Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 07, 2021

Change of seasons

Research Signals - August 2021

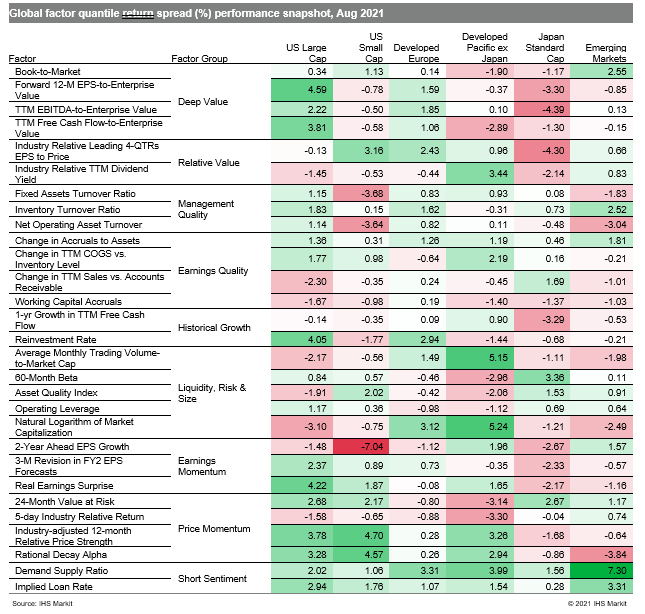

As the summer months come to a close in the northern hemisphere, investors geared up for the change of seasons by repositioning some factor exposures (Table 1) while pushing stocks higher in several major regional markets. US benchmarks led the way on the back of a strong earnings season; however, rising delta variant cases, in light of the upcoming flu season, raises some concerns that winds will change in the global economic recovery. Indeed, the upturn in the global manufacturing sector lost further momentum during August as supply chain disruptions drove up purchasing costs, feeding into higher selling prices and constraining output growth in several major markets including the US and eurozone, while markets in Asia, on average, slipped into contraction, according to the J.P.Morgan Global Manufacturing PMI.

- US: Top performing factors among large caps saw an uncommon pairing of Deep Value and Price Momentum measures, as demonstrated by outperformance of Forward 12-M EPS-to-Enterprise Value and Industry-adjusted 12-month Relative Price Strength, respectively

- Developed Europe: Earnings Momentum and Short Sentiment measures such as 3-M Revision in FY2 EPS Forecasts and Demand Supply Ratio, respectively, outperformed in August

- Developed Pacific: Low risk shares, captured by 60-Month Beta, were favored in Japan, while high dividend payers, gauged by Industry Relative TTM Dividend Yield, were sought after in markets outside Japan

- Emerging markets: Following two months of outperformance, Price Momentum measures including Rational Decay Alpha moved to the bottom extreme of factor performance last month

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchange-of-seasons.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchange-of-seasons.html&text=Change+of+seasons+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchange-of-seasons.html","enabled":true},{"name":"email","url":"?subject=Change of seasons | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchange-of-seasons.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Change+of+seasons+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchange-of-seasons.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}