Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 27, 2021

Daily Global Market Summary - 27 October 2021

All major European and most US equity indices closed lower, while APAC was mixed. US government bonds closed sharply higher, and most benchmark European bonds were also higher. CDX-NA closed slightly wider across IG and high yield, and European iTraxx was closed to flat on the day. Natural gas, silver, and gold closed higher, while the US dollar, oil, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Major US equity indices closed lower except for Nasdaq flat; S&P 500 -0.5%, DJIA -0.7%, and Russell 2000 -1.9%.

- 10yr US govt bonds closed -7bps/1.54% yield and 30yr bonds -9bps/1.95% yield.

- CDX-NAIG closed +1bp/52bps and CDX-NAHY +3bps/301bps.

- DXY US dollar index closed -0.2%/93.8.

- Gold closed +0.3%/$1,799 per troy oz, silver +0.4%/$24.19 per troy oz, and copper -2.1%/$4.39 per pound.

- Crude oil closed -2.4%/$82.66 per barrel and natural gas closed +5.4%/$6.20 per mmbtu.

- Oil prices find path higher at the intersection of fear and

greed. The oil market is gripped by fears: fear of stronger demand

as the economic recovery powers through Delta stumbles, fear of

contagion from frenzied gas and power markets, and the fear to rule

them all - global supply's inability to quickly douse the nascent

bullish fire. Combined, these forces have cleared the path for

higher prices, breaching out of the short-term band that has held

relatively firmly since spring and, more critically, untethering

oil from the 2014-2019 range (or the "shale band") and ushering in

a new phase of price discovery at higher levels. This process in

itself has fueled price upside by creating a fear of missing out on

a generational multi-year rally. Unlike the more speculative and

anticipation-driven rally of early 2021, this rally is anchored in

real signs of accelerating physical tightening due to short-term

(temporary) conditions that are perceived as the opening salvo of a

structurally tighter environment through the medium-term, with

capital (paper) abundance bridging the vision and prices. (IHS

Markit Energy Advisory's Roger

Diwan, Karim

Fawaz, Ian Stewart, and Sean Karst)

- A series of bullish events upend short- and medium-term oil market narratives. A couple of months ago, oil markets were looking at a markedly less rosy fall and winter amid intensifying Delta variant outbreaks and OPEC+ initiating a year-long process of production restoration that could see renewed bouts of oversupply, especially in 2022.

- Four major developments have unfolded since to definitively shift the trajectory of the market: 1) Disruption-led acceleration in global crude and product inventory draws (especially Hurricane Ida); 2) Contagion from gas and power to oil via demand substitution, shattering perceptions of oil being insulated from broader energy tailwinds; 3) A string of supply disappointments around the world reflecting the impact of under-investment eroding productive capacity, including within OPEC+; and 4) US E&P restraint appears to have weathered its first real-world price test in the face of surging oil and gas prices (so far).

- Physical shortage risks still low but easing of physical market conditions necessary to release some bullish steam. Unlike the gas situation in Europe, we still see supply buffers in oil. OECD inventories have fallen below 5-year averages but remain above 2010-2014 levels, while OPEC+ productive capacity, even with under-investment-induced woes in many smaller countries, remains comfortably above pre-pandemic levels. But OPEC+ producers with spare capacity have been reactive rather than proactive and have not deviated from their slow and methodical approach even after the latest rally.

- From supply complacency to supply anxiety. Despite significantly higher oil (and gas) prices, we have left our US supply forecast for 2022 largely unchanged. Behind that relatively tame revision to supply however lies one of the most significant changes to oil price formation. The past seven years have been defined by the combination of resource abundance and hyper-reactivity, the combination of which have served to anchor the "resource complacency" price regime, with hyper-reactive short-cycle barrels offsetting any investment risks from long-cycle projects into a decelerating demand world.

- We have raised our oil price outlook significantly to reflect the shift in the price regime. Our 4Q2021 ICE Brent price outlook is $84/bbl in our base case compared with $68bbl in our July outlook. We have lifted our price outlooks throughout 2022 to reflect this environment, with Brent and WTI revised to $77.25/bbl and $73.25/bbl, respectively. Our 2023 initial forecast has Brent and WTI set at $70.50/bbl and $67.50/bbl, respectively.

- How effectively can Saudi Arabia manage scarcity going forward? The post-COVID demand outlook remains full of uncertainties as supply chain disruptions, consumption, and travel patterns have significantly shifted from their previous patterns. This winter global energy crisis is likely to extend the exceptional and keep markets on a volatile path.

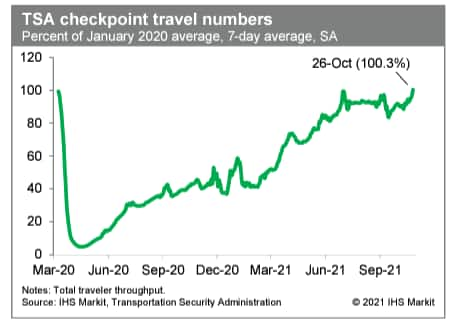

- Averaged over the last seven days, and after seasonal

adjustment, passenger throughput at US airports was 100.3% of the

January 2020 level. Air travel had been on a flat trend since July

but has risen steadily in recent weeks, perhaps reflecting

increasing comfort associated with declining COVID-19 new case

counts. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- US manufacturers' orders for durable goods declined 0.4% in

September, while shipments rose 0.4% and inventories rose 0.9%. The

decline in orders was smaller than the consensus expected. (IHS

Markit Economists Ben

Herzon and Lawrence Nelson)

- Orders for durable goods remain well above pre-pandemic levels, but that almost entirely reflects higher prices for manufactured durable goods.

- Year to date, orders for durable goods are up 10.0%, while prices for manufactured durable goods are up 9.9%.

- After adjusting for price gains, real orders for durable goods completed essentially a full recovery by last November but have made essentially no progress since.

- Firming manufacturing prices and the recent flat trend in real orders for durable goods reflect the effect of supply constraints on manufacturing activity. These constraints are likely to persist into next year.

- An area of strength in this report was inventories, which were revised higher for August and rose more than IHS Markit experts had assumed in September. This added about $15 billion to the IHS Markit estimate of third-quarter inventory investment.

- The US nominal goods deficit widened in September by $8.1

billion to $96.3 billion, while the combined inventories of

wholesalers and retailers rose 0.5%. We had assumed a stronger

trade balance and weaker inventories. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

- The widening of the trade deficit reflected a sharp decline in exports and a moderate increase in imports. The decline in exports reversed steady gains in exports since spring, and could be related to increasing congestion at ports.

- Even after accounting for the sharp decline in September, exports remained above pre-pandemic levels, but this is not necessarily good news. Much of the recent strength in nominal exports is in export prices, which have surged lately. After adjusting for price gains, exports of goods in September were below the February 2020 level.

- Import prices have risen sharply as well (both including and excluding petroleum and fuels). But real imports have, indeed, risen past pre-pandemic levels, reflecting elevated domestic demand for goods.

- An area of strength in the report was a sharp increase in net imports of capital goods. This accounted for roughly one-half of the widening of the trade deficit, and indicates a willingness of domestic business to invest in capital equipment.

- Vertex Pharmaceuticals and Mammoth Biosciences (both US) have jointly announced a new partnership to develop in vivo gene-editing therapies for two genetic diseases using Mammoth's next-generation CRISPR (clustered regularly interspaced short palindromic repeats) systems. Mammoth's CRISPR platform is driven by its protein discovery engine and consists of a proprietary toolbox of novel, ultra-compact Cas enzymes, including Cas14 and Casɸ. According to the two companies, the small size of Mammoth's systems could potentially play a key role in increasing the scope of in vivo gene-editing for genetic diseases. Under the terms of the agreement, Mammoth will receive USD41 million upfront, and is eligible to receive up to USD650 million in potential future payments based on the successful achievement of pre-specified research, development, and commercial milestones across two potential programs. In addition, Vertex will pay tiered royalties on future net sales on any products resulting from the collaboration. For Vertex, its deal with Mammoth is the latest in a series of CRISPR gene-editing collaborations, including its partnership with Arbor Biotechnologies (US) in late August. (IHS Markit Life Sciences' Milena Izmirlieva)

- In a news-filled day, General Motors announced a plan to add 40,000 "community-based" charging stations in the US and Canada, working with its dealership network. GM also announced plans to resume some Bolt EV production and revealed a new 2.6-second 0-to-60 mph V8 for the 2023 Corvette Z06. The new EV charging station installation program is part of a planned investment of USD740 million announced earlier to expand home, workplace and public charging, and is designed to help address EV needs in underserved areas with Level 2 chargers. The resumption of Bolt EV production is against the backdrop of the company working to ensure optimal battery production and supply-chain logistics following the recall of all Bolt EVs. The Corvette Z06 V8 could end up being the last clean-sheet V8 developed for light vehicles by GM and reflects that, although EVs may be the future, today's market requires the meeting of customer demand with the performance of traditional ICE vehicles as well. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Electric vehicle (EV) startup Canoo has announced a battery supply deal with Panasonic, ahead of the planned beginning of production by the startup in the fourth quarter of 2022. Under the new deal, Panasonic will supply batteries for Canoo's upcoming Lifestyle Vehicle to be manufactured by VDL Nedcar, according to the EV startup's statement. The batteries to be supplied will be sufficient for both Canoo's European and US production, the statement says. Canoo did not provide details of the Panasonic arrangement, in terms of the battery technology, the quantity of batteries to be supplied, or the expected value of the deal. As a startup, Canoo does not have the level of funding that traditional automakers are currently putting toward new battery production, and so it needs to ensure flexibility of supply. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Siemens Gamesa has struck an agreement with the State of Virginia, United States, to establish the first offshore wind turbine blade facility in the country. A USD200 million blade factory, producing the company's Offshore IntegralBlade, will be built at the Portsmouth Marine Terminal to support the delivery of Siemens Gamesa's 15 MW offshore wind turbines to Dominion Energy's 2.6 GW Coastal Virginia Offshore Wind Commercial (CVOW-C) project. The 32-hectare facility will be built on land leased from the Virginia Port Authority and will perform finishing of the offshore blades. Around 310 jobs will be created to support this function, including 50 to provide operations and maintenance services. The announcement comes shortly after Dominion Energy signed an agreement with the Port of Virginia to lease 29 hectares in the same area to use as a staging and pre-assembly area for foundations and wind turbines. The Bureau of Ocean Energy Management (BOEM) is currently performing the environmental review for the CVOW-C project. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- On October 25, the New York Power Authority (NYPA)—on

behalf of project partners the Electric Power Research Institute

(EPRI), General Electric (GE), Airgas, Sargent & Lundy and

Fresh Meadow Power—said it will commence a demonstration

project in November to assess the potential of substituting

renewable hydrogen for a portion of the natural gas used at its

Brentwood Power Station on Long Island. (IHS Markit PointLogic's

Barry Cassell)

- The effort to study renewable hydrogen in this application is a part of the state's decarbonization strategy as outlined in New York's nation-leading Climate Leadership and Community Protection Act. Representatives from the project partners were on-site in Brentwood on October 25 to view progress.

- This first-of-its-kind demonstration will evaluate the effects of different concentrations of hydrogen blended with natural gas at regular intervals to assess the blend's effect on reducing greenhouse gas emissions and its overall system and environmental impacts, including NOx emissions. At the close of this project, peer-reviewed results will be shared with the industry and public to better inform what efforts can help New York State reach its goal of reducing carbon emissions 85% by 2050. The project is expected to last six to eight weeks.

- NYPA's Brentwood Power Station, which is equipped with a GE LM-6000 combustion turbine fueled by natural gas, was commissioned in 2001 to increase power generation capacity for Long Island and New York City in anticipation of shortages. As the gas turbine original equipment manufacturer, GE will supply a hydrogen/natural gas blending system and support the project's planning and execution. Sargent & Lundy, acting as the engineer of record, will provide overall engineering and safety reviews. Airgas is the supplier of renewable hydrogen and Fresh Meadow Power is providing piping system design, material procurement and installation services.

- FDA's regulatory process for biotech animals is inhibiting the

development and commercialization of livestock that have been

gene-edited to provide resistance to costly diseases, witnesses

told members of the House Agriculture Committee on Tuesday (October

26). (IHS Markit Food and Agricultural Policy's JR Pegg)

- "The current US regulatory approach for [biotech] animals is not fit for purpose," said Elena Rice, chief scientific officer of Genus, an animal genetics company. "We need a practical, less expensive, risk- and science-based regulatory system that provides a safe and predictable path to market … and certainty for innovators, investors, producers and consumers."

- Testifying before two House Agriculture subcommittees, Rice backed the proposal to shift authority for genetically engineered livestock from FDA to USDA, saying the plan has "strong support" from industry stakeholders.

- At present USDA is on the sidelines when it comes to biotech animals. FDA retains sole authority over GE animals—including those made with new gene-editing tools—and regulates them as new animal drugs under the Federal Food, Drug and Cosmetic Act. The regime requires multiple generation safety and efficacy studies that biotech advocates argue are onerous and unnecessary for changes that could occur through nature or conventional breeding. So far, FDA has only approved two biotech food animals— AquaBounty's salmon and Revivicor's "GalSafe" pig.

- Led by pork producers, the ag industry has railed against the regulatory framework, voicing concerns it is impeding innovation by deterring ag biotech researchers from trying to commercialize in the US and prompting some to seek opportunities in other countries—notably Argentina, Brazil and Canada—that have laid out friendlier regulatory regimes.

- The Bank of Canada kept the overnight rate at the lower

effective bound of 0.25%, but made a small adjustment to its

extraordinary forward guidance. Quantitative easing ends and as

noted in earlier communiques, the Bank is transitioning to the

reinvestment phase in which Government of Canada bonds will be

purchased to replace maturing bonds on the Bank's balance sheet.

(IHS Markit Economist Arlene

Kish)

- The Bank lowered its global and domestic growth outlooks for this year and next in the October Monetary Policy Report (MPR). Canada's real GDP growth was cut 0.9 percentage point to 5.1% this year and 0.3 percentage point to 4.3% in 2022. Growth was revised up 0.4 percentage point in 2023 to 3.7%.

- The new inflation outlook is 3.4% for 2021, 3.4% for 2022, and 2.3% for 2023.

- The Bank projects that the 2% inflation target will be sustainably achieved "sometime in the middle quarters of 2022." Given persistent excess capacity amid a backdrop of supply-chain shortage and transportation delays, the Bank's current estimate of the output gap is narrower than forecast in July. As such, IHS Markit experts are revising the Bank of Canada's monetary policy tightening cycle to begin in July 2022.

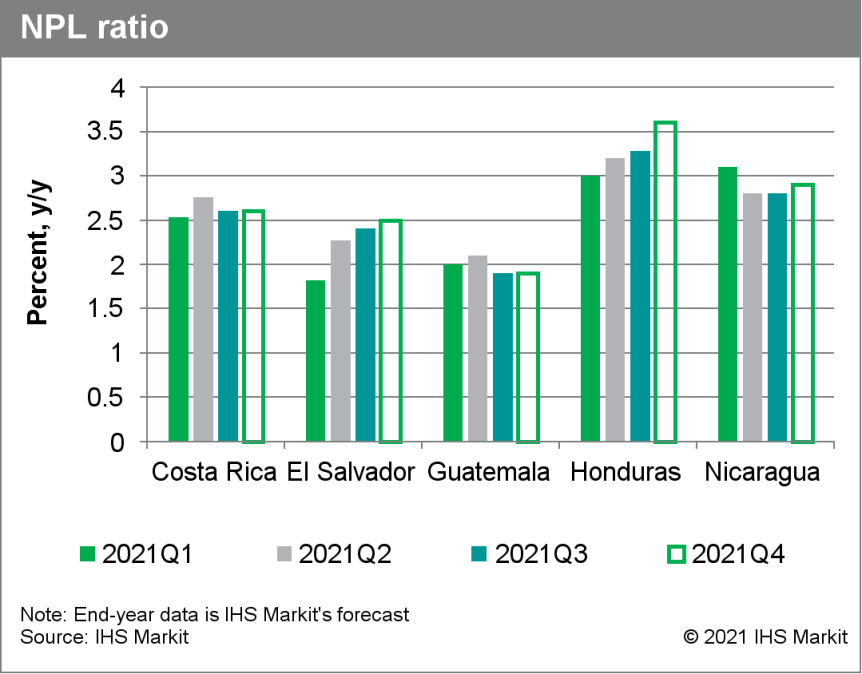

- IHS Markit has analyzed the main banking indicators for Costa

Rica, El Salvador, Guatemala, Honduras, and Nicaragua for the third

quarter of 2021. Our key findings indicate that credit growth

remains contained in most of the region; non-performing loans

(NPLs) are still slightly rising compared with June 2021, in line

with our previous assessment. All averaged figures presented here

are calculated using simple (non-weighted) averages. Due to

availability, data for Honduras are as of August 2021. (IHS Markit

Banking Risk's

Alejandro Duran-Carrete)

- Credit growth stayed at low levels, although it is still recovering from the 2020 decline. In the third quarter of 2021, the sectors' credit growth levels averaged 4.4% year on year (y/y), slightly above the 3.8% displayed in June. This was mostly led by Guatemala's strong loan growth at 8.9% y/y, primarily driven by a strong economic recovery during the second quarter of 2021.

- NPLs are increasing slowly, and we expect them to edge up slightly at the end of 2021. Averaging 2.6% in September 2021, the sectors' NPL ratio remains contained and relatively close to the 2.4% displayed in June. However, some deterioration in the quality of assets can be observed in other reported metrics, such as Costa Rica's, whose low-quality loans have risen sharply through this quarter, representing 9.9% of total loans, compared with 6.9% in the first quarter of 2020.

- Deposit growth is starting to stall, but liquidity ratios remain stable. The region has continued to display strong levels of deposit growth, although they are slowly returning to normal ratios because of a return of consumer spending. This, in turn, has led to banks increasing their holdings of liquid assets, decreasing the regional average of the loan-to-deposit ratio (LDR) from a high 87.9% in March 2020 to a very moderate 75.7% in September 2021.

- Capitalization remains high and is likely to retain its

stability. Shareholders' equity to total assets ratio remained very

stable in all the sectors, averaging 11.8% in September.

Europe/Middle East/Africa

- All major European equity indices closed lower; France -0.2%, UK/Germany/Spain -0.3%, and Italy -0.6%.

- Most 10yr European govt bonds closed higher; UK -13bps, Germany -6bps, France/Spain -5bps, and Italy flat.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover +1bp/254bps.

- Brent crude closed -2.1%/$83.87 per barrel.

- Jaguar Land Rover (JLR) has joined the European CO2 emissions passenger car pool with electric vehicle (EV) maker Tesla. As part of the arrangement, JLR is paying to pool emissions from its vehicles with Tesla's EVs. This will help JLR to lower its average figures and avoid paying fines for missing its targets. The financial terms of the deal are unknown, reports the Financial Times. JLR is joining Honda, which reached a pooling deal with Tesla almost a year ago. JLR had provisioned GBP35 million (USD48 million) in fines from failing to meet EU rules in 2020, and had previously announced that it expects to meet its target for CO2 emissions this year. Finding a competitor to work with in this way is likely to be more cost-effective than paying the fine of EUR95 per gram over their fleet average target per car sold in the region. This pooling arrangement is also a revenue boost for Tesla, which lost its pooling deal with Fiat Chrysler Automobiles in May. (IHS Markit AutoIntelligence's Tim Urquhart)

- The ECB's quarterly bank lending survey (BLS) for the third

quarter was compiled between 20 September and 5 October, based on

the responses of 146 banks across the eurozone's member states. The

ECB has also released actual loan data for September. Looking first

at developments in bank lending to households, the key takeaways

from the latest data include the following (IHS Markit Economist Ken

Wattret):

- Banks adopted a more cautious attitude towards lending to households for house purchase. The net percentage of banks reporting a tightening of credit standards for this type of loan rose to +8, the highest for four quarters (-1 in the second quarter's survey). For consumer credit, credit standards remained broadly unchanged (net percentage of -1 versus 0 in the second quarter).

- For housing-related loans, the net tightening was related to lower risk tolerance among banks, plus the cost of funds and balance-sheet constraints.

- Banks reported another increase in demand for loans from households for house purchase, although the net percentage of banks reporting an increase in demand for this type of loan moderated in the third quarter (to +11, versus +36 in the second quarter). Demand for consumer credit increased in the second quarter, although the net percentage also moderated (to +7, versus +11 in the second quarter).

- Elevated consumer confidence, the low level of interest rates, and positive housing market prospects all contributed positively to household loan demand.

- September's ECB data on actual bank lending growth to eurozone households for house purchases showed the first deceleration in eight months, from 5.8% to 5.5% y/y. Still, the recent growth rates are the highest since 2008.

- Growth in other types of lending to households, including consumer credit, remained weak.

- Banks again reported broadly unchanged credit standards on loans to enterprises in the third quarter. The net percentage of banks reporting a tightening edged up to +1 (versus -1 in the second quarter's survey), close to what was expected in the prior survey (+2).

- Credit standards remained unchanged for both SMEs (net percentage 0, versus -1 in the second quarter) and larger firms (0, versus -3 in the second quarter). The fact that credit standards for loans to enterprises were unchanged irrespective of the size of firm is indicative of the beneficial impact of government support measures. There was also little difference in credit standards for short-term loans (net percentage +1, versus -2) and long-term loans (+1, versus 0).

- A new survey found that 73% of Europeans think EU legislation

should ensure all products sold in the EU are sustainable and do

not lead to biodiversity loss. Commissioned by the World Wildlife

Fund (WWF), the survey showed most European adults want the EU to

step up its commitment to protect forests and other ecosystems

(76%) and set its own sustainability criteria for food imported

into the bloc (74%). (IHS Markit Food and Agricultural Policy's

Steve Gillman)

- Anke Schulmeister-Oldenhove, senior forest policy officer at WWF's European Policy Office, said the survey shows consumers understand the direct link between what they eat and nature destruction. "They want clear rules that keep all nature destruction off their plates. The EU must listen to its citizens," she said.

- The survey was conducted by Savanta ComRes, a market research consultancy, in April 2021. Responses were collected from 11,439 adults in nine European countries: Austria (1,032), Belgium (1,028), Estonia (1,044), Finland (1,031), France (2,098), Greece (1,017), Portugal (1,052), Sweden (1,074) and the UK (2,063). Anti-deforestation support was greatest in Portugal (88%) and Greece (84%) and the lowest in Belgium (55%).

- The survey also found that consumers place the biggest responsibility for reducing the environmental impact of food production on national governments (51%), manufacturers (49%) and the EU (41%).

- On 17 November, the European Commission is expected to present new legislation to curb the impact of EU consumption on worldwide deforestation and forest degradation, which the EU executive says is responsible for around 10% of total forest loss.

- BASF swung to a net profit of €1.25 billion ($1.45 billion) in

the third quarter from a net loss of €2.12 billion in the same

period last year, on a 42% surge in sales to €19.67 billion. EBIT

before special items more than tripled year on year (YOY) to €1.86

billion. The company has raised its full-year earnings and sales

outlook for the second time following the results. (IHS Markit

Chemical Advisory)

- Higher prices in all business segments, especially chemicals, surface technologies, and materials, drove BASF's third-quarter revenue increase, as did the big rise in volumes, which was in "almost all segments," the company says.

- The huge hike in EBIT before special items was mainly driven by the performance of BASF's upstream commodity-type businesses. The chemicals segment was the biggest driver of earnings growth with major contributions from the materials and industrial solutions segments, the company says. EBITDA before special items at the chemicals segment more than quadrupled YOY to €1.04 billion on a more than doubling in sales to €3.69 billion, and EBITDA before special items at the materials business jumped 90% YOY to €832 million on sales up 50% to €3.97 billion.

- However, the earnings contributions of downstream specialty-type businesses such as agricultural solutions, surface technologies, and nutrition and care declined considerably on higher costs. EBITDA before special items at the surface technologies segment dropped 24% YOY to €245 million on sales up 36%, to €5.63 billion, and EBITDA before special items in the ag solutions business fell 63% to €74 million on sales up 8%, to €1.59 billion.

- Major automotive OEMs are monitoring the ongoing cyber-attacks on the German component supplier Eberspächer Group, reports Automotive News. No production disruption has been reported so far due to this. The supplier's website has been inaccessible since Monday evening (25 October) and a message from the company says, "The Eberspächer Group was the target of an organized cyber-attack. The IT infrastructure is impaired". According to the reports, the supplier's IT specialists are working with external cyber security experts to eliminate the threat and bring operations back to normal. Cyber-attacks like these have become more frequent in the last few years. In June last year, Honda was forced to interrupt its production in North America, Europe, Asia, and South America following a global computer network problem. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- France's consumer confidence headline index has fallen from 101

in September to 99 in October, according to figures released by the

National Institute of Statistics and Economic Studies (Institut

national de la statistique et des études économiques: INSEE). (IHS

Markit Economist Diego

Iscaro)

- The consumer confidence index peaked at 102 in June 2012, slightly above its long-term average of 100, but has now declined in three out of the last four months. October's reading was also below a consensus of 101 as pooled by Reuters.

- The deterioration of the headline index was driven by households' less upbeat assessment of their future financial situation and the general economic outlook. The number of households considering making a major purchase over the coming 12 months has also declined to its lowest level since March.

- The fall in these indices is likely to be linked to higher expected inflation, as the index measuring households' views on consumer prices over the coming year has risen to its highest level since April 2012.

- On a more positive note for the outlook, the index measuring unemployment expectations has continued to decline substantially in September. It now stands at a level not seen since just the start of the pandemic.

- October's decline in confidence was expected given the sharp increase in energy prices recorded in France and most other European countries.

- The government has frozen natural gas prices, which increased by 12.1% in October, until April 2022. Furthermore, authorities have announced a EUR100 (USD116) grant (to be paid in December) for those earning less than EUR2,000 per month to mitigate the impact of higher energy prices.

- One of Europe's largest pension funds, the Netherlands-based

ABP, announced 26 October it will divest more than €15 billion

(approximately $17.4 billion) of equity and debt investments in 80

oil, natural gas, and coal companies, saying international reports

on the dire need to reduce CO2 emissions played a crucial role in

changing its strategy. (IHS Markit Net-Zero Business Daily's Kevin

Adler)

- "ABP will divest from the fossil fuel producers in phases; the majority of which is expected to be sold by the first quarter of 2023," the pension fund said in a statement.

- The divestment represents about 3% of ABP's total assets of about €493 billion.

- The May report of the International Energy Agency (IEA) and the August report of the Intergovernmental Panel on Climate Change (IPCC) prompted the portfolio shake-up by the pension fund, which invests on behalf of Dutch teachers and civil servants, a spokeswoman told OPIS on 26 October. "It's these reports that made us think about if we want to contribute to minimizing global warming, then more radical steps are necessary," she said.

- Saipem, AGNES and QINT'X have made an application to the Italian authorities for the development of an offshore energy hub including two wind farms, and a floating solar installation. The energy hub, to be named AGNES, will consist of the 200 MW Romagna 1 and 400 MW Romagna 2 wind farms projects located 33 km off the coast of Ravenna in the Adriatic Sea. The wind farms will feature a total of 75, 8 MW turbines installed on either jacket or monopile foundations in water depths of between 30 to 35 meters. The turbines will have a hub height of up to 170 meters and rotor diameters of up to 260 meters. The AGNES hub will also feature a floating photovoltaic system with a total capacity of 100 MW plus offshore transformer platforms. No construction timeline has been stated for the potential projects. In August this year, Saipem signed a memorandum of understanding (MoU) with AGNES and QINT'X for the development of one of the first wind farms in the Adriatic. (IHS Markit Upstream Costs and Technology's Lopamudra De)

Asia-Pacific

- Major APAC equity indices closed mixed; Australia +0.1%, Japan flat, India -0.3%, South Korea -0.8%, Mainland China -1.0%, and Hong Kong -1.6%.

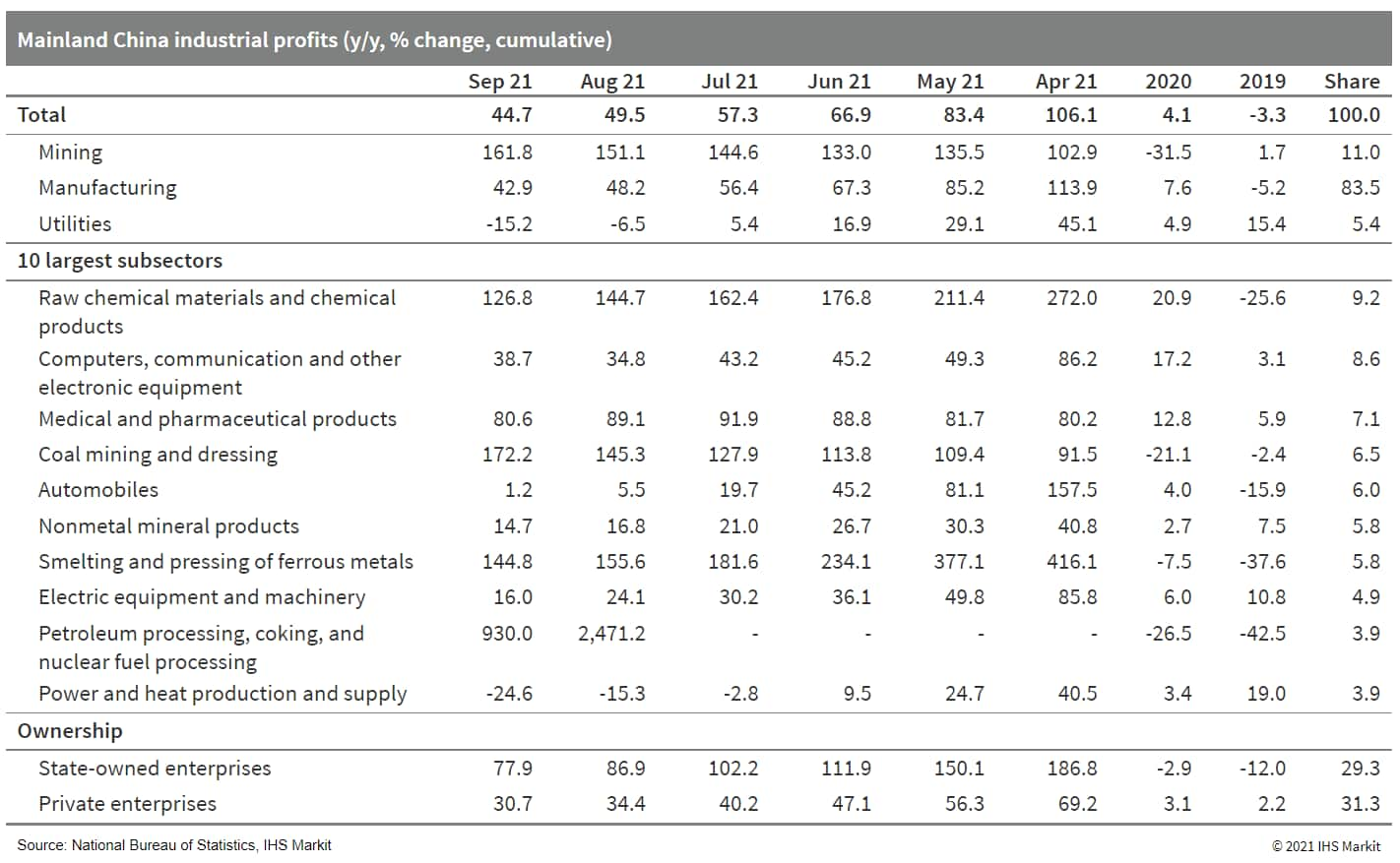

- Mainland China's industrial profits expanded by 44.7% year on

year (y/y) through September, down by 4.8 percentage points from

the first eight months. On a two-year (2020-21) average basis,

industrial profits increased by 18.8% y/y in the first three

quarters, 0.7 percentage point lower than the August reading. For

September alone, industrial profits recorded growth of 16.3% y/y,

ticking up from 10.1% y/y in August, according to the National

Bureau of Statistics (NBS). (IHS Markit Economist Lei Yi)

- The cumulative profitability ratio, although still high at 6.96%, has edged down for a third consecutive month through September. While the profitability ratio of the upstream mining sector continued to rise by 0.36 percentage point to 18.25%, that of the manufacturing and utility sectors further declined, falling by 0.05 and 0.43 percentage point to reach 6.58% and 5.09%, respectively.

- Soaring coal prices further dragged on industrial profits of the utility sector, which posted a wider contraction of 15.2% y/y through September. Notably, the profits of the subsector of power and heat production and supply dropped by 24.6% y/y, compared with the decline of 15.3% y/y in the prior month. The coal mining and dressing sector, on the other hand, recorded an even larger jump of 172.2% y/y in profit growth through September, up by 26.9 percentage points from the first eight months.

- Regarding the broader picture, 29 out of the 41 (70.7%)

industrial subsectors reported industrial profits exceeding the

pre-pandemic level in the third quarter. Profit strength in the

high-tech and raw material manufacturing sectors persisted, and

profits of consumer goods manufacturing also posted steady

recovery, registering a two-year average growth of 12.0% y/y in the

third quarter.

- China's State Council has released a new action plan with the aim to curb carbon dioxide emissions before 2030, reports Gasgoo. As per the plan, China will promote the use of low-carbon options for transportation such as electricity, hydrogen, natural gas, and advanced biology liquid fuel. In order to achieve that goal, the country plans to gradually lower the proportion of traditional fuel cars in new vehicle production and focus on the replacement of oil-fueled public service vehicles with electric ones. China also aims at speeding up the setting up of electric vehicle (EV) charging piles, supporting power grids, and gas and hydrogen filling stations in order to improve transport infrastructure. China has been aggressively pushing for the use of new energy vehicles (NEVs) in both the private and public transport domains. NEV sales have increased significantly in the past five years in China, thanks to the generous subsidies offered by the government. Despite the impact of the COVID-19 virus pandemic on vehicle sales, the Chinese NEV market continued to expand during 2020. Sales of NEVs increased by 10.9% to 1.37 million units last year. In the first nine months of this year, NEV sales in China rose by 185.3% y/y to 2.157 million units and are anticipated to increase by more than 40% each year for the next five years. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Chinese ride-hailing firm T3 has raised CNY7.7 billion (USD1.2 billion) in funding to support its expansion. Investors participating in this funding include Yingtong Technology, online travel platform Tongcheng, and Virtue Capital, an investment company led by Dong Yang, former head of China Association of Automobile Manufacturers. T3 did not disclose its valuation after the funding, reports Automotive News. T3 was established by three major Chinese automakers - FAW Group, Dongfeng Group, and Changan Auto - along with technology giants Tencent and Alibaba. In April 2019, T3 received CNY5 billion from its angel investors and the platform went online three months later. The new investment comes at a time when Chinese ride-hailing giant Didi Chuxing (DiDi) is undergoing a data security investigation following its initial public offering (IPO) in the United States. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Shin-Etsu Chemical reports 57.4% higher net profit for the

fiscal first half ended 30 September, to ¥220.9 billion ($1.9

billion), compared with ¥140.0 billion in the same period of the

previous year. Operating income increased by 62.0% year on year

(YOY) to ¥298.4 billion and sales grew by 32.5% YOY to ¥941.3

billion. Quarterly figures have not been disclosed. (IHS Markit

Chemical Advisory)

- Operating income at Shin-Etsu's infrastructure materials business grew threefold to ¥123.2 billion, compared with ¥38.1 billion in the year-earlier quarter, on sales of ¥364.0 billion, up 65.0% YOY. The company says that sales prices for polyvinyl chloride (PVC) grew, supported by strong global demand. It adds that market conditions for caustic soda have improved steadily since June. Increased production at Shintech, the company's US-based PVC business, also contributed to the higher earnings.

- Shin-Etsu's electronics materials business recorded a 12.6% YOY increase in operating income to ¥118.7 billion, on sales that rose 14.7% YOY to ¥335.5 billion. Products including semiconductor silicon, photoresists, and photomask blanks continued to be shipped at high levels for semiconductor device applications. Demand for rare-earth magnets has been strong in all applications, including automobiles, factory automation, and hard disk drives, despite the restrictions on operations in Malaysia, it adds.

- In the company's functional materials segment, operating income rose by 39.4% YOY to ¥22.7 billion, with sales growing 25.3% YOY to ¥188.4 billion. The company executed price revisions to counter higher prices of raw materials. Higher demand boosted the profitability of this sector.

- Shin-Etsu's processing and specialized services business reported operating income 44.3% higher YOY at ¥10.4 billion, on sales of ¥53.3 billion, up 13.3% YOY. Shipments of semiconductor wafer containers were strong, both for transporting use and for manufacturing processes.

- Sumitomo Chemical reports net profit of ¥88.8 billion ($778.5

million) in the fiscal first half ended 30 September, compared with

a net loss of ¥2.2 billion a year earlier. Sales increased 26.5%

year on year (YOY) to ¥1.3 trillion. Operating income more than

doubled to ¥144.2 billion, compared with ¥50.1 billion in the

year-ago period. (IHS Markit Chemical Advisory)

- Sales at Sumitomo's petrochemicals and plastics business segment, the company's largest, rose by 64.0% YOY to ¥399.4 billion. The unit swung to an operating profit of ¥42.0 billion from an operating loss of ¥31.2 billion a year earlier. The company adds that market prices for petchem products, synthetic resins, and synthetic fibers increased owing to demand recovery and a rise in raw material costs. Margins also improved.

- At the energy and functional materials segment, operating income more than doubled to ¥12.5 billion from ¥4.7 billion in the same period of the previous year, and sales rose 41.0% YOY to ¥148.4 billion.

- Revenue at Sumitomo's IT-related chemicals segment rose 6.7% YOY to ¥227.6 billion and operating income grew by 33.5% YOY to ¥29.5 billion. Shipments of processing materials for semiconductors, including high-purity chemicals and photoresists, increased, driven by growing demand. Shipments of materials for display applications grew because of stay-at-home demand, and telework demand continued.

- Operating profit at the health and crop-science business almost doubled to ¥18.5 billion, up by 98.0% YOY, against an operating profit of ¥9.3 billion a year earlier. Revenue at the business rose 12.5% YOY to ¥209.4 billion. Shipments of crop-protection products in North America, South America, and India stayed firm. Market prices for methionine increased YOY.

- The joint venture (JV) between SK Telecom's T Map Mobility and Uber will begin offering a ride-hailing service in South Korea, starting from 1 November. The JV, named UT, is targeting around 10,000 franchise taxis by the end of this year. The company also aims to expand into carpooling early next year, once a new bill allowing taxi providers to offer the service takes effect in late January, reports Bloomberg. In 2020, T Map Mobility, SK Telecom's mobility spin-off, announced its intention to form a JV with Uber that will invest USD100 million for a 51% stake. The JV - named UT - aims to launch a new taxi-hailing service based on existing services offered by Uber and T Map Mobility. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Indian online bus ticketing startup Chalo has acquired Shuttl, a bus aggregator for office commutes, in an all-cash deal. The amount was not disclosed, reports TechCrunch. Chalo founder and chief executive Mohit Dubey said the acquisition of Shuttl will help his company expand across the country including metropolitan areas, increase its technology and product offerings, and accelerate its international development plans. Dubey said, "Shuttl and Chalo, these are the firms that are positioned to become the largest mobility firms in the world. I wish the pandemic had not happened, but it has allowed the two companies with a similar focus to come together". This development comes days after Chalo announced a USD40-million Series C round of funding. Chalo's app, which has more than 7 million downloads as of July 2021, provides live tracking of over 15,000 buses in 21 Indian cities. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Thalamus Irwine, an India-based technology conglomerate with a

heavy emphasis on artificial intelligence (AI) and Blockchain, has

partnered with US-based electric vehicle (EV) manufacturer Triton

EV to accelerate India's autonomous vehicle (AV) future, reports

The Economic Times. The memorandum of understanding (MoU) signed by

the two companies outlines a three-phase strategy in which Thalamus

Irwine and Triton will roll out AI systems over a three-year

period, with Thalamus Irwine's AI technology being deployed in

Triton's EVs. "Thalamus Irwine will install AI based safety system

for Triton EV drivers in the first phase. We plan to use data

generated from Triton EV and use it for developing autonomous

vehicles. We have plans to upgrade the same car into an autonomous

vehicle in phase 2 through a firmware update," said Thalamus Irwine

CEO Rishabh Sharma. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-october-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-october-2021.html&text=Daily+Global+Market+Summary+-+27+October+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-october-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 27 October 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-october-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+27+October+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-october-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}