Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 23, 2020

Daily Global Market Summary - 23 July 2020

APAC and European equity markets closed mixed, while most US indices closed lower. iTraxx and CDX IG indices closed flat on the day, while HY closed slighter tighter in Europe and wider in the US. Gold reached a new all-time high close today and the US dollar is now near its lowest point in two-years. The combination of increasing tensions between the US/China and concerns over today's first uptick in seasonally adjusted US initial claims for unemployment insurance in 16 weeks potentially indicating prolonged economic stress in the US will likely weigh on the markets in the near term.

Americas

- Most US equity markets closed lower today, except for the Russell 2000 ending flat. Nasdaq -2.3%, DJIA -1.3%, and S&P 500 -1.2%.

- 10yr US govt bonds closed -1bp/0.59% yield.

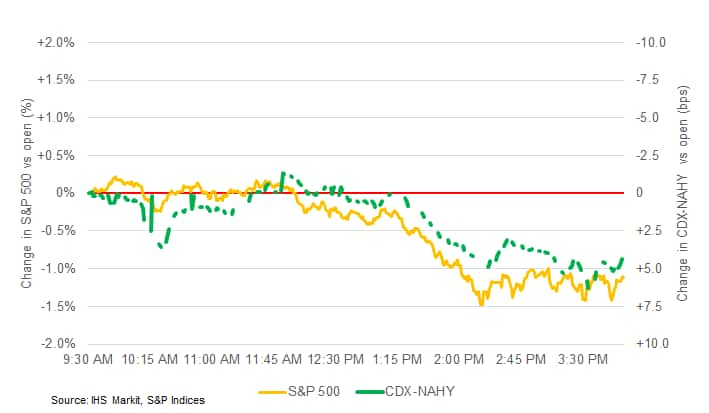

- CDX-NAIG closed flat/70bps and CDX-NAHY +7bps/460bps. The below

chart shows today's intraday change in the S&P 500 and CDX-NAHY

versus the 9:30am EST open (note the CDX-NAHY axis is inverted to

align better with S&P).

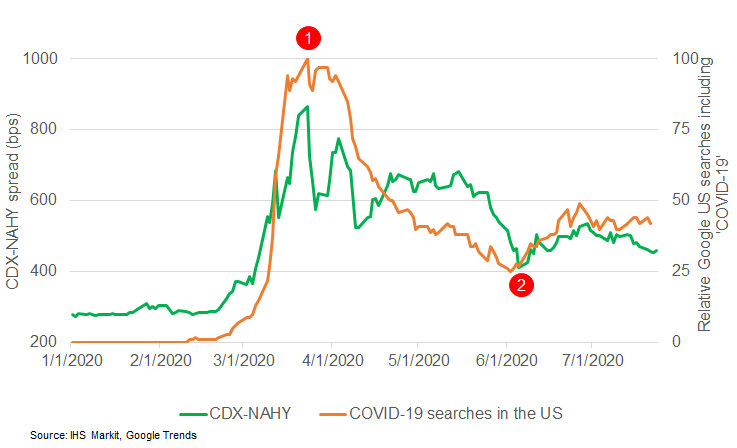

- The below is the updated comparison between the relative number

of Google searches for the term 'covid-19' in the US versus

CDX-NAHY spreads. The two most interesting aspects of the graph are

(1) the peak in searches and CDX-NAHY spreads both occurring on 23

March and (2) the widening trend in the CDX-NAHY index that began

in early-June occurred a day after searches for the term increased

on 5 June.

- Gold closed +1.3%/$1890 per ounce, which is an all-time high close. It's worth noting that the highest intraday price was $1,924 on 6 September 2011.

- The DXY US dollar index broke through this year's previous low and is near a two-year low, closing at 94.81 today.

- Crude oil closed -2.0%/$41.07 per barrel.

- Warren Buffett's Berkshire Hathaway increased its stake in Bank of America by more than $800 million this week, in a sign of confidence for the US banking sector. Berkshire's purchase of 34 million shares in the US's second-biggest bank represents a 4% increase in its holding, which is now worth some $24.1bn. That amounts to an 11.3% stake in the Charlotte-based lender. (FT)

- Ascena Retail Group Inc., the parent company of Ann Taylor and Lane Bryant, has filed for bankruptcy with plans to permanently close up to 1,600 stores and reduce its debt by about $1 billion in a debt-for-equity swap with lenders, the latest apparel seller unable to ride out the economic damage caused by coronavirus restrictions. (WSJ)

- After falling for 15 straight weeks, seasonally adjusted US

initial claims for unemployment insurance rose by 109,000 to

1,416,000 in the week ended 18 July. Although it is too early to

conclude that claims are on an upward trajectory again, this could

be early evidence of job losses because of bar and indoor dining

closings in some states as governments are forced to roll back

their reopening plans. (IHS Markit Economist Akshat Goel)

- While the seasonally adjusted number increased, the non-seasonally adjusted number of initial claims filed in the week ended 18 July fell to 1,370,947, a decrease of 9.4%. The unadjusted numbers might prove to be more reliable as the seasonal adjustment procedure may not be appropriate for levels of initial claims that are an order of magnitude higher than the historical norms because of factors unrelated to seasonality.

- The seasonally adjusted number of continuing claims (in regular state programs), which lags initial claims by a week, fell by 1,107,000 to 16,197,000 in the week ended 11 July. The insured unemployment rate in the week ended 11 July fell 0.7 percentage point to 11.1%.

- There were 974,999 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 18 July. In the week ended 4 July, continuing claims for PUA fell by 1,103,119 to 13,179,880.

- In the week ended 4 July, 940,113 individuals were receiving Pandemic Emergency Unemployment Compensation (PEUC) benefits.

- The Department of Labor provides the total number of people claiming benefits under all its programs with a two-week lag. In the week ended 4 July, the unadjusted total fell by 200,615 to 31,802,715. Of this total, 54% are from regular state programs and 41% from the PUA program.

- Dow reports a second-quarter net loss of $217 million, down

from income of $90 million in the year-ago period. Sales totaled

$8.354 billion, down 24% year-over-year (YOY) from $11.014 billion.

COVID-19 lockdowns cut into demand and low energy values weighed on

prices, says the company. Citing the prospect of a gradual and

irregular recovery, Dow says it will soon begin a restructuring

program aimed at $300 million in annualized EBITDA benefit by the

end of 2021. Measures include a 6% reduction in the company's

global workforce and plans to exit uncompetitive assets.

- The packaging & specialty plastics segment recorded net sales of $4 billion, down 23% YOY. Overall volume was flat. Strong gains in flexible food and specialty packaging, industrial and consumer packaging, and health and hygiene applications were offset by declines in durables, particularly automotive, infrastructure, and construction. Demand for cracker by-products also declined. Regionally, gains in Asia-Pacific and the Europe/Middle East/Africa/India were offset by declines in the US and Canada. Latin America was flat. Local price declined 22% owing to lower global energy prices, and currency decreased net sales by 1%. Operating EBIT was $318 million, down YOY from $768 million as targeted expense reductions, increased volume, and improved incremental integrated margin in packaging were more than offset by lower demand and integrated margins in durables.

- The industrial intermediates & infrastructure segment recorded net sales of $2.4 billion, down 28% YOY. Volume declined 18% on reduced demand into durables, primarily in polyurethanes & construction chemicals. Local price decreased 9%, and currency decreased net sales by 1%. Volume growth in Asia Pacific was more than offset by declines in other regions. Operating EBIT was a $220 million loss, down from earnings of $154 million in the year-ago period owing to much weaker demand, margin compression, and increased equity losses.

- Performance materials & coatings net sales totaled $1.9 billion, down 21% YOY. Volume declined 14% as growth in home care products and DIY architectural coatings in the US and Canada was more than offset by a decline in siloxanes reflecting weakness in automotive, construction, and personal care end-markets. Local price decreased 6%, and currency decreased net sales by 1%. Operating EBIT was $27 million, down from $214 million in the year-ago period, mainly on margin compression in siloxanes and lower demand. Acrylic monomers pricing remained under pressure globally on weaker supply/demand fundamentals.

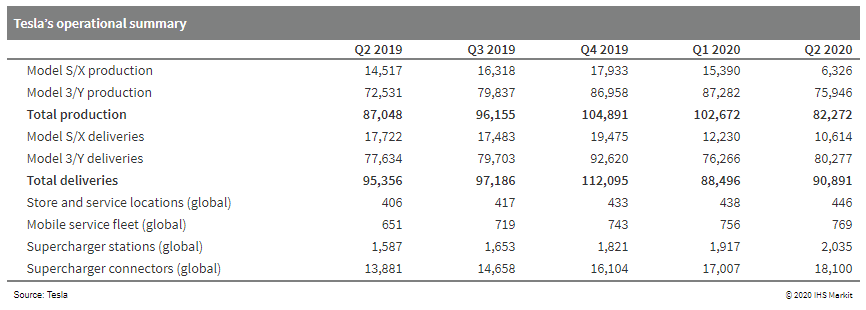

- Tesla has reported a fourth consecutive quarterly profit in the

second quarter of 2020, despite the impact of the COVID-19 pandemic

on its production and sales. In addition, the electric vehicle (EV)

manufacturer has announced that Austin, Texas, has been selected as

the location of its second US Gigafactory. (IHS Markit

AutoIntelligence's Stephanie Brinley)

- As it did when announcing its results in other recent quarters, Tesla stated in its announcement of its second-quarter results that reductions in average selling price continue as the mix shifts from the Model S and Model X towards the Model 3 and Model Y.

- While the company was profitable in the second quarter, Tesla's automotive revenue declined 4.9% year on year (y/y) and total revenue dropped 3.7% y/y.

- Although Tesla benefited from the addition of the Model Y, because of the COVID pandemic, deliveries were down by 17.1% y/y to 90,891 units in the second quarter.

- With the company's Shanghai plant having come online in October 2019, the y/y comparisons of the results in the first and second quarter 2020 benefited from the company having a second manufacturing facility, which contributed to Tesla's ability to weather the impact of the COVID-19 pandemic better than much of the rest of the automotive industry.

- In addition, Tesla reported selling USD428 million in

regulatory credits in the second quarter, compared with USD111

million in the second quarter of 2019 and USD354 million in the

first quarter of 2020. Tesla stated that volume growth at the

Shanghai plant resulted in a material improvement in margins for

the locally made Model 3.

- US chocolate and confectionery giant Hershey reported a moderate increase in its North American sales during Q2, regardless of the effects of the Covid-19 pandemic. Hershey's North America net sales hit USD1,583.8 million in the second quarter of 2020, an increase of 1.0% versus the same period last year. This time last year, Q2 US sales only saw a 0.5% rise compared to the year prior. However Q1 results for US sales showed a 2.1% boost back in April. "We delivered profitable sales growth in North America in the second quarter despite the increased complexities presented by the COVID-19 pandemic," said Michele Buck, The Hershey Company President and Chief Executive Officer. Overall consolidated net sales for all segments, still saw a 3.4% decrease to were USD1,707.3 mln in Q2 versus USD1,767.2 mln a year ago. Q1 overall sales this year also witnessed a 1% year-on-year rise. Meanwhile, the company is still not providing a new fiscal 2020 guidance, despites its "improved performance" over the course of the second quarter. Hershey admits that the impact of recent spikes in coronavirus cases on consumer mobility, retail operations, government regulations, and the macroeconomic environment, remains unclear and is the reason behind the guidance withdrawal. (IHS Markit Food and Agricultural Commodities' Sandra Boga)

- Ford is reportedly experiencing some production disruptions at its Mexican facility over a railway blockade in the country, while Volvo's US plant is experiencing production disruptions owing to parts supply issues and weak demand. A railway blockade in the Mexican state of Sonora is affecting operations in Hermosillo, also in Sonora, as well as imports and exports to and from the United States, reports Reuters. The report also notes that members of a local indigenous community are demonstrating for better land rights, and have blocked railways. Along with auto parts, the railways are used to move grains and steel. Ford was quoted as saying, "The recent blockade of the rail network in the municipality of Guaymas, Sonora, has affected operations at our Hermosillo plant. Currently, we are facing a situation unrelated to us, wherein imports and exports have been affected." The president of Mexico's railways association said he is confident that the situation will be resolved soon. Separately, Automotive News Europe has reported that Volvo's US assembly plant is being affected by parts shortages from Mexico as well as weak demand for the S60. Volvo CEO Håkan Samuelsson said, "First it is the disturbances in the supply of parts from Mexico. But it also is a supply-and-demand issue for the S60. There is definitely a market trend toward SUVs," and that the plant will be operating again within some weeks. The report says that the plant was closed from 16 June to 26 June owing to supply disruptions. Production resumed on 29 June but ended again on 2 July and is scheduled to resume again on 29 July, although this is in part a planned shutdown for the summer break. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Qualcomm Technologies has announced that it will test cellular vehicle-to-everything (C-V2X) technology in San Diego (California, US) in co-ordination with state and local government agencies. This trial intends to demonstrate the potential of C-V2X technology to improve automotive safety in realistic operating conditions. Qualcomm's 9150 C-V2X chipsets operating on the 5.9 GHz spectrum will allow roadside base station units installed along the corridor to communicate with vehicle onboard radio units. The trial is conducted with the San Diego Regional Proving Grounds (SDRPG) along a three-mile stretch of highways and traffic light intersections off Interstate-805 and State Route 52 between Sorrento Valley and Kearny Mesa. C-V2X is designed to allow vehicles to communicate directly with other vehicles, pedestrians, devices, and roadside infrastructure, and assists Advanced Driver Assistance Systems (ADAS) operations. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Costa Rica's Finance Commission at the Legislative Assembly on

20 July approved the government's second extraordinary budget that

will cut overall fiscal recurrent expenditure by an estimated

USD336 million, a reduction of 0.6% of GDP. The initiative will now

be discussed at the legislature's plenary, requiring 38 votes out

of 57 to be approved. (IHS Markit Economists Ellie Vorhaben and

Veronica Burford)

- IHS Markit forecasts a 3.8% decline in Costa Rica's rate of GDP growth in 2020 as demand in the tourism sector is depressed by COVID-19-virus-related restrictions on movement and international travel. Government revenue has remained depressed because of the slow reopening of the economy, with the Ministry of Finance reporting an 11.6% decline in tax collection for January to June of 2020 compared with the same period in 2019.

- However, opposition at the Legislative Assembly will almost certainly delay an agreement with the IMF. Minister of Finance Elián Villegas said on 15 July that the government hopes to finalize negotiations with the IMF in the third quarter of 2020 and obtain the approval of the Legislative Assembly by the end of 2020.

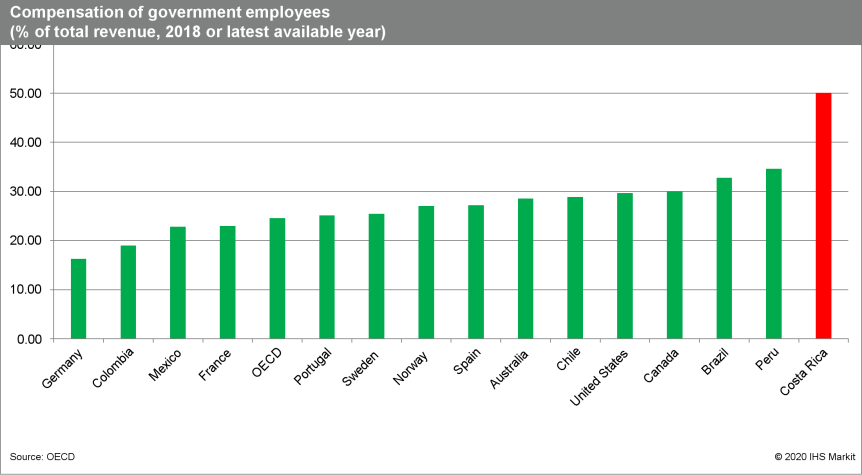

- Public-sector strikes are likely by year-end, with further austerity measures probably also increasing protest risks in 2020-21. The government presented a bill on 13 July to cut 15% of the working hours of 35,000 public employees who earn more than USD2,580 per month. According to the Organization for Economic Co-operation and Development (OECD), 50% of the government's revenue is destined for public salaries.

- The Legislative Assembly not approving the USD508-million RFI

loan from the IMF increases the likelihood of the government not

being able to negotiate an SBA with the IMF and having to carry out

further cuts, raising strike risks.

Europe/Middle East/ Africa

- Most European equity markets closed almost flat, except for Italy -0.7%; UK +0.1%, Germany flat, and France/Spain -0.1%.

- 10yr Italian govt bond yields closed -5bps/0.98% yield, closing below a 1.00% yield for the first time since 26 Feb.

- The other major 10yr European govt bonds issues closed mixed; Spain -1bp, UK/France flat, and Germany +1bp.

- iTraxx-Europe closed flat/58bps and iTraxx-Xover -3bps/70bps.

- Brent crude closed -2.2%/$43.31 per barrel.

- At the beginning of July, Seadrill Partners LLC elected not to make an approximately USD49 million interest payment due and payable on June 30, 2020 under its Term Loan B (TLB) and entered into a 30-day grace period expiring on July 30, 2020. The company has now concluded discussions with TLB lenders representing over 70% of TLB principal amounts outstanding (Ad Hoc Group). An agreement has been reached that removes the potential for an event of default related to non-payment of interest at the end of the grace period and allows the company to address its 2020 debt maturities by paying down USD230 million in secured bank debt. The vessels securing the bank debt will become part of the collateral securing the TLB after closing this amendment. The Ad Hoc Group has agreed to support the transaction and to provide a super senior loan in lieu of receipt of cash interest with respect to the June 30 interest payment. The option to participate will be offered to all TLB lenders on a pro rata basis. Assuming 100% participation of TLB lenders, a USD69 million super senior loan maturing in February 2021 will be created. Seadrill Partners is a limited liability company formed by drilling contractor Seadrill to own and operate offshore drilling units. (IHS Markit Upstream Costs and Technology's Matthew Donovan)

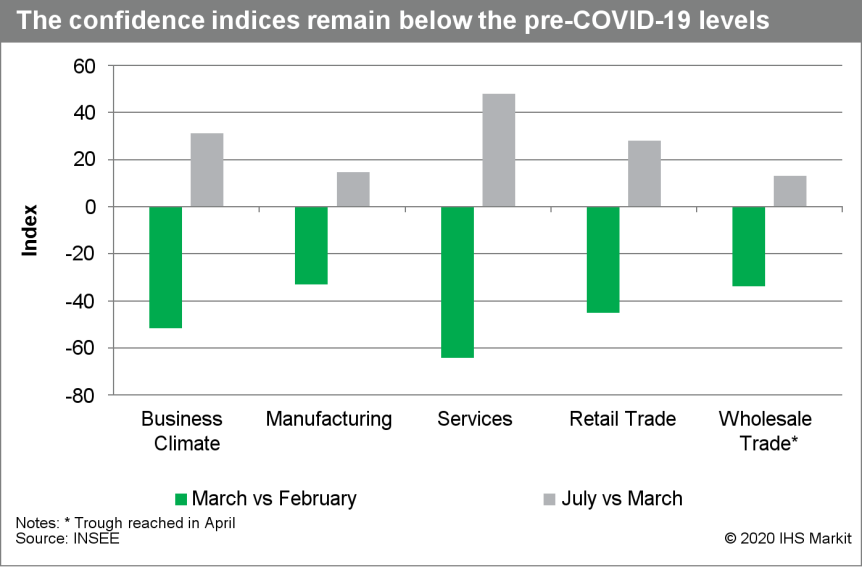

- The French business confidence index stands at 85 in July,

following a reading of 78 in June, according to figures released by

the National Institute of Statistics and Economic Studies. Although

the index now sits above March's all-time low of 53, it remains

well below its pre-COVID-19 level of 105 in February. (IHS Markit

Economist Diego Iscaro)

- Confidence remains depressed in all sectors included in the survey (see chart below). Confidence in the service sector, which had been particularly hit during the COVID-19 virus-related lockdown period, is rebounding strongly but remains 16 points below its February level at 89.

- Confidence in the retail trade sector has also continued to improve as activity has been supported by the reopening of non-essential shops in May. The situation is similar in the wholesale sector, although the recovery there is slightly more gradual.

- Similarly, confidence in the manufacturing sector has risen by 5 points to 82, still well below a pre-COVID-19 level of 101 in February.

- The quarterly business survey for manufacturing, also published by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE), shows a very gradually improvement in activity. The production capacity utilization rate has recovered more than half of its fall in April, standing at 74% in July (61% in April).

- The recovery in the utilization rate is particularly sluggish in the transport equipment sector (69% following 41% in April), while agro-foods is outperforming (78% in July).

- The survey suggests that supply bottlenecks have eased

considerably compared with April, with the assessment of production

capacity standing only slightly below its long-term average.

However, these bottlenecks are being replaced by weak demand

levels, although industrialists expect demand to firm during the

third quarter.

- The BMW Group has announced in a press release that it has already begun production of components for its flagship iNEXT electric vehicle (EV) at its Landshut plant in Germany. The plant has begun manufacturing the components for the car's front end, including what will be the most modern interpretation yet of BMW's famous "kidney grille" front-end design. The grille was developed at BMW Group's Landshut Lightweight Construction and Technology Centre (LuTZ). As well as the grille, the Landshut plant will also produce cockpit components and the electric drive system for the iNEXT. It will also build structural components made from carbon fiber compound materials such as carbon fiber reinforced plastic (CFRP). The front end of the iNEXT will be packed with technology designed to enable the EV to be a fully autonomous vehicle with Level 4 and potentially Level 5 capability; the latter is the highest level, allowing fully autonomous operation in all driving and road conditions. (IHS Markit AutoIntelligence's Tim Urquhart)

- Daimler has posted a second-quarter net loss of EUR1.906

billion (USD2.209 billion) according to full financial data for the

period published by the company. This compared to a net loss of

EUR1.242 billion in the second quarter of 2019, although the

financial results during the equivalent period last year were

significantly affected by expenses related to Mercedes-Benz diesel

vehicles and by an updated risk assessment for an expanded recall

of vehicles with Takata airbags. (IHS Markit AutoIntelligence's Tim

Urquhart)

- The increased net loss the company experienced in the second quarter of 2020 was related to the huge impact of the COVID-19 virus pandemic on Daimler's business activities.

- The company's net loss during the first half of 2020 came in at EUR1.738 billion compared to a first-half net profit in 2019 of EUR907 billion.

- The second-quarter revenue figure came in at EUR30.184 billion which was a 26% y/y decline on the figure of EUR42,650 billion, while the first-half revenue figure for 2020 was down by 18% y/y to EUR67.407 billion from EUR82.348 billion.

- The company's second-quarter 2020 EBIT loss came in at EUR1.687 billion down from EUR1.558 billion in the second quarter of 2019.

- The first-half EBIT loss in 2020 came in at EUR1.065 billion, down from an EBIT profit of EUR1.240 billion in the first half of 2019.

- The company's net industrial liquidity level stood at EUR6.618 billion, which was 43% down from last year's EUR9.481 billion.

- Covestro swung to a net loss of €52.0 million ($60.3 million)

in the second quarter from a net profit of €189 million in the

corresponding period of last year on sales down 32.9% to about €2.2

billion.

- The company confirms that EBITDA plunged 72.8% year on year (YOY) to €125 million, which it had communicated in preliminary results released earlier this month.

- The figures were "significantly impacted by the further spread" of the COVID-19 pandemic in Europe and North America, which caused core volumes to decrease 22.7% YOY on a "massive drop in demand in all key customer industries."

- Despite the slump, EBITDA was ahead of the company's earlier expectations due to "an accelerated recovery in demand," especially in the polycarbonates segment, in June, Covestro says.

- Free operating cash flow swung to a positive €24 million from a negative €55 million a year earlier as a result of strict liquidity management, the company says.

- All Covestro's businesses were hurt by COVID-19 in the second quarter. The polyurethanes segment saw core volumes drop 25.9% YOY and the trend affected all key customer industries, the company says.

- Sales were down 38.7% to €913 million, mainly due to the lower volumes sold and lower average selling prices. EBITDA for the business swung to a negative €24 million from a positive €172 million a year earlier as margins weakened, Covestro says.

- Second-quarter core volumes in the polycarbonates segment fell 14.4% YOY. The decreased volumes, a result of significant drops in demand from the automotive and transport industries, were cushioned by less of a decline in volumes from the electrical, electronics, and household appliances industries and volume growth in the construction industry. Sales decreased 27.8% YOY to €648 million as selling prices declined and EBITDA plunged 37.7% to €96 million.

- Core volumes in the coatings, adhesives, and specialties segment were down 25.3% YOY. The pandemic resulted in far weaker demand from key customer industries, a trend that was reflected in particular by a downturn in volumes in the automotive and transport industries. Sales of the business fell 28.7% to €443 million, mainly due to the decline in volumes and lower selling prices. EBITDA dropped 60.0% to €60 million as margins softened.

- Fiat Chrysler Automobiles (FCA) and CNH Industrial have had their offices searched in Germany, Italy, and Switzerland in relation to a probe into vehicle emissions being conducted by German prosecutors and co-ordinated by European agency EUROJUST, reports Reuters. Prosecutors in Frankfurt said in a statement that engines used by the Alfa Romeo, Fiat, and Jeep brands, as well as Iveco, have been found to contain potentially illegal engine management software related to emissions control. They added that the investigation was targeting nine individuals working at "an international carmaker" and seeking to establish what role they had in equipping vehicles with this software. A spokesperson for FCA confirmed to Reuters that a number of its offices in Europe were visited by investigators as part of a request for assistance by magistrates in Germany. The person added that FCA is fully co-operating with authorities. CNH Industrial also confirmed to the news service that it has had a number of offices visited by investigators, and it was co-operating fully with authorities. (IHS Markit AutoIntelligence's Ian Fletcher)

- Saipem has confirmed several offshore wind contract awards

totaling USD104 million (EUR90 million). The projects are located

offshore England, Scotland, and France. Saipem plans to deploy HL3

vessel Saipem 7000 to these contracts. The 7000 will be adding to

its offshore wind track record this August, when it mobilizes to

the Neart na Gaoithe wind farm offshore Scotland, to install pin

piles for the turbines' jacket foundations. The vessel is also set

to install the corresponding jackets, in 2021. (IHS Markit Upstream

Costs and Technology's Genevieve Wheeler Melvin)

- The awards include a transport and installation (T&I) contract for two HVDC platforms at Equinor and SSE Renewables' Dogger Bank A and B wind farms. Each 1.2 GW platform will consist of a 2,900 metric-ton jacket and 8,500 metric-ton topside. Installation will take place 130km offshore England.

- An installation subcontract from Subsea 7 subsidiary Seaway 7, covering 114 wind turbine foundations at Total and SSE Renewables' Seagreen wind farm offshore Scotland.

- A T&I contract for an offshore substation's jacket and topside at Ailes Marines' St-Brieuc wind farm offshore France. The contract scope also includes project management and engineering. Ailes Marines is part of Iberdrola.

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong +0.8%, India +0.7%, Australia +0.3%, China -0.2%, and Japan -0.6%.

- Didi Chuxing (DiDi) has launched a new economical ride-sharing service, called Huaxiaozhu, to target younger customers, reports Reuters. The service offers cheaper rides compared with DiDi's main app and uses the company's existing driver pool and operates according to the same set of safety and compliance standards. The new service is not integrated with DiDi's existing platform and has a separate app. The service has already conducted trial operations in selected cities of provinces such as Guizhou and Shandong. This launch follows DiDi's rollout of new delivery and logistics services in China this year. DiDi has more than 31 million drivers registered on its platform and has attracted 550 million customers, who are using the company's range of app-based transportation options. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- ZPMC-OTL Marine Contractor's (ZOMC) HL2 derrick barge Zhen Hua 30 is currently working China General Nuclear's (CGN) 500 MW Shanwei Houhu wind farm offshore China. The vessel is understood to be under contract through CCCC Third Harbour Engineering for the project's monopile installation scope. Zhen Hua 30 installed the first monopile on 14 July 2020. The 93.28 meter-long piles have diameters of 7.5-8.1 m and weigh around 1,370 metric tons. Shanwei Houhu will boast 91 units of Mingyang 5.5 MW wind turbines, two offshore substations, and one onshore control center. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Commodities at Sea data indicates that BHP iron ore shipments to China during the second quarter are calculated at 66.8mt, up 13% q-o-q and up 17% y-o-y. On the other hand, its shipments to South Korea, Japan, Taiwan, and Indonesia on an annual basis declined by 23%, 49%, 14%, and 14%, respectively. In its quarterly results, BHP although doesn't provide a breakup of its shipments in terms of import countries. However, the iron ore major mentioned that China has moved from intensive viral suppression to economic recovery. Chinese domestic industrial activity has been improving, spurred on by supportive credit and fiscal policy. In China, blast furnace utilization rates have increased from around 80pc earlier in February 2020 to above 90% in June 2020. Daily rebar transactions were above normal seasonal levels for much of 2Q20, helping support a crude steel run-rate of 1,117mtpa in June 2020 (up 4.5% y-o-y). On the Maritime front, the significant surge in iron ore shipments during 2Q20 from BHP benefitted Capesize vessel segment the most which loaded 33.8mt, which was 18% higher y-o-y. For the same duration, VLOC and Newcastlemax shipped 13.7mt (down 6% y-o-y) and 28.8mt (up 5% y-o-y), respectively. (IHS Markit Maritime and Trade's Rahul Kapoor and Pranay Shukla)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-july-2020.html&text=Daily+Global+Market+Summary+-+23+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-july-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 23 July 2020 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+23+July+2020+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}