Credit Union Rates Fall Below Banks and Captives

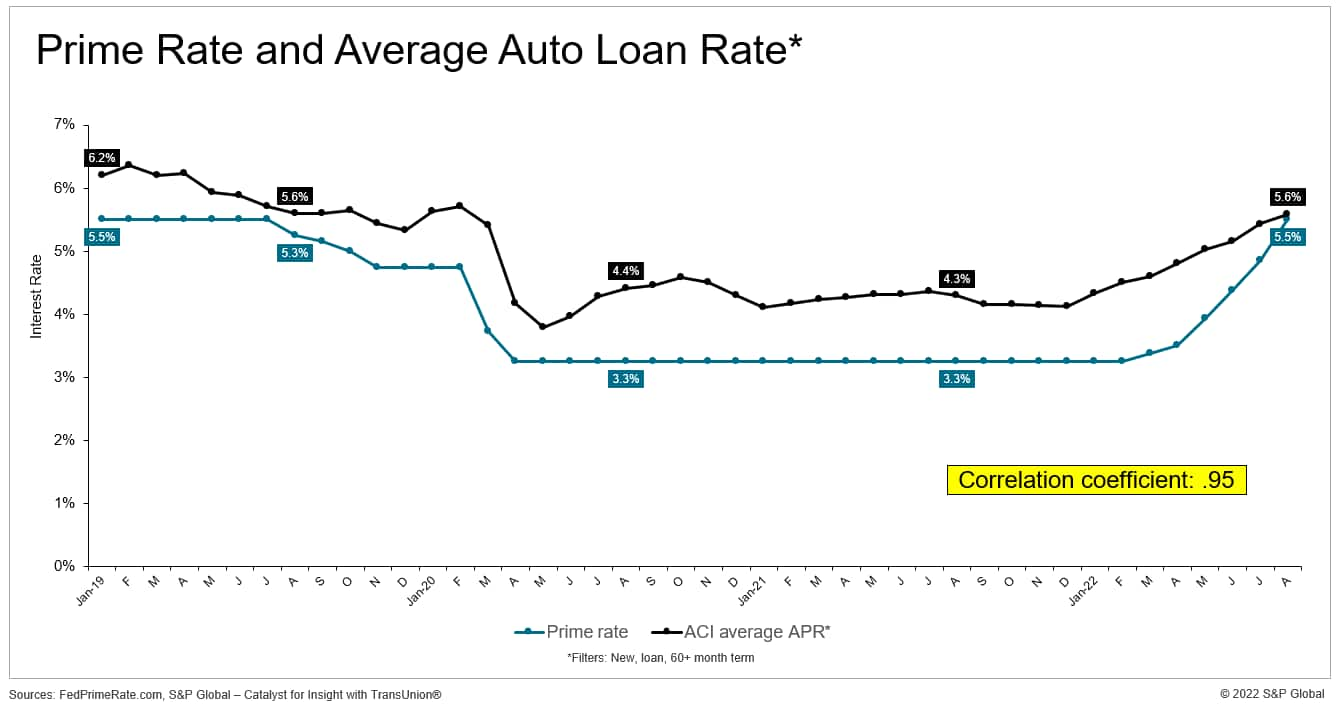

The Federal Reserve Bank's recent rate increases to curb inflation have quickly cascaded to the retail US auto industry. In fact, as shown below, average loan rates began climbing before the prime rate moved up. Back in January, the average loan rate increased .2 PP month-over-month to 4.3%, and it has been rising ever since, reaching 5.6% in July. Also, the concurrent increases in the prime rate and the average auto loan rate should not be surprising: the correlation coefficient between the two metrics is a very strong .95.

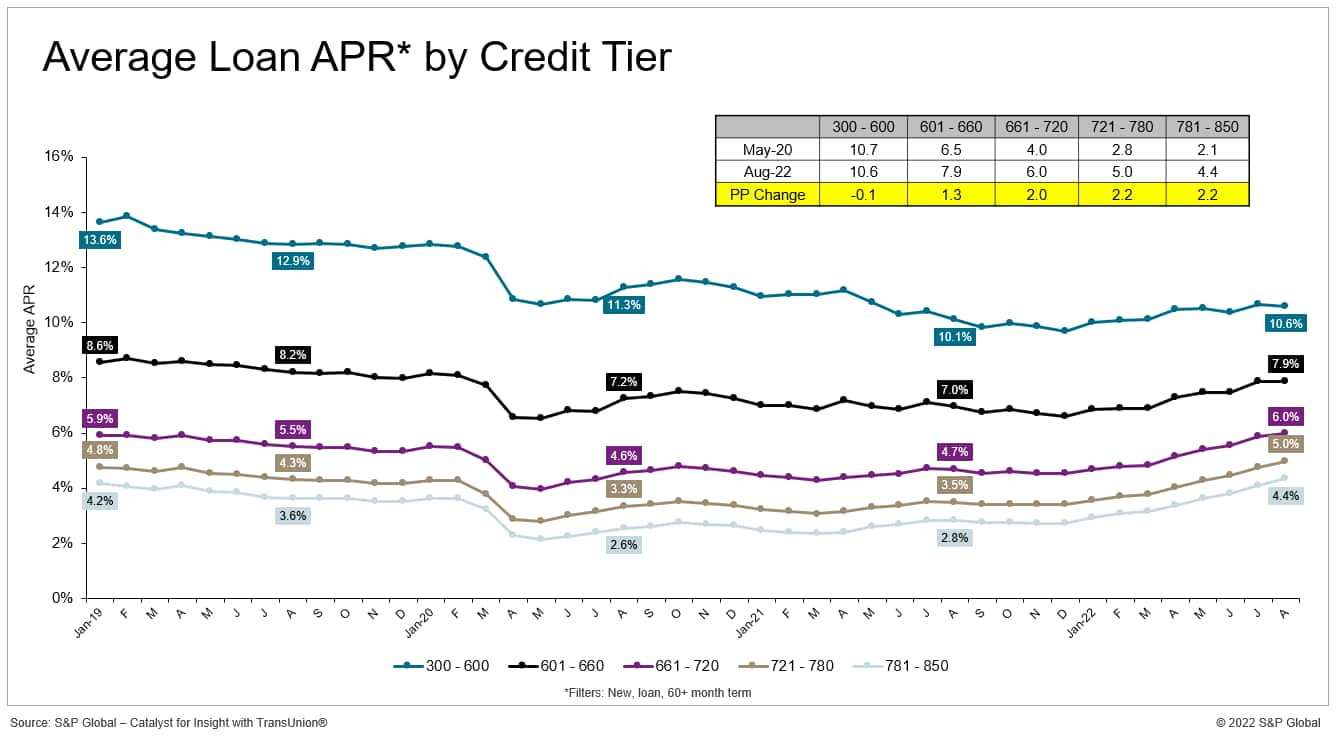

However, these rate increases have varied depending on the buyer's credit standing. While the most credit-worthy customers (781 - 850) have seen rates more than double from May 2020 to 4.4% this past August, households with the lowest credit scores (300-600) have actually seen a .1 PP rate decline to 10.6%. This lower tier of customers, though, still are paying a rate more than double that of the top tier.

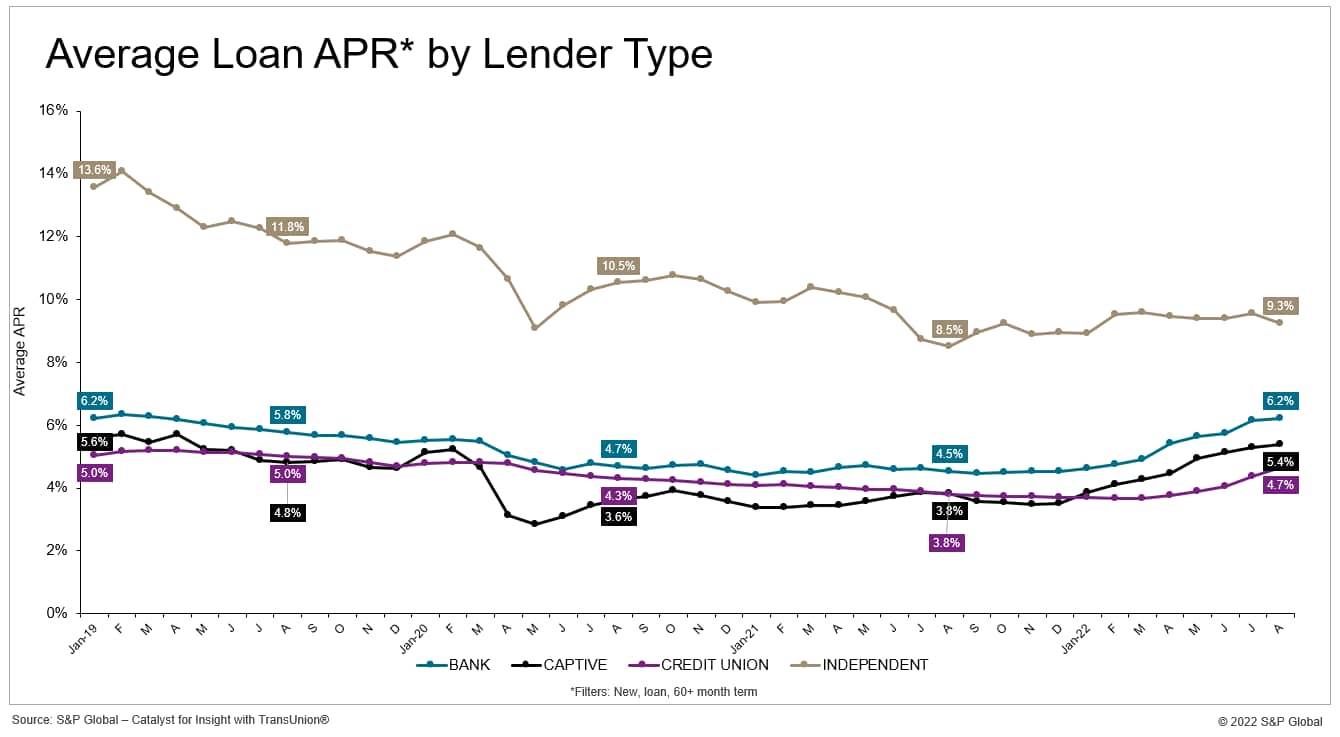

Auto loan rates also vary depending on the lender type. Independents (5% of the loan business August 2022 CYTD) consistently have been charging substantially higher rates than the other types, and independents' rates have been steady since early this year. Banks (32%) and captives (35%), on the other hand, have been raising rates since January.

Credit union (29%) rates, similar to bank and captive rates from January 2019 through the end of last year, have not risen this year in the same manner as bank and captive rates. As a result, credit unions now offer the lowest average rates in the industry, including 4.7% in August versus 5.4% for captives and 6.2% for banks. Without the need to focus on profits, credit unions can pass on any internal surpluses to their customers via lower rates. Many credit unions also do not pay federal taxes, another reason for their lower rates.

----------------------------------------------------------------------------------------------------

Top 10 Industry Trends Report

This automotive insight is part of our monthly Top 10 Industry Trends Report. The report findings are taken from new and used registration and loyalty data.

The October report is now available, incorporating August 2022 CFI and LAT data. To download the report, please click below.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.