Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 18, 2021

Daily Global Market Summary - 18 February 2021

APAC equity markets closed mixed, while major US and European indices were lower on the day. US and benchmark European government bonds were sharply lower on the day. European iTraxx and CDX-NA closed modestly wider across high yield, while IG was close to unchanged on the day. Gold and copper closed higher, WTI flat, and the US dollar, silver, and Brent were lower on the day. The energy sector continues to be one of the top performers in the US debt market, with BB E&P average yields now at the lowest level on record.

Americas

- US equity indices closed lower; Russell 2000 -1.7%, Nasdaq -0.7%, and DJIA/S&P 500 -0.4%.

- 10yr US govt bonds closed +3bps/1.30% yield and 30yr bonds +5bps/2.09% yield.

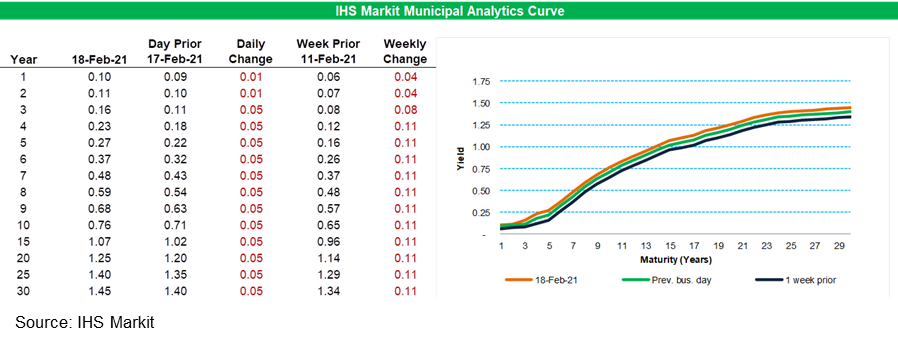

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

continued to sell-off today, closing +5bps for 3yr and longer paper

and is now +11bps week-over-week for ≥4yr paper.

- CDX-NAHY closed +1bp/51bps and CDX-NAHY +4bps/293bps.

- DXY US dollar index closed -0.4%/90.59.

- Gold closed +0.1%/$1,775 per ounce, silver -0.9%/$27.08 per ounce, and copper +2.1%/$3.90 per pound. Copper closed at the highest price since March 2012.

- Crude oil closed flat/$61.16 per barrel.

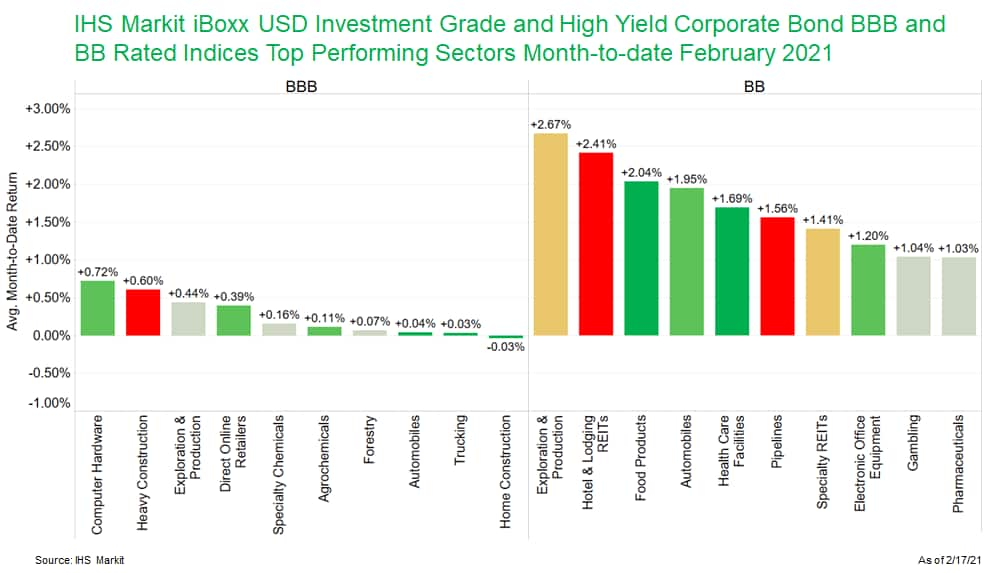

- Energy debt continues to be one of the top performing sectors

across USD investment grade and high yield every month since April

2021, with the below chart highlighting that BB rated E&P's

returning 2.67% MTD as of yesterday 17 February.

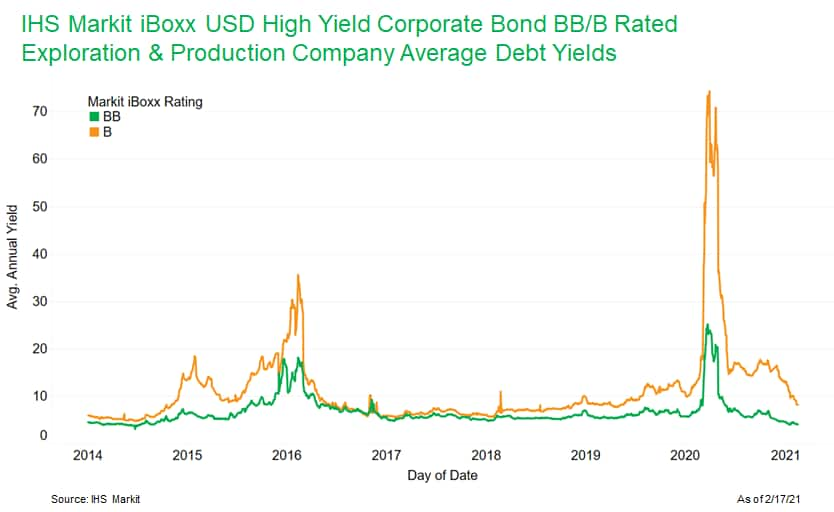

- The strong performance in the US energy debt sector has

translated into the lowest BB E&P corporate bond borrowing

costs on record (4.04% as of 17 February) and the lowest B rated

average yields (8.17%) since May 2019.

- Treasury Secretary Janet Yellen said that $1.9 trillion in pandemic-relief spending is still needed, despite recent strength in retail sales and record levels in U.S. stocks. The House is aiming to vote Feb. 26 on President Joe Biden's stimulus plan. The tight timeline reflects the urgency to approve another round of stimulus payments, unemployment benefits and funding for schools and vaccines before key elements from the last round of pandemic aid expire on March 14. In less than four weeks, Democrats are attempting to pass a bill out of the House and get all 50 Senate Democrats to back the legislation. (Bloomberg)

- The Federal Open Market Committee (FOMC) met virtually on 26 and 27 January to discuss monetary policy and related issues. The decision to maintain current policy settings was unanimous: the target for the federal funds rate was kept at a range of 0.00-0.25% and the FOMC repeated its directive to continue purchasing approximately $80 billion per month in Treasury securities and $40 billion per month in agency mortgage-backed securities (MBS). The minutes reveal sentiment to better coordinate communication about the outlook for monetary policy, including eliminating the possibility of unintentionally sparking a tightening of financial conditions through premature speculation about when it might be appropriate to scale back the pace of net securities purchases by the Federal Reserve. Policymakers expect to indicate well in advance of the time when progress toward employment and inflation goals will allow for a reduction in the pace of asset purchases. The staff's assessment of financial system vulnerabilities struck a more concerning tone than in November. (IHS Markit Economists Ken Matheny and Chris Varvares)

- Seasonally adjusted (SA) US initial claims for unemployment

insurance rose by 13,000 to 861,000 in the week ended 13 February.

The previous week's level was revised up by 55,000 from 793,000 to

848,000. The level of initial claims has increased over the last

two weeks even as COVID-19 cases have retreated from their January

highs and states have loosened business restrictions. (IHS Markit

Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 64,000 to 4,494,000 in the week ended 6 February. The insured unemployment rate remained unchanged at 3.2%.

- There were 516,299 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 13 February, the highest since mid-September. In the week ended 30 January, continuing claims for PUA fell by 258,059 to 7,685,389.

- In the week ended 30 January, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 718,036 to 4,061,305. With the latest extension to 24 weeks for PEUC, eligible recipients can receive up to 50 weeks of unemployment benefits between the regular state programs and PEUC.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 30 January, the unadjusted total fell by 1,325,567 to 18,340,161.

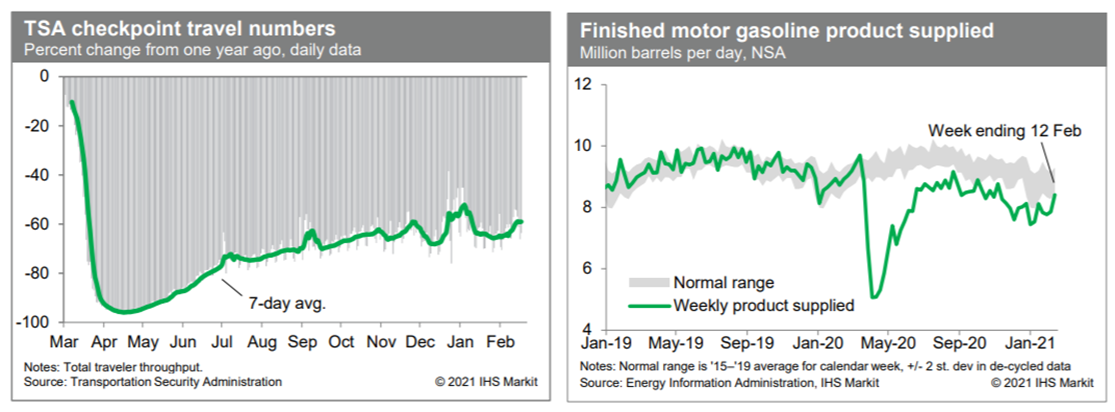

- The trend in passenger throughput at US airports has turned up

in recent days, according to the TSA, but remains well below

year-ago levels, as air travel has yet to show signs of solid

recovery. Meanwhile, gasoline consumption turned up last week,

according to the Energy Information Administration (EIA), to the

lower end of what we consider to be a normal range. Still, it would

take further and sustained improvement to conclude that internal

mobility had recovered. (IHS Markit Economists Ben Herzon and Joel

Prakken)

- US single-family permits, arguably the most important number in

this report, jumped 3.8% (plus or minus 0.9%; statistically

significant)—the ninth straight increase—to a 1.269 million

rate, the highest reading since August 2006. Single-family permits

improved in all four regions. (IHS Markit Economist Patrick

Newport)

- Multifamily permits rose to a 612,000-unit annual rate, the second highest reading in 30 years, bested only by a 671,000 spike in June 2015. Multifamily permits spiked in the South, Northeast, and West in January.

- Total permits climbed 10.4% to a 1.881 million rate—the highest since May 2005. Permits are quickly approaching the 2.26 million housing boom peak reached in September 2005—but it is a stretch to think that that level will be surpassed.

- Housing starts dropped 6.0% (plus or minus 16.4%, not statistically significant) in January from a 14-year-high rate of 1.680 million. Single-family starts fell 12.2% (plus or minus 11.3%, not statistically significant) to a 1.162 million rate; multifamily starts jumped 17.1% to a 418,000-unit rate.

- Despite sizzling permits numbers, we believe that the recent strength in the single-family market for new construction is temporary and that housing starts will start running out of steam in the first half of this year, dipping and stabilizing in about two to three years at a level set by increases in the number of households.

- Bottom line: The permit estimates are more reliable than the housing starts estimates, especially in the late and early months of the year—February's cold spell in the South, for example, will likely depress February's housing starts numbers and boost those in March, but have small effects on the permits estimates. This report was solid.

- The index of US import prices jumped 1.4% month on month (m/m)

in January following a 1.0% increase in December, marking the

largest monthly increase since March 2012. The index's 12-month

growth rate turned positive, registering at 0.9%. (IHS Markit

Economist Gordon Greer)

- The index of nonfuel import prices advanced 0.8% m/m in January, while its 12-month growth rate was 2.5%.

- Fuel import prices rose 7.4% in January after an upwardly revised 8.1% increase in December. The cost of imported fuel was down 13.4% versus January in the prior year.

- Export prices increased 2.5% m/m in January, and the 12-month growth rate was 2.3%. Monthly growth of both agricultural and nonagricultural export prices was positive.

- Nonagricultural commodities price growth came in at 2.2% m/m, the highest monthly rate on record, and was up 1.5% versus January in the prior year. Industrial supplies and materials export prices advanced 6.0% m/m, the highest rate on record.

- Aker Solutions has signed a FEED contract with Empire Offshore Wind to study the design and delivery of concrete foundations for the wind turbine generators (WTG) for the planned Empire Wind project offshore New York, US. Aker Solutions will analyze how to design, construct and install concrete substructures standing on the seafloor to support the WTGs. The scope also includes analysis of construction methods and models for marine operations to install the structures. Aker Solutions FEED work will also involve several U.S.-based partners and suppliers such as construction company Kiewit Infrastructure and regulatory and permitting expert McLaren. The FEED award for Empire Wind follows the completion of the pre-FEED won in 2019. The work starts immediately and will be completed by August 2021. Empire Wind is being developed by Equinor and BP through their 50/50 strategic partnership in the US. (IHS Markit Upstream Costs and Technology's Helge Qvam)

- Life Sciences venture capital investment firm Medicxi (UK) has launched a new company Centessa Pharmaceuticals (US) headquartered in Massachusetts (US), with the merger of 10 biotechnology firms with 15 highly validated programs. The unique business model brings together best-in-class or first-in-class assets led by specialized teams to help "reshape the traditional drug development process," according to the company statement. Medicxi has raised USD250 million in Series A financing, and will include the following companies as subsidiaries: ApcinteX, Capella BioScience, Janpix, LockBody, Morphogen-IX, Orexia Therapeutics, Palladio Biosciences, PearlRiver Bio, Pega-One and Z Factor. Among the 15 programs within Centessa's portfolio, four are in clinical developments (including two in late-stage development), and 10 target diseases with a high unmet need within oncology, hematology, immunology, inflammation, neuroscience, and rare diseases. The unique "asset-focused" approach will provide each team and development program with a significant amount of autonomy to advance promising candidates with oversight by the highly experienced Centessa management team. (IHS Markit Life Sciences' Margaret Labban)

- The US Department of Commerce (DOC) and the US International Trade Commission (USITC) on 9 February issued a decision that phosphate fertilizers imported from Morocco and Russia are unfairly subsidized, and calculated a 19.97% import duty on Moroccan phosphate company OCP Group. The US investigation began in June 2020, following a complaint of unfair competition filed by OCP's American competitor, Mosaic Company. Mosaic accused OCP of selling subsidized products in the US market, making US phosphate fertilizers uncompetitive, a claim that OCP denies. The USITC investigated eight potential subsidy programs under loans, taxes or credits regarding four phosphate fertilizers: MAP, DAP, SSP/NSP, and TSP. USITC is due to issue its final decision by the end of March. The commission will confirm the import duty should it find that the US fertilizer industry has been materially injured. Morocco accounts for 60% of total US imports of fertilizer and the US market represents 23% of Morocco's fertilizer exports. Although the USITC has previously overturned decisions by the DoC's International Trade Administration, such as in 2018 in a trade dispute over Canadian aerospace firm Bombardier, it is unlikely to completely reverse the Department of Commerce's conclusion. (IHS Markit Country Risk's Jihane Boudiaf)

- Waymo has expanded testing of its driverless ride-hailing service to San Francisco (California, US). The company has been testing its commercial driverless taxi service, Waymo One, in the Phoenix, Arizona area since December 2018. Waymo will initially deploy autonomous vehicles (AVs) for limited rider testing with its employees in San Francisco to gain feedback and improve its autonomous technology, reports VentureBeat. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Gatik has added a fully electric-powered autonomous vehicle to its fleet. The company has announced its electrification strategy, which includes the use of fully electric autonomous box trucks. The first electric models are to be used by Walmart for a pilot program in New Orleans, United States, this month. Gautam Narang, CEO and co-founder of Gatik, said, "Helping our customers as they meet their ambitious emissions targets is a key pillar of our long-term strategy. Our electric autonomous box trucks are defining a new frontier in sustainability while continuing to offer the cost reductions and shorter delivery times our autonomous solution is known for." Gatik is to integrate its autonomous system into the Ford Transit 350 HD chassis platform to support the operations of electric autonomous services. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Autonomous vehicle (AV) LiDAR sensor manufacturer AEye is planning to go public through a merger agreement with CF Finance Acquisition Corp. III, a special-purpose acquisition company (SPAC). This will bring AEye's market value to USD2 billion, reports TechCrunch. The deal includes USD230 million of cash from the SPAC and USD225 million of financing from private investors including GM Ventures, Subaru-SBI, Intel Capital, Hella Ventures and Taiwania Capital. As part of the agreement, the combined company will be called AEye Holdings Inc. and is expected to be publicly listed on Nasdaq. The deal is expected to be closed in the second quarter of 2021. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- BNP Paribas has announced a new policy to help tackle deforestation in Brazil driven by soy and beef production. The bank, France's largest lender, committed on 15 February to only provide financial services to companies with "strategies to achieve zero deforestation in their production and supply chains by 2025 at the latest". BNP said it will stop funding firms that produce or buy beef or soybeans grown on land in the Amazon where rainforests were cleared or converted, and that it would "encourage" its customers not to buy or produce these same commodities in the Cerrado, a vast tropical savanna region covering 20% of Brazil. The bank explained that Brazilian beef and soybean production has accelerated deforestation in these areas, which "legal or illegal, jeopardizes the ecological integrity and future of these two biomes". BNP said this is the first deforestation policy of a major international bank and its initiative reflects a growing understanding of the challenges associated with forest loss within the financial community. (IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- Volta Trucks has selected Proterra as a battery supplier for its Volta Zero electric truck, according to a statement from Proterra. The truck-maker is due to begin customer trials of the Volta Zero commercial truck later this year. Volta expects to see "tens of thousands" of its trucks on the road soon after series production starts. The company's target for beginning production is about 12 months after the customer trials. Proterra says its battery will give the Volta Zero a range of about 200 kilometers, which the supplier says is "more than enough for most inner-city logistics and distribution vehicles". The battery pack has a customizable design that allows it to be located between the chassis and rails on the Volta Zero. The selection of Proterra as battery supplier gives the US-based commercial vehicle electrification company a foothold in the European electrified commercial vehicle market. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- European equity markets closed lower; UK -1.4%, Italy -1.1%, Spain -0.8%, France -0.7%, and Germany -0.2%.

- 10yr European govt bonds closed sharply lower; Italy +7bps, France/Spain/UK +5bps, and Germany +3bps.

- iTraxx-Europe closed flat and iTraxx-Xover +3bps/250bps.

- Brent crude closed -0.6%/$63.93 per barrel.

- According to our February update, UK consumer price inflation

is likely to drift up to 1.4% in 2021 and 1.6% in 2022 from 0.9% in

2020. This implies the 12-month rate will climb steadily during

2021, and be close to the Bank of England's inflation target of

2.0% by the latter stages of this year. (IHS Markit Economist Raj

Badiani)

- The Office for National Statistics (ONS) reports that the UK's 12-month-rate consumer price index (CPI) edged up to 0.7% in January 2021.

- During 2020, inflation averaged 0.9%, well below the Bank of England's (BOE) target of 2.0%.

- A breakdown of the inflation rate in January reveals the continued price normalization for several consumer facing services, namely communications (+2.2% y/y), recreation and culture (+2.6% y/y) and education (+2.1% y/y).

- Clothing and footwear prices dropped by a sharp 3.4% y/y because of heavier than normal price discounting during the January sales. In addition, they have fallen in 10 of the last 12 months, which suggests that high street retailers with their physical outlets shut are resorting to heavier online price discounting to clear stock and bolster their financials.

- Restaurant and café prices rose for the fifth straight month in January, by 0.8% y/y, despite only being able to serve takeaways. This was also at odds with the value-added tax (VAT) rate cut from 20% to 5% in the hospitality, accommodation, and tourist attraction sectors from mid-July 2020.

- Energy-related prices continued to slide on an annual basis, with transport fuel and lubricant prices 8.2% lower than a year earlier. The main lever remained lower global crude oil prices, which fell by 25.6% y/y to average USD50.0 per barrel (pb) in December.

- A new partnership is exploring the possibility of building a large battery manufacturing facility in the UK. According to a statement, Coventry City Council is entering a joint venture (JV) with Coventry Airport to develop proposals for a site that will manufacture batteries for electric vehicles (EVs). The pair will "develop proposals and submit an outline planning application for a Gigafactory in 2021" which will "take place alongside regional discussions with battery suppliers and automotive manufacturers to secure the long-term investment needed." The statement went on to say that the JV is set to be approved by Coventry City Council's Cabinet at a meeting on 23 February, which will be followed by a planning application later in the year. It added that "subject to successful discussions with car makers and battery suppliers, a Gigafactory at Coventry Airport could be operational by 2025." (IHS Markit AutoIntelligence's Ian Fletcher)

- Subsequent upward surprises on January's inflation rates and

the fourth-quarter-2020 initial GDP estimate have shifted the focus

to the next European Central Bank (ECB) policy meeting and press

conference on 11 March. Highlights from the meeting account include

the following (IHS Markit Economist Ken Wattret):

- Incoming data, surveys, and high-frequency indicators suggested that the decline in activity in the fourth quarter of 2020 would be less pronounced than envisaged in the December 2020 staff macroeconomic projections. However, the recent intensification of the pandemic would weigh more heavily on activity in the first quarter of 2021 than had been foreseen.

- Although headline inflation was likely to increase in the coming months owing to energy price dynamics and the end of the temporary VAT reduction in Germany, underlying price pressures were expected to remain muted owing to weak demand, low wage pressures, and euro appreciation.

- Financial-market developments had had a broad-based positive effect on financial conditions in the eurozone. Sovereign real yields had dropped, spreads had remained resilient, equity prices had risen, and the euro had reversed its appreciation trend against the US dollar. This was a strong vote of confidence in the ECB's decision to focus on the duration of its policy support and on the preservation of favorable financing conditions.

- IHS Markit retains its long-held view that the ECB's monetary policy stance is going to remain highly accommodative for a very long time. This reflects a range of factors, including the exceptionally large output gap following the COVID-19 virus shock, persistent low inflation expectations, the fiscal vulnerabilities of some eurozone member states given surging public-sector budget deficits and precariously high debt-to-GDP ratios, and historical ECB policy missteps.

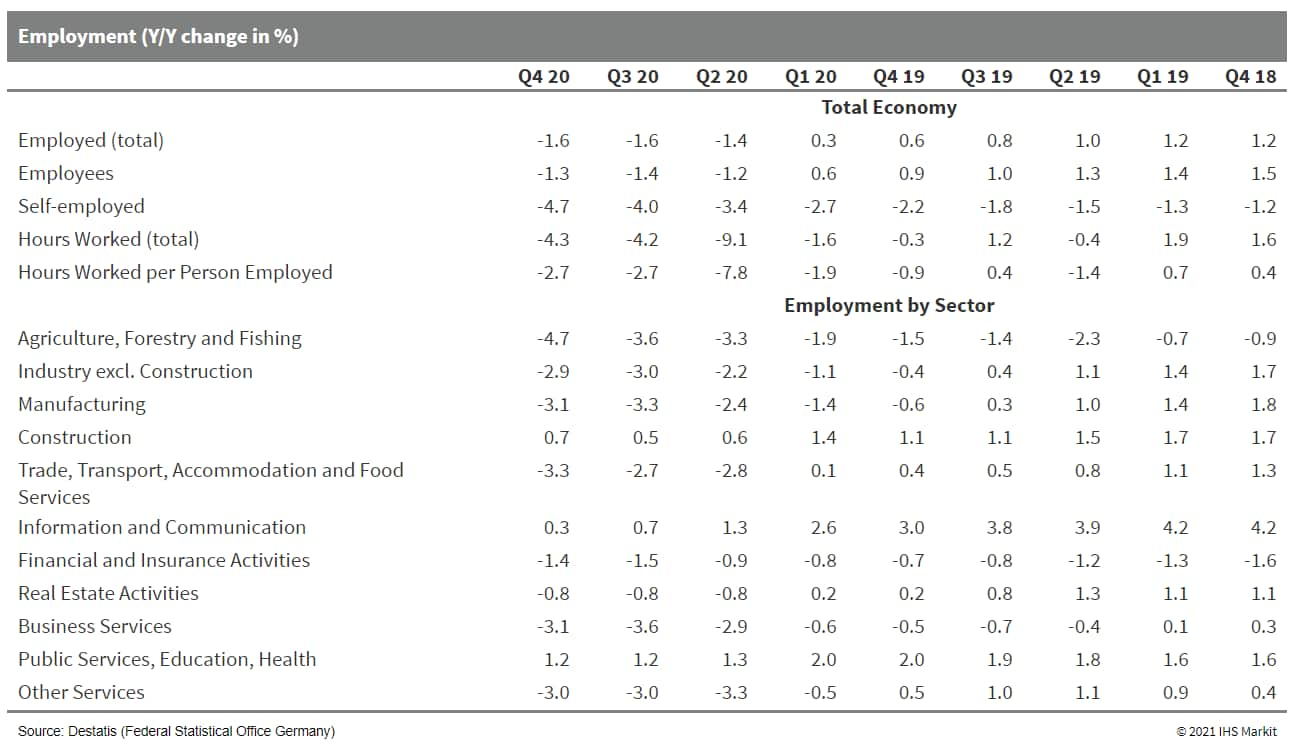

- Federal Statistics Office (FSO) data show that total German

employment in the fourth quarter of 2020 was at 44.791 million, up

mainly for seasonal reasons from the previous quarter's 44.646

million. The y/y change remained broadly steady at -1.6%; 747,000

people in absolute terms. This compares to a 1.0% average annual

gain during 2010-18, and the magnitude of the employment setback

remains much larger than the -200,000 (-0.5%) observed in

March-July 2009 due to the global financial market crisis. (IHS

Markit Economist Timo Klein)

- Ford of Europe has announced a road map for moving its products to all-electric propulsion, as well as a USD1-billion investment into its Cologne assembly plant. Cologne will also become a center of excellence for EV manufacturing and be renamed the Ford Cologne Electrification Centre. The announcement follows similar all-EV statements from other automakers recently, although Ford's statement is focused on Europe. The target for shifting to all battery-electric passenger cars in Europe in 2030 is attention-getting and a stretch goal. The announcement moves beyond regionally proposed bans on various levels of ICE vehicles to a broader corporate shift. Presuming the shift to EV takes hold with consumers, Ford will need to make product investment decisions with global as well as regional needs and regulations in mind. In addition, in January 2021, Ford announced that it was planning to double its investment into electrified vehicles. The Cologne announcement can be expected to be one of many in the next several years for Ford globally. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Saipem has bagged a major offshore wind construction contract for the Courseulles-sur-Mer Offshore Wind Farm in Normandy, France. The total value of the contract awarded by Eoliennes Offshore du Calvados SAS (EODC) is reported at EUR 460 million (USD 554 million) and entails the design, construction, and installation works for 64 monopile foundations and transition pieces. Fabrication will be in Europe and installation will be with Saipem's crane vessel Saipem 3000. The execution of the contract is contingent on EODC making a positive final investment decision. The wind farm is located up to 16 kilometers off the coast of the Calvados region, in water depths ranging from 22 to 31 meters. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- According to all measures, on an annual basis Sweden's headline consumer price inflation accelerated in January 2021. The consumer price index (CPI), which is the national definition, came in at 1.6% year on year (y/y), up from 0.5% in December 2020. According to the EU-harmonised measure (HICP), inflation was up 1.9% y/y, up from 0.6% y/y in December. Higher prices for food and non-alcoholic beverages, electricity (due to much colder weather) and housing costs all contributed to the annual upswing in inflation. (IHS Markit Economist Daniel Kral)

- Técnicas Reunidas has been awarded an EPC contract by Sasa Polyester—a manufacturer of polymers and chemicals—for the construction of a new petrochemical plant for the production of purified terephtalic acid (PTA) in Adana, Turkey. The plant will have a capacity of 1.5 million tons per year. This will be the first PTA plant in Turkey and is part of a larger investment program that Sasa Polyester is carrying out in the petrochemical sector in Turkey. The value of the contract is USD935 million and forms part of Técnicas Reunidas' goal of expanding into the PTA market as well as increasing its presence in Turkey. (IHS Markit Upstream Costs and Technology's William Cunningham)

Asia-Pacific

- APAC equity markets closed mixed; Mainland China +0.6%, Australia flat, Japan -0.2%, India -0.7%, South Korea -1.5%, and Jong Kong -1.6%.

- The combined sales of retail and catering enterprises rose

28.7% year on year (y/y) to CNY821 billion (USD127.27 billion)

during the Lunar New Year "Golden Week" holiday (11- 17 February

2021), according to releases from the Ministry of Commerce (MOF).

Compared with the pre-pandemic level, 2021 Lunar New Year sales

were 4.9% higher. (IHS Markit Economist Yating Xu)

- New changes and trends emerged; China's online sales exceeded CNY122 billion, with online catering sales surging 135% y/y as more people ordered ready-to-eat meals through e-commerce or online food delivery platforms.

- A fast return to positive GDP growth, a sustained recovery trajectory, and the government's foreign investment-facilitation program will continue to underpin China's foreign direct investment (FDI) inflows in 2021.

- China reported real GDP growth of 2.3% for 2020 and is expected to be the only major economy to realize economic growth during the year; this helped China become a safe haven for multinational investment amid the pandemic-ravaged year.

- The South Korean government aims to have 7.85 million

alternative-powertrain vehicles on the country's road by 2030, in

line with its vision to go fully carbon-neutral by 2050, reports

the Yonhap News Agency. (IHS Markit AutoIntelligence's Jamal Amir)

- The target will mark a sharp rise from 820,000 units tallied in the previous year, according to the South Korean Ministry of Trade, Industry, and Energy. The emission of greenhouse gases from vehicles will also fall by 24% over the period.

- In a bid to achieve the target, the government has made compulsory for public organizations to purchase only alternative powertrain vehicles starting this year, while more incentives will be provided to the private sector.

- It also plans to install at least 120 fast-charging stations for electric vehicles (EVs) this year. Parking lots will be obligated to have at least 10 charging booths for every 200 vehicles starting in 2022.

- It also plans to expand fuel-cell electric vehicle (FCEV) charging infrastructure in the country.

- The government plans to reduce the price of alternative powertrain vehicles by KRW10 million (USD9,025) through tax incentives and by developing home-grown parts, in a bid to make such vehicles more affordable.

- South Korea's top financial regulator, the Financial Services Commission (FSC), has said that it would be better to keep SsangYong afloat as its bankruptcy would result in massive job losses, reports the Yonhap News Agency. "It will be a demanding task to financially support SsangYong Motor's subcontractors. It appears to be better [for creditors] to focus on extending a financial helping hand to SsangYong if it costs less than expected," said FSC chairman Eun Sung-soo. SsangYong is struggling and recorded a net loss for the 16th consecutive quarter in the fourth quarter of 2020. The automaker filed for court receivership on 21 December 2020 after struggling with increasing debts owing to the COVID-19 virus pandemic. It had asked its creditors to roll over their loans but failed to obtain their approval. (IHS Markit AutoIntelligence's Jamal Amir)

- Samsung Engineering has been awarded an EPC contract by PTT Global Chemical Public for the Olefins 2 Modification Project (OMP) in Thailand. Under the terms of the contract—valued at USD125 million—Samsung Engineering will construct new facilities which will change the main composition of existing feedstock from ethane to propane to increase propylene production. The project is expected to be completed in 2023. (IHS Markit Upstream Costs and Technology's William Cunningham)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--18-february-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--18-february-2021.html&text=Daily+Global+Market+Summary+-+18+February+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--18-february-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 18 February 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--18-february-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+18+February+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--18-february-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}