Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 07, 2022

China slowdown vs. opportunities for South Asia and ASEAN countries

The most recent data for mainland China by S&P Global Market Intelligence, Global Trade Analytics Suite show that after a positive trend in year-on-year growth for exports in June and July 2022 (17.7% and 17.8% increase, respectively), we can observe a significant slowdown in mainland China exports in August (7.0% growth y/y) and September (5.6% y/y). When it comes to imports, after limited, but still positive growth by 1.5% and 2.5% in June and July 2022, August and September 2022 brought negative growth rates amounting to -0.2% y/y and -0.4% y/y, respectively.

As foreign investors are struggling with Chinese strict COVID restrictions and lockdowns, they are likely to seek alternatives for their business operations. Instead of relying just on China, investors will look for additional locations and here is the room for ASEAN or South Asian economies to step in.

Their COVID policies have been totally different than that of mainland China. Opening borders for tourists has already brought stimulus to economic growth for Thailand and Malaysia, whose economies rely heavily on tourism sector.

ASEAN region as well as South Asian nations, especially Vietnam, Indonesia, Philippines or Bangladesh, are perceived as the largest beneficiaries of mainland China slowdown, attracting investors with their friendly policies, young, large workforce, strategic localization on main trade lanes and stabilizing COVID situation with very limited restrictions or even full reopening of economies.

When it comes to Indonesia, merchandise exports will drive real export growth in 2022. Commodities responsible for that are coal (worldwide) and palm oil (mainly Europe and North America). Indonesia is also the world's largest nickel miner, but most of Indonesia's nickel output is currently a low-purity type used for stainless steel. The country's government and the mining sector are working on transformation of its nickel industry to produce and export the high quality (Class 1) nickel, a crucial component for electric vehicle batteries.

The economy of Philippines has lost track during second quarter of 2022, however, with COVID situation stabilizing, relaxation of travel conditions and opening the borders, we should see a recovery in the tourism sector. The government has also pledged for a full reopening of the economy to support further recovery of the country.

Moreover, the U.S. government, under the Indo Pacific Economic Framework (IPEF) initiative, assured that high quality investments will be made to support semiconductor and nickel sectors in Philippines, as the country is one of the main producers of nickel - mineral used for producing electronic devices and batteries.

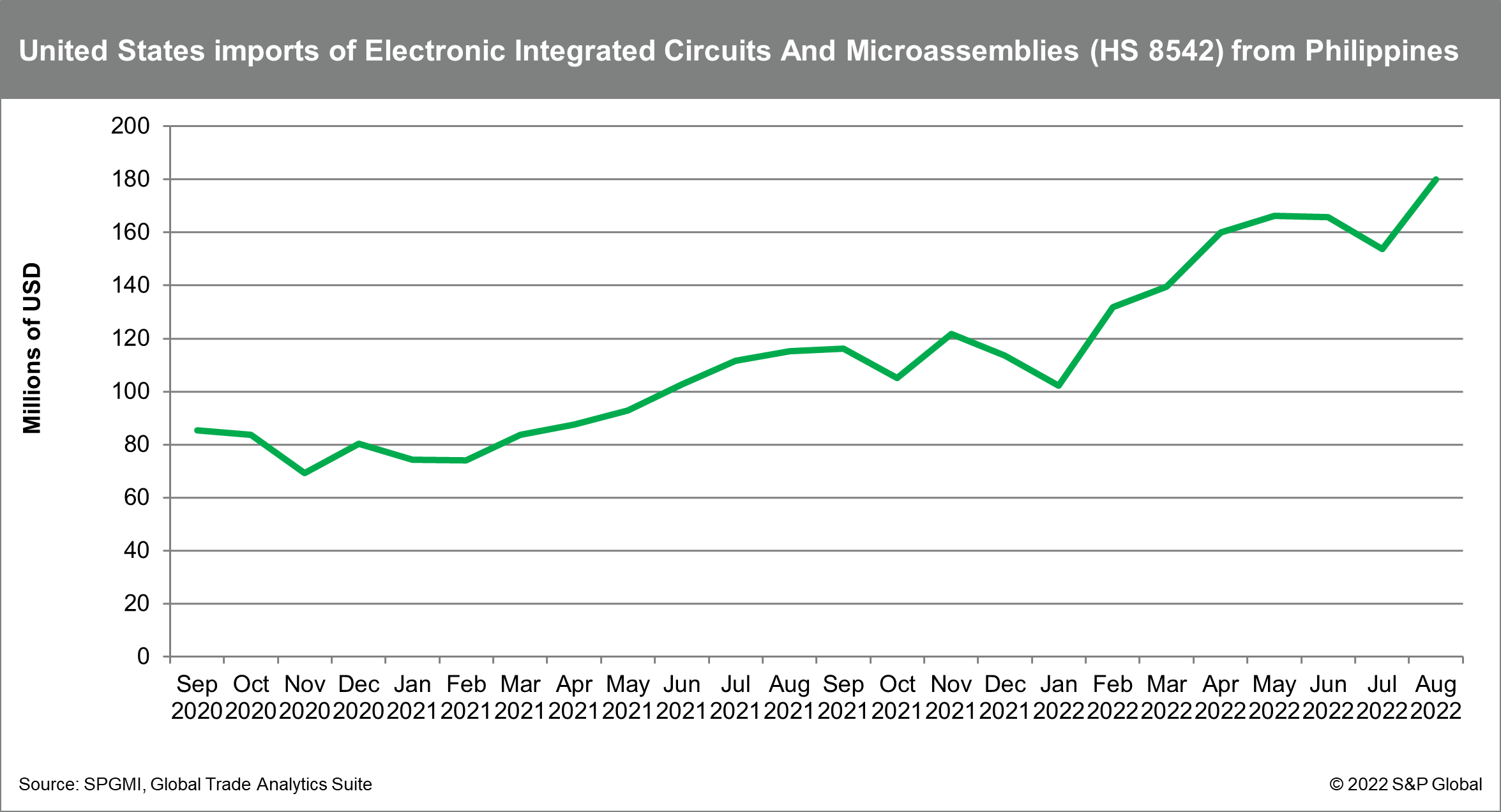

As shown on the chart below United States are already increasing their imports of electronic integrated circuits and micro assemblies from Philippines in recent months. In August 2022 U.S. imports of these goods from Philippines amounted to 180 million USD.

Some companies moving their operations away from China are seeing Vietnam as the most beneficial location for their business.

In third quarter 2022, we have seen a strong rebound in manufacturing production in Vietnam in the aftermath of improving COVID situation in the country. Exports continued to perform very well, remaining more resilient to the supply chain disruptions than earlier. This year U.S. imports from Vietnam year-on-year growth rates were oscillating around 30% or even 40 % (43.1% in June 2022) each month, except for February.

Vietnam's commercial opportunities are gaining interest especially among U.S. investors, making U.S. the largest export market for Vietnam, with exports worth over USD 100 billion in 2021.

Overall, Vietnam is emerging as a main beneficiary of China slowdown, and according to GTAS Forecasting, we can expect the compound annual growth rate (CAGR) for Vietnam exports for the years 2022-2025 to reach 4.2%.

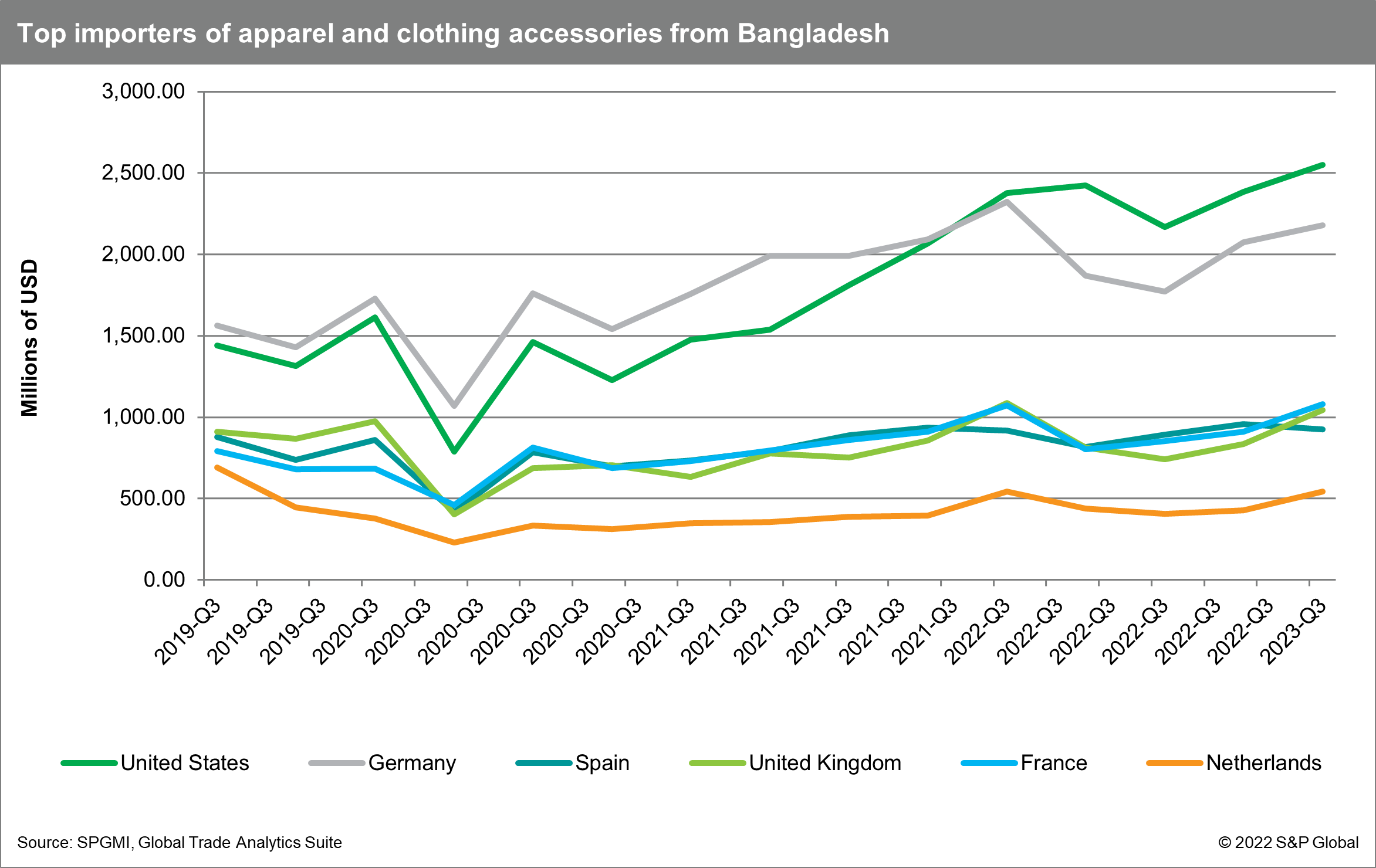

Bangladesh is second world apparel and clothing accessories exporter after mainland China and the value of trade with its main trading partners is increasing. GTAS Forecasting projects total exports from Bangladesh to increase 9.3% year on year in 2022. Much of this growth is driven by the apparel and clothing accessories (HS chapter codes 61 and 62) exports, which are estimated to reach 48 billion USD in 2022. The country's apparel and clothing accessories exports increased nearly 25% year-over-year in 2021 and are expected to grow 12% in 2022.

The Government of Bangladesh is actively supporting foreign investments and despite significant economic headwinds it is likely that the country will make use of its strategic location, large workforce and a vibrant private sector, attracting foreign investors and gaining importance among South Asian countries.

There is no doubt that mainland China is still the global exports superpower, but current constraints deriving from very strict COVID policy as well as Xi Jinping's economic policies to large extent responsible for the slowdown and scaring away foreign investors, might impact the global trade patterns in the long-term.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-slowdown-vs-opportunities-for-south-asia-and-asean-count.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-slowdown-vs-opportunities-for-south-asia-and-asean-count.html&text=China+slowdown+vs.+opportunities+for+South+Asia+and+ASEAN+countries+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-slowdown-vs-opportunities-for-south-asia-and-asean-count.html","enabled":true},{"name":"email","url":"?subject=China slowdown vs. opportunities for South Asia and ASEAN countries | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-slowdown-vs-opportunities-for-south-asia-and-asean-count.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+slowdown+vs.+opportunities+for+South+Asia+and+ASEAN+countries+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-slowdown-vs-opportunities-for-south-asia-and-asean-count.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}