Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 22, 2021

Daily Global Market Summary - 22 January 2021

US equity indices closed mixed, while European and APAC markets were lower. US government bonds were higher on the day and benchmark European government bonds closed mixed. IG was flat across the iTraxx and CDX-NA credit indices, while high yield closed modestly wider in both regions. The US dollar closed slightly higher and oil, gold, silver, and copper were all lower.

Americas

- US equity markets closed mixed; Russell 2000 +1.3%, Nasdaq +0.1%, S&P 500 -0.3%, and DJIA -0.6%.

- 10yr US govt bond closed -2bps/1.09% yield and 30yr bonds -2bps/1.85% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY +7bps/305bps, which is

-1bp and +1bp week-over-week, respectively.

- DXY US dollar index closed +0.1%/90.24.

- Gold closed -0.5%/$1,856 per ounce, silver -1.1%/$25.56 per ounce, and copper -0.5%/$3.63 per pound.

- Crude oil closed -1.6%/$52.27 per barrel.

- On 20 January 2021, day 1 for the Biden Administration, the

Department of Interior issued an order putting a 60-day freeze on

new drilling permits on federal lands. While the immediacy of the

order may have surprised the market, such a move was widely

expected following a year in which the topic received a lot of

airtime in both the Democratic Primary and the Presidential

election. (IHS Markit Energy Advisory's Roger Diwan, Breanne

Dougherty, Lauren Droege, Sean Karst, and Yulia Ivanovskaya)

- What exactly is in the order? Effective 20 January 2021, and for the following 60 days, there can be no issuance of onshore or offshore leases, amendments to a lease, lease extensions, contracts, other agreements, or permits to drill on federal lands. The order does not have any implications for existing operations under a valid lease.

- Offshore production is more exposed, but of limited scale. Inclusive of offshore production, the share of US natural gas produced on federal lands is only 6%. As production has grown in Appalachia, and with the strong growth emerging in Haynesville, the sector's reliance on offshore production has progressively declined.

- The onshore impact is even more limited, particularly for natural gas. The share of US onshore natural gas production from federal lands is a little more than 2%. Oil has a slightly larger representation at just under 5% of total lower-48 onshore oil production. That oil number has crept up over the past two years, driven primarily by development on federal lands in the New Mexico Permian.

- A policy of permit bans on federal land had been telegraphed. Operators anticipated a Biden policy change, and permitting on federal lands in New Mexico reached record levels in 2020. The number of permits granted for wells on federal land was 60% higher in 2020 than in 2019 with EOG, Devon, and Occidental leading the way. Chevron, ExxonMobil, ConocoPhillips, and other operators held permitting close to prior-year levels.

- The Ocean Wind offshore wind farm, located in the state of New Jersey, has finalized the supply and service contracts with GE Renewable Energy for its Haliade-X 12 MW turbines. The agreements include a five-year service and warranty agreement for operational support. The award follows on from the 2019 selection by developer Ørsted for two of its offshore wind farms in the United States, Ocean Wind, and Skipjack.The contracts include an option to utilize the 13 MW variant. The 13 MW variant uses the same turbines but with enhancements to its cooling system and other electrical equipment modifications to allow for greater power output. Type certificate for the Haliade-X 13 MW variant, trialed in the Port of Rotterdam in 2019, was received from DNV GL in November 2020. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Adjusted for seasonal factors, the IHS Markit Flash U.S.

Composite PMI Output Index posted 58.0 in January, up from 55.3 in

December. The private sector seemed to regain growth momentum at

the start of 2021, as the pace of increase quickened to the

second-fastest since March 2015. (IHS Markit Economist Chris

Williamson)

- The seasonally adjusted IHS Markit Flash U.S. Services PMI™ Business Activity Index registered 57.5 in January, up from 54.8 at the end of 2020. The rise in output was often linked to another monthly increase in customer demand. The rate of expansion was the second-sharpest since March 2015 and steep overall.

- Manufacturing firms signaled the sharpest improvement in operating conditions on record in January, as highlighted by the IHS Markit Flash U.S. Manufacturing Purchasing Managers' Index (PMI) posting 59.1, up from 57.1 in December. Alongside stronger expansions in output and new orders, the headline figure was driven up by another substantial deterioration in vendor performance.

- Meanwhile, significant supply chain delays, raw material shortages and evidence of stockpiling at goods producers pushed input prices up. The rate of cost inflation was the fastest since April 2018, with firms raising output charges at the sharpest pace since July 2008 in an effort to partially pass on higher cost burdens to clients.

- Last year was a banner year for the US existing home sales market: annual sales totaled 5.64 million, up 5.6% from 2019 and the highest annual number since 2006. All four regions saw higher sales in 2020 than in 2019, with sales in the South and Midwest soaring to levels last seen in 2007. (IHS Markit Economist Patrick Newport)

- The year ended on a pleasant note: sales rose 0.7% in December to a 6.76-million-unit annual rate—the second-highest reading in 14 years. Single-family sales increased 0.7% to a 6.03 million rate—also the second highest in 14 years; condo/coop sales climbed 1.4% to a 730,000 rate.

- The inventory rundown continues. The year ended with a record-low 890,000 single-family homes for sale. Our seasonally adjusted single-family homes inventory estimate, 1.06 million, was also an all-time low. Unsold inventory of single-family homes amounted to a record-low 1.8-month supply at the current sales pace; a 5.0-month supply was once considered normal.

- Scarcity is driving home prices up. The median price of a single-family home was up 13.5% from a year earlier; regionally, the median price was up 21% in the Northeast, 15% in the West, 14% in the Midwest, and 12% in the South.

- The Mortgage Bankers Association's seasonally adjusted purchase index is currently at levels last seen in 2008—suggesting that home sales will stay strong in early 2021. Lawrence Yun, the National Association of Realtors (NAR)'s chief economist, wrote: "momentum is likely to carry into the new year, with more buyers expected to enter the market."

- Bottom line: The surge in home sales may be in its final stages, but sales could remain elevated in early 2021. With inventories still dropping, double-digit price gains in the median price are likely to continue in early 2021.

- Jensen Meat has joined the growing list of US meat companies looking to tap into consumer demand for plant-based proteins. The Southern California-based company, which normally specializes in processing ground beef, is expanding its facilities and team to manage co-packing opportunities for plant-based beef alternatives. To accelerate production, Jensen has already broken ground on a new processing plant, which will be completed by April 2021. The company said the facility will allow it to pursue new partnerships, providing opportunities to test new processes and increase national production of plant-based products. Jensen's new plant, which will include multiple capabilities for creating food service and retail finished products, will also help drive costs down for smaller companies. "With sixty years' experience, Jensen Meat has perfected how to process and pack quality ground beef," said Abel Olivera, CEO of Jensen Meat. "We now want to leverage our world-class knowledge to create a cost-effective process for producing plant-based products." Olivera said the goal is to create cost-effective and innovative foods from alternative sources of protein, adding that this would also play a part in reducing world hunger. Beyond its new plant-based operations, Jensen Meat produces ground beef products, which are sold through retail, foodservice, and club store channels throughout the US. (IHS Markit Food and Agricultural Commodities' Max Green)

- Autonomous truck startup TuSimple has secured investment funding from truckload carrier US Xpress Enterprises, although the terms of the deal were not disclosed. The companies also announced that they have begun testing autonomous technology on select lanes. In addition, Eric Fuller, president and CEO of US Xpress, has joined TuSimple's newly established executive advisory board. Cheng Lu, CEO of TuSimple, said, "US Xpress has been a valuable partner in the testing of our autonomous technology and Eric will continue to provide expert guidance in helping drive the adoption of autonomous trucks as a member of our Executive Advisory Board" Autonomous trucks are gaining a great deal of traction in the logistics industry because of a growing shortage of drivers and improved efficiency. TuSimple focuses on developing Level 4 autonomous solutions for the logistics industry. The company currently has about 40 vehicles in its test fleet and expects to achieve fully autonomous operations in 2021. TuSimple has been conducting trials with US Xpress since 2019 and these trials will help it to gather important data required for bringing the autonomous technology to market safely and reliably. Two months ago, TuSimple raised USD350 million in a Series E funding round. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- PPG Industries today reported fourth-quarter net income down 7%

year on year (YOY), to $272 million, on net sales up 2%, to $3.76

billion. Adjusted earnings, which exclude some impairment charges,

totaled $1.59/share, up 21% YOY and slightly ahead of analysts'

consensus estimate of $1.58/share, as reported by Refinitiv (New

York, New York). Sales volumes were down 1.5% YOY, but this was

offset by a 1.5% increase in selling prices, favorable exchange

rates, and acquisitions. (IHS Markit Chemical Advisory)

- Performance coatings segment sales declined 1% YOY, to $2.2 billion, while segment income was down 3%, to $8 million. Volumes fell 6% YOY, while selling prices were up 3%. The declines were mostly due to a 30% drop in sales for aerospace coatings, and smaller declines in protective and marine and automotive refinish coatings. However, architectural coatings sales grew YOY, and automotive refinish coatings sales increased on a sequential basis.

- Industrial coatings segment sales grew 7% YOY, to $1.6 billion, while segment income was up 40%, to $282 million. Sales volumes grew in the automotive OEM, industrial coatings, and packaging coatings businesses. Automotive OEM sales growth differed by region, with particularly large increases in China.

- The company cut costs by about $115 million in full year 2020, a result of restructuring programs put in place partly in response to the pandemic. PPG generated about $2.1 billion in cash during 2020, McGarry says.

- Renault has begun to offer subscription options in Brazil for the Kwid, Stepway and Duster models. The plans will include options for 12, 20, 24, or 36 months; the payment includes insurance, documentation, scheduled maintenance, and 24-hour roadside assistance, with financial insurance in the case of unemployment, disability or death also available. At the end of the period, the vehicle is returned. According to Automotive Business, the program is called Renault On Demand and will be administered the financial arm of the Renault-Nissan Alliance. The program evolved from a test program in March 2020, which acquired about 200 customers. The service is offered at most of Renault's dealerships in Brazil already, Bruno Hohmann, commercial vice-president of Renault do Brasil is cited as saying. The plans are offered on a variety of models and at a variety of price points, depending on the model and trim level, mileage allowed and time of the subscription. Hohmann told Automotive Business that the company is not yet sure the potential size of this opportunity, but believes that there is opportunity after the pandemic. The availability of credit and financing incentives were a help to the Brazilian market's improvements immediately prior to the COVID-19 virus pandemic, which resulted in 2020 light-vehicle sales falling by 26.7% compared with 2019. However, the move by Renault also part of a broader effort to explore mobility services in all markets, including emerging markets. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- European equity markets closed lower; Italy -1.5%, Spain -1.1%, France -0.6%, UK -0.3%, and Germany -0.2%.

- 10yr European govt bonds closed mixed; Italy +5bps, Spain flat, France -1bp, and UK/Germany -2bps.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover +4bps/254bps,

which is -2bps and -5bps week-over-week, respectively.

- Brent crude closed -1.2%/$55.41 per barrel.

- The Office for National Statistics (ONS) has reported that UK

retail sales (including fuel sales) in volume terms increased by

0.3% month on month (m/m) in December, standing 2.7% above their

pre-COVID-19 virus level in February 2020. (IHS Markit Economist

Raj Badiani)

- In annual terms, they were 2.9% higher than in December 2019, implying that they fell by a record 1.9% in the full year 2020.

- The reporting period for the December publication covers 29 November 2020 to 2 January 2021. This captured initially a period of eased restrictions early in December before tighter restrictions on non-essential retail in England, Scotland, and Wales later in the month.

- This followed retail sales falling by 4.1% m/m in November during a month-long shutdown.

- The volume of retail sales in the three months to December was 0.4% lower when compared with the three months to September, the first drop on this comparison since June 2020.

- Clothing stores reported sales rising by 21.5% m/m during December, rebounding from a large fall in November 2020 after shops were closed because of the second lockdown.

- Sales in food stores dropped by 3.4% m/m in December, partly attributed to a technical correction from a 2.8% m/m gain in November. Supermarkets during November benefited from the closure of the hospitality industry and other non-essential retail sectors across the UK.

- Non-store retailing grew by 1.7% m/m in December, implying that it was 45.2% higher than the February 2020 pre-COVID-19 virus levels. It accounts for about one-third of all retail spending.

- Sales on the high street, or in physical shops, fell again below their pre-lockdown levels. Specifically, spending in non-food stores in December was 3.0% lower than February's level.

- Fuel sales volumes edged down by 0.6% between November and December and remained 24.1% below February's level because of reduced travel as more people worked from home in November and December.

- The third national lockdown in place in England since 5 January and tougher restrictions elsewhere in the UK have forced many non-essential stores to close, which will trigger lower retail spending in January. However, this is likely to be less acute than during the first lockdown when all non-essential shops had to close, and we are unlikely to see a repeat of the 18.1% m/m drop witnessed in April 2020.

- UK-wide footfall is notably lower after England endured its second week of the fresh national lockdown. Specifically, retail analyst Springboard reports that footfall in the week starting 10 January was 67.5% lower than in the same week in 2019, but it did not reach the low levels recorded in the first or second week of the first shutdown in March.

- A testbed dubbed Smart Mobility Living Lab (SMLL) in London (UK) that supports testing of connected and autonomous vehicles (CAVs) is now open for business. SMLL will allow companies to study an entire connected transport environment helping them to make their products and services market-ready, reports Traffic Technology Today. The facility provides a unique testing ground by bringing together technology, public infrastructure and transport experts. Linders, general manager of SMLL, said, "We have opened at a time when the demand for transport innovation is intensifying. The need for decarbonization, alongside initiatives including increasing shared mobility, and new ways of moving goods about, have brought the requirement for SMLL to the forefront of the transport agenda. Despite the impact of COVID-19, because the testbed is a live environment, it is genuinely 'open for business' and we are confident we can deliver vehicle and technology trials safely". SMLL claims to be the first CAV testbed in the UK to be open for business and is designed to accelerate the commercialization of market-ready future mobility solutions. Mobile network operator O2 has provided 5G connectivity for the testbed. The facility provides expertise to help with sensor technology validation and working in support of major CAV projects Endeavour, ServCity and Darwin. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Crown Estate Scotland has opened applications for the first cycle of ScotWind leasing where registered developers can apply for seabed rights to build commercial-scale offshore wind projects. The opening of the application window follows the publication by Marine Scotland of their Sectoral Marine Plan for Offshore Wind Energy outlining the areas suitable for development. Also made available to registered applicants are the final technical details of the application requirements including provisions reflecting the Sectoral Marine Plan. The ScotWind leasing round began in June 2020, where interest from investors and developers was solicited. The application deadline closes on 31 March. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Ireland's Kerry Group is in talks to spin off its dairy products operation into a joint venture with its main shareholder, Kerry Co-op. Kerry Co-op is considering raising a EUR240 million sale of shares in food giant to fund its participation in a EUR800 million joint venture with Kerry Group. The value of the venture was initially estimated at EUR640 million, but it has recently been revealed that an unnamed foreign player is also interested in acquiring the business, which pushed the value of the deal to EUR800 million. Kerry Co-op owns a 12.3% stake in Kerry Group, which, based on the group's market capitalization of more than EUR20 billion, is worth EUR2.46 billion. The sale of around 1.2% stake would raise EUR240 million, according to The Irish Times. The Co-op, whose shareholders are farmers that sell milk to Kerry Group's processing plants, former suppliers, and parties that would have acquired stock on a grey market, has been in talks for some months on taking a controlling 60% stake in Kerry Group's manufacturing facilities and brands. It is expected that only the farmers currently supplying milk to Kerry Group will be shareholders in the dairy joint venture. Kerry Group is also looking to sell its chilled meats and convenience meals business, which includes labels such as Denny and Galtee. It also has ranges of frozen and chilled meals. This would see the group exit the low-margin consumer foods business and free up funds for acquisitions in its main fast-growing division, Taste & Nutrition (T&N). (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

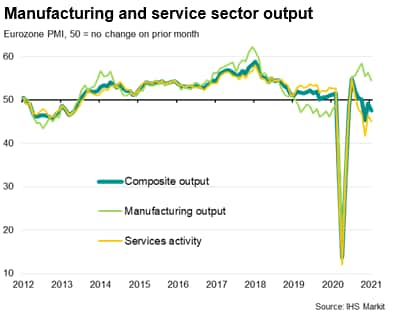

- The headline flash IHS Markit Eurozone Composite PMI® fell from

49.1 in December to 47.5 in January, indicating a third successive

monthly decline in business activity and the steepest deterioration

since November. However, the last three months have seen the PMI

remain higher than during the initial months of the pandemic in the

spring of last year, suggesting that the economic impact of the

second wave of virus infections has so far been considerably less

severe than in the first wave. (IHS Markit Economist Chris

Williamson)

- The worsening performance in January was broad based across the eurozone, albeit with marked variations. Business activity growth in Germany waned to the slowest since the recovery began in July, but the sustained expansion contrasted with output falling at quicker rates in France and the rest of the eurozone as a whole.

- The flash composite PMI for France fell from 49.5 in December to 47.0, while the index for Germany merely slipped from 52.0 to 50.8.

- The rest of the eurozone collectively meanwhile saw an even steeper rate of contraction than France, with output falling for a sixth straight month as the index dropped from 46.1 to 44.7. However, like France, the decline remained less severe than in November

- Eurozone factory output expanded for a seventh consecutive month in January thanks to sustained growth of new orders, exports and backlogs of work. Although the overall pace of factory output growth slowed to the lowest in seven months, it remained among the highest seen over the past three years. Strong manufacturing output growth in Germany contrasted with a renewed fall in production in France and a comparatively subdued rise in the rest of the eurozone.

- January also saw employment across the eurozone fall for an eleventh consecutive month, albeit with modest increases in employment seen in both France and Germany helping to ease the overall rate of decline to the lowest recorded since the pandemic began. Modest job losses were again reported in both manufacturing and services.

- Business expectations about output in the coming 12 months pulled back from December's recent peak, largely linked to worries about the persistence of the pandemic's impact on demand, though remained the second-highest since May 2018. While sentiment about future prospects cooled slightly in the service sector, optimism among manufacturers improved to a three-year high.

- Average rates charged for goods and services meanwhile fell for

an eleventh successive month, dropping at the sharpest rate since

September. Although manufacturing prices rose, albeit only modestly

and at a reduced rate, prices levied for services fell at the

steepest rate since June, reflecting slumping demand.

- Individual EU member states are reportedly threatening potential legal action against Pfizer (US)/BioNTech (Germany) over alleged manufacturing and logistical delays involved in distributing the COVID-19 vaccine Comirnaty (tozinameran). Senior officials in Italy and Poland have reportedly indicated the possibility of legal action amid claims that lower-than-expected volumes received in January risk disrupting carefully planned immunization schedules. Reports suggest that a small number of other unnamed EU states are also considering potential legal remedies, although only Italy and Poland have come forward to say that they are actively studying the possibility to date. Italy's attorney general was tasked with assessing the possibility earlier this week. On 22 January, Polish government spokesperson Piotr Muller was quoted by Reuters as saying that the Polish government could launch legal action against Pfizer/BioNTech in February unless a full shipment of all scheduled doses of Comirnaty is received. These threats to bring the matter before the courts would certainly be contested robustly by manufacturers, and Pfizer and BioNTech are likely to be able to mount a strong legal defense based on the terms of advanced purchase agreement (APA) contracts negotiated by the European Commission. One of the central legal points of contention is likely to be over whether APA contracts are based on the delivery of doses or vials. A new six-dose-per-vial label for Comirnaty approved by EU regulators on 10 January led to Italian officials alleging that the contract is for vials, not doses. This is disputed by Pfizer/BioNTech. Nevertheless, even the threat of legal action could have secondary benefits for EU states. It is potentially a useful public relations tool as governments try to convince the general public that blame for delays lies with manufacturers. It may also help dissuade manufacturers against altering future delivery schedules to the most litigious countries. The threat to resort to legal action appears to be confined to Italy and Poland at the time of writing. However, it illustrates that there are rising tensions between vaccine manufacturers and governments over the reliability of vaccine delivery schedules. (IHS Markit Life Sciences' Eóin Ryan)

- Porsche is looking to expand its investment and interests in the area of digital startups, according to a company statement. The company will continue to work with its established partner in the field, media business Axel Springer, to increase investments in their joint venture (JV) APX. This will fund new and existing portfolio companies with a new cash investment of EUR55 million (USD66.8 million). The substantially increased funding allows APX to expand its investment model. The new capital will increase the number of yearly initial investments in ambitious pre-seed startups with digital business models which means that 'APX' will be in on the ground floor on companies that have huge growth potential and whose technology could form part of Porsche's digital platforms in the future. While the total investment amount per startup remains uncapped, APX will focus particularly on the earliest stages, deploying up to EUR500,000 in portfolio startups even before a Series A (the usual first investment round in a startup in Germany). APX has invested in more than 70 startups since launching in early 2018, and its ambition is to create a portfolio of close to 200 companies by 2022, which makes APX one of Europe's most active early-stage investors. (IHS Markit AutoIntelligence's Tim Urquhart)

- The French government said on 16 January that it would

incorporate provisions from the European Commission-proposed

Digital Services Act (DSA) in its upcoming legislation, introducing

content moderation obligations for social media companies and fines

for non-compliance. The Commission presented the DSA and the

Digital Markets Act (DMA) in December 2020 to update rules on

digital services, including tightened regulatory oversight of "big

tech" platforms. (IHS Markit Country Risk's Petya Barzilska)

- The DSA and DMA imply increased compliance costs for service providers and online platforms. Although the new legislation will predominantly affect "big tech" companies such as Facebook, Google, and Amazon, which are defined as "gatekeepers" in the DMA, all hosting service providers and online platforms face increased compliance costs.

- The DSA and DMA are unlikely to be adopted in the two-year outlook given several areas of contention. Stakeholder consultations and other formal EU policy-making mechanisms are likely to produce legislative amendments before a final draft is put to a vote in the European Parliament and the European Council.

- Fragmented EU regulation affecting digital activities is likely to persist in the two-year outlook. Should the DSA and DMA be adopted, the package is likely to enable a more uniform regulatory framework across the EU.

- Skatteverket, Sweden's Tax Agency, has called on the country's government to delay planned company car tax changes, reports Dagens Industri. According to the report, the government wants to make the changes by 1 July 2021. However, Skatteverket has suggested that this should be postponed until 1 January 2022 to avoid differing evaluation regulations during the same tax year. The Swedish government is currently reviewing changes to the taxation on company car taxes which BIL Sweden, the local importers association, has said will make them less beneficial versus privately owned vehicles. The report in Dagens Industri suggests that this would affect hybrid vehicles, which would be subject to an increase in taxation of around 70%. However, after already reducing the benefit for plug-in hybrids and battery electric vehicles (BEVs) at the beginning of the year, BIL Sweden fears that more changes could lead to a fall back in the demand for such vehicles after a strong performance during 2020 of around 10%. The report notes that around 30% of the market was made up of such vehicles in 2020, of which 75% were company cars. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Turkish central bank kept its one-week repo interest rate

unchanged at its January policy meeting. Although inflation

continued to accelerate in the latest, December report, the

stabilization of the lira in recent weeks allowed the Bank to end

its sharp tightening cycle, which lasted just two months. The bank

reiterated the intention that it would maintain restrictive

monetary policy for "an extended period", suggesting a reduction of

interest rates should not be expected before mid-year, at the

earliest. (IHS Markit Economist Andrew Birch)

- At the regularly scheduled, 21 January meeting of the Monetary Policy Committee of the Central Bank of the Republic of Turkey (TCMB), the main policy rate (the one-week repo rate) was held unchanged, at 17.0%.

- The Committee had previously raised the repo rate by 475 basis points and 200 basis points at the November and December meetings, respectively. Under Governor Naci Aǧbal, who was appointed to his position in early November 2020, the TCMB has pivoted to much more defensive monetary policy.

- IHS Markit had anticipated one more rate rise in January due to the further acceleration of inflation in December, which was broadly believed to have underreported actual price increases at the end of the year. However, since 28 December, the Turkish lira had stabilized against the US dollar, allowing the TCMB to end the tightening cycle.

- Of some concern, early, weekly data reflected a re-erosion of foreign currency reserves corresponding with the stabilization of the lira in early January. This decline of reserves suggest that the Bank may once again be spending down its reserves to support the lira, thus paving the way to bring an end to the interest-rate tightening cycle.

- The week prior to the January interest-rate decision, President Recept Tayyip Erdoǧan had once again gone public with a call for the TCMB to lower interest rates due to rising costs for Turkish businesses. The subsequent decision by the Bank to indeed end its tightening cycle has allowed an opportunity to pass to further rebuild its independence and authority from political influence.

- Nevertheless, Aǧbal has publicly committed to maintaining tight monetary policy throughout 2021 in order to combat elevated inflation and move annual price growth closer to the TCMB's medium-term target of 5%. In the January press release alongside the interest-rate decision, the Monetary Policy Committee also stated that tight monetary policy would be maintained for "an extended period until strong indicators point to a permanent fall of inflation and price stability".

- The South African Reserve Bank (SARB) left its policy rate, the

repo rate, unchanged at 3.5% during the January meeting of its

monetary policy committee (MPC), which ended yesterday (21

January). The MPC's decision was in line with market expectations.

(IHS Markit Economist Thea Fourie)

- The SARB's expectations are for inflation to remain within the inflation target range of 3-6% in the medium term. The SARB expects headline inflation to average 4.0% in 2021 (up from a forecast of 3.9% previously) and 4.5% in 2022 (up from 4.4% previously). In the short term, the SARB expects a small narrowing of the output gap while global production and oil prices, as well as local food prices, are expected to rise.

- The risk to the inflation outlook remains balanced, nonetheless, the SARB states. Local food prices are likely to remain contained from the second quarter onwards, while a temporary reduction in medical insurance price inflation is expected this year. "A more appreciated nominal exchange rate in recent months is expected, however, to moderate some inflationary pressure," the MPC states.

- South African GDP is expected to grow by 3.6% in 2021 (up from a forecast of 3.5% previously) and by 2.4% in 2022. The SARB considers the risk to the domestic growth outlook as balanced. Output will benefit from stronger global growth, COVID-19 vaccine distribution, low cost of capital, and high global commodity prices. "However, new waves of the Covid-19 virus are likely to periodically weigh on economic activity both globally and locally," the SARB warns. Electricity disruptions, weak investment, and uncertainty about the vaccine rollout program are expected to be drags on South Africa's growth performance in the near term.

- The unchanged monetary policy stance by the SARB during January is in line with IHS Markit's expectation. We are of the view that the SARB's policy rate will remain unchanged until end-2021.

- South African GDP growth vulnerabilities combined with a slight uptick in headline inflation from the second quarter onwards underline the expectation. The low base year of comparison, tightening of the output gap, and higher fuel costs are likely to increase headline inflation over the period.

Asia-Pacific

- APAC equity markets closed lower; Hong Kong -1.6%, India -1.5%, South Korea -0.6%, Mainland China/Japan -0.4%, and Australia -0.3%.

- The People's Bank of China (PBOC) on 20 January issued draft

regulations for non-bank payment service providers for public

feedback until 19 February. (IHS Markit Economist Yating Xu)

- The draft rules are designed to diversify regulatory measures with a focus on strengthening financial regulation and preventing systemic financial risks, according to a statement from the PBOC. They also clearly define the scope of the market and the standards for determining market dominance, and are aimed at strengthening anti-monopoly measures in the payment field and maintaining fair competition and market order, according to Caixin.

- In the draft guidelines, the PBOC for the first time has defined what constitutes a monopoly for third-party payment companies; i.e., any non-bank payment provider with a share of 50% and above of the electronic payments market, or two providers with a combined two-thirds share of the market, or three providers controlling 75% of the market.

- The release of the proposed regulations are the latest step in the government's campaign to control financial risks and crack down on anti-competitive practices in the financial technology (fintech) and platform sector. The annual Central Economic Working Conference held in December 2020 listed curbing market monopolies and preventing the disorderly expansion of capital as among the government's top priorities for 2021. Also, the State Administration for Market Regulation (SAMR) released antitrust regulations for the platform economy in November 2020. Besides financial markets, other applications of the platform economy, such as online education, could face similar scrutiny this year.

- Once the rules governing non-banking payment services are approved, the government will gain more authority to fight monopolies by dominant players. Mainland China's biggest third-party payment providers, Alipay and WeChat Pay, could face antitrust investigations and forced divestiture under the new rules. According to Caixin, private firms Alipay and WeChat Pay together control over 90% of China's third-party payment market while state-owned China UnionPay still remains a small player in the market.

- China is to ease regulatory controls further on contract manufacturing in the automotive sector to encourage companies without production permits to enter the industry. The action follows a statement on 26 May last year by the then minister of the Ministry of Industry and Information Technology (MIIT), Miao Wei, that controls on contract manufacturing in the new energy vehicle (NEV) sector would be eased. The minister said that his department would carry out "[an] orderly [easing of] control of contract manufacturing for new energy vehicles". Chinese regulators have taken an open attitude towards contract-manufacturing deals between automakers and startup companies. The NEV sector, in particular, will benefit from such an approach as the eased regulatory environment will continue to encourage new players into the sector. Over the past few months, deals have been struck between conventional carmakers and technology companies over EV manufacturing. Companies involved in contract manufacturing these days are tempted more by the vast business opportunities that such partnerships could unlock than the cost efficiency of contract manufacturing. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Japan's CPI fell by 0.1% month on month (m/m) on a seasonally

adjusted basis in December 2020 and by 1.2% year on year (y/y), the

largest contraction since April 2010. The CPI for full-year 2020

finished at the same level as in 2019. The December 2020 CPI

excluding fresh food (core CPI) and the CPI excluding fresh food

and energy (core-core CPI) held at the November level, but the y/y

contractions widened to -1.0% y/y and -0.4% y/y, respectively. (IHS

Markit Economist Harumi Taguchi)

- Although the faster drop in the CPI was due to weaker fresh food prices, the main factors behind the decline were lower energy prices (partially due to slack demand because of warmer temperatures) and the negative effects of the government's travel subsidies. Accommodation fees declined by 33.5% y/y.

- The CPI is likely to remain below the year-earlier level over the short term, although recent lower temperatures and an uptrend for oil prices will lift fresh food and energy prices. Despite accelerating deflation, the Bank of Japan (BoJ) is unlikely to introduce further monetary easing. While the BoJ is reviewing measures under the current framework, the weakness driven by energy prices and the effects of travel subsidies is in line with the bank's price outlook.

- The BoJ expects the CPI to start rising moderately as it believes that price cuts aimed at stimulating demand have not been observed widely to date. That said, a weak recovery because of the negative effects of COVID-19, declines in wages, large output gaps, and low growth expectations could increase downward pressure on prices, which could persist.

- Exports have continued to surge despite the strengthening of

the South Korean won, while consumer demand remains muted because

of the coronavirus disease 2019 (COVID-19) pandemic restrictions.

(IHS Markit Economist Dan Ryan)

- Exports have been on an uptrend for months; December was no exception, registering a 10% gain over November. Monthly exports were nearly at the 50-billion-dollar level, which was last seen in 2018.

- Imports have also been rising, but are now similar to levels seen in 2019. These are lower than typical 2018 levels, reflecting lower demand because of depressed consumer spending.

- Inflation remains negligible. The Consumer Price Index (CPI), core CPI, and Producer Price Index (PPI) showed small changes month on month and year on year.

- Prices, however, have been volatile on a monthly basis. This reflects the uneven effect of the pandemic-induced lockdowns and the uneven recoveries in different sectors.

- There has been no change to the official policy rate. Short-term and long-term rates, however, have risen slightly, suggesting optimism regarding the upcoming economic recovery.

- The won has been strengthening for months - at first a rebound from the excessive pessimism of the pandemic, but now reflecting the large external surpluses. The currency is expected to stabilize now and could correct to slightly weaker levels in the post-pandemic phase when imports rise in mid-2021.

- Foreign reserves have increased substantially in recent months. This results from the Bank of Korea intervening in the forex market to slow the appreciation of the won.

- The industrial production index has been rising, albeit erratically, since the nadir of the pandemic. However, it understates actual manufacturing output and is therefore lagging behind exports that have been surging for months.

- Retail sales, both nominal and real, remain depressed. This will continue until the pandemic has ended and service-sector firms no longer face lockdowns.

- Like many countries, the labor force was lower than a year earlier because of discouraged unemployed workers dropping out of the labor market. However, the decline - a half-percentage point - is relatively small and the labor force has in fact been increasing in recent months.

- The recent rising labor force had included a rising number of unemployed. However, the market began to improve in November, with the number of employed increasing and unemployed falling marginally.

- The trend of the past several months continues, with the export sector driving growth. This necessarily pulls in imports of raw and semi-finished materials, but still leaves a sizeable trade surplus because of a lack of demand for consumer goods.

- Renault Samsung has said that it will receive applications for voluntary retirement from all employees on permanent payroll, except for those hired after March 2019, reports the Korea JoongAng Daily. Retirement will be effective from 28 February. Those who retire will receive an average of KRW180 million (USD163,537) per person on top of their severance pay, which will include special bonuses, KRW10 million in education expenses for each child they have, insurance fees, and car purchase discounts, among other things. This is the first time in eight years that the automaker has offered voluntary retirement to employees at all levels, not just the executive level. In 2012, around 900 employees left the company in the aftermath of the global financial crisis as the automaker recorded a KRW215-billion operating loss in 2011 and a KRW172.1-billion operating loss in 2012, highlights the report. This latest labor-force reduction is the second this year. Earlier this month, Renault Samsung announced that it would reduce the number of executives and their salaries as it entered emergency management owing to the COVID-19 virus pandemic. The automaker plans to cut the number of executives by 40% to 30 and their pay by 20% starting from January. Renault Samsung is currently struggling and reported an operating loss for the first time in eight years in 2020 as its global sales plunged 34.5% year on year (y/y) to 116,166 units, according to data released by the automaker. (IHS Markit AutoIntelligence's Jamal Amir)

- JGC has signed a FEED contract for a hydrogen related project planned by Sumitomo Corporation in Gladstone, Australia. This project is part of a broader program that aims to build local hydrogen production and consumption in Gladstone by producing hydrogen from electrolysis of water using electricity from Solar PV (photovoltaics) as the main power source. The hydrogen production plant initially plans to produce 250-300 tons of hydrogen annually, with plans to scale up production. (IHS Markit Upstream Costs and Technology's Dag Kristiansen)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-january-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-january-2021.html&text=Daily+Global+Market+Summary+-+22+January+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-january-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 22 January 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-january-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+22+January+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-january-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}