Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 25, 2022

Daily Global Market Summary - 25 January 2022

All major European equity indices closed higher, while all US and most APAC indices closed lower. US and benchmark European government bonds closed lower. European iTraxx closed tighter across IG and high yield, while CDX-NA was wider on the day. The US dollar closed flat, and gold, silver, copper, oil, and natural gas were all higher on the day. Tomorrow's 2:00pm ET FOMC meeting statement and the press conference that follows could potentially drive heightened late day volatility in the US markets.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -0.2%, S&P 500 -1.2%, Russell 2000 -1.5%, and Nasdaq -2.3%.

- 10yr US govt bonds closed +1bp/1.78% yield and +1bp/2.13% yield.

- CDX-NAIG +1bp/59bps and CDX-NAHY +7bps/332bps.

- DXY US dollar index closed flat/95.95.

- Gold closed +0.6%/$1,853 per troy oz, silver +0.4%/$23.90 per troy oz, and copper +0.8%/$4.45 per pound.

- Crude oil closed +2.7%/$85.60 per barrel and natural gas closed +0.5%/$3.89 per mmbtu.

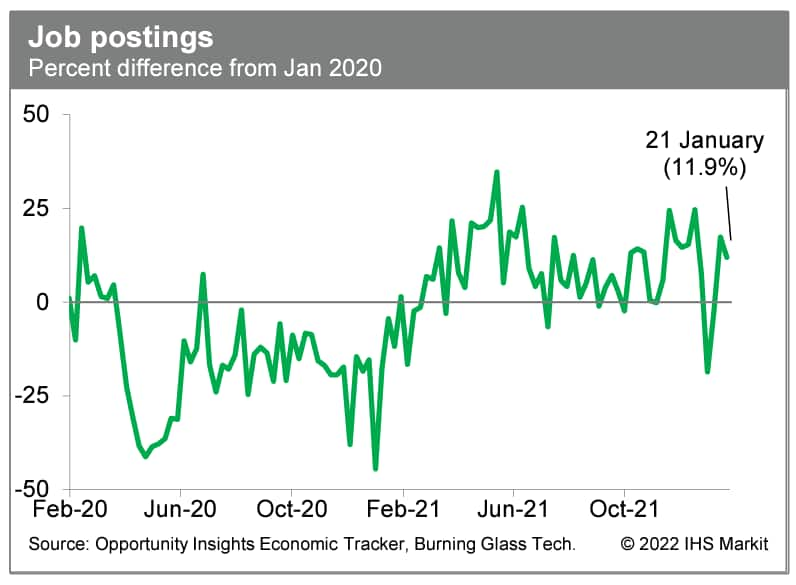

- US job postings last week were 11.9% above the January 2020

level, down somewhat from the prior week's reading and close to

levels in November and December. This suggests that labor demand is

holding up well, despite signs of caution in response to the

Omicron wave in some areas of the economy. (IHS Markit Economist Ben

Herzon and Lawrence Nelson)

- The US Conference Board Consumer Confidence Index edged down

1.4 points to 113.8 (1985=100) in January after recording gains for

three straight months. December's reading was revised down from

115.8 to 115.2. (IHS Markit Economists Akshat Goel and William

Magee)

- The index of views on the present situation improved to 148.2 in January from 144.8 last month, despite headwinds from continued price increases and the rapid spread of the Omicron variant.

- The labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) edged lower to 43.8 but remains near historical highs.

- The expectations index fell 4.6 points to 90.8 even as a higher proportion of consumers planned to buy homes, automobiles, and major appliances over the next six months.

- The expectations index was driven lower by weakening optimism about business conditions and job prospects in the short term, with 23.8% of consumers expecting business conditions to improve, down from 25.4%. A greater percentage (19.0%) expects business conditions to worsen, up from 18.6%.

- Consumers are also less optimistic about their job prospects: 22.7% of consumers expect more jobs to be available in the coming months, down from 24.2%; 15.7% anticipate fewer jobs, up from 14.7%.

- According to data released by S&P CoreLogic Case-Shiller,

US home price growth continued to slowly retreat from its recent

peak. The national index was up 18.8% y/y in November, the third

month in which it has decelerated from its high of 20.0% in August.

The slowdown is, however, unlikely to bring any reprieve to

potential homebuyers who have been priced out of the market.

November's reading tied that of June 2021 for the fifth-fastest

pace of growth on record. Both the 10-city and 20-city indexes

slowed as well, but only marginally. The housing market remains

plagued by a dearth of existing inventory. (IHS Markit Economists

Troy

Walters)

- Monthly home price gains ticked up slightly in November. The 10-city index was up 1.1% month over month (m/m) while the 20-city index was up 1.2%. In both cases, this was faster than the respective October rates.

- Monthly home price changes remained in positive territory in all 20 cities, ranging from 0.1% in Boston to 2.1% in Seattle.

- Annual growth in both the 10-city and 20-city indices decelerated again in November, although by lesser degree than in recent months. The 10-city index was up 16.8% year over year (y/y) after rising 17.2% in October. The 20-city index was up 18.3% y/y following an 18.5% increase the previous month.

- Despite continued deceleration, all 20 cities measured have yet to see growth fall below the double-digit mark as of November. Gains ranged from 11.1% in Washington DC to 32.2% in Phoenix.

- The national index was up 18.8% y/y in November, the third consecutive month in which growth has slowed.

- The State of New York will hold an offshore wind auction in 2022, and invest USD500 million in ports, manufacturing, and supply chain infrastructure need to advance its offshore wind industry. The New York State Energy Research and Development Authority (NYSERDA) will launch an offshore wind auction in 2022, which is expected to result in at least 2 GW of new projects. NYSERDA will couple this procurement with a USD 500million investment in ports, manufacturing, and supply chain infrastructure required to advance the offshore wind industry. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- Hess Midstream LP guided for 2022 saying it would spend $235

million this year, primarily on expanding gas compression capacity

in the Bakken. The company said it was also expanding gathering

system well connects there to meet its accelerated pace of

development in the basin. More specifically, the company provided

details on the capex program: "Approximately $135 million of the

2022 capital budget is allocated to gas compression, with

activities focused on the completion of two new greenfield

compressor stations and associated pipeline infrastructure, which

are expected to provide, in aggregate, an additional 85 MMcf per

day of gas compression capacity when brought online during the

year. (IHS Markit Economist Annalisa Kraft)

- "In addition, Hess Midstream expects to initiate construction on a third greenfield compressor station, which is expected to provide an additional 65 MMcf per day of gas compression capacity when brought online in 2023, further enhancing gas capture capability and supporting Hess' development in the basin. Reflecting increasing drilling activity by Hess, approximately $90 million is allocated to gathering system well connects to service Hess and third‑party customers," Hess Midstream continued.

- "We are poised for continued volume and Adjusted EBITDA growth after a strong finish to 2021. The tie-in of our newly expanded Tioga Gas Plant gives us the capacity to capture further volume growth and drive free cash flow, creating an opportunity to return additional capital to our shareholders," Hess Midstream COO John Gatling said. "We remain focused on operational and commercial execution to capture increasing gas volumes, which are expected to increase by more than 30% by 2024 relative to 2021 based on Hess' current nominations."

- The January 25 guidance also touched on volumes. "In 2022, full year gas gathering volumes are anticipated to average 350 to 365 million cubic feet (MMcf) of natural gas per day and gas processing volumes are expected to average 330 to 345 MMcf of natural gas per day, reflecting Hess' announced three-rig program in the Bakken."

- The company also guided longer term. "In 2023 and 2024, Hess Midstream expects continued growth in Adjusted EBITDA and Adjusted Free Cash Flow generation sufficient to fully fund growing distributions without incremental debt or equity while creating additional capital allocation flexibility, including potential return of capital to shareholders. Hess Midstream continues to expect gas gathering and processing to comprise approximately 75% of total affiliate revenues excluding passthrough revenues, with 2023 and 2024 gas gathering and gas processing MVCs providing visibility to expected future revenue growth."

Europe/Middle East/Africa

- All major European equity markets closed higher; UK +1.0%, Germany +0.8%, France +0.7%, Spain +0.7%, and Italy +0.2%.

- 10yr European govt bonds closed lower; Italy +1bp, France/Spain +2bps, Germany +3bps, and UK +4bps.

- iTraxx-Europe closed -1bp/57bps and iTraxx-Xover -4bps/277bps.

- Brent crude closed +2.2%/$88.20 per barrel.

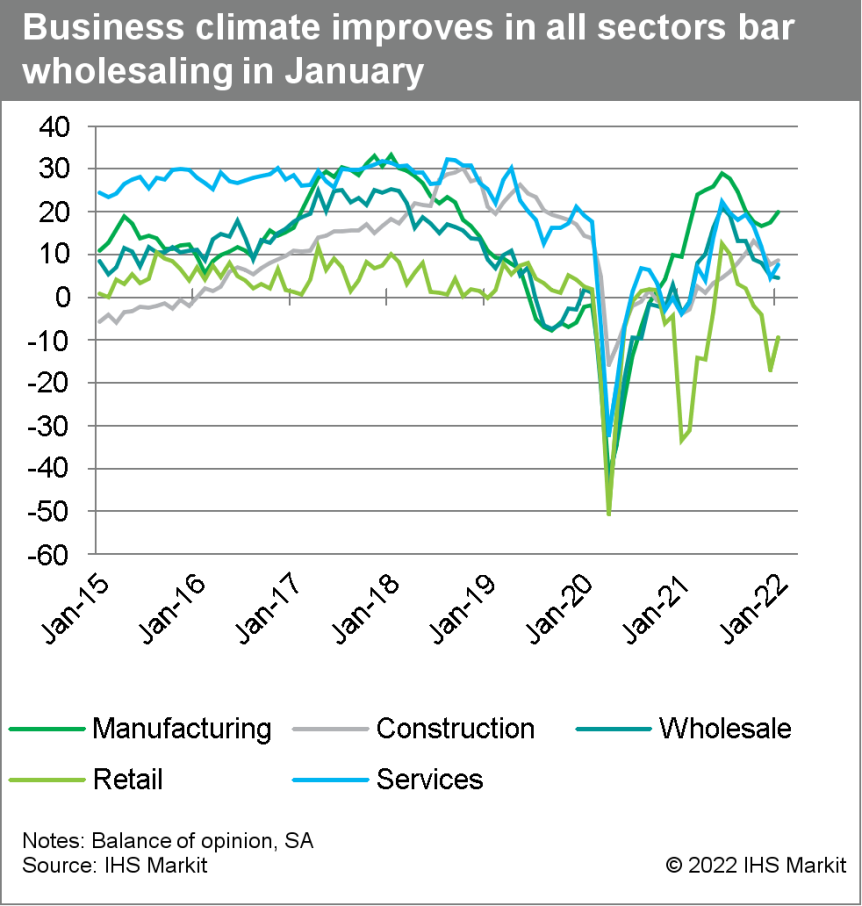

- January's headline German Ifo index, which reflects business

confidence in industry, services, trade, and construction combined,

rebounded from 94.8 to 95.7, its first improvement since June 2021.

This latest level is modestly below its pre-pandemic level of

February 2020 (96.4) and the long-term average of 97.0. The Ifo

institute interprets this cautiously, commenting that "the German

economy is starting the new year with a glimmer of hope". (IHS

Markit Economist Timo

Klein)

- Business expectations alone drove January's improvement, increasing from an 11-month low of 92.7 to 95.2. This remains somewhat below their long-term average (97.5), although far above their all-time low of 71.9 in April 2020. Confidence about the next six months rose the most in the retail and service sectors, which had been hurt the most in the final quarter of 2021 by the level of administrative restrictions imposed to keep the pandemic situation under control. Manufacturing and construction expectations improved too, however, in this case linked to diminishing supply chain problems.

- In contrast, the assessment of current conditions worsened modestly once more, the sub-index slipping from 96.9 to an eight-month low of 96.1. This is slightly below its long-term average of 96.7 and moderately lower than its pre-pandemic level of 99.1 in February 2020. The sector breakdown shows that services and retail continued to suffer from broadly unchanged restriction levels that have greatly reduced access of unvaccinated persons to most shops and services. This contrasts with the current situation in manufacturing and construction, where survey participants see matters in a brighter light now.

- Pulling current conditions and expectations together, January's

sectoral breakdown reveals that the retail sector, which had

suffered the most in late 2021, also has improved the most at the

start of 2022. This is followed by services and manufacturing, with

construction sector confidence rising the least. In manufacturing,

capacity utilization increased from 84.9% to 85.6%, a level close

to its long-term average. This demonstrates that output is starting

to catch up with the orders backlog. Only the wholesale sector

declined slightly once more as current conditions deteriorated

again, which could not be compensated fully by rising optimism

about the future.

- The Volkswagen (VW) Group has met the latest European Union (EU) emissions targets in 2021 as a result of the growing percentage of electrified vehicles in its sales parc, according to a company statement. Based on the company's own preliminary figures, the VW Group's fleet average CO2 emissions of new passenger cars in the EU came in at 118.5g/km in 2021. This is around 2% less than the legal target, according to VW's own data, but the European Commission will report its own data at a later date. Christian Dahlheim, the VW Group's head of sales, said, "Our Group-wide electric offensive picked up significant speed last year with many attractive new models. Nearly one in five vehicles delivered in Europe was electrified, and more than half of these were all-electric. This helped us to further reduce CO2 fleet emissions and fulfil the EU target. We were also able to inspire many new customers for e-mobility." Emissions for Bentley and Lamborghini are measured in a separate category and therefore are not included in the above fleet average figure. VW stated that 472,300 electrified vehicles (battery electric and plug-in hybrids) were sold in the EU, Norway, and Iceland in 2021, which was a 64% year-on-year (y/y) increase. This raised the proportion of VW's electrified vehicle sales to an overall share of 17.2%, up from 10.1% in 2020. In 2020 the Group achieved average CO2 emissions of 99.9 g/km for its fleet in the EU, UK, Norway, and Iceland, although this figure was calculated based on the New European Driving Cycle (NEDC). (IHS Markit AutoIntelligence's Tim Urquhart)

- BMW has announced that it will discontinue production of its V12 engine and mark the end of production with a special-edition 7-Series featuring the powertrain. The engine is only available in the 7-Series, and the 760 V12 variant sells in very small numbers around the globe, with the United States being the biggest market. The Final V12 limited edition will be based on the BMW M760i xDrive, which features the twin-turbocharged 6.6 liter gasoline (petrol) V12 that generates 601 bhp and that accelerates the F-segment sedan to 60 mph in 3.6 seconds. The run will be limited to just 12 vehicles. (IHS Markit AutoIntelligence's Tim Urquhart)

- SSE Renewables plans to bid for the upcoming 1.4GW Hollandse Kust (west) tender for the 1.4 GW Hollandse Kust (west) wind farm zone off Netherlands. The window for tender submissions is scheduled between 14 April and 12 May 2022, with winners announced by the end of first half 2022. The Hollandse Kust (west) wind farm zone, located some 53km off the west coast of Netherlands, will accommodate a minimum of 1.4GW of fixed bottom offshore wind power capacity. If SSE Renewables is successful in the tender, the Hollandse Kust (west) project is expected to be commissioned by 2026. (IHS Markit Upstream Costs and Technology's Chloe Lee)

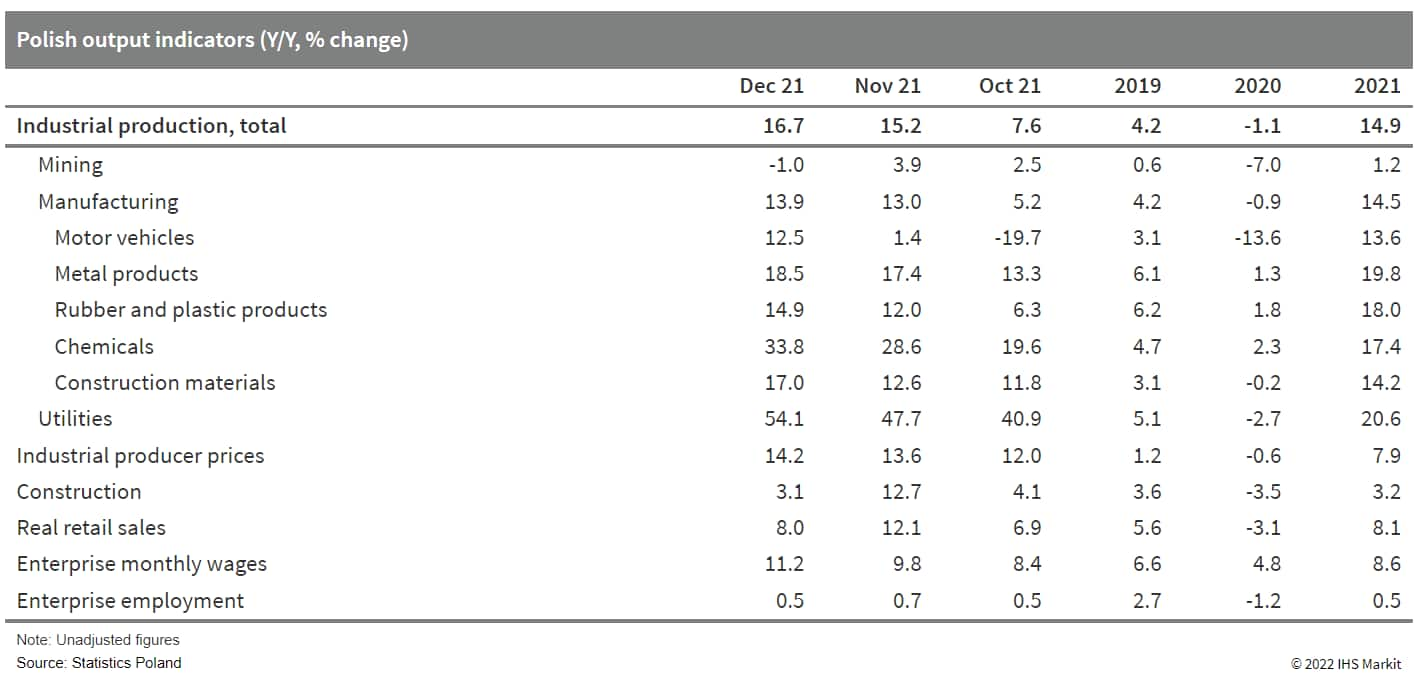

- After the November 2021 surge, Poland's industrial output edged

downwards by 0.2% m/m in December 2021. Despite the decline, y/y

growth accelerated to 16.7%, boosted by a solid manufacturing

performance and soaring utilities production. (IHS Markit Economist

Sharon

Fisher)

- Within manufacturing, a number of key branches reported robust gains. Perhaps the most notable was the recovery of motor vehicle output, which rose by an estimated 12.5% y/y after declines in July-October 2021 due to supply chain constraints.

- In the fourth quarter of 2021 as a whole, industrial output jumped by 13.1% y/y, accelerating from 10.3% y/y during the previous period. This brought full-year industrial output growth to 14.9% in 2021, precisely in line with our latest estimate from the January forecast round.

- In a separate release, construction activity rose by 3.1% y/y in December 2021 while slumping by 5.6% m/m in seasonally adjusted terms. Despite positive growth in all three components (civil engineering, building, and specialized construction), y/y construction output slowed to the weakest pace since April 2021.

- In the fourth quarter of 2021 as a whole, growth in construction activity rose by an estimated 6.3% y/y, a moderate acceleration over the previous period (at 5.8% y/y). Nevertheless, full-year-2021 output growth (at 3.2%) was pulled downwards by a drop in building construction, failing to compensate for the previous year's 3.5% drop.

- Real retail sales (including the automotive category) rose by 8.0% y/y in December 2021, considerably slower than in November 2021, while seasonally adjusted sales fell by 3.4% m/m. The fastest y/y growth was recorded in the clothing category, whereas automotive sales dropped by 8.5% y/y, largely owing to supply chain constraints.

- Although December 2021 retail sales were weaker than

anticipated, low base effects helped boost real retail sales by an

estimated 9.0% y/y in the fourth quarter of 2021 as a whole, nearly

double the rate for the previous period. In full-year 2021, real

sales increased by 8.1%, following a 3.1% drop the previous

year.

- The Central Bank of the Republic of Turkey (Türkiye Cumhuriyet

Merkez Bankası: TCMB) on 20 January held its benchmark policy rates

at 14%, following four consecutive rate cuts from September 2021, a

decision indicated previously by President Recep Tayyip Erdoğan.

(IHS Markit Country Risk's Jessica Leyland)

- This cycle of monetary easing at a time of widespread global tightening pushed the Turkish lira to record lows of over TRY18:USD1, although it now stands at around TRY13.5:USD1, and inflation to 36% year on year in December 2021, the highest in almost 20 years and well over the TCMB's 5% inflation target.

- The president's statement and the TCMB's subsequent implementation further indicates the executive's direct control of the TCMB and monetary policy. The TCMB cited wider geopolitical issues, such as high energy prices and Russia-Ukraine war risks, as drivers of the decision.

- IHS Markit assesses that, instead, the rate decision is a move seeking to quell growing domestic economic discontent and perceptions that President Erdoğan's unorthodox policies are responsible - sentiment held even among Erdoğan's traditional voter base. Unofficial but credible polls from the PolitPro political data and statistics platform show Erdoğan's ruling Justice and Development Party (Adalet ve Kalkınma Partisi: AKP) polling at its lowest level since 2015.

- Holding interest rates should reduce downside risks for the local currency and upward pressure on annual consumer price inflation. IHS Markit forecasts that high inflation will not retreat significantly until late- 2022. Although this would increase the risk of popular protests, the Turkish security forces have sufficient capacity to prevent these from escalating rapidly.

- Loss of government popularity also increases the risk that the AKP will target potential presidential opposition candidates and others with criminal investigations and allegations ahead of the 2023 general and presidential elections, to reduce the popularity and divide the opposition amid economic decline and diminishing support for the incumbent president.

Asia-Pacific

- Most major APAC equity indices closed lower except for India +0.6%; Japan -1.7%, Hong Kong -1.7%, Australia -2.5%, South Korea -2.6%, and Mainland China -2.6%.

- Bloomberg has reported that according to several of its

sources, the People's Bank of China (PBoC) has given banks window

guidance to boost lending to both households and companies.

Although official data have not been released yet, Bloomberg's

sources have noted that preliminary data from the first half of

January 2022 show that credit disbursements has been slower than a

year earlier. (IHS Markit Banking Risk's Angus

Lam)

- The PBoC has slashed both the short-term and the medium-term loan prime rates (LPRs) in recent weeks and has also directed banks to ease lending to real estate companies in order to acquire projects from weaker counterparts as well as to boost consumer mortgage loans.

- There was some news on 24 January regarding project financing, with developer Agile Property selling its stake to China Overseas Land and Investment in a joint project with the latter to boost its liquidity as part of the aforementioned project acquisition policy.

- IHS Markit assesses that, considering that the reserve requirement ratio (RRR) is still at around 8.4% after it was reduced in December 2021 and after a succession of LPR cuts, it is likely that a further cut in the RRR will come in the first quarter (see China: 7 December 2022: China's central bank cuts RRR by 0.5% points, non-focused cut likely to drive broad-based credit growth). Overall, based on the current situation, we expect credit growth in China to be around 11.6% in 2022, around 0.3% points higher than the 2021 credit growth rate.

- Mainland China's "dynamic zero-COVID-19" strategy has again

proved effective in containing the domestic Omicron variant-led

infection flareups since early January. While major regional

outbreaks (Shaanxi, Henan, and Tianjin) have seen the local

pandemic situation ebbing entering the second half of January,

overall pandemic responses still lean towards the tighter end as

the Spring Festival travel rush kicking off and Beijing Winter

Olympics approaching. With health officials firmly holding current

pandemic containment strategy "best choice for now" given

uncertainties regarding COVID-19 variants, likelihood of near-term

deviation from zero-COVID-19 stance remains low. (IHS Markit

Economist Lei Yi)

- Mainland China has reported a total of 4,802 domestically transmitted COVID-19 cases over 25 November 2021 to 24 January 2022, with 63 areas across the nation escalated to medium-to-high risk region (15 high-risk and 48 medium-risk) in terms of COVID-19 infection as of noon 25 January. For January alone, cumulatively 2,114 symptomatic cases have been logged in 13 provincial-level regions through 24 January, with Henan (47%), Shaanxi (29%), and Tianjin (17%) having the three highest infection counts. Furthermore, since Tianjin detected its first domestic community-level transmission of Omicron variant on 8 January, Omicron cases have been found in eight other cities across mainland China as of this writing, including Beijing, Shanghai, Shenzhen, Zhongshan, Zhuhai, Meizhou (four cities in Guangdong Province), Dalian (Liaoning Province), and Anyang (Henan Province).

- The escalating pandemic situation clearly does not bode well for the upcoming Spring Festival peak travel season (17 January—25 February) and the Beijing Winter Olympics (4-20 February). On a 15 January press conference, the Ministry of Transport projected total passenger trips to reach 1.18 billion during the 40-day Spring Festival travel period, representing a 35.6% increase from 2021, a 20.3% decline from 2020, and a 60.4% drop from pre-pandemic 2019 level. Local governments have already returned to their year-ago playbook of advocating "stay put" and offering cash incentives for employees to avoid traveling home, therefore minimizing pandemic risks. With testing requirements and certain period of health monitoring becoming the standard procedures for interprovincial travel at least in the near term, the service sector should continue to bear the brunt as mainland Chinese authorities are sticking to the zero-COVID-19 strategy.

- Mainland China has administered over 2.97 billion doses of COVID-19 vaccines as of 24 January, equivalent to 210.6 doses per 100 people. The latest release from the National Health Commission (NHC) showed that fully vaccinated population share had reached 86.7% by 21 January, up approximately 0.2 percentage point from a week before. Still, such inoculation rate level "is not yet sufficient for the establishment of a solid herd immunity", as assessed by Liang Wannian, head of expert panel of COVID-19 response of NHC.

- China has formulated guidelines for the conduct of field trials

for the safety evaluation of gene-edited plants. The measures have

been formulated as an adjunct to a raft of rules finalized in

December involving genetically modified crops. In December, public

opinion was sought on the drafts of four ministerial regulations

mainly focusing on: biosafety evaluations of GM crops; naming and

examination of crop varieties; seed production licenses of GM

crops; and the amendment to national regulations on agricultural

GMO safety controls and the country's Seed Law. At the same time,

the Ministry consulted on data requirements for herbicides used on

herbicide-tolerant maize and soybeans and two guidelines for

efficacy trials on those GM crops. (IHS Markit Crop Science's

Sanjiv Rana)

- The rehauling of the country's seed rules have raised speculation about a gradual move towards the commercial cultivation of GM maize and soybeans. It is expected that China could allow the commercial cultivation of GM soybeans or maize by late 2023. That would be in line with the goal of commercial cultivation of GM food crops envisaged in the country's 14th national five-year plan running from 2021-2025.

- The only GM crops cultivated in China are cotton and papayas. In 2019, China planted 3.2 million ha of the crops.

- Chinese agricultural biotechnology companies such as Origin Agritech and Beijing Dabeinong Technology Group (DBN) have been conducting trials on GM maize and soybeans for many years in anticipation of commercial cultivation for these crops. Origin has agreed deals with Chinese research institutes and companies to broaden its trait portfolio. In 2020, DBN received import approval for its GM herbicide-tolerant (DBN09004) soybeans. That was the first Chinese import approval for GM soybeans developed by a domestic company. In 2021, the two companies also agreed a collaboration deal for the development of GM maize hybrids.

- Changan New Energy Automotive Technology, the subsidiary of Chongqing Changan Automobile, has completed its Series B round of financing, reports Reuters. The round of investment helped the subsidiary to raise CNY4.9773 billion. In addition, Changan New Energy reportedly is planning a listing in around 2025. According to a filing at the Shanghai Stock Exchange, Changan's shareholding in Changan New Energy will be lowered from 48.95% to 40.66% after the deal, although the automaker will still be the majority shareholder of its new energy vehicle (NEV) arm. Wang Jun, president of Changan, said the company aims to bring its annual sales volume of NEVs to 700,000 units by 2025. The Chinese automaker and its joint ventures sold 2.3 million vehicle last year, up 14.8%. Of this total volume, sales of Changan's wholly owned brands increased 16.7% to 1.75 million units. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Panasonic will begin mass production of its new lithium-ion batteries in 2023, with the first shipment heading for Tesla. According to Nikkei Asia, the new batteries are expected to increase the driving range of Tesla's electric vehicles (EVs) by more than 15%. With the new 4680 battery cells, calculations show that the range of the Model S will improve from 650 km to around 750 km on a single charge. The Japanese battery supplier is adding JPY80 billion (USD702.5 million) in fresh investment to expand its production facility in Wakayama prefecture and bring in new equipment. According to the report, the Wakayama facility is expected to have total battery production capacity of 10 GW per year, which is sufficient for 150,000 EVs. Panasonic is the primary battery supplier for Tesla and has a multi-year supplier agreement with the automaker for the latter's Nevada Gigafactory. Recently, Panasonic announced plans to add a 14th production line at the Tesla Gigafactory in Nevada to increase the plant's capacity by about 10%. With a significant increase in the EV sector in the last five years, the race is on to develop and mass manufacture batteries with better efficiency that can provide more driving range. In August 2020, Chinese battery maker Contemporary Amperex Technology Company Limited (CATL) was reported to be working on a new technology that will allow battery cells to be integrated with an EV chassis, shedding traditional casings that make battery systems bulky. At the time, CATL chairman Zeng Yuqun hinted at the rollout of the new technology before 2030. By integrating cells directly into an EV's frame, the battery maker can fit more cells into the vehicle, thus extending its range. With the new technology, EVs could have a driving range of more than 800 km. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- South Korea's LG Chem plans to build the nation's first

supercritical pyrolysis recycling plant by 2024, the company

announced last week. The company will begin constructing this year

a 20,000 mt/year pyrolysis oil facility in Dangjin City, within

South Korea's South Chungcheong Province, it said. (IHS Markit

Chemical Market Advisory Service's Chuan Ong)

- This plant will use a supercritical pyrolysis-based process, developed by UK-based Mura Technology, to decompose plastic waste as raw material, LG Chem said.

- LG Chem expects this plant to have industry-leading productivity as more than 80% of the plastic waste feed can be converted into renewable oils, while the remaining 20% of by-product gases can serve as energy.

- Mura Technology said LG Chem can use its process in the upcoming plant to recycle 25,000 mt/year of plastics into raw materials, that can in turn produce new plastic.

- LG Chem has not decided what kind of plastic it intends to produce at this new facility - LG said it will further review expansions once the plant is fully operational by Q1 2024, and may consider construction of similar facilities at other sites.

- Mura Technology confirmed that LG Chem had also become a shareholder of its company, besides licensing its technology. Mura Technology added that it had also licenced its process to Mitsubishi Chemical Corporation in June 2021, and has strategic partnerships with Dow and Chevron Phillips Chemical Corporation.

- According to LG Chem, supercritical pyrolysis technology allows decomposition of used plastic with steam at high temperature and pressure, using supercritical water. Using supercritical water is unlike technologies that apply heat directly to a reactor as it suppresses the generation of chars during pyrolysis, hence there is no anticipated limit to continuous operation.

- LG Electronics will showcase its autonomous mobility concept solution next month at a fair in southern Seoul (South Korea), reports Yonhap News Agency. Named LG Omnipod, it can serve as "a home office, an entertainment center or even a lounge" and is fitted with LG home appliances retooled for in-vehicle use. The vehicle features artificial intelligence concierge services from LG's virtual influencer Reah and "adaptive" interior that can be reconfigured in real time using a metaverse display system. Lee Chul-bae, head of LG's design center, said the Omnipod represents "LG's vision for futuristic autonomous, smart vehicles based on the company's strength in consumer appliances, display and vehicle components". LG Electronics is expanding its presence in the future mobility sector with three areas of focus: infotainment, powertrain, and auto lighting systems. LG's vehicle components solutions (VS) business unit reported sales of KRW5.80 trillion in 2020, up by 6.1% from 2019. To expand its powertrain business, the company has formed a joint venture (JV) with Magna International, which will produce key components, including e-motors, inverters, and on-board chargers for electric vehicles (EVs). It also launched a JV called Alluto with Swiss-based software firm Luxoft, which will develop solutions for the digital cockpit, in-vehicle infotainment, passenger-seat entertainment, and ride-hailing systems based on LG's webOS Auto platform. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ola Electric has raised USD200 million in its latest funding round from Tekne Private Ventures, Alpine Opportunity Fund, and Edelweiss, among others. Ola Electric said the new round of funding values the company at USD5 billion, reports The Economic Times. The company plans to use the capital to accelerate its plans to launch newer models, expand charging infrastructure, and build cell manufacturing capabilities. Bhavish Aggarwal, co-founder and CEO of Ola Electric, said, "I thank investors for their support and look forward to partnering with them to take the EV [electric vehicle] revolution from India to the world". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The National Bank of Kazakhstan (NBK) in its January monetary

policy meeting announced a relatively bold interest rate rise of 50

basis points, following a respite in monetary tightening in

December. Given increased inflation expectations and persisting

inflation pressures from both demand and supply sides, further

monetary tightening during the first half of 2022 seems

increasingly likely, although it is not yet included in our

baseline forecast in January. (IHS Markit Economist Venla

Sipilä)

- The Monetary Policy Committee (MPC) of the NBK in its first monetary policy meeting of 2022 decided to lift its refinancing interest rate by 50 basis points, taking the policy rate to 10.25%. With the interest rate corridor remaining at +/-1 percentage points, the rates on standing access to liquidity and to operations withdrawing liquidity are set at 11.25% and 9.25%, respectively.

- The NBK based the decision on the need to reduce inflation expectations and to bring inflation down to the target range of 4-6% by the end of this year. It notes that, notwithstanding some disinflationary phenomena impacting prices over the past months, both demand- and supply-side inflation risks are currently identified.

- Kazakh consumer price inflation ended 2021 at 8.4% year on year (y/y), having decelerated over the last two months of the year. Food inflation continued to decelerate, although it was still high at 9.9% y/y. This figure was the lowest since May. Easing of food price pressures was partly due to administrative measures as well as a favorable base effect.

- Price regulation also suppressed gains in prices of paid services. On the contrary, non-food inflation accelerated to its highest level since May 2018, with a key contribution coming from increased fuel prices, as well as more expensive cars.

- PetroGreen Energy Corporation, renewable energy arm of

Philippines' oil and gas company PetroEnergy, is proposing to build

3GW scale wind projects off Philippines. It was unveiled in 2021

that PetroEnergy was in collaboration with a foreign partner to

expand its footprint into offshore wind. (IHS Markit Upstream Costs

and Technology's Chloe

Lee)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-january-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-january-2022.html&text=Daily+Global+Market+Summary+-+25+January+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-january-2022.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 25 January 2022 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-january-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+25+January+2022+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-january-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}