Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 07, 2021

Daily Global Market Summary - 7 June 2021

Most major European equity indices closed higher, while US and APAC markets were mixed. US and benchmark European government bonds closed lower. European iTraxx and CDX-NA credit indices were both flat across IG and high yield. Gold and silver closed higher, copper was flat, and the US dollar, oil, and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

1. Major US equity indices closed mixed; Russell 2000 +1.4%, Nasdaq

+0.5%, S&P 500 -0.1%, and DJIA -0.4%.

2. 10yr US govt bonds closed +2bps/1.57% yield and 30yr bonds

+2bps/2.25% yield.

3. CDX-NAIG closed flat/50bps and CDX-NAHY flat/283bps.

4. DXY US dollar index closed -0.2%/89.95.

5. Gold closed +0.4%/$1,899 per troy oz, silver +0.4%/$28.02 per

troy oz, and copper flat/$4.53 per pound.

6. Crude oil closed -0.6%/$69.23 per barrel and natural gas closed

-0.9%/$3.07 per mmbtu.

7. President Joe Biden's first budget request on May 28 furnished

the US Department of Energy's (DOE) Office of Fossil Fuel Energy

with a new and longer name that reflects a revised mission to

decarbonize the nation's economy with technologies that promote

greater use of hydrogen and carbon capture, use, and storage. The

DOE fiscal year 2022 budget request renames it the Office of Fossil

Energy and Carbon Management (FECM), and charges it with advancing

Biden's goal to reach net-zero carbon levels by 2050 in alignment

with the 2015 Paris Agreement. DOE is not just making cosmetic

changes with a name change, nor is it stopping at taking newly

developed technology to the point of deployment. It is creating an

Office of Clean Energy Demonstrations (OCED), which, armed with a

$400 million budget (subject to congressional approval), will serve

as DOE's hub for demonstrating "near- and mid-term" technologies

and systems with the goal of quicker commercial adoption and

increased availability. (IHS Markit Climate and Sustainability

News' Amena

Saiyid)

8. The Securities and Exchange Commission is drafting a proposal

that would restrict plans that corporate insiders use to avoid

insider-trading claims when buying or selling their own company's

stock. Speaking Monday at The Wall Street Journal's CFO Network

event, SEC Chairman Gary Gensler said he is seeking to revise rules

that govern the arrangements, known as 10b5-1 plans. Insiders set

up plans ahead of time and use them to schedule future trades. The

arrangement gives executives a defense against insider-trading

claims that would stem from having undisclosed material nonpublic

information at the time of a trade. (WSJ)

9. U.S. health regulators approved the first new Alzheimer's drug

in nearly two decades, casting aside doubts about the therapy's

effectiveness. The approval Monday of the therapy, which has the

molecular name aducanumab and will be sold as Aduhelm, marked a

watershed in Alzheimer's drug research after billions of dollars in

investment. Maker Biogen Inc. developed the therapy to do what

previously approved Alzheimer's medicines can't: slow the

memory-robbing march of the disease. (WSJ)

10. Former shareholders of Celgene (US) have launched a

USD6.4-billion lawsuit against Bristol Myers Squibb (BMS, US)

alleging that the company delayed launching its gene therapy

Breyanzi (lisocabtagene maraluecel; also known as liso-cel) in

order to avoid making payments to them. The lawsuit, which was

filed by UMB Bank NA on behalf of the shareholders at the United

States District Court for the Southern District of New York,

claimed that BMS broke its contractual obligations by failing to

make appropriate efforts to secure US FDA approval for Breyanzi

prior to a deadline of 31 December 2020. If the deadline had been

met, then BMS would have had to make milestone payments of USD9 per

share to Celgene shareholders. (IHS Markit Life Sciences' Milena

Izmirlieva)

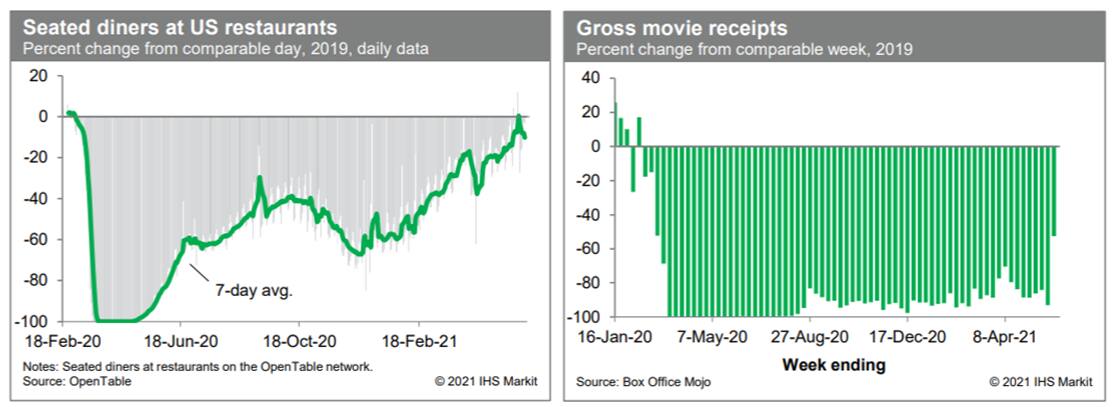

11. The trend in dining out is solid. Averaged over the week ending

yesterday (6 June), the count of seated diners on the OpenTable

platform was about 10% below the comparable period in 2019, as nice

weather, easing restrictions on restaurants, and rising comfort

levels are boosting restaurant activity. Meanwhile, there was a

dramatic improvement in movie-theater activity last week. Relative

to the comparable week in 2019, box-office revenues were down

roughly 53%, up sharply from recent weeks. Relative to the week

including Memorial Day 2019 (one week earlier), revenues were down

about 58%; still a vast improvement from prior weeks. (IHS Markit

Economists Ben

Herzon and Joel

Prakken)

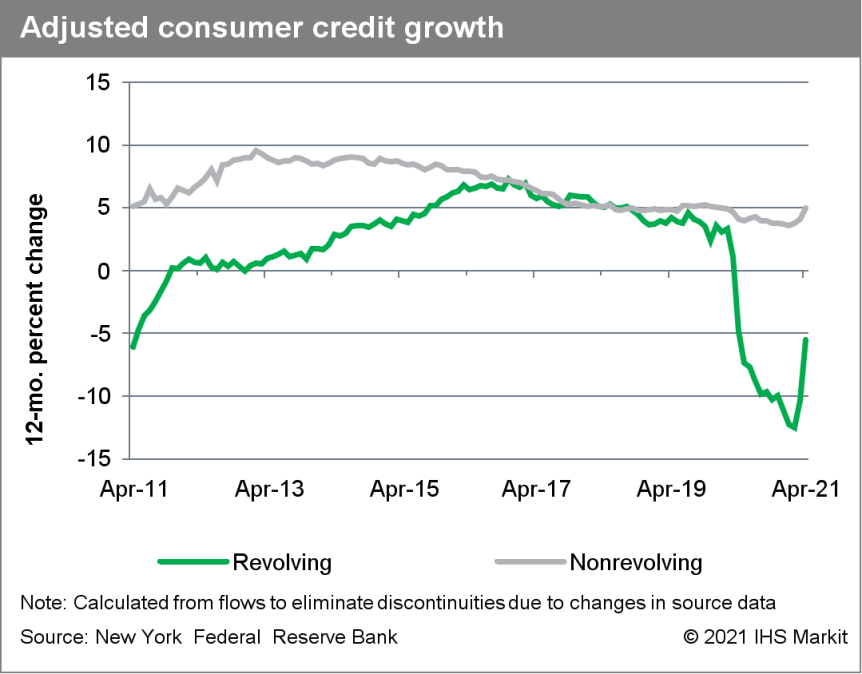

12. Outstanding US nonmortgage consumer credit rose $19 billion to

$4.24 trillion in April after similar increases during February and

March. The 12-month change in outstanding consumer credit was 2.4%,

2.0 percentage points higher than in March owing to "base

effects"—i.e., comparison to a depressed level in April 2020,

when widespread shutdowns in response to COVID-19 inhibited

economic activity. (IHS Markit Economist David Deull)

a. Revolving credit fell by $2 billion, leaving the entirety of

April's increase in the nonrevolving category of loan, which rose

by $21 billion.

b. In spite of sharp declines a year ago, outstanding revolving

credit was still 5.5% lower this April than last, as consumers have

cut back sharply on credit card borrowing during the pandemic and

paid down card balances.

c. However, nonrevolving debts, which include student and auto

loans, have seen an accelerating increase amid towering demand for

new and used vehicles. The 12-month change in nonrevolving debt in

April 2021 was 4.9%, a return to rates of change seen in late

2019.

d. The ratio of nonmortgage consumer credit to disposable personal

income rose, as expected, increasing 3.4 percentage points to

22.5%. This was a function of the sharply reduced rate of

disbursement of stimulus checks in April relative to March.

e. Outstanding nonmortgage consumer credit rose $19 billion to

$4.24 trillion in April after similar increases during February and

March.

13. Albemarle has announced a set of sustainability goals,

including aiming for net-zero carbon emissions by 2050. Goals also

include a 35% reduction in carbon intensity for the company's

catalysts and bromine business by 2030, and a commitment to

"growing the lithium business in a carbon-intensity neutral manner

by 2030." The company also announced initiatives around water use

and resource efficiency. (IHS Markit Chemical Advisory)

a. The emission reductions will come in phases, with an early focus

on building out infrastructure to measure and track progress, and

on what CEO Kent Masters calls "low-hanging fruit" projects to cut

emissions. "We've identified some projects and are working on

them," Masters says. This includes water recycling projects in

Australia and Jordan, and a $100 million investment in a thermal

evaporator in Chile.

b. Albemarle is undertaking aggressive capacity expansion in

lithium to meet growing demand from the electric vehicle (EV)

market. Projects in Chile and Australia will, combined, increase

the company's lithium conversion capacity by 175,000 metric

tons/year of lithium carbonate equivalent (LCE), with commercial

volumes expected to be available in 2022.

14. A coalition of 11 environmental, health, and consumer groups

has petitioned FDA to ban all uses of PFAS in food and food contact

applications. The petition says FDA should revoke all approvals of

per and poly-fluorinated compounds (PFCs) in food contact materials

unless companies can demonstrate the substances are safe. American

Chemistry Council says the petition is "misguided and unnecessary,"

defends FDA process. While it's unclear if FDA would act on the

petition, new legislation from Congress may force the agency's

hand. Rep Rosa DeLauro (D-Conn.) introduces bill seeking to

overhaul FDA's Generally Recognized as Safe (GRAS) process.

Criticizing FDA for not taking a tougher stance on PFAS, the

petition urges FDA to revoke all approvals for use of PFAS in food

and food packaging and issue regulation that bans the use of both

short-chain and long-chain PFAS in food packaging and food handling

equipment. Moreover, the petition states FDA should take stronger

action on all per and poly-fluorinated compounds (PFCs) - a broad

category of chemicals that includes PFAS as well as cyclic

chemicals. FDA should require industry to provide information

demonstrating that all PFCs - including types of PFAS that fall

outside the long-chain PFAS (LC-PFAS) and short-chain (SC-PFAS)

categories - do not biopersist or do not cause cancer. (IHS Markit

Food and Agricultural Policy's Margarita Raycheva)

15. Autonomous vehicle (AV) company Cruise LLC has received a

permit that allows it to shuttle passengers in its driverless test

vehicles in California, United States, reports TechCrunch. The

permit, issued by the California Public Utilities Commission (CPUC)

as part of its driverless pilot program, allows Cruise to offer

passengers rides in its vehicles without a human safety operator

behind the wheel, but it does not allow the company to charge

passengers for any rides. Cruise must submit quarterly reports

about the AV operation and outline a passenger safety plan to CPUC.

(IHS Markit Automotive Mobility's Surabhi Rajpal)

16. Ineos is looking to enter the US market in early 2023, as well

as Canada and Mexico, after first launching its Grenadier sport

utility vehicle (SUV) in Europe. The company has appointed Greg

Clark to the post of vice-president of Americas. Clark is tasked

with selecting a location for US headquarters, deciding how to get

dealers in all 50 states, and hiring all staff of US arm

(marketing, compliance managers, warranty administrators, zone

managers, parts and service personnel, and so on). In an interview

with Automotive News, Clark said of the headquarters location, "We

have to make the right decision. Being in an area where we can

attract good talent and attract talent from other places of the

country and that has the appropriate infrastructure is a big

driver." Clark says the ideal location would be within reasonable

driving distance of punishing off-road driving, and he is looking

at locations on the US Eastern Seaboard, near ports and areas with

transportation in place to move parts and vehicles. Clark is

reportedly aiming to have between 30 and 50 dealers open at launch,

with about 70% US market coverage. Once its North American

operations are fully up, Ineos is aiming to sell about 30,000 units

per year. The Grenadier reportedly could be followed by a pick-up

truck and a hydrogen-powered version. (IHS Markit

AutoIntelligence's Stephanie

Brinley)

17. Autonomous vehicle (AV) startup Aurora Innovation is close to

finalising a merger deal with Reinvent Technology Partners Y, a

special-purpose acquisition company (SPAC), reports Reuters. This

deal's targeted valuation, which had been as high as USD20 billion,

is now closer to USD12 billion. According to the report, the

companies are expected to announce the deal as early as next week.

In a separate statement, Aurora has formed a committee of experts

to provide guidance and recommendations on safety matters related

to driverless operations. The Safety Advisory Board includes

outside professionals from fields such as aviation safety,

insurance, medicine, and automotive. The company has also detailed

its own safety efforts by publishing a voluntary safety

self-assessment report. The report discussed Aurora's use of LiDAR,

a virtual testing suite, and how vehicle operators are trained.

(IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

1. Most major European equity indices closed higher except for

Germany -0.1%; Italy +1.0%, Spain +0.8%, France +0.4%, and UK

+0.1%.

2. 10yr European govt bonds closed lower; Italy +4bps,

France/Germany +2bps, and Spain/UK +1bp.

3. iTraxx-Europe closed flat/49bps and iTraxx-Xover

flat/244bps.

4. Brent crude closed -0.6%/$71.49 per barrel.

5. In 2020, the UK had a total area of 489,000 hectares of land

farmed organically (combined the fully converted area and area

under conversion), an increase of 0.8% compared with 2019,

according to the UK Department for Environment, Food & Rural

Affairs (Defra). This increase was entirely driven by a 12% rise in

the area of in-conversion land compared with the preceding year.

The organically farmed area represents about 3% of the total farmed

area on agricultural holdings in the UK. The area in-conversion

gives an indication of the potential growth in the organic sector.

The three main crop types grown organically are cereals, vegetables

including potatoes and other arable crops. About 62% of UK organic

land is accounted for by permanent grassland; 9% of the total UK

organic area is used to grow cereals. This echoes the performance

across Europe, where the number of producers and amount of organic

land continue to rise to achieve the EU's ambition for 25% of all

agricultural land to be organic by 2030. (IHS Markit Food and

Agricultural Commodities' Hope

Lee)

6. Transport for West Midlands (TfWM) is working with Vodafone,

Nokia, and Chordant to trial a new "mobility cloud" platform on

open roads in the UK. The platform uses 5G-based

vehicle-to-everything (V2X) technology to connect with road users

in the West Midlands and provide them with live updates about local

lane closures, speed restrictions, and traffic incidents. Vodafone

will integrate its 4G and 5G network and multi-access edge

computing (MEC) technology into the platform, which will serve as

"a new type of information superhighway". The platform will offer

real-time road information that will be displayed initially on

users' smartphones, and in the future, on in-car infotainment

systems. (IHS Markit Automotive Mobility's Surabhi Rajpal)

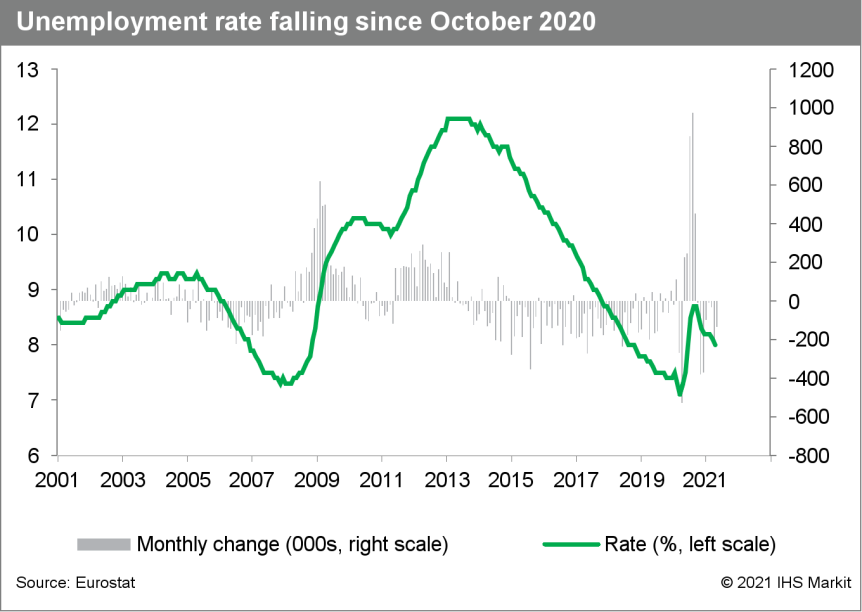

7. The eurozone's harmonized unemployment rate showed another

modest decline in April, the fifth in seven months, from 8.1% to

8.0%. The unemployment rate is now 0.7 percentage point below its

post-pandemic peak in October 2020. (IHS Markit Economist Ken

Wattret)

a. The level of unemployment fell by 134,000 in April compared with

March, the eighth consecutive month-on-month (m/m) decline. April's

three-month moving average rate of decline accelerated sharply to

125,000, roughly three times the equivalent rate of a decline in

February.

b. Since the initial wave of COVID-19 in March 2020, the eurozone

unemployment rate has risen by just 0.9 percentage point net, a

remarkably small increase given the large output and expenditure

losses over the same period. As of the first quarter of 2021, the

latest data available, eurozone GDP was still 5.5% below its

pre-pandemic level in real terms.

c. A comparison with the post-Global Financial Crisis (GFC) period

highlights the remarkable recent resilience of eurozone labor

markets. Between early 2008 and mid-2010, during a less severe

recession, the eurozone unemployment rate rose by three percentage

points (from a similar trough of 7.3% up to 10.3%).

d. The divergence in the unemployment rate over the two periods

reflects three key differences.

i. First, while the initial COVID-19-driven recession in early 2020

was much deeper, it was also much shorter, with the subsequent

second dip in late 2020 and early 2021 much less severe than the

first.

ii. Second, and related to the point above, policy-makers

introduced a variety of labour market support schemes to bridge the

gap to the post-COVID-19 recovery, which is now gathering

momentum.

iii. Third, participation rates declined markedly in some member

states during the COVID-19 shock, partly related to the closures of

schools.

e. Eurozone employment data are released quarterly, and the latest

figures, for the first quarter of 2021, showed a quarter-on-quarter

(q/q) decline of 0.3%. This was the first q/q fall for three

quarters, reflecting the second leg of the COVID-19-driven

recession in the eurozone.

8. Majors BP and Shell, utilities like Vattenfall and RWE, and

chemical refiners like BASF, Linde, and Dow all are likely to

benefit from promised German state funding for 62 hydrogen

projects. Their projects are due a share of over €8 billion ($9.73

billion) in German state and federal funds announced jointly by

Germany's Federal Ministry of Economics and Federal Ministry of

Transport on 28 May. An additional €20 billion ($24 billion) in

backing for projects is set to come from private investors and

other sources so that funding levels reach an expected €33 billion

($40 billion). Germany's funding for the projects is contingent on

the outcome of an application for EU State Aid law exemptions under

the EU's Important Project of Common European Interest (IPCEI)

program. The EU put out a call for proposals to regional companies

to join a hydrogen IPCEI in December. (IHS Markit Climate and

Sustainability News' Cristina Brooks)

9. Greece's GDP rose by 4.4% quarter on quarter (q/q) during the

first quarter of 2021. This follows revised increases of 3.4% q/q

(previously estimated as a rise of 3.1%) and 3.8% q/q (up from 2.7%

q/q) during the third and fourth quarters of 2020, respectively.

(IHS Markit Economist Diego

Iscaro)

a. On a year-on-year (y/y) basis, GDP still declined by 2.3%,

following a drop of 6.9% during the previous quarter. The economy

is now estimated to have declined by 7.8% in 2020, as opposed to

8.0%.

b. Exports continued to rebound during the first quarter, boosted

by a recovery in exports of services, growing by 4.0% q/q. Imports

of goods and services rebounded from their 2.8% q/q decline in the

fourth quarter, rising by 2.0% q/q.

c. The tightening of COVID-19 pandemic-related restrictions led to

a 1.2% q/q decline in private consumption (-4.9% y/y). Household

spending was still 6.0% below its level during the fourth quarter

of 2019.

10. The Russian government has said that the country is gearing up

to provide the framework to produce 150,000 battery electric

vehicles (BEVs) a year by 2030, according to a Prime-Tass news

agency report. The directive was communicated by the Russian

Economic Development Ministry's department director, Maksim

Kolesnikov. He said, "We believe that the implementation of the

concept [for the development of production and use of electric

transport in Russia - Tass] will allow [the creation of] a new

technological sector in the country and [production of] electric

cars [will have a] share of at least 10% of the total production of

transport vehicles by 2030." Given the rapid ramping up of BEV

production in other major economies, the 150,000 BEV production

target is a modest one, albeit necessarily so given the equally

modest program that the Russian government is currently talking

about to accelerate BEV take-up in the country. (IHS Markit

AutoIntelligence's Tim Urquhart)

11. Car-sharing service provider Delimobil has received a

USD75-million investment from Russia's second-largest lender, VTB

Bank, reports Reuters. In return, VTB Bank has bought a 15% stake

in Delimobil, which runs a fleet of cars that can be hired by the

minute in Russia. The company intends to use the proceeds for

further development and to strengthen its position in the Russian

car-sharing market. Delimobil was established in 2015, and

currently has a fleet of over 15,000 vehicles with more than 1

million members. (IHS Markit Automotive Mobility's Surabhi

Rajpal)

12. The Economic Community of West African States (ECOWAS) and the

African Union announced decisions on 30 May and 1 June

respectively, to suspend Mali's membership and participation in the

organizations' bodies. On 3 June, France announced the suspension

of joint military operations and training activities with Mali and

the World Bank, which is currently financing projects amounting to

USD1.8 billion in Mali, on 4 June suspended its financial

operations there until further notice. (IHS Markit Economists Jihane

Boudiaf and Anton

Casteleijn)

a. After six years of robust real GDP growth averaging 7.5%, Mali's

growth declined by 2% in 2020 due to the impact of the COVID-19

virus pandemic, the worsening political climate and the eventual

imposition of ECOWAS sanctions for several weeks, following the

removal of President Keïta in a military coup on 18 August

2020.

b. To cover the financing gaps that resulted from the impact of the

COVID-19 pandemic, the International Monetary Fund (IMF) approved a

USD200-million Rapid Credit Facility disbursement to Mali on 30

April 2020. The government announced a pandemic response plan

amounting to 5% of GDP in May 2020, to support businesses and

households.

Asia-Pacific

1. APAC equity markets closed mixed; India +0.4%, South Korea

+0.4%, Japan +0.3%, Mainland China +0.2%, Australia -0.2%, and Hong

Kong -0.5%.

2. China's merchandise exports rose 27.9% year on year (y/y) in May

in US dollar terms, down from 32.3% y/y in April, according to the

General Administration of Customs. Merchandise imports growth

continued to accelerate to 51.1% y/y in May from 43.1% y/y in the

previous month. On a two-year (2020-21) average basis, exports

growth slowed from 16.8% in April to 11.1% in May and imports

growth accelerated from 10.7% to 12.4%. (IHS Markit Economist Yating

Xu)

a. The headline exports slowdown was driven by double-digit

declines in growth of exports to the United States and European

Union. However, exports to Hong Kong, Association of Southeast

Asian Nations (ASEAN) member states, South Korea, and Japan

accelerated. By product, export growth decelerated across high-tech

manufacturing goods, mechanical goods, and labor-intensive

goods.

b. Notably, exports of pandemic-prevention supplies declined year

on year as the global vaccination progress continues to advance and

the pandemic situation in Southeast Asia gradually stabilized.

Meanwhile, exports of consumption goods such as clothes, home

appliances, furniture, and automobiles moderated. On the other

hand, with the production recovery in the United States and

European Union, exports of investment goods and materials such as

general-purpose equipment and plastic accelerated.

c. The acceleration in imports growth was largely driven by a low

base - as imports dropped to contraction in April 2020 - and rising

commodity prices. To illustrate, the import value of crude oil rose

by 105% y/y, while the import volume dropped by 14.6% y/y; the

situation was similar for copper, coal, and iron ore imports. By

product, imports of agricultural products, mechanical goods, and

high-tech manufacturing goods accelerated.

d. Trade surplus continued to increase to USD45.5 billion in May,

while the cumulative surplus increase was down from 174%y/y in

April to 26.5% y/y decline compared to a year ago, expanding from a

4.7% y/y decline in April to 70.2% y/y.

3. Japan's government is debating its future strategy for the

pharmaceutical sector, amid rising concerns within the industry

that the country's drug pricing regulations are increasingly

hampering innovation. The debates over the pharmaceutical sector

come as Japan finalizes its 2021 Basic Policy for Economic and

Fiscal Management and Reform (honebuto in Japanese). Among the

leading drug-pricing topics debated is the long-established 2%

adjustment rate (or adjustment range), also known as the reasonable

zone (R-zone). The adjustment rate, which was set at 2% in April

2000, is added to a drug's market price and is intended to offer a

"cushion" following market price-based revisions of a drug's

National Health Insurance (NHI) price. The overall aim of the

addition of the adjustment rate is to maintain stable drug

distribution in Japan. The debate over the potential revision of

the 2% adjustment rate follows a year of extraordinary pricing

reforms, due in part to the off-year FY 2021 NHI revision cycle, as

well as the impact of the COVID-19 virus pandemic. In addition, the

policies of the 2016 four-minister accord have now also been

carried out, opening the door to a new round of drug pricing

reforms. (IHS Markit Life Sciences' Sophie

Cairns)

4. Toyota Motor is rebranding its corporate investment arm as

Toyota Ventures, which was formerly known as Toyota AI Ventures,

according to a company statement. The new brand has added two

USD150-million early-stage funds - the Toyota Ventures Frontier

Fund and the Toyota Ventures Climate Fund - bringing Toyota

Ventures' total assets under management to more than USD500

million. The Frontier Fund will continue to invest in such areas as

artificial intelligence, automated vehicles, cloud computing, and

robotics, while expanding its range to include smart cities,

digital health, fintech, materials, and energy. The Climate Fund

will be focused on finding and funding early-stage startups that

develop solutions for carbon dioxide reduction. (IHS Markit

Automotive Mobility's Surabhi Rajpal)

5. The Australian Securities and Investments Commission, the

Australian Prudential Regulation Authority (which supervises banks

and insurance companies) and the Reserve Bank of Australia issued a

joint statement on 4 June which urges rapid migration from LIBOR

use and requests no new LIBOR-based contracts to be issued from

end-2021. Australian regulators thus have reacted rapidly to apply

the Financial Stability Board (FSB) recommendations on LIBOR

transition. The joint statement warned that continued use of LIBOR

would present "significant risks and disruptions" to financial

stability and integrity, with individual financial groups facing

"financial, conduct, litigation and operational risks" from

inadequate preparation for migration. (IHS Markit Economist Brian

Lawson)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--7-june-2021-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--7-june-2021-.html&text=Daily+Global+Market+Summary+-+7+June+2021++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--7-june-2021-.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 7 June 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--7-june-2021-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+7+June+2021++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--7-june-2021-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}