Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 02, 2021

Daily Global Market Summary - 2 November 2021

All major US equity indices closed higher, while most APAC markets were lower and Europe was mixed. US government bonds closed almost flat on the day and benchmark European bonds were sharply higher. CDX-NA closed modestly tighter across IG and high yield, iTraxx-Xover was also tighter, and iTraxx-Europe was flat on the day. The US dollar and natural gas closed higher, Brent was flat, and WTI, gold, copper, and silver were all lower on the day. All eyes will be on tomorrow's FOMC statement and press conference for the long-awaited details of the Fed's plan to begin to unwind QE.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; DJIA/S&P 500 +0.4%, Nasdaq +0.3%, and Russell 2000 +0.2%.

- 10yr US govt bonds closed -1bp/1.55% yield and 30yr bonds flat/1.96% yield.

- CDX-NAIG closed -1bp/52bps and CDX-NAHY -4bps/302bps.

- DXY US dollar index closed +0.2%/94.09.

- Gold closed -0.4%/$1,789 per troy oz, silver -2.4%/$23.51 per troy oz, and copper -0.6%/$4.37 per pound.

- Crude oil closed -0.2%/$83.91 per barrel and natural gas closed +6.3%/$5.64 per mmbtu.

- US President Joe Biden announced a range of domestic actions

aimed notably at the oil and natural gas sector that the White

House said will help as part of a push to reduce nearly one-third

of worldwide methane emissions by the decade's end under a global

pledge launched with the EU on 2 November. (IHS Markit Net-Zero

Business Daily's Amena

Saiyid)

- Released on the second day of the UN COP26 meeting in Glasgow, the actions recognize the opportunity capturing methane presents because of its potency as a GHG. Although a short-lived GHG, methane has a global warming potential that is at least 80 times that of CO2 over a 20-year span.

- At the global pledge launch, Biden released the US Methane Emissions Reduction Action Plan, which includes various actions his administration is taking to tackle methane emissions. The plan to a large extent targets methane leaks arising from the extraction, production, storage, transportation, and distribution of oil and gas products, but it also tackles emissions from the agriculture sector and landfills.

- The EPA is seeking increased monitoring at well sites and compressor stations to detect and plug methane leaks. At well sites with estimated methane emissions of at least 3 metric tons (mt) per year, EPA will require quarterly monitoring for leaks and prompt repairs for any that are found. This provision alone would result in routine monitoring at 300,000 well sites nationwide that are responsible for 86% of fugitive emissions.

- Among other provisions, the agency also is proposing to give owners and operators the flexibility to use advanced detection technology that can find major leaks more rapidly and at lower cost than ever before. It also is proposing standards to eliminate venting of associated gas and requiring capture and sale of gas where a sales line is available—at new and existing oil wells.

- New York State legislators have introduced S6843, which would require that all new buildings in the state be all-electric after 2023, with some exceptions. While California is moving towards a state rule to limit natural gas service in new homes and buildings, to date the drive in that state has been from municipalities. No state has issued a statewide gas ban, and at least 19 states have prohibited municipalities from writing such regulations. The language of the New York bill "provides that no city, town or village shall issue a permit for the construction of new buildings that are not an all-electric building if the initial application for a permit was submitted after December 31, 2023 unless certain circumstances apply." Major renovations of existing buildings also would be covered after 2022. Kavanaugh has been challenging new natural gas pipeline projects planned for Brooklyn, which he represents in the legislature. On 19 October, he joined other legislators in asking Gov. Kathy Hochul (D) to review the Public Service Commission's approval in September of a rate increase for National Grid to pay for the North Brooklyn Pipeline that is under construction. That seven-mile pipeline is needed to improve system reliability, according to National Grid, but its choice of route has been dogged by charges of environmental racism as well as investment in a resource that is in long-term decline. (IHS Markit PointLogic's Kevin Adler)

- Municipal bond Investor demand for new issue paper remains intact after last week's double-digit calendar of $10.1 billion presented buyside accounts an array of credits and purposes, with a large presence of tax-exempt paper geared towards retail investors. Volume registered across last week's offerings were substantial after the State of Ohio (Aa1/AA+/AA+) sold $329 million of general obligation improvement bonds across four tranches with bumps peaking at 7bps in the 2036 maturity, falling +33bps off the interpolated MAC Curve. The Cities of Dallas and Fort Worth, TX (A1/-/A+/AA) also experienced a successful pricing after selling $299 million of international airport bonds spanning 11/2022-11/2045 with corresponding investor demand suppressing yields after the 2045 maturity was bumped 15bps, marking a 2.17 yield to allotted investors. This week's calendar is slated to remain quiet ahead of the FOMC meeting taking place tomorrow with $6.3 billion spanning 189 new issue offerings and large presence of health care deals throughout the week. The Texas Public Finance Authority (-/AAA/AAA/-) will lead the negotiated calendar offering $831 million general obligation and refunding bonds across two series with maturities spanning 10/2022-10/2041. The Economic Development Authority of The City of Lynchburg (Baa1/A-/A-/-) will also come to market to sell $212 million hospital revenue and refunding bonds across 01/2027-01/2055 on Thursday, 4 November, senior managed by Barclays. This week's competitive calendar will span across 101 new issues for a total of $1.34 billion with the School District of Miami-Dade County, FL (Aa3/-/-) leading the auction calendar with $169 million general obligation school refunding bonds spanning 3/2022-3/2043, selling on Wednesday, 3 November. (IHS Markit Global Market Group's Matthew Gerstenfeld)

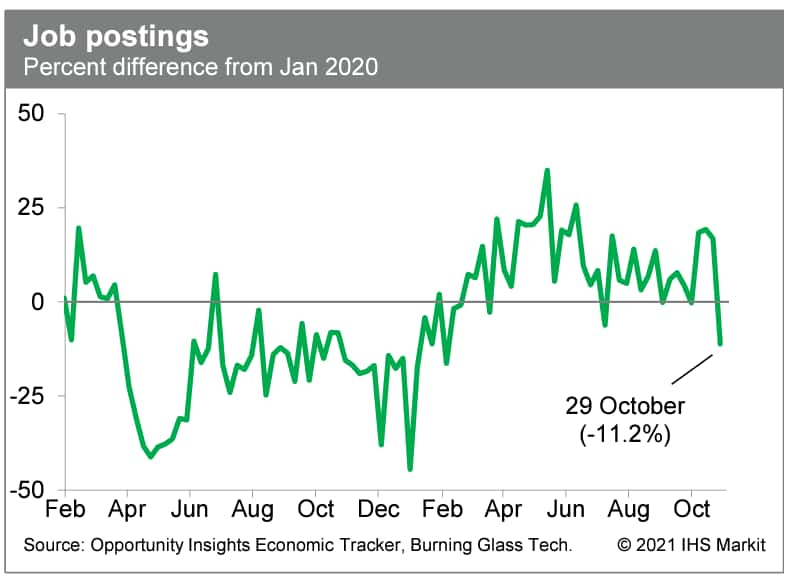

- US job postings fell last week to 11.2% below the January 2020

level, according to the Opportunity Insights Economic Tracker. This

followed robust readings over the prior three weeks, implying a

four-week average that is still above what had previously been a

softening trend. The next few weekly readings will reveal whether

the trend in labor demand has, indeed, been firming. (IHS Markit

Economists Ben

Herzon and Joel

Prakken)

- After rounding, the US homeowner vacancy rate remained at a

record low 0.9%. The Census, which rounds the vacancy rate

estimates to one decimal place, noted that the third-quarter rate

was 0.86% and lower than the 0.95% recorded in the third quarter of

2020—which also rounded to 0.9%. This suggests that the

homeowner vacancy rate possibly hit a record low in the third

quarter—if it were slightly lower, it would round to 0.8%. (IHS

Markit Economist Patrick

Newport)

- The rental vacancy rate—the proportion of rental inventory vacant and for rent—fell to 5.8%, from 6.4% a year earlier.

- The homeownership rate edged up to 65.4% from 64.1 eight quarters earlier.

- Estimated housing inventory increased to 142.100 million, up 1.223 million from a year earlier.

- Electric vehicle (EV) manufacturer Rivian is considering raising as much as USD8.4 billion in its initial public offering (IPO), according to the company's filing with the US Securities and Exchange Commission (SEC). The company is reportedly planning to offer 135 million shares at a price of between USD57 and USD62, with an option for underwriters to purchase up to 20.25 million additional shares. At the top of that range, Rivian would have a market value of USD53 billion based on the outstanding shares listed in its filing. Rivian's valuation could be as high as USD60 billion by taking employee stock options and other restricted shares into account. Rivian said investors, including Amazon and T. Rowe Price, have indicated an interest in buying up to USD5 billion in shares of Class A common stock, reports TechCrunch. (IHS Markit AutoIntelligence's Surabhi Rajpal)

- Mexico's national statistics office, Instituto Nacional de

Estadística y Geografía (INEGI), reported that real GDP declined by

0.2% in the third quarter as compared with April-June (quarter on

quarter [q/q]). This is based on seasonally adjusted data. Although

the agricultural and industry sectors posted expansions, this was

more than offset by a sizeable decline in services. Services

account for almost two-thirds of total GDP. (IHS Markit Economist

Rafael

Amiel)

- The service sector was affected significantly during August when new legislation regarding outsourcing was implemented. This implied that many workers and services stopped operations, which led to decreased overall output. Mexico also faced a third wave of COVID-19 infections in August, which led to some closures and restrictions that negatively affected retail and other services.

- This "flash" GDP report does not provide details about aggregate demand components. However, balance-of-payments data suggest that exports declined while imports increased sizably. Therefore, the contributions of net exports to growth must have been negative.

- The monthly index of economic activity (MIEA), which attempts to mirror GDP, was down 1.6% in August (with respect to July, month on month [m/m]). While there are no data for September, the flash GDP report implies that Mexico's economy jumped back up 3.7% m/m in the ninth month of the year. This was driven by fewer COVID-19-related restrictions and the partial normalization of activities by workers previously subcontracted by third parties.

- The Central Bank of Colombia (Banco de la República: Banrep)

decision follows a 25 bps rate increase in September as the central

bank seeks to control above target inflation. In September,

Colombia's annual inflation rate rose further to 4.5%, in large

part due to the price increases of foods and regulated items. This

was the highest rate of inflation since April 2017 and was above

the upper limit target set by Banrep. The central bank targets

inflation at 3.0% +/- 1 percentage point. (IHS Markit Economist

Dariana Tani)

- The bank's decision was supported by a majority of Banrep's seven board members, with five board members backing a 50-point increase and the remaining two backing a 25-point uptick.

- Banrep also revised higher its 2021 GDP forecast from 8.6% previously to 9.8% (above our forecast of 8.5%) and now forecasts inflation to end this year at 4.9% (below our expectations of 5.4%).

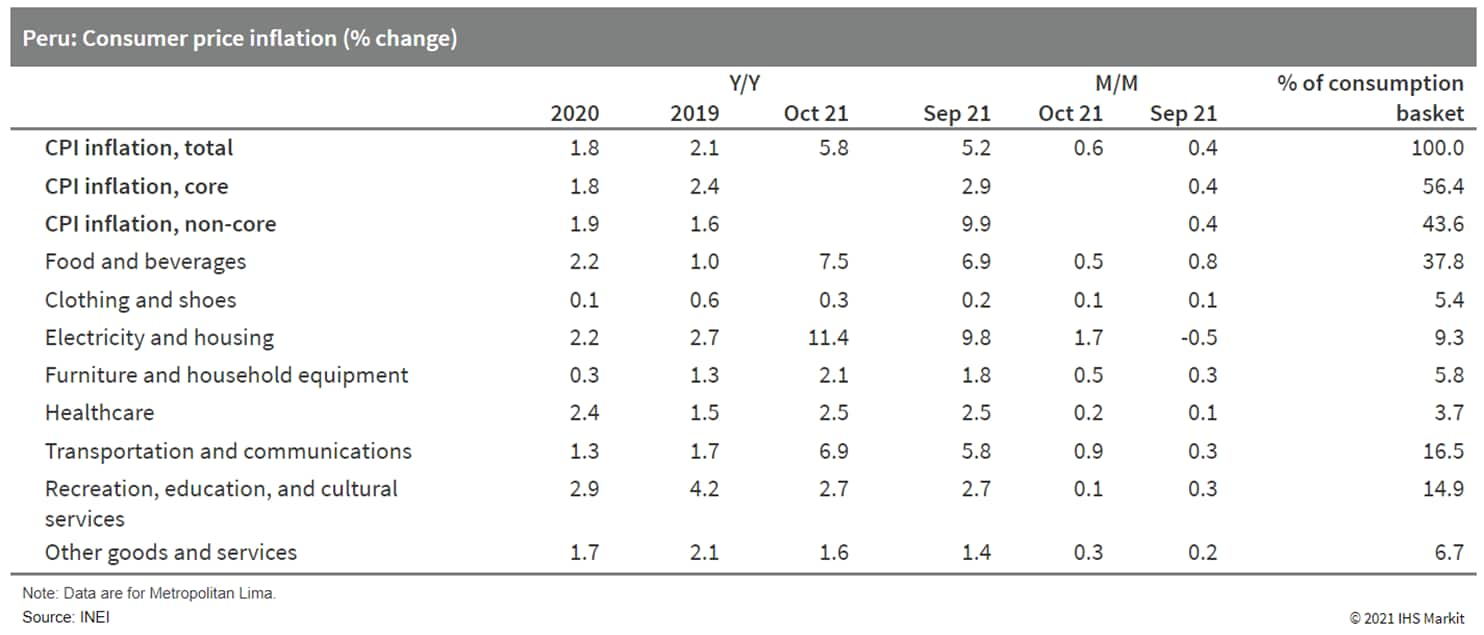

- Peru's Consumer Price Index (CPI) increased by 0.6% month on

month (m/m) and 5.8% year on year (y/y) in October, according to

the National Institute of Statistics and Information (Instituto

Nacional de Estadística e Informática: INEI). Annual inflation

stood at 2.5% as recently as May. (IHS Markit Economist Jeremy

Smith)

- Price movements were once again closely tied to renewed increases in international commodity prices, especially crude oil, staple grains, and vegetable oils. The electricity and housing, food and beverages, and transportation and communications consumption categories accounted for 88% of CPI variation compared with September.

- The Peruvian sol appreciated in October for the first time in

2021 following a cabinet reshuffle and reappointment of the highly

regarded central bank president. In prior months, politics-driven

currency depreciation had exacerbated the effect of rising import

costs. Still, earlier bouts of depreciation were likely still

filtering into consumer prices in October.

- Peruvian exporters of passion fruit juice concentrate (PFC)

sold 17,463 tons (+22.7% y/y) of the product worth $38.1 million

(+8.0% y/y) to foreign buyers in the first nine months of 2021.

(IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- PFC of South American origin (Peru/Ecuador) sold in the spot market for $4,750/ton (50 brix, 200 kg) cfr Rotterdam on 29 October, with prices unchanged since late June.

- Despite the strong outflow of PFC, juice prices are unlikely to return to levels above $7,000/ton seen in early October 2019, as the Peruvian passion fruit harvest rebounded strongly last year.

- The Netherlands imported 10,218 tons (+14.1% y/y) of Peruvian PFC worth $22.4 million (-3.1% y/y) between January and September. The US was the second largest buyer with 3,957 tons, or 76.0% more than the 2,248 tons that the US bought in the first three quarters of 2020.

- On the other hand, France more than halved its imports of Peruvian PFC from 1,417 tons in January-September 2020 to 545 tons in the same period of this year. As a result, Chile overtook France as the third largest importer of Peruvian PFC with 797 tons (+392.0% y/y) imported in 2021.

- In recent years, the Netherlands has been losing some of its outsized dominance in terms of market share. The US has been importing rapidly increasing volumes of Peruvian PFC over the years. As a result, US imports (3,957 tons) in the first nine months of 2021 are already higher than in any full calendar year over the past decade.

Europe/Middle East/Africa

- Major European equity indices closed mixed; Germany +0.9%, France +0.5%, Italy -0.1%, UK -0.2%, and Spain -0.8%.

- 10yr European govt bonds closed sharply higher; Italy -14bps, Spain -12bps, France -8bps, Germany -6bps, UK -3bps.

- iTraxx-Europe closed flat/51bps and iTraxx-Xover -2bps/260bps.

- Brent crude closed 0%/$84.72 per barrel.

- British farmers have hit back at suggestions that the UK could

introduce a carbon tax on meat and dairy and warned that this would

put them out of business. On 29 October, ahead of the UN COP26

climate summit in Glasgow, UK Secretary for Food and Rural Affairs

George Eustice said Britain will "start to move into the realms of

things like carbon taxes" after they transitioned to a new

agricultural policy to improve the farming's environmental impact.

(IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- Eustice explained that the UK government has already been working on a new tax system for the parts of the food sector that contribute most to global warming and said this could target meat and dairy.

- The UK farming chief admitted that these taxes could increase prices for red meat, estimating that these could rise by 10% over the next five years, but he claimed UK farmers would benefit from the taxes and suggested British meat would also become cheaper for consumers.

- Eustice explained that the purpose of the carbon border tax would be to encourage countries like Australia and New Zealand "to tackle their own greenhouse gas emissions".

- But Eustice's statements still attracted sharp criticism from UK farmers, with the National Farmers Union of England and Wales (NFU) warning that the carbon tax would "put farmers out of business" if it is implemented in the UK alone.

- NFU president Minette Batters pointed out that the UK government just signed post-Brexit trade deals with New Zealand and Australia and argued that additional taxes on UK farmers would lead to more imports from these countries.

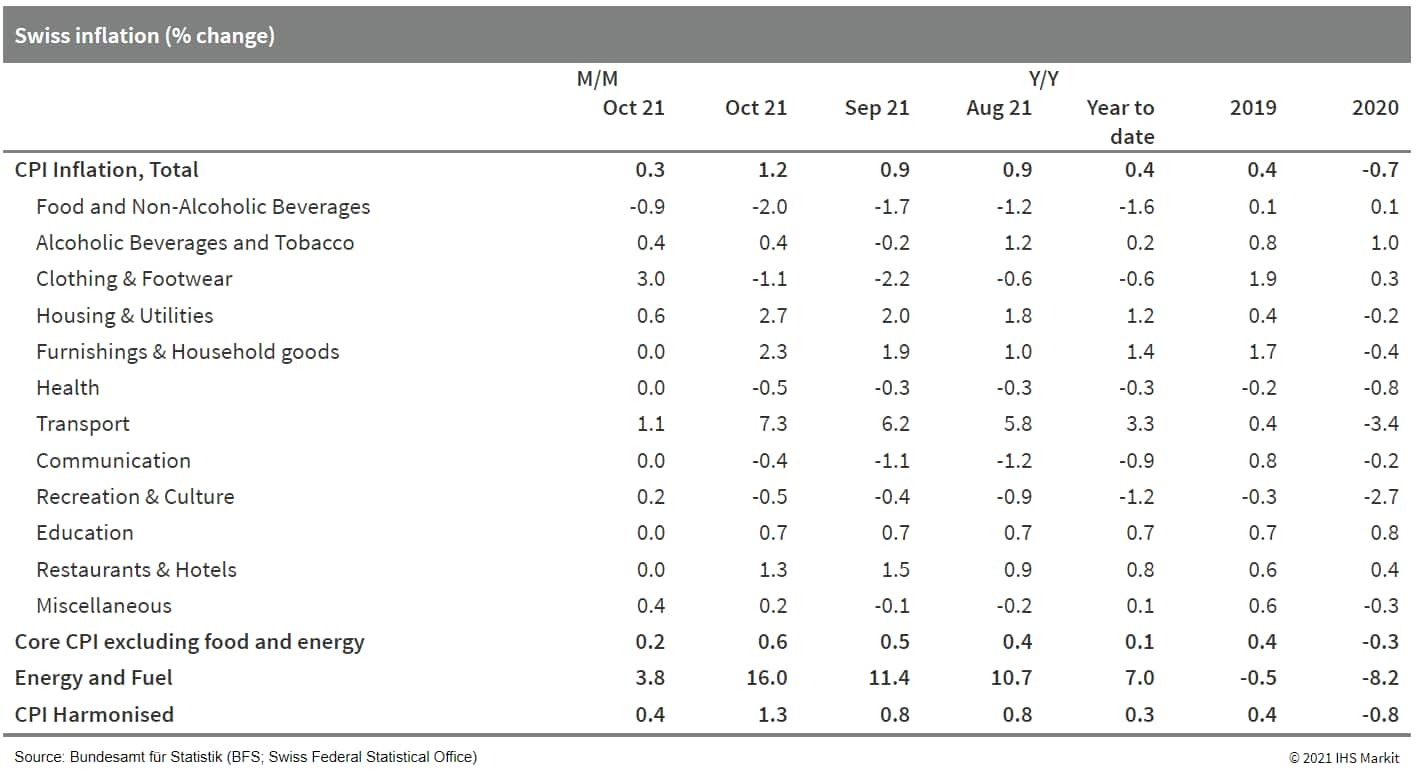

- According to the Swiss Federal Statistical Office (SFSO), Swiss

consumer prices increased by 0.3% month on month (m/m) in October,

exceeding the October average of recent years by 0.3 percentage

point. This has boosted the annual inflation rate from 0.9% to an

11-year peak of 1.2%. (IHS Markit Economist Timo

Klein)

- Seven of the 12 main Classification of Individual Consumption According to Purpose (COICOP) categories of goods and services saw their annual rate going up, while four posted a decline and one (education) held steady (see table below). The two categories driving higher inflation were housing and utilities and transport. In both cases, energy prices were the underlying cause, which increased by a sizeable 3.8% m/m and thus boosted their year-on-year (y/y) rate from 11.4% to 16.0%.

- Energy was also the decisive factor for goods price inflation

generally (0.6% m/m, thus the y/y rate up from 1.2% to 1.8%),

although core items such as clothing and footwear and household

goods equally contributed. In contrast, services-sector prices only

increased by 0.1% m/m, leaving their annual rate steady at 0.8%.

Meanwhile, the split between domestic and imported goods also

revealed a marked divergence. The former were unchanged during the

month, also allowing their y/y rate to keep steady at 0.6%, whereas

the prices of imported goods increased by 1.3% m/m and therefore

pushed up the y/y rate from 2.0% to 3.2%.

- According to the Austrian Public Employment Service (AMS),

there were 269,514 unemployed people in Austria at the end of

October, essentially unchanged from September and down by 89,000

(-24.8%) versus October 2020. The latest annual decline is the

largest of recent months. (IHS Markit Economist Timo

Klein)

- The national unemployment rate (not seasonally adjusted) has kept stable at 6.5%, which is down by more than two percentage points from 8.7% in October 2020 and is even lower than the level of 7.0% observed in October 2019 ahead of the pandemic. This demonstrates that Austrian labor market conditions are still improving at a remarkable pace.

- Vacancies are still growing rapidly, with October's year-on-year (y/y) increase of 73.4% being at the upper end of annual increases recorded in recent months. Meanwhile, dependent employment, which had been losing annual growth momentum since peaking at 4.7% y/y in April, accelerated from 2.1% y/y in September to 2.6% y/y in October. Finally, the labour force as the sum of dependent employment and registered unemployed declined by about 17,000 in October, following a dip of only 5,000 in September but 50,000 in August. These monthly gyrations are largely seasonal, however.

- Tesla said that electric vehicles (EVs) manufactured by other automakers will be able to use its network of chargers for a new pilot in the Netherlands. This "Non-Tesla Supercharger Pilot" will be tested at 10 locations in the country, according to a company statement. The superchargers are open to EVs with a Combined Charging System (CCS) connector and users can access the charging stations through Tesla's smartphone app. Tesla drivers can continue to use these stations and the company will closely monitor each site for congestion. Charging prices for non-Tesla drivers will include extra costs to support a broad range of EVs and site adjustments to accommodate these vehicles. This development aligns with Tesla's mission to accelerate the world's transition to sustainable energy. This is the first time Tesla has opened its charging network to other electric cars, which has created another revenue stream for the company. (IHS Markit AutoIntelligence's Surabhi Rajpal)

- Ericsson, Urban ICT Arena, Intel, Keolis, T-Engineering, and Telia are collaborating on a project called 5G Ride, which is testing a 5G-connected, remotely monitored autonomous electric minibus at Kista Science Centre in Stockholm, Sweden. It is now testing new safety features to explore how 5G and remote monitoring of vehicles via control towers could facilitate in safely introducing autonomous electric buses in urban environments. 5G connectivity is provided by Telia in collaboration with Ericsson, while Intel focuses on analytics in the bus for increased passenger safety. The vehicle is equipped with autonomous technology, which is provided by T-engineering. The initiative is also backed by Vinnova and Drive Sweden. Jan Jansson, mobility services developer at bus operator Keolis, said, "On today's buses, you can turn to the driver for help. It is a security for the passengers, especially for older person, that you feel welcome and taken care of. With the help of new technology, we can create the same experience on self-driving buses. It can be about quickly getting in touch with the operators in the control tower via simple digital interfaces on the buses". 5G technology provides high-speed data transfer, low latency, and reliability so that the vehicle can respond to the centralized control tower's commands in real time. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Autobrains, a Tel Aviv (Israel)-based developer of self-learning artificial intelligence (AI) technology for automated and autonomous vehicle, has raised USD101 million in Series C financing led by Singapore state investor Temasek, reports Vietnam News. Other investors included Knorr-Bremse AG (a German manufacturer of braking systems for commercial vehicles), VinFast (a Vietnamese car manufacturer), existing investor BMW, and long-term strategic partner Continental AG. Karl-Thomas Neumann, chairman at Autobrains, said, "This funding round is an exciting milestone for Autobrains and further validation for our self-learning AI solution to ADAS and autonomous driving. The future of mobility will be powered by intelligent AI. Along with new and existing partners we will bring self-learning AI to additional global markets, expand our commercial reach, and continue developing as the leading AI technology company enabling safer assisted driving capabilities and higher levels of automation for next generation mobility." The funding is intended to grow the company's commercial reach into new global markets. Autobrains, formerly called Cartica AI, lays its basis on a multi-disciplinary research and development and self-learning AI that does not require brute-force data and labelling, which is typical of deep learning AI. (IHS Markit AutoIntelligence's Tarun Thakur)

- South Africa received a promise of an $8.5-billion helping hand

from five G20 members 2 November as the globe's 12th-largest

emitter seeks to cuts its GHG emissions and transition away from a

coal-centric power generation sector. (IHS Markit Net-Zero Business

Daily's Keiron Greenhalgh)

- The climate finance backing came as the South African government prepared to submit a roadmap for tackling climate change to the nation's parliament and an initiative to transform the country's energy sector launched.

- Change is needed because the same day all these developments took place, state-owned power generator Eskom was warning of load shedding because its power plant fleet's health was even creakier than usual, with almost 18 GW of capacity offline for maintenance. South Africa's installed power generation capacity is just over 58 GW.

- Help from the G20 nations-France, Germany, the UK, the US, and the EU-will come in the form of the "Just Energy Transition Partnership." The partnership will mobilize an initial $8.5 billion in a first phase of financing involving grants, concessional loans and investments, and risk sharing instruments, its backers said. The premise of partnership is to prevent up to 1.5 gigatons of emissions over the next 20 years, and accelerate South Africa's transition to a low emissions, climate resilient economy, they said.

Asia-Pacific

- Major APAC equity indices closed lower except for South Korea +1.2%; India -0.2%, Hong Kong -0.2%, Japan -0.4%, Australia -0.6%, and Mainland China -1.1%.

- As COP26 completed its second day, announcements of new GHG

emissions reductions commitments arrived from a number of Asian

nations, and multilateral groups announced a range of funding

programs aimed at bringing clean energy to the developing world and

improving management of forests and biodiversity. (IHS Markit

Net-Zero Business Daily's Kevin Adler)

- Nepal, New Zealand, Thailand, and Viet Nam each presented updated climate commitments at or just prior to COP26, while noting that they are responsible for miniscule shares of global GHG emissions and yet are disproportionately at-risk from climate change.

- New Zealand will raise its nationally determined contribution (NDC) goal to a 50% GHG reduction, up from a prior goal of 36%, said Prime Minister Jacinda Ardern prior to speaking at the global meeting. This would reduce the nation's targeted emissions to 571 million metric tons (mt) in 2030, compared with the current 623 million mt.

- NDCs are the promises made under the Paris Agreement to put the world on a path to limiting global warming to 1.5 degrees Celsius by 2050.

- Viet Nam, which is described by COP26 President Alok Sharma as one of the most vulnerable nations to rising sea levels in the world, came to Glasgow and announced new goals of reducing its GHGs per GDP by at least 15% by 2030 and at least 30% by 2050, compared with 2014. This is on top of the September NDC of a 9% net GHG reduction by 2030.

- Thailand produces about 0.72% of global GHG emissions annually, said Prime Minister Prayut Chan-o-cha, but is considered in the top 10 of most vulnerable nations. "That was why I participated in the Paris Climate Change Conference in 2015, and Thailand was among the first group of nations that ratified the Paris Agreement," he told the COP26 assembly on 1 November.

- China's Ganfeng Lithium, a supplier of lithium to automakers, has signed a three-year supply deal with Tesla, according to Reuters. Ganfeng will supply battery-grade lithium products to Tesla, but the total sales amount and value of the deal has not been disclosed yet. In order to ensure uninterrupted production of their electric vehicles (EVs), automakers are securing direct contracts with suppliers for raw materials such as lithium hydroxide, which is used for battery production. In September 2018, Ganfeng signed a deal with Tesla regarding the supply of lithium hydroxide, under which Tesla's designated battery manufacturer would purchase lithium hydroxide from Ganfeng. The contract was effective until 2020, with an option to extend it for another three years. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Chinese electric vehicle (EV) startups Xpeng and Li Auto have

reported substantial increases in vehicle sales during October,

while EV maker NIO has registered a sales decline during the month.

(IHS Markit AutoIntelligence's Nitin Budhiraja)

- Xpeng reported deliveries of 10,138 vehicles in October, a 233% year-on-year (y/y) increase, making deliveries of over 10,000 units for a second month in a row. In October, the EV startup's deliveries included 6,044 units of the P7, the sports smart sedan, and 3,657 units of the G3 and G3i smart compact sport utility vehicles (SUVs). Sales of the P5 sedan launched in September were 437 units last month. In the year to date (YTD), Xpeng's cumulative deliveries stood at 66,542 units, up 289% y/y.

- During October, Li Auto posted 107.2% y/y growth in sales of the Li One SUV to 7,649 units, the only model launched by the company so far. In the YTD, the startup's deliveries stood at 62,919 units. Yanan Shen, co-founder and president of Li Auto, said, "It took us 708 days to reach the production milestone of 100,000 Li ONEs, making us the fastest to achieve this among emerging NEV manufacturers in China."

- Meanwhile, NIO said that its EV deliveries in October declined by 27.5% y/y to 3,667 units due to restructuring and upgrades of manufacturing lines and preparation for launches of new products.

- EV startups in China have been riding the new energy vehicle (NEV) wave in the country. The NEV segment has been experiencing substantial growth in sales despite the impact of the COVID-19 virus pandemic and supply-chain constraints. According to a recent statement by the China Association of Automobile Manufacturers (CAAM)'s executive vice-chairman, Fu Bingfeng, Chinese NEV sales are expected to increase by more than 40% each year for the next five years.

- IHS Markit forecasts sales of NIO, Xpeng, and Li Auto vehicles will be around 91,400 units, 72,000 units, and 73,000 units respectively during 2021.

- Geely Auto plans to manufacture an automotive-grade 7-nanometer (nm) system-on-chip in 2022, reports the China Daily. According to this report, this system-on-chip will be the first of its kind in China and will support the automaker in accelerating its efforts to produce autonomous vehicles (AVs). The chip, called SE1000, is designed by Siengine and will be used to offer smart onboard features. Geely also plans to roll out two 5-nm high-performance chips from 2024 to 2025. One of them, with a computing capability of 256 tera operations per second, is to be used for Geely's AVs. Chips and AVs are one of nine goals that Geely announced for 2025. Geely has begun mass production of low-earth-orbit satellites to enable accurate navigation data for AV development. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Taiwan's economy lost some steam during the third quarter of

2021 amid an uneven performance in economic activities. Consumer

spending also slumped at a record pace because of the prolonged

scars from the coronavirus disease 2019 (COVID-19) virus outbreak

in mid-May despite a slow improvement in the third quarter. That

said, this was offset by buoyant investment demand that was

prompted by booming exports and factory expansions. Uneven recovery

is expected ahead as investment and exports will probably remain

the driving force of the economy, while consumer spending will

continue to lag behind. Meanwhile, unfavorable base effects, along

with headwinds from mainland China's economic concerns,

supply-chain disruption, and the continued fallout of the pandemic,

will cloud the short-term outlook. (IHS Markit Economist Ling-Wei

Chung)

- Preliminary data show that Taiwan's economy lost traction in the third quarter as the slump in consumer spending deepened at a record pace, partially offsetting a surge in investment demand and still-robust export performance. Real GDP expanded by 3.8% year on year (y/y) in the third quarter, decelerating from a 7.4% y/y jump in the second quarter and a 9.3% y/y surge in the first quarter. The first-quarter 2021 expansion was the fastest since the third quarter of 2010.

- In seasonally adjusted quarter-on-quarter (q/q) terms, the economy rebounded in the third quarter of 2021, as real GDP increased at an annualized 2.3% from the preceding quarter, reversing a 4.2% drop posted in the second quarter.

- Domestic demand turned into the driver's seat in the third quarter as investment spending soared at a pace not recorded in 11 years, outweighing the plunge in consumer demand. Domestic demand contributed 4.1 percentage points to GDP growth as gross investment added 6.3 percentage points and government spending contributed 0.5 percentage point, offsetting the subtraction of 2.6 percentage points by private consumption. On the other hand, net exports turned negative in the third quarter, subtracting 0.3 percentage point, reversing the contribution of 5.1 percentage points in the second quarter. Despite still-robust exports, import growth outpaced export gains in the third quarter, fueled by soaring investment demand.

- Gross investment provided the main impetus to economic growth in the third quarter of 2021, surging 28% y/y, which marked the fastest expansion since the third quarter of 2010. Local companies, such as semiconductor and other technology firms, have continued to expand capacity to meet demand, which has in turn bolstered investment in machinery equipment and related outlays.

- According to a press release from VPBank, Japan's Sumitomo

Mitsui Banking Corporation (SMBC), together with Taiwan's CTBC

Bank, Hua Nan Commercial Bank, First Commercial Bank, and India's

State Bank of India, signed a syndicated loan of USD200 million

(VND4.5 trillion) to Vietnam's VPBank on 27 October. Over recent

weeks, SMBC has also issued USD100-million worth of loans to the

bank. VPBank did not disclose the funding cost of the loans. At the

same time, VPBank announced that it has successfully completed the

sale of a 49% stake in VPBank Finance Company to SMBC Consumer

Financer after the agreement was signed in April 2021. (IHS Markit

Banking Risk's Angus

Lam)

- Based on IHS Markit's research, as of 2021 Q3, VPBank's outstanding borrowing from financial institutions (FIs) stood at VND52.0 trillion; this suggests these two latest loans will increase the bank's borrowing from FIs by nearly 13%. Overall, as a proportion of total liabilities, borrowings from FIs will increase to 15.6%, from 14.0% previously.

- The 2020 annual report shows that the majority of borrowings

from other FIs are denominated in foreign currency (around 50%) and

this will likely boost this ratio to more than half. In 2020, the

bank received funding/loans from the International Monetary Fund

(IMF)'s IFC and Asian Infrastructure Investment Bank, totaling

around USD500 million, to on-lend to specific projects.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-november-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-november-2021.html&text=Daily+Global+Market+Summary+-+2+November+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-november-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 2 November 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-november-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+2+November+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-november-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}