Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 05, 2021

Daily Global Market Summary - April 5, 2021

All major US equity indices closed higher, while markets were closed for the holiday across most of APAC and all of Europe. US government bonds closed higher and the US dollar was lower. CDX-NAIG closed flat and CDX-NAHY closed slightly tighter. Coper closed higher, gold flat, and silver, oil, and natural gas lower.

Americas

- US equity indices closed higher, with the S&P 500 +1.4% and DJIA +1.1% closing at new all-time highs; Nasdaq closed +1.7% and Russell 2000 +0.5%.

- 10yr US govt bonds closed -2bps/1.70% yield and 30yr bonds -1bp/2.35% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY -3bps/296bps.

- DXY US dollar index closed -0.4%/92.6.

- Gold closed flat/$1,729 per troy oz, silver -0.7%/$24.78 per troy oz, and copper +3.7%/$4.14 per pound.

- Crude oil closed -4.6%/$58.65 per barrel and natural gas closed -4.9%/$2.51 per mmbtu.

- Janet Yellen, the US Treasury secretary, has called on other countries to join Washington in setting a global minimum tax for companies as she vowed to reassert America's leadership in international economic policy. Yellen's appeal on the eve of the spring meetings of the IMF and the World Bank comes as the Biden administration puts a crackdown on tax avoidance and tax shelters at the heart of its economic agenda. (FT)

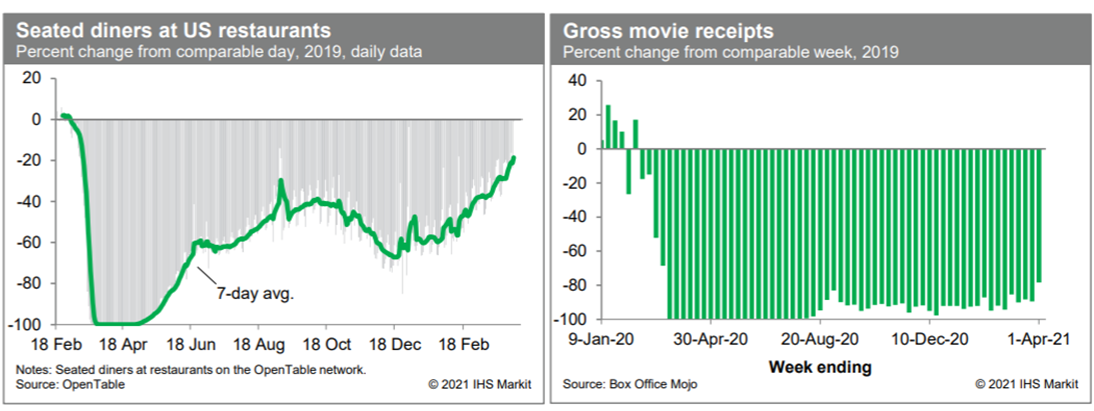

- The trend in US dining out has continued to firm. Averaged over

the last week, the count of seated diners on the OpenTable platform

was about 19% below the comparable period in 2019. This is well up

from prior weeks and reflects ongoing easing of restrictions on

indoor dining and expanding opportunities for outdoor dining as

temperatures rise. Meanwhile, movie-theater activity is showing

signs of life. For the week ending last Thursday, gross movie

receipts were 78% below the comparable week in 2019, well up from

the prior week's 2019 comparison of 89% down. This was the first

significant improvement in box-office revenues since last summer.

(IHS Markit Economists Ben Herzon and Joel Prakken)

- US nonfarm payroll employment rose 916,000 in March, well beyond the consensus expectation. Prior months' gains were revised materially higher. The unemployment rate declined 0.2 percentage point to 6.0%, even as the labor force expanded. All in all, this morning's (2 April) report on the employment situation for March was robust. (IHS Markit Economists Ben Herzon and Michael Konidaris)

- Unusually harsh winter weather in February is evident in the monthly pattern of construction employment through March. After climbing steadily through January, construction employment fell 56,000 in February and rebounded 110,000 in March. The acceleration of construction employment accounted for more than half of the acceleration of overall payroll employment from February to March.

- Loosing restrictions on social and economic activity are boosting employment. Leisure and hospitality added 280,000 jobs in March, while private and public education added 190,000 jobs. These two sectors accounted for about one-half of overall job gains in March.

- To be sure, the recovery in employment has come a long way … and yet it has a long way to go. Roughly 22 million jobs were shed over March and April of last year. Since then, about 14 million jobs have been added back, with about 8 million left to get back to the pre-pandemic peak.

- In the Household Survey, the 0.2-percentage-point decline in the unemployment rate was accompanied by the first increase in the labor-force participation rate since last October.

- US manufacturers' orders declined 0.8% in February, while shipments declined 2.0% and inventories rose 0.8%. Orders and shipments of core capital goods were little revised from their advance estimates. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- For both orders and shipments, February's declines were the first since the recovery in manufacturing began last May. Despite the declines, their levels remained above the February 2020 (pre-pandemic) values.

- The goods sector of the US economy has performed well so far in the recovery, thanks, in part, to surging demand for consumer goods as a stand-in for services forgone because of the pandemic.

- Another source of strength in the goods sector is capital equipment, as businesses appear to be optimistic about the near future and are re-engaging investment plans that were put on hold last spring.

- Indeed, both orders and shipments of core capital goods have surged well beyond their pre-pandemic trends. We look for healthy growth of equipment spending in the first quarter (7.1%, annual rate), although a recent leveling-off of core orders and shipments suggests that equipment spending in the second quarter could level off as well; we look for 0.8% growth then.

- In March 2021, there was one more selling day than in March 2020 and US light-vehicle sales improved 61.9% y/y, but the comparison is with a month in much of which there was a US lockdown to slow the spread of COVID-19. (IHS Markit AutoIntelligence's Stephanie Brinley)

- In the first quarter of 2021, US light-vehicle sales improved 11.5% y/y. The seasonally adjusted annual rate (SAAR) improved sharply, estimated at between 17.5 million and 17.9 million units. March's auto sales results exceeded expectations, even with the pandemic-related poor performance of March 2020, improving on the results in February 2021 as well as sales a year earlier.

- Amid continued pressure on auto production due to supply-chain issues, light-vehicle sales last month were boosted by pent-up demand from the inclement weather conditions in February, and stimulus payments that supported already-simmering US consumer demand.

- The pace of sales will certainly fall back from the growth in March, but the result last month helped to push the first-quarter average SAAR to approximately 16.7 million units.

- Given that inventory issues will only be amplified by the strong sales rate, we expect continued volatility in the month-to-month results ahead.

- A new study from researchers at New York University detailed climate impacts of the 35 largest meat and dairy companies, suggesting their climate change efforts often fail to address greenhouse gas (GHG) emissions across their entire supply chains and highlighting past lobbying efforts opposing climate-related legislation. (IHS Markit Food and Agricultural Policy's Richard Morrison)

- Of the 35 companies included in the study, only seven have committed to achieving net-zero GHG emissions by or before 2050: Dairy Farmers of America, Nestlé, Danish Crown, Danone, JBS and Smithfield. Two of those companies—JBS and Smithfield—announced their commitments after the study was originally authored.

- Most companies' GHG mitigation efforts are focused on carbon dioxide emissions, which comprise "a small fraction" of their overall GHG emissions compared to the primary driver, methane, explained NYU Department of Environmental Studies associate professor Sonali McDermid, another study co-author.

- Relative to the US, the authors found that nine US-based meat and dairy companies currently represent 6% of total US GHG emissions. That share that would rise to 9% by 2025 if the US meets its overall GHG reduction goals under the Paris Climate Agreement.

- In a press release, Whitecap Resources Inc. announced the signing of an agreement to acquire Kicking Horse Oil & Gas Ltd. for a total consideration of C$308.4 million ($245.2 million). The transaction is expected to close by the end of May 2021. Under the deal, Whitecap will pay C$56 million ($44.5 million) in cash and will issue 34.5 million Whitecap common shares valued at C$198.4 million ($157.7 million) based on its closing price on 1 April 2021. The total transaction value includes Whitecap's stated assumption of net debt of C$54 million ($42.9 million) as of 28 February 2021. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

Europe/Middle East/Africa

- All major European equity and bond markets were closed for the holiday.

- Brent crude closed -4.2%/$62.15 per barrel.

- The UK government will invest GBP32 million (USD44.2 million) for research into electric vehicle (EV) and fuel-cell electric vehicle (FCEV) production, according to a report by Autocar, citing Investment Minister Gerry Grimstone. Of the total, around GBP9.4 million will be spent on 22 studies, including one that will explore the feasibility of establishing a low-carbon lithium hydroxide plant in St Austell (Cornwall); a separate study to investigate the potential of a lightweight-magnet plant in Cheshire; and another which will research into the suitability of a lightweight hydrogen fuel tank, developed by Haydale Composite Solutions. The remaining GBP22.6 million has been allocated to the government-backed Faraday Institution, which will explore battery safety and the causes of battery-cell fires, the future of solid-state batteries, and the sustainability of such technology by recycling and reusing old battery units. The institution will also study how EV batteries can be used on the energy grid. This will allow the national grid to borrow electricity from EVs that have been plugged in to charge, helping to ease pressure on the system at times of peak demand. (IHS Markit AutoIntelligence's Jamal Amir)

- The UK government plans to invest heavily in emerging carbon capture, utilization, and storage (CCUS) and hydrogen technology as it tasks the country's oil and natural gas sector with building infrastructure it needs to reach net zero nationwide by 2050. (IHS Markit Climate and Sustainability News' Cristina Brooks)

- Under its 24 March North Sea Transition Deal, the UK will invest £14 to £16 billion (US$19 billion to $22 billion) by 2030 in the pair of technologies, jointly with the private sector, to save jobs amid a decline in fossil fuel reserves. These private backers were not named. The government said it planned to continue working with the oil and gas sector, largely in Scotland and northeast England.

- Government efforts to move the transition along include its past pledge for four net-zero or near-net-zero industrial clusters and awarding £171 million ($236 million) for CCUS design studies, which will "unlock" about £2 to £3 billion ($3 billion to $4 billion) in private sector spending for CCUS and related transportation, it said.

- The government also hinted at "billions" in private sector funding available for hydrogen. It reiterated that it has pinned its net-zero hopes on growing non-renewable hydrogen output, as well as renewable hydrogen using the UK's world-leading offshore wind sector.

- The government might also pay £5 million ($7 million), on top of £1.3 million ($2 million) committed last year, for the Global Underwater Hub in Scotland, pending business case studies. The hub was initially announced in 2019 as a private-sector and academic venture to research underwater robotics for use with offshore renewables, oil and gas, marine science, and defense.

Asia-Pacific

- Several APAC equity markets were closed for the holiday; Japan +0.8%, South Korea +0.3%, and India -1.7%.

- Sinopec-SK Wuhan Petrochemical Co. (Wuhan, China), a joint venture (JV) between Sinopec and SK Global Chemical (Seoul, South Korea), a subsidiary of SK Innovation, plans to complete expansion of petrochemical facilities at Wuhan and start full operation in the second half of 2021. (IHS Markit Chemical Advisory)

- The company completed the extension of ethylene production facilities in December last year, and successfully carried out the initial operation. These facilities are maintaining an operating ratio of around 90%.

- Polypropylene (PP) and butadiene facilities have been completed in March and are in operation without major issues, says SK Innovation.

- When the expansion of petrochemical production facilities is completed in the second half of 2021, Sinopec-SK Petrochemical will secure production capacity of 3 million metric tons/year (MMt/y) of petchem products, including 1.1 MMt/y of ethylene, 900,000 metric tons/year polyethylene (PE), 300,000 metric tons/year of PP, and 19,000 metric tons/year of butadiene. "This is approximately 40% increase from 2.2 MMt/year of petchem production capacity Sinopec-SK Petrochemical used to have."

- The JV entity in 2019 acquired the Sinopec-owned 170,000 b/d Wuhan refinery in Hubei Province for about $1.9 billion. The deal will allow it to secure feedstocks to make petchem products and integrate refining and petchem operations at Wuhan. The transaction marked the first time a South Korean company has taken a direct ownership stake in a refinery in China.

- South Korean automakers posted a 11.9% year-on-year (y/y) increase in their combined global vehicle sales to 672,613 units in March, according to data released by five major domestic manufacturers, as reported by Yonhap News Agency and compiled by IHS Markit. The five automakers reported a 6.7% y/y decline in their combined domestic sales last month to 140,971 units, while their combined overseas sales surged 18.1% y/y to 531,642 units. (IHS Markit AutoIntelligence's Jamal Amir)

- The country's best-selling automaker, Hyundai, posted global sales growth of 22.4% y/y to 375,924 units in March. Its domestic sales totaled 73,810 units, up by 2.3% y/y, while its overseas sales grew by 28.6% y/y to 302,114 units. Global sales of its affiliate, Kia, rose by 8.6% y/y to 251,362 units, with domestic sales flat at 51,011 units and overseas sales up by 11.0% y/y to 200,351 units.

- General Motors (GM) Korea reported a 21.8% y/y decline in sales to 29,633 units during the month, with domestic sales down by 31.4% y/y to 6,149 units and overseas sales down by 18.9% y/y to 23,484 units.

- Renault Samsung's global sales decreased by 43.2% y/y to 8,572 units during March. The automaker sold 5,695 units in its domestic market in March, down by 52.6% y/y, while its overseas sales decreased by 6.8% y/y to 2,877 units.

- SsangYong's global sales fell by 23.8% y/y to 7,122 units in March, with domestic sales down by 37.2% y/y to 4,306 units and overseas sales up by 13.3% y/y to 2,816 units.

- Piramal Pharma Solutions (PPS, India), a contract development and manufacturing organization (CDMO) and a subsidiary of Piramal Pharma Limited (PPL, India), has entered into an agreement to acquire a 100% stake in Hemmo Pharmaceuticals (India). The acquisition has been agreed for an upfront payment of INR7.75 billion (USD105.7 million) and earn-outs linked to the achievement of certain milestones. The acquisition marks PPS's foray into the development and manufacture of peptide active pharmaceutical ingredients (APIs), a capability that complements the CDMO's existing service offering. The purchase is expected to add more than 250 employees to PPS. The addition of Hemmo's capabilities will enable PPS to gain access to a growing peptide API market, since the use of peptide medicines has increased in recent years, particularly in the treatment of cancer, diabetes, obesity, and various rare diseases. (IHS Markit Life Sciences' Sacha Baggili)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--april-5-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--april-5-2021.html&text=Daily+Global+Market+Summary+-+April+5%2c+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--april-5-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - April 5, 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--april-5-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+April+5%2c+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--april-5-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}