Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 12, 2021

Daily Global Market Summary - 12 October 2021

Most major APAC equity indices closed lower, while US and European markets were mixed. US government bonds closed lower, while benchmark European bonds closed mixed. CDX-NA closed wider across IG and high yield, iTraxx-Xover was also wider, and iTraxx-Europe was flat on the day. The US dollar, natural gas, and WTI closed higher, while Brent, silver, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most US equity indices closed lower except for Russell 2000 +0.6%; Nasdaq -0.1%, S&P 500 -0.2%, and DJIA -0.3%.

- 10yr US govt bonds closed -3bps/1.58% yield and 30yr bonds -7bps/2.10% yield.

- CDX-NAIG closed +1bp/55bps and CDX-NAHY +7bps/308bps.

- DXY US dollar index closed +0.2%/94.52.

- Gold closed +0.2%/$1,759 per troy oz, silver -0.7%/$22.51 per troy oz, and copper -0.9%/$4.33 per pound.

- Crude oil closed +0.1%/$80.64 per barrel and natural gas closed +3.0%/$5.51 per mmbtu.

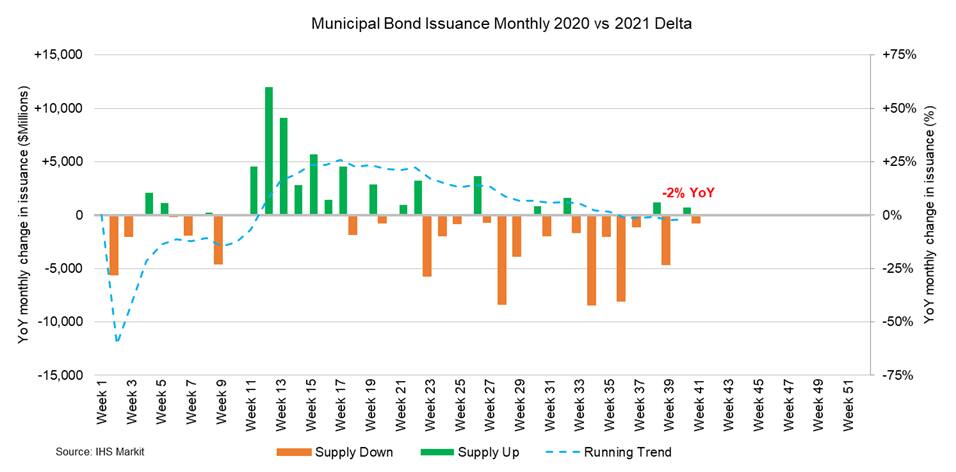

- Municipal bond buyside activity continues to remain strong

after last week's calendar supplied $11.4 billion, led by several

large-scale issuers funding new money activity with a noteworthy

presence of ESG offerings spanning across various states and

purposes. As muni benchmarks climb higher, investor activity

appears firm, after new issue offerings noted substantial

oversubscriptions, with the $1.5 billion Alabama Federal Aid

Highway Finance Authority witnessing bumps of 2-12bps across the

scale with the greatest bump noted in the 2033 maturity, falling

+73bps off the 10YR treasury. The Riverside County Transportation

Commission also experienced positive investor feedback, with

extreme bumps across the scale, ranging from 5-22bps as accounts

remained eager to take down bonds, with the greatest bump noted in

the 2037 maturity (+63bps off the MAC benchmark). This week's

calendar is slated to ease to $8.3 billion driven by the Columbus

Day Holiday-shortened week, represented by 212 new issue offerings

and a large presence from the State of New York, for an aggregated

par of $2.8 billion across negotiated and competitive offerings.

The Texas Water Development Board (-/AAA/AAA/-) will lead this

week's negotiated calendar, supplying $366 million state revolving

fund revenue bonds across 08/2022-08/2041, senior managed by

Jefferies. The San Ramon Valley Unified School District (Aa1/AA+/-)

will also come to market on Thursday, selling $257 million general

obligation refunding bonds across a 10-year scale duration, led by

Stifel. This week's competitive calendar will include 120 new

issues for a combined total of $3.82 billion driven by the Empire

State Development Corporation offering a combined total of $2.4

billion across six tranches selling throughout Thursday 10/14. (IHS

Markit Global Markit Group's Matthew

Gerstenfeld)

- US job openings fell by 659,000 to 10.4 million in August,

snapping a five-month string of record highs. Healthcare and social

assistance (down 224,000) and accommodation and food services (down

178,000) recorded the largest declines. The job openings rate edged

down from 7.0% to 6.6%. (IHS Markit Economist Patrick

Newport)

- The number and rate of hires fell to 6.3 million and 4.3%, from 6.8 million and 4.6%. Hires fell the most in accommodation and food services (down 240,000) and state and local government education (down 160,000).

- Job separations and that rate experienced little change at 6.0 million and 4.1%. Separations consist of quits, layoffs and discharges, and other separations.

- A record 4.3 million workers quit their jobs in August, as the quits rate moved up to a series-high 2.9% (Note: December 2000 is the initial data point.) Typically, a high quits rate is a good thing—it indicates that workers can improve their lot by pursuing opportunities elsewhere. In the age of COVID-19, though, quits could rise because workers are leaving unsafe working conditions. Quits were highest in accommodation and food services (up 157,000) and wholesale trade (up 26,000).

- Layoffs and discharges fell to a series-low 1.343 million; the rate was unchanged at a record-low 0.9%.

- Other separations moved up by 49,000 to 390,000, the highest since January 2016. Other separations consist of retirements, deaths, employee disabilities, and transfers to other locations.

- There was a record-low 0.8 unemployed worker for every job opening at the end of August, as the number of job openings exceeded the number of unemployed.

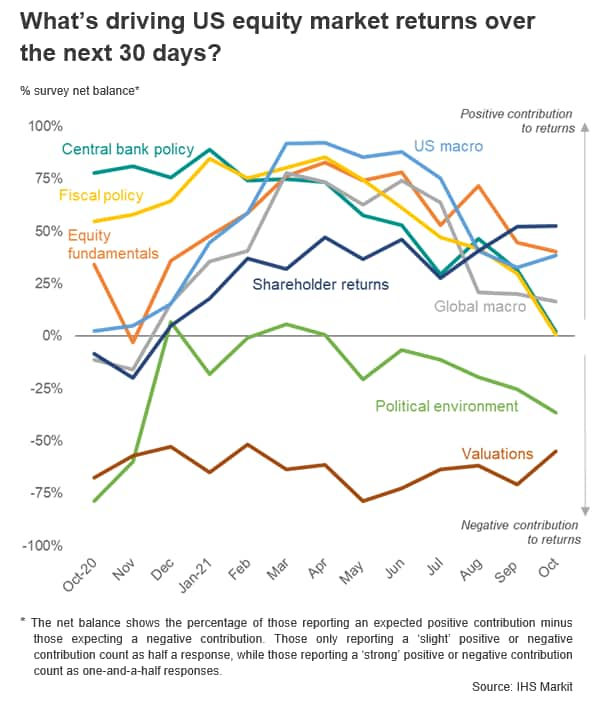

- US equity investors' risk appetite has picked up in October

from the one-year survey low seen in September, but remains subdued

compared to earlier in the year as investors cite concerns over the

political environment and perceive waning equity market support

from monetary and fiscal policy. (IHS Markit Economist Chris

Williamson)

- The positive views on shareholder returns, which hit a survey high in October, have played a role in driving financial stocks to the top of the sector preferences for the next 30 days, followed closely by energy names. The outlook for the latter has also been buoyed by recent surging spot prices for energy.

- This subdued level of risk appetite evident in October compared to earlier in the year corresponds with a marked pull-back in investors' expectations of year-end equity market performance over the past six months. While the US is seen to be the best performing equity market in 2021, followed by Japan and the EU, sentiment towards all three has fallen compared to April. The UK market's expected performance has meanwhile slipped behind the other developed markets, while investment managers have now taken a bearish view towards China and, to lesser extents, Latin America and the rest of Asia.

- When comparing how the perceived drivers have changed over the

past year, it is central bank policy that has seen the largest

pull-back in sentiment, falling even further in October to hit a

new survey low. Similarly, investor perceptions of how government

fiscal policy can help drive the market have also fallen to a new

survey low and - like monetary policy - is seen as providing only

marginally positive support to US equities over the coming

month.

- Supernus Pharmaceuticals and Adamas Pharmaceuticals (both US) have announced that they have reached a deal whereby Supernus will acquire Adamas for approximately USD400 million, rising to approximately USD450 million, depending on the sales achieved by Adamas's Parkinson's disease (PD) drug Gocovri (amantadine). The proposed acquisition corresponds to a tender offer of USD8.10 per share, with this price rising by USD0.50 per share if Gocovri's net sales reach USD150 million in any four consecutive quarters between closing and the end of 2024, and by a further USD0.50 per share if Gocovri's net sales reach USD225 million in any four consecutive quarters within this time period. The transaction is expected to close towards the end of the current year, or in early 2022. (IHS Markit Life Sciences' Milena Izmirlieva)

- Dozens of House Ag Committee members urged USDA Secretary Tom Vilsack and FDA Acting Commissioner Jane Woodcock last week to continue work aimed at modernizing the regulatory process for genetically engineered (GE) animals. The October 7 letter, signed by committee Chair David Scott (D-Ga.), Ranking Member GT Thompson (R-Pa.) and more than 30 other members from both sides of the aisle emphasized the importance of the regulatory modernization effort. "Zoonotic disease, climate change, and a growing global population require us to consider new solutions to protect our food supply and sustainably meet demand," the letter said. "Ongoing research and existing innovations in animal genetics show great promise in addressing these challenges." The lawmakers noted genetic improvements through traditional plant and animal breeding techniques have time and again proven key in increasing "the success and sustainability of agricultural production," such as long-term gains in dairy cow productivity. But they said, "many of the challenges we face today will not afford us another 70 years to make similar incremental improvements." The advances in animal genetics made through new GE technologies could help tackle issues ranging from zoonotic diseases like SARS-CoV-2 (the virus that causes COVID-19) to reducing methane emissions from livestock, they emphasized. Challenges facing society broadly and the food supply system specifically "demand an improved regulatory approach," and the lawmakers conclude by urging the Biden administration to "rise to the occasion and empower agriculture with the tools necessary to be a part of the solution." (IHS Markit Food and Agricultural Policy's Richard Morrison)

- ExxonMobil has announced plans to build its first large-scale advanced recycling facility in Baytown, Texas, with start-up slated for late 2022. The facility, which will employ a process developed in-house, will initially have capacity to convert 30,000 metric tons/year of waste plastics to chemical feedstock. ExxonMobil says an initial trial of its process has recycled more than 1,000 metric tons of plastic waste and demonstrated the capability of processing 50 metric tons per day. The company intends to build about 500,000 metric tons of advanced recycling capacity globally through 2026. In Europe, the company is collaborating with Plastic Energy on a plant in Notre Dame de Gravenchon, France, that is expected to process 25,000 metric tons/year of plastic waste when it starts up in 2023, with the potential for further expansion to 33,000 metric tons/year. (IHS Markit Chemical Advisory)

- On October 12, Clēnera LLC and Michigan's Wolverine Power

Cooperative announced a 20-year Power Purchase Agreement (PPA)

between Wolverine and Clēnera affiliate Gemstone Solar LLC. (IHS

Markit PointLogic's Barry Cassell)

- The Gemstone Solar project is scheduled to be commercially operational by the end of 2023. It will deliver 150 MW (ac). Clēnera, a developer of large-scale solar and storage projects, and a subsidiary of Enlight Renewable Energy LTD, will manage construction and operation of Gemstone Solar.

- Wolverine said it is Michigan's leader in new renewable energy—currently providing members with power that is 60% carbon-free. Wolverine's current renewable portfolio includes more than 210 MW of wind and solar.

- Gemstone Solar will occupy approximately 1,000 acres of land in Cass County, Michigan. Construction is expected to begin in the spring of 2023.

- On October 12, the Public Service Commission of Wisconsin

approved an October 2020 application from Springfield Solar Farm

LLC for a Certificate of Public Convenience and Necessity (CPCN) on

a 100-MW (ac) solar photovoltaic (PV) facility. (IHS Markit

PointLogic's Barry Cassell)

- The project would be located in the Town of Lomira and the Village of Lomira in Dodge County, Wisconsin. The proposed project would use either polycrystalline or monocrystalline, or bi-facial PV modules, the specific model of which is to be evaluated and selected closer to the time of construction. Panel models will be evaluated closer to the time of construction and may range from 425 watts per panel to potentially 450 watts per panel, requiring approximately 300,000 total panels for the 100-MW (ac) size. The selected panels would connect to a single-axis tracking system.

- The solar PV array would connect to a new 34.5 kV/138 kV project collector substation. A 453-foot generator tie line would connect the new collector substation to the Butternut substation.

- Wisconsin Power and Light (WP&L) has proposed to purchase this project, with that application from the utility under review in another docket. The project company is currently a wholly-owned subsidiary of National Grid Renewables.

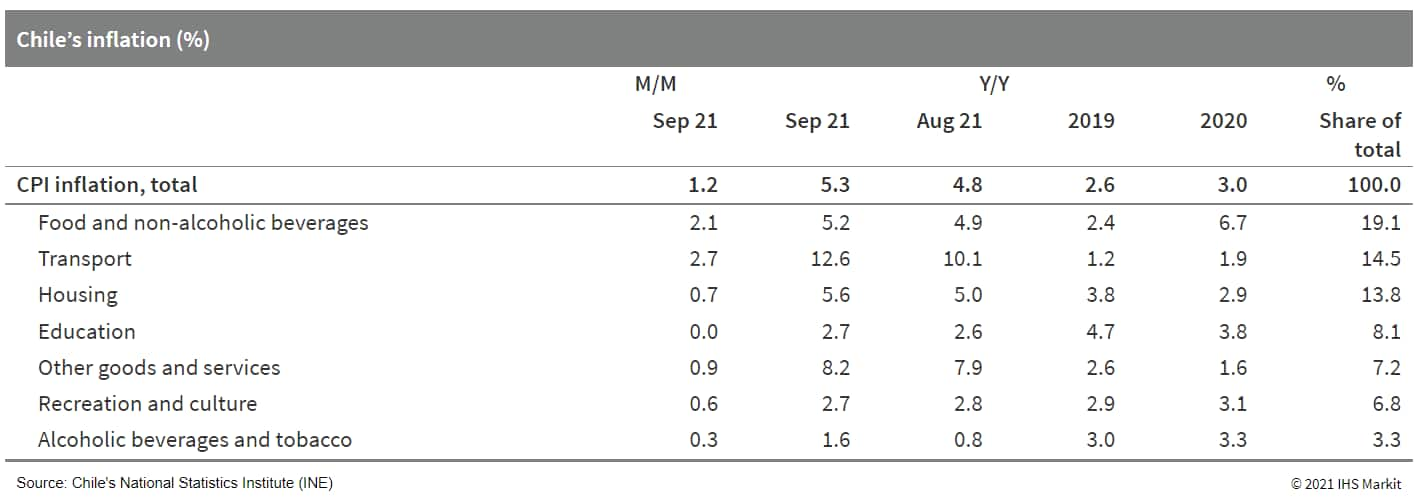

- Chile's consumer price inflation jumped in September to the

highest monthly reading in over a decade. The annual reading

remains well above the 4% upper bound of the inflation target range

since July. (IHS Markit Economist Claudia

Wehbe)

- After slowing from 0.81% in July to 0.36% month on month (m/m) in August, Chile's consumer prices surged by 1.18% in September mainly because of increases in the prices of all basket categories.

- Prices in the food and non-alcoholic category recorded the largest increase since September 2020, largely driven by increases in meats and vegetables. Meanwhile, transportation prices soared as a result of increases in motor vehicles and air transportation. Housing and basic services' prices rose because of increases in liquefied gas and water.

- The month-on-month increase again pushed year-on-year (y/y)

inflation to 5.3%, up from 4.8% in August. On an annual basis, all

consumption basket components show rising prices.

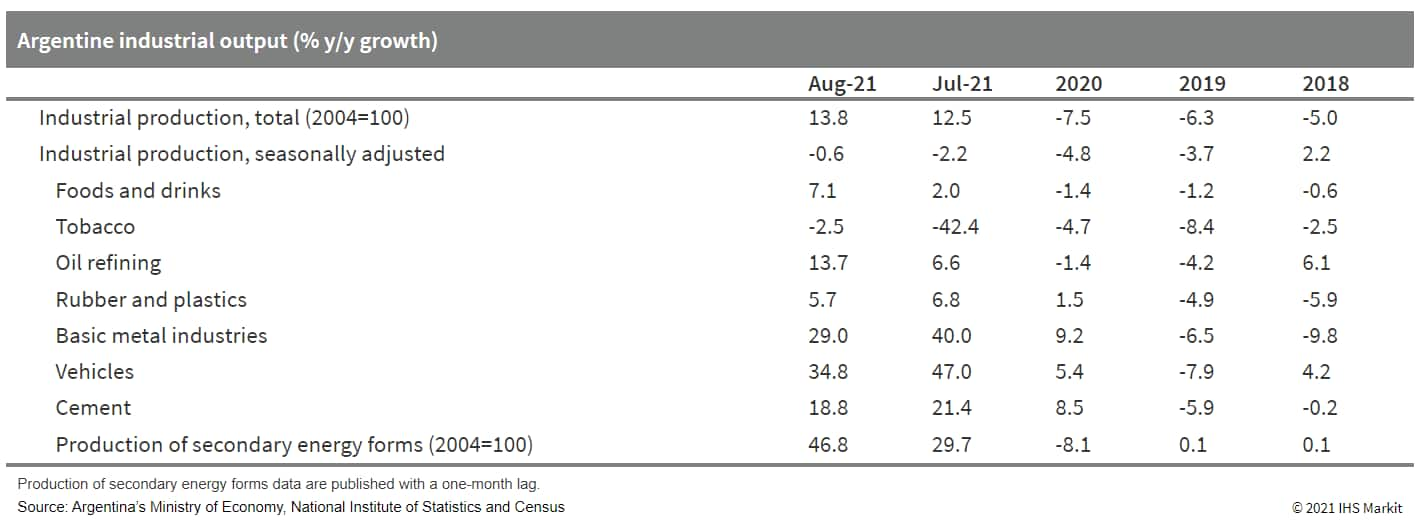

- According to Argentina's National Institute of Statistics and

Censuses (Instituto Nacional de Estadística y Censos: INDEC), the

country's industrial production increased by 13.8% year on year

(y/y) in August. Seasonally adjusted data show a 0.6%

month-on-month (m/m) decrease in August, compared with a 2.2% m/m

decline in July (revised figures). (IHS Markit Economist Paula

Diosquez-Rice)

- The largest annual increases in August were in transportation equipment, clothing and apparel, general equipment, vehicle assembly, and basic metals, among others. A few sectors posted a slower year-on-year expansion in August: chemicals; food and beverages; wood, paper, and printing; and oil refining. Tobacco products and household furniture and mattresses posted an annual decline.

- A qualitative industrial poll of companies conducted by INDEC

shows that 31.3% of respondents estimate that demand will expand in

September-November 2021, compared with the same period in 2020 (up

from 30% in the previous month's survey). The percentage of

respondents that expect demand to remain relatively the same

decreased to 46%, while 52% of respondents expect exports to remain

at a similar level during the period.

Europe/Middle East/Africa

- Major European equity indices closed mixed; Spain +0.4%, Italy +0.2%, UK -0.2%, and France/Germany -0.3%.

- 10yr European government bonds closed mixed; UK -4bps, Italy flat, France/Spain +2bps, and Germany +3bps.

- iTraxx-Europe closed flat/53bps and iTraxx-Xover +3bps/272bps.

- Brent crude closed -0.3%/$83.42 per barrel.

- One of the biggest supply chain pressures facing the UK meat

industry was tackled on Monday (11 October) as carbon dioxide (CO2)

producers struck an agreement to ensure supplies to British

businesses. (IHS Markit Food and Agricultural Commodities' Max

Green)

- Under the terms of the deal, CO2 suppliers have agreed to pay CF Fertilisers a price for the CO2 it produces that will enable it to continue operating while global gas prices remain high. The company produces around 60% of the UK's commercial CO2 requirements.

- Two plants owned CF Fertilisers halted activities in September due soaring gas prices. With capacity already hit by staff shortages, this threatened major disruption to the pork supply chain as CO2 is used to stun pigs in most large abattoirs.

- In September, the government agreed a stop-gap arrangement with CF Fertilisers involving millions of pounds of taxpayer-funded support for three weeks to get the plants up and running.

- The new deal offers a longer-term solution as it runs until January 2022. This means that key sectors, including processors of meat and other types of food are ensured supplies of CO2 until then.

- Septon Technology, a US-based company that deals in automotive advanced driver assistance system (ADAS), LiDAR, and smart city technologies, has partnered with Vortex IoT (Vortex), a UK-based internet of things (IoT) solutions company, reports Yahoo Finance. The partnership will allow UK buses to access real-time road inspection tools, enabling a LiDAR-based vehicle-to-infrastructure (V2I) solution by using Vortex's Continuous Urban Scanner System (CURBS) for sending data to the road management team to identify specific road depressions, damage, and roadside imperfections. The solution also uses artificial intelligence (AI) and machine learning with Septon's Vista-P60 high-resolution sensor to map the urban environment, while integrating CURBS products into vehicles for real-time 3D scanning and dynamic monitoring. CURBS products mounted on public vehicles like buses, garbage trucks, and mobile enforcement vehicles will be able to guide maintenance teams and proactively conduct repairs by gathering real time insights. Other uses of the technology include controlling traffic violations, reducing carbon emissions, and making cities smarter. (IHS Markit Automotive Mobility's Tarun Thakur)

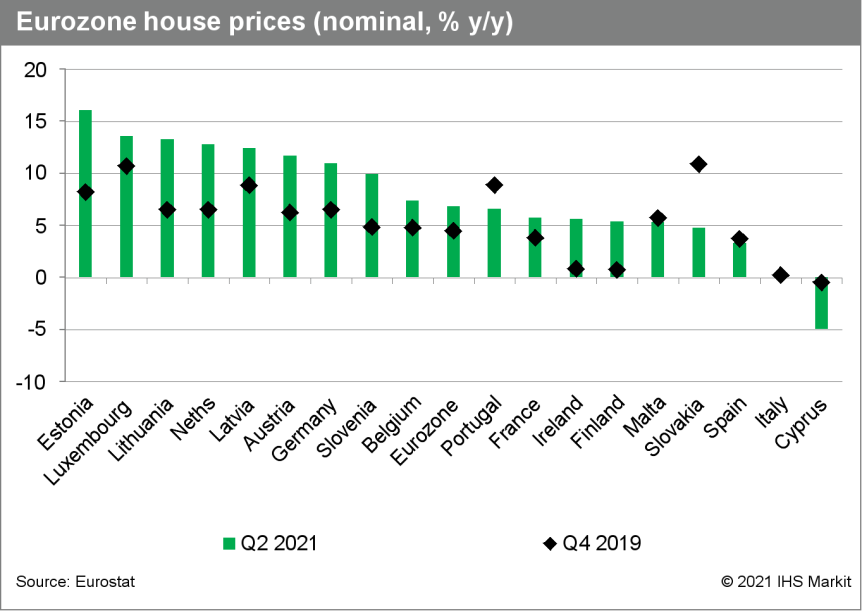

- House prices in the eurozone increased by 6.8% y/y in the

second quarter of this year, the fastest rate of increase since the

second quarter of 2006. The y/y rate of increase has increased in

six of the past seven quarters and the cumulative rise in eurozone

house prices compared with pre-pandemic levels is now approaching

10%. (IHS Markit Economist Ken

Wattret)

- The quarterly time series for the eurozone goes back to the first quarter of 2005 and the cumulative increase in prices since then is just shy of 50%. This is despite two crises during that period, in 2008-09 and 2011-12, which saw house prices decline markedly in some member states.

- The strength in the second quarter's data was broad-based across most of the eurozone, with seven member states showing y/y increases in double digits.

- Of the larger member states, the highest y/y increases in the

second quarter were in the Netherlands (12.8%) and Germany (10.9%).

The lowest were in Spain (3.3%) and Italy (0.4%). Cyprus was the

only member state to show a y/y contraction (-4.9%).

- Tesla CEO Elon Musk has said that he hopes that the eventual capacity of the company's new German plant in Grünheide will be 10,000 units a week., according to a Reuters report. The initial ramp-up stage would target a figure of 5,000 units a week, before "hopefully" reaching a target of 10,000 units in the medium term. Commenting on start of production (SoP) at the plant Musk said, "Starting production is nice, but volume production is the hard part. It will take longer to reach volume production than it took to build the factory." The first cars to be built at the plant are due to roll off the production line next month, with the Model Y crossover being the first model to be produced at the plant. (IHS Markit AutoIntelligence's Tim Urquhart)

- Covestro is coordinating an EU innovation project, called

Circular Foam, to develop waste-management systems and

chemical-recycling processes for rigid polyurethane (PU) foams. The

company says it is working with 21 partners from across nine

countries to "close the material cycle" for rigid PU foams, used as

insulation material in refrigerators and buildings. (IHS Markit

Chemical Advisory)

- Through the project, experts from science, business, and society will develop "a comprehensive solution model" over the next four years, Covestro says. The goal is to close the material cycle for PU rigid foams and prepare the Europe-wide implementation of this blueprint. The project could save 1 million metric tons (MMt) of waste, 2.9 MMt of carbon dioxide (CO2) emissions, and €150 million ($174 million) in incineration costs every year in Europe from 2040, Covestro says.

- PU rigid foams from refrigerators and buildings are today incinerated for energy recovery rather than recycled. "In this process, the raw materials used are lost and high CO2 emissions are produced," Covestro says.

- Under the leadership of Covestro, the Circular Foam project is investigating and developing two possible recycling paths for PU rigid foams: chemolysis and smart pyrolysis. The aim in developing the two processes is to obtain polyols and amines as raw materials for the production of PU rigid foams in as high a quality as possible and so enable their reuse.

- According to the national statistical office (ISTAT), Italy's

industrial production fell 0.1% month on month (m/m) in August

after gains of 1.0% m/m in July and 1.1% m/m in June. However, the

average level of industrial production in July and August was 1.0%

above the second quarter's level. (IHS Markit Economist Raj

Badiani)

- The sector has begun to normalize, with Italy removing its main COVID-19-related restrictions during the second quarter.

- Industrial output in August was 2.2% above its February 2020 level, the last pre-pandemic month.

- Falling output in August took place in consumer (-2.0% m/m), intermediate (-1.3%) and energy goods (-2.1% m/m). However, the output in investment goods rose for a third successive month when rising by 0.8% m/m in August.

- On a working-day-adjusted basis, total industrial output was unchanged In August when compared to a year earlier.

- Industrial production in the first eight months of 2021 rose by 15.1% year on year (y/y), compared to a drop of 11.4% in the full year 2020.

- HERE Technologies, a Netherlands-based provider of mapping and location services, has showcased the latest iteration of its navigation software that has upgraded real-time traffic information, reports Tu-Auto. According to the source, the system claims to feature new lane level information and expanded inner-city coverage, provide accurate speeds on arterial lanes, and congestion information at intersections, as well as different road speeds on high-occupancy vehicle lanes. The system also provides a better granular traffic coverage in more than 100 cities across the globe covering all street types. (IHS Markit Automotive Mobility's Tarun Thakur)

- Energy company Endesa is planning to set up an electric vehicle (EV) battery recycling site in Spain with partner Urbaser, reports Europa Press. According to the article, the facility will be set up in the town of León. Around EUR13 million will be invested in the facility that will have the capacity to treat around 8,000 tons of batteries per year. The move is expected to create around 50 direct jobs when operations start by the end of 2023, after construction begins "as soon as possible". However, it is expected that the collection and storage of batteries for recycling will begin before the site is completed to ensure the necessary volume to start out at full capacity. (IHS Markit AutoIntelligence's Ian Fletcher)

- Greek consumer prices, measured by the EU-harmonised index of

consumer prices, rose by 1.9% year on year (y/y) in September. This

followed an increase of 1.2% y/y in August. (IHS Markit Economist

Diego

Iscaro)

- Although Greece's inflation rate has remained well below the eurozone's average (+3.4% y/y, according to the 'flash' estimate), September's reading was the highest since early 2012.

- Inflation measured by the national index, which gives a higher weight to items such as food and housing costs, stood at 2.2% in September, following 1.9% in August.

- While energy prices continued to be the main driver of inflation in September, the increase in inflation compared with August was driven by higher core inflation, which stood in positive territory (+0.2%) for the first time since May 2020.

- Food prices also rose by more than average in September (+3.1% y/y, following +3.0% y/y in August), while the increase in prices in hotels/restaurants continued to pick up, although it remained modest at 0.5% y/y.

- Five out of the 12 main categories still showed falling prices in September. For example, communication costs decreased by 2.5% y/y, while the prices of miscellaneous goods/services and recreation/culture dropped by 0.8% y/y and 0.4% y/y, respectively.

- Northvolt has announced that it is to expand its Northvolt Labs facility in Västerås (Sweden). According to a statement, the battery-maker plans to spend approximately USD750 million to turn the site into "Europe's leading campus for battery technologies". The company says the first new facility is already under construction at the site. The statement said this is a research-and-development (R&D) center "which will enable development of novel battery cell materials and products, thereby widening the scope of Northvolt's ability to meet increasing demand for customized solutions, whilst also pushing the boundary on next-generation cell technologies". The battery-maker is also constructing a new 15,000-square-metre office that will allow it to expand its headcount from 400 to at least 1,000 employees at the site. (IHS Markit AutoIntelligence's Ian Fletcher)

- Nova Energies—a joint venture between Technip Energies and NIPIGAS—has been awarded a Pre-FEED contract by SIBUR to study potential carbon capture solutions for its ZapSibNeftekhim plant. The scope of work includes technology and optimal technical solutions development, along with a cost estimate for the process of capturing, transporting and utilizing carbon dioxide from the operating enterprises of ZapSibNeftekhim and the Tobolsk thermoelectric power station, which is the unique supplier of steam for the plant and the key supplier of heat for housing and social facilities of the region. Nova Energies is a full-fledged independent player on the Russian market which provides a wide range of expertise, including engineering and design, project documentation and capex estimates ("FEED/PD") as well as engineering, procurement, construction, installation, and commissioning ("EPC/EPCM") for carbon dioxide removal, carbon capture, clean hydrogen production, bio Energies, bio refineries, bio chemistry, ammonia, as well as other energy transition related themes. (IHS Markit Upstream Costs and Technology's William Cunningham)

Asia-Pacific

- Most major APAC equity indices closed lower except for India +0.3%; Australia -0.3%, Japan -0.9%, Mainland China -1.3%, South Korea -1.4%, and Hong Kong -1.4%.

- Home sales in China are dropping by a third or more in some cases as curbs on property lending and worries about the financial health of China Evergrande Group and other developers are sidelining house buyers. In recent days, numerous big developers have reported lower sales figures for September, with many showing year-over-year declines of more than 20% or 30%. That is a stark drop-off for what is usually one of the strongest months in the year, thanks in part to promotions offered around China's Oct. 1 National Day holiday. (WSJ)

- In response to increasing downward pressure on the Mainland

China economy, more regions are expected to take measures to

stabilize their property markets. However, the general policy

stance will remain measured. (IHS Markit Economist Yating

Xu)

- Harbin, the capital city of northeastern province Heilongjiang, issued a slew of measures to ease developers' liquidity difficulties and shore up demand, according to the local government website. The measures came into effect on 1 October and will last until the end of 2021.

- The measures include easing restrictions on developer's presales funds and providing support for property firms' sales promotion campaigns. Authorities have also decided to offer subsidies to certain first-time home buyers and lower the land value-added tax rate for all types of housing. Additionally, the government eased the requirements for provident fund applications for second-hand houses, including prolonging the mortgage period from 20 years to 30 years.

- Mainland China's resource-abundant Shanxi Province experienced

record autumn flooding during 2-7 October, resulting in direct

economic losses amounting to over CNY5 billion so far, according to

the local government officials at a press conference on 12 October.

A total of 1.76 million people have been affected by the flood in

Shanxi; of this total, 0.12 million have been displaced and 15 lost

their lives. (IHS Markit Economist Lei Yi)

- For safety reasons, production at 60 out of the total 682 coal mines in Shanxi was temporarily suspended from 2 October. As of this writing, only 4 coal mines remain closed, including 3 mines in the city of Linfen with a total capacity of 3.6 million tons per year and 1 mine in the city of Taiyuan with an annual capacity of 1.2 million tons.

- Transportation infrastructure in Shanxi, highways in particular, suffered severe damage due to the disastrous weather; this may also to some extent disrupt coal shipping.

- Mainland China's other major coal-producing region, Shaanxi, is also experiencing record rainfalls. Although the local economic loss estimate is not yet available, the Ministry of Finance and Ministry of Emergency Management has allocated CNY80 million to Shanxi and Shaanxi for disaster relief.

- The recovery in tourism over the 2021 National Day holiday was

weaker than the recovery during previous holidays in 2021,

reflecting the impact of escalated pandemic-control measures in

response to the regional COVID-19 outbreaks. Private consumption

may remain subdued as winter and the Beijing 2022 Winter Olympics

draw nearer. (IHS Markit Economist Yating

Xu)

- According to the Ministry of Culture and Tourism, more than 500 million domestic trips generated CNY389 billion in spending during the week-long National Day holiday, down 1.5% and 5%, respectively, from levels reported in the same period in 2020. Compared with the 2019 levels, tourism trips were 30% lower and spending was over 40% lower.

- A survey carried out by the tourism ministry showed that almost 90% of chose to visit places within 300 km of their homes and nearly half of respondents stayed within their province.

- Meanwhile, data released by the Ministry of Transport showed that the average number of daily trips remained 34% lower than during the National Day holiday in 2019 and 7.5% lower than during the 2020 National Day holiday. By transportation mode, airplane trips declined 20%, train trips declined 2.9%, and highway trips fell 8%, compared with 2020 levels.

- Taiwan's merchandise exports surged 29.2% y/y in September

2021, marking the seventh straight month of climbing by more than

25% y/y and the 15th consecutive month of expansion. This came

despite some moderation from an average 37% surge in April-July,

which was the fastest since July 2010. (IHS Markit Economist Ling-Wei

Chung)

- Reflecting surging demand worldwide, exports to all major markets jumped by more than 20% y/y in September. Exports to mainland China, which remained Taiwan's largest export destination, continued to expand, jumping 25.4% y/y in September, after slowing to a six-month low of 13% y/y in August. This came despite rising worries of mainland China's power shortages during the month. Meanwhile, shipments to ASEAN climbed 23.7% y/y in September, although this was a deceleration from 40-50% y/y surges in April-July when resurging COVID-19 infections restrained demand.

- Shipments to Europe continued to soar in September, up 39.3% y/y. Boosted by higher demand as activities reopened and a low comparison base, exports to Europe surged 47.1% y/y during April-September. Concurrently, shipments to the US reaccelerated, jumping 34% y/y in September, after increasing 28.9% y/y in August. Surging demand for metal, electrical machinery, and machinery remained the key support of shipments to the territory on the back of demand prompted by its stimulus measures.

- By products, electronic exports - accounting for 42% of total exports - continued to provide the major support to overall export growth, climbing 26.8% y/y in September, after expanding 21.9% y/y in August. Within that, shipments of semiconductor products - accounting for 91% of electronic exports or 38% of total exports - jumped 27.6% y/y, after increasing 21.7% y/y in August. Shipments of diodes continued to surge, by 37.1% y/y in September.

- Concurrently, exports of information and communication products climbed 22.8% y/y in September, faster than a 17.2% y/y increase in August. Shipments of computer parts and components continued soar, up 50% y/y in September with an average of 47.6% y/y during March-September. On the other hand, exports of storage devices decelerated, rising just 4.9% y/y, slowing for four straight months after surging 44.2% y/y in May.

- Toyota announced today (12 October) in a company statement that it will aim to equip its vehicles with highly efficient solar power generation systems as it ramps up its efforts to achieve carbon neutrality. Toyota has started discussions on joint research with the National Institute of Advanced Industrial Science and Technology (AIST) and Toyota Central R&D Labs Inc. (Toyota CRDL). AIST is one of the largest national research institutions in Japan and carries out advanced research into solar power and other forms of renewable energy, and into the production and use of hydrogen; and Toyota CRDL is focused on achieving technological advances. Using the joint research, Toyota will seek to improve the conversion efficiency of solar power generation systems and batteries and bring down costs to allow for wider adoption by using data collected by AIST. (IHS Markit AutoIntelligence's Isha Sharma)

- Hyundai has announced the proposed launch of an autonomous technology test bed at its Namyang R&D Centre in South Korea, reports The Korea Herald. The test bed will allow experimenting with different autonomous technologies. According to the source, the test bed project has been divided into three parts - a demand-responsive robot shuttle, autonomous vehicle control system, and an autonomous parking tower, all of which use Hyundai's autonomous operation and autonomous parking technologies. Hyundai will continue testing the robot shuttle - which is based on Hyundai's four-door van, the Solati - on the test bed, while offering a shuttle service with 45 stops on the test bed, using a smartphone app called Shucle. Hyundai's autonomous vehicle control system will monitor the shuttles in real time. Hyundai's autonomous parking tower (with completion slated for (the second half of 2022) will be able to accommodate about 600 vehicles, and will be aided by a remote parking pilot system for parking. (IHS Markit Automotive Mobility's Tarun Thakur)

- The administration of the union territory (UT) of Chandigarh

has proposed a 100% waiver on parking charges for electric vehicles

(EVs) at municipal corporation-run parking facilities for a period

of five years, reports The Times of India. According to the source,

the policy aims to set up at least 50 public charging stations with

one placed in each residential/commercial sector. Last month, the

administration of the UT of Chandigarh announced the removal of the

proposed upper limit of INR1.5 million (USD20,300) on the purchase

of EVs to get a subsidy in its first ever e-vehicle policy. (IHS

Markit AutoIntelligence's Tarun Thakur)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-october-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-october-2021.html&text=Daily+Global+Market+Summary+-+12+October+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-october-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 12 October 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-october-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+12+October+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-october-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}