Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 15, 2021

Daily Global Market Summary - 15 April 2021

All major US equity indices closed higher, while APAC and European markets were mixed. US and benchmark European government bonds both closed sharply higher. European iTraxx and CDX-NA closed modestly tighter across IG and high yield. The US dollar closed lower, while oil, natural gas, gold, silver, and copper were higher. Much better than expected US retail sales and initial claims for unemployment insurance reports started the US trading session on solid footing, while the sharp rally in US Treasury bonds may indicate that inflation fears are on hold to some degree for the time being.

Americas

- US equity indices closed higher with the S&P 500 +1.1% and DJIA +0.9% closing at new record highs; Nasdaq +1.3%, and Russell 2000 +0.4%.

- 10yr US govt bonds closed -8bps/1.55% yield and 30yr bonds -8bps/2.24% yield, with a sell-off occurring between 3:00-5:00pm ET for 10s +4bps and 30s +7bps.

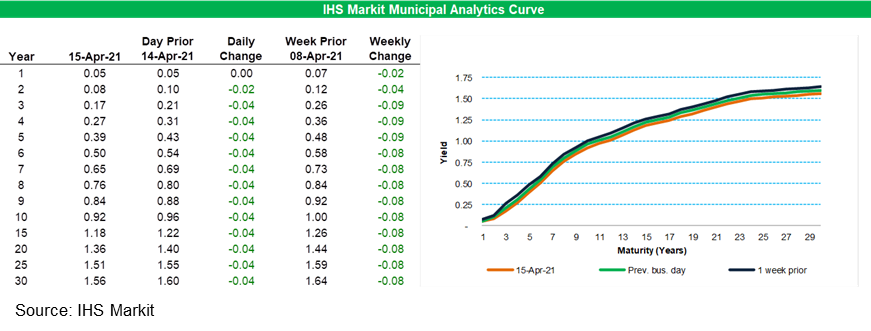

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

rallied 4bps for 3-year and longer paper, with that same part of

the curve 8-9bps better week-over-week.

- CDX-NAIG closed -1bp/50bps and CDX-NAHY -6bps/286bps.

- DXY US dollar index closed -0.1%/91.62.

- Gold closed +1.8%/$1,767 per troy oz, silver +1.7%/$25.96 per troy oz, and copper +2.2%/$4.22 per pound.

- Crude oil closed +0.5%/$63.46 per barrel and natural gas closed +1.5%/$2.66 per mmbtu.

- IHS Markit Vice Chairman Daniel Yergin cautioned that the

transition to a net-zero economy will take time, and not happen

overnight, but power company executives said they are ready to

embrace the challenge. (IHS Markit Climate and Sustainability News'

Amena Saiyid)

- It took five decades for wind and solar to clamber out of a niche existence and for costs to come down, and it took at least a century for electric vehicles to gain ground after Thomas Edison first introduced them, Yergin said 14 April at the Edison Electric Institute (EEI) Global Electrification Forum, where the theme "Destination 2050" -- as in net-zero emissions by 2050 -- dominated the talks.

- The forum, which runs through April 23, has brought together leaders of global as well as US power companies in the runup to the Leaders' Climate Summit on April 22-23. At this summit, US President Joe Biden is expected to ask leaders of the 40 invited nations to develop a new ambitious target that improves on the carbon emissions reductions they or their predecessors agreed to make as part of the 2015 Paris climate treaty.

- Total US retail trade and food services sales increased 9.8% in

March following a 2.7% decline in February, which was partially

attributable to harsh winter weather. Warmer weather, increasing

vaccination rates, and a fresh injection of stimulus authorized by

the American Rescue Plan Act boosted retail sales. The Treasury

Department disbursed stimulus payments beginning 17 March and by

the end of the month, more than three-quarters of the authorized

$410 billion had been doled out to households. (IHS Markit

Economists James Bohnaker and David Deull)

- Sales for food services and drinking places rose 13.4% in March and were only 4.8% shy of the pre-pandemic level of February 2020. This likely marks the beginning of a faster recovery in the restaurant industry as a greater portion of the population becomes vaccinated and comfortable with dining out, especially outdoors.

- Although shopping at physical retail locations is improving rapidly, this is not yet cannibalizing e-commerce. Nonstore (mostly online) retail sales rose 6.0% in March and were a whopping 35% higher than February 2020.

- Auto sales blew through expectations in March, propelling monthly sales growth at auto dealers to 15.5%.

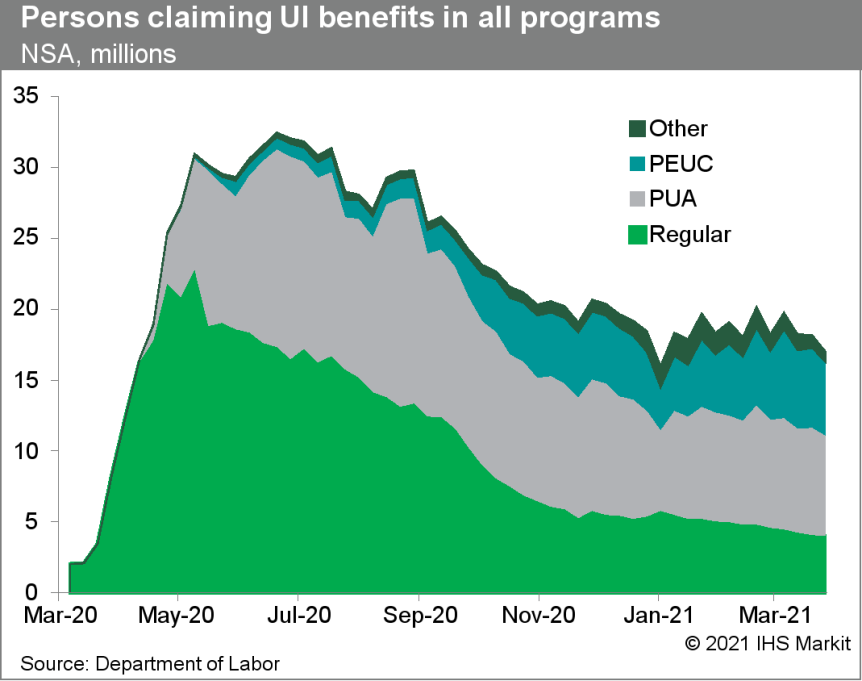

- Seasonally adjusted (SA) US initial claims for unemployment

insurance fell by 193,000 to 576,000 in the week ended 10 April,

the lowest since 14 March 2020. With the number of new daily

infections falling and the pace of the inoculation campaign

accelerating, states have eased restrictions on social and economic

activity, giving a boost to employment, especially in the service

sector. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, rose by 4,000 to 3,731,000 in the week ended 3 April. The insured unemployment rate edged up 0.1 percentage point to 2.7%.

- In the week ended 27 March, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 474,700 to 5,160,267.

- There were 131,975 unadjusted initial claims for PUA in the week ended 10 April. In the week ended 27 March, continuing claims for Pandemic Unemployment Assistance (PUA) fell by 500,715 to 7,053,575.

- The Department of Labor provides the total number of claims for

benefits under all its programs with a two-week lag. In the week

ended 27 March, the unadjusted total fell by 1,235,856 to

16,934,061.

- Total US industrial production rose 1.4% in March, reflecting

increases in manufacturing (2.7%) and mining (5.7%) that were

partially offset by a crash in utilities IP (-11.4%). Total

industrial production in March was 1.0% higher than its

year-earlier level but was still 3.4% below its pre-pandemic

(February 2020) level. (IHS Markit Economists Ben Herzon and Akshat

Goel)

- Manufacturing industrial production rose 2.7% in March, rebounding partially after falling 3.7% in February as severe winter weather disrupted manufacturing in the south-central region of the country.

- Petroleum & coal products and chemicals posted strong increases of 5.7% and 4.1%, respectively, after falling in February as plants in Texas shutdown; some factories continue to remain offline because of weather-related damages.

- Output of vehicles, while up 3.5% in March, continues to be restrained by a shortage of semiconductor chips used in vehicle components. Earlier this month, GM and Ford announced they would extend closures in several plants in North America due to the ongoing semiconductor shortage.

- Output from utilities declined 11.4% in March. Demand for heating fell, with March bringing unseasonably warm weather after an unseasonably cold February.

- Mining activity increased 5.7% in March, with oil and natural gas extraction (+6.4%) accounting for most of the gain.

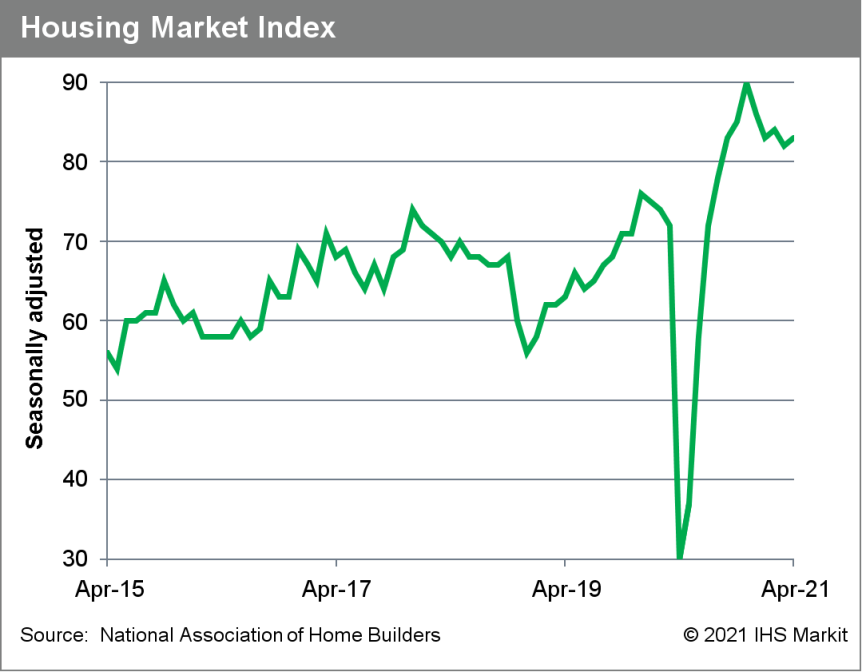

- The headline US housing market index inched up a notch to a

solid 83 in April. A reading above 50 indicates that more builders

view conditions as good rather than poor. (IHS Markit Economist

Patrick Newport)

- The current sales conditions index increased one point to 88, the index measuring sales prospects over the next six months slipped two points to 81, and the traffic of prospective buyers' index rose three points to 75.

- By region, the West increased four points to 92, the South rose

by two to 84, the Midwest slipped three points for the second

straight month to 75, and the Northeast moved down from 86 to 84

points.

- Autonomous truck startup TuSimple has reportedly raised USD1.35 billion in its initial public offering (IPO). TuSimple and a selling shareholder sold almost 34 million shares for USD40 each, above an estimated price between USD35 and USD39. Based on the outstanding stock listed in TuSimple's filings, the company has a market value of USD8.49 billion, reports Bloomberg. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Apple is "very near" to signing a deal with a new LG and Magna joint venture (JV) to develop its vehicle project, a media report suggests. The Korea Times reports that Apple is planning to work with the USD1-billion LG Magna e-Powertrain JV. The JV combines LG's expertise in electric vehicle (EV) components and Magna's powertrain and vehicle manufacturing expertise. However, the report also cites a source as saying that Apple is currently only looking at powertrains for market-evaluation purposes only, which would mean Apple's initial volume would be low. (IHS Markit AutoIntelligence's Stephanie Brinley)

- General Motors (GM) and LG Chem are reported to be planning an announcement regarding their second US battery plant on 16 April 2021. Reuters has reported that the announcement will include confirmation of a USD2.3-billion investment for a new plant in Spring Hill, Tennessee, near the plant set to produce the Cadillac Lyriq in 2023. Reuters sources indicate that the Spring Hill facility will use a different and more cost-effective battery chemistry than the plant being constructed by the two companies in Lordstown, Ohio. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Uber Technologies is selling the software that powers its ride-hailing business to three transit agencies, reports Reuters. Denver's Regional Transportation District, Cecil County Transit in Maryland and the transit agency of Central California's Porterville will use Uber's software, which offers routing and matching technology for their public transportation fleets. Users in those cities can book transit or wheelchair-friendly rides through Uber's smartphone app. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Software systems developer Apex.AI has partnered with Toyota's Woven Planet Group to build autonomous vehicle operating system, according to a company statement. Under this partnership, Toyota's Woven Planet Group will integrate Apex.OS, a software development kit developed by Apex.AI, with its own vehicle development platform, called Arene. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Whole Foods has become the target of a class action lawsuit that alleges the company is misleading consumers with the labels on its brand-name flavored sparkling water. Filed April 11 at the United States District Court for the Southern District of New York, the proposed class action alleges that the labeling of Whole Foods' Lemon Raspberry Italian Sparkling Mineral Water misrepresented the content of the product and used language and images that mislead consumers to believe the drink was flavored with real lemons and real raspberries. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

Europe/Middle East/Africa

- Major European equity indices closed mixed; UK +0.6%, France +0.4%, Germany +0.3%, and Italy/Spain -0.2%.

- 10yr European govt bonds closed sharply higher; UK -7bps, Italy -6bps, France/Italy -4bps, and Germany -3bps.

- iTraxx-Europe closed -1bp/50bps and iTraxx-Xover -3bps/244bps.

- Brent crude closed +0.5%/$66.94 per barrel.

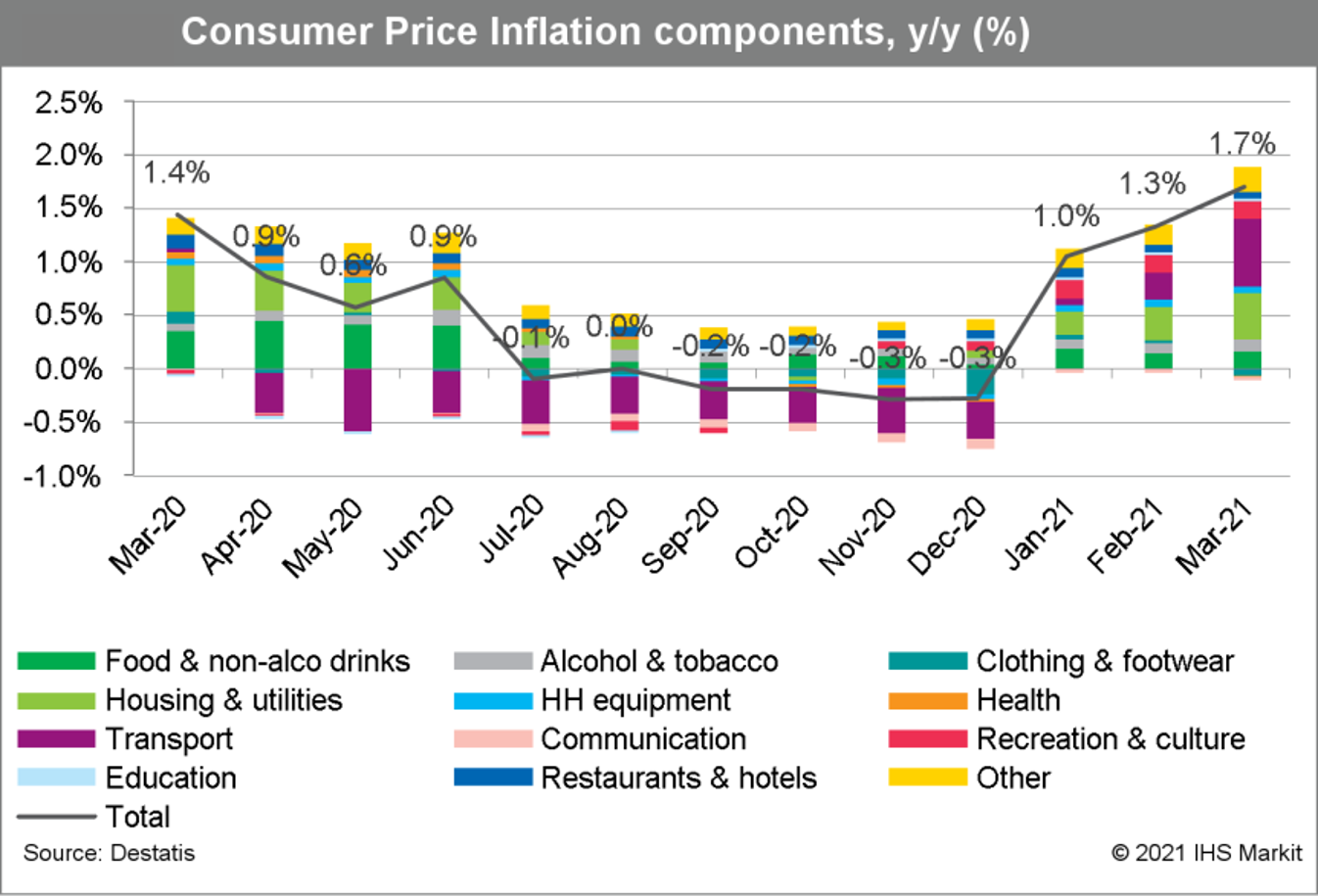

- Final March data based on national methodology from the German

Federal Statistical Office (FSO) confirm the "flash" data release

of 30 March, posting readings of 0.5% month on month (m/m) and 1.7%

year on year (y/y), the latter increasing from 1.3% in February.

This exceeds average inflation of 1.4% in 2019 and 0.5% in 2020.

The EU-harmonised consumer price index (CPI) measure also increased

by 0.5% m/m in March, boosting its annual rate from 1.6% to 2.0%

y/y. This compares with -0.7% y/y as recently as December 2020.

(IHS Markit Economist Timo Klein)

- The BMW Group and NVIDIA have launched a collaboration that will see them work together on planning the next generation of complex Industry 4.0 digital manufacturing system, according to a BMW Group press release. The so-called virtual factory planning tool integrates a range of planning data and applications and allows real-time collaboration by designers and engineers in different locations. (IHS Markit AutoIntelligence's Tim Urquhart)

- Polestar has announced that it has raised USD550 million from a group of new long-term investors. According to a statement, newly issued shares have been private placed with a group of investors led by Chongqing Chengxing Equity Investment Fund Partnership, Zibo Financial Holding and Zibo Hightech Industrial Investment. They have also been joined by SK Inc., the South Korean global conglomerate, and a range of other investors. Full financial details of the transaction are not being disclosed at this stage but has suggested that they have been attracted to the business by the automaker's products, brand, industrial capability, financial ambitions and high growth potential. (IHS Markit AutoIntelligence's Ian Fletcher)

- Consumer prices in Saudi Arabia inched down 0.1% month on month

(m/m) in March, according to GASTAT, while year-on-year (y/y) price

inflation decelerated further from 5.2% in February to 4.9% in

March. (IHS Markit Economist Ralf Wiegert)

- Excluding the effect of July 2020's VAT increase, however, which lifted annual inflation by 5.5-6.0 percentage points, consumer price inflation in Saudi Arabia has been between -0.6% and -1.1% in March and has moved further into negative territory.

- Food and beverages provided the strongest increase for y/y consumer price inflation in March, rising by 10.2% y/y but edging down 0.2% m/m. Housing costs, in turn, declined slightly as rents went down on the month.

- Transport prices went up by 0.8% from February as prices for motor cars rose, lifting annual price inflation for that category to 10.5%.

- South Africa's real retail trade sales grew by 9.2% month on

month (m/m) during February, pulling the annual growth rate to 2.3%

year on year (y/y), from a 3.7% y/y contraction in the previous

month. (IHS Markit Economist Thea Fourie)

- Real retail trade sales were down by 0.7% y/y in January-February.

- Sectors that showed the biggest contribution to the annual gain in retail trade sales during February included textiles, clothing, footwear, and leather goods (contributing 2.0 percentage points), followed by general dealers (contributing 1.7 percentage point).

- The other retailers segment was the only category that recorded lower sale numbers during February, with sales falling 3.2% y/y.

- South African chemicals to energy company Sasol issued a 900-MW renewable energy request for proposals (RFP) 13 April, part of a wider push toward renewables in a country historically overwhelmingly reliant on coal-fired plants. Longer term, its investments are also set to include sustainable aviation fuel and green hydrogen. Sasol's RFP is a joint venture with Air Liquide after the French industrial gas company bought oxygen production units at the Secunda complex in South Africa in 2020. The two companies are looking to buy the 900 MW of renewable capacity by 2030, with Sasol responsible for 500 MW and Air Liquide the rest, they said. Before the sale, Sasol had said it would buy 600 MW of renewable power for the Secunda site in the province of Mpumalanga. (IHS Markit Climate and Sustainability News' Keiron Greenhalgh)

Asia-Pacific

- APAC equity markets closed mixed; India/Australia +0.5%, South Korea +0.4%, Japan +0.1%, Hong Kong -0.4%, and Mainland China -0.5%.

- Chinese battery maker Contemporary Amperex Technology Co. Limited (CATL) has partnered with China Molybdenum Co. (CMOC), one of the largest cobalt producers in the world, to develop a major cobalt and copper mine in the Democratic Republic of the Congo (DRC), according to China Daily. As per the deal, CATL would acquire a 25% stake in a subsidiary in CMOC unit KFM Holding for USD137.5 million. KFM currently holds 95% share in the Kisanfu mine in DRC. The mine is said to have 365 million tons of ore resources, including over 6.2 million tons of copper and 3.1 million tons of cobalt metal. The two partners will also co-operate in nickel projects in Indonesia and other countries. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Shell and CNOOC (Beijing) have announced the start-up of a propylene oxide-styrene monomer (POSM) facility and downstream derivatives units at their joint-venture (JV) petrochemicals complex in Huizhou, China. The site is operated by CNOOC and Shell Petrochemicals Co. (CSPC), a 50/50 JV of CNOOC Oil & Petrochemicals Co.—a subsidiary of CNOOC—and Shell Nanhai, a wholly owned subsidiary of Shell. The POSM plant has a nameplate production capacity for 630,000 metric tons/year of styrene and 300,000 metric tons/year of PO, making it the largest unit of its type in China, Shell says. The unit uses Shell's proprietary process technology and further design improvements mean it uses "significantly less energy," it says. Three new derivatives units will process the PO into up to 600,000 metric tons/year of polyols, using Shell's advanced polyols technologies in China for the first time, it says. The units will supply the Chinese market with performance polyols for end use in products such as coatings, adhesives, sealants, elastomers, and foams. (IHS Markit Chemical Advisory)

- Hino has unveiled an all-new compact electric truck called Dutro Z in Japan. According to a company release, the truck has an ultra-low-floor structure with a floor height of about 400 mm and is based on a new EV chassis with front-wheel-drive option. The model is powered by a 50kW electric motor with lithium ion battery of 40kWh capacity. The company claims the truck's range of 100 km. Hino President and CEO Yoshio Shimo has said, "Hino's first full-scale EV, the Dutro Z EV, is a 'usable EV truck' that we can confidently propose to the last one mile of logistics in the future." Hino plans to launch the truck by early 2022. (IHS Markit AutoIntelligence's Isha Sharma)

- Tata Motors is looking to add compressed natural gas (CNG) versions of some of its models in the current fiscal year (FY) 2021/22, reports Times Now. "Currently, we have a comprehensive passenger vehicle portfolio with ICE [internal combustion engine] and EV [electric vehicle] options for customers to choose from. Our customers also have the option to get the CNG kits fitted at the dealerships. In FY2021/22, our customers will also get a factory fitted CNG option for some of our models," said Shailesh Chandra, president of Tata Motors' passenger vehicle business unit. The automaker is yet to reveal further details, including the identities of the selected models. (IHS Markit AutoIntelligence's Isha Sharma)

- The Reserve Bank of New Zealand (RBNZ) Monetary Policy

Committee (MPC) left the official cash rate (OCR) on hold at 0.25%

- where it has been since March 2020 - while also leaving the

Large-Scale Asset Purchase (LSAP) program and Funding for Lending

Programme (FLP) unchanged. (IHS Markit Economist Andrew Vogel)

- The RBNZ's forecasts have not changed substantially since its February meeting. The RBNZ flagged that domestic economic activity appears to have slowed from its record growth in mid-to-late 2020, although the bank is monitoring for the possible positive impact of the imminent opening of a trans-Tasman travel bubble with Australia.

- The MPC expects the impact of recent increases in inflation due to global supply chain disruptions and rising oil prices to be temporary, and maintains the position that inflation will not consistently hold at or above the informal 2% target unless prolonged monetary stimulus is applied.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-april-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-april-2021.html&text=Daily+Global+Market+Summary+-+15+April+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-april-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 15 April 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-april-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+15+April+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-april-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}