 MW of energy storage, and two Virtual Power Plants.

- Implementation of $1.9 billion in HUD Grant Funding - In 2022, the Puerto Rico Department of Housing (PRDOH) will implement an action plan to enhance electrical system reliability and resilience. Puerto Rico's proposed plan includes the development of both small and large microgrids.

- Amid a surge in output, US productivity (output per hour in the

nonfarm business sector) rose at a 6.6% annual rate in the fourth

quarter, more than reversing a 5.0% decline in the third quarter.

During 2021, productivity rose 2.0% following a 2.5% increase

during 2020. Those increases exceeded the average annual increase

during the three years prior to the pandemic of 1.5%. (IHS Markit

Economists Ken

Matheny and Lawrence Nelson)

- Compensation per hour rose at a 6.9% annual rate in the fourth quarter following increases averaging 6.1% over the prior two quarters. Growth in compensation per hour has been elevated, on average, during the pandemic: since the fourth quarter of 2019, compensation per hour has risen at a 6.8% annual rate. Employment in lower-wage sectors has declined relative to employment in higher-wage sectors, while wage gains have risen particularly in lower-wage sectors such as leisure and hospitality.

- With productivity growth nearly matching growth in compensation per hour, unit labor costs edged up at a slight 0.3% annual rate in the fourth quarter. However, this follows much larger increases in previous quarters so that during 2021, unit labor costs rose 3.1%.

- Unit labor costs surged in the early stages of the pandemic, as compensation per hour rose much more than productivity. The rise in unit labor costs slowed on average after the initial surge but quickened again over the second and third quarters of 2021. Over those two quarters, unit labor costs rose at an average annual rate of 7.6%, as compensation per hour rose at a robust pace (6.1%) while productivity declined (down 1.3%).

- The rise in labor costs during the pandemic is contributing to inflationary pressures.

- US manufacturers' orders declined 0.4% in December, close to

the consensus estimate. Shipments rose 0.4%, and inventories rose

0.3%. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

- Orders for core capital goods, a key predictor for equipment spending in the National Accounts, were revised higher through December. Shipments of core capital goods were essentially unrevised.

- Nominal figures in the manufacturing sector remain elevated due to rapidly rising prices.

- Over the 12 months of 2021, manufacturers' orders and shipments posted double-digit gains, with orders up 13.3% and shipments up 11.3%. Nominal inventories also rose briskly, up 8.9% on the year.

- Over the same 12-month period, manufacturing prices rose more; the Producer Price Index (PPI) for the net output of the manufacturing sector rose 15.0%.

- In real terms, after mounting a full recovery by late 2020, manufacturers' shipments declined and have since remained below pre-pandemic levels.

- This reflects ongoing bottlenecks in manufacturing supply chains that have prevented manufacturers from keeping pace with elevated demand for goods. Indeed, after accounting for the effect of price gains on inventories, real manufacturers' inventories declined 3.6% over the 11 months that ended last November (the most recent month for which these data are available).

- US employers announced 19,064 planned layoffs in January,

according to Challenger, Gray & Christmas—essentially

unchanged from the 19,052 announced cuts in December and low by

historical standards. The total for January is down 76% from the

January 2021 reading. (IHS Markit Economist Juan

Turcios)

- Vaccine refusal was the number one reason cited by employers for announcing job cuts. Roughly 30% of the announced job cuts in January were due to employee refusal to get vaccinated against COVID-19 (5,757 out of the 19,064 announced job cuts).

- According to Andrew Challenger, senior VP of Challenger, Gray & Christmas, "Many employers who implemented vaccine policies last year gave workers until early January to comply. Job cuts remain low, and companies are still hard-pressed to fill open positions. This is a lot of people to cut, particularly in Health Care, where workers are increasingly leaving while those who remain battle intensifying burnout."

- Last year, employers announced plans to cut 321,970 jobs. This was the lowest annual total on record and 86% lower than the 2,222,249 job cuts announced over 2020 (Challenger began tracking job-cut announcements in January 1993).

- With job-cut announcements hovering near historic lows, job openings near all-time highs, and an elevated quits rate, the labor market appears to be tight and tilted in the favor of workers.

- While the Omicron wave likely dampened employment gains in January, employers were still making their best efforts to retain existing talent.

- COVID-19 was cited as a reason for 330 planned job cuts in January. Since August, COVID-19 has been cited only a total of 1,284 times as a reason for planned job cuts despite the increase in cases that occurred first because of the Delta variant and then the massive wave of new infections brought on by the Omicron variant.

- The healthcare sector announced the highest number of cuts in January at 5,053 (4,934 of which were due to vaccine refusal). Rounding out the five sectors that reported the most job cuts in January are warehousing (3,051), services (1,786), entertainment/leisure (1,691), and consumer products (1,432).

- Ford has partnered with Sunrun to advance home energy management by using the onboard battery capability of the F-150 Lightning electric vehicle (EV) pick-up. According to a company statement, Sunrun will facilitate installation of the 80-amp Ford charge station pro and home integration system, which will allow the truck to store and supply power to homes. The F-150 Lightning is equipped with Ford intelligent backup power, which enables customers to use bidirectional power technology to provide energy to their homes. The extended-range battery system for the F-150 Lightning can store 131 kWh and supply up to 9.6 kW of power. If the grid goes down, the truck uses Ford intelligent backup power and the home integration system to automatically power a home. Matt Stover, Ford charging and energy services director, said, "F-150 Lightning brings new innovations to customers, including the ability to power their homes when they need it most. Teaming up with Sunrun leverages their expertise to bring solar power to even more customers, giving them the chance to turn their truck into an incredible energy storage source —and future truck features can help accelerate the development of a less carbon-intensive grid". (IHS Markit AutoIntelligence's Surabhi Rajpal)

- TuSimple has partnered with Union Pacific Railroad to haul freight using fully driverless trucks on a route in Arizona, United States. TuSimple plans to conduct "Driver Out" freight deliveries without a human behind the wheel for Union Pacific. Loup Logistics, a wholly owned subsidiary of Union Pacific, is coordinating the freight shipments and supporting seamless transit between rail and the critical first and last mile. Kenny Rocker, executive vice-president of marketing and sales at Union Pacific, said, "Partnering with TuSimple allows us to extend our operations beyond our rail hubs and serve our customers faster and more efficiently. This groundbreaking autonomous driving technology and our partnership provide us a significant opportunity to scale the technology in our network, proactively reducing global supply chain congestion." TuSimple has also announced that its autonomous trucks have completed more than 550 miles of driving without a human behind the wheel on public roads in Arizona, reports FreightWaves. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- US lawmakers are eyeing federal legislation to combat price

gouging in the wake of COVID-19, but one retail group tells

Congress that market forces, not price gouging, are increasing

prices. (IHS Markit Food and Agricultural Policy's Joan

Murphy)

- At a February 2 hearing of a House Energy and Commerce subcommittee, Democrats and Republicans faced off on the need for the first federal price-gouging law, with Republicans accusing Democrats of intentionally deflecting the issue of rising inflation with heightened concerns over price gouging.

- "Corporate greed is motivating some large companies to use the pandemic and supply chain issues as an excuse to raise prices simply because they can," said House Energy and Commerce Chairman Frank Pallone, Jr. (D-N.J.) at the hearing. "The pandemic has been a windfall for the largest companies and their investors."

- "Americans are feeling the pain of a year of one-party rule. President [Joe] Biden's inflation has hit a 40-year high," said Rep. Cathy McMorris Rodgers (R-Wash.). "[Democrats are] running the show, and we see record spending, we see top-down mandates, COVID-19 restrictions, surging energy costs that are making rising prices and empty shelves worse. Unfortunately, today is a deliberate diversion on the root issues."

- No federal price gouging law To date, there is no federal law that expressly bans price gouging, and while the Federal Trade Commission (FTC) can pursue unfair and deceptive acts, the agency lacks authority to obtain civil penalties, the committee's Democrats said. More than three dozen states have authority to pursue price-gouging cases during emergencies or disasters, but the definition of an emergency varies widely.

- Under the bill, COVID-19 Price Gouging Prevention Act (H.R. 675), FTC would be granted authority to seek civil penalties from those price gouging during the COVID-19 pandemic, and state attorneys general would also be able to enforce the legislation without losing any of their existing authority under state law.

- Mexico's Alpek plans to acquire Oman-based polyethylene

terephthalate (PET) producer OCTAL, Alpek announced on Tuesday. The

Mexican petrochemical producer intends to purchase 100% of OCTAL's

shares for $620 million, subject to regulatory approval, by H1 this

year. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- Alpek sees value in OCTAL's PET sheet business, which has the potential to grow 6.4% annually through 2025, amid a demand for 100% recyclable packaging.

- OCTAL's proprietary "DPET" technology is also attractive to Alpek, and can be deployed across its existing plants to save costs, on top of synergy savings from asset integration.

- Alpek explained that OCTAL's DPET technology produces PET sheets with a carbon dioxide footprint that is 25% lower than industry standards, an improvement to Alpek's carbon intensity, helping Alpek reduce emissions in a transition to more sustainable packaging alternatives.

- The Mexican company added that the acquisition will allow Alpek to benefit from projected strong global demand for PET resin, and will expand Alpek's presence into the PET sheet and thermoforming industries.

- Alpek splits its business into two segments - the polyester segment encompasses purified terephthalic acid (PTA), PET, recycled PET (rPET), and polyester fibres, while its plastics and chemicals segment includes polypropylene (PP), expandable styrenics, and other specialty and industrial chemicals.

- According to Alpek, it is the largest rPET producer in the Americas, the third-largest expandable polystyrene (EPS) manufacturer worldwide, and the only producer of PP in Mexico.

- OCTAL said its operations span four plants in Saudi Arabia, the U.S., and Oman, with the world's largest single-location integrated PET producing site in Salalah, Oman.

Europe/Middle East/Africa

- All major European equity markets closed lower; Spain -0.3%, UK -0.7%, Italy -1.1%, France -1.5%, and Germany -1.6%.

- 10yr European govt bonds closed significantly lower; Germany +10bps, UK +12bps, France +14bps, Spain +15bps, and Italy +23bps.

- iTraxx-Europe closed +5bps/57bps and iTraxx-Europe +19bps/300bps.

- Brent crude closed +1.8%/$91.11 per barrel.

- The ECB's press release following its February policy meeting

was very similar to the December 2021 version, which was relatively

dovish compared with those of other major central banks recently.

The key elements of the ECB's policy guidance remain unchanged, as

follows (IHS Markit Economist Ken

Wattret):

- Policy rates are expected to remain "at their present or lower levels" until the three inflation criteria introduced in July 2021's guidance are achieved.

- Net asset purchases under the Pandemic Emergency Purchase Programme (PEPP) are being conducted at a slower pace in the first quarter of 2022. They will cease at the end of March.

- The Governing Council intends to reinvest the principal payments from maturing securities purchased under the PEPP until at least the end of 2024.

- Monthly net purchases under the Asset Purchase Programme (APP) will amount to EUR40 billion (USD46 billion) in the second quarter of 2022 and EUR30 billion in the third quarter. From October onwards, they will be maintained at a monthly pace of EUR20 billion for as long as necessary. Net purchases are expected to end "shortly before" policy rates start to rise.

- Principal payments from maturing securities purchased under the APP will be reinvested for an extended period past the date when policy rates start to rise.

- Under stressed conditions, flexibility will remain an element of monetary policy whenever threats to monetary policy transmission jeopardize the attainment of price stability. Net purchases under the PEPP could be resumed, if necessary.

- The Governing Council stands ready to adjust all of its instruments, as appropriate, to ensure that inflation stabilizes at its 2% target over the medium term.

- There was one subtle but significant change to the latter element of the guidance above. While it was reiterated that the ECB stands ready to adjust all of its instruments, the prior reference to "in either direction" was removed, implying a tightening bias (although the easing bias for policy rates was retained). Furthermore, the press conference was littered with indications that the ECB's assessment of inflation prospects and risks had changed, potentially materially.

- Continental has unveiled a potentially key piece of technology in the acceleration of the electrification of the global vehicle parc in the form of a robotic battery electric vehicle (BEV) charging system, according to a company press statement. Continental is partnering on the new technology with startup Volterio; it became clear after discussions that they were both working on a similar solution simultaneously. Continental's development and production service provider Continental Engineering Services (CES) will combine its own know-how and proprietary technology with Volterio's; CES will also be able to meet all necessary certification criteria while developing the system to production maturity. The plan is for the first near production-ready system to be available this year. It will be demonstrated practically to OEMs and other potential customers before full series volume production begins in 2024, and Germany is planned as the production location. This robotized BEV charging system is potentially an exciting development for the speed of electrification in Europe and in other regions. As around half of the EU's residents do not have access to a garage or driveway in which they can home charge a BEV, compelling home charging solutions for those consumers are needed. While this solution does not necessarily help those potential BEV owners who live in houses with no off-street parking, it could be easily rolled out in city centre parking garages and the kind of car parking spaces that are allocated to flat developments in Europe and elsewhere. There are also many potential benefits for the user. Unlike conventional charging stations, users no longer have to worry about handling heavy, potentially contaminated or rain-soaked charging cables in confined garages, while the system does not require very accurate parking - unlike aforementioned wireless charging infrastructure. (IHS Markit AutoIntelligence's Tim Urquhart)

- Opel has been forced to take on temporary workers to cover for its employees that have been struck down by the Omicron variant of the COVID-19 virus as it looks to roll out the new Astra, according to a report by the Wirtschaftswoche newspaper. The temporary workers have been employed at Opel's biggest plant location in Rüsselsheim (Germany), which is currently ramping up production of the company's latest generation C-Car model. The newspaper report stated the employment agency Adecco was recruiting workers for production, final assembly and warehouse work. Customer deliveries of the new sixth-generation Astra began in January, and Opel has high hopes for a model that appears vastly improved over its predecessor. Astra production has been moved from Ellesmere Port (UK) back to the Rüsselsheim facility. Opel appears to be suffering as a result of the decision to cut 2,100 positions at the company between January 2020 and 2022 through allowing contracts to expire, early retirement and then not rehiring. IHS Markit forecasts that Astra production will increase from 121,000 units in 2021 to 182,000 units. (IHS Markit AutoIntelligence's Tim Urquhart)

- Dutch renewable-chemicals and polymers company Avantium expects

to start constructing the world's first commercial furan

dicarboxylic acid (FDCA) plant this year, the company said last

week. The company said that its shareholders gave the mandate to

raise funds using both debt and equity to finance this flagship

project. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- Avantium expects to begin construction of the FDCA plant around Q1 or afterwards within this year, and to complete works by 2023.

- This will enable it to commercially produce and launch its downstream polymer, polyethylene furanoate (PEF), by 2024, it said.

- Tereos Cooperative will supply high fructose syrup as feedstock for Avantium's FDCA plant.

- This FDCA plant will be built in Delfzijl, a city within the province of Groningen in the Netherlands, with a nameplate capacity of 5,000 mt/year.

- Avantium said its technology catalytically converts plant-based sugars into FDCA, which is then made into PEF, a novel polyester.

- As a material, polyester most commonly refers to polyethylene terephthalate (PET), which is made using purified terephthalate acid (PTA) and monoethylene glycol (MEG).

- Avantium's PEF is 100% plant-based, 100% recyclable and degradable, with superior performance properties compared to current petroleum-based packaging materials, it said.

- According to Avantium, it has partnered Mitsui, Toyobo, Alpla, Danone, Carlsberg, Paboco, BillerudKorsnäs, and R&F Chemical, to develop 100% plant-based PEF bottles and film.

- ElectReon, an Israel-based company specializing in inductive charging of electric vehicles (EVs), has announced plans to make its debut in the US market with the deployment of its wireless charging infrastructure in Detroit, Michigan, reports the Times of Israel. According to the source, ElectReon has won a bid to build an Electric Road System (ERS) on a public road in Detroit as part of a program called the Inductive Vehicle Charging Pilot announced by Michigan governor Gretchen Whitmer. The program aims to test electrified roads to promote the adoption of EVs and enhance environmental sustainability. Whitmer said, "As we aim to lead the future of mobility and electrification by boosting electric vehicle production and lowering consumer costs, a wireless in-road charging system is the next piece to the puzzle for sustainability." The pilot scheme is intended to run in partnership with the Michigan Department of Transportation, which will provide USD1.9 million for the project. In the United States, Electreon will design, evaluate, test, and implement the electrified road, with the aim of making it operational by 2023 on a one-mile-long stretch of road in Detroit including dynamic and stationary wireless charging. (IHS Markit AutoIntelligence's Tarun Thakur)

- Dubai-based Swvl Inc, a ride-sharing technology startup, has secured additional private investment in public equity (PIPE) financing from the European Bank for Reconstruction and Development and Teklas Ventures. This is related to the company's proposed merger deal with a special-purpose acquisition company (SPAC), Queen's Gambit Growth Capital. According to a company statement, the additional investment increases the amount of expected PIPE proceeds to USD121.5 million. Swvl plans to use the infused capital to fund its expansion efforts and technology platform, as well as to support its strategic growth initiatives. Swvl allows customers to book fixed-rate rides on buses and vans in its network. Its algorithms and technologies help make vehicles and routes more efficient. The company currently operates in 10 cities across six countries and makes more than 3 million trips a month. Last year, Swvl acquired a controlling stake in Latin American mass-transit company Viapool and agreed to buy on-demand bus service Shotl. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- Major APAC equity markets closed mixed; South Korea +1.7%, Australia -0.1%, Japan -1.1%, and India -1.3%.

- Preliminary data show that Hong Kong SAR's real GDP expanded by

4.8% year on year (y/y) in the fourth quarter of 2021, decelerating

from a 5.5% y/y expansion in the third quarter. It also marked the

third quarter of deceleration after hitting an 8% y/y surge in the

first quarter of 2021. For 2021 as a whole, real GDP climbed by

6.4% y/y, reversing two straight years of contractions beginning in

mid-2019. (IHS Markit Economist Ling-Wei

Chung)

- Domestic demand moderated somewhat in the fourth quarter of 2021, as a substantial deceleration in fixed investment offset a still-robust expansion in consumer spending. Private consumption added 3.9 percentage points to fourth-quarter-2021 growth, and government consumption contributed 0.5 percentage point, but fixed investment came in flat. Meanwhile, net exports' contribution to fourth-quarter-2021 growth turned positive, after falling in the previous two quarters as export growth outpaced import expansions.

- Supported by robust external demand, merchandise exports continued to expand at a double-digit pace, albeit at a slower rate in the fourth quarter of last year. Exports of goods climbed by 13.3% y/y, after expanding by 14.2% y/y in the third quarter. This compares with 20%-30% surges in the first and second quarters of 2021. Exports to all major markets continued to climb at more than 20% y/y in the last quarter, except Japan. In December 2021 alone, merchandise exports expanded by 24.8% y/y, similar to a 25% y/y jump in November 2021. The strong momentum came despite an unfavourable comparison base when merchandise exports began double-digit expansions during the same period in December 2020.

- Accounting for about 60% of total exports, shipments to mainland China climbed by 20.8% y/y in December 2021, accelerating from a 10-month low of 11.2% y/y growth in September 2021 amid power shortages there. In addition, the revivals in the regional economies continued to provide support, led by an 84% y/y surge in exports to India, a 52.2% y/y jump to Thailand, and a 46.2% y/y expansion to South Korea. In addition, shipments to the United States remained strong, rising by 19.9% y/y, albeit slowing from a 32.2% y/y surge in November 2021. Shipments to Germany climbed by 37.6% y/y, partly offsetting a mere 2.6% y/y gain in sales to the United Kingdom.

- Sales of consumer durable goods increased by 5.1% y/y in December 2021, after gaining by just 1.5% y/y in November 2021, but still slowing substantially from a 29.9% y/y surge in October 2021. Within that, sales of vehicles expanded by 8.7% y/y and those of electrical products gained 5.5% y/y in December 2021. They helped offset a 4.1% y/y drop in furniture sales, higher than a 1% y/y fall in November 2021.

- Online sales also jumped by 31.5% y/y in December 2021, as consumers turned to online shopping amid the impact of the pandemic, accelerating from a 28.2% y/y expansion in November 2021. Online sales accounted for 10.8% of total retail sales in December 2021.

- Concurrently, fixed investment came in flat, rising by a mere 0.1% y/y in the fourth quarter of 2021, decelerating sharply from a 13.1% y/y expansion in the third quarter. Although stable local outbreak conditions have provided support to business sentiment, confidence was nonetheless undermined by the continued correction in the local stock market.

- Hyundai's premium Genesis brand is planning to open electric vehicle (EV) charging stations across South Korea, according to a company statement. The automaker has deployed two high-speed chargers at each of five locations: Genesis Gangnam, Genesis Suzy, Dongbu Hi-Tech Center, Nambu Hi-Tech Center, and Hyundai Motorstudio Goyang. Genesis also plans to operate a pilot project for wireless charging, a technology that can charge an EV by parking it on a charging pad installed on the floor. Genesis will install one wireless charger at each of the Genesis Gangnam, Genesis Suji, and Hyundai Motorstudio Goyang EV charging stations, as well as demonstrating wireless charging in conjunction with test drives of the GV60 at the Genesis Gangnam and Genesis Suji locations. By 2023, Genesis plans to expand and build about 75 wireless chargers in collaboration with various partners. (IHS Markit AutoIntelligence's Surabhi Rajpal)

- SsangYong will launch its first electric vehicle (EV), the Korando e-Motion sport utility vehicle (SUV), in South Korea on 4 February. In the past three weeks, it has received preorders of 3,500 units for it, reports Yonhap News Agency. It is equipped with LG Energy Solution's 61.5 kWh lithium-ion battery and can travel up to 307 km on a single charge. The SUV costs between KRW39 million (USD32,000) and KRW46 million depending on options, and will be available at less than KRW30 million after the government subsidy is applied. (IHS Markit AutoIntelligence's Surabhi Rajpal)

- India's new budget for the fiscal year (FY) starting 1 April

(FY 2022-23) proposes sharp increases in public capital expenditure

(capex) but includes few measures to directly support private

consumption and address rising unemployment, suggesting that the

recovery will be increasingly led by public investment and

spending. The budget targets a deficit of 6.4% of GDP, only

marginally down from an estimated 6.9% of GDP in the current FY.

(IHS Markit Economists Deepa

Kumar and

Hanna Luchnikava-Schorsch)

- Finance Minister Nirmala Sitharaman on 1 February presented a budget for the FY starting April 2022 (FY 2022-23), bringing the proposed total spending to a record INR39.4 trillion (USD530 billion) and targeting the central government fiscal deficit at 6.4% of GDP. Indian states would be allowed to run deficits of up to 4% of GDP, potentially bringing the general government deficit to 10.4% of GDP.

- The budget is expansionary and is seen as another stimulus budget to tackle the impact of the protracted COVID-19 virus pandemic that led to an economic contraction of 7.3% in FY 2020. The economy partially recovered in FY 2021 despite the severe second wave of infections at the start of the year, with real GDP growth estimated by IHS Markit at 8.1%.

- Infrastructure investment will remain the focus of the government's capital spending, with INR200 billion allocated for a highway expansion plan, in addition to large allocations for railways, airports, mass transport, waterways, and logistics infrastructure. The affordable housing scheme received INR480 billion, while the running water, power (with a focus on renewable energy), and telecommunications sectors will also benefit from announced government schemes.

- Indian integrated electrical utility and power company Tata Power Limited has announced a strategic partnership with Apollo Tyres Limited for the deployment of public charging stations across India, reports Live Mint. As part of the agreement, Tata Power will deploy charging stations at 150 of Apollo Tyres' commercial and passenger vehicle tire retail outlets to support electric vehicle (EV) charging for two- and four-wheelers. The charging stations will be accessible by customers visiting these outlets, and by the general public as well. Tata has also launched a mobile application called Tata Power EZ Charge to give its customers a simple and easy charging experience. The app helps users to locate EV charging stations as well as making bill payments online. (IHS Markit AutoIntelligence's Tarun Thakur)

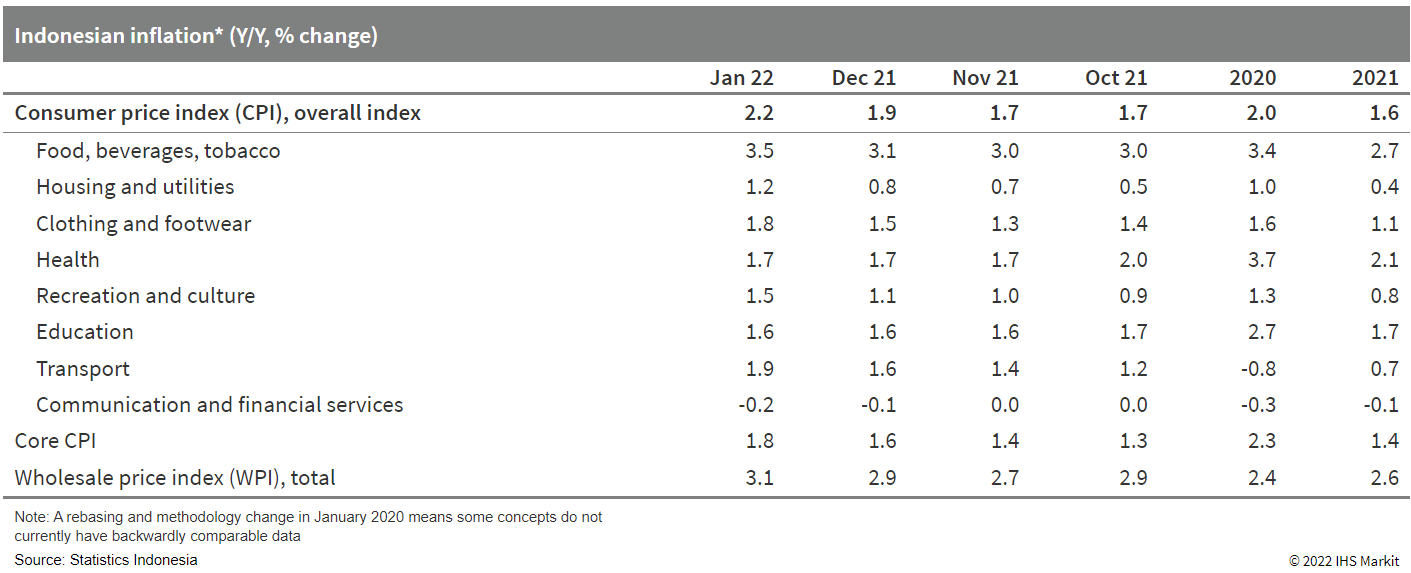

- Headline inflation picked up to 2.2% year on year (y/y) in

January, putting it solidly within Bank Indonesia's (BI)'s 2-4%

inflation target range for the first time since May 2020. BI

officials have started laying out monetary policy tightening

expectations for the year ahead, and they indicate that inflation

has to become more of an issue to trigger actual interest rate

hikes. (IHS Markit Economist Bree

Neff)

- Headline inflation in Indonesia averaged 4.4% for the pre-pandemic years of 2014-19, therefore current inflation levels remain low in historical terms. Headline consumer price inflation has held under 2% y/y since June 2020 when COVID-19 containment measures were ramped up, triggering job losses and collapsed consumer demand.

- Not only has the headline figure hit a pandemic high, but so has core inflation. The measure, which removes volatile food and energy prices, hit a 16-month high, pointing to a broader buildup in price pressures in the economy.

- A government policy worsened the food, drinks, and tobacco inflation rate in January, while the government worked to mitigate other price pressures. A portion of the increase in this sub-component stemmed from a planned excise tax increase for cigarettes on 1 January. Concurrently, the government stepped in and announced a subsidy for cooking oil after its prices rose sharply in recent months. However, this proved insufficient, and at the end of January the government capped retail prices for cooking oil. On top of the price cap, the government announced a domestic market obligation for palm oil producers in late January to sell 20% of their planned crude palm oil exports to the domestic market in order to help contain domestic cooking oil prices.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-february-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-february-2022.html&text=Daily+Global+Market+Summary+-+3+February+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-february-2022.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 3 February 2022 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-february-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+3+February+2022+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-3-february-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}