Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 14, 2021

Daily Global Market Summary - 14 October 2021

Most APAC and all major US and European equity indices closed higher. US and benchmark European government bonds closed higher. European iTraxx and CDX-NA closed sharply tighter across IG and high yield. The US dollar closed lower, while natural gas, oil, gold, silver, and copper all closed higher.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- <span/>All major US equity indices closed higher, with none of the indices breaching into negative territory at any point of the day; Nasdaq/S&P 500 +1.7%, DJIA +1.6%, and Russell 2000 +1.4%.

- Global securities finance revenues totaled just over $963

million in September, a 46% YoY increase. The comparison with 2020

remained favorable in September, partly owing to a particularly

remunerative arbitrage related trade in EMEA. In general, return

drivers which were in place for the first two months of Q3

continued to play out in September, including lockup expiries for

recent IPOs; some other drivers include increased borrow demand for

corporate bonds and related exchange traded products, the uptrend

in APAC equity special balances and corporate action event related

trades. In this note we'll discuss the drivers of September

revenue, which pushed total Q3 revenues to $2.75 billion, a 23% YoY

increase. (IHS Markit Securities Finance's Sam

Pierson)

- 10yr US govt bonds closed -2bps/1.52% yield and 30yr bonds -1bp/2.02% yield.

- CDX-NAIG closed -2bps/52bps and CDX-NAHY -10bps/301bps.

- DXY US dollar index closed -0.1%/93.96.

- Gold closed +0.2%/$1,798 per troy oz, silver +1.3%/$23.48 per troy oz, and copper +2.6%/$4.63 per pound.

- Crude oil closed +1.1%/$81.31 per barrel and natural gas closed +1.7%/$5.69 per mmbtu.

- US producer prices for final demand increased 0.5% in September

and 8.6% from a year earlier. Food prices, up 2.0% for the month,

were only bested by energy prices, which climbed 2.8%. All other

producer prices rose a comparatively modest 0.2%. (IHS Markit

Economist Michael Montgomery)

- Final demand prices for services grew 0.2%. Retail and wholesale trade margins climbed thanks to large margins at gas stations and "other" services, which edged 0.2% higher, but transportation and warehousing prices plunged 4.0% because of a 16.9% drop in airline passenger fares; airfares surged a total of 18.0% in July and August.

- The rise in energy prices was across the board, with natural gas, electricity, and oil-based products all rising between 2% and 12% over the month. Disruptions to supplies of petroleum and natural gas caused by Hurricane Ida played a role in the September increases, but it was far from the sole cause of the spike. Oil prices have continued to rise in October, suggesting no reversal soon.

- Bottom line: Inflationary pressures persisted in September because of bottlenecks, supply shortages, and strong demand in addition to the usual number of special forces. Alas, the massive drop in airline fares is not likely to repeated soon to bail out the aggregates.

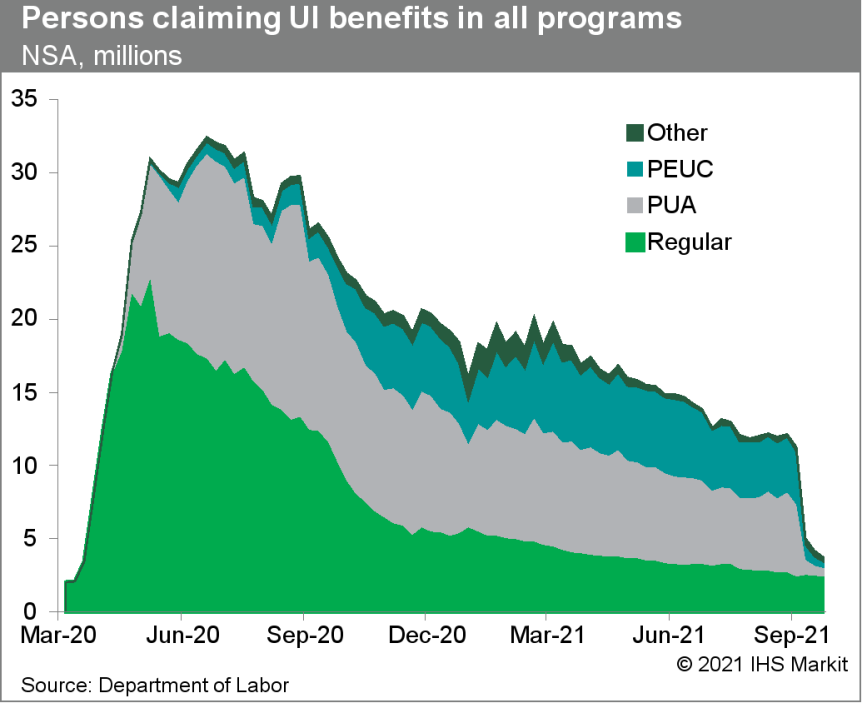

- US seasonally adjusted initial claims for unemployment

insurance decreased by 36,000 to 293,000 in the week ended 9

October, hitting its lowest level since 14 March 2020. The not

seasonally adjusted (NSA) tally of initial claims rose by 16,017 to

277,632. With the peak of the fourth wave of COVID-19 behind us and

consumer spending expected to post strong gains in the fourth

quarter, hiring should continue to improve and the level of claims

should continue trending towards its pre-pandemic steady state.

(IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 134,000 to 2,593,000 in the week ended 2 October, hitting its lowest since 14 March 2020. The insured unemployment rate edged down 0.1 percentage point to 1.9%.

- In the week ended 25 September, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 190,379 to 440,435.

- In the week ended 25 September, continuing claims for Pandemic Unemployment Assistance (PUA) fell by 98,587 to 549,103. Because no benefits can be paid for weeks of unemployment after 4 September, the 990,000 individuals still receiving benefits under these federal programs are likely being paid for backdated weeks of unemployment as some states continue to process such claims retroactively.

- In the week ended 25 September, the unadjusted total of

continuing claims for benefits in all programs fell by 523,426 to

3,649,013.

- Electric vehicle (EV) startup Electric Last Mile Solutions (ELMS) has opened an urban mobility lab in San Francisco, California (United States), and has agreed a battery supply deal to 2025 with Contemporary Amperex Technology Company (CATL), according to a company announcement. On 13 October, ELMS announced the opening of the new lab in San Francisco, stating that its focus will be on developing advanced technology solutions for fleet customers. ELMS calls the facility the Urban Mobility Lab, which is to develop technology including advanced in-vehicle technology, edge-to-edge cloud architecture, and data-intensive applications. ELMS selected the location to enable it to obtain additional hardware and to recruit software development talent, aiming to scale up its capabilities rapidly. The new lab is to analyze data from ELMS' commercial EVs and their environments, and its employees will also work in collaboration with partners to better serve all-electric fleets. (IHS Markit AutoIntelligence's Stephanie Brinley)

- US regulators at the National Highway Traffic Safety Administration (NHTSA) are requesting information from Tesla and asking why an update to Autopilot was not reported as a recall. The NHTSA opened an investigation into Tesla vehicles specific to Autopilot's ability to recognize emergency vehicle lights in low-light conditions. While the investigation has not been completed, Tesla pushed an OTA aiming to improve that performance after the investigation was announced. In addition, the company recently began making a beta version of its self-described fully autonomous driving system available to select owners. Tesla is finding itself under closer scrutiny by the agency, which oversees vehicle safety in the United States. Within the letter to Tesla was an outline of the civil penalties the automaker may face; this includes civil penalties up to USD22,992 per violation per day, with a maximum of USD114,954,525 for a related series of daily violations. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Aurora has announced that its autonomous trucks and taxis will be available to customers via subscriptions, reports The Verge. The autonomous vehicle (AV) company expects to launch self-driving trucks and ride-hailing vehicles in 2023 and 2024 respectively. According to the news source, Aurora's trucking service is to be called 'Aurora Horizon', which will include trucking carriers and private fleets, while the ride-hailing service is to be called 'Aurora Connect'. The company will deal with logistics firms and companies that operate for-hire vehicle fleets and not individual customers. Both Aurora Horizon and Aurora Connect will have access to Aurora Driver, the hardware and software used by Aurora to enable a vehicle to run in fully autonomous mode under certain conditions. They will also have access to a mission control system called Aurora Beacon and a roadside assistance program and extended support system called Aurora Shield. The prices of the subscriptions have not been revealed yet. (IHS Markit Automotive Mobility's Tarun Thakur)

- On October 11, Florida Power & Light (FPL), representing

the merged and consolidated operations of FPL and the former Gulf

Power, filed a post-hearing brief at the Florida Public Service

Commission in support of its August 10 settlement with many of the

parties to its latest rate case. (IHS Markit PointLogic's Barry

Cassell)

- One aspect of that settlement is the latest version of the Solar Base Rate Adjustment (SoBRA) mechanism, which in this iteration authorizes FPL to recover costs associated with the installation and operation of up to 1,788 MW of cost-effective solar generation in 2024 and 2025.

- "The SoBRA provision in the Agreement includes measures that enhance cost certainty," the utility argued. "For example, the average cost of all solar projects will be subject to a $1,250 per kWAC cost cap. Based on the cap, the SoBRAs are estimated to recover approximately $140 million of annual revenues effective January 1, 2024, and an additional approximately $140 million of annual revenues effective January 1, 2025. In the event that FPL constructs the solar facilities for less than the applicable cost cap, customers and FPL will share in the revenue requirement savings represented by the difference on a 75 percent-25 percent basis, respectively, still resulting in revenue requirements that fall below the estimated $140 million."

- Bruce Power, which for 20 years has leased a massive nuclear plant on Lake Huron from Ontario Power Generation, on October 14 announced a series of changes, including increased power output and supply of medical isotopes. The new site generation peak is 6,550 MW, an increase from 6,300 MW in 2016, which has been achieved through investments and innovations in the facility. Bruce Power also announced a Cobalt-60 isotope harvest later this year. The medical isotopes will be sent to Ottawa-based Nordion for processing and distribution, and will provide enough isotopes to sterilize 10 billion pairs of surgical gloves and COVID swabs. Isotopes from the harvest will also be used in the treatment of breast cancer and brain tumors. The company also launched 'Project 2030' with the goal of achieving a site peak of 7,000 MW by 2030 in support of climate change targets and future clean energy needs. Project 2030 will focus on continued asset optimization, innovations, and leveraging new technology, which could include integration with storage and other forms of energy to increase the site peak at Bruce Power. (IHS Markit PointLogic's Barry Cassell)

Europe/Middle East/Africa

- All major European equity indices closed higher, with none of the indices breaching into negative territory at any point of the day; Germany +1.4%, France +1.3%, Italy +1.2%, UK +0.9%, and Spain +0.5%.

- 10yr European govt bonds closed higher; Germany -7bps, Italy/France -6bps, and Spain/UK -5bps.

- iTraxx-Europe closed -2bps/51bps and iTraxx-Xover -12bps/257bps.

- Brent crude closed +1.0%/$84.00 per barrel.

- Volkswagen (VW) Group CEO Herbert Diess has reportedly warned the automaker's supervisory board that delaying its battery electric vehicle (BEV) program could lead to up to 30,000 job losses. Two sources told Reuters that Diess added that competition from new entrants in the German market had led to the company accelerating this shift to BEVs. VW spokesperson Michael Manske confirmed Diess's position, stating, "There is no question that we have to address the competitiveness of our plant in Wolfsburg [Germany] in view of new market entrants." Referring to Tesla preparing to start production in the country, he added, "Tesla is setting new standards for productivity and scale in Grunheide [Germany]." Manske went on to say, "A debate is now underway and there are already many good ideas. There are no concrete scenarios." Following the report, which first appeared in Handelsblatt, a spokesperson for VW's workers' council said that although it would not comment on the remarks, "a reduction of 30,000 jobs is absurd and baseless". It is unclear why the comments were made in this situation. However, the threat of a 30,000-employee headcount reduction under any circumstances would create huge ripples within the organization, and especially among its highly unionized workforce in Germany. The report indicates that the comments were made in relation to Tesla's upcoming site in the country, which is expected to have a capacity of around 500,000 units per annum (upa) yet will employ just 12,000 staff. In comparison, VW's main Wolfsburg facility is said to be capable of building 700,000 upa with 25,000 staff. (IHS Markit AutoIntelligence's Ian Fletcher)

- France has outlawed plastic packaging on around 30 types of

fruit and vegetables from January 1, 2022, rolling the ban out in

stages to cover all unprocessed fresh produce by June 30, 2026.

Around 37% of fruit and vegetables sold today in France are wrapped

in plastic, according to a government statement on the decree that

the Agriculture and Food, Finance and Ecology ministers, Julien

Denormandie, Bruno Le Maire and Barbara Pompili respectively,

signed into law on October 11. (IHS Markit Food and Agricultural

Policy's Sara Lewis)

- The statement says that the ban will eliminate over a billion "unnecessary" pieces of plastic packaging every year and comes as a follow up to France's February 2020 law against waste and the circular economy.

- From January 1, 2022, French stores will be banned from selling around 30 types of unprocessed fruit and vegetables wrapped in plastic packaging. Processed fruit and vegetables, such as ready cut fruit pieces or a mixed pack of vegetables to cook in a wok, will not be affected, since the restrictions only apply to unprocessed produce.

- The French government is taking a tough stance on retailers that break the new law, with plans for penalties going up to two years imprisonment and a €100,000 fine.

- The vegetables covered by the 2022 ban are leeks, courgette (zucchini), aubergine (eggplant), peppers, cucumbers, potatoes, carrots, round tomatoes, onions, turnips, cabbages, cauliflower, squash, parsnips, radishes, Jerusalem artichokes and root vegetables.

- The fruit affected include apples, pears, oranges, clementines, kiwis, tangerines, lemons, grapefruits, plums, melons, pineapples, mangoes, passion fruit and persimmons.

- The latest monthly inflation data from Statistics Sweden show

that prices as measured by the national consumer price index (CPI)

measure increased by 2.5% year on year (y/y). Prices increased by

0.5% from August. (IHS Markit Economist Marie-Louise Deshaires)

- Rising housing prices due to increasing electricity prices had the largest contribution to inflation in September. Housing costs rose significantly more in September than in the same month of the last two years. Indeed, the inflation rate excluding energy (CPIF-XE) only moderately accelerated from 1.4% y/y in August to 1.5% y/y in September. Transport prices also increased, largely affected by fuel prices.

- Price increases were offset by falling prices in the audiovisual, photographic equipment, and telecommunications equipment groups.

- The CPI with fixed interest rates (CPIF), which the Riksbank uses as its target inflation measure, accelerated to 2.8% y/y from 2.4% in August. This is the highest inflation rate in 13 years, since October 2008.

- Ceyhan Polipropilen Uretim, a joint venture (JV) between

Rönesans Holding (Ankara, Turkey) and Sonatrach (Algiers), has

broken ground on its previously announced $1.7-billion propane

dehydrogenation (PDH) and polypropylene (PP) project at Ceyhan,

Turkey. (IHS Markit Chemical Advisory)

- The 450,000-metric tons/year PP plant is scheduled to start operations in 2025 and is one of the largest private sector industrial investments ever made in Turkey, according to Rönesans. LyondellBasell has licensed its Spheripol process for the PP facility. The PDH unit will be the first to operate in Turkey and will use Honeywell UOP's C3 Oleflex technology to produce 457,000 metric tons/year of propylene. The complex is planned to triple Turkey's annual PP production capacity, substituting 20% of Turkey's annual imports, Rönesans says.

- Rönesans says it will partner with Spain's Tecnicas Reunidas on the project's construction, with Tecnicas's contract including detailed engineering studies, procurement, completion, and commissioning (EPCC). France's SPIE will oversee the management of operations, periodic maintenance services, and sustainable production during the plant's construction and operational period. Belgium-based Ravago will distribute "a certain portion" of the plant's products not only to the market in Turkey but also to some export markets, Rönesans says.

- Sonatrach will supply 550,000 metric tons/year of propane feedstock to the facility. The PDH/PP plant will also generate its own hydrogen for fuel use, and be supplied with renewable electricity from Rönesans's domestic hydroelectric plants, achieving close to 80% of its total energy needs from renewable energy sources, Rönesans says.

Asia-Pacific

- Most major APAC equity indices closed higher except for Mainland China -0.1%; South Korea +1.5%, Japan +1.5%, India +0.9%, and Australia +0.5%.

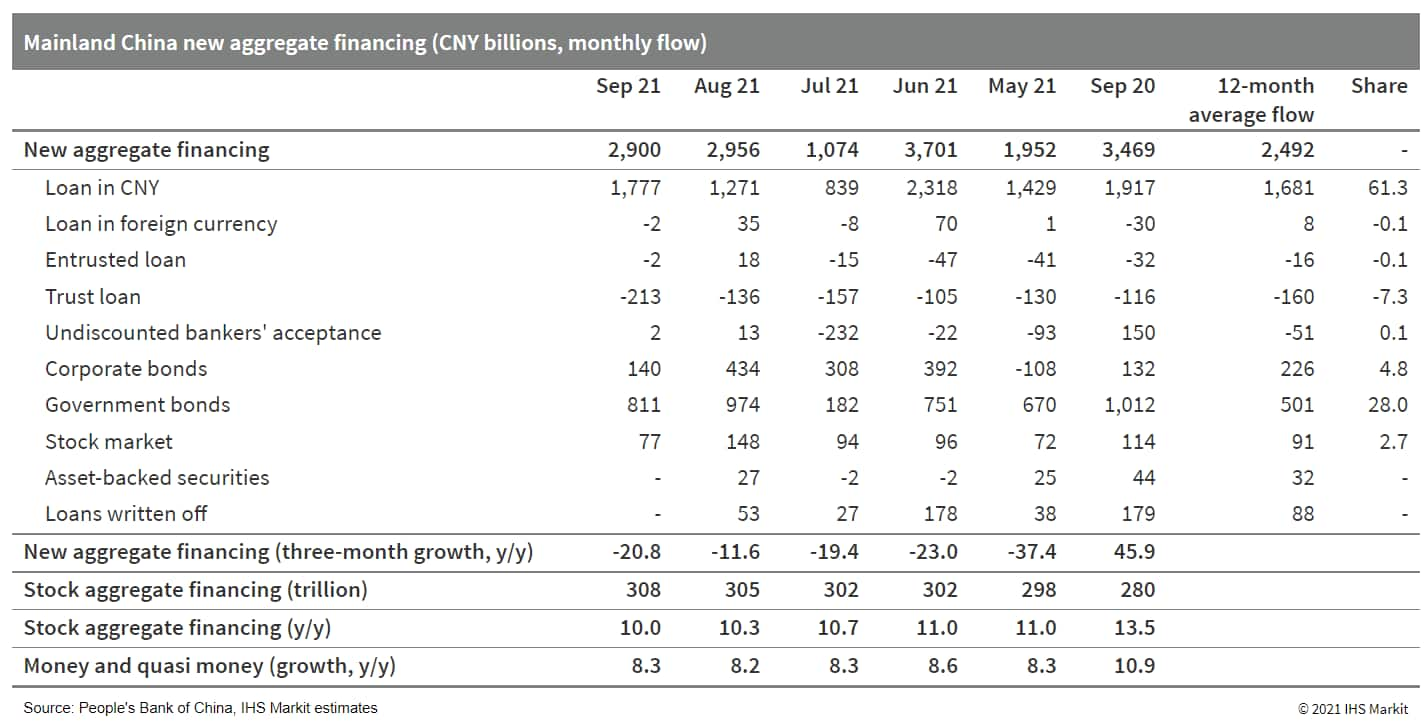

- Mainland China's new total social financing (TSF), the broadest

measures of net new financing to the real economy, reached CNY2.9

trillion (USD449.13 billion) in September, down by CNY567.5 billion

year on year (y/y) yet up by CNY387.6 billion from the comparable

2019 level, according to the People's Bank of China (PBoC). Stock

TSF has expanded by 10.0% y/y through the end of third quarter,

further slowed from 10.3% y/y in August and marked the seventh

consecutive month of decline or no change in year-on-year growth

rate. (IHS Markit Economist Lei Yi)

- Government bond issuance remained the major contributor to the year-on-year decline in new TSF, which registered a contraction of CNY200.7 billion y/y. This should partially be attributed to the relatively high base of over CNY1 trillion in September 2020, as this year's September reading was still higher than the 2019 level by CNY433.2 billion. On a month-on-month (m/m) basis, government bond issuance edged down by 17% from August, yet the September reading of CNY811 billion was still the second highest so far this year.

- Dissipated pandemic impact in September supported the mild

month-on-month improvement in financing demand of the real economy.

Renminbi-denominated loans rose by CNY506.1 billion from August, or

a 40% m/m increase. Both household and corporate bank borrowing

registered a month-on-month increase in September; yet year-on-year

contraction persisted for medium-to-long-term borrowing, owing to

the production curbs and power shortage disruptions, as well as

continued financial de-risking and the Evergrande event weighing on

home buying demand.

- SAIC has launched a project in Mongolia targeting over 10,000 hydrogen heavy-duty trucks in annual production volume. According to Gasgoo, the project will cover a planned area of around 800,000 square metres, and is set to be carried out in two phases. The first phase will have manufacturing capacity of 12,000 new energy heavy-duty trucks and 3,000 units of fuel cell and hydrogen systems annually. It is expected to start operations by the end of 2022 or 2023. The second phase is expected to begin operations in 2024 and will have an annual production capacity of 24,000 new energy heavy-duty trucks and 5,000 units of fuel cell systems and fuel cell stacks. SAIC is a pioneer among Chinese automakers to push for the commercialization of FCVs and plans to launch 10 fuel-cell vehicles (FCVs) by 2025, aiming to secure a 10% share of the segment in China. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Hyundai plans to develop its own semiconductors to reduce reliance on chipmakers, reports Reuters, citing Hyundai's global chief operating officer José Muñoz. It is working on developing its own chips, an effort which he said "takes a lot of investment and time". The automaker's parts affiliate Hyundai Mobis would play a key role in the in-house development plan. Muñoz noted the worst has passed for the industry chip shortage, adding Hyundai had the "toughest months" in August and September. "The [chip] industry is reacting very, very fast," he said, adding that Intel is investing a lot of money to expand capacity. "But also in our case, we want to be able to develop our own chips within the group, so we are a little bit less dependent in a potential situation like this". He also said that Hyundai aims to deliver vehicles at the level of its original business plan in the fourth quarter, and offset some of its production losses next year. It is also on track to produce electric vehicles (EVs) in the US in 2022, and is looking into both enhancing its existing factory in Alabama and increasing its production capacity. (IHS Markit AutoIntelligence's Jamal Amir)

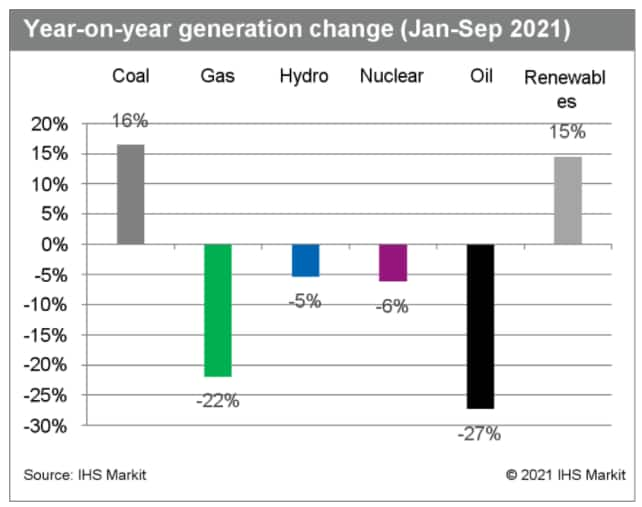

- India's economic activity accelerated sharply after the easing

of lockdown restrictions in July, led by a rebound in industrial

growth. A sharp rise in electricity demand, coupled with domestic

supply constraints and soaring international energy prices, led to

fuel shortages at power plants that are projected to last until at

least mid-November, and potentially up to six months. With the

effects of rising demand set to be dampened by emerging supply

constraints, the real GDP growth forecast for fiscal year (FY) 2021

remains at 7.7%, with supply disruptions posing a significant

downside risk to the recovery's momentum. (IHS Markit Economists Rashika

Gupta, Deepa

Kumar, and

Hanna Luchnikava-Schorsch)

- India's industrial sector has undergone a solid recovery in recent months, after state-level restrictions to contain the second wave of the coronavirus disease 2019 (COVID-19) virus pandemic were progressively eased. The weak base of the previous year's national lockdown has kept the index of industrial production in double-digit expansion in annual terms since March, but it has also shown a sequential improvement in growth since June, with output now exceeding pre-pandemic levels.

- Post-lockdown pent-up demand drove the expansion of capital, infrastructure, and intermediate goods, as well as consumer durables in June and July, while non-durable goods production finally returned to growth in August.

- The Reserve Bank of India (RBI)'s consumer survey showed a sharp rebound in sentiment in September, with the current situation and future expectation indices now either above or nearing the level seen before the start of the second pandemic wave in April. This improvement is largely due to subsiding pandemic concerns and improved vaccination progress since August, with approximately 20% of the population now being fully vaccinated and nearly 52% having received at least one dose of vaccine. Although the risk of a possible third pandemic wave has not fully subsided, it has now diminished greatly, with new daily infections remaining in decline.

- Electricity demand has remained strong throughout the year, registering robust growth of 11% year on year (y/y) in January-September 2021, despite localized lockdown measures in April-May 2021 and normal-to-good monsoon rainfall during June-September 2021. After two consecutive years of poor growth, the rebound in power demand in 2021 was expected. However, it has exceeded all records, registering average growth of 5% on pre-pandemic levels (January-September 2019).

- India's power output has also remained strong since the start

of 2021 and was up by 13.7% in the first half of the year, as

indicated by the index of industrial production. However, the surge

in demand and disproportionate pressure on coal as a source of

power generation have led to supply constraints, leaving power

plants with critically low stocks. India's power generation

capacity (388 GW) is dominated by coal, which accounts for about

54% of the total capacity mix and approximately 72% of the

generation mix. The availability of coal resources is therefore

critical for the smooth operation of the Indian power system.

- Technip Energies has been awarded an engineering, procurement,

construction and commissioning (EPCC) contract by NTPC for its

proton exchange membrane (PEM) based hydrogen generation plant

project at Vindhyachal, Madhya Pradesh, India. The EPCC contract

covers the delivery of a 5MW hydrogen generation plant using proton

exchange membrane (PEM) electrolysis technology at a super thermal

power station. This project is suited for a large scale green

hydrogen production facility as power to electrolyzer can be

replaced with renewable electricity in the future. NTPC is setting

up this plant along with two other units—the first, a carbon

dioxide (CO2) capture facility that captures CO2 from flue gas

stream of the coal fired power plant and the second being a

methanol unit that uses the captured CO2 and the hydrogen through

PEM electrolyzer being supplied by Technip Energies to convert it

into green methanol. (IHS Markit Upstream Costs and Technology's

William Cunningham)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-october-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-october-2021.html&text=Daily+Global+Market+Summary+-+14+October+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-october-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 14 October 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-october-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+14+October+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-october-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}