Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 16, 2021

Daily Global Market Summary - 16 September 2021

All major European equity indices closed higher, while US and APAC markets closed mixed. US government bonds closed lower, while benchmark European bonds closed mixed. CDX-NA and European iTraxx closed almost unchanged across IG and high yield. The US dollar, natural gas, and Brent closed higher, WTI was flat, and gold, copper, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except for Nasdaq +0.1%, Russell 2000 -0.1%, S&P 500 -0.2%, and DJIA -0.2%.

- 10yr US govt bonds closed +3bps/1.33% yield and 30yr bonds +2bps/1.88% yield.

- CDX-NAIG closed flat/46bps and CDX-NAHY flat/273bps.

- DXY US dollar index closed +0.4%/92.93.

- Gold closed -0.7%/$1,795 per troy oz, silver -4.2%/$22.79 per troy oz, and copper -2.8%/$4.28 per pound.

- Crude oil closed 0%/$72.61 per barrel and natural gas closed +3.8%/$5.46 per mmbtu.

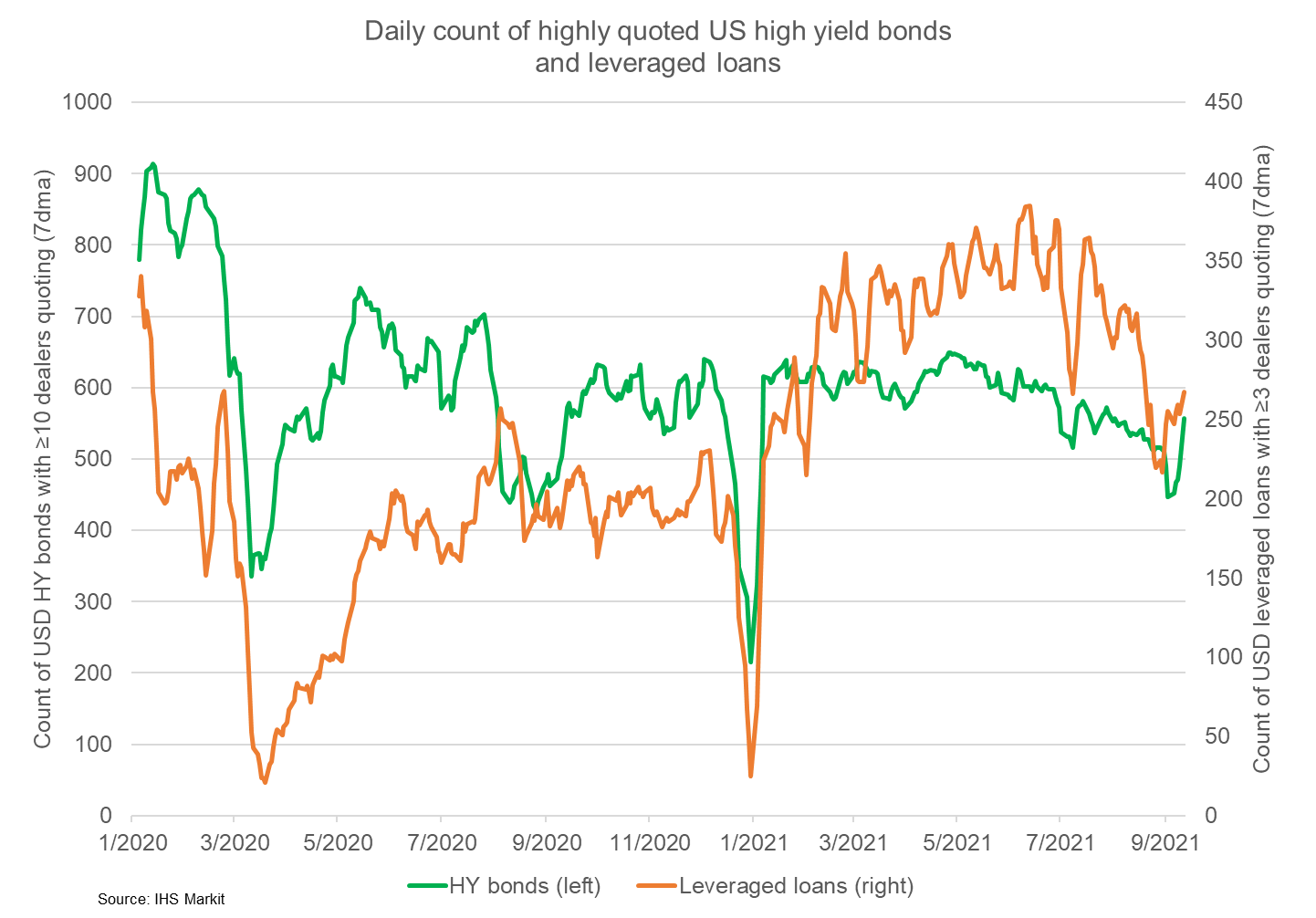

- The below graph shows the 7-day moving average of the number of

US high yield bonds quoted by 10 or more dealers (left axis)

alongside the number of US leveraged loans quoted by three or more

dealers (right axis). Quote depth is a proven liquidity metric and

the data highlights the declines and then recovery in liquidity for

both sectors in 2020. In addition, the chart shows the typical

seasonal declines in liquidity in December and how liquidity for

both have recently been picking up since Labor Day.

- Hyundai has partnered with the US-based solar firm OCI Solar Power and utility firm CPS Energy to test recycled electric vehicle (EV) batteries for solar energy storage, according to a company statement. They plan to install the energy storage system (ESS) by September 2022 in San Antonio (Texas, US). Hyundai will develop the ESS, while OCI Solar Power will procure certain ESS components and supervise construction and CPS Energy will operate the ESS. All three parties will work to build the ESS and then analyze and share data from the project. In light of the project, the three companies will further expand partnership in other renewable energy projects. (IHS Markit AutoIntelligence's Jamal Amir)

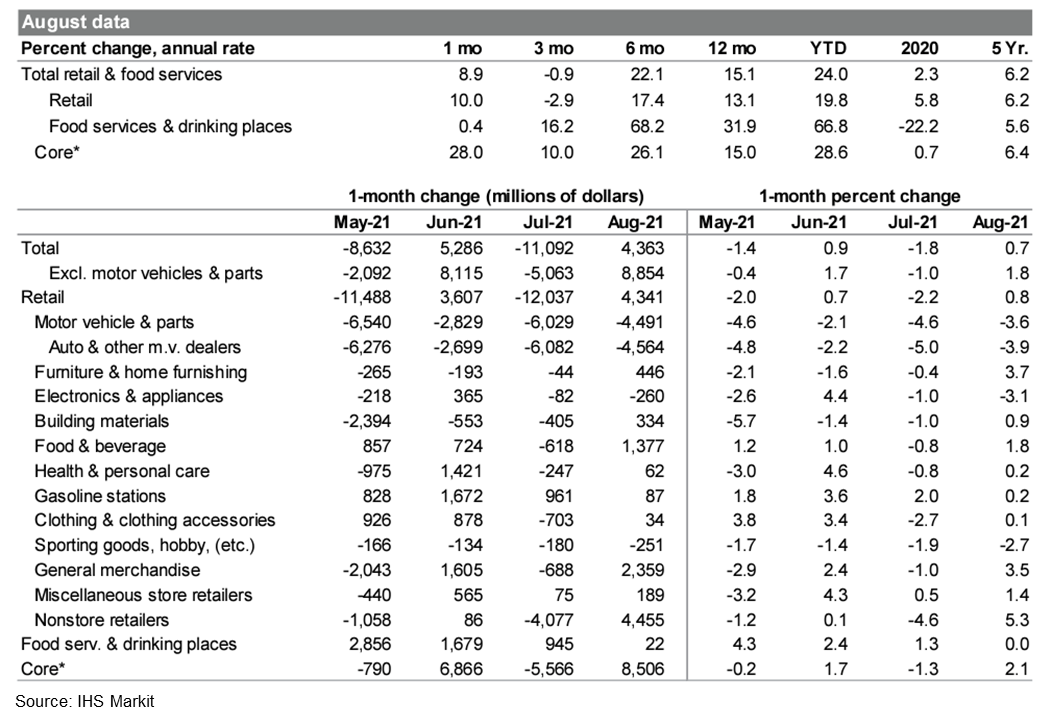

- Total US retail trade and food services sales increased 0.7% in

August. Excluding autos and gasoline stations, retail sales rose

2.0%. (IHS Markit James

Bohnaker and William Magee)

- Retail sales were broadly higher with nonstore retail (up 5.3%), furniture & home furnishing stores (up 3.7%), and general merchandise stores (up 3.5%) leading the way. Retailers in these categories likely benefitted from an uptick in back-to-school shopping as most students resumed in-person learning this year.

- Sales at motor vehicle and parts dealers declined 3.6% in August, extending a four-month slide after sales peaked in April. Consumers satisfied much of their demand for autos with the support of early-year stimulus, and now semiconductor chip shortages and high retail prices are hampering sales.

- Sales at food services and drinking places were roughly unchanged (0.0%), which is generally consistent with the plateau in the number of seated diners on the OpenTable platform during August.

- Retail sales rebounded strongly and broadly in August as

consumers showed an ongoing proclivity to purchase goods while

likely pulling back on some services amid concerns about the Delta

variant. This may signal a more gradual return to pre-pandemic

spending patterns as virus concerns are likely to linger. However,

supply chain disruptions are a downside risk for retail sales over

the upcoming holiday shopping season.

- US seasonally adjusted initial claims for unemployment

insurance increased by 20,000 to 332,000 in the week ended 11

September. Despite edging higher last week, claims continue to

trend lower and show no signs of a new round of layoffs in response

to the fourth wave of COVID-19; however, there was some localized

weakness reflecting fallout from Hurricane Ida. Louisiana, which

was the hardest hit by the hurricane, reported the largest increase

in claims for the second straight week, with unadjusted claims

rising from 9,724 to 13,782 in the week ended 11 September. (IHS

Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 187,000 to 2,665,000 in the week ended 4 September, hitting its lowest since 14 March 2020. The insured unemployment rate fell 0.2 percentage point to 1.9%.

- In the week ended 28 August, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) inched up by 787 to 3,805,795.

- In the week ended 28 August, continuing claims for Pandemic Unemployment Assistance (PUA) rose by 396,709 to 5,487,233.

- Pandemic-related federal unemployment benefits expired on 5 September. As a result, more than nine million people claiming benefits under PUA and PEUC will lose access to benefits entirely and individuals claiming regular state benefits will see their weekly checks reduced by $300.

- In the week ended 28 August, the unadjusted total of continuing claims for benefits in all programs rose by 178,937 to 12,106,727.

- Ford Motor Company and technology partner Argo AI have teamed up with US retail giant Walmart to launch an autonomous delivery service in Miami, Austin, and Washington, DC. This is Walmart's first collaboration on multi-city autonomous deliveries in the United States. The service will use Ford autonomous test vehicles equipped with Argo AI's autonomous system to deliver orders to Walmart customers. This will enable Walmart customers within the defined service areas of the three cities to place online orders for groceries and other popular items for door-to-door autonomous delivery to their homes. Delivery services are an attractive option as one of many potential autonomous-vehicle business use cases. The expectation is that, eventually, being able to eliminate the cost of a human driver could make delivery services far more affordable for both the merchant and the consumer. This autonomous delivery trial comes as Walmart has mentioned that consumer expectations are shifting to next-day or same-day delivery, particularly in urban areas with a higher concentration of deliveries. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The much anticipated 800 MW Vineyard Wind project in the United States has achieved financial close, announced joint-venture partners Avangrid Renewables and Copenhagen Infrastructure Partners (CIP). The construction of the project will be financed through USD2.3 billion of senior debt raised from nine international and US-based banks. The project will provide notice to proceed to its contractors in the coming weeks. Onshore work will begin this quarter with offshore work targeted for 2022. First power is expected to be delivered to the grid in 2023. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Rivian is looking to raise between USD5 billion and USD8 billion from the initial public offering (IPO) it registered with US regulators last month, reports Reuters. According to the report, the Amazon- and Ford-backed company's IPO, therefore, will be one of the biggest IPOs launched in the United States in recent years. Rivian is seeking a valuation of around USD80 billion, with the IPO expected to take place in October or November, according to the report, citing sources familiar with the deal. (IHS Markit AutoIntelligence's Tarun Thakur)

- The defense arm of General Motors (GM) has announced that it has won a USD36.4-million contract to produce 10 heavily armored versions of its Surburban sport utility vehicle (SUV) for the US State Department. GM Defense said that it would deliver the vehicles over the next two years as part of a development contract for the State Department's Diplomatic Security Service. GM Defense expects this contract to be a precursor to another contract that will begin in 2023, under which the subsidiary will commit to annual production of 200 heavy-duty Surburbans over a period of nine years, although GM gave no information on the potential value of this contract. (IHS Markit AutoIntelligence's Tarun Thakur)

- Though US broiler chicken production increased 21% between 2010

and 2020, new efforts focused on sustainability and resource

conservation have resulted in across-the-board improvements in key

sustainability intensity measures, such as reduced water

consumption, lower land use, and smaller carbon footprint,

according to the first-ever sustainability report for the chicken

broiler industry. (IHS Markit Food and Agricultural Policy's

Margarita Raycheva)

- The report was released Wednesday (September 15) and featured findings from a 2020 third-party broiler life cycle assessment (LCA) data showing that for every kilogram of live weight of broiler chicken and cull breeder hen produced between 2010 and 2020, the industry achieved reductions, including: 22% decrease in particulate-forming emissions; 18% decrease in carbon footprint; and 13% drops in both water consumption and land use.

- The report found more room for improvement in the cumulative impact of broiler production, where just two of the five key sustainability indicators showed a decrease.

- For cumulative broiler chicken production in the past decade, the carbon footprint decreased only 0.8% and use of fossil resources decreased by 5.7%. Meanwhile, cumulative land use and water consumption went up 5.4%, and particulate-forming emissions increased 4.4% between 2010 and 2020.

- Canadian housing starts fell 3.9% month over month (m/m) to

260,239 units (annualized). (IHS Markit Economist Chul-Woo

Hong)

- Urban single and multiple starts decreased 2.0% m/m and 5.7% m/m, respectively, while rural starts rebounded 5.1% m/m.

- The solid gains in Ontario and Manitoba were offset by the widespread regional declines in the rest of Canada.

- Despite the further monthly drop, it is still at a historically strong level with a high level of total dwellings under construction while the momentum has decelerated.

- The largest contribution to the overall monthly starts decline was the 21.2% m/m plunge in Quebec's multifamily starts, with significant declines in Montreal and Quebec City.

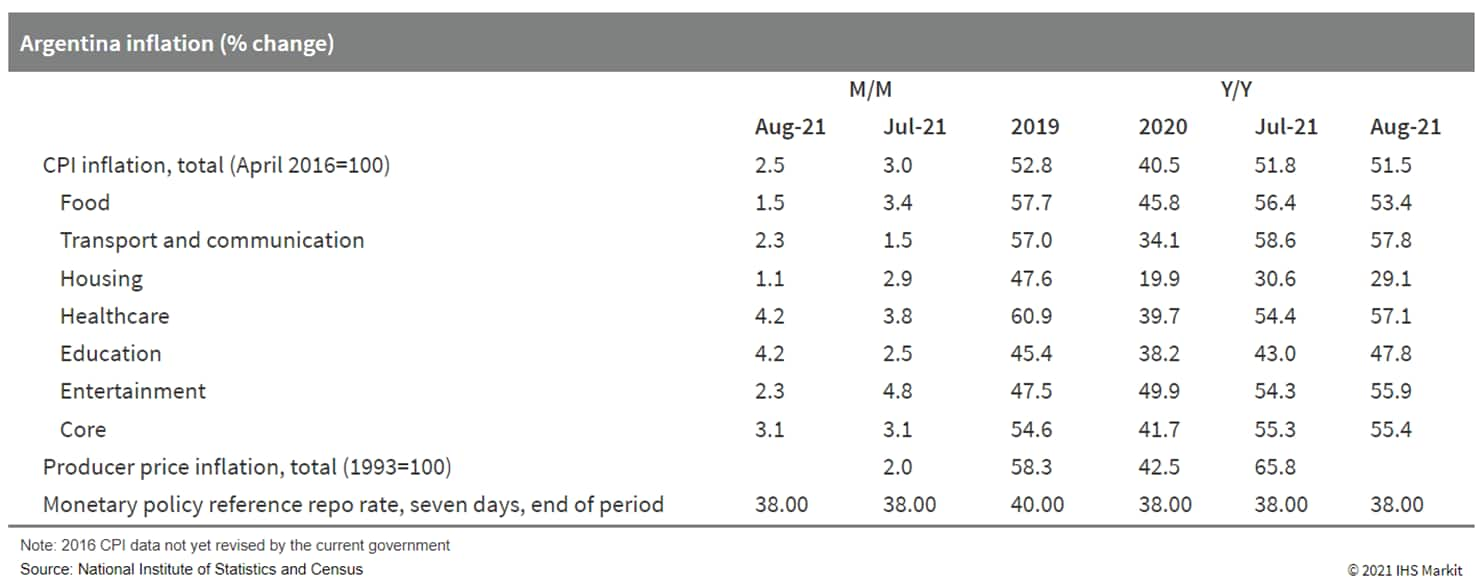

- Argentina's consumer price index (CPI) increased by 2.5% month

on month (m/m) during August. The increase in consumer prices was

most pronounced in the healthcare, education, and the clothing and

apparel sectors. (IHS Markit Economist Paula

Diosquez-Rice)

- Argentina's inflation rate in August was driven by price increases in service sectors: healthcare, education, leisure, and culture. In the food and beverages category, there were substantial price rises for coffee, rice, dairy products, and fresh produce, as well as increases in the alcoholic beverages and transportation sectors. The rise in the transportation component was mainly driven by the increase in vehicle prices and the cost of personal vehicle maintenance.

- The prices of regulated items increased by 1.1% m/m, driven by the adjustment in petrol prices, while the prices of seasonal items rose by 0.6% m/m. The core inflation rate stood at 3.1% m/m. Wholesale prices climbed by 66% year on year (y/y) in July, a lower rate compared with the previous month. The annual CPI rate in August was slightly lower than the July rate.

- Inflation expectations for the next 12 months remain very high;

Torcuato Di Tella University reported a median of 50% y/y, similar

to the previous month. However, the average expected annual

inflation rate declined to 48%, from 49.1% in July 2021. The

inflation expectation survey by the country's central bank, the

Central Bank of the Argentine Republic (Banco Central de la

República Argentina: BCRA), shows a median of 43.7% in August.

Europe/Middle East/Africa

- All major European equity indices closed higher; Spain +1.1%, Italy +0.8%, France +0.6%, and Germany/UK +0.2%.

- 10yr European govt bonds closed mixed; Italy -1bp, France/Spain flat, Germany +1bp, and UK +4bps.

- iTraxx-Europe closed flat/45bps and iTraxx-Xover -2bps/224bps.

- Brent crude closed +0.3%/$75.67 per barrel.

- Harland & Wolff owned by Infrastrata, has signed a

Memorandum of Understanding (MoU) with Navantia and Windar

Renovables to target specific fixed and floating offshore wind

projects. This MOU aims to actively secure wind farm development

projects and execute them together primarily within the UK. (IHS

Markit Upstream Costs and Technology's Monish Thakkar)

- Harland and Wolff operates four yards Methil, Belfast, Arnish and Appledore. The combined footprint of four sites together is of over 334.6 hectares, with well over 72,000 meter square of undercover fabrication capacity. Both companies are currently investing in a new XXL monopile facility in Spain.

- The JV between Navantia and Windar Renovables have been working together since 2015 after which they have executed of seven offshore wind projects. They are currently fabricating and assembling 62 jackets for Iberdrola's St Brieuc offshore wind farm after having recently completed five floating hull foundations for the Scottish based, Kincardine Floating Offshore wind farm.

- GE Renewable Energy has received planning approval for its 78,000 square meter Teesside offshore wind blade manufacturing plant. The approval will allow GE to begin construction later this October at the South Bank of Teesworks, once the final contractual documents are completed. The Opening of the plant is planned for 2023. The facility, which will be operated by GE's LM Wind Power, will be dedicated to the production of 107-meter long blades for GE's Haliade-X wind turbines, which are to be supplied to the three phases of the 3.6 GW Dogger Bank offshore wind farm. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

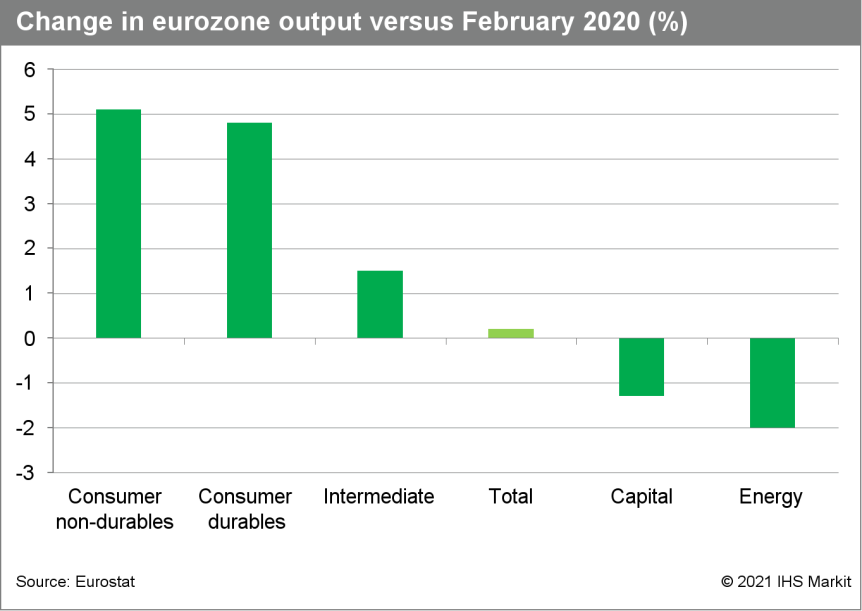

- Eurozone industrial production rose by 1.5% month on month

(m/m) in July, the highest increase for eight months and almost one

percentage point higher than the market consensus expectation (of

0.6% m/m, according to Reuters' survey). June's initially reported

decline of 0.3% m/m has also been moderated to a marginal 0.1% m/m

fall. (IHS Markit Economist Ken

Wattret)

- As of July, eurozone industrial production was 0.2% above February 2020's pre-pandemic level.

- Manufacturing production data were stronger still. Output jumped by 1.8% m/m in July, again the largest increase for eight months, and was 0.4% above February 2020's level.

- The breakdown of July's eurozone data by good type shows broad-based strength. All categories of production increased versus June, except for energy (-0.6% m/m), which contracted for the third straight month.

- Production of non-durable consumer goods (+3.5% m/m) and capital goods (+2.7% m/m) outperformed in July, although the rebound in the latter followed declines in four of the prior five months.

- Production of energy (-2.0%) and capital goods (-1.3%) remained

below their pre-pandemic levels in July, while production of

intermediate (+1.5%), consumer durables (+4.8%), and consumer

non-durables (+5.1%) were well above.

- Nikola is preparing with its production partner Iveco to begin manufacturing its first heavy-duty electric truck in Germany, according to a Bloomberg report. Nikola showed the news agency the production line in Ulm, where its manufacturing partner Iveco will begin series production of the Nikola Tre heavy-duty trucks by the end of the year. The Tre has a claimed range of 560 km (348 miles) and is will be used for shorter duty cycles such as moving freight within industrial ports or refuse collection. The Tre uses an Iveco platform with modules from the latter's production facility in Spain. (IHS Markit AutoIntelligence's Tim Urquhart)

- A second estimate shows French EU harmonized prices rising by

2.4% year on year (y/y) in August. This matches a provisional

estimate published in late August and follows readings of 1.5% in

July and 1.9% in June. (IHS Markit Economist Diego

Iscaro)

- June's inflation rate was the highest since October 2018.

- Core inflation, which is not released with the provisional estimate, accelerated from 0.4% in July to 1.5% in August, the highest reading since July 2012.

- The acceleration in core inflation was due to higher prices of manufactured goods. They rose by 1.1% y/y, their highest increase since 2012.

- Prices of clothing and footwear, which had fallen by 7.1% y/y in July, jumped by 4.6% y/y, influenced by the change in timing of the summer sales compared with 2020. Prices of 'other' manufactured goods also rose, by 1.0% y/y.

- Higher energy prices continued to be the main contributor to inflation in August. They increased by 12.7% y/y, boosted by a 31.2% y/y increase in gas prices, while petroleum products and electricity prices rose by 16.9% y/y and 2.2% y/y, respectively.

- Food price growth accelerated from 0.9% y/y in July to 1.3% y/y, driven by a 6.8% y/y increase in prices of fresh food products.

- Service price inflation (which accounts for almost 50% of the overall index) stood at 0.7% in August, slightly above 0.6% in July. Transport services prices rose by 3.7% y/y (compared with 2.0% y/y in July), while the increase in housing costs accelerated from 1.1% y/y to 1.3% y/y.

- Private equity firm Apollo Global Management (New York, New

York) has entered into exclusive talks to acquire Kem One Group

(Lyon, France), one of Europe's leading integrated polyvinyl

chloride (PVC) and caustic soda producers, for an undisclosed

amount. Apollo and Kem One's president and sole owner Alain de

Krassny are in negotiations for the sale of Kem One to Apollo funds

managed by affiliate companies, Apollo says. The proposed sale, for

which the two parties have signed a put option agreement, is

expected to be finalized by the end of the year.(IHS Markit

Chemical Advisory)

- Kem One's most recent sales information, published on its website in 2017, states its annual turnover at €800 million ($944 million).

- Kem One has eight industrial sites located in France and Spain, leading positions in both mass and suspension PVC in Europe, and recognized expertise in specialty PVC, including paste PVC and post-chlorinated PVC, and chlorinated derivatives, according to Apollo. The company is Europe's second-largest producer of PVC, producing 870,000 metric tons/year, as well as 660,000 metric tons/year of chlorine, and 730,000 metric tons/year of caustic soda, according to Kem One's website.

- The company's industrial footprint is based primarily in France at Saint-Fons, Balan, Saint-Auban, Berre, Lavéra, Fos-sur-Mer, and Vauvert, and also in Hernani, Spain. Kem One has nearly 1,400 employees, divided between its industrial sites, R&D laboratories, sales offices in Europe, and its Lyon head office. It is also a leading producer in France of low-carbon hydrogen, it says. Kem One produces 18,000 metric tons/year of hydrogen and 10,000 metric tons/year of hydrogen chloride, according to its website.

- Kem One and de Krassny were advised by Evercore as sole strategic and financial advisor, with Orrick, Herrington & Sutcliffe acting as legal advisor.

- The Apollo funds were advised by Paul, Weiss, Rifkind, Wharton & Garrison and Bredin Prat as legal advisors. Debt financing for the transaction will be provided by J.P. Morgan, Barclays, HSBC, and RBC Capital Markets, who are also serving as financial advisors to the Apollo funds in connection with the transaction.

- Volvo Cars is on course for an initial public offering (IPO) before the end of the year, reports Reuters. Sources have told the news service that Zhejiang Geely Holdings is in advanced discussions with a number of financial institutions for a listing in Stockholm (Sweden), with this process expected to begin before the end of September. The sources said that Goldman Sachs and SEB are leading the transaction, while other banks involved in the deal include BNP Paribas, Carnegie and HSBC. One source said that Volvo is hoping to secure a valuation of around USD20 billion, while another has said that the valuation range is between USD20 billion and USD30 billion. However, a third source suggested that a valuation of USD16 billion was more realistic, citing Volvo's revenue outlook. (IHS Markit AutoIntelligence's Ian Fletcher)

- Petrofac has signed an agreement with carbon capture technology company, CO2 Capsol, which enables collaboration on carbon capture projects. Under the terms of the non-exclusive agreement, Petrofac will work as a preferred engineering services partner to support CO2 Capsol's carbon capture opportunities across the UK and Europe. Under the terms of the agreement, Petrofac will combine its engineering and project delivery experience with CO2 Capsol's carbons capture technology. Petrofac and CO2 Capsol are currently working together on a planned CO2 capture facility at one of Stockholm Exergi's combined heat and power plants in Sweden. Stockholm Exergi awarded a Front-End Engineering Design (FEED) contract to Petrofac and selected CO2 Capsol's End of Pipe (EoP) solution as its capture technology. Design work has begun on what will be the largest Bio Energy Carbon Capture and Storage (Bio-CCS) plant in Europe, and Petrofac will integrate CO2 Capsol's capture technology, which is based on the Hot Potassium Carbonate (HPC) process, to deliver the FEED study. Petrofac has also previously gained a foothold in the carbon capture market through the winning of an engineering and project management office support contract for the Acorn Carbon Capture and Storage (CCS) and hydrogen project in the United Kingdom, which was awarded in June 2020. (IHS Markit Upstream Costs and Technology's William Cunningham)

- Real seasonally adjusted retail trade sales in South Africa

decreased in July, falling by 11.2% month on month (m/m) and 1.9%

year on year (y/y). This follows the 40.4% y/y expansion in retail

sales recorded during the second quarter, as the low base of

comparison last year was a period of business disruptions related

to government restrictions imposed to contain the COVID-19 virus

outbreak. (IHS Markit Economist Thea

Fourie)

- Social unrest, particularly in KwaZulu-Natal and Gauteng provinces, and the reinstatement of COVID-19 pandemic-related restrictions, although to a lesser degree than in the second quarter of 2020, pulled real seasonally adjusted retail trade sales down during July. Sale volumes of general dealers took the biggest hit, falling by 21.8% m/m during July, followed by sales of food, beverages, and tobacco (down 13.6% m/m) and household furniture, appliances, and equipment (down 4.4%v m/m). Other retail sales volumes, in seasonally adjusted terms, decreased 11.9% m/m in July.

- South Africa's seasonally adjusted retail trade sales at current prices fell by ZAR11.5 billion (USD793 million) during July from a month earlier, but they were still up by 3.1% y/y. The biggest annual declines in sales at current prices were recorded in the categories of household furniture and appliances stores (down 9.6% y/y) and hardware, paint, and glass (down 1.4% y/y). Retail sales at current prices of pharmaceuticals and medical goods, cosmetics and toiletries increased 6.9% y/y, spurred by the spread of the Delta variant of COVID-19 across the country, while sales at current prices of textiles, clothing, footwear, and leather goods rose by 12.2% y/y.

- Tanzanian President Samia Suluhu Hassan appointed January Makamba as minister of energy on 12 September, replacing Medard Kalemani. Kalemani was a relative of former president John Magufuli and a proponent of his resource nationalism policy. Between 2018 and 2020, the Natural Gas Audit Committee reviewed production-sharing agreements (PSAs) in the oil and gas sector with a view to increasing the state take, although renegotiations of the PSAs have not yet begun. Separately, negotiations between investors and the government to establish a Host Government Agreement (HGA) to construct a USD30-billion liquefied natural gas (LNG) export terminal in Lindi have stalled since 2019 under Kalemani's stewardship. IHS Markit sources state that Kalemani was unreceptive to President Hassan's announcement that his ministry would expedite the negotiations. As chairman of the parliamentary committee on energy and minerals under the economically liberal former presidency of Jakaya Kikwete (in office 2005-15), Makamba publicly proposed that the state-owned power company TANESCO should be split into three businesses (generation, transmission, and supply) and privatized. (IHS Markit Country Risk's William Farmer)

Asia-Pacific

- Major APAC equity markets closed mixed; India +0.7%, Australia +0.6%, Japan -0.6%, South Korea -0.7%, Mainland China -1.3%, and Hong Kong -1.5%.

- Chinese electric vehicle (EV) startup Leapmotor has signed an agreement with the China Construction Bank in Zhejiang, China. According to a Gasgoo report, the bank is to provide CNY10 billion (USD1.5 billion) in funding to the automaker over the next five years and both parties are to co-operate in offering various financial services, such as assets management, supply-chain finance, auto finance, and settlement. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Thai-based oil and gas conglomerate PTT Plc and Taiwan's Foxconn will set up a new company to build an electric vehicle (EV) production facility worth USD1-2 billion in Thailand's Eastern Economic Corridor, reports the Bangkok Post. The new company, which is yet to be named, will be established with registered capital valued at not more than THB3.22 billion (USD97.8 million). Registration of the company is expected to be completed by the fourth quarter of this year. PTT is investing in the new company through its wholly owned Arun Plus Co., while Foxconn is making its investment through its wholly owned Lin Yin International Investments Co., highlights the report. The final investment decision will be made within the second half of next year. Arun Plus and Lin Yin will hold 60% and 40% stakes, respectively, in the new company, according to PTT president and chief executive Auttapol Rerkpiboon. The new EV production facility will serve end-to-end operations covering the design, manufacture, and assembly of EVs, as well as producing key components for such vehicles. The plant will initially have the capacity to produce 50,000 vehicles per year, which will increase to 150,000 vehicles annually in the next stage. As reported earlier, the facility will initially cater to the domestic market and will gradually export to countries in the Association of Southeast Asian Nations (ASEAN) region. (IHS Markit AutoIntelligence's Jamal Amir)

- Japan's trade balance recorded a deficit of JPY635 billion

(USD5.8 billion) on a non-seasonally adjusted basis in August. The

seasonally adjusted balance also recorded a deficit (JPY272

billion) for the third consecutive month. Exports continued to rise

but growth softened to a 26.2% year-on-year (y/y) increase

following a 37.0% y/y rise in the previous month, while imports

accelerated to 44.7% y/y after a 28.5% y/y rise. (IHS Markit

Economist Harumi

Taguchi)

- The major contributors to export growth were iron and steel, semiconductor production machinery, auto parts, semiconductors, and plastics; however, the overall softer increase in exports was partially because of easing low base effects and declines in the exports of autos and aircraft. Semiconductor and part shortages due to the infections caused by the Delta variant of the COVID-19 virus in Asia have suppressed production of autos and electrical machinery.

- Higher prices for energy and other commodities continued to drive import growth. While imports of mineral fuels remained the major driver of imports, accounting for 15.8 percentage points of total imports, other major contributors include medical products, iron ore and concentrates, non-ferrous metals, and semiconductors.

- South Korean electric bus manufacturer Edison Motors, electric vehicle (EV) and battery manufacturer EL B&T, and US-based EV startup Indi EV have submitted final bids for a controlling stake in SsangYong, reports the Maeil Business News Korea. The Edison Motors-led consortium has proposed KRW800 billion (USD684 million) to KRW1.5 trillion for the buyout of SsangYong and future research and development (R&D) investment. It has already raised KRW270 billion from individual investors, while private equity funds (PEFs) Korea Corporate Governance Improvement (KCGI) and Keystone Private Equity have pledged investment of KRW400 billion. Edison aims to transform SsangYong into an EV-focused automaker in the next decade in line with changes in the automotive market. SsangYong has been struggling with snowballing debts amid the coronavirus disease 2019 (COVID-19) virus pandemic and the Seoul Bankruptcy Court put the debt-laden automaker under court receivership on 15 April. A majority stake in SsangYong was put up for auction on 28 June after its Indian parent company Mahindra & Mahindra (M&M) failed to attract an investor. (IHS Markit AutoIntelligence's Jamal Amir)

- India's Union Cabinet announced the approval of a Production Linked Incentive (PLI) scheme with a budgetary outlay of INR259.5 billion (USD3.5 billion) to boost domestic manufacturing capabilities of the automobile industry, reports Business Standard. The scheme includes electric vehicles (EVs) and hydrogen fuel cell electric vehicles (FCEVs). According to the source, the scheme will be effective from fiscal year (FY) 2023 for five years, while the base year for eligibility criteria would be FY 2020. The incentives offered by the government over a five-year period seek to attract more than INR425 billion in investment in production of EVs and FCEVs, generate 2.3 trillion units of incremental production, and generate 760,000 jobs. The scheme can be used by OEMs with a minimum of INR100 billion in revenue and INR30-billion investment in fixed assets, while component suppliers should have a minimum revenue of INR5 billion and INR1.5-billion investment in fixed assets. (IHS Markit AutoIntelligence's Tarun Thakur)

- The Thai economy was in severe recession in 2020, with a GDP

contraction of 6.2% year on year (y/y). This reflected the impact

of the COVID-19 pandemic on domestic economic activity as domestic

lockdown measures were put in place, as well as the impact of

global lockdowns on international merchandise trade. A particular

severe negative shock for the Thai economy has been from the

effects of global travel bans on international tourism travel. (IHS

Markit Economist Rajiv

Biswas)

- Some recovery in economic momentum was evident during the first half of 2021 (H1 2021), with GDP growth of 2.0% y/y. Base year effects contributed to the rapid growth rate of 7.5% y/y recorded in Q2 2021, although compared to Q1 2021, quarter-on-quarter growth was a modest 0.4%.

- Private consumption rose by 4.6% y/y in Q2 2021, and by 2.1% y/y in H1 2021. Private investment rose by 9.2% y/y in Q2 2021 and by 5.9% y/y in H1 2021.

- Exports of goods performed strongly in Q2 2021, rising by 30.7% y/y, with H1 2021 exports of goods up by 15.7% y/y. In July, merchandise exports were up 20.3% y/y. However, services exports have been experiencing deep and protracted recessionary conditions due to the collapse in international tourism. In 2020, exports of services contracted by 60% y/y, with a further 47% y/y decline recorded in H1 2021.

- Manufacturing output rose strongly in Q2 2021, up by 16.8% y/y, with expansion of 8.2% y/y in H1 2021.

- Low COVID-19 vaccination rates have contributed to Thailand's vulnerability to the latest pandemic wave. However, the Thai government has ramped up its vaccination program in recent weeks, with an estimated 39% of the total population having received their first dose vaccinations by mid-September. Although there has been some decline in daily new COVID-19 cases reported in Thailand during the first half of September, the level of daily new cases still remained high by mid-September 2021.

- By 2019, direct tourism spending accounted for an estimated 12% of Thai GDP, with Chinese tourism having played an increasingly important role in underpinning the Thai tourism economy. Thailand has been one of the most notable beneficiaries of the boom in Chinese tourism over the past decade, with total annual Chinese tourist visits to Thailand having risen from 2.7 million in 2012 to 11 million in 2019. Chinese tourism spending in Thailand was estimated to have reached USD 18 billion in 2019, amounting to more than 25% of total international tourism spending in Thailand.

- Afghanistan's central bank (Da Afghanistan Bank: DAB) has

instructed banks and money changers to process remittances in local

currency amid an ongoing shortage of US dollars. Even combined with

fresh donor pledges of more than USD1.1 billion secured on 13

September, this would not stop the depletion of DAB's liquid

reserves, likely resulting in strict capital controls and payment

arrears. (IHS Markit Economists Alyssa

Grzelak and

Hanna Luchnikava-Schorsch)

- Reuters reported on 11 September that both Western Union and MoneyGram International are processing new money-transfer requests in the local currency, the afghani, only after receiving a directive from the central bank to do so last week. Western Union and MoneyGram International's representatives in Afghanistan both resumed money-transfers in early September after activity was suspended following the Taliban's takeover of the capital Kabul in August.

- The central bank also reportedly instructed banks to limit withdrawals by corporate customers to 20% of each customer's weekly operating costs and to pay that amount in local currency only. It was not immediately clear whether the new cap would supersede a USD200 weekly withdrawal limit instituted by banks since re-opening last month.

- Severe cash shortages have emerged after crucial foreign donor financing was suspended and the central bank's currency reserves - which were estimated at more than USD9 billion in June 2021 and are mostly held in foreign banks - were frozen following the country's takeover by the Taliban in August. The afghani has depreciated by nearly 10% against the US dollar in the past month.

- On 13 September, international donors pledged more than USD1.1

billion in fresh humanitarian aid to Afghanistan at the United

Nations' appeal during the emergency conference on Afghanistan in

Geneva, Switzerland. However, given that this is only a fraction of

pledges made before the Taliban takeover (approximately USD12

billion over 2021-2024), it would be barely sufficient to provide

urgent food and medical assistance.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-september-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-september-2021.html&text=Daily+Global+Market+Summary+-+16+September+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-september-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 16 September 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-september-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+16+September+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-september-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}