Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 14, 2021

Daily Global Market Summary - 14 December 2021

All major US and most APAC equity indices closed lower, while Europe was mixed. US and benchmark European government bonds closed modestly lower. iTraxx-Europe and CDX-NAIG closed flat, while iTraxx-Xover and CDX-NAHY were slightly wider on the day. The US dollar closed higher, while oil, natural gas, gold, silver, and copper were all lower on the day. All eyes will be focused on tomorrow's pivotal FOMC meeting to better gauge the degree of the shift in the Fed's concerns over inflation risk.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower for a second consecutive day; DJIA -0.3%, S&P 500 -0.8%, Russell 2000 -1.0%, and Nasdaq -1.1%.

- 10yr US govt bonds closed +3bps/1.45% yield and 30yr bonds +3bps/1.83% yield.

- CDX-NAIG closed flat/54bps and CDX-NAHY +4bps/312bps.

- DXY US dollar index closed +0.3%/96.57.

- Gold closed -0.9%/$1,772 per troy oz, silver -1.8%/$21.92 per troy oz, and copper -0.6%/$4.26 per pound.

- Crude oil closed -0.8%/$70.73 per barrel and natural gas closed -1.2%/$3.75 per mmbtu.

- US producer prices for final demand increased 0.8% in November

and rose 9.6% from a year earlier. All six major components scored

large gains, with trade and other services with the weakest gains

at 0.6%. Energy, up over 10.0% in just the past three months, led

the pack with a 2.6% increase. (IHS Markit Economist Michael

Montgomery)

- Final demand prices for services grew 0.7% in November, that component's largest gain since July. Transportation and warehousing prices climbed 1.9% but the October increase was revised lower. The other services complex as well as trade scored 0.6% gains.

- The rise in energy prices was dominated by natural gas with a 2.0% gain and gasoline up 7.3%; the gasoline spike partly came from rising when it normally falls. Oil and oil product price gains were mixed outside of gasoline. Since crude costs have fallen gasoline prices should fall in December, but that would be cold comfort to drivers who saw wholesale gas prices double that of a year earlier in November.

- Bottom line: Inflationary pressures persisted once again and will continue to persist so long as the supply chain is in shambles and energy and food prices are running wild. The price increases have become both chronic and large, with few companies deferring small increases to the end or middle of the year because the gains are no longer small. It will take more than a small change to break price expectations in business, but gains can slowly moderate.

- Federal Reserve officials meet Tuesday and Wednesday for the first time since Chairman Jerome Powell said last month that the central bank needed to shift its focus toward preventing higher inflation from becoming entrenched and away from fostering a rapid rebound in hiring from the pandemic. The pivot raises the prospect that the Fed's post-meeting statement—a document parsed by markets as a signal of likely future policy—could be overhauled at the conclusion of their meeting Wednesday. (WSJ)

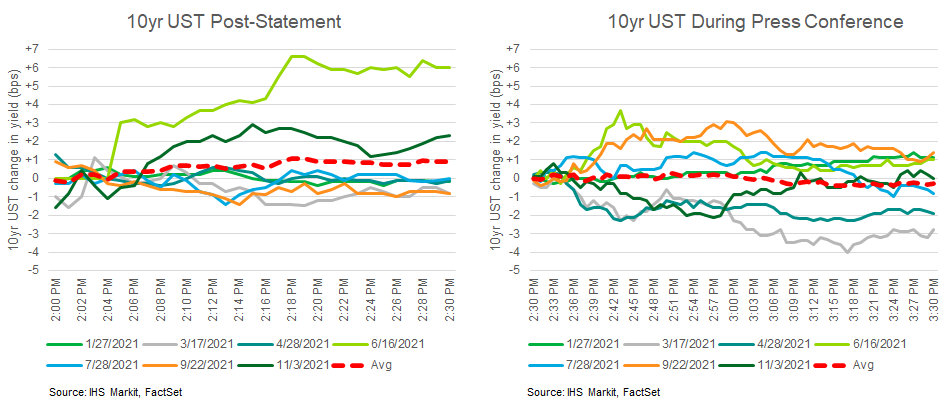

- The below graphs show the intraday reaction of 10yr US

government bonds to the FOMC post-meeting statement and Fed

Chairman Powell's press conference during each of the 2021 FOMC

Meetings. 10yr UST's rallied during the first 28 minutes of the 3

November press conference (dark green line) before changing course

to end the press conference lower after already selling off 2bps

post-statement.

- On December 14, Shell New Energies US LLC, a subsidiary of

Royal Dutch Shell plc, announced that it has signed an agreement to

buy 100% of Savion LLC, a utility-scale solar and energy storage

developer in the US, from Macquarie's Green Investment Group. (IHS

Markit PointLogic's Barry Cassell)

- "Savion's significant asset pipeline, highly experienced team, and proven success as a renewable energy project developer make it a compelling fit for Shell's growing integrated power business," said Wael Sawan, Integrated Gas and Renewables & Energy Solutions Director. "As one of the fastest-growing, lowest-cost renewable energy sources, solar power is a critical element of our renewables portfolio as we accelerate our drive to net zero."

- Savion specializes in developing solar power and energy storage projects and currently has more than 18 GW of solar power and battery storage under development for a variety of customers, including utilities and major commercial and industrial organizations. It has over 100 projects under development in 26 states. The acquisition is expected to close by year end.

- The Savion acquisition bolsters Shell's strategy to develop an integrated power business as it moves to become a net-zero emissions energy business by 2050. As part of this strategy, Shell aims to sell more than 560 terawatt hours of power globally per year by 2030, which us twice as much electricity as the company sells today.

- Savion's acquisition will expand Shell's existing solar and energy storage portfolio, where Shell holds interest in developers such as Silicon Ranch Corp. in the US. Savion is based in Kansas City, Missouri, and currently employs 126 staff.

- On December 14, the Florida Department of Environmental

Protection issued a draft air permit that would allow Florida Power

& Light (FPL) to test hydrogen as a supplemental fuel for the

natural-gas-fired Okeechobee Clean Energy Center (OCEC). This power

plant is located in Okeechobee County, approximately 27 miles

north-northeast of Okeechobee and 24 miles west of Vero Beach. OCEC

primarily consists of Unit 1, which is three combustion turbines

(CTs) each connected to a heat recovery steam generator (HRSG),

which are then connected to a single steam turbine electrical

generator (STEG) in a "3- on-1" combined cycle configuration. Each

individual CT of Unit 1 has a nominal gross capacity of 350 MW. The

unfired HRSGs generate steam from the hot exhaust gases of the CTs

that goes to the STEG to generate an addition 550 MW for a total

nominal generating capacity of 1,600 MW (net). The CTs are

primarily fueled with natural gas, with ultra-low-sulfur diesel

(ULSD fuel oil) as a limited-use backup fuel. (IHS Markit

PointLogic's Barry Cassell)

- "FPL submitted an application requesting authorization from the Department to allow the firing of a blended fuel consisting of natural gas and hydrogen in the General Electric (GE) Frame HA.02 combustion turbines (CTs) at the OCEC," said a permit support document. "The CTs are Units 1A, 1B and 1C. The blend will consist of up to 5 percent (%) hydrogen by volume with natural gas at a minimum of 95% by volume."

- The document added: "Hydrogen only has approximately 32% of the heat content of typical natural gas (325 British thermal units per cubic foot (Btu/ft3) versus 1,020 Btu/ft3). Consequently, at a bended ratio of 95% natural gas and 5% hydrogen by volume, the blended fuel will have a slightly lower heat content (985 Btu/ft3 versus 1,020 Btu/ft3 or 3.4%) when compared to pure natural gas. The slight change in heat content should have a minimal effect on pollutant emissions, especially when you consider that hydrogen from the electrolysis of water will contain fewer impurities than fossil fuel natural gas. Overall, the Department believes that any effect on pollutant emissions from the FPL Cavendish NextGen Hydrogen Hub will be negligible. However, the Department will include a permit condition limiting the maximum amount of hydrogen that can be blended into the natural gas to 5.0% by volume or less."

- United Airlines has become the largest airline in the world to

invest in hydrogen-fueled electric engines that manufacturer

ZeroAvia is developing for regional aircraft that can carry fewer

than 100 passengers. (IHS Markit Net-Zero Business Daily's Amena

Saiyid)

- The Chicago-based airline's announcement came less than a fortnight after it demonstrated that sustainable aviation fuels made from woody waste and renewable feedstock can be used in commercial airplanes without any operational problems.

- Through a new equity stake in ZeroAvia, United said it had agreed to a conditional purchase of 100 aircraft engines known as ZA2000. These engines would be powered by 100% hydrogen fuel cells and capable of producing between 2,000 and 5,000 kilowatts of power with a 500-mile range.

- Hydrogen-electric engines use electricity created by a chemical reaction in a fuel cell to power an electric motor instead of burning a fossil fuel. Because no fuel is burned, there are no climate-harming emissions or carbon released into the atmosphere when the engines operate.

- United's aim is to retrofit its regional jet fleet with ZeroAvia's hydrogen powertrains as early as 2028, placing it squarely on its net-zero path. This includes plans to halve its carbon intensity compared with 2019 by 2035.

- The California regulator has suspended Pony.ai's driverless testing permit following an accident, reports Reuters. This is the first time the regulator has issued such a suspension, but this does not affect Pony.ai's permit for testing with a safety driver. According to a report filed with the California Department of Motor Vehicles (DMV), a Pony.ai vehicle driving in autonomous mode struck a road center divider and a traffic sign in Fremont after turning right on 28 October. Pony.ai said there were no injuries and no other vehicles were involved in the accident. The suspension comes only six months after Pony.ai became the eighth company to receive a driverless testing permit in California. Pony.ai has now launched autonomous vehicle (AV) tests in seven cities in China and the US. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Following US lawmakers' approval last month of USD7.5 billion in funding for a national network of electric vehicle (EV) chargers, US Joe Biden's administration released yesterday (13 December) an 'Electric Vehicle Charging Action Plan' for deploying the funds and enabling the process. According to a document released by the White House, the plan includes establishing a Joint Office of Energy and Transportation. The aim of the new office is to ensure the Department of Transportation (DOT) and the Department of Energy (DOE) work together on implementing the charging network plan and other electrification provisions in the administration's infrastructure law, as well as to co-ordinate the federal strategy and the provision of resources to states, communities, and industry. In addition, the White House intends to publish guidance and standards for states and local governments relative to EV charger deployment no later than 11 February 2022. The administration says that it is already working on the guidance, which will cover where states and cities need to "strategically deploy" EV charging stations as part of a national network on the highway system. The guidance will also cover where there is EV charging and where it is needed, including for the disadvantaged and rural communities, and the ensuring of smart connections to the electric grid. In addition, a new Advisory Committee on Electric Vehicles is to be appointed in the first quarter of 2022, after "convening a series of initial stakeholder meetings" to cover partnerships with state and local government, domestic manufacturing, equity and environmental justice, civil rights, and partnering with tribal communities and others. In addition, no later than 13 May 2022, the US administration intends to publish standards for EV chargers to ensure safety, reliability, and accessibility. The administration has a key target of ensuring that as much of the EV charging network as possible is produced in the US. To meet that goal, the DOT and the DOE have requested information from manufacturers, automakers, and labor representatives. The new plan includes further efforts to support US battery manufacturing, including on raw materials sourcing and recycling. The investment plan in a more-robust EV charging network is significant in terms of the amount of money involved, but also because the objectives include creating a network that is more consistent than currently. Developing the charging infrastructure necessary to support a transition to EVs is not something automakers are positioned to take on themselves, despite Tesla's Supercharger network. A robust system will need both public and private investment. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The governments of Nicaragua and mainland China signed on 9 December an agreement to establish full diplomatic relations after Nicaragua broke official ties with Taiwan. Nicaraguan President Daniel Ortega said that the alignment with mainland China was based on ideological reasons and his affinity with the Chinese Communist Party. Following Nicaragua's termination of diplomatic relations with Taiwan, mainland China on 12 December announced the delivery of 200,000 doses of the COVID-19 Sinopharm vaccine to Nicaragua. Taiwan has donated to Nicaragua approximately USD200 million since 2007. It has also been a major funding source of the Central American Bank for Economic Integration (CABEI), an entity that provided Nicaragua with an estimated USD2.2 billion between January 2017 and June 2021. The timing of Ortega's decision overlapped with the United States' hosting of the first Summit for Democracy, to which Nicaragua was not invited. Nicaragua's deteriorating relationship with the US was further confirmed by US President Joe Biden, who, on 10 November, ratified the Reinforcing Nicaragua's Adherence to Conditions for Electoral Reform (RENACER) Act, which strengthens sanctions against Nicaragua, imposing reinforced limitations and oversight mechanisms for multilateral loan approvals. (IHS Markit Country Risk's Veronica Retamales Burford)

Europe/Middle East/Africa

- Major European equity indices closed mixed; Spain +0.7%, Italy 0%, UK -0.2%, France -0.7%, and Germany -1.1%.

- 10yr European govt bonds closed lower; Germany +1bp, France/Italy/Spain +2bps, and UK +3bps.

- iTraxx-Europe closed flat/52bps and iTraxx-Xover +2bps/259bps.

- Brent crude closed -0.9%/$73.70 per barrel.

- The Volkswagen (VW) Group will create a new separate company to host its European battery business, and it will also invest EUR2 billion in its German battery hub which will be based in Salzgitter. The Salzgitter site, which already hosts VW's main battery R&D center and is the location for an already announced battery Gigafactory that is under construction, will be rolled into the new company which will be headquartered there. The company's scope will include 'developing new business models based around reusing discarded car batteries and recycling the valuable raw materials', in addition to battery production, R&D and raw material processing. The site will combine development, planning and production functions control in one location, and will thus become the VW Group's battery center. VW is making a clear investment in its future in the creation of this company with this announcement fleshing out the battery information from last week's planning round announcement. Europe's largest carmaker is looking to control the supply chain and value chain of the batteries that it is using in its massive ramp up in its electric vehicle (EV) range, with the automotive semiconductor supply shortage showing only too starkly how vulnerable OEMs are in terms of their reliance on outside suppliers and supply chain disruption. The aim is to create a futureproof structure and organization that VW has control over and which will act as the foundation to the company's BEV push. As previously announced, VW is planning to add four more Gigafactories in Europe by the end of 2030 to complement the two already announced in Salzgitter and Skellefteå. (IHS Markit AutoIntelligence's Tim Urquhart)

- Valeo has integrated its second-generation LiDAR, Valeo Scala, into the new Mercedes-Benz S-Class sedan, according to a company statement. This will enable the S-Class sedan to reach Level 3 automation, allowing the car to drive in conditionally automated mode under controlled conditions. Valeo claims that this car will be the first in the world to be equipped with its second-generation LiDAR. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Bulgaria's 2021 essential oil production is expected to reach

400 tons, a 10-year record-low, due to low rose and lavender crops.

Low yields, labor shortages and high production costs have been the

drivers of the fall. (IHS Markit Food and Agricultural Commodities'

Jose Gutierrez)

- The rose petal crop fell by 40% y/y to 10,000 tons in 2021 due to low paid prices after several years with large outputs. The Bulgarian research firm explained that growers have been dependent on EU subsidies to cover production costs. However, large farmers may receive a premium price as processors cannot match the global demand.

- The 2021 lavender crop reached 82,000 tons. This volume is within the Bulgarian average although the yield was extremely low due to unfavorable weather and high prices for fertilizers. The planted area reached a record of 18,000-21,000 hectares.

- The lavender oil production is expected to be behind 400 tons, far from the record of 500-600 tons achieved in previous years.

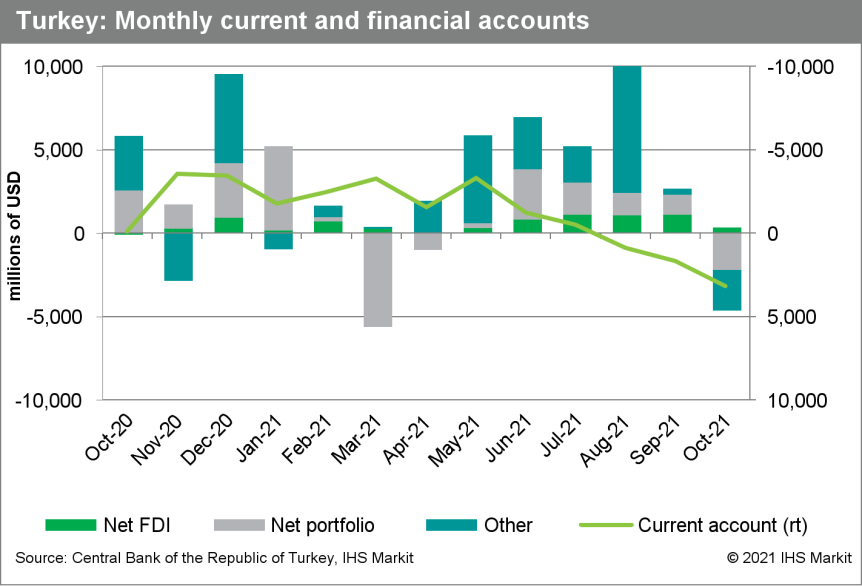

- The lira's sharp losses contributed to the largest

current-account surplus in a single month in Turkey. However, net

outflows of portfolio investment are putting downward pressure on

the currency, raising external financing questions and drawing down

foreign currency reserves. In 2022, the current account is expected

to move back into deficit, although it will be a smaller one than

previously assumed. Net portfolio outflows will persist as long as

rate cuts continue. (IHS Markit Economist Andrew

Birch)

- For the third consecutive month, Turkey posted a current-account surplus in October 2021 according to data from the Central Bank of the Republic of Turkey (TCMB). In October, the surplus of USD3.156 billion was the largest in a single month in the country's history.

- The sharp lira fall has improved Turkish export competitiveness, contributing to a 34.1% year-on-year (y/y) increase in merchandise trade growth in January-October 2021. Meanwhile, the recovery in tourism service exports in 2021 - although they remain well below pre-pandemic levels - led to a 61.9% y/y surge of total service exports in that same period.

- The historically large surplus in October cut the 10-month 2021 cumulative deficit to just USD8.426 billion, down more than USD20 billion from the same period a year earlier. Along with the improved merchandise and service balances, Turkey received net transfer inflows due to bilateral aid to support the TCMB in its efforts to stabilise the lira. Government net inward transfers reached nearly USD500 million, up from just USD65 million in 2020.

- In the financial account, however, Turkey's net portfolio

investments turned outward in October, reaching USD2.2 billion.

Portfolio investment was outward on a net basis for the first time

since April. The beginning of the TCMB's rate-cutting cycle at the

end of September prompted a sharp outflow of bank debt security

investments as returns on investments fell with the rate cuts. The

sharp lira losses in October reflected the shifting flow of net

capital.

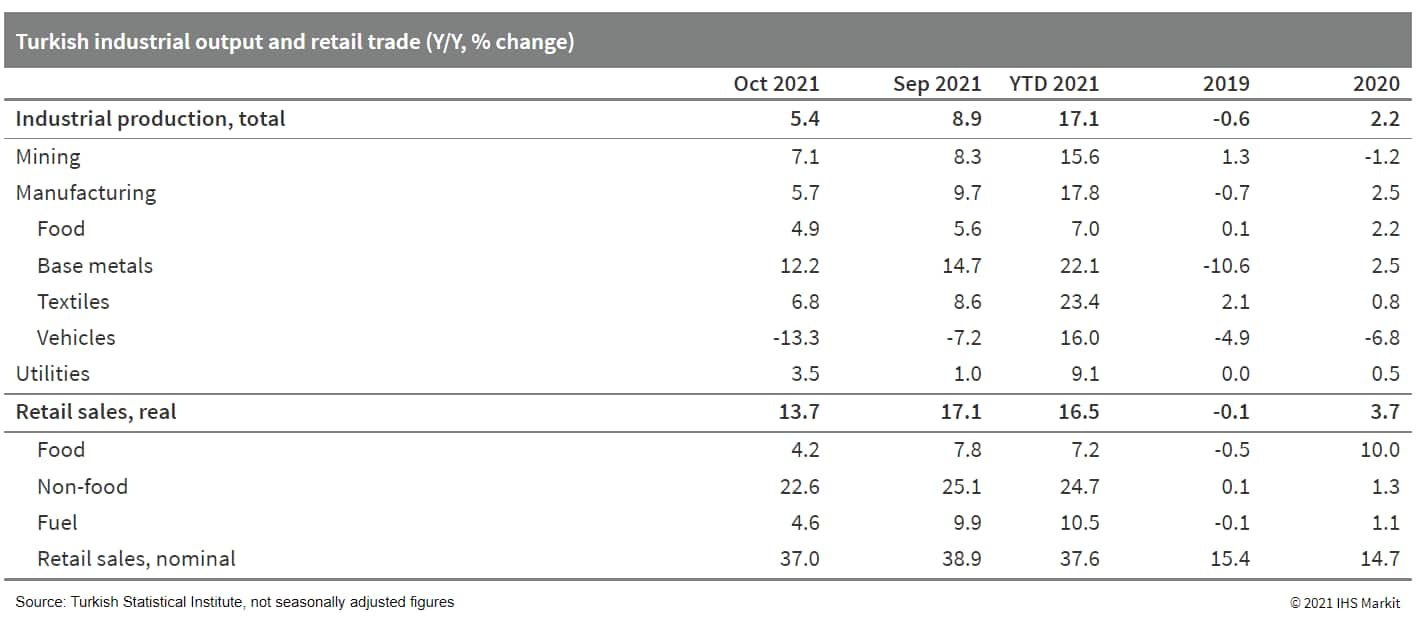

- Turkish industrial production growth remained sluggish in

October, yet to respond to the government's efforts to stimulate

domestic economic activity. Although total industrial output was

well up from year-earlier levels due to base effects, production

edged up by only 0.6% month on month (m/m) in seasonal and

calendar-adjusted data. Output was lower than it had been in August

and was up just 1.2% as compared to June. (IHS Markit Economist Andrew

Birch)

- Similarly, the retail trade data for October also showed that consumer activity did not immediately positively react to the rate cutting cycle that began in late September. Again, base effects have total retail trade activity well above year-earlier levels, but in seasonal and calendar-adjusted data, retail sales grew by only 0.9% m/m. After surging ahead in June following the relaxation of coronavirus disease 2019 (COVID-19)-related lockdown measures, retail trade has failed to increase by more than 2% m/m since.

- Beginning in late September, Turkish authorities have aggressively attempted to stimulate domestic economic activity. The Central Bank of the Republic of Turkey (TCMB) cut the main policy rate by 400 basis points. Credit growth has skyrocketed, from less than 14% annually as of late September to over 35% annually as of early December.

- Moreover, official unemployment has pushed downward since June,

falling to 10.7% as of October, with total employment having

expanded m/m in eight of the first ten months of the year.

- Prime Minister Ali Asadov's government has submitted for legislative consideration a package of amendments to the Tax Code that aim to attract investments in the extractive sector. The main measure is a proposed 75% reduction of land tax for projects related to geological exploration, assessment of subsoil resources and reconnaissance of potential mineral deposits. The proposed amendments do not apply to oil and gas. The measure appears designed to encourage investments in mining projects - notably for gold - in the territories over which Azerbaijan re-established control after the 44-day hostilities with Armenia over the breakaway region of Nagorno-Karabakh in 2020. Most of the gold deposits in the newly regained territories are concentrated in the Zangilan (Vejnali deposit) and Kelbajar (Soyudlu and Agduzdag deposits) districts, where the government estimates gold reserves of roughly 6.5 and 143 tons respectively. In May, President Ilham Aliyev granted the Turkish mining company Artvin Maden A.Ş. the right to develop Agduzdag gold mine. On 2 December, the British mining company Anglo Asian Mining Plc (London-listed, ticker symbol: AAZ) received a permit to develop the Vejnali gold mine. The development of the non-oil extractive sector is a strategic priority for the Azerbaijani government, as it strives to diversify its economy away from dependence on hydrocarbon resources. At present, only two mining companies export gold from Azerbaijan - the state-owned conglomerate AzerGold and Anglo Asian Mining Plc. The government is keen to increase the number of foreign mining companies operating in Azerbaijan, but the presence of unexploded ordnance and landmines left by the Armenian forces in the newly regained territories is likely to slow geological exploration. (IHS Markit Country Risk's Alex Melikishvili)

- Saudi Arabia's fiscal revenues are projected at SAR1,045

billion (USD278.7 billion) for 2022, an increase of 12.4% compared

with the currently estimated revenue outcome for 2021 and a 23.1%

rise over the revenue that was penciled in the original budget

draft a year ago. The finance ministry revealed this data in a

budget statement on its website. (IHS Markit Economists Jack

Kennedy and Ralf

Wiegert)

- Tax revenues account for SAR283 billion, including SAR223 billion in taxes on goods and services (mostly value-added tax), while so-called other revenues account for SAR763 billion. The latter category includes oil revenues, which are no longer separated out since Saudi Aramco went public. Combined with an average projected oil output of 10.2 million barrels per day (Mb/d), IHS Markit believes that the Saudi government calculates with an average oil price of USD70-USD75 per barrel in the budget for 2022.

- Moreover, the revenue side also benefits from robust economic growth in 2022. The budget statement anticipates growth to reach 7.4% on the back of a strong rebound of oil output; however, the non-oil economy is on the recovery path as well. IHS Markit's Purchasing Managers' Index (PMI, covering the entire non-oil economy) moderated to 56.9 points in November, the second month of a decline following a post-pandemic high in September; the November level shows a solid rate of expansion in the Saudi economy, though.

- The spending side of the budget is projected to shrink relative to 2021. In 2022, total spending is expected to amount to SAR955 billion, unchanged from the figure that was previously published in the medium-term budget strategy. Against the estimated outcome in 2021, though, spending is expected to decline.

- The budget statement a year ago was still driven by the prevailing low oil price environment, but circumstances one year later have profoundly changed. Although the spending allocated for investment in the budget is still expected to decline in 2022, the broader level of investment outside of the budget (but under the auspices of government-related agencies and companies) is expected to level up by 12% for the domestic economy in 2022 compared with 2021.

Asia-Pacific

- Most major APAC equity indices closed lower except for Australia flat; India -0.3%, South Korea/Mainland China -0.5%, Japan -0.7%, and Hong Kong -1.3%.

- China's Zhejiang Tiansheng Chemical Fiber has slashed its

polyester production to 65% of full capacity on Tuesday, two

sources told OPIS. This production cut was due partly to tight

COVID-19 restrictions on Shaoxing City, said both sources.

Inventory pressure played another part, they added. (IHS Markit

Chemical Market Advisory Service's Chuan Ong)

- "Restrictions in the Shaoxing area are more severe than those in Zhenhai. Today, the new COVID cases reported were mostly from the Shaoxing area," said one source, a fellow polyester producer based in Xiaoshan City.

- OPIS reported that tight restrictions on vehicular passage through virus hotspots have impacted commodities logistics, with plants like Ningbo Zhongjin nearly shutting down as a result.

- Tiansheng Chemical Fiber is based in Keqiao District, part of Shaoxing City. Shangyu District, also in Shaoxing, remains in a state of lockdown.

- Keqiao District has not been locked down amid disease spread, but is in a state of heightened control, said a market analyst from Hangzhou City.

- Zhenhai District, the first district to be locked down in this wave of infections, is further away, part of Ningbo City. Both Shaoxing City and Ningbo City are in China's Zhejiang Province.

- "Tiansheng also pondered its high product inventory before initiating this production cut. Foremostly of course, all polyester producers in Shaoxing have been impacted by the emergency measures," said the polyester maker.

- The analyst said that Tiansheng has cut production by 35%, to 65% at its 1.2-1.4 million mt/yr polyester plant.

- The company will further slash its production by another 15% to 50% at the beginning of January, the analyst added.

- Geely Auto announced on 13 December that it has entered an agreement with Lifan Technology on the formation of a new joint venture (JV) in China. The JV will be engaged in design, development and sales of vehicles as well as development of related software and technologies. Each party will hold a stake of 50%. Geely's subsidiary, Geely Technology, holds 28.98% of Lifan Technology, formerly Lifang Industry (Group). Lifan had been suffering both poor vehicle sales and financial performance before Geely and Chongqing-government-backed Liangjiang investment fund joined forces to invest in it. The announcement of the new JV indicates the two companies are speeding up their plans in the development of battery swappable EVs. In May, Lifan began Chinese production of its first electric model, the 80V, which features a swappable battery. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Toyota has unveiled its battery electric vehicle (BEV) strategy aimed at achieving carbon neutrality on 14 December (today). The automaker revealed 16 Toyota and Lexus BEV models that it is readying for market launch, including the all-new Toyota bZ4X due next year. Talking about Toyota's strategy, Toyota's president, Akio Toyoda, announced that the company plans to introduce 30 BEV models and is expecting sales of 3.5 million BEVs globally by 2030. The Lexus brand aims to have BEVs account for 100% of total sales in Europe, North America, and China by 2030. It also aims for BEVs to make up 100% of its global vehicle sales in 2035. The president highlighted the difference between "carbon-reducing" and "carbon-neutral" vehicles, and that Toyota is focused on developing and producing carbon-neutral vehicles that run on clean energy and achieve zero emissions in the whole lifecycle. Working in this direction, the company has kept a target to achieve carbon neutrality at its manufacturing plants by 2035 by expanding the use of innovative production engineering technology. Toyota has accelerated its push to further electrify its line-up in recent months. In May, it announced that it intends for battery and fuel-cell electric vehicles (BEVs and FCEVs) to make up 15% of its US sales by 2030, and for electrified vehicles to make up 70% of US sales by 2030. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Volkswagen (VW) Passenger Cars India hopes to double its used-car sales volume this year to 20,000 units, reports the Times of India, citing VW India brand director Ashish Gupta. According to the report, Gupta said, "In the past almost two years, the one clear shift in customer preference I see is that customers are going for additional cars. That's driven by the need for individual mobility. So, people who can afford to buy a car again are more likely to buy an additional car. Last year, we sold close to 10,000 pre-owned cars. This year, we are on track to sell 20,000. So, that's the kind of uptick we see." VW India entered the used-car market in 2012 with the opening of its first Das Welt auto showroom. The automaker launched multi-brand Das WeltAuto (DWA) 3.0 in June 2020 to facilitate buying and selling of used cars after the COVID-19 pandemic hit the country. Demand for used cars has increased due to the greater need for personal mobility since the pandemic, as well as due to the ongoing semiconductor shortages that have affected the supply of new cars by automakers. (IHS Markit AutoIntelligence's Isha Sharma)

- Kia India has confirmed that it is to enter the used-car business in the country in 2022, reports Autocar. Commenting on the plans, Hardeep Singh Brar, Kia India president and head of marketing and sales, said, "We are also planning to get into the used car market. Come 2022, when our cars will turn about three years old, it'll be the right time to start [with our used car business], especially in the bigger towns." Brar added, "If you look at the scenario today, what I understand is that the used car market is about 1.4 times the new car market and, come 2025, this is projected to be almost two times the new car market. So there is tremendous potential that we can see in this area." The Indian used-car market is largely unorganized, but several OEMs have a presence in the segment, including Maruti Suzuki, Mahindra & Mahindra (M&M), Hyundai, Toyota, BMW, Audi, and Jaguar Land Rover (JLR). There are also online sales platforms such as CarDekho, Cars24, and Droom. Last year, MG Motor launched its used-car program MG Reassure. Kia will join the list of automakers that have entered the pre-owned car business in a bid to leverage potential revenues. The latest development also comes as demand for used cars has increased due to the need for personal mobility since the COVID-19 pandemic, as well as due to the ongoing semiconductor shortages that have affected the supply of new cars by automakers. (IHS Markit AutoIntelligence's Isha Sharma)

- Australia's dairy exports in the 10 months to October 2021,

increased by 12% y/y in volume and 27% y/y in value, thanks to

steady global demand for its milk powders. According to the latest

trade data, total exports totaled 396,200 tons in January-October,

a new record which is some 150 tons higher than volumes in the same

period of 2017. Total value surged to US$1.8 billion. (IHS Markit

Food and Agricultural Commodities' Jana Sutenko)

- The largest increase in volume exports was seen in the category of milk powders, specifically SMP, which rose 15% y/y to 121,700 tons. Less sizeable were exports of WMP, which were up 54% y/y to 40,000 tons.

- Significant gains were also registered in the supplies of butterfat, up 61% y/y to 20,200 tons. Whey was the only commodity to see a slip in January-October, down 6% y/y to 27,000 tons.

- Fonterra Australia and Saputo Dairy Australia have both lifted farmgate milk prices to AU$7.05 per kgMS in the southern regions of the country, therefore adjusting upward the prices set out in Juna.

- Rabobank said there is potential of more increases due to benefit of exporters from higher commodity prices, especially for SMP.

- There are, however, lingering headwinds for local exporters given the weaker-than-expected spring flush and supply chain bottle necks. Therefore, Rabobank has revised its forecast farmgate milk price for 2021/22 to AU$7.75 per kgMS, underpinned by rising commodity prices and weaker currency.

- The Philippines has taken a step towards its climate goal by

offering electricity users more options for purchasing renewable

power, but experts say further utility market reforms are required

to put the coal-reliant country firmly on a greener path. (IHS

Markit Net-Zero Business Daily's Max Lin)

- In an effort to achieve a national target of cutting GHG emissions by 75% from a business-as-usual cumulative level of 3.34 billion metric tons in 2020-2030, Manila introduced the long-awaited Green Energy Option Program (GEOP) to promote renewable power expansion.

- Under the GEOP, electricity users with a monthly average peak demand of 100 kW or higher can opt to acquire purely renewable energy in their supply contracts from 3 December.

- "By allowing commercial and industrial customers freedom to choose 100% renewable energy, the GEOP offers a modest, incremental improvement in offtake options," Simon Cowled, a Singapore-based partner of law firm King & Spalding, told Net-Zero Business Daily.

- Filipino power users had only been able to acquire renewable electricity though on-site installations, or, if their average peak demand exceeded 500 kW per month, sign power purchase agreements via the Retail Competition and Open Access (RCOA) program. Launched in 2013, the RCOA is the first Filipino electricity marketspace that offers off-site purchases.

- Isabella Suarez, a Philippines-based analyst at the Centre for Research on Energy and Clean Air, said the RCOA failed to promote the green transition much as it did not guarantee all energy could come from renewable sources. But she suggested the GEOP could play a bigger role in the country's green drive.

- In July, Toyota Motors, Yokohama Tire, and some multinationals

teamed up with Filipino energy suppliers like Ayala's AC Energy to

call for the full implementation of GEOP in a joint statement.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-december-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-december-2021.html&text=Daily+Global+Market+Summary+-+14+December+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-december-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 14 December 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-december-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+14+December+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-december-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}