Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 12, 2021

Daily Global Market Summary - 12 July 2021

All major US, European and most APAC equity indices closed higher. US government bonds closed modestly lower, while most benchmark European government bonds closed higher. European iTraxx and CDX-NA were close to flat on the day across IG and high yield. The US dollar and natural gas closed higher, while oil, gold, silver, and copper were lower on the day. All eyes will be on tomorrow morning's 8:30am ET US CPI report for any significant changes in monthly inflation beyond the higher or lower ends of expectations.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher, with the DJIA +0.4%, S&P 500 +0.4%, and Nasdaq +0.2% closing at new record highs for a second consecutive day; Russell 2000 +0.1%.

- 10yr US govt bonds closed +1bp/1.37% yield and 30yr bonds +1bp/2.00% yield.

- CDX-NAIG closed flat/48bps and CDX-NAHY +1bp/277bps.

- DXY US dollar index closed +0.1%/92.26.

- Gold closed -0.3%/$1,806 per troy oz, silver flat/$26.24 per troy oz, and copper -0.7%/$4.32 per pound.

- Crude oil closed -0.6%/$74.10 per barrel and natural gas closed +2.0%/$3.75 per mmbtu.

- The world's publicly listed companies must dramatically accelerate GHG emissions reductions if the 1.5-degrees Celsius global warming target set out in the Paris Agreement is to be met, warned global index provider MSCI. Without a dramatic turnaround in emissions trajectory, public companies will exceed their share of the world's "carbon budget" for meeting the Paris Agreement in less than six years, it said as it released its new quarterly update, MSCI Net-Zero Tracker. The tracker covers 9,300 companies on the MSCI All Country World Investable Market Index (MSCI ACWI IMI), accounting for 99% of listed equities. This information could put added pressure on the world's largest companies to curb their emissions. With the next global climate meeting, COP26, coming in Scotland in November, nations have been announcing commitments to greater reductions in emissions by 2030 on their way to goals of net-zero emissions by 2050 (see here and here). But companies have usually been looked at as individual entities, rather than as a whole, though entire industries have mandatory and voluntary emissions-reduction programs. The MSCI tracker puts it together at the corporate level. Companies in the MSCI ACWI IMI emitted an estimated 10.9 gigatons of direct GHGs (Scope 1) in 2019, it said. To limit warming to 1.5 degrees Celsius by 2050, they would need to collectively cap future direct emissions at 61.4 gigatons of CO2-equivalent. Without any change, the companies would deplete their remaining emissions budget in five years and eight months. (IHS Markit Climate and Sustainability News' Kevin Adler)

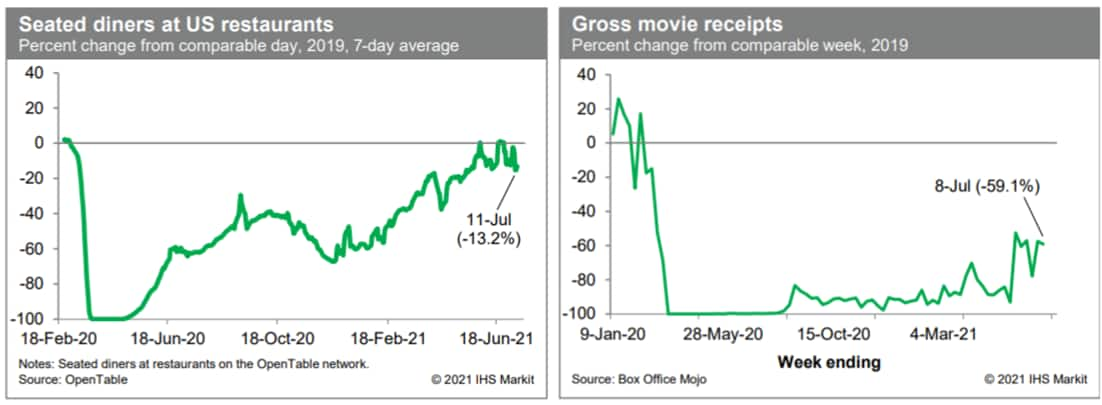

- Averaged over the last week, the count of seated diners on the

OpenTable platform was 13.2% below the comparable period in 2019.

This is somewhat below recent averages but is nevertheless

consistent with nearly a full recovery in dining out. We will be

watching these figures for signs that the recent upturn in new

COVID-19 cases in some areas is beginning to weigh on dining out.

Meanwhile, box office revenues over the week ending last Thursday

(8 July) were 59.1% below the comparable week in 2019, close to

readings in four of the previous five weeks. These data indicate

that the recovery in movie-theater activity is far from complete.

(IHS Markit Economists Ben

Herzon and Joel

Prakken)

- COVID-19 infections in New York City are climbing for the first time in months as the delta variant gains traction and vaccination rates in some boroughs remain stubbornly low. The city's seven-day average rate of positive tests has risen slowly throughout July, and had roughly doubled in two weeks to 1.27% as of Saturday. On average, there were 328 new confirmed and probable cases daily over the past week, up from 208 as of June 28. Staten Island has emerged as a miniature hot spot, with its seven-day positivity rate averaging 2.34% as of July 8, well above the citywide average. (Bloomberg)

- The US government has unveiled plans to invest at least USD500 million to expand processing capacity and increase competition in the meat and poultry sector. The USDA said the initiative would ensure that farmers, ranchers, and consumers have more choices in the marketplace. The department also announced more than USD150 million for existing small and very small processing facilities to help them weather COVID, compete in the marketplace and get the support they need to reach more customers. USDA said it is also holding meatpackers accountable by revitalizing the Packers and Stockyards Act, issuing new rules on 'Product of USA' labels, and developing plans to expand farmers' access to new markets. Vilsack said the measures would begin to level the playing field for farmers and ranchers, while also making the food system more resilient to shocks. The USD500 million investment will be used to provide grants, loans, and technical assistance to support new meat and poultry processing facilities. (IHS Markit Food and Agricultural Commodities' Max Green)

- US tobacco giant Philip Morris has announced that it has agreed a deal to acquire UK inhaled-therapeutic specialist Vectura for a price of GBP852 million (USD1.2 billion). Under the deal - which is subject to a shareholder vote and regulatory approval - shareholders would receive GBP1.50 per share, which represents a 46% premium on Vectura's ex-dividend closing price of GBP1.03 on 25 May 2021. With the dividend payments taken into consideration, the acquisition price equates to about USD1.45 billion. For Philip Morris, the deal aligns with the goal that it had announced in February to generate more than 50% of its total net revenue from smoke-free products by 2025. The company had also stated its aim to generate at least USD1 billion in net revenues by 2025 from its so-called "Beyond Nicotine" products. The deal is expected to close in the second half of 2021. (IHS Markit Life Sciences' Milena Izmirlieva)

- Electronics contract manufacturer Foxconn and electric vehicle (EV) startup Fisker have confirmed holding talks with Wisconsin Economic Development Corporation (WEDC) regarding producing EVs at a Foxconn facility in the state of Wisconsin, according to various media reports. A joint statement from the two companies reportedly said, "As part of the site selection process, Foxconn and Fisker have engaged with the Wisconsin Economic Development Corporation to discuss plans for electric vehicle manufacturing. Foxconn and Fisker look forward to discussions with the WEDC." Although Foxconn and Fisker have confirmed the talks, local media sources report that WEDC has not confirmed the status of any discussions with the two companies, preferring to keep the potential discussions confidential. Foxconn built a manufacturing site in Wisconsin in 2018 after obtaining USD2.85 billion in state tax credits and subsidies. Initially, the plant was to build LCD screens, and then smartphone screens. According to media reports, Foxconn and the state authorities later worked out a lower level of support (USD80 million), also based on job creation. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Startup Hercules Electric Vehicles has announced an agreement with Pininfarina on vehicle design, to begin with the Hercules Alpha electric pick-up truck. According to a statement issued by Hercules outlining the deal, the Alpha pick-up is to be followed by other electric vehicle (EV) products under development by the startup. The two companies are to begin their collaboration immediately, with production of the Alpha expected to begin in late 2022. (IHS Markit AutoIntelligence's Stephanie Brinley)

- In a press release, Penn Virginia Corporation announced the signing of an agreement to acquire Lonestar Resources US Inc. in an all-stock transaction valued at $430.5 million. The transaction is expected to close in the second half of 2021. Under the deal, Lonestar shareholders will receive 0.51 shares of common stock of Penn Virginia for each share of common stock of Lonestar. Based on Penn Virginia's closing price on 9 July 2021 and 11.2 million Lonestar shares outstanding (including share warrants), the total equity offer value is $131.6 million or $11.74 per share. The offer price is a 17% premium to the 9 July closing price of Lonestar. The total transaction value also includes the assumption of Lonsetar's 31 March 2021 working capital deficit of $38.6 million and long-term debt and liabilities of $260.3 million. Lonestar's net proved reserves were 79.2 MMboe (74% oil and NGLs; 37% developed) at year-end 2020 and net production averaged 10,377 boe/d (74% oil and NGLs) during the first quarter of 2021. The company reported 32,793 net undeveloped acres at year-end 2020. On closing, Penn Virginia shareholders will own approximately 87% of the combined company, and Lonestar will hold the remaining 13% of the combined company. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- Maire Tecnimont's subsidiaries NextChem and MET Development have signed an agreement with FerSam to develop projects to produce green ammonia and bioethanol in Latin America. As per agreement, Maire Tecnimont and FerSam will undertake feasibility studies for two projects. The first project is to evaluate and assess the possibility of jointly producing green ammonia. The second project is to develop a second-generation bioethanol project based on the GranBio technology, which produces second generation ethanol from non-food biomass. Maire Tecnimont will provide technological solutions and its expertise in project development, design and engineering, and execution. FerSam will secure the biomass feedstock and energy sources for the projects, as well as provide local regulatory expertise. (IHS Markit Upstream Costs and Technology's Ravi Rawat)

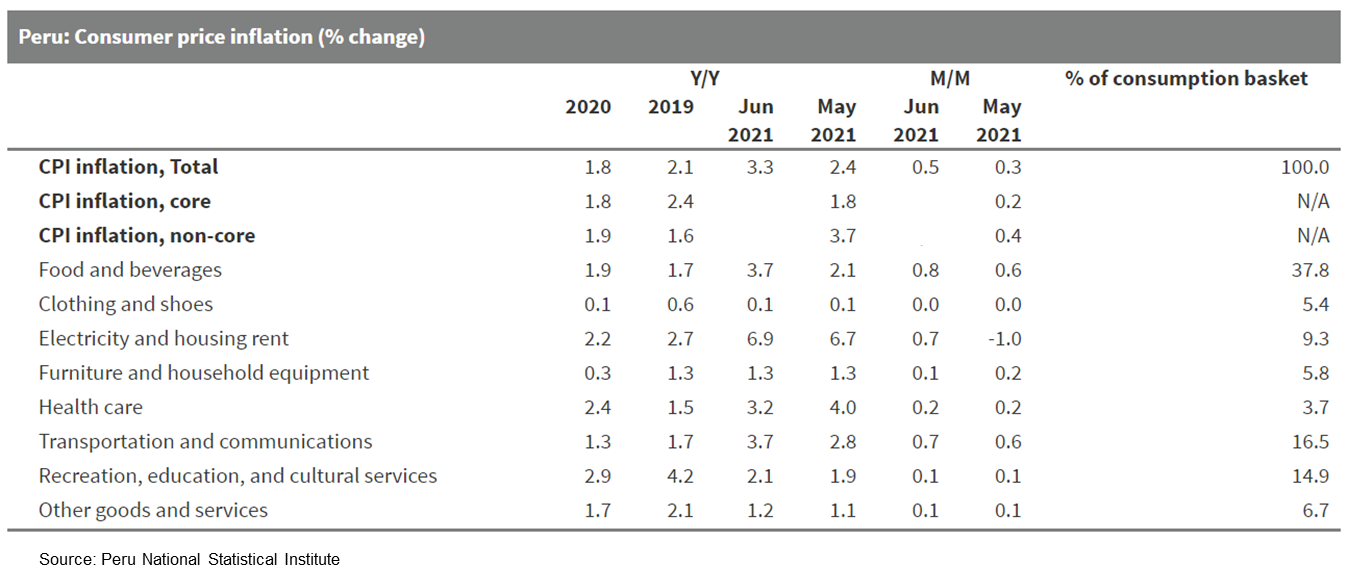

- Peru's consumer price index (CPI) increased 3.3% year on year

(y/y) in June, exceeding the upper bound of the 1-3% target range

set by the Central Reserve Bank of Peru (Banco Central de Reserva

del Perú: BCRP). The BCRP nonetheless left interest rates unaltered

at its June policy meeting. (IHS Markit Economist Jeremy Smith)

- Consumer prices increased 0.5% in June, raising inflation to 3.3% y/y, the highest rate since early 2017.

- Rising food prices - especially grains, oils, and meats - accounted for around 60% of June inflation, with the remainder mainly explained by the increasing cost of fuels and other energy products.

- Depreciation of the Peruvian sol, which lost 12.6% against the US dollar in the 12 months ended in June, has made food and energy imports even more expensive. The BCRP estimates that each percentage point of currency depreciation is associated with a 0.1-0.2 percentage point increase in the rate of inflation a year later.

- Indeed, excluding products in the volatile food and energy categories, annual inflation measured 1.9% in June. This value is essentially unchanged from a year ago and is right at the midpoint of the 1-3% target range.

- Meanwhile, the wholesale price index surge continues unabated,

increasing 9.3% y/y in June on rising raw material costs.

Europe/Middle East/Africa

- All major European equity indices closed higher; Italy +0.9%, Germany +0.7%, France/Spain +0.5%, and UK +0.1%.

- Most 10yr European govt bonds closed higher except for German Bunds closing flat; Italy -3bps, Spain -2bps, and France/UK -1bp.

- iTraxx-Europe closed flat/47bps and iTraxx-Xover flat/233bps.

- The minutes of June's European Central Bank (ECB) meeting show

a "broad" consensus to continue net purchases at a significantly

higher pace than during the first months of the year and, while

July's meeting will incorporate an updated forward guidance, a

decision on asset purchases may be delayed until September. (IHS

Markit Economist Diego

Iscaro)

- The ECB decided to maintain the higher rate of asset purchases under its pandemic emergency purchase programme (PEPP), which was initially introduced in March 2020, in its June meeting.

- This decision was taken against a backdrop of ongoing financial market concerns over rising inflationary pressures, inflation reached 2.0% in May, and despite substantial upward revisions to the ECB's macroeconomic projections in June's quarterly staff projections. For example, the eurozone's real GDP is now projected to grow by 4.6% in 2021 and 4.7% in 2022, an upward revision of 0.6 percentage points for both years compared to March's estimates.

- The annual Harmonized Index of Consumer Prices (HICP) inflation projections for 2021 and 2022 were revised sharply upwards, by 0.4 percentage point to 0.9% in the former, and by 0.3 percentage point to 1.5% in the latter. The growth and inflation projections for 2023 were unchanged at 2.1% and 1.4%, respectively.

- The account of June's policy meeting shows that the Governing Council sees risks surrounding the growth outlook as "balanced". While the pace in which households unwind their savings accumulated since the start of the pandemic was seen as a key upside risk, a worsening of the epidemiological situation and a potential increase in corporate bankruptcies may result in worsening economic conditions.

- Regarding inflation, there was a "broad agreement" with the view that inflation is being boosted by temporary factors, such as higher energy prices, while underlying price pressures were expected to "remain subdued overall".

- However, some members highlighted that the inflationary pressures in place in some of the cyclically more advanced economies, such as the United States, could "be a harbinger of developments in the euro area further down the road".

- Moreover, it was suggested that the current inflation situation could be different from the past, as "companies had less scope for absorbing pipeline pressures in their margins" and the expected surge in demand "might offer an opportunity to adjust prices". Some Governing Council members also expressed concerns about potential side effects of the "highly accommodative monetary stance", noting that property price dynamics are accelerating.

- While it was argued that asset purchases under the PEPP should be scaled back in line with the improved outlook for growth and inflation, overall there was a "broad consensus" among Governing Council members to continue net purchases at a significantly higher pace than during the first months of the year.

- An EU-wide mega petition for the European Commission to

introduce EcoScore labelling, giving the environmental profile of

food and other products, starts its year-long campaign to gather a

minimum million signatures from at least seven member states on

July 23. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- The latest European Citizen's Initiative (ECI) - European EcoScore - calls on the Commission to propose "a reliable European EcoScore" specifying that it should be "a mandatory label providing consumers with information about the environmental impact of products manufactured or sold on the EU market".

- The "compulsory and clearly visible indication on the packaging would provide simple and reliable information on the environmental impact of the product according to the letter selected" with A signaling a product was "very environmentally friendly" and F on the other end of the scale "very harmful to the environment".

- Like the Nutri-Score nutrition labelling system, the EcoScore would be based on a standardized, calculation using science-based criteria. The organizers stop short of spelling out what the criteria will be, considering that this will be for the Commission and experts to decide, but suggest life cycle analysis as a possibility.

- The International Organization for Standardization (ISO) technical committee, along with an international group of experts led by WMG, has published an international safety standard for Level 4 low-speed automated driving (LSAD) systems. The new standard, ISO 22737, which is claimed to be the first of its kind, will provide specific minimum safety and performance requirements for LSAD systems. In addition, it will offer a common language to support the development and safe deployment of this technology worldwide. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- German battery electric vehicle (BEV) startup Next e.Go Mobile will build a factory to produce its low-cost city car concept in Bulgaria, according to a Reuters report that cited comments from Bulgarian Economy Minister Kiril Petkov. The politician informed journalists that Next e.Go Mobile will invest EUR140 million (USD166 million) in the project to build a factory in the city of Lovech, with the plan for production to begin in 2023. Next e.Go Mobile is positioning itself at the entry level for BEV ownership with a novel, low-cost car concept aimed at urban environments. Bulgaria, and its neighboring Eastern European countries, are seen as the ideal target market for the vehicle; and the company plans to produce its E.Go Life and E.Go Life Cross models there. (IHS Markit AutoIntelligence's Tim Urquhart)

- Vestas has been named as the pre-selected turbines tenderer for EnBW's 900 MW He Dreiht offshore wind project. Under the agreement, Vestas will supply 60 of its V236-15.0 MW turbines for installation at the project from the second quarter of 2025. The He Dreiht project is located in the German North Sea within 85 km of the island of Borkum and 104 km west of the island of Helgoland in water depths of approximately 40 meters. EnBW stated that the final investment decision is planned for 2023 with the project to be fully commissioned in the fourth quarter of 2025. A firm and unconditional order will be made thereafter. EnBW is 100% owner of the project with Tennet to own and operate the related export transmission system. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- Georgia's wide current-account deficit narrowed by 15% in the

first quarter of 2021 in both annual and quarterly comparison, as

the service account returned to modest surplus after two quarters

of deficits, and goods exports returned to annual growth. (IHS

Markit Economist Venla

Sipilä)

- Georgia's current account in the first quarter of 2021 posted a deficit of USD364 million, narrowing by 14% year on year (y/y) and by over a third in quarter-on-quarter (q/q) terms.

- The goods trade deficit, in particular, narrowed by around 15% in both y/y and q/q comparison. Exports increased by nearly 5% y/y, while imports contracted, whereas a slightly steeper fall in imports than in exports secured the strengthening from the previous quarter.

- Meanwhile, the service account balance encouragingly returned to a surplus after two quarters of deficits. However, it dwindled by over 90% y/y with service export income more than halving from the first quarter of 2020.

- With the service account surplus remaining very modest, the secondary income surplus retained its position as the largest positive component on the Georgian current account that it had reclaimed from the first quarter of 2020. The surplus strengthened by some 36% y/y, with income inflows rising by 30%.

- In May, Turkey's current-account deficit narrowed year on year

(y/y) and net portfolio investment turned inward once again. The

country's overall current-account deficit remains dangerously

large, however, with net capital inflows still precarious in 2021

as a whole. (IHS Markit Economist Andrew

Birch)

- Turkey's current-account deficit fell to USD3.1 billion in May 2021, down by nearly one-quarter as compared to a year earlier. A USD1.1-billion turnaround in the services balance (from a deficit to a surplus) was the overwhelming cause for the improvement in the headline figure.

- In April-May 2020, the worsening of the global coronavirus disease 2019 (COVID-19) virus pandemic devastated service export earnings. While Turkey has struggled to attract foreign tourists back into the country, the low base nonetheless led to a more than doubling of service export earnings in both months of 2021 as compared to a year earlier.

- A stabilization of its currency after the sharp losses through the first quarter of 2021 reflected a return of net portfolio capital inflows. In May, these net inflows reached USD836 million, reversing huge net outflows in the previous two months. For the first five months of the year as a whole, net capital was still outward, by over USD900 million, but at least the losses were far less severe than they had been in the same period of 2020 - USD11.3 billion.

- The long-term erosion of foreign direct investment (FDI) continued in the first part of 2021, however. The 12-month, trailing net inflow of FDI was only USD4.1 billion as of May 2021, down from USD5.8 billion just a year earlier and averages of USD8-10 billion annually in the late 2010s.

- Turkish officials are reportedly considering injecting additional capital into state-owned banks to increase capacity for new lending, unidentified bankers and government officials interviewed by Reuters have suggested. Six sources contacted by Reuters suggested that the capital injections are likely to come before the recently extended deadline on the classification of non-performing loans (NPLs) and other COVID-19-virus-related forbearance arrives at the end of September. The same sources suggested that moving bad assets from bank balance sheets to a centralized asset management company is also still being discussed but no concrete plans are under way. Meanwhile, Turkey's banking sector regulator, the Banking Regulation and Supervision Agency (BDDK), has asked banks to prepare a three-year strategy for NPL management, including the creation of a separate unit to oversee NPL resolution and an operational plan to reduce them. Even in the absence of existing support from forbearance measures, which IHS Markit's analysis of large banks' financial statements suggests is adding around 300 basis points to reported capital adequacy ratios (CARs), the sector's overall CAR of 18% when last reported would still exceed the higher threshold of 12% (minimum 8%) targeted by the BDDK. (IHS Markit Banking Risk's Alyssa Grzelak)

Asia-Pacific

- Most major APAC equity markets closed higher except for India flat; Japan +2.3%, South Korea +0.9%, Australia +0.8%, Mainland China +0.7%, and Hong Kong +0.6%.

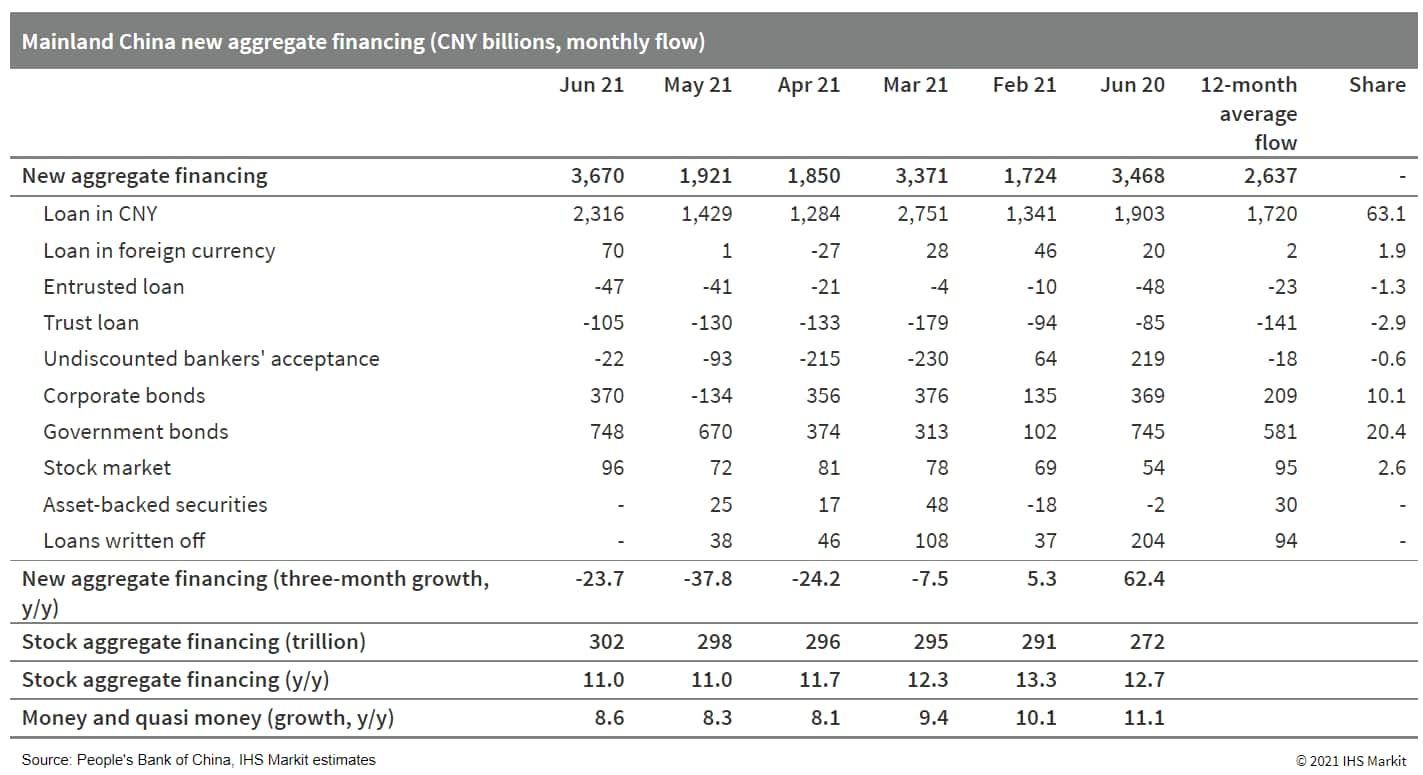

- Mainland China's new TSF—the broadest measure of net new

financing to the real economy - totaled CNY3.67 trillion (USD571.4

billion) in June, up by CNY201.9 billion year on year (y/y)

according to the People's Bank of China (PBoC). Stock TSF reached

CNY301.56 trillion by June end, up by 11.0% y/y - stabilizing after

three consecutive months of stock TSF growth rate decline. (IHS

Markit Economist Lei Yi)

- Increased lending to the real economy was the main driver for the uptick in June TSF, with CNY loans recording year-on-year gains of CNY413.1 billion. While strength in medium-to-long term bank borrowing by corporates sustained in June, the year-on-year expansion in corporate borrowing largely came from paper financing, which registered increase of CNY484.9 billion y/y.

- Household borrowing on the other hand, saw a second month of year-on-year contraction in medium-to-long-term loans. This may to do with tightened mortgage availability - especially in cities where local housing market has showed overheating signs - resulting from the property loan ceiling imposed on commercial banks.

- Bro ad money supply (M2) expanded by 8.6% y/y in June, accelerating from 8.3% y/y in the prior month. M1 grew by 5.5% y/y, down by 0.6 percentage point from May; note that year on year M1 growth has posted continuous decline so far this year.

- Cumulatively, new TSF amounted to CNY17.74 trillion in the

first half of 2021, lower by CNY3.13 trillion y/y yet higher by

3.12 trillion from comparable 2019 level. New bank loans totaled

CNY12.76 trillion, up by CNY667.7 billion y/y through June.

- Shanghai Zhenhua Heavy Industries (ZPMC) has loaded out a ±400 kv 1,100 MW high-voltage direct current (HVDC) offshore substation for China Three Gorges New Energy's 800 MW Jiangsu Rudong H6 and H10 offshore wind farm (OWF) and China General Nuclear Power's 300 MW Jiangsu Rudong H8 OWF in China. A loadout ceremony was held at ZPMC's fabrication yard in Nantong on 8 July where the HVDC offshore substation was loaded onto China Merchants Heavy Industry's (CMHI) semisubmersible heavy lift vessel Zhao Shang Zhong Gong 3. The HVDV substation will be installed between Jiangsu Rudong H6 and H10 OWFs, approximately 70 km from shore, in water depths of 17 m. In February 2020, ZPMC commenced the construction work for the offshore substation and the jacket foundation. The jacket foundation was delivered and installed in November 2020. Three 220 kV offshore substations from Jiangsu Rudong H6, H8, and H 10 OWFs will be connected to the HVDC substation, which will convert the 220 kv input power for transmission onward to the onshore substation. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Chinese tech giant Xiaomi has reportedly acquired autonomous vehicle (AV) technology startup DeepMotion. DeepMotion's team of more than 20 employees will join Xiaomi, reports Pandaily. They will assist Xiaomi in filling the staff line-up at its AV division and its technology research and development. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- SsangYong has decided to sell the site of its plant in Pyeongtaek (South Korea) as part of self-rescue efforts, reports the Yonhap News Agency. The Pyeongtaek city government has signed a memorandum of understanding (MOU) with the court-appointed manager of SsangYong and its labor union regarding the sale of the site, which measures 850,000 square meters and is valued at KRW900 billion (USD785.1 million). The plant was constructed in 1979. The automaker will build a new plant in Pyeongtaek, and the city will provide administrative support in the process of construction and relocation. "We will actively support SsangYong Motor to grow into a global company that contributes to the development of the local economy," said Jung Jang-seon, mayor of Pyeongtaek. Separately, the automaker's employees also began to take unpaid leave in rotation as part of self-help measures. From July through to June 2022, 50% of assembly line workers at the Pyeongtaek plant and 30% of office workers will take turns going on unpaid leave. (IHS Markit AutoIntelligence's Jamal Amir)

- India-based ride-hailing firm Ola has raised USD50 million from the Singapore government's investment fund, Temasek, and Plum Wood Investment, an affiliate of Warburg Pincus, reports The Financial Express. Ola co-founder and chief executive Bhavish Aggarwal also participated in the new investment, which is ahead of the company's planned initial public offering (IPO). However, the company did not disclose specific details of the deal and the timeline of its IPO. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Reserve Bank of New Zealand (RBNZ) announced its intention

to consult over the development of a central bank digital currency

(CBDC), after releasing reports on 7 July that highlighted

declining use of physical cash. The RBNZ noted that some groups

were struggling with declining availability of physical cash and

the curtailment of traditional banking service provision. (IHS

Markit Economist Brian

Lawson)

- The initial consultation will span "issues key to the future of how New Zealanders pay and save". The RBNZ announced it will issue a series of papers looking broadly at means of payment discussing "what a stable cash and currency system… might look like" and how to respond to "digital innovations".

- In a second stage, it suggested that a subsequent paper will look specifically at the possible role of a CBDC. Overall, the RBNZ assesses that digital payment channels are now preferred by "the majority of us" and that the future "will undoubtedly involve less cash".

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-july-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-july-2021.html&text=Daily+Global+Market+Summary+-+12+July+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-july-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 12 July 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-july-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+12+July+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-july-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}