Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 13, 2022

Containerized Trade Outlook by GTAS Forecasting – June 2022

Key Findings:

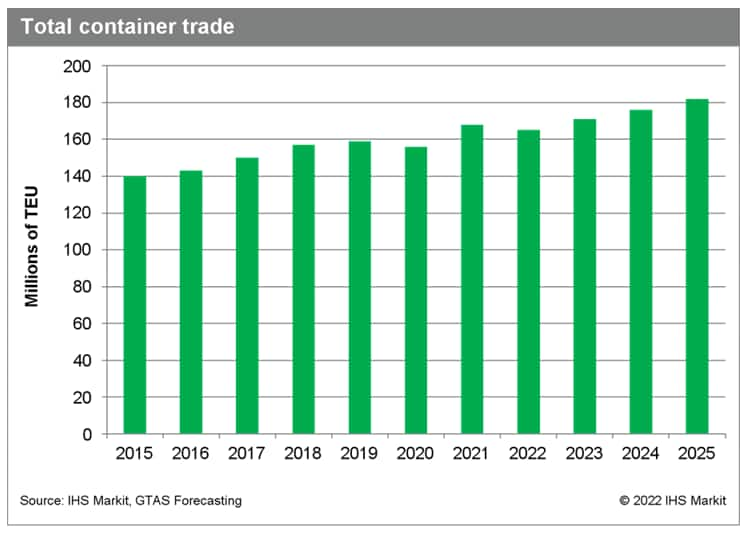

- Strong recovery in container trade during the year 2021; annual growth amounting to 7.9%

- Slowdown in containerized trade in the year 2022

- The global compound annual growth rate (CAGR) for containerized trade is projected to reach 3.2% in the medium-term (2022-25) and 2.9% in the long-term (2022-30)

- Russian invasion in Ukraine and lockdowns in mainland China causing disruptions to global supply chains and adding to ports congestion levels

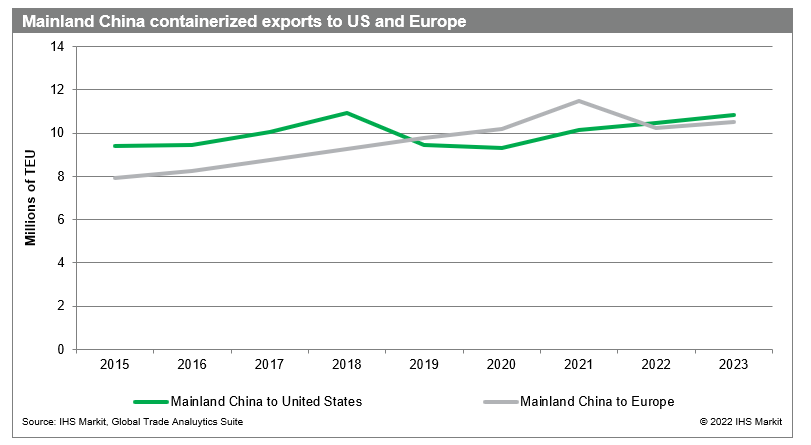

- US imports from China still high, while European imports estimated to fall by 11.1% in 2022

- Global container freight rates falling, but still around 50% higher than at the same time year ago

GTAS Forecasting Latest Estimations

GTAS Forecasting has noted a strong recovery in global container trade during the year 2021 with an annual growth amounting to 7.9%, and the volumes reaching 168.2 million TEU. The first and second quarters of 2021 marked significant increases by 12.8% and 20.6% y/y. Third quarter of 2021 has already brought a milder growth by 6.4% y/y, while in the last quarter of 2021, we have observed a decrease by 5.9% y/y according to GTAS Forecasting data.

For 2022, we are projecting 1.7% drop in containerized trade and the global compound annual growth rate (CAGR) is estimated to reach 3.2% in the medium term (2022-25) and 2.9% in the long term (2022-30).

* The detailed forecast results are available to our Global Trade Analytics Suites (GTAS) clients only on Connect platform. Contacts IHS Markit Customer Care Customer.Care@ihsmarkit.com for details.

Major Events Shaping Global Trade Flows In 2022

In the year 2022, the two major events shaping the global economy and the global trade flows are the Russian invasion in Ukraine and mainland China zero-COVID policy resulting in a number of restrictions around the country and a full lockdown introduced in one of the main global trade hubs and largest port city - Shanghai.

In 2021, we have seen supply chains disruptions and massive congestion in ports across North America, Asia, and North Europe because of the pandemic, introduced restrictions, production stoppages, and port closures. This year, the lockdown in Shanghai has already created additional challenges for global supply chains and most probably will put pressure on the ocean freight rates to remain at high levels.

Even though the ocean ports in Shanghai remained open during the lockdown, the manufacturers and warehouses were closed and overland logistics was disrupted, which led to the limited availability of goods. Thus, ports in Shanghai were operating at about 50% capacity, mainly due to the lack of goods, but also due to labour shortage. Consequentially, some shippers were shifting to alternate ports such as Ningbo, but in general, the major ocean carriers have canceled over 30% of their sailings out of Asia.

In 2021, European ports have been struggling with record levels of congestion, with very limited chances for relief in the short term, when Russian invasion on Ukraine came in play, making the situation even worse. At the beginning of March, we have seen a lot of cargo destined for Russia, floating on the water with no guarantee to reach its destination. The only chance for the goods to reach its final destination was to be transshipped in Northern European terminals, adding to the high level of congestion in the main European hubs.

On the other side, a number of hub ports and feeder operators have boycotted Russian cargo and the largest carriers, including Maersk, CMA-CGM, MSC, and Hapag-Lloyd suspended their bookings for cargo going to and from Russia. This came along with the long list of sanctions imposed on Russia since the start of the invasion in Ukraine.

Mainland China Containerized Exports To United States And Europe

From the point of view of the main containerized trade routes, the consequences of lockdown in mainland China will not hit transpacific volumes as badly, as East Asia to North Europe trade. We are still seeing factors driving the US demand before the peak holiday season to avoid delays experienced last year as well as to avoid possible slowdowns at West Coast ports in July due to labour shortage as an important dockworker labor contract will expire at the time. US containerized imports from China are projected to grow 3.3% y/y in 2022 in line with latest GTAS Forecasting release.

The Asia-Europe trade will be affected more severely by the cancellation of sailings. We are also seeing a decrease in European demand for goods due to inflation, still very high transportation costs, and signs of changing consumer pattern from goods to services. Thus, according to GTAS Forecasting estimations, mainland China containerized exports to Europe will decrease by 11.1% y/y.

Container Freight Rates Falling But Still Around 50% Higher Than Last Year

Due to the disruptions in manufacturing and lack of available goods for export, Asia-U.S. West Coast container freight rates continue to fall, reaching $10,762/FEU on 1 June, which is over 30% lower than before the lockdown in March 2022. Still, the prices are 33% higher than at the same time year ago.

When it comes to Asia-North European container rates, the prices have decreased by more than 20% since late January 2022, reaching $10,579/FEU on 1 June, even though the congestion in main European hubs is getting worse.

The global container freight rates are also falling, reaching $7,851 per FEU on May 28. This is still 52% higher than at the same time year ago, according to Freightos data, published weekly on our JOC.com data platform.

Middle-term projections for container trade (2022-2025)

The GTAS Forecasting projections have been adjusted to account for the impact of Russia-Ukraine conflict as well as the consequences of mainland China lockdowns for global trade flows.

This column is based on S&P Global Market Intelligence GTAS data. The full version of the article is available for our clients on Connect platform. For more details about GTAS, please visit the product page.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcontainerized-trade-outlook-by-gtas-forecasting-june-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcontainerized-trade-outlook-by-gtas-forecasting-june-2022.html&text=Containerized+Trade+Outlook+by+GTAS+Forecasting+%e2%80%93+June+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcontainerized-trade-outlook-by-gtas-forecasting-june-2022.html","enabled":true},{"name":"email","url":"?subject=Containerized Trade Outlook by GTAS Forecasting – June 2022 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcontainerized-trade-outlook-by-gtas-forecasting-june-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Containerized+Trade+Outlook+by+GTAS+Forecasting+%e2%80%93+June+2022+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcontainerized-trade-outlook-by-gtas-forecasting-june-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}