Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 16, 2021

Daily Global Market Summary - 16 March 2021

All major European and most APAC equity indices closed higher, while only the Nasdaq closed higher in the US. US government bonds closed slightly lower and benchmark European bonds closed mixed. IG credit indices were flat across European iTraxx and CDX-NA, while corresponding high yield indices closed modestly tighter and wider, respectively. Natural gas and gold closed higher, the US dollar was unchanged, and oil, silver, and copper were lower on the day. All eyes will be on the conclusion of this week's FOMC meeting tomorrow to gauge the Fed's current assessment of inflation and growth risks, which may give a clearer picture to the markets on when to expect increases in rates.

Americas

- Most US equity indices closed lower except for Nasdaq +0.1%; S&P 500 -0.2%, DJIA -0.4%, and Russell 2000 -1.7%.

- US equity markets had one of the worst single-day sell-offs on record exactly one year ago today, with S&P 500 closing -12.0%, DJIA -12.3%, Nasdaq -12.9%, and Russell 2000 -14.3%.

- 10yr US govt bonds closed +1bp/1.62% yield and 30yr bonds +2bp/2.38% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY +3bps/299bps.

- DXY US dollar index closed flat/91.86.

- Gold closed +0.1%/$1,731 per troy oz, silver -1.1%/$26.00 per troy oz, and copper -1.6%/$4.07 per pound.

- Crude oil closed -0.9%/$64.80 per barrel and natural gas closed +3.1%/$2.60 per mmbtu.

- Total US retail trade and food services sales declined 3.0% in

February following a strong, stimulus-fueled increase of 7.6% in

January. Core retail sales for January were revised materially

higher and declined in February to about the level that we

previously expected. This raised our forecast for first-quarter

real consumer spending growth from 4.7% to 5.8%. (IHS Markit

Economists James Bohnaker and David Deull)

- Outside of food and beverage store sales, which were unchanged from January, and the aforementioned gasoline store sales, all other major retail categories saw sales decline in February.

- While harsh winter storms in Texas and elsewhere likely played a small role, the dominant force behind this see-saw pattern is likely a temporary spending surge from the January stimulus payments.

- February is the final month for which 12-month growth rates will be unaffected by the pandemic. Over those 12 months, nonstore sales surged 25.9%, sporting goods and hobby store sales increased 15.4%, and building material and garden supply store sales increased 14.2%.

- Food services and drinking places were at the other end of the spectrum with sales 17.0% lower than February 2020.

- The monthly pattern of retail sales through February supports the theme that January's stimulus resulted in an immediate but temporary surge in retail sales. With even larger direct payments to households arriving imminently, we expect a similar pattern over the next couple months.

- Total US industrial production (IP) fell 2.2% in February,

reflecting decreases in manufacturing (down 3.1%) and mining (down

5.4%) that were partially offset by a spike in utilities IP (up

7.4%). (IHS Markit Economists Ben Herzon, Lawrence Nelson, and

Akshat Goel)

- The decline in IP can be largely attributed to the once-a-generation freeze in the south-central region of the country. Excluding the effects of the winter weather, manufacturing output would have been down only 0.5% while mining activity would have been up 0.5%.

- Soft data on vehicle assemblies, mining IP, and computer IP lowered our first-quarter estimates of motor-vehicle output and business fixed investment, while broad-based weakness in manufacturing IP stemming from extreme weather and power outages led to a separate downward adjustment to our estimate of February manufacturing inventories.

- Manufacturing IP fell 3.1% in February. There were losses across the board with the largest drop (8.3%) coming from motor vehicles and parts. The decline in vehicles output reflected both a global shortage of semiconductors used in vehicle components and the severe winter weather.

- The production of chemical materials was hit the worst by the winter storms in February. After suffering damage from the deep freeze in mid-February, petroleum refineries, petrochemical facilities, and plastic resin plants in Texas went offline for the rest of the month and, as a result, output from chemical materials was down 14.5%.

- Output from utilities was a beneficiary of the extremely cold weather as the heightened demand for heating boosted the output 7.4% in February.

- Mining activity decreased 5.4% in February as oil and natural gas extraction tanked 6% because of the severe weather.

- The US headline housing market index dipped two notches to a

still-solid reading of 82 in March. A reading above 50 says that

more builders view conditions as good rather than poor. (IHS Markit

Economist Patrick Newport)

- The current sales conditions index dropped three points to 87, the index measuring sales prospects over the next six months rose three points to 83, and the traffic of prospective buyers' index was unchanged at 72.

- The West decreased three points to 88, the South was unchanged for the second straight month at 82, the Midwest slipped three points to 78, and the Northeast inched up from 86 to 87.

- Single-family permits, arguably the most important monthly housing data set (being accurate and covering every state and large metropolitan area) jumped 3.8% in January in a ninth straight increase to a 1.269 million rate, the highest reading since August 2006.

- Headwinds have picked up in housing, with the chief among these are lumber prices. The Random Length Lumber Continuous Contract (LB00) closed at $862.40 per thousand board feet on 15 March, down from the record-high $1,021 recorded 22 February, but still up from the $375-400 range last year in the weeks heading into the pandemic.

- Another major headwind is the mortgage rate: the 30-year fixed mortgage rate (Freddie Mac) edged up to 3.05% last week, up 40 basis points since the beginning of the year.

- The US Securities and Exchange Commission (SEC) is asking for comment on how it can obtain reliable and consistent reporting on risks posed by climate and environmental impacts, as it embarks on an effort to set up a comprehensive reporting regime for these risks. The risks posed by climate as well as environmental, social and governance (ESG) factors that companies have been reporting have not been up to par, according to SEC Acting Chairwoman Allison Herren Lee, who discussed the request during a 15 March discussion on "Meeting Investor Demand for ESG Information," convened by the Center for American Progress. Investors need climate risk reports that are consistent, comparable, and reliable so they can use them to price risk and allocate capital, Lee said. (IHS Markit Climate and Sustainability News' Amena Saiyid)

- The president of Cruise has confirmed that the General Motors (GM) autonomous vehicle division has acquired self-driving startup Voyage. However, the terms of the deal were not disclosed. Cruise president Kyle Vogt confirmed the GM division's acquisition of Voyage in a post on Twitter. Bloomberg reports that the transaction brings about 60 people trained in developing self-driving vehicles into the Cruise team. Voyage CEO Cameron reportedly takes the post of vice-president of product at Cruise. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Auto industry lobbying groups are reportedly asking US President Joe Biden's administration to review the US authorities' interpretation of some of the provisions of the United States-Mexico-Canada Agreement (USMCA) trade deal. Reportedly at issue is the way in which parts "rolling up" into other components are counted. An Automotive News report quotes a source saying on the issue that the industry understood that if "a part is conforming to its [regional content] rule, and you put it in another assembly, it is now 100 percent conforming for all other purposes of the rule. So I have Part X. It has to meet a 70 percent content rule, and it does. [If] I put Part X into component Y ... I can count all of Part X toward the content for Part Y instead of 70 percent of Part X." However, the source reportedly said that US Customs is now saying that if it is 70%, and you put it in something else, 70% is all that is counted toward the larger part. Davis Adams, president of the Global Automakers of Canada industry association, is reported as saying, "This interpretation was entirely unexpected, and if it sticks, it will take many manufacturers time to make adjustments and potentially rejigger supply chains to avoid the tariff. Either way, there are inefficiencies, which [equal] costs." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Costa Rica's seasonally adjusted IMAE contracted by 1.0% in

January, following five consecutive months of positive monthly

growth, including December, which recorded the greatest monthly

growth of 2.9% m/m since the pandemic began. This slight setback in

the country's recovery has left overall economic activity 3.7%

below pre-COVID-19-virus levels. (IHS Markit Economist Lindsay

Jagla)

- Six out of 15 sub-categories of economic activity have recovered fully and risen above pre-COVID-19-virus levels. The categories experiencing the greatest year-on-year (y/y) growth were mining and quarrying (1.9%), manufacturing (7.4%), and real estate (3.3%).

- The sub-categories putting the most downward pressure on Costa Rica's economic activity were transportation and storage (-24.7% y/y) and lodging and food services (-49.8% y/y).

Europe/Middle East/Africa

- European equity markets closed higher; UK +0.8%, Germany +0.7%, Italy +0.5%, and France/Spain +0.3%.

- 10yr European govt bonds closed mixed; Italy/Spain +2bps, France/Germany flat, and UK -2bps.

- iTraxx-Europe flat/47bps and iTraxx-Xover -3bps/242bps.

- Brent crude closed -0.7%/$68.39 per barrel.

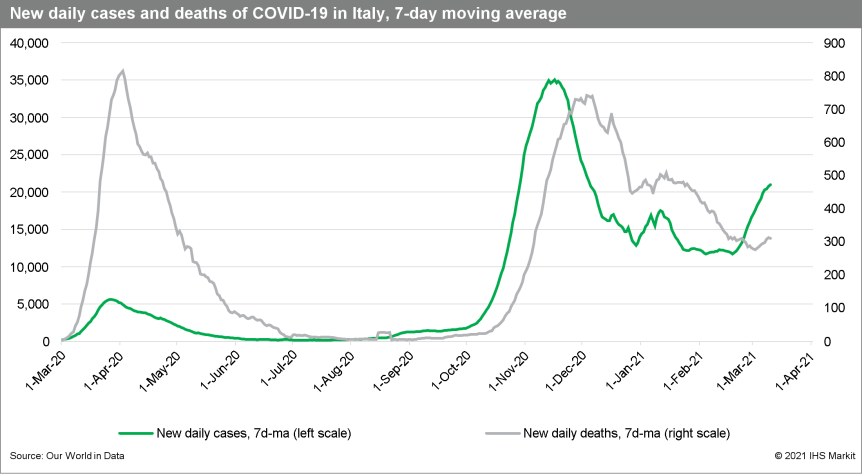

- The tougher COVID-19-related restrictions during March raise

the probability that Italy will face a short-lived double-dip

recession in early 2021 after the economy contracted during the

final quarter of 2020. Half of Italy's regions now face the

country's toughest COVID-19 virus restrictions amid rising new

infections, which have been overloading hospitals and intensive

care units during March. (IHS Markit Economist Raj Badiani)

- The Volkswagen (VW) Group has outlined its medium- and

long-term battery procurement and charging technology strategy at

its Power Day. The announcements at the Power Day will be the

technological foundations of VW's electrification push and also

show how the company will drive value through scale and make

battery electric vehicles (BEVs) viable for all. At the core of the

strategy is a new standardized battery cell design across the vast

majority of its BEVs. (IHS Markit AutoIntelligence's Tim Urquhart)

- In terms of cell production, VW also outlined how it would boost supply independence which will allow it to simply its current somewhat complex existing battery procurement network and safeguard battery supply to its European production network in particular.

- The company intends to have six Gigafactories making battery cells by 2030, with partners including Swedish battery startup Northvolt. VW owns a 20% stake in Northvolt and the companies have previously announced a joint venture (JV) project to build a Gigafactory in Salzgitter (Germany).

- Swiss firm Roche has announced a definitive merger agreement with US biotech GenMark Diagnostics, for an estimated USD1.8 billion in total transaction value. The deal will include GenMark's rapid single-sample multi-pathogen testing technology, using its proprietary ePlex platform. In particular, GenMark's Respiratory Pathogen Panels may be used for rapid identification of common viral and bacterial pathogens associated with upper respiratory tract infections, including SARS-CoV-2. The merger agreement has been unanimously approved by the GenMark and Roche boards of directors; after completion, GenMark will continue its main operations at its current Carlsbad location in California. Roche may submit a tender offer to acquire all outstanding shares of GenMark's common stock under the terms of the merger. The deal is expected to close in the second quarter of 2021, subject to customary closing conditions. (IHS Markit Life Sciences' Janet Beal)

- A second estimate shows France's EU-harmonised price index

rising by 0.8% year on year (y/y) in February. This is slightly

above the 'flash' estimate of 0.7% released in late February. (IHS

Markit Economist Diego Iscaro)

- The inflation rate during the first two months of the year was the highest since July 2020, when it had spiked because of the effect of the delayed summer sales. Inflation averaged 0.5% in 2020.

- Food prices also decelerated from 1.0% y/y to 0.8% y/y, their weakest increase in two years. Meanwhile, services price inflation remained unchanged at 0.8%, as higher rental prices were offset by decelerating communications and transport costs.

- As expected, the effects of the timing of the winter sales was reversed in February, driving a moderation in the core inflation rate.

- Bechtel is partnering with Swedish windfarm developer Hexicon to demonstrate offshore wind technology for large-scale floating power generation projects off the coast of the United Kingdom. The companies hope that the floating technology can be deployed in deep waters at a lower cost of energy than other solutions. This would be an important development for the industry that currently relies on shallow water platforms that are fixed to the seabed. (IHS Markit Upstream Costs and Technology's Dag Kristiansen)

- Fugro has signed a SFA with dCarbonX for decarbonization exploration projects supporting the development of geo-energy resources such as CCS, hydrogen storage and geothermal energy. Fugro will apply its consultancy mindset to help progress opportunities, and its Geo-data acquisition, analysis and advice will provide dCarbonX with critical information to characterize sites and support decision-making at the project concept stage. Fugro's consultancy services in the SFA will include comprehensive desktop studies to derisk ground conditions, recommendations on the survey or ground investigation data required, baseline environmental, geochemical and bathymetric surveys, and geophysical and geotechnical site investigation campaigns. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

- In a press release, Saudi Arabia's General Authority for

Statistics confirmed the growth rate of GDP for the final quarter

2020 at 2.5% on the quarter and a decline by 3.9% on the year. (IHS

Markit Economist Ralf Wiegert)

- Together with the steep decline in the first half and the rebound of the economy in the third quarter, this adds up to a 4.1% drop of the Saudi economy for 2020, as had been previously announced.

- The detailed data for the fourth quarter show the oil sector and the non-oil sector marching almost in lockstep. Oil and non-oil increased by 2.6% and 2.4% year on year (y/y).

- Adjusted for seasonal factors, the private sector, growing by 3.2% on the quarter, outpaced the government part of the economy, which went up by just 0.6% quarter on quarter (q/q).

Asia-Pacific

- Most APAC equity markets closed higher except for India -0.1%.; Mainland China +0.8%, South Korea +0.7%, Hong Kong +0.7%, Japan +0.5%, and Australia +0.1%.

- In a speech during the National People's Congress in March,

Chinese Premier Li Keqiang set a lending target for banks to micro,

small, and medium-sized enterprises (MSMEs) at 30% for 2021,

Reuters reports. Additionally, banks are expected to lower their

interest rates for businesses and industries affected by the

COVID-19-virus pandemic. (IHS Markit Banking Risk's Angus Lam)

- This news came at around the same time as banks were asked to rein in overall lending.

- The 30% growth target is similar to the disbursements growth to micro and small enterprises in 2020. IHS Markit expected that banks would continue to be pushed into lending to MSMEs because of the desire to rebalance lending away from large corporations and real estate companies.

- Overall, like in 2020, the majority of the growth in lending for MSMEs will be likely to come from large banks because of recent restrictions placed on collaboration between banks and internet platforms, which will disproportionately affect smaller banks

- Chinese automaker Zhejiang Geely Holding Group (Geely Group) plans to spend up to USD5 billion to build a new battery plant in China. According to a Bloomberg report, Geely Technology Group, a company directly controlled by Geely Group's chairman, Li Shufu, has signed an agreement with local authorities to invest CNY30 billion (USD4.6 billion) to build an electric vehicle (EV) battery factory in Ganzhou, Jiangxi province. The plant is to have an annual capacity of 42 GWh. The plant is to be constructed in two phases, with the first phase to have an annual capacity of 12 GWh. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Evergrande New Energy Vehicle, the electric vehicle (EV) arm of China Evergrande Group, has announced plans to form a joint venture (JV) with a unit of Tencent Holdings to develop a smart vehicle operating system (OS), reports Reuters. The EV firm will contribute 60% of capital to the venture while Tencent unit Beijing Tinnove Technology will make up the remainder. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- TuSimple has received a permit that allows its autonomous truck fleet to carry freight on public roads in Shanghai (China). TuSimple will conduct pilot operations on designated roads in Lin-gang Logistics Park, Donghai Bridge, Yangshan Deep Water Port and the main urban areas of China (Shanghai) Pilot Free Trade Zone Lin-gang Special Area, reports Gasgoo. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese electric vehicle (EV) startup Xpeng is expected to introduce a new sedan in the market during 2021. Images of the new model have surfaced on the internet recently, showing a camouflaged compact sedan. According to local media reports, the new Xpeng sedan will be positioned lower than the P7, which is a mid-size model. Xpeng earlier this month communicated to the media and investors its plan to launch the company's third model in the second half of 2021. The new model is referred to as a smart EV featuring lidar technologies. (IHS Markit AutoIntelligence's Abby Chun Tu)

- China's largest restaurant company, Yum China Holdings has

secured a minority stake in its poultry supplier, Fujian Sunner

Development ('Sunner'). (IHS Markit Food and Agricultural

Commodities' Max Green)

- Yum China said it has acquired a 5% equity interest in Sunner, which claims to be China's biggest white-feathered chicken producer.

- Sunner has a vertically integrated business model covering the full production chain, which primarily includes chicken breeding and farming, feed processing and meat processing.

- Samsung Electronics has reportedly won a project to develop chips for Waymo's autonomous vehicles (AVs). The chips can compute the data collected from the various sensors embedded in AVs or exchange information with Google data centers in real time to centrally control functions. The project is expected to be conducted by Samsung's logic chip development division, reports Automotive News. Waymo is at the forefront of automated transportation development. The company has conducted 20 million miles of AV testing on public roads in 25 cities and more than 10 billion miles of simulation. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The headline IHS Markit Philippines Manufacturing PMI™ posted 52.5 in February, matching the reading seen in January and indicative of another improvement in the overall health of the sector. This extended the current period of growth to two months, with the pace of expansion the joint-fastest since December 2018. Survey data suggested that production rose again in February, with more firms re-opening their factories or expanding capacity. (IHS Markit Economist Shreeya Patel)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-march-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-march-2021.html&text=Daily+Global+Market+Summary+-+16+March+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-march-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 16 March 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-march-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+16+March+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-march-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}