Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 02, 2021

Daily Global Market Summary - 2 August 2021

All major APAC and most European equity indices closed higher, while most US markets were lower. US and European government bonds closed sharply higher. European iTraxx and CDX-NA closed almost flat on the day across IG and high yield. Natural gas, gold, and silver closed higher, while the US dollar, oil, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except for Nasdaq +0.1%; S&P 500 -0.2%, DJIA -0.3%, and Russell 2000 -0.5%.

- 10yr US govt bonds closed -5bps/1.18% yield and 30yr bonds -5bps/1.85% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY +2bps/294bps.

- DXY US dollar index closed -0.1%/92.05.

- Gold closed +0.3%/$1,822 per troy oz, silver +0.1%/$25.58 per troy oz, and copper -1.1%/$4.43 per pound.

- Crude oil closed -3.6%/$71.26 per barrel and natural gas closed +0.5%/$3.94 per mmbtu.

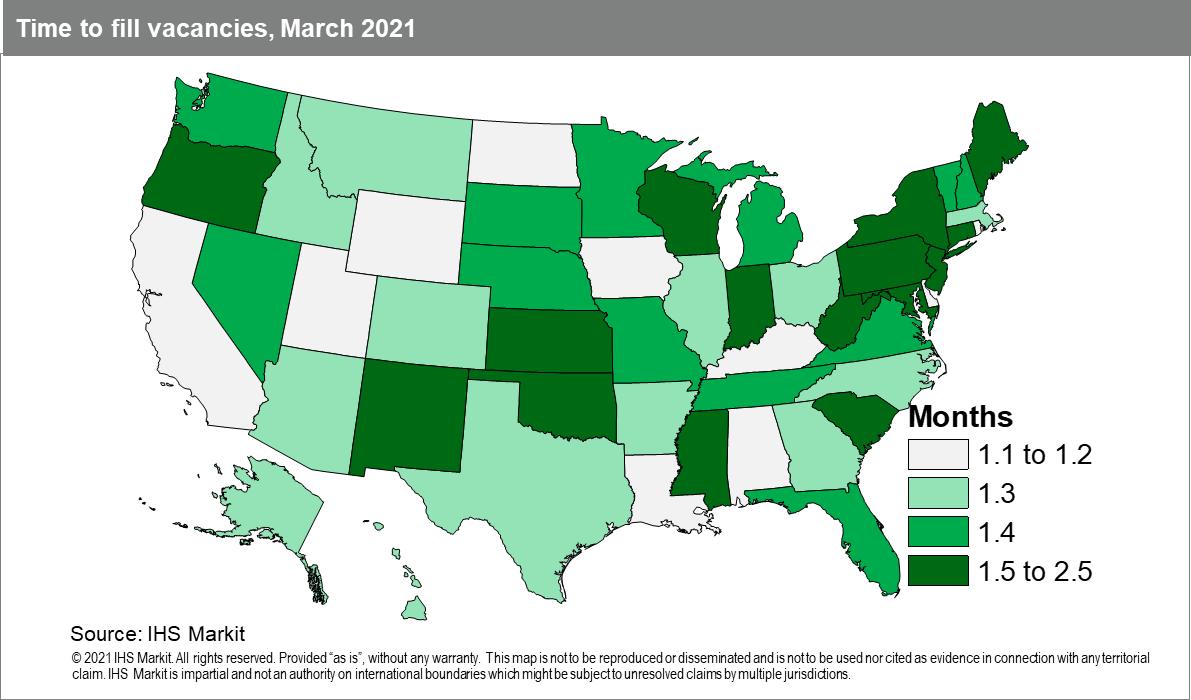

- The Job Openings and Labor Turnover Survey (JOLTS) State

Estimates show a clear picture of regional labor markets moving

from excess slack during the early stages of the COVID-19 pandemic

to widespread tightness starting in the second half of 2020 as

states began to reopen their economies. Firms looking to capitalize

on the pent-up demand have encountered difficulty filling open

positions, however, with labor-force participation remaining well

below pre-pandemic levels to-date. (IHS Markit Economist Alexander

Minelli)

- In the first half of 2020, the quits rate plunged in all

regions following business closures and hiring freezes that shook

workers' confidence in their ability to find another job.

- While the Northeast had the lowest quits rate of any region at 1.1% in May 2020, the West and North Central saw the largest decreases between February and May, falling 0.7 point each.

- The South weathered the onset of the pandemic relatively well with a May quits rate of 1.9% after a 0.5-point decline from its pre-pandemic level.

- Within a few months every region's quits rate rebounded and by March 2021 all regions saw their quits rate return to pre-pandemic levels amid renewed confidence among workers.

- By March 2021, the time to fill vacancies matched that during

the tight labor market in early 2019 in every region.

- The Northeast took the longest to fill vacancies with an average of 1.5 months, matching series highs from January 2019.

- Within the Northeast, Pennsylvania had the longest time to fill vacancies at 1.8 months followed by New Jersey (1.6 months), Connecticut (1.5 months), and Maine (1.5 months).

- Northeastern states struggled with low hires rates[4] owing to pandemic restrictions and high job openings rates as vacancies went unfilled with fewer workers in the labor force.

- The South took 1.4 months to fill vacancies, breaking the

previous series high of 1.2 seen in December 2018.

- In the first half of 2020, the quits rate plunged in all

regions following business closures and hiring freezes that shook

workers' confidence in their ability to find another job.

- US total construction spending rose only 0.1% in June, short of

both the IHS Markit estimate and the consensus expectation. Prior

months were revised higher. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

- Core construction spending slipped 0.1% in June (following modest upward revisions to April and May), in contrast to our assumption of a solid gain. In response, we lowered our forecast of third-quarter GDP growth by 0.2 percentage point to 6.7%.

- Over the three months ending in June, total construction spending rose at only a 0.9% annual rate. The recent trend is sharply slower than that of the last six months, a period over which total construction spending rose at a 6.5% annual rate.

- Core construction spending slowed over this period as well. The slowdown in activity follows a period of rapid growth fueled largely by strength in residential construction spending.

- Low mortgage rates, intra-region migration (from urban to suburban areas), and the release of some pent-up demand has been bolstering residential construction activity.

- Going forward, we expect single-family housing activity to slow. To be sure, limited inventories of homes for sale should support housing construction to an extent. But single-family housing permits are, in fact, trending lower, and the recent trend in permits is still above what we view to be the underlying longer-term demographic trend.

- Recent progress on talks surrounding an infrastructure bill suggest that fiscal support to the construction sector may be in the offing. We are watching these talks closely as we prepare our base forecast.

- The US Senate Judiciary Committee has voted unanimously to advance four bipartisan bills, which it says aim to address the lack of competition in the pharmaceutical industry and the rising cost of prescription drugs. According to a Senate press release, the four bills include: Stop Significant and Time-wasting Abuse Limiting Legitimate Innovation of New Generics Act; Preserve Access to Affordable Generics and Biosimilars Act; Prescription Pricing for the People Act of 2021; and Affordable Prescriptions for Patients Act of 2021. The unanimous decision by the Senate Judiciary Committee means that the four bills will now progress to the wider Senate for a vote. Among the contents of the four bills are measures to restrict "pay-for-delay" deals; to prevent companies from filing frivolous petitions with the FDA to delay the entry of generics and biosimilars; to prevent "evergreening" patent products by making minor modifications to their composition; and to give the Federal Trade Commission (FTC) greater authority to act against anti-competitive practices. (IHS Markit Life Sciences' Milena Izmirlieva)

- Cummins has been selected to complete development of the Advanced Combat Engine (ACE) for the US Army, in a contract worth USD87 million, according to a company statement. Cummins says that its product is a modular and scalable diesel engine solution that uses opposed-piston (OP) technology and it is able to electrify it to create a hybrid solution. Cummins says the OP technology provides "leap-ahead" capabilities in power density and heat rejection. The new contract builds on a multi-year effort by the US Army's Ground Vehicle Systems Center (GVSC) to develop "transformational power density". The US Army is looking for a solution that is power dense, thermally efficient, modular, scalable, and affordable and meets the toughest mobility, survivability, and lethality vehicle requirements. Cummins says its "innovative OP technology provides a 50% increase in power density, a 20% reduction in heat rejection, and 13% improved fuel efficiency when compared to today's best in class combat engine. ACE's flexible layout options allow the engine to be configured in 3 cylinder, 4 cylinder, and 6 cylinder arrangements to deliver power ranging from 750 to 1,500 horsepower. ACE can be integrated into hybrid architectures, enabling commonality, thereby eliminating the expensive logistical burden of having multiple combat powertrains and facilitating the incorporation of new electrified technologies." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous vehicle (AV) startup Argo AI has received permission from the California Public Utilities Commission (CPUC) to offer free rides in its autonomous vehicles on state's public roads, according to Techcrunch. Aurora, AutoX, Cruise, Deeproute, Pony.ai, Voyage, Zoox, and Waymo have all received permits to participate in the CPUC's Drivered Autonomous Vehicle Passenger Service Pilot program, which requires a human safety operator to be behind the wheel. Companies with this permit cannot charge for rides. (IHS Markit Automotive Mobility's Nitin Budhiraja)

- In a press release, Eni announced a new oil discovery at the Sayulita Exploration prospect in Block 10 offshore Mexico. The discovery is estimated to hold an in-place volume of 150 to 200 MMboe of oil and gas. The Sayulita-1 well, located approximately 70 kilometers off the coast and just 15 km away from the Saasken oil discovery, encountered 55 meters (180 feet) of net oil pay and was drilled to a total depth of 1,758 meters (5,768 feet) in 325 meters (1,066 feet) of water, the company said. In June 2017, Eni was awarded Block 10, located in the Sureste Basin. This is the second successful well in the block. In February 2020, Eni announced its first oil discovery at Saasken-1 NFW well in Block 10. Eni is the operator of the block with a 65% interest. Lukoil (20%) and Cairn Energy (15%) are holding the remaining stake. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

Europe/Middle East/Africa

- Most major European equity indices closed higher except for Italy -0.1%; Spain +1.0%, France +1.0%, UK +0.7%, and Germany +0.2%.

- 10yr European govt bonds closed sharply higher; Italy -5bps, UK -4bps, and France/Spain -3bps.

- iTraxx-Europe closed -1bp/46bps and iTraxx-Xover -1bp/235bps.

- Brent crude closed -3.3%/$72.89 per barrel.

- The UK government is said to have secured commitments from companies with large fleets in the country to purchase locally built battery electric light commercial vehicles (LCVs). Daily Telegraph reports that among those that have committed to acquire around 70,000 battery electric vehicles (BEVs) are postal company Royal Mail, energy company BP, telecoms firm BT, retailer Tesco, insurer Direct Line, and utility companies Severn Trent and Scottish Power. (IHS Markit AutoIntelligence's Ian Fletcher)

- Battery electric vehicle (BEV)-maker Rivian is said to be considering a manufacturing facility in the United Kingdom, reports The Sunday Times. According to the newspaper, discussions are taking place with the UK government regarding a possible vehicle production facility near Bristol. It adds that investment could reach GBP1 billion. This is expected to require government backing as well as this investment, but talks are currently at an early stage. The site is also said to be facing competition from Germany and Netherlands. (IHS Markit AutoIntelligence's Ian Fletcher)

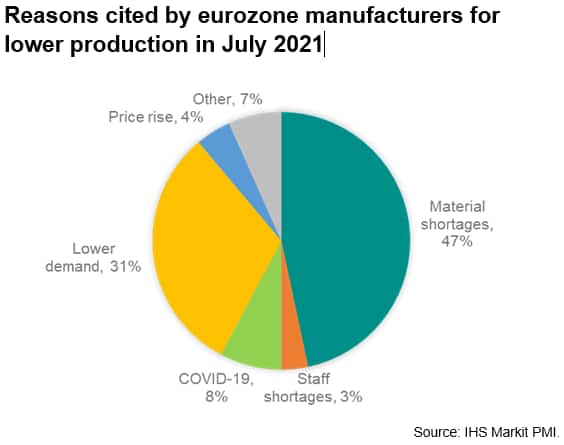

- Growth of eurozone manufacturing cooled slightly in July after

a record-breaking expansion during the second quarter. Having

beaten prior records for a fourth straight month in a row during

June to reach 63.4, the IHS Markit's eurozone manufacturing PMI,

fell back to a four-month low of 62.8 in July. However, that was

still higher than anything seen prior to April in the survey's

24-year history. (IHS Markit Economist Chris

Williamson)

- Although growth of demand has come off the boil slightly as the initial boost from the reopening of the economy fades, the July survey showed inflows of new orders outstripping production to an unprecedented extent in the survey's 24-year history.

- July consequently saw another near-record jump in backlogs of uncompleted orders, and that's despite firms taking on staff at an unprecedented rate in the survey's history during the month.

- Many firms clearly want to produce more goods but are simply unable to due to constraints. An analysis of reasons for production falling by firms reporting lower output across the eurozone during July show that some 47% attributed the decline to shortages of components and other inputs. A further 3% reported that output fell due to insufficient staff numbers. This suggests that half of all cases of falling output were linked to supply side constraints. Note that a further 4% reported that output had fallen as a result of sales being hit by customers baulking at higher prices.

- Mounting concerns about how the Delta variant poses a further

threat to supply chains and staff availability have meanwhile

helped push future growth expectations to the lowest so far this

year. Safety stock building also remains widespread as speculation

about future supply difficulties remains rife, again linked to the

Delta variant and exacerbating the supply and demand imbalance.

- On 30 July, the European Banking Authority (EBA) published the results of its 2021 stress testing exercise, which covered a sample of 50 banks representing 70% of the assets in 15 EU countries. The hypothetical adverse scenario projected a cumulative 12.9% negative deviation in GDP from its baseline projected level, versus an 8.3% deviation in the prior stress testing exercise conducted in 2018: plans to hold tests in 2020 were postponed due to the coronavirus disease 2019 (COVID-19) virus pandemic. On a transitional basis, the Common Equity Tier 1 (CET1) ratio of the sample declined by 497 basis points (versus 410 in 2018) to stand at 10.3%, with a similar outcome on a fully loaded basis. For the largest banks studied, those supervised by the ECB, fully loaded CET1 declined from 14.7% to 9.7%. The sample showed a wide dispersion of results, with the worst-affected bank having its CET1 ratio fall 11.79 percentage points: that of the least-affected firm dropped only 80 basis points (on a transitional basis). The fully loaded leverage ratio is projected to decline from 5.6% to 4.3%. Results for each bank are provided, showing that by 2023, only two banks fell below a 6% CET1 ratio in the adverse scenario, with Monte dei Paschi reaching -0.1% CET1 (fully loaded). (IHS Markit Country Risk's Brian Lawson)

- The European Commission has opened a public consultation on its plan for revising the list of priority substances, including pesticides, that are subject to EU rules for minimizing water pollution. A roadmap outlining its plans was issued last October for feedback. The Commission plans to assess options for revising the three lists of substances that are: monitored to gather data; subject to maximum concentration limits in water; and subject to stronger measures to stop releases to water. The public consultation is open until November 1st. The initiative was prompted by a "fitness check" (REFIT) of EU water legislation that concluded that the operation of the lists and their effectiveness needed improvement. The revision aims to address shortcomings in regular reviews of the lists and the need to accelerate the implementation of measures in EU member states. "Pollution caused by pesticides, PFAS or from residues of pharmaceuticals must be avoided as much as possible," says EU Environment Commissioner Virginijus Sinkevičius. (IHS Markit Crop Sciences' Jackie Bird)

- Five European foundations manufacturers (Sif, Bladt, EEW, Smulders, and Steelwind) have established the Offshore Wind Foundation Alliance (OWFA). The aim of the OWFA is to advocate for a level playing field in the offshore wind foundations market with first-class industry-led EU quality and environmental standards. The OFWA will also lobby for foundations to be supplied from the shortest possible distance to minimize any transport-related carbon footprint. The OFWA is active in Brussels and has started to share its expertise with EU policymakers as part of the European strategy for offshore renewable energy and other related policy areas. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

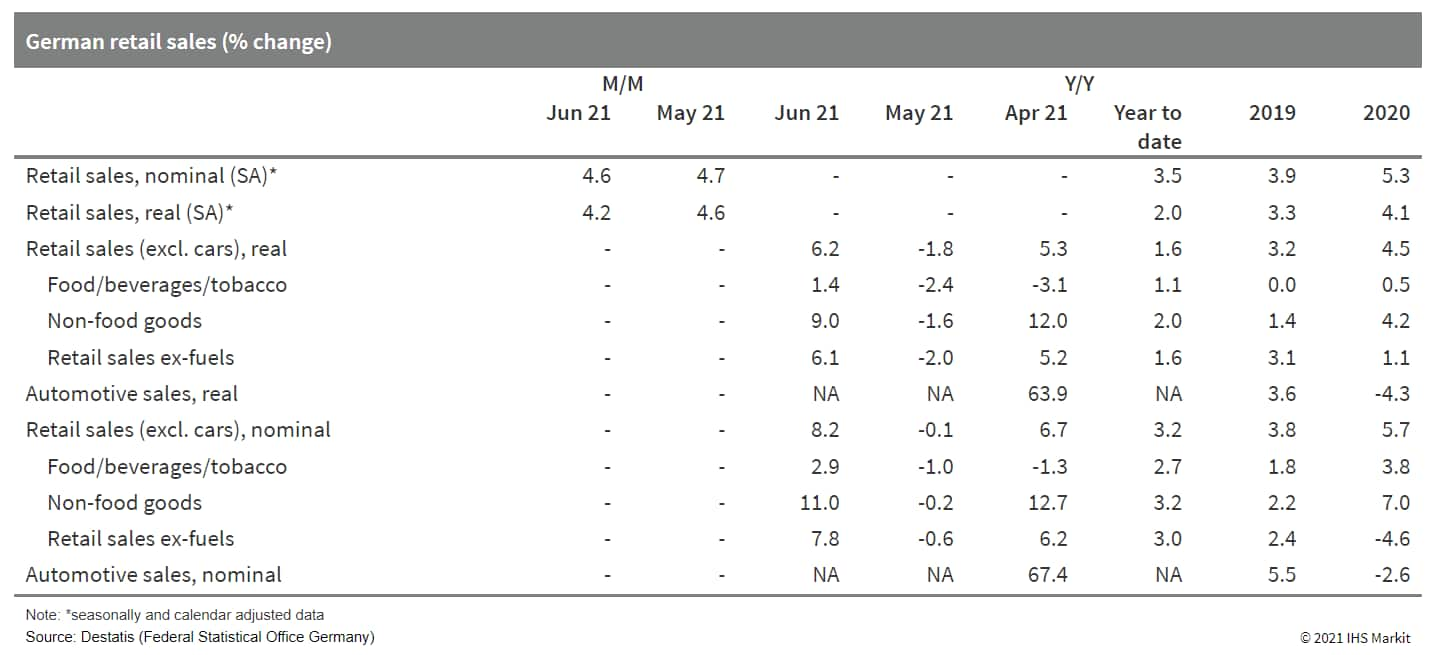

- According to Germany's Federal Statistical Office (FSO) data,

real retail sales excluding cars increased at a similarly sharp

pace in June as in May. They rose by 4.2% month on month (m/m,

seasonally and calendar adjusted), following 4.6% m/m in May and

thus more than offsetting April's one-off plunge of -6.8% m/m. (IHS

Markit Economist Timo

Klein)

- Helped additionally by an extra shopping day versus June 2020, the real adjusted year-on-year (y/y) rate has recovered to 4.6%. Noting that sales in June 2020 had been unusually strong as well, owing to the rebound after the very first lockdown, the gap with February 2020 - just before the pandemic erupted - is even 9.1%.

- Sales buoyancy during May-June is closely linked to the

staggered process of lifting COVID-19 restrictions from mid-May

onwards, with stores for non-essential goods being allowed to

receive customers spontaneously without appointments or tests

again.

- Orsted awarded a USD71 (EUR60 million) contract to Prysmian for the design, supply, termination and testing of inter-array submarine cable systems for the Gode Wind 3 and Borkum Riffgrund 3 offshore wind farms. Prysmian's delivery scope comprises of inter-array cable systems with a total of 150 kilometers of 66 kV XLPE-insulated cables that will connect the wind turbines of Gode Wind 3 to an offshore substation platform. For Borkum Riffgrund 3, the cables will connect the wind turbines to an Offshore Converter Station, where the voltage will be increased and converted for onward transmission to the German mainland. Orsted is the developer of the two offshore wind farms, which have a combined capacity of more than 1,100 MW. As per the Prysmian Group's press release, the cables will be produced in Montereau and Gron (France), as well as in Nordenham (Germany). These projects will add to Prysmian's growing portfolio of 66 kV inter-array cable systems, alongside projects such as Borssele III & IV, Hornsea 2, Hollandse Kust Zuid 3 and 4 and Provence Grand Large in Europe, and Empire Wind in the United States. (IHS Markit Upstream Costs and Technology's Amey Khanzode)

- Ineos says it has sold its sulfur chemicals business to

International Chemical Investors Group (ICIG; Frankfurt, Germany)

for an undisclosed amount. The business is Spain's largest

dedicated manufacturer of sulfuric acid and oleum, serving end

applications ranging from agriculture to chemical intermediates,

Ineos says. It operates a 400,000-metric tons/year manufacturing

facility at Bilbao, Spain. (IHS Markit Chemical Advisory)

- The sulfur chemicals business will become part of WeylChem's advanced intermediates and reagents portfolio, which includes a sulfuric acid and oleum plant at Lamotte, France. WeylChem is ICIG's wholly owned fine chemicals platform and has annual sales of about €460 million ($547 million).

- Privately owned ICIG has three main business areas: fine chemicals under WeylChem; pharmaceuticals under CordenPharma; and chlorvinyls under Vynova. ICIG has combined sales of about €2 billion/year.

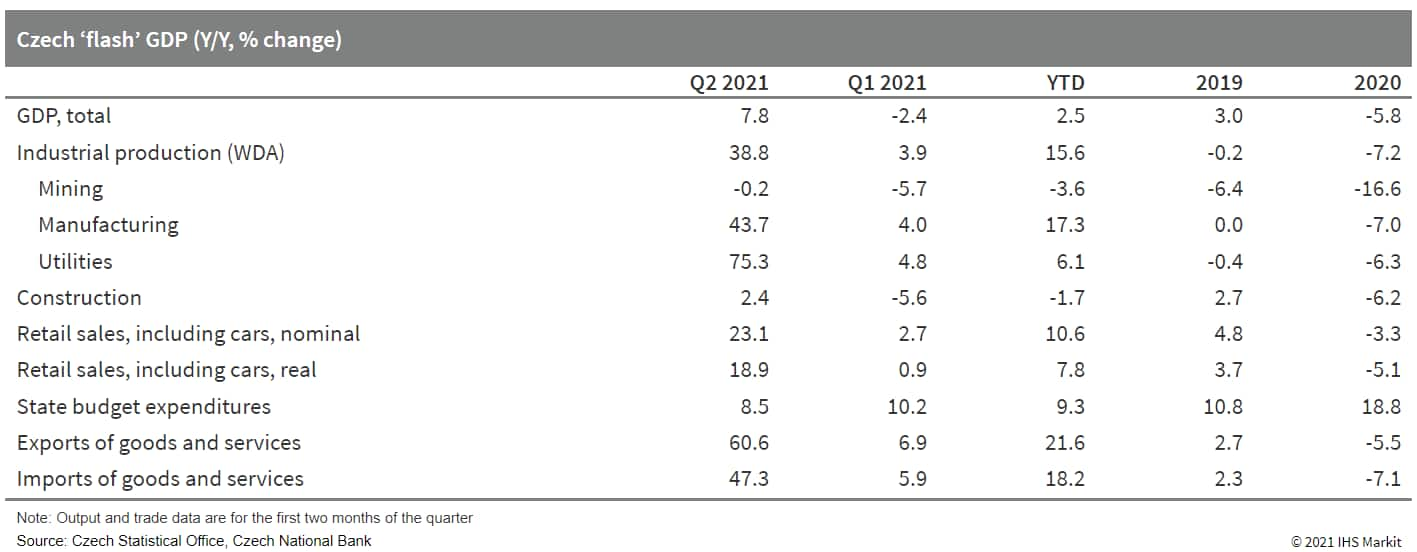

- The Czech seasonally adjusted GDP rose by 0.6% quarter on

quarter (q/q) in the second quarter while increasing by 7.8% year

on year (y/y). IHS Markit's July forecast for second-quarter growth

stood at 0.8% q/q and 8.1% y/y, more optimistic than the actual

result but still below consensus. (IHS Markit Economist Sharon

Fisher)

- So far, output data are only available through May, signaling strong y/y growth in industry, retail sales, and net exports. However, these gains were mainly due to low base effects, and seasonally adjusted data were less favorable, particularly in the case of industrial production and exports.

- According to the Czech Statistical Office, y/y growth during the second quarter was boosted mainly by external demand and gross capital formation, but household consumption also increased. By sector, industry was the main driver of y/y growth, while trade, transport, and hospitality had a positive impact on q/q growth.

- Labor market data have remained favorable. Indeed, employment

rose by 0.8% q/q and 0.4% y/y during the second quarter.

- The Kenyan central bank's monetary policy committee (MPC) left

the key policy rate, the central bank rate, unchanged at 7.0%

during the July meeting. The CBK reports that inflation

expectations in Kenya remain well anchored at 5%, with a margin of

2.5 percentage points on either side, while a negative output gap

limits demand price pressures in the economy. (IHS Markit Economist

Thea

Fourie)

- Headline inflation in Kenya accelerated to 6.3% year on year (y/y) in June, from 5.9% y/y in May, on the back of higher food and fuel prices. The MPC warns that "inflation pressures are expected to be elevated in the near term mainly driven by increases in food and fuel prices, and the impact of the recently implemented tax measures".

- The economic recovery continued during the first half of 2021 with stronger growth in the construction, information and communication, education, and real estate sectors of the economy, the MPC states. Private-sector credit growth reached 7.7% y/y in June, from 6.8% y/y in April. "Strong credit growth was observed in the following sectors: manufacturing (8.1%), transport and communications (11.8%), and consumer durables (23.4%)," the MPC reports, as businesses continued to benefit from the government's Credit Guarantee Scheme, which became operational in October 2020. "The ratio of gross non-performing loans (NPLs) to gross loans stood at 14.0 percent in June compared to 14.2 percent in April," the MPC reports.

- Kenya's current-account deficit averaged 5.4% of GDP during the first half of 2021. A strong rebound in imports of 21.9% y/y, fueled primarily by higher global oil prices, was not matched by export growth, which increased 11.1% y/y over the same period. Remittances remain resilient, growing by 20.4% y/y during the first half of 2021. Kenya's import cover ratio stood at 5.72 months at the end of June.

Asia-Pacific

- All major APAC equity indices closed higher; Mainland China +2.0%, Japan +1.8%, Australia +1.3%, Hong Kong +1.1%, and India/South Korea +0.7%.

- Chinese battery manufacturer SVOLT Energy Technology has started mass production of cobalt-free battery cells for electric vehicles (EVs) at its Jintan plant in China. According to China Daily, the batteries, which consist of 75% nickel and 25% manganese, are 5% less expensive than the conventional nickel-cobalt batteries. The cobalt-free batteries will be first used to power Great Wall Motors's (GWM)'s Ora-badged Cherry Cat, a subcompact electric sedan. With rising competition in the new energy vehicle (NEV) segment in China and limited global supply of cobalt, this low-cost and cobalt-free battery is likely to become popular among automakers, provided the battery's performance does not deteriorate. SVOLT Energy, which is a spin-off from GWM, has announced several new projects in recent months to boost its manufacturing capacity. These new projects include a 20-GWh battery plant in Huzhou. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Mainland China's MingYang Smart Energy has unveiled the new MySE 11-99A1 blade to be used on its latest 11 MW offshore wind turbines. The company, which made announced on its social media site, said that the 99-meter blade, produced at its Guangdong Shanwei offshore blade production facility, is designed for high-wind IEC IB sites and typhoon conditions of up to 70 meters per second wind speed. The company claims that the blade is China's first 100-meter class ultra-long glass-carbon composite blade and incorporates innovative technologies such as the use of glass-carbon composite materials, aerodynamic kit, and a carbon fiber lightning protection system. The blade design will be used on the MySE11-203 hybrid drive offshore wind turbine, which was announced by company around a year ago. The turbine will have a rotor diameter of 203 meters, and will be available commercially in 2022. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Alternative protein company Next Meats has unveiled plans to build a large-scale production facility in Niigata, Japan. In a press conference announcing the construction of the facility, founders Hideyuki Sasaki and Ryo Shirai said the new plant will incorporate a range of sustainable technologies, and is scheduled for completion in summer 2022. Sasaki and Shirai said the new facility should help further stabilize the global supply chain of Next Meats products while lowering retail costs and strengthening the company's R&D capacities. Tokyo-based Next Meats is scheduled to co-produce a new product with Kameda Seika—one of the most prominent snack manufacturers in Japan. The company has also recently signed a cooperative research and development agreement with Nagaoka University of Technology, to study epigenetics and its new applications in developing alternative meat products. Next Meats says it hopes to continue collaborating with local entities and spark open innovations and keep accelerating the growth of the alternative meat industry in Japan, and the world. (IHS Markit Food and Agricultural Commodities' Max Green)

- Toyota and Sumitomo Mitsui Banking Corporation (SMBC) will invest in another fund, established by SPARX Group, that will support the development of advanced technologies, according to a company statement today (2 August). The new fund, Mirai Creation Fund III, will also include global companies that provide solutions promoting carbon neutrality in addition to the five categories of intelligent technology (such as artificial intelligence), robotics, technologies for a hydrogen-powered society, electrification, and new materials that Fund II (formed in October 2018) focused on. The Mirai Creation Fund III investment activities are expected to begin operations from October 2021 with a total capital of about JPY15.0 billion (USD136.7 million). The fund will try to attract more investors by March next year, which could take its total investment capital to about JPY100 billion. (IHS Markit AutoIntelligence's Isha Sharma)

- South Korea's GDP grew by 0.7% quarter-on-quarter (q/q) in the

second quarter of 2021, following an increase of 1.7% q/q in the

first quarter of 2021. GDP rose by 5.9% year-on-year (y/y) in the

second quarter of 2021, compared with growth of 1.9% y/y in the

first quarter of 2021. (IHS Markit Economist Rajiv

Biswas)

- Continued economic expansion in the second quarter of 2021 was underpinned by strong consumption expenditure growth. Private consumption expanded by 3.5% q/q, compared with growth of 1.2% q/q in the first quarter of 2021. Government consumption spending also strengthened, rising by 3.9% q/q in the second quarter of 2021, compared with growth of 1.6% q/q in the first quarter of 2021. Overall, final consumption expenditure rose by 3.6% q/q in the second quarter, strengthening compared with growth of 1.3% q/q in the first quarter.

- Compared to a year ago, final consumption expenditure rose by 4.1% y/y in the second quarter, improving on the 1.5% y/y growth rate in the first quarter. In 2020, final consumption had been in a protracted slump, having recorded four consecutive quarters of negative year-on-year growth. The Ministry of Trade, Industry and Energy released data showing that South Korea's overall retail sales saw year-on-year growth of 11.4 percent in June.

- Manufacturing output grew by 13.7% y/y in the second quarter of 2021, reflecting increasing output of autos, electronic, optical and chemical products, with strengthening business conditions. Auto production rose by 11.5% y/y during the first six months of 2021.

- The seasonally adjusted IHS Markit South Korea Manufacturing Purchasing Managers' Index (PMI) edged up to 53.9 in June from 53.7 in May, indicating a further improvement in the health of the manufacturing sector and extending the current sequence of expansionary conditions to nine months.

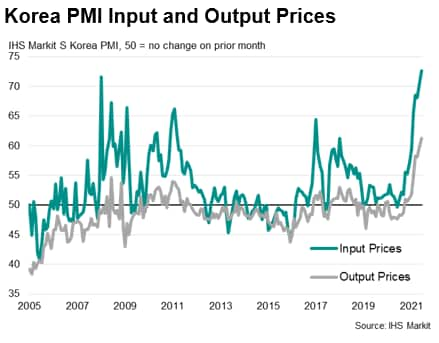

- In the latest IHS Markit South Korea Manufacturing PMI Survey,

manufacturers pointed to a further acceleration in input cost

inflation during June. Input price pressures intensified in the

latest survey period and were the steepest on record as businesses

widely reported sharp rises in the cost of raw materials amid acute

shortages. At the same time, South Korean goods producers sought to

pass these costs on to clients, resulting in the strongest rise in

output prices since the survey began in April 2004.

- Nine companies have submitted letters of intent (LOIs) to acquire struggling South Korean automaker SsangYong, which is currently under court receivership, reports The Korea Herald. They include Cardinal One Motors, set up by US-based auto importer and distributor HAAH Automotive Holdings, a consortium led by Korean electric bus maker Edison Motors, another led by Korean electric scooter maker K-Pop Motors, Samra Midas Group, and a local private equity. SsangYong and its lead manager EY Hanyoung plan to conduct preliminary due diligence on the companies that pass an initial screening process by the end of August. They aim to select a preferred bidder in September. (IHS Markit AutoIntelligence's Jamal Amir)

- Ashok Leyland's UK-based electric vehicle (EV) arm Switch Mobility has announced a strategic agreement with Dana Incorporated, a drivetrain and e-propulsion system supplier, reports Live Mint. Under the terms of the agreement, Dana will make a strategic investment in Switch Mobility. The components company will also be a preferred supplier of electric drivetrain components for Switch mobility's e-bus and EV commercial vehicle offering (and will include e-axles, gearboxes, motors, and software, among others). (IHS Markit Automotive Mobility's Tarun Thakur)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-august-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-august-2021.html&text=Daily+Global+Market+Summary+-+2+August+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-august-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 2 August 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-august-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+2+August+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-2-august-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}