Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 15, 2021

Daily Global Market Summary - 15 January 2021

US and European equity markets closed lower and APAC was mixed. US government bonds and the dollar were higher on the day, while benchmark European bonds closed mixed. European iTraxx and CDX-NA closed wider across IG and high yield. Oil, gold, silver, and copper were all lower on the day.

Americas

- US equity markets closed lower; Russell 2000 -1.5%, Nasdaq -0.9%, S&P 500 -0.7%, and DJIA -0.6%.

- 10yr US govt bonds closed -4bps/1.09% yield and 30yr bonds -3bps/1.84% yield.

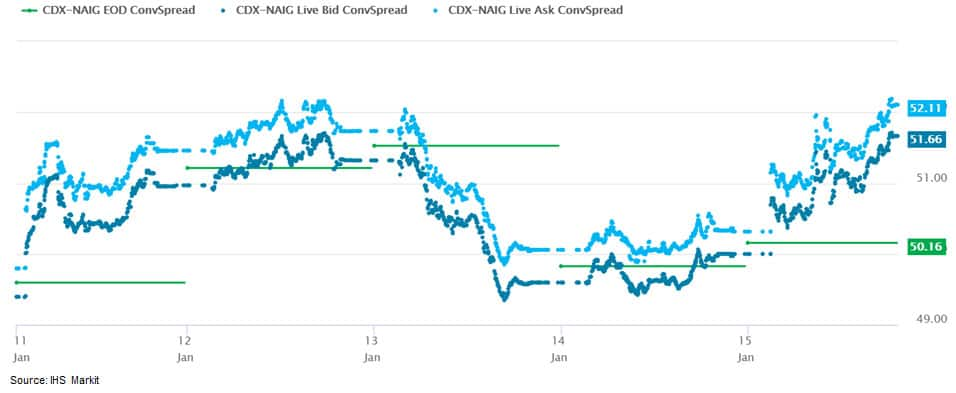

- CDX-NAIG closed +2bps/52bps and CDX-NAHY +8bps/304bps, which is

+2bps and +12bps week-over-week, respectively.

- DXY US dollar index closed +0.6%/90.77.

- Gold closed -1.2%/$1,830 per ounce, silver -3.6%/$24.87 per ounce, and copper -1.6%/$3.60 per pound.

- Crude oil closed -2.3%/$52.36 per barrel.

- New York City property values are set to decline 5.2% from the current fiscal year, the biggest decline since the early 1990s, highlighting the toll the pandemic has taken on the city's commercial and residential property values. The city has set a value of $1.3 trillion for its more than one million properties for the fiscal year beginning in July, according to a tentative assessment roll released by the Department of Finance Friday. Commercial properties led the decline. Retail and hotel values dropped 21.1% and 22.4%, respectively, while office building values fell 15.6%. (Bloomberg)

- Equinor has scored a second win with The New York State Energy Research and Development Authority (NYSERDA) with the award of the state's second offshore wind solicitation. The company, along with BP, will develop the Empire Wind 2 and Beacon Wind 1 offshore wind projects, generating 1,260 MW and 1,230 MW, respectively. As part of their bid proposal, Equinor will also invest in transforming the South Brooklyn Marine Terminal (SBMT) and the Port of Albany into offshore wind bases. Equinor is currently developing the 816 MW Empire Wind 1 offshore wind farm, which was selected previously, in 2019, in New York's first-ever offshore wind solicitation. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- As per IHS Markit's Commodities at Sea, total coal shipments

from USEC, USG, and USWC for December 2020 stood at 6mt (up 10%

y/y). For the said period, shipments from USEC, USG, and USWC stood

at 3.7mt (at almost previous year levels), 1.6mt (up 40% y/y), and

0.7mt (up 11% y/y), respectively. (IHS Markit Commodities at Sea's

Pranay Shukla)

- Overall, during full 2020, USA coal shipments stood at 60.3mt (down 21% y/y). In terms of regions, from USEC, USG and USWC shipments stood at 40.5mt (down 17% y/y), 14.3mt (down 25% y/y), and 5.6mt (down 35% y/y), respectively.

- During the entire 2020, Baltimore shipments stood at 14.7mt (versus 16.8mt). In terms of Consol Energy Coal and CSX Chesapeake (Curtis Bay) shipments stood at 9.1mt (versus 10.5mt) and 5.6mt (versus 6.3mt).

- Compared to Baltimore, coal shipments during December 2020 from Hampton Roads declined and stood at 2.2mt (down 20% y/y)).

- During 2020, Mobile coal exports stood at 9.8mt (down 7% y/y). Annual shipments declined to Japan (1.3mt, down 45% y/y), Netherlands (1.6mt, down 7%), and Germany (0.6mt, down 16%).

- Overall during 2020, in terms of import regions, total USA coal shipments declined to NW Europe (9.8mt, down 33% y/y), JKT (8.2mt, down 46% y/y), Med (5.9mt, down 13%), Black Sea (3.8mt, down 32%) and North Africa (2.1mt, down 63%). Shipments increased to the Indian sub-continent (12.4mt, up 5% y/y) and EC South America (7.9mt, up 9%).

- For 1Q21 and full 2021, USA coal shipments are forecasted at 18.2mt and 68.9mt, respectively.

- JPMorgan Chase, Citigroup and Wells Fargo have released a total of more than $5bn of pandemic-era loan loss reserves in a sign of their optimism for the economic outlook even as the US reels from the latest wave of COVID-19. The move helped three of America's biggest banks end the year on a high and reflects the lenders' confidence that their clients will make good on debts despite the fallout from the pandemic. (FT)

- Total US retail trade and food services sales declined 0.7% in

December after a downwardly revised decrease of 1.4% in November.

Despite a third consecutive monthly decline, the level of retail

sales through December was still 2.6% above the pre-pandemic

February level. (IHS Markit Economists James Bohnaker and David

Deull)

- Nonstore (mostly online) retail sales plunged 5.8% as more online holiday shopping was presumably pulled forward into October and November. Other holiday categories also underperformed; electronics and appliances (down 4.9%), general merchandise (down 1.2%), sporting goods (down 0.8%) and furniture and home furnishing stores (down 0.6%) likely suffered from less foot traffic amid the worsening COVID-19 pandemic around the holidays.

- Motor vehicles and parts (up 1.9%) and building materials and garden supply stores (up 0.9%) were among the few winners in December—a sign that consumers will continue to allocate more of their discretionary income to durable goods and home improvement while large swaths of the service industry remain limited by social distancing and containment measures.

- The restaurant industry's double-dip contraction worsened in December as food services and drinking places sales fell 4.5% in December and 12-month growth slipped to -21.2%—the lowest since June.

- Retail sales have weakened amid the worsening pandemic, but new fiscal stimulus will help prevent a more substantial pullback in the first quarter.

- Total US industrial production (IP) rose 1.6% in December, the

largest gain since July, reflecting increases in manufacturing

(0.9%), mining (1.6%), and utilities IP (6.2%). (IHS Markit

Economists Ben Herzon, Lawrence Nelson, and Akshat Goel)

- The details in this report that feed into our GDP tracking suggested some minor changes in composition, but were nevertheless consistent with our prior estimate for fourth-quarter and first-quarter GDP growth of 2.9% and 2.2%, respectively.

- The increase in manufacturing IP was more than a percentage point above our estimate and beat the consensus expectation by several tenths of a percentage point. The increase would have been higher but for a decline in IP of motor vehicles and parts (down 1.6%); excluding motor vehicles and parts, manufacturing output rose 1.1%.

- Manufacturing output continues to close in on its pre-pandemic level. Over the eight months through December, manufacturing output had reversed 87% of the two-month contraction through April. The level of manufacturing IP in December was 2.6% below February.

- The sharp increase in utilities IP in December reflected a rebound in demand for heating after an unusually warm November.

- Mining activity increased for the second consecutive month in December, supported by a strong increase in oil and gas extraction (10.7%) even as mining excluding oil and gas contracted.

- Industrial production remains strong despite a resurgence in COVID-19 cases and tightening business restrictions.

- The US University of Michigan Consumer Sentiment Index fell 1.5

points (1.9%) to 79.2 in the preliminary January reading. The level

of the index is consistent with our expectation for an essentially

unchanged rate of consumer spending in the first quarter. (IHS

Markit Economists David Deull and James Bohnaker)

- Views on current conditions led the decline. The index measuring views on current conditions fell 2.3 points to 87.7, while the index of consumer expectations slipped 0.8 point to 73.8. Both were above November but below their December readings.

- The interview period for this survey ran during 2-13 January, including the day of the Capitol breach and culminating in Trump's impeachment.

- The recent relative calm in the headline index masks sharp swings in views by individual respondents based on political leaning. According to the University of Michigan, between June and December in 2020, the partisan gap in the expectations index swung by 74.0 points, nearly identical to the 74.6-point swing in the opposite direction in 2016.

- Record-high readings on new COVID-19 cases, hospitalizations, and deaths were likely somewhat counterbalanced by the strong performance of equity markets. The S&P 500 Index hovered near record highs during the second week of January.

- Consumer sentiment fell more among higher-income households. Sentiment reported for households earning less than $75,000 a year fell 0.3 point to 76.0, while sentiment for higher earners fell 1.7 points to 82.3.

- The index of buying conditions for large household durable goods fell 5 points in January to 114, matching its November level. The index for vehicles edged down 3 points to 118, while that for homes fell 9 points to 125; these were the lowest since April and May, respectively.

- The expected one-year inflation rate rebounded 0.5 percentage point to 3.0%, while expected five-year inflation rose 0.2 point to 2.7%.

- Passenger throughput at US airports has weakened in recent days, according to daily data from the Transportation Security Administration (TSA), and is back in line with readings prior to the holidays. This suggests that the holidays provided a temporary boost to the travel sector. The broader recovery has been slow. Meanwhile, revenue per available room at US hotels (relative to year-earlier levels) fell last week but appears to be improving more broadly. Furthermore, job postings last week were 17.7% below the January 2020 level, according to the Opportunity Insights Economic Tracker. Readings in recent weeks have been volatile but broadly indicative of a weak labor market. (IHS Markit Economists Ben Herzon and Joel Prakken)

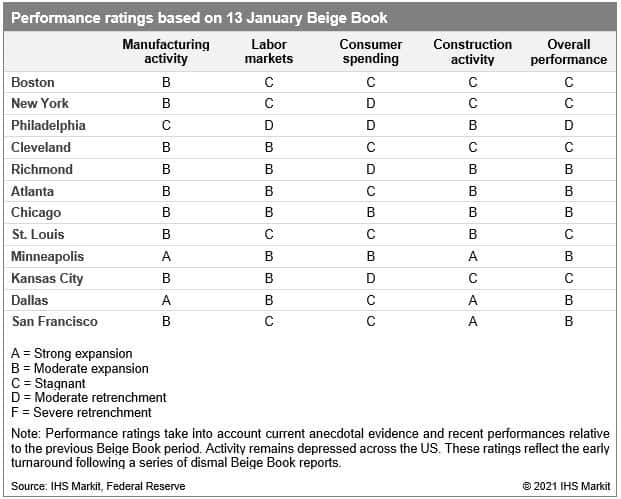

- The latest release of the Federal Reserve's Beige Book reports

that surging COVID-19 cases and hospitalizations in November and

December resulted in weakening or declining economic activity in

the Northeast and parts of the Midwest according to the US Federal

Reserve's latest Beige Book report, containing anecdotal

information from regional business contacts. The onset of cold

winter weather and reinstated restrictions on indoor dining and

capacity limits led to an overall decline in consumer spending and

weaker hiring in these regions, especially in leisure and

hospitality services. Hiring activity rose modestly in much of the

country including strong gains among manufacturers in the South and

Midwest. Despite scattered reports of supply chain disruptions and

production slowdowns owing to COVID-19 infections, most

manufacturers saw higher new orders and shipments over the final

weeks of 2020. Home construction gains were strongest in Texas and

the rest of the South where demand for new homes continued to

outpace supply, while sluggish homebuilding and very low

inventories in the Northeast contributed to further home price

appreciation. Employment gains and consumer spending growth,

especially in the heavily impacted leisure and hospitality

industry, remain contingent on the rising or falling prevalence of

the virus in local communities. Winter weather and restrictions on

indoor dining and entertainment will limit economic growth in the

West and Northeast. Rising caseloads and hospitalizations will

threaten the manufacturing recovery and consumers' willingness to

spend in the South and Midwest. Widespread implementation of

COVID-19 vaccines, expected to ramp up over the first half of 2021

and reach critical mass over the summer, will be crucial to

consumer confidence and renewed growth in hiring. (IHS Markit

Economist James Kelly)

- US regulatory agency the National Highway Traffic Safety Administration (NHTSA) has issued updated rules for vehicles equipped with automated driving systems and which do not have "traditional manual controls" for human drivers and for vehicles designed purely for moving cargo. The changes are in a "final rule" issued following the agency's proposal, issued on 30 March 2020, to modernize vehicle crashworthiness standards "to remove or amend terms or other text that did not account for the unconventional interior designs that are expected to accompany Automated Driving System-equipped vehicles (ADS-equipped vehicles), including the lack of driving controls". The NHTSA's report on the final rule changes addresses the reactions received and input gathered from the consultation on the 30 March 2020 proposal and, step by step, acknowledges the comments received, explains what change the NHTSA finally did or did not make, and why it made a particular decision. The agency says its updated rules remove unnecessary wording that may act as a barrier to innovation and provide regulatory certainty. The new rules exempt certain vehicles from compliance with Federal Motor Vehicle Safety System (FMVSS) regulations related to crashworthiness, specifically those designed to carry goods instead of people and which have an automated driving system (ADS) and do not have traditional manual controls for the driver (steering wheel and brake and accelerator pedals), referred to as "occupant-less vehicles". These vehicles do not have human occupants and, therefore, have no designated seating positions. Additionally, the new rules apply to vehicles with forward-facing seats; the NHTSA states that additional research is needed for rear-facing seats or a campfire-type seating arrangement. The rules also address what the NHTSA calls dual-mode ADS vehicles, which have traditional manual controls as part of a conventional driving mode, but can operate in ADS mode. The rules do not yet contain a definition of manually operated controls that includes future potential use of joystick controls or possibly control using a tablet or cell phone, as such solutions have not been developed yet. However, in the new rules, the agency has changed the term "steering wheel" to "steering control", noting that steering controls may not be circular. There is also a series of changes that improves how the rules define passenger and driver seating positions, and addresses steering control as a spatial reference. The updated rules come into effect 60 days after being filed in the Federal Register, and a PDF of the "final rule" on "Occupant Protection for Vehicles With Automated Driving Systems" is available on the NHTSA's website. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The US administration has imposed a ban on all cotton and tomato products from China's western Xinjiang region over concerns of use of forced Uighur Muslim labor, US Customs and Border Protection (CBP) said. A Withhold Release Order (WRO) was issued and all cotton and tomato products would be seized at US ports. The ban will apply to raw fibers, apparel and textiles produced from cotton grown in western Xinjiang. It also includes all tomato-based food products, such as ketchup, and seeds from the region. The ban is based on the information on the use of detainee or prison labor with authorities claiming to have found examples of debt bondage, forced labor, isolation, intimidation and threats, withholding of wages, and abusive working conditions. The US State Department estimates that more than 1.0 million Uyghurs, as well as members of other Muslim minority groups, have been detained in working camps in Xinjiang. Xinjiang is China's cotton and tomato growing hub. US imported an estimated about USD9 billion of cotton products and USD10 million worth of tomato products last year, according to CBP. However, concerning tomato products China accounts for less than 3% of the about 40,000 tons imported in 2019. This is not the first attempt from the US authorities to contrast alleged forced labor in the region. In December, CBP issued a ban against cotton products made by Xinjiang governmental organization, Xinjiang Production and Construction Corps (XPCC). Similar measures have also been announced by the UK and Canadian governments. Beijing has denied accusations explaining that it consists of vocational training aiming to deradicalize Islamic extremists. More recently Foreign Ministry spokesman Zhao Lijian stated that "The so-called forced labor is nothing but a lie fabricated by certain institutions and individuals in Western countries". (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- BMW is to end a limited subscription service in the United States at the end of this month, reports Automotive News. According to the report, the pilot subscription program, which started in 2018, operated only in Nashville, Tennessee. A BMW spokesperson reportedly said, "Our intent with the pilot was to learn about the viability of the subscription model and gauge customer interest. We are in the process of developing the next iteration of the program." According to the report, BMW's National Dealer Forum chairman, David Sloane, commenting on the fact that the program has not been financially viable, said, "It's been difficult for automakers to figure out subscription fleet sizes and product mix. It's important manufacturers test these different business models, but it's also good that, when they don't work, they acknowledge that." The BMW pilot subscription program was launched in April 2018 and the pricing was adjusted soon afterwards. BMW started its subscription program at a similar time as Mercedes-Benz began a program in the US, which has also been dropped, although Mercedes expanded its program to Atlanta, but BMW did not expand its program beyond its original area. A number of automakers have tried subscription ownership services in the past several years, and most programs showed promise but ultimately were dropped. An exception to this is Porsche's subscription program in the US and Canada, which it has continued to expand. Other automakers that have dropped subscription programs include Cadillac, Lincoln, and Ford. There is no doubt that each of these automakers gathered insights on consumer demand for use when developing potential ownership models in future. However, the immediate learning from these programs seems to be that consumers are not warming up to the idea of an all-inclusive service and car ownership based on daily or weekly needs. (IHS Markit AutoIntelligence's Stephanie Brinley)

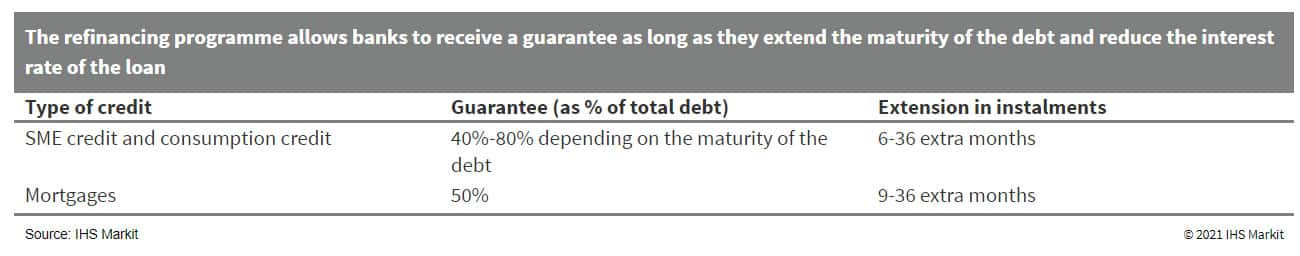

- Peru's development bank, the Financial Cooperation for

Development (Corporación Financiera de Desarrollo: COFIDE), on 12

January approved a list of financial institutions that can offer

loan rescheduling as stated by the recently approved law for loan

refinancing. The permits were given to 18 financial institutions, 6

of them banks: Ripley, Santander, Azteca, BBVA, Interbank, and

Banbif. According to media, the banks will begin the program in the

next few days. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- Since the approval from Peru's Ministry of Economy and Finance in November 2020, there had been no official statements regarding the implementation of the program. However, despite being expected to start by mid-November, the plan's approval experienced significant delays related to several regulatory processes, such as approvals and checks from regulatory bodies.

- IHS Markit has previously highlighted that banks would benefit from a rapid and efficient application of this program. It would limit rises in impairment, while minimizing losses related to the rescheduling of loans that had the potential to pay. Nevertheless, the program's delayed approval and the fact that it is set to end by law by the end of January could potentially take away the advantage.

- There have been some calls from the Banking Association of Peru

(Asociación de Bancos del Perú: ASBANC) and COFIDE to increase the

timeframe of the program. Although this would improve the

application and the benefits of the plan, it is uncertain that the

government will grant an extension.

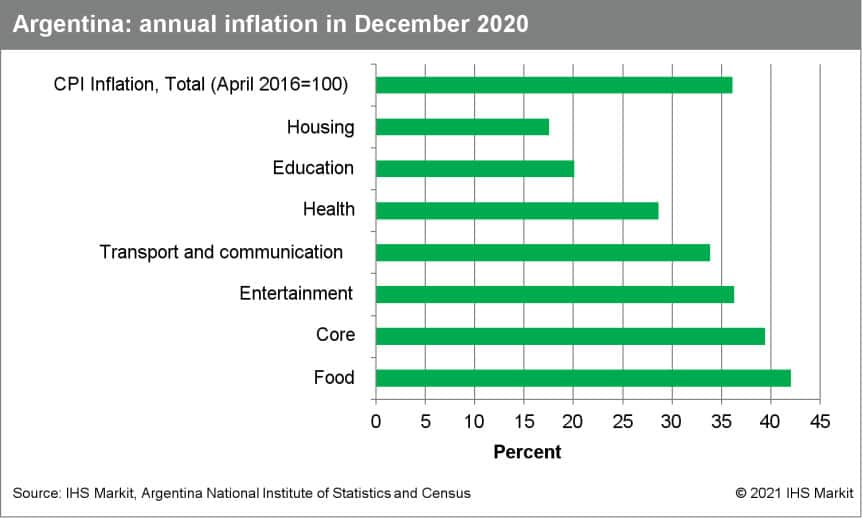

- Argentina's consumer price index increased by 4.0% month on

month (m/m) during December 2020. The increase in consumer prices

was most pronounced in the health sector, in the leisure and

culture activities, and the food and beverages sector. (IHS Markit

Economist Paula Diosquez-Rice)

- Argentina's inflation rate in December was driven by price increases in the food and beverages category, with significant price rises for beef and other meats, and fresh fruit, as well as rises in the recreation and leisure, clothing and apparel, and home furnishings and maintenance sectors. The rise in the transportation component was mainly driven by the increase in public transportation tariffs and in vehicle prices (up by 64% year on year [y/y] in December).

- Prices of regulated items increased by 2.6% m/m, while prices of seasonal items rose by 1.3% m/m. The core inflation rate stood at 4.9% m/m. Meanwhile, wholesale prices climbed by 39.2% y/y in November, a slight deceleration compared with the previous month. The annual consumer price inflation rate in December was 36.1%, an acceleration compared with November.

- Inflation expectations for the next 12 months remained relatively stable in December; Torcuato Di Tella University reported a median of 40% y/y, similar to the previous month. The average expected annual inflation rate is 42.9%. However, the inflation expectation survey by the Central Bank of the Argentine Republic (Banco Central de la República Argentina: BCRA) shows a median of 49.8% in December.

- The prices of regulated items and services rose by 14.8% y/y in December 2020 (the first year of the Alberto Fernandez administration), which is much lower than the headline rate (36.1% y/y). The cost of food and non-alcohol beverages increased by 42.1% y/y in December, prompting restrictive policy responses from the government (further the price control policy and the corn export ban: short-lived as the restriction was later suspended).

- Although the monetary policy is currently in positive territory

in real terms (the policy rate has been maintained at 38% for the

past two months), Argentina continues with its expansionary

monetary approach with monetary aggregates increasing above 83% y/y

in December 2020.

Europe/Middle East/Africa

- European equity markets closed lower; Spain -1.7%, Germany -1.4%, France -1.2%, Italy -1.1%, and UK -1.0%.

- 10yr European govt bonds closed mixed; Italy -2bps, Spain -1bp, UK flat, and Germany/France +1bp.

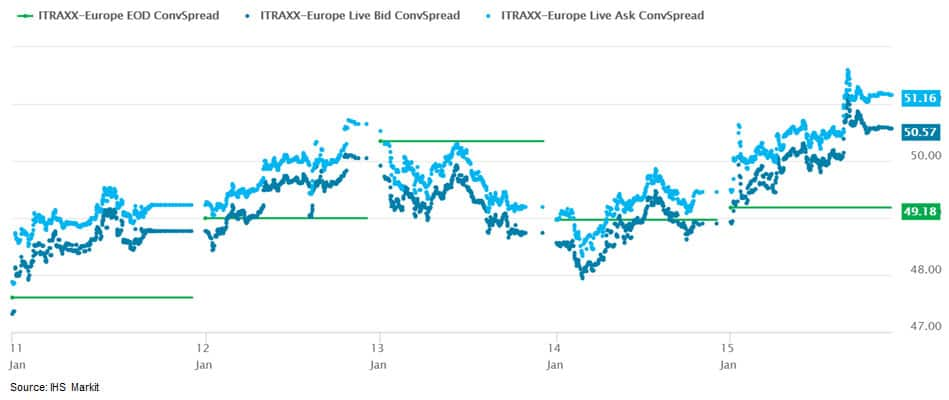

- iTraxx-Europe closed +2bps/51bps and iTraxx-Xover +9bps/259bps,

which is +3bps and +16bps week-over-week, respectively.

- Brent crude closed -2.3%/$55.10 per barrel.

- UK monthly GDP contracted for the first time in six months in

November 2020, but the decline was less severe than expected.

Nevertheless, the economy appears to be approaching a double-dip

recession in early 2021. The Office for National Statistics (ONS)

reports that the UK economy contracted by 2.6% m/m in November

2020, which followed m/m gains of 0.6% in October, 1.1% in

September, and 2.2% in July. In addition, it stood 8.9% below the

January level, which represents the pre-COVID-19 virus peak. (IHS

Markit Economist Raj Badiani)

- This was less severe than expected, and it outperformed the 5.7% m/m drop consensus forecast by economists polled by Reuters.

- In annual terms, the economy in November 2020 was 8.9% smaller than a year earlier.

- The economy grew by 4.1% in the three months to November compared with the three months to August, down from growth of 10.5% in the three months to October. Nevertheless, GDP was still 7.6% smaller compared with September-November 2019.

- A breakdown by type of output reveals that the services sector decreased by 3.4% m/m in November while remaining 9.9% lower than the February 2020 level.

- All 14 services sub-sectors reported falling output between October and November 2020 because of the reintroduction of COVID-19 virus restrictions in some parts of the UK. The accommodation and food service activities endured the sharpest drops, followed by wholesale and retail trade, other service activities and arts, and entertainment and recreation.

- Meanwhile, industrial production was broadly stable, edging down by 0.1% m/m in October 2020, after slowing notably in September and August.

- We estimate that the economy had lost further ground in December 2020, with the government implementing a three-tiered system of restrictions in England to tackle rising new COVID-19 cases. London transitioned into the highest tier of restrictions from 16 December, meaning that 34 million from the 56.2 million people faced the closure of the hospitality and leisure sectors.

- Furthermore, the restrictions were further tightened for 24 million people in the second half of December, which entailed the closure of non-essential retailers, bowling alleys, hair salons, cinemas, and gyms for a two-week period.

- The economy is likely to struggle again in the first quarter of 2021 in the face of even tighter restrictions in January and February, namely a third national lockdown in England. It also entailed the closure of schools this time around.

- Robotics Research has partnered with Gaussin to develop vehicles for logistics and yard automation. Gaussin will deploy Robotic Research's autonomy kit, AutoDrive, into its fleet of zero-emission yard trucks, heavy-duty logistics vehicles, and shuttle buses. Christophe Gaussin, CEO of Gaussin, said, "This new agreement with Robotic Research is an excellent opportunity for Gaussin to enhance our autonomous vehicle technology. Robotic Research has a proven track record developing autonomous and robotic technology for government agencies and commercial customers. Robotic Research's technology is the ideal complement to our self-driving technology and will allow Gaussin to expand our presence in North America." Autonomous vehicles are gaining a great deal of traction in the logistics industry because of a growing shortage of drivers and improved efficiency. Robotics Research is an engineering and technology company, founded in 2002 to offer autonomy software and robotic technology. Robotics Research has also provided its AutoDrive autonomy kit to Local Motor's Olli, a 3D-printed electric autonomous shuttle, to help the shuttle to navigate in mixed-traffic environments. Meanwhile, Gaussin is an engineering company that designs and sells products and services in the transport and logistics field. Last year, US-based package delivery company UPS tested Gaussin's autonomous electric shifters at its hub in London. (IHS Markit Automotive Mobility)

- Essar Oil (Mumbai, India) and clean energy specialist Progressive Energy (Stonehouse, UK) say they have agreed to partner on the development of two low-carbon hydrogen production plants at Essar's Stanlow, UK, refinery that will supply Progressive's planned HyNet low-carbon regional distribution network. The companies say they have signed a memorandum of understanding to invest £750 million ($1 billion) jointly to build two hydrogen production hubs. The first hub will initially produce 3 terawatt-hours (TWh) of low-carbon hydrogen each year from 2025, converting natural gas and fuel gases from the refinery. This will be followed by a facility twice as large, enabling a total capacity of more than 9 TWh/year of hydrogen. Carbon dioxide (CO2) from the process will be captured and injected using existing pipelines into subsurface geological reservoirs off the UK's west coast in Liverpool Bay. The Stanlow refinery produces 16% of UK road transport fuels and processes 10 million metric tons/year (MMt/y) of crude oil and other feedstocks. The new plants will provide Essar with low-carbon hydrogen to decarbonize its own energy demand, in addition to creating a regional hydrogen economy, the company says. The hydrogen supplied into Progressive's HyNet North West system will be used for industrial and domestic purposes, it says. The plants will utilize Johnson Matthey's Low Carbon Hydrogen™ technology, with engineering in partnership with SNC-Lavalin well advanced, Essar says. An initial £7.5 million in funding for early engineering work on the hydrogen project was provided by the UK government in February last year. The hydrogen development will set the Stanlow refinery "on a journey to be the UK's first net-zero emission refinery," says Stein Ivar Bye, CEO of Essar's UK energy business. The project has the potential to remove more than 2 MMt/y of CO2 emissions currently being produced, he says. Essar acquired the Stanlow refinery from Shell in 2011. (IHS Markit Chemical Advisory)

- In contrast to the November 2020 collapse in eurozone retail

sales, subsequent industrial production and export data continued

their recent run of strength, rising by 2.5% month on month (m/m)

and 2.0% m/m in November, respectively, their seventh successive

monthly increases. (IHS Markit Economist Ken Wattret)

- The level of eurozone industrial production was just 0.8% below where it was in February 2020, following a striking V-shaped recovery (see chart below). Even assuming no further increase in output in December 2020, the implied quarter-on-quarter (q/q) increase for the fourth quarter of 2020 overall would be in excess of 4%.

- Production of capital goods outperformed in November 2020, surging by 7% m/m. Output in this sub-sector was 1.7% above its pre-pandemic level, although given the volatility in big-ticket items, a partial correction is likely in subsequent months.

- Production of consumer durable goods returned to its February 2020 level in November 2020, while output of intermediates (-1.3%) and non-durable consumer goods (-3.3%) have yet to fully regain their COVID-19-related losses.

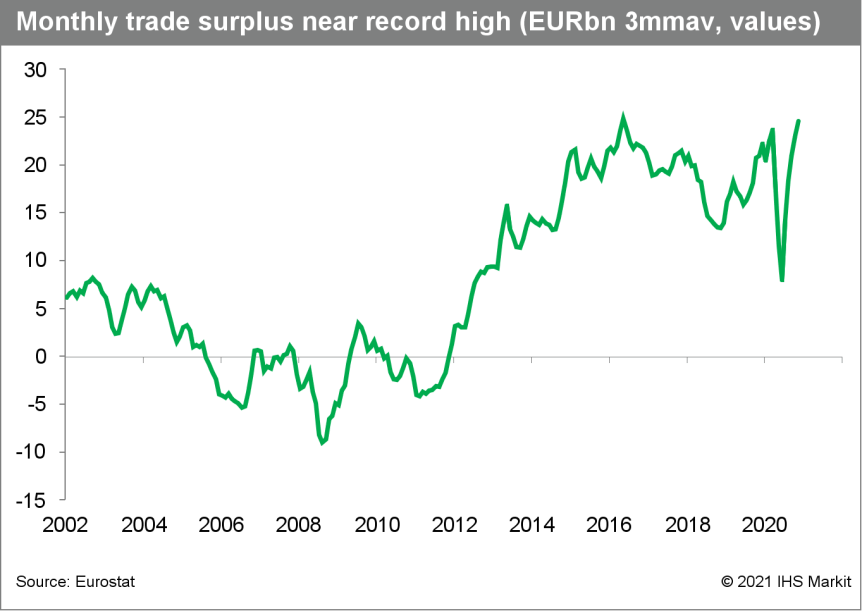

- The eurozone's seasonally adjusted trade surplus remained broadly stable in November last year, at a very elevated of EUR25.1 billion, with the three-month moving average monthly surplus of EUR24.5 billion a whisker shy of the record high in May 2016.

- Following the seventh consecutive m/m increase, the level of exports was just over 4% below where it was in February 2020, compared with a peak decline of over 30% as of April 2020.

- Imports rose by 2.4% m/m in November 2020, also their seventh straight monthly increase, and were around 5% below their February 2020 pre-pandemic level.

- The economic data over the fourth quarter of 2020 to date have

been mixed, with the ramping up of COVID-19 virus containment

measures in many eurozone member states having a very adverse

effect on consumer spending, while the industrial and trade data

have remained relatively unaffected.

- Automotive test systems supplier AB Dynamics has collaborated with the Volkswagen (VW) Group to conduct scenario testing using a swarm of vehicles. This accelerates testing and development of advanced driver-assistance systems (ADAS) and autonomous systems while reducing risk and cost. AB Dynamics used its vehicle control robots and wireless telemetry system with VW Group to synchronize eight objects in a swarm test. Scenarios tested a range of common overtaking maneuvers, such as merge-ins, caused by lane closures on divided highways, cut-in, and cut-out. Jeremy Ash, sales director at AB Dynamics, said, "We are the only company to use the same software toolchain for simulated and real world testing; this means we can develop and run a test in the virtual world and simply 'copy and paste' it when at the test track. Swarm testing is very complex and can involve the precise choreography of eight or more test items. Our solution enables customers to run thousands of iterations of tests virtually and then confidently replicate a sample of these in the real world for correlation." AB Dynamics and VW Group have previously demonstrated synchronization of vehicles in a swarm test using dual-band IP radio, which enables the transfer of data from vehicle-to-vehicle (V2V) and vehicle-to-base through networks. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- A total of six companies and consortia will vie to develop the Thor offshore wind farm, located in the North Sea, off the coast of Denmark. The Danish Energy Agency revealed that it had received a total of six applications, and all met its criteria for financial and technical capacity. The shortlisted developers include Ørsted, Vattenfall, a consortium of Total and Iberdrola, RWE Wind Holding and RWE Offshore Wind (bidding as Thor Wind Farm), the joint venture of SSE Renewables and Thor OFW (owned by Copenhagen Infrastructure and Andel Holdings), and Swan Wind (a joint venture between Eneco Wind and European Energy). Interested developers will now have until mid-March to submit their preliminary bids, with negotiations set immediately in the following month. Final bids are expected by November with the project award announced in December. Thor will have a capacity of around 800 to 1,000 MW and is expected to be fully completed by 2027, with first connection to the grid by the end of 2024. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- According to all measures, on an annual basis Sweden's headline

consumer price inflation accelerated in December 2020. The consumer

price index (CPI), which is the national definition, came in at

0.5% year on year (y/y), up from 0.2% in November 2020. According

to the EU-harmonised measure (HICP), inflation was 0.6% y/y, up

from 0.2% y/y in November. (IHS Markit Economist Daniel Kral)

- CPI at fixed interest rates (CPIF), which is the most closely watched indicator by the central bank, accelerated to 0.5% y/y in December 2020, which is 0.5 percentage point (pp) above the Riksbank's November 2020 forecast. CPIF excluding energy came in at 1.2% y/y, up from 1.1% in November and 0.2 pp above the Riksbank's November forecast (see Chart 2). The main reason for the upwards surprise in CPIF inflation in December was higher energy prices.

- For the full year 2020, CPI and CPIF inflation was at 0.5%, HICP inflation at 0.7%, and CPIF excluding energy at 1.2%. Annual CPIF inflation was the lowest since 2014, shortly after which, in early 2015, the Riksbank cut the policy rate to negative territory.

- For the full year, the largest drop in CPI inflation came from communications, down by 5.5%; recreation and culture, down by 1.1%; and clothing and footwear, down by 0.5%. Housing and utilities dropped by 0.1%, compared with growth of 2.9% in 2019. The highest increases were in the prices of food and non-alcoholic beverages, up by 2.1%; alcoholic beverages and tobacco, up by 1.8%; and healthcare, up by 1.8%.

- Owing to the lack of availability of some services, prices comprising 2.2% of the consumption basket had to be estimated in December 2020, up from 1.8% in November.

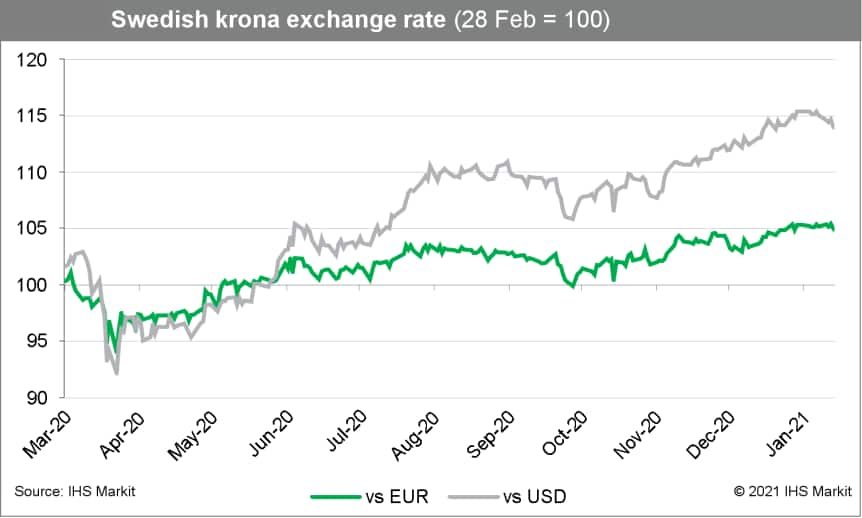

- Although inflation surprised on the upside in December 2020, it

is significantly below the Riksbank's target. The broader

deflationary environment is reinforced by a strong krona, which in

mid-January is trading almost 15% stronger versus the US dollar and

5% stronger versus the euro compared with the end of February 2020.

We expect headline inflation to remain subdued in 2021, despite a

temporary acceleration in spring (March-May) due to base

effects.

- European meat processor Danish Crown is strengthening its position in the Swedish market with the acquisition of charcuterie company Ingemar Johansson. Danish Crown said the acquired business would allow its existing Swedish subsidiary KLS Ugglarps to builds its share of Sweden's market for sausages and other processed products. Already approved by Swedish competition authorities, the deal is in line with Danish Crown's 4WD strategy, where the focus is on supplementing the group's strong position within slaughtering pigs and cattle with new activities within processing and breeding. Ingemar Johansson is a company based in Gothenburg that produces charcuterie with a focus on Swedish food tradition and Swedish ingredients. The company had a turnover of about SEK230 million in 2019. Danish Crown's Swedish arm, KLS Ugglarps is a leader in Swedish meat production with four slaughterhouses and two processing plants in the south of the country. In the most recent financial year, KLS Ugglarps had a turnover of just over DKK6 billion. (IHS Markit Food and Agricultural Commodities' Max Green)

- SEAT has announced that its sales dropped 25.6% in 2020 amid the coronavirus disease 2019 (COVID-19) virus pandemic. According to a company statement, the combined sales of the SEAT and Cupra brands dropped to 427,000 units last year. The statement added that, although the Cupra brand recorded a sales gain of around 11% to 27,400 units, the SEAT brand's sales dropped by 27.3% to 399,600 units in 2020. On a market basis, Germany remained its largest with sales of 109,500 units last year, although this represented a decline of 17.4%. SEAT's domestic market, Spain, was its second largest in 2020, but its sales tumbled there by 32.1% to 73,300 units. The company's third-largest market was the United Kingdom, despite a sales slump of 33.8% to 45,600 units. However, the company reported a strong improvement in both Turkey and Israel. The fall in sales suffered by the SEAT unit in 2020 is not surprising given the impact that the COVID-19 virus has had on some of its key markets, with the imposition of lockdown measures and production stoppages in the first half of the year. The SEAT brand suffered the brunt of the company's market falls due to the volume and mass-market nature of its products. However, it must be some relief that the Leon remained its biggest-selling brand on its replacement early in the year. The growth by the performance-orientated Cupra brand suggests that its positive momentum is being maintained, although the difference compared to 2019 is entirely down to the introduction of the Formentor late in the year, of which 3,600 units were sold. IHS Markit forecasts that SEAT's registrations will grow by 10% in 2021, although this will still be well below the 500,000 unit mark achieved in 2018 and 2019. (IHS Markit AutoIntelligence's Ian Fletcher)

Asia-Pacific

- APAC equity markets closed mixed; South Korea -2.0%, India -1.1%, Japan -0.6%, Australian/Mainland China flat, and Hong Kong +0.3%.

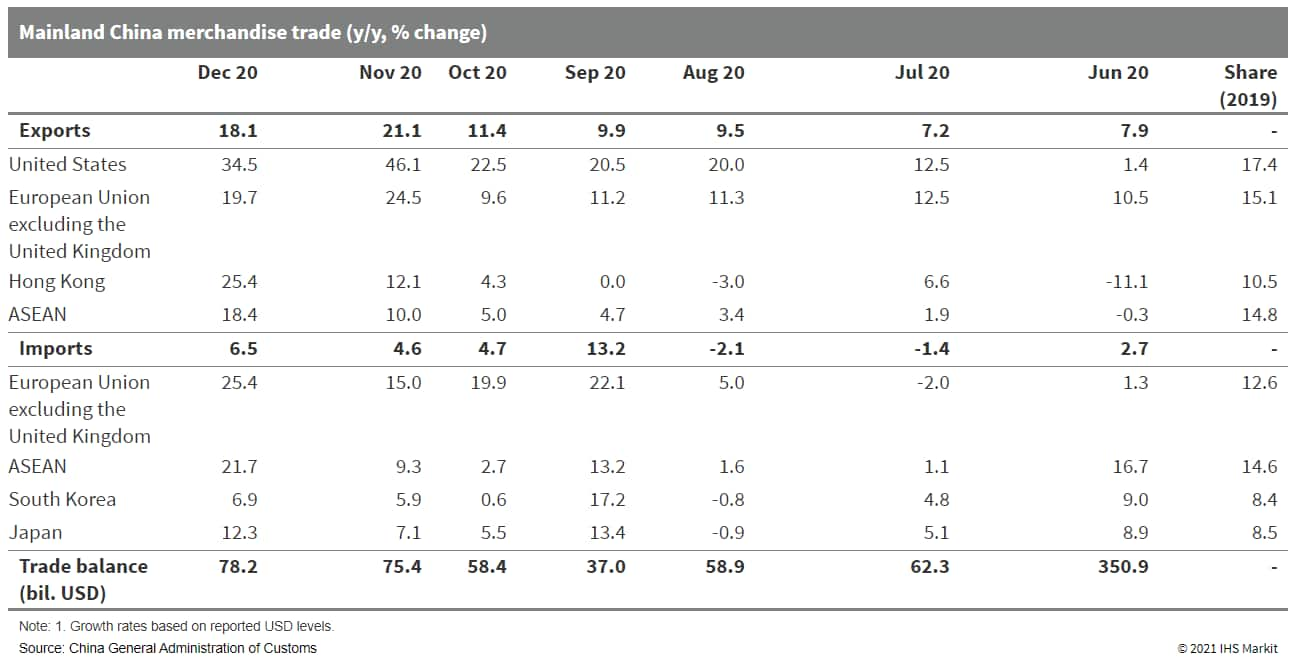

- Mainland China's merchandise exports rose 18.1% year on year

(y/y) in December 2020 in US dollar terms, slightly down from the

21.1% y/y expansion recorded in November; however, it remains one

of the highest rates recorded in three years despite a high base in

2019, according to the General Administration of Customs (GAC).

(IHS Markit Economist Yating Xu)

- Merchandise imports growth recovered to 6.5% y/y from 4.6% y/y in November. Mainland China's exports expanded 3.6% y/y for full-year 2020, making mainland China the only economy among major economies reporting year-on-year increase in exports in 2020. However, imports fell 1.1% y/y overall in 2020. Excluding the impact of currency appreciation, Chinese yuan-denominated exports rose 10.9% y/y and Chinese yuan-denominated imports declined 0.2% y/y.

- By market, strong demand from Hong Kong and Association of Southeast Asian Nations (ASEAN) supported exports in December. Growth of exports to the United States and European Union (excluding the United Kingdom) moderated, but stands at a three-year high.

- By product, growth of exports of high-tech products and mechanical products remained strong, at 26.5% y/y and 23.1% y/y, respectively. However, the contribution from pandemic-prevention supplies declined as the growth of textile, medical equipment, and plastic products exports moderated from 48% in November to 35.6% in December, the lowest rate registered since April 2020. Meanwhile, exports of other labor-intensive goods such as clothes, toys, and shoes sharply declined.

- Imports have been in expansion for four consecutive months. Strong growth in imports of agricultural products, auto, and integrated circuits supported the headline growth figure. However, iron ore, crude oil, and copper imports moderated despite rising prices.

- Trade surplus hit a new record high of USD78.2 billion in December on strong exports growth. The trade surplus for full-year 2020 amounted to USD535 billion, up 27% y/y. mainland China's trade surplus with the United States reached USD317 billion, up 7% y/y.

- Mainland China's current exports strength is expected to be

maintained through the first quarter of 2021 as new, major

outbreaks impede global production recovery and leads to supply

shortages, thus increasing demand for mainland Chinese exports.

Meanwhile, the low base in first-quarter 2020 will contribute to a

higher growth figure for 2021. Moreover, to reduce population

mobility during the upcoming Lunar New Year festival, local

governments are encouraging enterprises to continue production

through the holiday; this may lead to above-seasonal production

growth this year.

- Chinese AJC is now priced at USD8.60, or thereabouts, per gallon ex-dock east coast. This is equivalent to USD1,580 per ton, and is a marked increase from average prices of around USD7.75/gallon only a week ago. Sales of Turkish AJC, both organic and conventional, are reported as too few to establish a market, which reinforces reports that Turkey is now sold out. The same applies to Latin American juice. European offerings are described as very light and mostly between USD8.40-8.90/gallon. US-manufactured AJC is actually cheaper than most imported juice at prices between USD8.25-8.50/gallon fob shipping point. IHS Markit thinks that the new Chinese price reflects a calculation that there is now little competition and the market can bear a higher price. Given the incredibly high present freight rates from China, China is probably supplying from stocks previously shipped to the US. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- Subaru has halted production at its Gunma prefecture plants in Japan for two days, between 15 and 16 January, because of a shortage of certain parts that use semiconductors. According to a company release, operations will be halted at the Ota Main and Yajima vehicle production plants and at the Oizumi engine and transmission plant. Automakers around the globe are facing semiconductor shortages. According to IHS Markit light-vehicle production data, combined production volume at Subaru's Ota Main and Yajima plants totaled 556,009 units in 2020, down by 8.9% year on year. The company produces models such as the BRZ, Impreza, XV, Forester, Legacy, Levorg, Outback, WRX, and XV at the two plants. Prior to this, Honda announced plans to cut production by around 4,000 units per month, which would mainly affect the Fit, built at its Suzuka facility. Nissan also has similar plans, to reduce production of the Note hybrid built at its Oppama facility. According to a report by the Nikkei, output will be slashed from 15,000 units to 5,000 units in January. IHS Markit's initial analysis suggests that global light-vehicle production over the first quarter of 2021 will fall by around 485,000 units. In Japan, we see the lack of semiconductors affecting around 37,500 units. (IHS Markit AutoIntelligence's Isha Sharma)

- Dutch manufacturer Sif has delivered the first nine of 33 monopiles to Japan, for the Akita and Noshiro wind farms. The monopiles were delivered from Sif's terminal in Rotterdam, to client Kajima Corporation, the main contractor for the project. The monopiles delivery to Japan is the first for Sif following its 2019 establishment of a sales office in Tokyo to further explore opportunities in the growing Japanese offshore wind market. The Akita and Noshiro wind farms will be the first utility-scale offshore wind farm projects in Japan. The project is expected to generate 139 MW from 33 Vestas V117-4.2 MW turbines, once completed in 2022. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- According to data released by the Society of Indian Automobile

Manufacturers (SIAM), new vehicle wholesales in India, including

passenger vehicles and commercial vehicles (CVs), declined by 23%

year on year (y/y) during 2020. Sales volume totaled 2.43 million

units last year, down from 3.8 million units in 2019. (IHS Markit

AutoIntelligence's Isha Sharma)

- The SIAM's figures represent vehicles dispatched by automakers to their dealers, rather than retail sales. Of this total, passenger vehicle sales declined by 17.8% y/y to 2.43 million units. The volumes were led by cars, sales of which declined by 21.2% y/y to 1.43 million units, while sales of utility vehicles (UVs) were down by 8.9% y/y to 896,956 units.

- Van sales decreased by 34% y/y to 103,754 units. In the case of CV sales, manufacturers dispatched 505,189 units during the year, a steep 40.9% y/y decline. This performance was led by light commercial vehicles (LCVs), sales of which was down by 33.5% y/y to 376,431 units, while sales of medium and heavy commercial vehicles (MHCVs) declined by 55.3% y/y to 128,758 units.

- Overall, 2020 posted several challenges that prompted automakers to realign their sales and production operations in the country owing to the COVID-19 virus pandemic. In the early months of the COVID-19 virus crisis (April-June 2020), sales crashed because of the strict lockdown rules across India.

- The market recovered gradually in the second half of the year aided by increased demand for personal mobility, improving consumer confidence in rural and semi-urban markets, and continued government policy support.

- Vehicle sales gained considerable ground in October and November 2020 mainly on the back of the festive season and the normalization of the supply chain.

- According to IHS Markit light-vehicle forecasts, total vehicle sales in India, including light vehicles and MHCVs, are expected to recover by 21% y/y to nearly 3.46 million units in 2021. Factors such as lower interest rates and preference for personal mobility to avoid public transportation could be key drivers that will help the industry grow in the next six months.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-january-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-january-2021.html&text=Daily+Global+Market+Summary+-+15+January+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-january-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 15 January 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-january-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+15+January+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-january-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}