Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 10, 2021

Daily Global Market Summary - 10 November 2021

All major US and most APAC equity indices closed lower, while most European markets closed higher. US and benchmark European government bonds closed sharply lower. CDX-NA closed wider across IG and high yield, while European iTraxx was close to flat on the day. The US dollar, silver, and gold closed higher, while copper natural gas and oil closed lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower for a second consecutive day; DJIA -0.7%, S&P 500 -0.8%, Russell 2000 -1.6%, and Nasdaq -1.7%.

- 10yr US govt bonds closed +11bps/1.56% yield and 30yr bonds +10bps/1.92% yield. 2yr bonds closed +11bps/2.51% yield and are hovering near the highest yields since March 2020.

- CDX-NAIG closed +1bp/51bps and CDX-NAHY +6bps/296bps.

- DXY US dollar index closed +1.0%/94.85, closing at the highest level since July 2020.

- Gold closed +1.0%/$1,848 per troy oz, silver +1.9%/$24.77 per troy oz, and copper -1.1%/$4.32 per pound.

- Crude oil closed -3.3%/$81.34 per barrel and natural gas closed -1.9%/$4.97 per mmbtu.

- The US CPI rose 0.9% in October following a 0.4% increase in

September. The core CPI, which excludes the direct effects of moves

in food and energy prices, rose 0.6% in October after a 0.2%

increase in September. Both increases were well above expectations.

The headline CPI was boosted by price increases for food (0.9%) and

energy (4.8%). (IHS Markit Economists Ken

Matheny and Juan

Turcios)

- The rise in consumer prices in October was broad based. Notable increases occurred for used vehicles (2.5%), new vehicles (1.4%), and shelter (0.5%). The price of new vehicles rose for the seventh consecutive month and is up 10.1% since February. Severe supply-chain bottlenecks have resulted in extraordinarily lean inventories and encouraged dealers to raise prices. Used car prices increased in October following two months of de-clines. The ongoing supply issues in new vehicles has shifted demand to used vehicles and placed renewed upward pressure on used car prices.

- Rent inflation is starting to pick up, as the recent surge in house prices is translating into higher rents. Owners' equivalent rent (OER) rose 0.4% for the second consecutive month. Rent of primary residence (RPR) rose 0.4% in October after increasing 0.5% in September, the largest increase in two decades. At 3.1% for OER and 2.7% for RPR, annual (12-month) rent inflation readings in October were low in a broad historical context, but have moved up from 2.4% and 1.9% since July, respectively.

- The twelve-month change in the overall CPI increased to 6.2%, the highest reading since November 1990, while the twelve-month change in the core CPI increased to 4.6%, the highest reading since August 1991. We anticipate that 12-month inflation readings will moderate over the course of 2022 as base effects recede and supply-chain issues are addressed.

- Residents of the Atlanta area are experiencing the worst inflation among major U.S. cities, with October prices up 7.9% from a year ago -- more than double the rate in San Francisco. The St. Louis and Phoenix metro areas also saw inflation above 7% last month, data from the Bureau of Labor Statistics show. The cities are above the national average of 6.2%, which itself was the fastest annual pace since 1990 in the county. (Bloomberg)

- Seasonally adjusted US initial claims for unemployment

insurance decreased by 4,000 to 267,000 in the week ended 6

November, hitting its lowest level since 14 March 2020. With new

COVID-19 cases down well more than one-half from the peak at the

beginning of September and consumer spending expected to post

strong gains in the fourth quarter, hiring should continue to

improve and the level of claims should continue trending towards

its pre-pandemic steady state. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) rose by 59,000 to 2,160,000 in the week ended 30 October, rising for the first time in seven weeks. The insured unemployment rate was unchanged at 1.6%.

- In the week ended 23 October, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) rose by 22,812 to 256,496.

- In the week ended 23 October, continuing claims for Pandemic Unemployment Assistance (PUA) fell by 23,516 to 253,593. Because no benefits can be paid for weeks of unemployment after 4 September, the 510,000 individuals still receiving benefits under these federal programs are likely being paid for backdated weeks of unemployment as some states continue to process such claims retroactively.

- In the week ended 23 October, the unadjusted total of continuing claims for benefits in all programs fell by 107,095 to 2,565,853. With the expiration of pandemic-related benefits, claims under all programs have declined sharply—there were 11,250,306 claimants in the week ended 4 September.

- The WHO has warned that the pressure of the global COVID-19 vaccination drive risked generating a shortage of "at least one billion" syringes unless manufacturing is ramped up. WHO Senior Advisor at the Access to Medicines and Health Products division Lisa Hedman said the situation could lead to a generation of children missing out on routine immunizations unless manufacturing of single-use, disposable syringes is scaled up. According to the WHO, at an estimated 6.8 billion injections per year, the COVID-19 vaccination campaign represents more than double the number of routine inoculations delivered annually worldwide, generating a major gap in syringe supply that does not match the number of vaccines that need to be administered. Hedman said that "it's pretty clear that a deficit in 2022 of over a billion could happen if we continue with business as usual", adding that syringes were also prone to transport delays as they take up "10 times the space of a vaccine". The warning comes amid calls to increase the production of COVID-19 vaccines to make it possible to reach the target of vaccinating 40% of the global population by the end of 2021. (Life Sciences by GlobalData's Ewa Oliveira da Silva)

- Voluntary carbon trading markets are booming due to rising

demand globally for carbon offsets generated from nature-based

solutions (NBS), but market participants and climate activists

remain concerned about their overall social and decarbonization

effects. (IHS Markit Net-Zero Business Daily's Max Lin)

- While more than 600 companies have set voluntary targets of net-zero emissions by 2050 or earlier, many of them plan to achieve at least some emissions reductions with offset credits from agriculture, forestry, or land-use projects.

- Such offsetting mechanisms are under scrutiny during some COP26 side events this week, as climate negotiators struggle to complete the final piece of Paris Agreement rulebook— the Article 6 rules—which could integrate voluntary carbon markets into government-administered trading schemes.

- "Demand right now is overriding supply…I mean, it's all over the place," said VNV Advisory Services Co-Founder Sandeep Roy Choudhury, referring to carbon offsets from NBS. "I'm excited about the amount of money that is there, but I'm a little worried about how that money is going to be deployed in the future."

- Business information provider Ecosystem Marketplace estimated the total transaction value of voluntary carbon credits from forestry and land-use projects reached $544 million in in the first eight months of 2021, compared with $269 million for the entirety of 2020.

- The transaction value of agricultural projects amounted to $4.6 million in the eight-month-period, versus $2.8 million last year.

- The potential for future growth is strong. Business giants like Facebook, Delta Airlines, Eni, and BP are purchasing offsets from afforestation and reforestation projects developed by third parties to compensate for emissions elsewhere in their value chains. Shell and TotalEnergies have established dedicated entities for direct investment in NBS-based carbon offset projects.

- The food supply chain may overtake farming as the largest

contributor to greenhouse gases (GHGs) from the agri-food and land

use sector in many countries. A new report from the Food and

Agriculture Organization of the United Nations (FAO) found that the

increase in food processing, packaging, transport, retail,

household consumption, waste disposal and manufacturing of

fertilizers has seen the sector's emissions growth shift away from

farmers. (IHS Markit Food and Agricultural Policy's Steve Gillman)

- "The most important trend over the 30-year period since 1990 highlighted by our analysis is the increasingly important role of food-related emissions generated outside of agricultural land, in pre- and post-production processes," said FAO senior statistician Francesco Tubiello, who led the study.

- The FAO researchers said that of the 16.5 billion tons of emissions from global agri-food systems in 2019, 7.2 billion tons came from within the farm gate, 3.5 from land use change, and 5.8 billion tons from supply-chain processes.

- Their report explains that these agri-food system emissions from land use changes - such as turning forests into cropland - decreased by 25% since 1990, while emissions within the farm gate increased by 9%, which the FAO said highlights how supply-chain factors are now driving the increase in overall emissions of the sector.

- Tubiello adds their findings will have "important repercussions for food-relevant national mitigation strategies, considering that until recently these have focused mainly on reductions of non-CO2 within the farm gate" and land use change.

- Eneti plans to sell USD200 million worth of shares in an underwritten public offering, to fund construction of the company's next wind turbine installation vessel (WTIV). Shares will be valued at USD0.01 per share. As part of the public offering, Scorpio Holdings Limited, a related party of the company, has expressed an interest to purchase at least USD30 million of shares. In addition to vessel construction, proceeds of the sale will be applied to general corporate purposes. Headquartered in New York, United States, Eneti has one contracted USD330 million newbuild under construction at DSME in South Korea, one optional newbuild at the same shipyard, and one proposed Jones Act compliant newbuild. In August 2021, the company acquired WTIV contractor Seajacks and added five in-service wind market vessels to its fleet. Citigroup, DNB Markets, BTIG and Nomura are acting as joint book-runners. Clarksons Platou Securities, Fearnley Securities and Kepler Cheuvreux are acting as co-managers. Kepler Cheuvreux is not a broker-dealer registered with the US Securities and Exchange Commission (SEC) and therefore may not make sales of any shares in the United States or to US persons, except in compliance with applicable US laws and regulations. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Motional and Lyft have selected Las Vegas, Nevada (United States), as the first city for their deployment of fully driverless robotaxis in 2023. The decision follows extensive testing of driverless robotaxis in the city. Motional says this will be the first time that fully driverless robotaxis will be available for rides to member of the public in Nevada, which suggests none of the other companies looking to deploy robotaxis in 2022 or 2023 are looking at Las Vegas. As previously announced, Motional's vehicle is to be based on the Hyundai Ioniq5 electric vehicle. The first vehicles are to be deployed in 2022, and the companies plan to scale up to a "full-fledged commercial launch" in 2023. The Lyft app will have a fully customized self-driving interface, in addition to Lyft options that customers are already familiar with. (IHS Markit AutoIntelligence's Stephanie Brinley)

- EVgo, in partnership with Uber Technologies, is expanding its electric vehicle (EV) charging program, according to a company statement. As part of the expanded EVgo Discount Program with Uber, drivers will be offered new discounts and benefits, including pricing based on their Uber Pro status. Drivers with Uber Pro Gold, Platinum, or Diamond status will receive higher discounts and can save up to 30% on charging costs over EVgo's standard pay-as-you-go rates. Drivers using Uber, regardless of status, can still access EVgo's member rates without any monthly fees. Adam Gromis, head of sustainability policy at Uber, said, "Helping drivers go electric remains one of the most important things we can do as a company. The enhanced incentives from EVgo's program help drivers save money and take another step towards transforming Uber into a zero emissions platform." (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- Most major European equity indices higher except for France flat; UK +0.9%, Spain +0.7%, Italy +0.4%, and Germany +0.2%.

- 10yr European govt bonds closed sharply lower; Germany +5bps, France/Spain +6bps, Italy +9bps, and UK +10bps.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover +2bps/247bps.

- Brent crude closed -2.5%/$82.64 per barrel.

- Ride-hailing firm Gett is planning to go public through a reverse merger deal with Rosecliff Acquisition Corp I, a special-purpose acquisition company (SPAC). The deal will value the combined entity at around USD1.1 billion, reports the Wall Street Journal. As part of the deal, Gett is expected to raise about USD30 million through a private investment in public equity (PIPE) transaction. Gett offers services in Israel, Russia, the United Kingdom, and the United States. It is present in more than 120 cities and has more than 15,000 corporate clients. The company was founded in 2010 and became operationally profitable in December 2019. Gett has formed partnerships with ride-hailing firms Lyft and Ola to expand its reach in the US and the UK, respectively. (IHS Markit Automotive Mobility's Surabhi Rajpal)

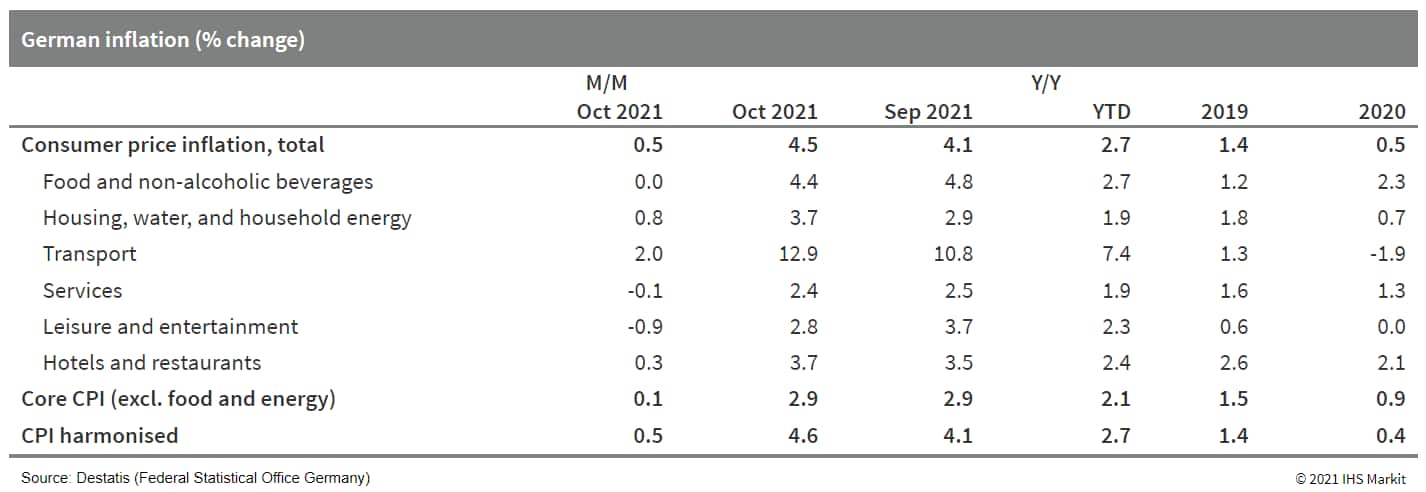

- Final October data based on national methodology from Germany's

Federal Statistical Office (FSO) confirm the 'flash' data release

of 28 October, showing consumer price index (CPI) inflation rates

of 0.5% month on month (m/m) and 4.5% y/y. The latter is up from

September's 4.1% y/y and has not been this high since 1993, then

related to reunification. It contrasts starkly with average

inflation of 1.5% in 2019 and 0.5% in 2020. (IHS Markit Economist

Timo

Klein)

- The EU harmonized CPI measure equally increased by 0.5% m/m, raising its annual rate from 4.1% to a 29-year high of 4.6% y/y. This continues to exceed the eurozone average (4.1%). The divergence between the harmonized and the national measures observed during the first eight months of 2021, owing to differences in the weighting pattern, has largely disappeared since September.

- Unlike the headline measure, the national core CPI rate (excluding food and energy) remained steady at 2.9% y/y in October. Nevertheless, this was more than twice as high as the 1.4% average during January-April, not to mention the December 2020 level of 0.4%. Although this partly owes to the temporarily lower value-added tax (VAT) rate during July-December 2020, an effect that will unwind in January 2022, strong upward pressures persist at the data edge. These are caused by this year's surge in energy prices (including not just oil but also natural gas and electricity) and much higher prices for commodities and intermediate goods owing to global supply-chain bottlenecks. The demand boost related to the loosening of pandemic-related restrictions since May has been contributing too, as companies are able to pass on their higher costs fairly easily because consumers have a strong urge to satisfy their pent-up demand.

- Specifically, energy prices increased sharply by 4.0% m/m in

October, boosting their annual rate from September's 14.3% to

18.6%. Along with higher food price inflation, this raised the y/y

rate for goods from 6.1% to 7.0%, whereas its service-sector

counterpart actually softened slightly from 2.5% to 2.4%.

- German automotive components supplier Eberspaecher has said that most of its manufacturing worldwide is now back on line after a cyber-attack that halted its operations, reports Automotive News Europe (ANE). The company was the subject of a cyber-attack, which started in late October and which it has still has not recovered from completely, with the firm's corporate website remaining down, while some production remains out of commission. The attack led to Eberspaecher closing down its factory at its corporate headquarters in Esslingen, Germany, with workers put on emergency short-time working, while other locations around the world were also affected. (IHS Markit AutoIntelligence's Tim Urquhart)

- Volkswagen (VW) is planning to build a completely new state-of-the-art battery electric vehicle (BEV) factory to build the forthcoming 'Project Trinity' model, reports Reuters. According to the report, the Project Trinity vehicle is designed to represent a step-change in VW's BEV technology. The model is to be built on a brand-new physical and digital architecture and it is to use a new universal battery-cell design that the company is developing. The Trinity car was scheduled to go into production at VW's main Wolfsburg plant in Germany in 2026, leading the facility's transformation into the company's lead BEV plant in Europe. However, the plan appears to be to build a brand-new facility to build the model. The head of the VW passenger car brand, Ralf Brandstaetter, confirmed the plan, saying the decision had been made to create the most-efficient plant possible. He said, "That's why we are planning greenfield construction: efficient and without limitations by existing structures. That way we are gaining time and space to gradually modernize the main factory in a far-reaching way and raise production there, too, to a new level." However, as this news was coming out, Greenpeace announced that it planned to sue VW, claiming that the company is not doing enough to lower its carbon emissions. The environmental organization wants VW to end production of ICE cars by 2030 and reduce carbon emissions by at least 65% from 2018 levels by then. A VW spokesperson rejected Greenpeace's case, stating, "Volkswagen stands for climate protection and decarbonizing the transport sector, but it cannot tackle this challenge alone. The task of designing appropriate measures belongs to parliament. Civil court disputes through lawsuits against singled-out companies are not the place or way to do justice to this task of great responsibility." (IHS Markit AutoIntelligence's Tim Urquhart)

- Greek consumer prices, as measured by the EU harmonized index

of consumer prices, rose by 2.9% year on year (y/y) in October.

This followed an increase of 1.9% y/y in September. October's

reading was the highest since November 2011. However, Greece's

inflation rate remained below the eurozone average (4.1% y/y,

according to the 'flash' estimate for October). (IHS Markit

Economist Diego

Iscaro)

- Inflation measured by the national index, which gives a higher weight to items such as food and housing costs, stood at 3.4% in October, following 2.2% in September.

- Energy prices continued to be the main driver of inflation in October, causing large increases in transport and housing costs (up by 9.2% y/y and 11.7% y/y, respectively). Food prices also increased at an above-average pace, despite a modest easing compared with their rise in September (+3.0% y/y, following +3.1% y/y).

- The remaining categories showed more modest increases. Moreover, 3 out of the 12 main categories still showed falling prices in October (communication costs, recreation/culture, and miscellaneous goods and services).

- However, in most cases price rises were above September's levels. For example, prices at hotels/restaurants/cafés rose by 0.9% y/y (+0.5% y/y in September), while prices of clothing/footwear went up by 0.4% y/y (-0.5% y/y in September).

- Core inflation stood at 0.5% in October, up from 0.2% in September. Core inflation had been negative in the 15 months to September.

- Tanzanian commercial banks' financial statements for the third

quarter of 2021 show banks heading for record profits in 2021.

According to several articles on news portal AllAfrica.com in the

past two weeks, the figures have spurred a debate in the financial

sector in Tanzania on whether the recent monetary policy measures

introduced by the Bank of Tanzania (BoT) to improve liquidity and

boost the private-sector lending have indeed achieved the required

results. According to Charles Kimei, former CEO of CRDB Bank, banks

have expanded their profitability instead of passing on the

measures to the borrowers. (IHS Markit Banking Risk's Ronel

Oberholzer)

- The largest bank in Tanzania (according to assets), CRDB Bank, for instance, posted pre-tax return on asset growth of 5.5% year on year (y/y) in September 2021 compared with 4% over the same period a year earlier. The loan book grew by 8.8% y/y, but the non-performing loan (NPL) ratio dropped to 3.6% from 4.6% over the same period in 2020. A fair amount of other medium-sized banks followed this pattern, according to AllAfrica.com.

- The BoT's September Monthly Economic Review shows that the annual growth of private-sector credit was 3.2% y/y in August 2021, down from 6.8% y/y in August 2020. Credit extension to small and medium-sized enterprises grew by 20% y/y in August, but credit extension to the mining and quarrying (-0.3% y/y), manufacturing (-0.8% y/y), transport and telecommunications (-7.4% y/y), building and construction (-10.3% y/y), and agriculture (-14.6%y/y) sectors recorded a contraction vis-a-vis a year earlier.

- In July, the BoT introduced some policy measures to increase liquidity in the banking sector and reduce the cost of lending to the private sector.

- The BoT's report shows that the interest rates charged on loans by banks have remained unchanged in recent months, with overall and one-year lending rates hovering around 17% in August 2021, while negotiated lending rates (the rate charged on loans to prime borrowers) averaged 14%. This indicates that the BoT's measures have not yet achieved the desired result of lowering the cost of funds.

Asia-Pacific

- Most major APAC equity indices closed lower, except for Hong Kong +0.7%; India -0.1%, Australia -0.1%, Mainland China -0.4%, Japan -0.6%, and South Korea -1.1%.

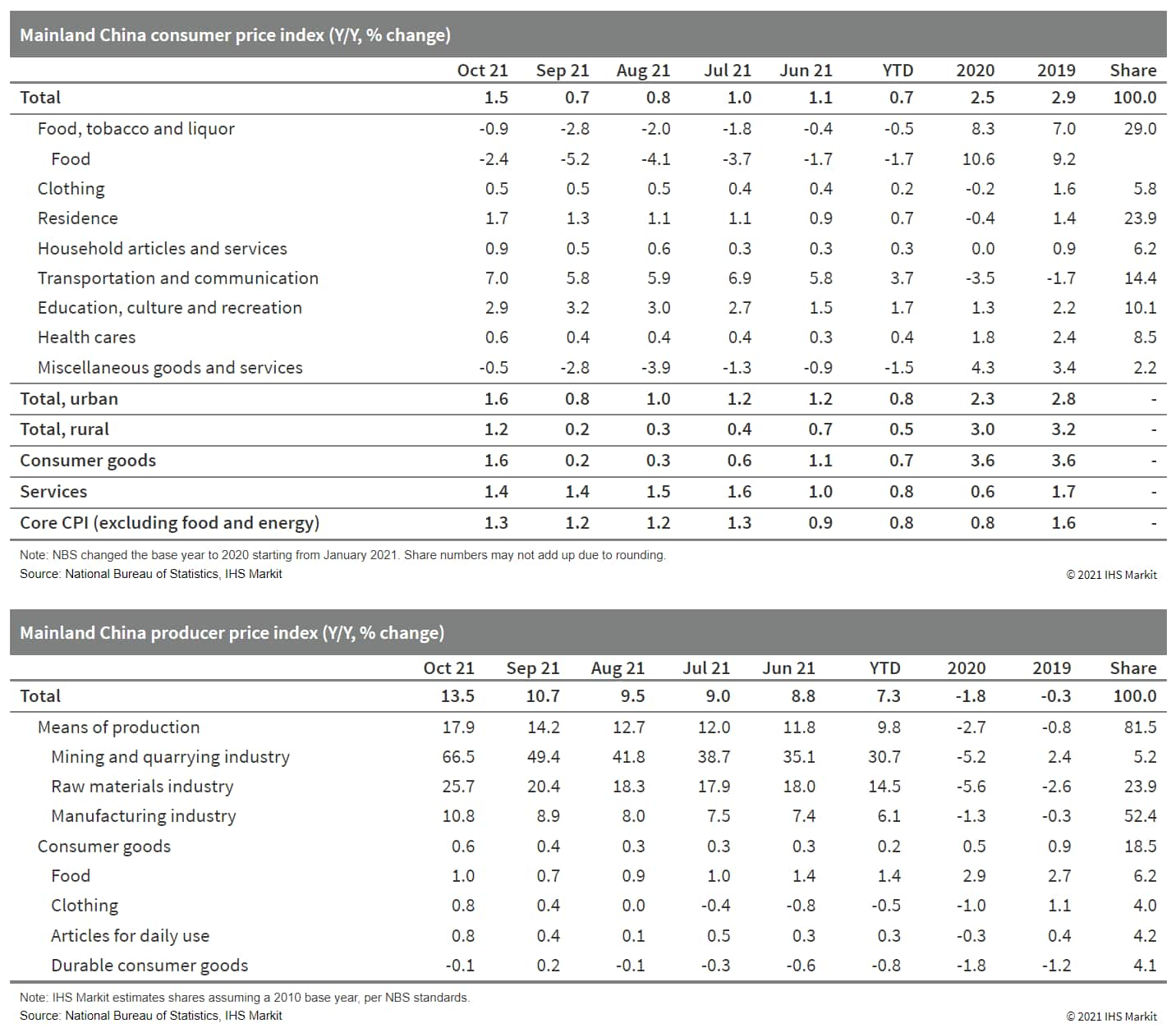

- Mainland China's consumer price index (CPI) rose by 1.5% year

on year (y/y) in October, up by 0.8 percentage point from the

September reading, according to the National Bureau of Statistics

(NBS). Month-on-month (m/m) CPI inflation reached 0.7%, higher by

0.7 percentage point from the prior month. (IHS Markit Economist Lei Yi)

- Narrowed food price deflation was the main driver for the uptick in October headline CPI inflation. Compared with the 5.2% y/y drop in food prices in September, October food price deflation only came in at 2.4% y/y. Notably, pork price deflation narrowed by 2.9 percentage points to 44.0% y/y thanks to rising seasonal demand and the government's price support measures (i.e. purchasing pork for state reserves). Furthermore, with rainfall and pandemic situations disrupting supply, prices of fresh vegetables jumped by 15.9% y/y in October, compared with a 2.5% y/y decline in the prior month.

- Non-food prices ticked up in October by 0.4 percentage point to 2.4% y/y as vehicle fuel prices continued to surge. Despite the week-long National Day holiday at the beginning of October, resurgence of COVID-19 infections dampened travel demand recovery, leaving services price inflation unchanged at 1.4% y/y. Excluding the volatile food and energy components, core CPI ticked up by 0.1 percentage point to 1.3% y/y.

- The Producer Price Index (PPI) surged by 13.5% y/y in October, up by 2.8 percentage points and setting a new record high. Month-on-month PPI inflation registered 2.5%, rising by 1.3 percentage points from the month-ago reading.

- Rising crude oil prices and persistently tight coal supply resulted in the October PPI inflation increase. With energy-intensive industries being the target of power rationing, their output price gains also expanded further. According to the NBS, 11.38 percentage points out of the 13.5% y/y increase in October PPI—which is over 80%—should be attributed to 8 out of the 41 surveyed industries, including coal mining and dressing, petroleum and natural gas extraction, fuel processing, non-ferrous and ferrous metal smelting and pressing, raw chemical materials and chemical products, chemical fiber, and non-metal mineral products.

- Cumulatively, CPI and core CPI had been up by 0.7% y/y and 0.8%

y/y, respectively, in the first 10 months of 2021; year-to-date PPI

inflation had surged to 7.3% y/y through October, up by 0.6

percentage point from September.

- Some investors feared that China Evergrande Group, the world's most indebted real-estate firm, would collapse spectacularly, triggering losses far and wide. Instead, the Chinese state is dismantling the giant developer slowly and behind the scenes, in what amounts to one of the biggest financial challenges Beijing has faced in years. The plan, according to people familiar with the matter and official government statements, is to manage a controlled implosion by selling off some Evergrande assets to Chinese companies while limiting damage to home buyers and businesses involved in its projects. (WSJ)

- Geely Group's commercial vehicle (CV) brand, Farizon Auto, has unveiled its next-generation smart new-energy semi-truck, the Homtruck. According to a company statement, production and deliveries of the Homtruck are planned for early 2024. The company says that, with the semi-truck, it is focusing on efficiency, and driver and pedestrian safety. The Homtruck is to have a number of powertrain options, including range extender, methanol hybrid, and pure electric with battery-swapping option based on government standards. Farizon Auto says it is focusing on producing clean- and new-energy commercial vehicles. The company's core products are light commercial vehicles, as well as urban buses and coaches. Farizon Auto's core drivetrain technologies are self-developed, with a focus on achieving zero-emission capability with pure electric solutions and range extension. If this semi-truck concept comes to reality, the Homtruck will be one of its kind in the medium and heavy commercial vehicle (MHCV) industry and could make Farizon a strong competitor to existing players such TuSimple and Plus in the autonomous segment. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Hyundai Motor Group has formed a new company, Supernal, which is an evolution of its Urban Air Mobility (UAM) division, according to a company statement. The new company plans to integrate Advanced Air Mobility (AAM) solutions into existing transportation networks through ride-sharing platforms by leveraging advanced technologies, systems, and airframe materials. Supernal expects to release an eVTOL (electric vertical takeoff and landing) vehicle for urban operation by 2028. Supernal plans to begin certification with US regulatory agencies for its first eVTOL craft in 2024. Supernal's first air vehicle is to be electric-powered and autonomous, with seating for four to five passengers, for operation initially on urban and urban-adjacent routes. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Korea Development Bank (KDB) has officially questioned the Edison Motors-led consortium's eligibility as the sole bidder for a controlling stake in bankrupt SsangYong Motor, claiming that the consortium's request for financial assistance to cover nearly 80% of the buyout makes it unable to afford the automaker, reports the Maeil Business Newspaper. The winning consortium requested an KRW800-billion (USD679-million) collateralised loan from the bank, following which the KDB informed the Seoul Bankruptcy Court that the consortium was unsuitable as the preferred bidder, highlights the report. The bank also told the bankruptcy court that it had never spoken to Edison Motors about the SsangYong purchase and that it had never discussed or agreed to a loan. It said that it deemed the consortium unqualified if the buyout was conditional on a loan from the KDB. (IHS Markit AutoIntelligence's Jamal Amir)

- Mahindra Logistics Ltd (MLL) has acquired 100% of the equity share capital of ride-sharing firm Meru Cabs from its parent company Mahindra & Mahindra (M&M). The acquisition will allow MLL to have a 100% stake in three arms of Meru Travel Solutions Private Limited - Meru Mobility Tech Private Ltd, V-Link Fleet Solutions Private Ltd, and V-Link Automotive Services Private Ltd. It is an all-cash deal worth INR13.1 billion (USD0.18 billion) and is expected to be completed by December, reports Business Standard. MLL, which is a third-party logistics company, is a 58.3% subsidiary of M&M. With this acquisition, MLL will consolidate and expand its enterprise mobility service (ETMS) business, which operates under the 'Alyte' brand. Currently, Meru provides app-based transport services to individuals as well as corporations in 24 cities across India. Meru has more than 200 electric vehicles (EVs) in its fleet, which it claims is the largest in India. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ørsted has proposed a 3.9 GW offshore wind project off the port

city of Hai Phong, Vietnam, estimated to cost around USD11.9

billion to 13.6 billion. The project, located offshore 14

kilometers southeast of Bach Long Vy island and 36 kilometers

northwest of the Long Chau archipelago, will be developed in three

phases, and may feature 20 MW capacity offshore wind turbines. The

project will be the largest offshore wind project planned in

Vietnam, surpassing that of Enterprize Energy's 3.4 GW Thang Long

project. (IHS Markit Upstream Costs and Technology's Melvin

Leong)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-november-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-november-2021.html&text=Daily+Global+Market+Summary+-+10+November+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-november-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 10 November 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-november-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+10+November+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-november-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}