Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 27, 2021

Daily Global Market Summary - 27 September 2021

All major European equity indices closed higher, while US and APAC markets were mixed. US and most benchmark European government bonds closed lower. CDX-NA and European iTraxx closed flat across IG and high yield. The US dollar, natural gas, oil, silver, and copper closed higher, while gold was flat.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; Russell 2000 +1.5%, DJIA +0.2%, S&P 500 -0.3%, and Nasdaq -0.5%.

- 10yr US govt bonds closed +3bps/1.49% yield and 30yr bonds +2bps/2.00% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY 292bps (CDX-NAHY rolled to 37.1 today)

- DXY US dollar index closed +0.1%/93.38.

- Gold closed flat/$1,752 per troy oz, silver +1.2%/$22.69 per troy oz, and copper +0.1%/$4.29 per pound.

- Crude oil closed +2.0%/$75.45 per barrel and natural gas closed +10.2%/$5.73 per mmbtu.

- Averaged over the last week, the count of seated diners on the OpenTable platform was 11% below the comparable period in 2019. This is down from averages during the summer and indicative of increased caution in response to the latest wave of new COVID-19 infections. Meanwhile, box-office revenues last week were 62.6% below the comparable week in 2019. This was the worst comparison for several weeks and, as with the OpenTable data, is further evidence of increased caution. (IHS Markit Economists Ben Herzon and Joel Prakken)

- US manufacturers' orders for durable goods rose 1.8% in August,

while shipments slipped 0.5% and inventories rose 0.8%. The

increase in orders outpaced the consensus estimate. (IHS Markit

Economists Ben

Herzon and Lawrence Nelson)

- Orders for manufactured durable goods have been surging higher, but most of this year's gains have been accounted for by rising prices.

- Year-to-date, nominal orders for durable goods are up 11.0%. Over the same period, a shipments-weighted producer price index (PPI) for manufactured durable goods is up 9.4% (our estimate), putting the year-to-date gain in real orders at 1.6%.

- Real orders have, indeed, surpassed the pre-pandemic (February 2020) level, but not by much; they are 2.4% above February 2020.

- The combination of a stalled recovery in real orders (for durable goods) and rapidly rising prices reinforces the notion that supply constraints are limiting expansion in the manufacturing sector.

- Inventories of durable goods, on the other hand, were robust in August, continuing solid increases of recent months. The strength in August was unexpected and raised our estimate of third-quarter inventory investment by about $10 billion.

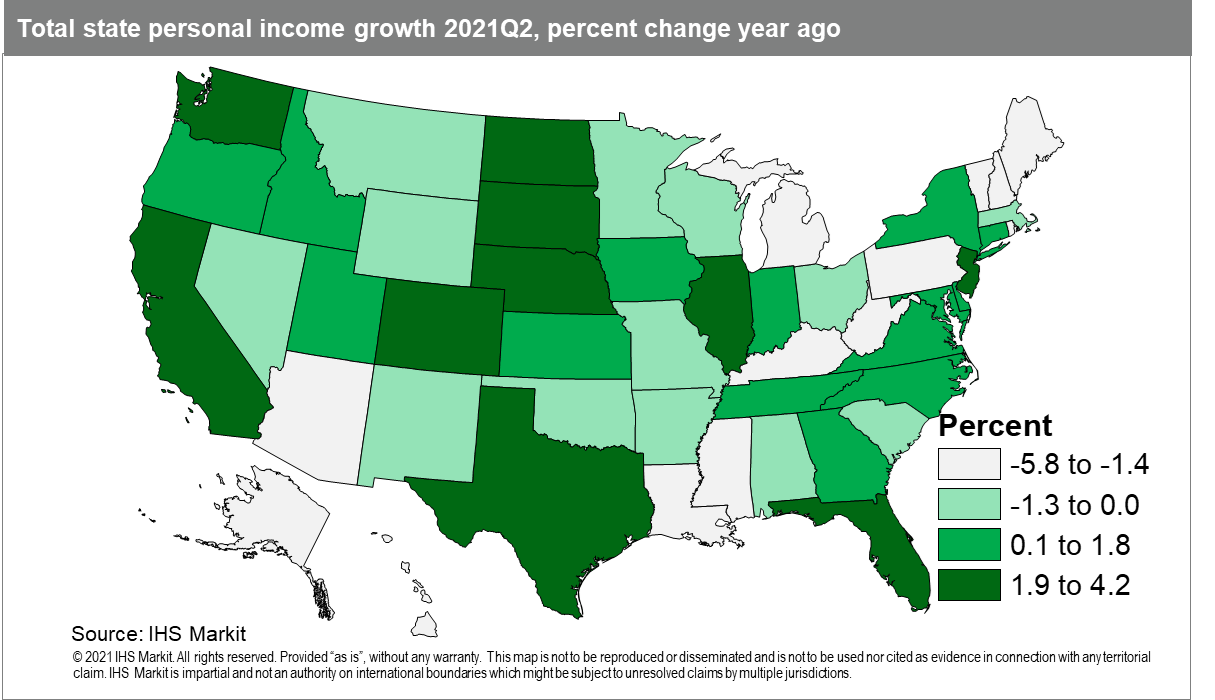

- The second quarter of 2021 experienced record declines in state

personal income after a retreat of the fiscal stimulus that pushed

first-quarter income to all-time highs. Plummeting transfer

payments accounted for the entire decline in personal income for

every state, and income from net earnings and dividends, interest,

and rents could not come close to making up the difference.

Personal income contracted the most in West Virginia (34.0% quarter

on quarter: q/q), Mississippi (30.9% q/q), and New Mexico (30.2%

q/q), places where transfer payments make up a significant share of

total income. Meanwhile, incomes fell the least in the District of

Columbia (10.1% q/q), Massachusetts (14.5% q/q), and North Dakota

(14.9%), locations where transfer payments account for a lower

portion of income and decreased at lower rates. (IHS Markit

Economist Alexander Minelli)

- During the second quarter, transfer payments dropped by 72.6% q/q nationally following reductions in direct economic impact payments and state unemployment insurance (UI) compensation. Eighteen Southern and Midwestern states ended participation in federally bolstered UI during June. The East South Central region recorded the largest decline in personal income at 28.8% q/q, following a greater-than-average decrease in transfer payments, which make up just over one-fourth of total personal income, the highest share of any region.

- Net earnings growth was 10.7% q/q in the second quarter, a notable improvement on its second-quarter growth rate of 2.6% q/q, indicating continued strength in ongoing state recoveries. Growth in net earnings was highest in the West North Central (14.5%) region thanks to a robust expansion in farm earnings in North Dakota, South Dakota, and Nebraska. The West South Central and South Atlantic regions were close behind, adding 13.0% q/q and 12.2% q/q to net earnings after healthy earnings growth in accommodation and food services in Georgia, Mississippi, and Florida.

- Over the last year, state personal incomes have been held up by

direct economic impact payments and federally bolstered UI, which

pushed income growth to record rates during the second quarter of

2020 and first quarter of 2021. Despite the reduction in transfer

payments during the second quarter of 2021, personal income still

managed a modest expansion of 1.1% year over year (y/y), though

income declined in 26 states. Michigan (5.8% y/y), West Virginia

(5.6% y/y), and Vermont (4.9% y/y) experienced the largest

contractions in state personal income because of severe drops in

transfer payments.

- Kraton Corporation (Houston, Texas) announced today that it has entered into a definitive agreement to be acquired by DL Chemical Co., Ltd for $2.5 billion. The all-cash transaction comes at a 50% premium to Kraton's trading value as of early July 2021. Kraton stockholders will receive $46.50 in cash for each Kraton common stock share. Kraton produces specialty polymers and biobased products derived from pine wood pulping coproducts. DL Chemical, formerly Daelim Industrial Co., Ltd., is the world's largest producer of polybutene with a production capacity of 200,000 metric tons/year. Kraton sold its Cariflex isoprene rubber latex business to Daelim for $530 million in March 2020. Kraton reported a net loss of $221.7 million and sales of $1.8 billion in 2020. The agreement was unanimously approved by Kraton's board of directors, which has recommended that Kraton stockholders vote in favor of the transaction. The acquisition is subject to certain customary closing conditions, including the receipt of stockholder and regulatory approvals, and is expected to close by the end of the first half of 2022. J.P. Morgan Securities LLC is acting as exclusive financial advisor, and King & Spalding LLP is acting as legal counsel to Kraton. Goldman Sachs is acting as financial advisor, and O'Melveny & Myers LLP is acting as legal counsel to DL Chemical in connection with the transaction. (IHS Markit Chemical Advisory)

- Environmentalists and farmworker advocates have filed a lawsuit challenging EPA's decision to allow continued use of paraquat, an herbicide banned by the European Union, Brazil, China and dozens of other nations. Filed Friday (September 24) in the US Court of Appeals for the Ninth Circuit by Farmworker Justice and others, the petition for review claims EPA's July 13 interim registration decision to reapprove paraquat—including aerial applications—violated federal pesticide law and should be vacated. The petitioners contend EPA ignored the severe health risks from paraquat, including studies that link exposure to Parkinson's Disease. First registered for use in the US in 1964, paraquat is used on cotton, corn, soybeans, peanuts, grapes and more than 100 other crops, and remains a vital crop protection tool for many US farmers. EPA estimates more than 8.5 million pounds of paraquat are applied across nearly 16 million acres of crops to control invasive weeds and plants. Cotton growers also use the herbicide as a desiccant or plant growth regulator to dry the leaves of the crop and make it easier to harvest. (IHS Markit Food and Agricultural Policy's JR Pegg)

- Kraft Heinz Company has announced that it has entered into an agreement to acquire Companhia Hemmer Indústria e Comércio ("Hemmer"), a Brazilian company producing condiments and sauces. The acquisition of the 106-year-old company, based in Blumenau, Santa Catarina, is designed to expand product options in Brazil, while supporting Kraft Heinz's strategy to expand its presence in emerging markets. The completion of this transaction is subject to regulatory approvals by CADE (Brazil's Administrative Council for Economic Defense). Rothschild & Co is acting as the exclusive financial advisor for Kraft Heinz and Madrona Law as the legal advisor to Kraft Heinz for this potential transaction. Pabst & Hadlich Advogados Associados are acting as exclusive advisors to the selling shareholders and Hemmer. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

Europe/Middle East/Africa

- All major European equity indices closed higher; Spain +1.5%, Italy +0.6%, Germany +0.3%, and France/UK +0.2%.

- Most 10yr European govt bonds closed lower except for France flat; Germany/Italy/Ppain +1bp, and UK +3bps.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover flat/243bps.

- Brent crude closed +1.9%/$78.72 per barrel.

- The Bank of England's (BoE)'s MPC voted unanimously to leave

the key policy rate unchanged (at 0.1%) following its September

meeting. However, there were various signals in the published

minutes of the meeting that support IHS Markit's baseline forecast

of a rate hike in the first quarter of 2022. In the period ahead,

two key influences on inflation prospects are likely to be highly

significant for the rate setters on the MPC. (IHS Markit Economist

Ken

Wattret)

- First, labour market trends. September's minutes revealed that the BoE's estimate of underlying pay growth had risen above its pre-pandemic rate and cited other upward pressures too, including the following: there had been few signs of any increase in redundancies and the stock of vacancies had increased further, as had recruitment difficulties.

- MPC members cited uncertainty over the outlook, and hence underlying inflationary pressures, but expected this to be at least partially resolved over the coming months. Hence, there was a preference to wait for additional information.

- Notably, the MPC would review labour market developments as part of its forthcoming forecast round ahead of November's monetary policy report. This would also include its periodic assessment of the supply side of the economy.

- Second, inflation expectations. September's minutes highlighted that indicators of UK households' inflation expectations had increased, with some longer-term measures reaching their highest levels for several years.

- The second shows the recent persistent upward pressure on the five-year forward inflation swap in the United Kingdom. This is approaching 4%, almost twice the BoE's inflation target. In contrast to the eurozone equivalent, it has been running well above the central bank's inflation target for several years.

- The BoE's latest quarterly survey of UK households' inflation expectations looks less alarming at face value. As of August, the median expected inflation rate in one year's time had risen to 2.7%, up from the prior 2.4%. This is some way above the 2% inflation target, although still well below the pre-pandemic high of 3.3% and even further below its historic peaks of over 4% in 2008 and 2011.

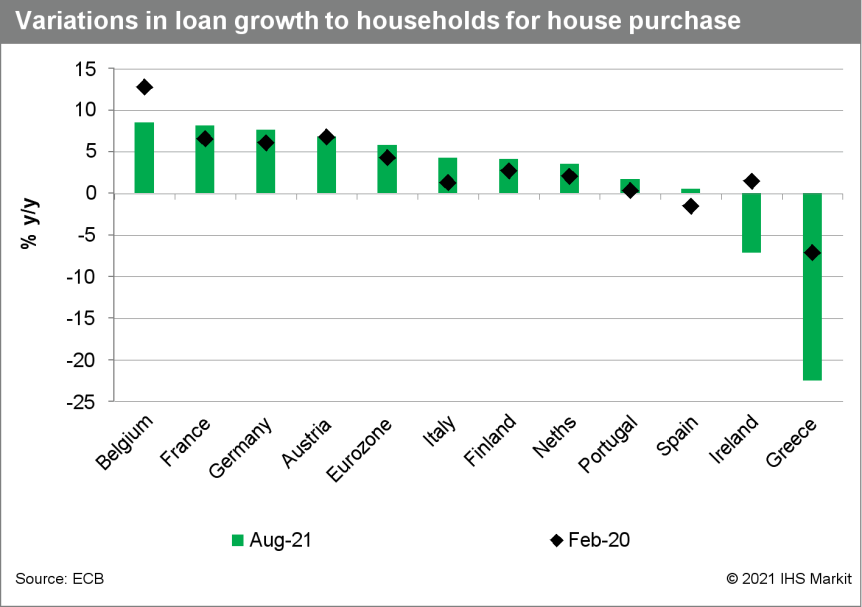

- The key takeaways from August's monetary developments data from

the European Central Bank (ECB) include the following (IHS Markit

Economist Ken

Wattret):

- Growth rates of narrow and broad money aggregates picked up, as the prior downward pressure from coronavirus disease 2019 (COVID-19) virus-related base effects diminished.

- The expansion of the ECB's asset purchase programs remains the key driver of elevated money and credit growth rates.

- Growth in loans to households for house purchase rose to its highest rate since April 2008, although there are significant variations across member states.

- Lending growth to non-financial corporations (NFCs) slowed to

its lowest rate since April 2016.

- Commercial vehicle (CV) registrations in the European Union (EU) have slipped back again during the typically weak month of August. According to data published by the European Automobile Manufacturers' Association (ACEA), demand for light commercial vehicles (LCVs) under 3.5 tons, medium and heavy commercial vehicles (MHCVs), and medium and heavy buses and coaches over 3.5 tons declined by 5.4% y/y to 119,525 units. Nevertheless, because of the low base during the first half of 2020 caused by COVID-19 virus lockdown measures, volumes remain up during the first eight months of 2021. Volumes for this period now stand at 1,292,628 units, a gain of 24% y/y. It has been another challenging month for the CV market in the EU. While growth in the first half of the year was underpinned by the low base of comparison against the same period in 2020 due to lockdown measures to prevent the spread of COVID-19 virus, there was a shift towards decline at this year's halfway point. Indeed, data published at the same time as that for August shows a fall in the CV market during July of 11.9% y/y to 148,178 units. This was all down to the LCV category, which dropped by 15.7% y/y to 121,213 units, as MHCV registrations expanded 10.6% y/y to 23,808 units. (IHS Markit AutoIntelligence's Ian Fletcher)

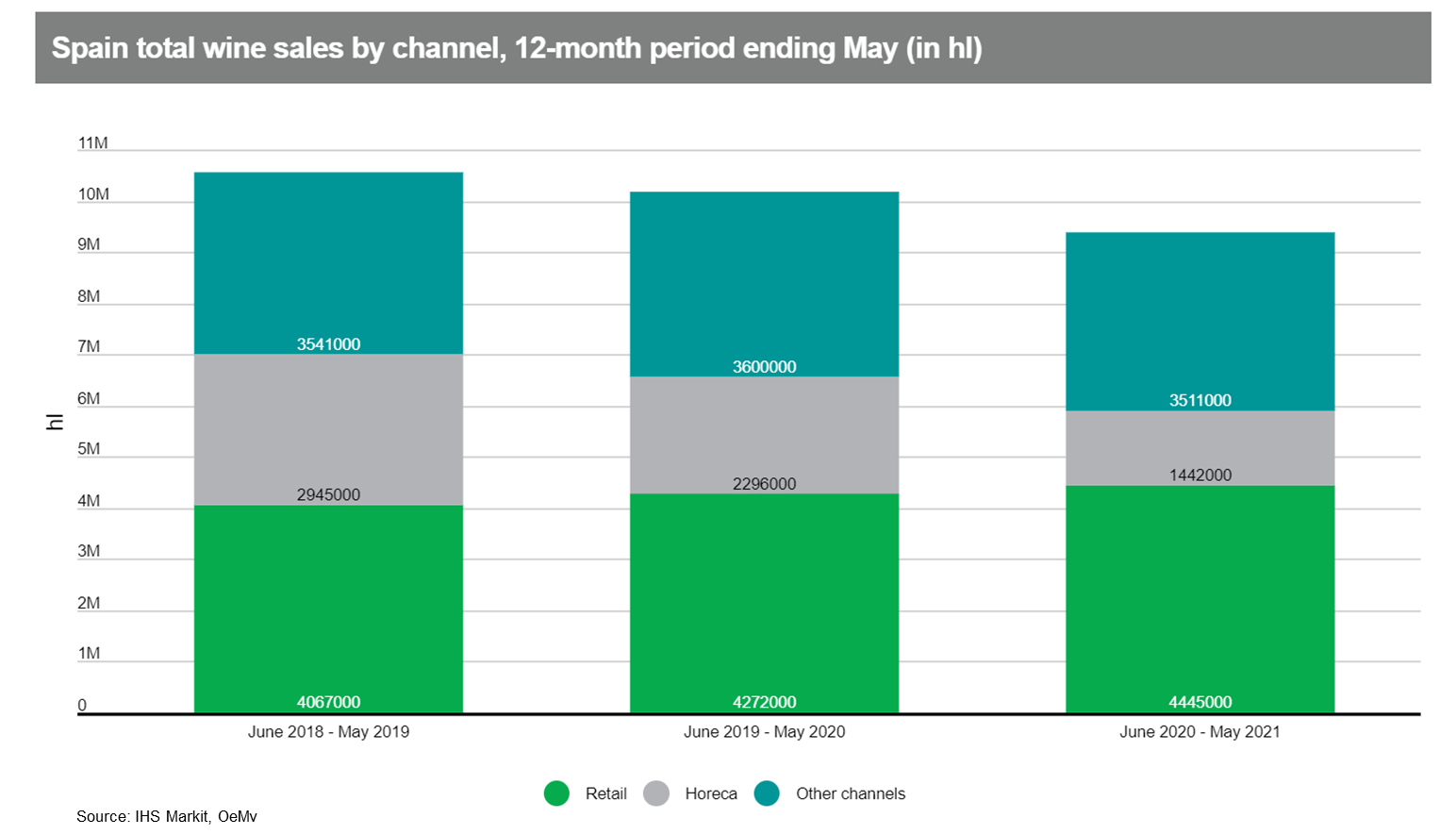

- Spain's wine grape growers are expected to harvest a crop that

will yield between 39 and 40 million hectoliters of wine and grape

must, depending on the weather conditions during the last few weeks

of the season, announced the Spanish Wine Interprofessional (OIVE)

on 23 September. (IHS Markit Food and Agricultural Commodities'

Vladimir Pekic)

- Harvesting of this year's grape crop is expected to last a shorter length of time than usual and the expected wine and grape must production will be 15% lower than the 46.5 million hl that were produced in 2020, said the organization.

- However, given the diversity of Spain's wine-making regions, the production decline is not generalized across all regions. This year, viticulture in Spain has had to face extreme weather events such as the effects of drought, the consequences of the isolated high-altitude depression meteorological (DANA) event, mildew outbreaks in some areas and even fires.

- OIVE added that a decrease in production can also be seen in

other leading European wine producing markets and direct

competitors, such as France that will have a 30% lower production

and Italy with a 9% lower production this season.

- Vestas plans to cease production at its factories in Viveiro,

Spain, and Esbjerg, Denmark, as well as the onshore wind factory in

Lauchhammer, Germany. According to Vestas, this move is part of the

company's integration of its onshore and offshore business started

after Vestas acquired a 100 per cent stake in MHI Vestas from

Mitsubishi Heavy Industries. (IHS Markit Upstream Costs and

Technology's Monish Thakkar)

- The factory in Esbjerg, manufactures power conversion modules for the V164 and V174 offshore turbines. With the view of changing demands for these modules gradually shifting to markets primarily outside of Europe, Vestas expects to conclude the production of power conversion modules in Esbjerg during the first half of 2022 and explore opportunities to localize their facilities outside Europe in future.

- The Viveiro factory manufactures control panels for the V164 offshore turbine for markets outside of Spain. Hence to optimize the offshore manufacturing, the company feels that it is no longer sustainable to continue activities in Viveiro. Vestas expects to finalize production in Viveiro end of 2021.

- GE Renewable Energy and Acta Marine have signed a supply contract for the chartering of a Service Operation Vessel (SOV) for the commissioning activities of 80 Haliade 150-6MW turbines at the Saint-Nazaire offshore wind farm. The vessel, Acta Auriga, is owned and operated by the Dutch shipping company Acta Marine, which will provide safe accommodation and transportation for the project personnel and will have the capacity to transport goods that are needed offshore. The vessel will start operating on behalf of GE Renewable Energy in the second quarter of 2022, when the offshore wind turbine installation is set to begin. The 480 MW Saint-Nazaire wind farm, currently owned by EDF (50%), Enbridge (25.5%) and CPP (24.5%), is expected to be fully commissioned by the end of 2022. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- Siemens Gamesa has started installation of the SG 14-222 DD prototype offshore wind turbine at the test center in Østerild, Denmark. As of now, the wind turbine's tower has been erected at the site. The rate output of the Direct Drive SG 14-222 DD wind turbine is 14 MW and can be increased to 15 MW by using the Power Boost function. The model features a 222-metre diameter rotor, 108-metre blades, and a 39,000 square meter swept area. The turbine prototype is expected to be ready in 2021, and the model will be commercially available in 2024. Conditional orders received so far total 4.34GW capacity ― the 300 MW Hai Long project in Taiwan planned by Northland Power and Yushan Energy, the 1,400 MW Sofia project in the UK planned by innogy, and the 2,640 MW Coastal Virginia Offshore Wind project in the USA, planned by Dominion Energy. This product features Siemens Gamesa's new B108 blades, with each 108-metre blade cast in one piece using the company's patented blade technology. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- Hikma Pharmaceuticals (Hikma), a Jordan-based and London Stock Exchange-listed generic drugs company, has agreed to acquire Custopharm (US), a generic sterile injectables company, from Water Street Healthcare Partners (US). According to a Hikma press release, the Jordan-founded company will pay an initial cash consideration of USD375 million on a debt and cash-free basis, and a further USD50 million in contingent consideration upon the achievement of certain commercial milestones. The transaction, which is subject to US Federal Trade Commission approval, will add 13 approved products to Hikma's injectable drugs product portfolio in the United States, as well as additional pipeline products. Custopharm currently markets its generic injectable products in the US through its commercial arm, Leucadia Pharmaceuticals. (IHS Markit Life Sciences' Sacha Baggili)

- Sasol (Johannesburg, South Africa) has committed to achieving

net-zero emissions by 2050, tripled its target for cutting

greenhouse gas (GHG) emissions from its energy and chemicals

businesses to 30% by 2030, and said it will invest 15-25 billion

South African rand ($1.66 billion) on its energy transition by the

end of the decade. (IHS Markit Chemical Advisory)

- Sasol says it has increased its previous scope 1 and 2 GHG emissions-reduction target for 2030 from an initial 10% announced last year for its South African operations to 30% for the energy and chemicals businesses, using its 2017 emissions total as a baseline. The company is also introducing a scope 3 reduction target for its energy business, using a 2019 baseline, it says.

- Sasol says its refocused strategy is underpinned by a financial framework that will enable it to grow shared value, while accelerating its transition. In the short-to-medium term, the company says a first phase up to 2025 will see it strengthen its balance sheet and improve its cost competitiveness and ability to increase cash-flow generation in a low oil price scenario. It is targeting a return on invested capital (ROIC) of 12-15% during this period.

- A second phase, through 2030, will prioritize balancing returns and investing in Sasol's transition plan, it says. "In this period up to 2030, Sasol plans to invest between R20-25 billion per annum to maintain its asset base, comply with all relevant environmental and air-quality regulations, as well as fund the transition to reach the 30% GHG emissions-reduction target. This includes a total of R15-25 billion in aggregate transformation capital up to 2030, while targeted ROIC is anticipated to be above 15%," it says.

- Sasol, one of the world's largest producers of grey hydrogen, says it aims to leverage its expertise to decarbonize through lower-carbon feedstocks and increase production of cost-competitive sustainable fuels and energy.

- The resumption of business activities following the lifting of

COVID-19 pandemic-related restrictions pushed Namibia's GDP up by

3.7% quarter on quarter (q/q) during the second quarter of 2021.

(IHS Markit Economist Thea

Fourie)

- Namibia's GDP bounced back with growth of 3.7% q/q and 1.6% year on year (y/y) during the second quarter. This leaves Namibia's GDP down by 2.6% in the first half of 2021, from a 7.4% contraction during the same period last year.

- Sectors of the Namibian economy that showed the strongest rebound during the second quarter of 2021 include fishing (up 13.8% y/y), wholesale and retail trade (up 17.3% y/y), hotels and restaurants (up 34.4% y/y), real estate and business services (up 5.3% y/y), and government services (up 6.7% y/y).

- In the second quarter, sectors of the economy in which output was below the level recorded in the second quarter of 2020 were mining and quarrying (down 1.5% y/y), construction (down 16.9% y/y), manufacturing (down 5.0% y/y), and financial intermediation (down 17.0% y/y). Output in the electricity and water sector contracted by 11.6% y/y during the second quarter of 2021.

Asia-Pacific

- APAC equity markets closed mixed; Australia +0.6%, South Korea +0.3%, Hong Kong +0.1%, India +0.1%, Japan flat, and Mainland China -0.8%.

- Mainland Chinese authorities have so far managed to contain the

recent regional outbreaks in Fujian and Heilongjiang Province and

prevent spillovers. Still, preventive measures in other regions,

especially the testing and quarantine requirements to discourage

intercity travel, have exerted pressure on broader offline services

recovery. Efforts have been ramping up in several regions to start

distributing booster shots to the most vulnerable group; more local

authorities are likely to follow suit in the near future. On top of

addressing pandemic control loopholes, a more accommodative policy

stance may also be necessary should downside risks further pile up.

(IHS Markit Economist Lei Yi)

- Mainland China has reported a total of 515 domestically-transmitted symptomatic cases so far in September, largely linked to inbound travelers. Pandemic control loopholes exposed during the recent regional outbreaks involved campuses and quarantine sites; this will likely motivate authorities to accelerate vaccination of minors aged below 12 years and also strengthen isolation effectiveness to avoid cross infections.

- According to media reports, mainland China's first giant quarantine station for inbound travelers in Guangzhou - a 250,000-square-meter large building area with 5,074 rooms - is expected to be put into use. Facilities such as this should help to replace existing designated hotels as quarantine sites, which are usually close to densely populated city centers and pose larger infection risks.

- Despite the fact that the Fujian and Heilongjiang outbreaks have not spread to other regions for now, the "stay put" travel guidance from authorities appears to have weighed on holiday travel during the three-day (19-21 September) Mid-Autumn Festival to some extent. The number of tourists recovered to 87.2% of the comparable 2019 level, compared with 98.7% over the three-day Dragon Boat Festival in June when the Delta variant was raging in Guangdong.

- The Northeast Heilongjiang Province had reported 49 symptomatic cases cumulatively from 21-26 September; most of the cases were in the capital city Harbin besides one in the city of Suihua. The source of this local outbreak remains unidentified as of this writing, but gene sequencing data show that the outbreak is also linked to the Delta variant.

- China frozen French fries production is projected to increase

by 20% to 420,000 tons in 2021/22 as logistic disruptions depressed

imports and increased export demand by neighboring countries.

Higher volumes should be earmarked for processing as the crop

output should go 5% down to 94 million tons due to a contraction in

the cultivated area. (IHS Markit Food and Agricultural Commodities'

Cristina Nanni)

- Potato planting declined across China following a 25% drop in wholesale prices in the first half of 2021 compared with the same period in 2020 when prices were between CNY2.62-3.30-/kg ($0.40-0.51/kg). Prices in 2020 were extremely profitable leading to an increase of the cultivated area, but oversupplies for the northern single crop zone, which accounts for half of the domestic harvest, depressed prices in the second half of the year.

- For the current season, growers in the northern single crop have switched to the more profitable corn production. The potato area sown from September to November 2021 in the southwestern, mixed crop zone is also expected to decrease.

- According to the 2021 China Agricultural Outlook Report, over the next 10 years, China's potato acreage and yields will increase by an average of 0.7% annually resulting in a 1.4% increase in annual production for the next 10 years.

- The shift in frozen French fries' output is partially linked to a new processing line in Inner Mongolia entering production in 2020/21. Chinese producers are likely to boost production in order to offset declining imports. In the first 11 months of MY2020/21, China imported 76,797 tons of frozen French fries, 25% less than in MY2019/20, due to disruptions in international shipping with cancellations and delays reported. Logistics difficulties and container shortages are likely to continue until the early or mid-2022.

- Geely-backed ride-hailing platform Caocao Mobility has announced that it is negotiating a new round of financing with its investors, reports Bloomberg. The ride-hailing company expects to break even within two years. At the beginning of September, Caocao Mobility raised CNY3.8 billion (USD589 million) in a Series B funding round. Caocao Mobility claims to be one of the first companies in China to offer new energy vehicle (NEV) ride-hailing services. (IHS Markit Automotive Mobility's Tarun Thakur)

- Chinese automaker Geely has announced plans to have 5,000 battery-swapping stations globally by 2025 through E-ENERGEE, the battery-swapping service platform under Geely Technology Group, reports Gasgoo. E-ENERGEE offers an open platform that is compatible with multiple types of vehicles with wheelbases between 2,700mm and 3,100mm, and enables a battery swap to be completed within 60 seconds, according to Zhejiang Geely Holding Group. (IHS Markit AutoIntelligence's Jamal Amir)

- Arcfox, BAIC Motor's premium brand, has announced that it has

signed a framework agreement with Huawei to deepen their ongoing

strategic co-operation for building vehicles equipped with Huawei's

HI solution, reports Pandaily. The new agreement is a supplement to

the pact that both parties signed in January 2019. Under the

current agreement, Huawei and BAIC will strengthen the R&D of

all Arcfox models, as well as build an operation mechanism for the

product development. The two companies will also increase

co-operation on intelligent-connected vehicle business, while

conducting product development, testing and validation together.

The two companies will also jointly formulate and implement

marketing channel planning. (IHS Markit AutoIntelligence's Tarun

Thakur)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-september-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-september-2021.html&text=Daily+Global+Market+Summary+-+27+September+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-september-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 27 September 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-september-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+27+September+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-september-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}