Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 16, 2022

Daily Global Market Summary - 16 February 2022

Most major APAC equity indices closed higher, while European and US markets closed mixed. US government bonds closed almost flat on the day, while benchmark European bonds closed sharply higher. CDX-NA closed slighter tighter across IG and high yield, while European iTraxx was close to unchanged on the day. The US dollar closed lower, while natural gas, oil, gold, silver, and copper all closed higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; Russell 2000 +0.1%, S&P 500 +0.1%, Nasdaq -0.1%, and DJIA -0.2%.

- 10yr US govt bonds closed -1bp/2.04% yield and 30yr bonds flat/2.36% yield.

- CDX-NAIG closed -1bp/65bps and CDX-NAHY -4bps/356bps.

- DXY US dollar index closed -0.3%/95.7.

- Gold closed +0.8%/$1,872 per troy oz, silver +1.1%/$23.61 per troy oz, and copper +0.1%/$4.54 per pound.

- Crude oil closed +1.7%/$93.66 per barrel and natural gas closed +9.5%/$4.72 per mmbtu.

- The minutes of the last meeting of the Federal Open Market Committee (FOMC), held on 25-26 January, were released this afternoon (16 February). The minutes reflect widespread consensus that it will soon be appropriate to begin the process of removing monetary stimulus implemented during the pandemic, with increases in interest rates likely to be followed within a few months by a plan to begin shrinking the Federal Reserve's securities portfolio primarily through run-off—that is, through limits on the reinvestment of principal payments. The minutes provide no clear signal about whether the first increase in the target for the federal funds rate will be the "usual" increase of 25 basis points or a larger increase of 50 basis points. Differences of opinion among policymakers about the scope for further gains in labor supply and about how quickly inflation might recede suggest a high bar for an increase of 50 basis points in March. The minutes are consistent with IHS Markit analysts' expectation that rate hikes will be front-loaded this spring, then slow later in the year as inflation moderates and to allow for balance-sheet shrinkage by the Fed. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

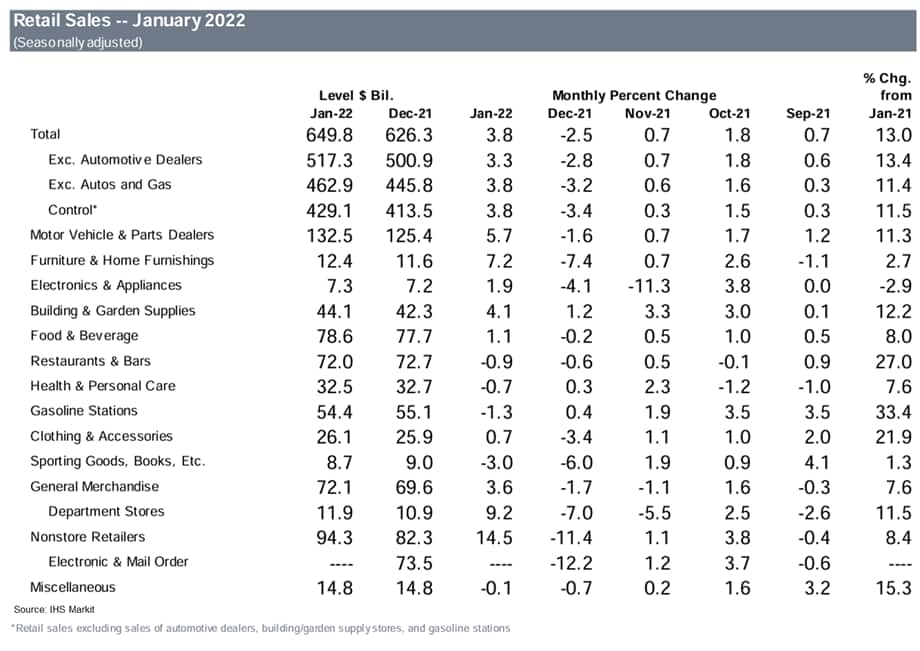

- US total retail trade and food services sales jumped 3.8% in

January, a stronger reading than expected. Nonautomotive sales rose

3.3%, while core sales rose 3.8%. (IHS Markit Economists Kathleen

Navin and William Magee)

- The surge in January followed a sharp decline in December, as news reports of supply chain issues and delays in shipping likely shifted sales forward into October and November. Seasonal factors, which anticipated a pop in December for holiday shopping and a reversal in January, are now playing a role in the data, contributing to the sharp decline in December and the jump in January.

- Sales at nonstore retailers, which are particularly sensitive to shipping delays, help illustrate this story. These sales, which make up less than one-sixth of total sales, rose 14.5% on the month and accounted for roughly half of the increase in total retail trade and food services sales in January. IHS Markit analysts had anticipated this swing after observing the same pattern last year.

- Elsewhere in today's (16 February) report, sales for food services and drinking places declined 0.9% in January. The weakness in January was previewed by soft readings from the OpenTable data as would-be diners became more cautious upon Omicron concerns. These data have since turned up, suggesting restaurant sales will improve in February.

- Meanwhile, retail sales at building materials stores continued to strengthen in January, with an increase of 4.1%. The strength in January came even as weather turned more severe.

- While some reversal in retail sales is expected in February,

IHS Markit analysts continue to anticipate that solid fundamentals,

including wages and net worth, will remain supportive of consumer

spending in the near term.

- Total US industrial production (IP) rose 1.4% in January,

reflecting increases in manufacturing (0.2%) and mining (1.0%), and

a record-high gain in utilities IP (9.9%). Total IP is 2.1% above

its pre-pandemic (February 2020) level and 4.1% higher than it was

a year ago. (IHS Markit Economists Ben

Herzon and Akshat Goel)

- The output of utilities leaped 9.9% in January owing to significantly colder-than-normal temperatures following unseasonably mild temperatures in December. Natural gas distribution recorded a large gain of 24.2% due to a surge in the demand for heating. The outsized gain in utilities IP accounted for most of the increase in total IP in January.

- Manufacturing IP rose 0.2% in January as marginal gains were recorded in the production of both durable and nondurable goods. The output for durable goods (up 0.2%) was supported by a large gain in the production of machinery (up 1.1%), even as the production of vehicles and parts remained weak (down 1.3%). Nondurable manufacturing also edged higher (up 0.2%), helped by gains in its two major components—food, beverage, and tobacco products (up 0.9%) and chemicals (up 0.2%).

- Motor vehicle production and assemblies over the past few months have been above averages from earlier in the year when manufacturers first started cutting production due to a shortage of chips used in vehicle components. While the worst of production cuts may be over, IP for motor vehicles and parts is still 6.3% below the February 2020 level as production continues to be constrained by the global chip shortage.

- Mining activity increased 1.0% in January, helped by a 0.6% increase in oil and gas extraction.

- The headline US Housing Market Index moved down 1 point in

February to a still solid 82. A reading above 50 indicates that

more builders view conditions as good rather than poor. The current

sales conditions index edged up a point to 90, the third-highest

reading on record; the index measuring sales prospects over the

next six months dropped 2 points to 82; the traffic of prospective

buyers' index lost 4 points and now stands at 65. (IHS Markit

Economist Patrick

Newport)

- By region and three-month averages, the South, West, and Midwest each lost a point, while the Northeast, which accounted for only 6% of single-family housing starts last year, gained 3 points.

- "Production disruptions are so severe that many builders are waiting months to receive cabinets, garage doors, countertops and appliances. These delivery delays are raising construction costs and pricing prospective buyers out of the market. Residential construction costs are up 21% on a year over year basis. Higher interest rates in 2022 will further reduce housing affordability even as demand remains solid due to a lack of resale inventory."

- The reality is that builders are facing stiff, pandemic-fueled headwinds—rising material costs, labor shortages, and issues with the supply chain for building materials—on top of the pre-pandemic headwinds—lack of buildable lots and skilled labor and the forces of Not in my Backyard (NIMBYism). Another headwind—higher mortgage rates, which have moved up 64 basis points in the past seven weeks—is picking up.

- All this adds up to declining rates of single-family new construction over the course of this year. We expect single-family housing starts to move down from 1.13 million in 2021 to 1.05 million in 2022.

- US-based upcycling start-up Novoloop has received funding that

brings it nearer to commercializing its polyethylene (PE)-to-

thermoplastic polyurethane (TPU) technology, the company announced

late-Tuesday. (IHS Markit Chemical Market Advisory Service's Chuan

Ong)

- The company said it received $11 million in Series A funding that will allow it to complete crucial pilot scale-ups and commercialize its technology.

- Novoloop did not detail where and when it plans to construct pilot plants for its process.

- The company said its proprietary process technology, termed 'Accelerated Thermal Oxidative Decomposition', is a form of chemical recycling that breaks down PE into chemical building blocks for synthesis into high-value products.

- According to Novoloop, PE is the most widely used plastic today but only 9% is recycled, and virtually none is upcycled. The company aims to increase commercial demand for waste PE, believing its technology can upcycle carbon content found in common plastic waste like grocery bags, packaging, and agricultural plastics that are too low value for material recovery facilities and instead sent into landfills or incinerators.

- Novoloop's first product based on its advanced recycling technology is a TPU, which can be used in footwear, apparel, sporting goods, automotive, and electronics. The company says its TPU is the first made from post-consumer PE waste that matches the performance characteristics of virgin TPU made from petrochemicals. Novoloop says its TPU has a carbon footprint 46% smaller than conventional TPUs.

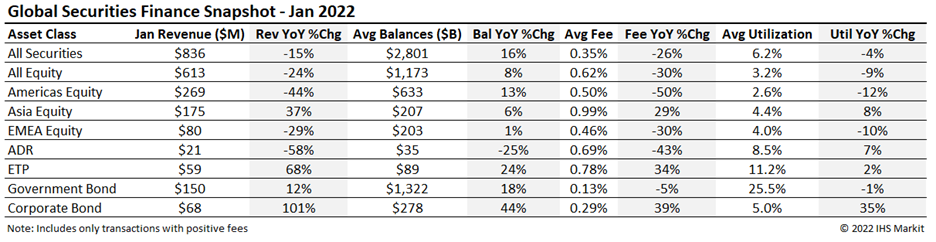

- Global securities finance revenues totaled $836 million in

January, a 15% YoY decline. January saw the lowest global equity

revenue since February 2021 which can be attributed to narrower

EMEA and Americas equity spreads. The general rise in borrow demand

seen last year for ETPs, Corporate Bonds and ADRs took a turn for

the worse for ADRs, as revenues fell by 58% YoY. In this note we

will discuss the drivers of January revenue. (IHS Markit Securities

Finance's Paul

Wilson)

- Municipal bond retail and institutional investors continue to navigate subdued new issue supply levels after last week's calendar presented $8.7Bn of new issue deals, with the majority of bonds offered marked as tax-exempt, supporting greater activity among retail accounts. The Port of Portland, Oregon (-/AA-/-) witnessed stagnant investor demand last week, with cuts of 2-32bps registered across the scale, with the widest spread noted in the 2047 maturity, falling +100bps off the interpolated MAC curve. The State of Ohio (Aa3/A+/A+) also came to market last week with maturities spanning 2/2024-2/2039 and bumps of 4bps distributed across the scale as a result of investor demand, with the 2039 tranche presenting allotted investors a yield of 2.53% or (+85bps to the interpolated MAC). This week's calendar is expected to throttle down to $6Bn across 163 new issues with $1.3Bn of day-to-day deals as issuers stand on the sidelines amid increased volatility market-wide. The National Finance Authority of New Hampshire (-/BBB/-) will lead this week's negotiated calendar, offering an aggregate $1.3Bn across two separate 2037 tranches with a corresponding social certificate selling on Wednesday 02/16 and lead managed by Citigroup. The Pennsylvania Housing Finance Agency (Aa1/AA+/-) will also tap into the negotiated arena to offer $255mm single family mortgage revenue bonds, spanning across 10/2022-10/2052, selling today 16 February. This week's competitive calendar will span across 84 new issues for a total of $1.7 billion, led by the State of Delaware (Aaa/AAA/AAA) auctioning $252 million of general obligation bonds across 3/2023-3/2042 maturities on Wednesday. (IHS Markit Global Market Group's Matthew Gerstenfeld)

- The flavor and essential oil processor IFF, listed on the New

York Exchange, has reported that it net sales reached $3.03 billion

(+139% y/y) in Q4 2021, bringing 2021 sales to $11.65 billion, 129%

more y/y, once the company has completed the merger with Nutrition

& Biosciences (N&B). (IHS Markit Food and Agricultural

Commodities'

Jose Gutierrez)

- The operating profit increased by 3% y/y to $585 million.

- Inventories totaled $2.51 billion in 2021, up from $1.13 billion in 2020.

- Nourish and Scent were the drivers of growth.

- Nourish sales rose by 9% on a combined currency-neutral (non-GAAP) basis to $2.6 billion due to robust activity in the ingredients industry. Scent grew by 8% to $2.25 billion thanks to strong demand for fine fragrances and cosmetic actives.

- The company projects that sales ranged between $12.3-12.7 billion in 2022.

- US electric vehicle (EV) maker Fisker Inc started taking orders for its second product, the Pear, on 15 February, according to a company announcement. Fisker has begun taking reservations for the Pear even though it has not yet started deliveries of its first model, the Ocean electric sport utility vehicle (SUV). According to a Fisker statement, the Pear is a compact, five-passenger electric utility vehicle and deliveries are expected to start in 2024. Fisker says the Pear - standing for Personal Electric Automotive Revolution - will have a starting price of USD29,900 before taxes and incentives in the United States. This will make it one of the more-affordable EVs in the market and potentially making it strong competition for General Motors (GM)'s Chevrolet Equinox EV, which the automaker has not yet shown. GM has said the price of the Chevrolet Equinox EV will start at USD30,000, and it is due on the market in 2024 as well. In a statement, Fisker Inc CEO Henrik Fisker said, "PEAR will feature the very latest technology in a beautifully designed, affordable urban mobility device. It's an exciting vehicle and an exciting time for the company as we expand our lineup." The Pear is to be produced for Fisker by Foxconn at a former GM facility in Ohio (US), acquired by Foxconn through Lordstown Motors. Meanwhile, the upcoming Ocean is being produced for Fisker by Magna. Fisker states that reservations for the Pear can be made for USD250 for a first reservation, or USD100 for a second reservation. (IHS Markit AutoIntelligence's Stephanie Brinley)

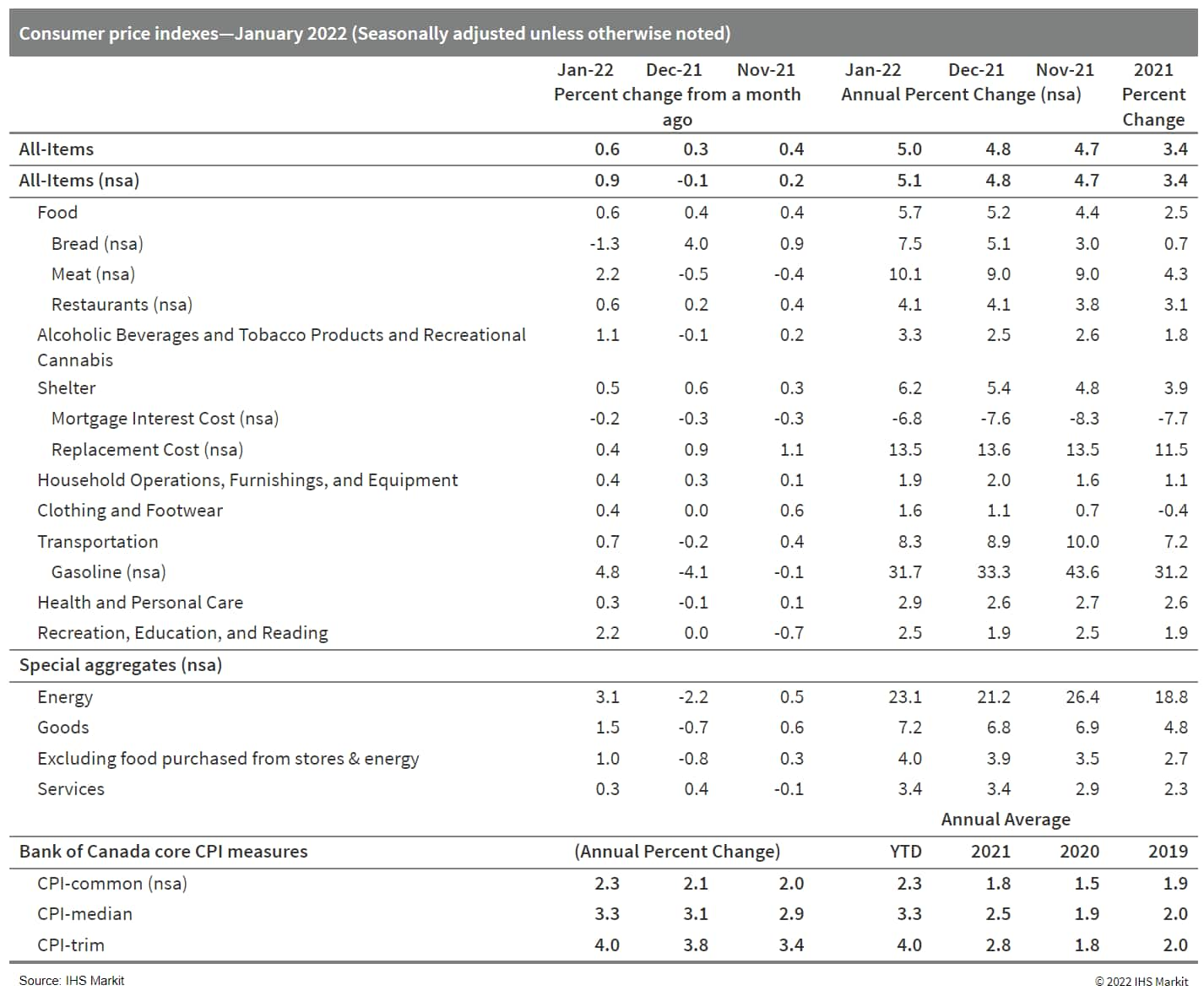

- The monthly jumps in Canada's consumer prices were quick at

0.6% month on month (m/m) on a seasonally adjusted basis (SA) and

0.9% m/m on a non-seasonally adjusted basis (NSA). (IHS Markit

Economist Arlene

Kish)

- Annual inflation was 5.0% year on year (y/y) SA and 5.1% y/y NSA.

- Two of the three Bank of Canada preferred core inflation rates were above 3.0% y/y, averaging 3.2%.

- The runup in consumer prices, particularly for goods, validates the necessary unwinding of monetary policy stimulus in Canada. The Bank of Canada is expected to raise interest rates 25 basis points at the next policy announcement on 2 March.

- The IHS Markit inflation forecast for the month was higher than

consensus for several reasons. Inflation drivers continued their

upward trend, particularly for food. The acceleration in meat

prices at 10.1% was a main upside contribution to inflation this

month.

- The Canadian Pest Management Regulatory Agency (PMRA) has

proposed the cancellation of most uses of the fungicide,

chlorothalonil, and products containing the active ingredient, to

mitigate dietary and environmental risks associated with its use.

It is proposing continued registration of the ai and products

derived from it for use on greenhouse ornamentals. (IHS Markit Crop

Science's Akashpratim Mukhopadhyay)

- The move to cancel most uses of the ai was prompted by concerns over its carcinogenicity and the potential toxicity of its metabolites, besides its exposure to certain metabolites through groundwater. Risks were also flagged concerning chlorothalonil's potential harm to amphibians and fishes, with the Agency expanding its review to include the effects of the ai's transformation products on the environment.

- Dietary risks posed by chlorothalonil were concluded to be unacceptable when used in accordance with its registration conditions, with the PMRA proposing to revoke all maximum residue limits (MRLs) and cancelling all food uses. It arrived at a similar conclusion regarding the fungicide's effects on the environment, noting that risks posed by chlorothalonil to aquatic organisms were not acceptable under the conditions of registration.

- As far as greenhouse uses are concerned, the use of chlorothalonil-based products has been allowed in mushroom houses. Risks in such settings were shown to be "acceptable", provided mitigation measures were implemented. In greenhouses with closed recirculation systems such as closed chemigation setups, a third-party audit has been proposed to validate that the facility's closed recirculation system and other measures are "sufficient" to prevent run-off containing the products from reaching lakes, streams, ponds or other waterbodies.

Europe/Middle East/Africa

- Major European equity markets closed mixed; Spain +0.2%, Italy flat, UK -0.1%, France -0.2%, and Germany -0.3%.

- 10yr European govt bonds closed higher; Italy -7bps, France/Spain/UK -5bps, and Germany -4bps.

- iTraxx-Europe closed flat/66bps and iTraxx-Xover -2bps/322bps.

- Brent crude closed +1.6%/$94.81 per barrel.

- The UK Office for National Statistics (ONS) has reported that

the UK's 12-month rate of consumer price index (CPI) inflation

increased from 5.4% in December 2021 to 5.5% in January, the

highest rate since the series began in January 1997, and since

March 1992 (7.1%) when using the historical-modelled data. (IHS

Markit Economist Raj

Badiani)

- During 2020 and 2021, CPI inflation averaged 0.9% and 2.6%, respectively.

- Meanwhile, the CPI including owner-occupiers' housing (CPIH) costs rose by 4.9% in the 12 months to January, up from an increase of 4.8% in December 2021.

- In addition, the 12-month rate of the retail price index increased to a 30-year high of 7.8% during the same month.

- Energy-related prices continued to rise at a blistering pace on an annual basis during January, with transport fuel and lubricant prices growing by 23.6% year on year (y/y), the 10th successive double-digit increase. This was in line with global crude oil prices rising by 57.9% y/y to average USD86.5 per barrel (pb) in January, the 13th successive y/y gain.

- The ONS also reported an acute rise in household energy bills during January after the increased regulatory price cap on domestic natural gas and electricity from 1 October 2021. Natural gas and electricity prices increased by 28.3% y/y and 19.2% y/y in January, respectively.

- Restaurant and café prices increased by 4.7% y/y in January, compared with a gain of 6.0% y/y in December 2021.

- Food and non-alcoholic beverage prices rose at a brisker rate, increasing by a nine-year high of 4.3% y/y in January from 4.2% y/y in December 2021. This is a worrying development, adding to the cost-of-living crisis facing many UK households.

- United Kingdom-based battery manufacturing startup Britishvolt will open a third round of funding, with mining heavyweight Glencore committing GBP40 million (USD54 million). Britishvolt is aiming to raise GBP200 million towards building its planned battery factory in Blyth, in the northeast of England, while there will also be a research and development (R&D) center attached to this project. Britishvolt has so far raised GBP100 million in funding for its factory and R&D center, which will initially supply battery electric vehicle (BEV) manufacturers operating in the UK. (IHS Markit AutoIntelligence's Tim Urquhart)

- Eurozone retail sales volumes plunged by 3.0% month on month

(m/m) in December 2021, the largest decline in eight months. The

weakness was much more pronounced than expected, undershooting the

market consensus expectation of a 0.5% m/m decline by some

distance. (IHS Markit Economist Ken

Wattret)

- Although retail sales in the fourth quarter of 2021 as a whole rose by 0.3% quarter on quarter (q/q), this was the weakest rate of increase for three quarters and given the December 2021 drop, carryover effects for sales growth in the first quarter of 2022 will be unfavorable.

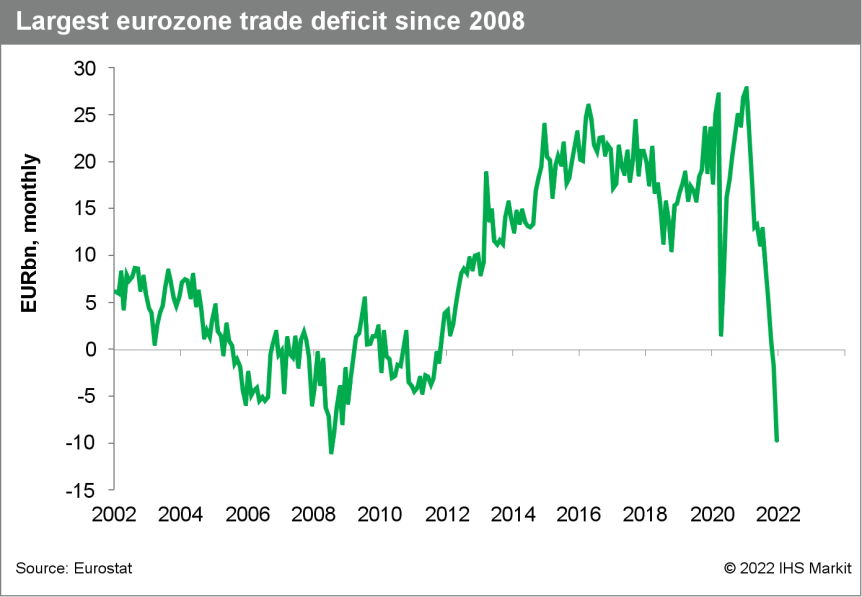

- The eurozone trade balance swung into the red in November 2021 for the first time in over a decade and the deficit increased markedly in December 2021, jumping from EUR1.8 billion to EUR9.7 billion, the highest since July 2008 amid the global financial crisis.

- By way of comparison, the eurozone's monthly trade surpluses peaked at over EUR25 billion prior to the pandemic.

- Eurozone exports (in value terms) fell by 0.6% m/m in December 2021. This followed consecutive strong increases in the two prior months, however, meaning that in the fourth quarter of 2021 as a whole, exports rose by 4.2%, the highest growth rate for four quarters. Relative to their pre-pandemic level, exports were up by 6.7% in December 2021.

- Imports (again in value terms) rose by 3.1% m/m in December 2021, the 11th straight increase, and surged by over 10% q/q in the fourth quarter of 2021 overall. Imports were up by over 27% in December 2021 relative to their pre-pandemic level.

- Eurozone industrial production rose by a much stronger-than-expected 1.2% m/m in December 2021. Given the November 2021 initial 2.3% m/m increase (subsequently revised up to 2.4%), the market consensus expectation had been for a modest 0.3% m/m gain. For the first time in five months, industrial production exceeded its pre-pandemic level, by 1%.

- The breakdown of the December 2021 output data by type of goods showed a mixed picture, with production of capital goods outperforming (2.6% m/m). Production of capital goods surpassed its pre-pandemic level in December last year for the first time in five months, although it continues to lag the recovery in output of consumer goods.

- Despite back-to-back strong increases, industrial production

contracted by 0.5% q/q in the fourth quarter of 2021, the third

consecutive q/q decline, with supply chain disruptions having

hindered the sector since early in 2021. Carryover effects for

growth in the first quarter of 2022 are very positive, however,

given the very strong end to last year, while leading indicators

have been improving in recent months.

- On 11 February, EU regulatory body for securities markets the European Securities and Markets Authority (ESMA) published its environmental, social, and governance (ESG) work agenda to 2024, the 'Sustainable Finance Roadmap 2022-2024'. The roadmap specifies three core focus areas. First, the risk of "greenwashing", whereby disclosure relating to an instrument (or issuer) fails to reflect "underlying sustainability risks", assessing that such problems can reflect issues relating to the value chain, inadequate data and disclosure, and "regulatory arbitrage" reflecting uneven EU standards, and can lead to a misallocation of resources by ESG-oriented investors. ESMA will seek to investigate and define the problem and seek "coordinated action" and "common solutions across the EU". Given the growing use of ESG-based finance, the second core focus flagged that national regulators also need to expand capacity beyond traditional financial regulation. ESMA plans the active sharing of experience and a multi-year training program to strengthen national ESG financial regulatory capacity. Lastly, it plans ongoing work in "monitoring, assessing and analyzing" ESG risk, including climate stress-testing for central counterparties, climate "scenario analysis" for investment funds, and developing common methodology for climate-risk analysis together with other public bodies. (IHS Markit Country Risk's Brian Lawson)

- According to the latest Trend Indicator of Output published by

Statistics Finland, total output in the economy in December 2021

increased by a reaccelerated annual rate of 4.5%, adjusted for

variation in the number of working days. Seasonally adjusted

figures suggest an expansion of 0.7% month on month (m/m). (IHS

Markit Economist Venla

Sipilä)

- Details of the output indicator signal significant recovery in secondary production in December, comprising manufacturing and construction, whereas the service sector is estimated to have grown more modestly. Conversely, primary production, which includes agriculture, contracted year on year.

- On the basis of the monthly output indicator, Statistics Finland constructed a preliminary estimate for fourth-quarter GDP, which showed growth of 0.6% quarter on quarter (q/q) in seasonally adjusted terms and a calendar-adjusted expansion of 3.7% y/y.

- As measured by surveys conducted by the Confederation of Finnish Industries (Elinkeinoelämän keskusliitto: EK), business confidence in the manufacturing industry edged up by one point in January and remains clearly above its long-term average. Both construction and service sector sentiment indicators have deteriorated, while retail sector confidence remains unchanged; all of them, however, remain positive and above their long-term averages.

- The latest industrial output figures suggest strengthening performance within the last quarter, with working-day adjusted year-on-year growth sharply accelerating to 11.5% y/y in December and to 3.1% m/m adjusted seasonally. Moreover, unlike the GDP estimates, the preliminary industrial output figures also signal strengthening momentum in the final quarter compared with the third quarter.

- TotalEnergies and Norwegian engineering consultant Semar have entered into a research and development partnership to further develop the latter's Honeymooring solution for floating offshore wind. The Honeymooring technology appears to use a system of floating buoys to allow the floating platforms to anchor to in an anchor-sharing configuration. The pattern of the mooring lines and buoy nodes resemble a honeycomb network. TotalEnergies has stated that the method will reduce the cost of mooring hardware and floater structure by reducing peak load on the mooring system, and lower the cost of marine operations partly due to lower mooring line pre-tension and line weight. TotalEnergies has partnered Norsk Havvind and Iberdrola to bid in the latest 4.5 GW tenders for the Utsira Nord and Southern North Sea II areas. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Samsung Engineering signs contract for petrochemical project in Russia. This would be Samsung Engineering's first petrochemical project in Russia. The scope of activity includes engineering and procurement for an ethane cracker unit with total capacity of 2.8 million t/y, which would be the core process element of the petrochemical plant and will be producing ethylene from separated C2 out of natural gas. Baltic Chemical Complex LLC (BCC) is the owner of the contract and the project is located at the Gulf of Finland near the seaport of Ust-Luga, which is 110 km southwest of St. Petersburg, Russia. This project is a key step in Samsung Engineering's plans to advance into the Russian market by further diversifying their overseas markets. (IHS Markit Upstream Costs and Technology's Pranay Gaur)

- Mozambique's real GDP grew by 2.2% during 2021. The recovery in

real GDP is expected to continue during 2022, supported by the

starting up of liquefied natural gas (LNG) production, lower

inflation, and an International Monetary Fund (IMF) Extended Credit

Facility. (IHS Markit Economist Thea

Fourie)

- Mozambique's real GDP strengthened further by 3.3% year-on-year (y/y) during the fourth quarter of 2021, marginally down from a 3.4% y/y expansion recorded in the previous quarter. This leaves average real GDP up by 2.2% in 2021, from a 1.2% contraction recorded in 2020 - in line with IHS Markit's expectation.

- Sub-sectors showing the strongest recovery during the fourth quarter of 2021 included hotels and restaurants (up 7.2% y/y), mining production (up 6.9% y/y), and transport and communication (up 4.9% y/y).

- Output in the sub-sectors with the largest contributions to Mozambique's overall economic activity also strengthened during the fourth quarter. Production in the agriculture, forestry and fishing sector increased by 3.9% y/y, trade activity increased by 2.4% y/y, and output in the other services sector (including government services) rose by 2.8% y/y.

- The electricity and water sector was the only sector in the Mozambican economy that recorded lower output during the fourth quarter, contracting by 2.2% y/y.

Asia-Pacific

- Most major APAC equity markets closed higher except for India -0.3%; Japan +2.2%, South Korea +2.0%, Hong Kong +1.5%, Australia +1.1%, and Mainland China +0.6%.

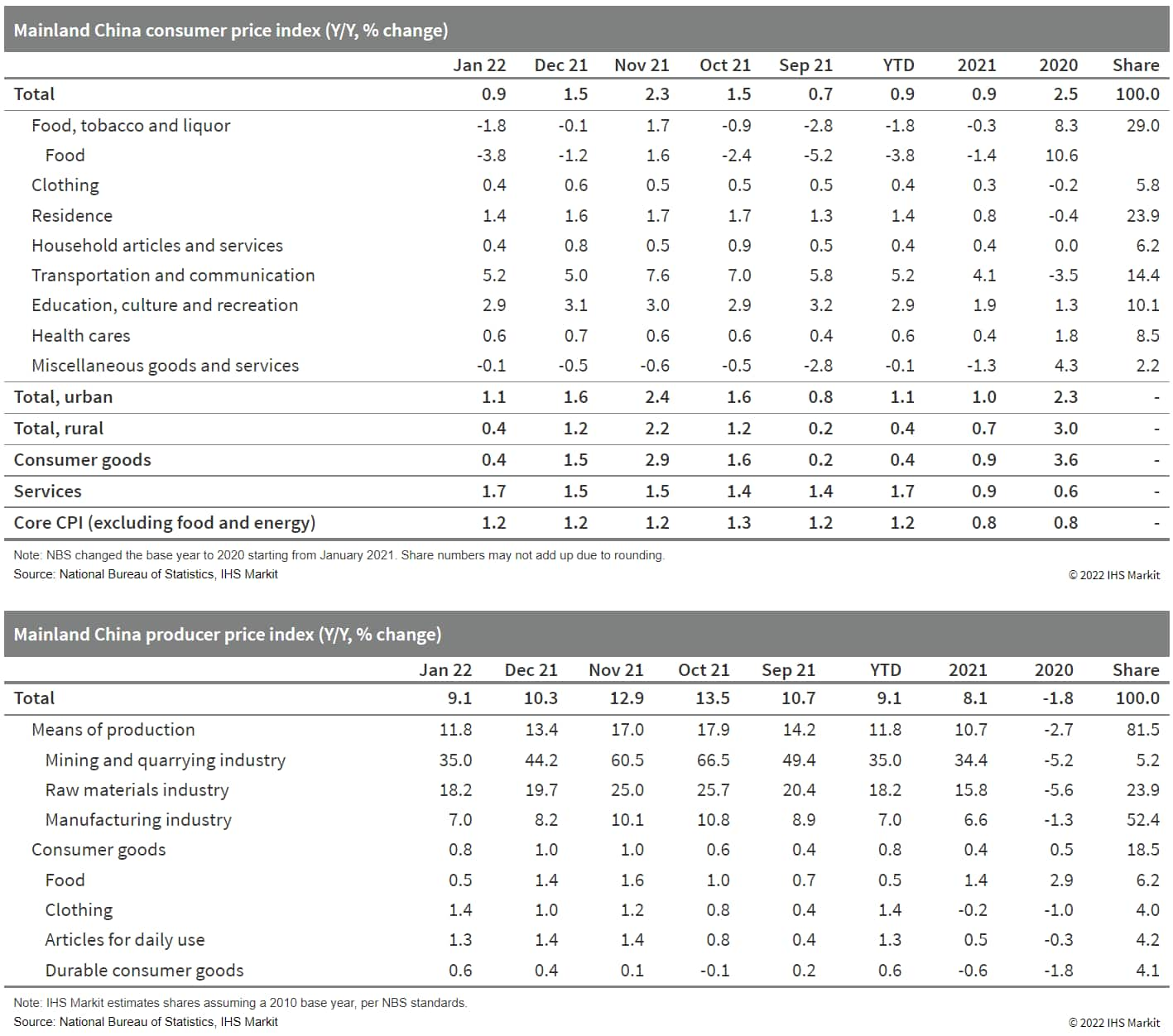

- Despite less stringent pandemic restrictions than the year-ago

Spring Festival holiday supporting mild improvement in service

prices, overall consumer demand remained weak. With the continued

zero-COVID-19 stance amid more frequent regional outbreaks, further

policy easing remains likely to counter the growth headwinds. (IHS

Markit Economist Lei Yi)

- Mainland China's consumer price index (CPI) increased by 0.9% year on year (y/y) in January, down by 0.6 percentage point from the December 2021 reading, according to the National Bureau of Statistics (NBS). Month-on-month (m/m) CPI inflation came in at 0.4%, bouncing back from the month-ago deflation of 0.3% m/m, owing to the seasonal demand pickup ahead of Spring Festival holiday (31 January—6 February) as well as the recent rise in oil prices.

- The headline CPI disinflation, on the other hand, was again largely driven by the falling food prices, which recorded deflation of 3.8% y/y in January compared with a 1.2% y/y decline in the prior month. In particular, pork price deflation widened further by 4.9 percentage points to 41.6% y/y owing to the relatively high base; while fresh vegetable prices slid into deflation territory, logging a 4.1% y/y decrease in January from the 10.6% y/y increase in the month before. Regarding the non-food components, service price inflation ticked up by 0.2 percentage point to 1.7% y/y thanks to eased travel restrictions ahead of the Spring Festival holiday than in 2021, with air ticket prices notably higher by 20.8% y/y. Excluding the volatile food and energy components, core CPI inflation kept unchanged at 1.2% y/y.

- The producer price index (PPI) rose by 9.1% y/y in January, lower by 1.2 percentage points from December 2021 and marking a third month of moderation thanks to government interventions. Month-on-month PPI deflation narrowed by 1.0 percentage point to 0.2%, which was almost entirely led by the 0.2% m/m decline in the means of production subindex; while the PPI subindex of consumer goods reported no change in January.

- By sector, coal and steel-related sectors including coal mining

and dressing and ferrous metal smelting and pressing continued to

register month-on-month price deflation in January. However, higher

crude oil and nonferrous metal prices—partially contributed by

the geopolitical tensions in Eastern Europe—led to

month-on-month re-inflation in prices of petroleum and natural gas

extraction as well as nonferrous metal smelting and pressing

sectors.

- The Chinese city of Suzhou has stepped up control measures amid a recent outbreak of the COVID-19 virus, affecting the operations of companies such as Robert Bosch. The city, 90 kilometers from Shanghai, closed more than 30 access points from highways as of Tuesday (15 February), after its daily new cases soared to eight on Monday. Local media reports suggest that 18 new cases were reported on Tuesday, increasing risks of further community spreading of the COVID-19 virus. According to a Reuters report, the operations of companies such as Robert Bosch have been affected by control measures such as mass testing. Reuters reports a statement by Bosch on Monday as saying, "We expect a short-term impact on our manufacturing and logistics operations in Suzhou." The statement added that local office staff were working from home. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese autonomous truck startup Trunk.Tech has announced the completion of its Series B financing round led by BAIC Capital, reports Gasgoo. According to the source, the funding will aid Trunk.Tech in its business development in the digital, intelligent, and autonomous commercial vehicle field. In November 2021, Chinese autonomous truck startup Trunk.Tech announced that it had raised hundreds of millions of yuan in its latest round of Series B financing. The funding was led jointly by Yuexiu Industrial Fund, ZWC Partners, and BHCP; the company plans to put the infused capital towards research and development (R&D), and mass production of its new-generation autonomous trucks. (IHS Markit Automotive Mobility's Tarun Thakur)

- Chinese electric vehicle (EV) startup Hozon New Energy Automobile has chosen banks including China International Capital Corp. and Citic Securities Co. for an IPO in Hong Kong, reports Bloomberg, citing people familiar with the matter. The Chinese EV firm is also working with Morgan Stanley and UBS Group AG on the planned IPO, which could take place as soon as this year. The IPO could raise about USD1 billion, according to the source. The Zhejiang-based company is seeking to raise about USD500 million ahead of the IPO at a valuation of about USD7 billion, according to Bloomberg. In October 2021, Hozon announced that it had raised CNY4 billion (USD631 million) in its D1 funding round, led by the Chinese internet safety giant 360 Security. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Taiwan Semiconductor Manufacturing Company (TSMC) is planning to increase its investment in a new chip manufacturing plant in Japan after Denso was confirmed to be an investor in the project. According to Taiwan News, the facility will be set up in Kumamoto Prefecture as a joint venture (JV) between TSMC, Sony Semiconductor Solutions Corporation (SSS), and Denso. The JV, called the Japan Advanced Semiconductor Manufacturing (JASM), will invest over USD350 million and will take a 10% stake, while Sony will invest USD500 million for a share of up to 20% and TSMC will be the majority stakeholder. Total planned investment in the plant has been increased from USD7 billion to USD8.6 billion, with production slated to begin by the end of 2024. The new plant will focus on production of chips, which are currently in short supply because of high demand from automakers and technology companies. In addition to the earlier plan to produce 22-nm and 28-nm chips at the plant, there will now be a production line for 12-nm and 16-nm chips. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Tata Motors's president of passenger vehicles and electric vehicles (EV) Shailesh Chandra expects compressed natural gas (CNG) and EVs to account for a higher share of its sales in the next three to five years, reports the Times of India. The share of both CNG-powered vehicles and EVs are expected to increase to 20% each of the overall sales. According to the automaker, the share of diesel cars in its overall sales currently stands at 15%, gasoline vehicles at 66%, CNG vehicles at 12%, and EVs at 7%. "I think CNG is a segment which is going to grow in the coming years. This will be a subset of, I would say, the petrol, because this is being more triggered with the rising cost of petrol. It uses a petrol engine… and therefore, it will mostly cannibalize petrol and to a great extent, also diesel, replacing diesel, replacing diesel in the entry segment," said Chandra. The automaker plans to add the CNG option to more hatchback and compact sedan models. (IHS Markit AutoIntelligence's Isha Sharma)

- German aviation startup Volocopter plans to launch air taxi services in Singapore in 2024 and is also in talks to offer flights to nearby destinations in Indonesia and Malaysia, reports the Automotive News Europe. The company plans to operate a fleet of 10 to 20 air taxis around the popular tourist destinations of Marina Bay and Sentosa, according to Volocopter chief commercial officer Christian Bauer. It also plans to set up maintenance operations in Singapore and is carrying out a feasibility study to manufacture electric vertical take-off and landing (eVTOL) aircraft in Asia, including in the city-state. "Volocopter is one of the first eVTOL partners in Singapore," said Bauer, adding, "On manufacturing, we are assessing that and we're giving us the next 12 months to see if we should do it or if there are other potentials." To support its expansion in Asia, the company plans to increase its staff to 500 by 2030 from about 10 currently in Singapore. (IHS Markit AutoIntelligence's Jamal Amir)

- The Malaysian Transport Ministry, together with the Road Transport Department (JPJ), has started offering road tax exemption for electric vehicles (EVs) and vehicles for people with disabilities, reports Malay Mail, citing Malaysian transport minister Datuk Seri Wee Ka Siong. The exemption for EVs, which applies to battery electric vehicles and fuel-cell electric vehicles but not hybrid vehicles, will be valid from 1 January 2022 to 31 December 2025. Meanwhile, the exemption given to vehicles for people with disabilities, which also applies to parents, guardians, and spouses, is valid to all vehicles that have been specially modified for use by disabled people. (IHS Markit AutoIntelligence's Jamal Amir)

- Tesla has signed a five-year agreement with Australia's

Liontown Resources for the supply of lithium spodumene concentrate.

According to Reuters, the automaker will procure 100,000 dry metric

tonnes (DMT) of the concentrate from the Australian supplier in the

first year starting 2024, increasing to 150,000 DMT per year in

subsequent years. As per the report, Liontown already has a lithium

supply deal with the battery unit of South Korea's LG Chem from its

flagship Kathleen Valley Lithium project. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-february-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-february-2022.html&text=Daily+Global+Market+Summary+-+16+February+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-february-2022.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 16 February 2022 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-february-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+16+February+2022+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-february-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}