Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 15, 2022

Bargain shoppers accelerate US retail inventory shift

Discount retailers in the US are expanding their distribution

networks under the strain of inventory that is shifting from

higher-end stores to bargain outlets. That shift will eventually

free up scarce warehousing space and improve supply chain fluidity,

but the process could last well into 2023, retailers say.

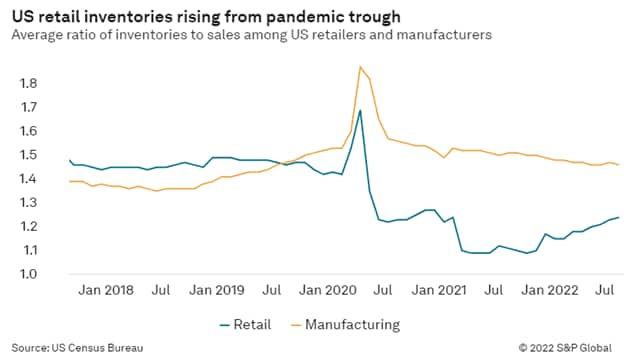

US inventory and sales data released by the US Census Bureau

Thursday shows goods are moving faster through supply chains and

stores, but that overall stockpiles are still stuck at elevated

levels.

Ollie's Bargain Outlet — a discount retailer with nearly 470

stores in the US — plans to expand its distribution facility in

York, Pennsylvania, and open a fourth distribution center in the

Midwest in the first half of 2023 to meet continued high consumer

demand for lower prices amid high inflation.

"We have agreed to purchase land in Princeton, Illinois," for a new

distribution hub, John Swygert, Ollie's president and CEO, said

during an earnings call last week. Combined with the expansion in

Pennsylvania, "our distribution center network will be able to

support over 700 stores," he said.

That's a sign of how much business Ollie's believes it stands to

gain as inflation-battered consumers search for bargains. Although

the rate of inflation is slowing, it is still far above the 2

percent target set by the US Federal Reserve. The October consumer

price index was up 7.7 percent year over year.

Squeeze the inventory balloon at one end of the market, and goods

rush to the other end, driving greater growth in stores,

warehouses, and distribution facilities among discounters.

The expanding distribution footprint in the bargain retail sector

is the latest consequence of the inventory buildup that began early

this year as shippers shifted large amounts of imports to the first

half, hoping to avoid the supply chain disruption and stockouts

they suffered in 2021.

Inventories rise, but move faster

The inventory and sales data released by the Census Bureau Thursday

showed retailers are struggling to reduce inventories, as measured

by dollar value. Total business inventories, unadjusted for

seasonality, rose 1.7 percent in October from September, and were

up 16.4 percent from October 2021.

There were some significant changes in specific retail sectors that

indicate goods are moving off shelves at a faster pace. The

inventory-to-sales ratio at general merchandise stores stayed

between 1.56 and 1.58 from May through August, then dropped to 1.49

in September and 1.45 in October.

Furniture, home furnishings, electronics, and appliance stores had

a ratio of 1.58 in October, compared with 1.71 in July and 1.65 in

February 2019. Those stores hit a low ratio of 1.25 in January 2021

and were only back to 1.33 in September 2021. The inventory

acceleration in 2022 is clear in the Census Bureau data.

A lower inventory-to-sales ratio means goods are moving more

rapidly, creating, in theory, greater need for replenishment. The

overall US retail inventory-to-sales ratio dropped from 1.25 in

September to 1.22 in October, exactly where it was in July 2020 in

the immediate aftermath of the COVID-19 recession.

Inventories remain far above year-ago levels, however, which is why

retailers need more warehousing and distribution space and time to

clear their shelves. "We see inventory returning to normalized

levels by the end of the spring/summer 2023 season," Jerome

Griffith, CEO of Land's End, said earlier this month.

Ollie's increased its inventory 11 percent year over year in the

third quarter to $524 million, thanks in part to an increased

number of stores, the timing of deliveries, and higher supply chain

costs. Pressure on transportation costs "continues to ease,"

Swygert told investment analysts.

Ollie's is seeing "good activity" in flooring, automotive, lawn and

garden, domestics, and housewares, Swygert said. "We think we're

going to continue to see momentum," he said. "With the overall

inventory challenges that people are facing, a lot of goods are

sitting in warehouses."

Subscribe now or sign up for a

free trial to the Journal of

Commerce and gain access to breaking industry news, in-depth

analysis, and actionable data for container shipping and

international supply chain professionals.

Sign-up to Maritime Trade & Supply Chain

monthly newsletter.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbargain-shoppers-accelerate-us-retail-inventory-shift.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbargain-shoppers-accelerate-us-retail-inventory-shift.html&text=Bargain+shoppers+accelerate+US+retail+inventory+shift+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbargain-shoppers-accelerate-us-retail-inventory-shift.html","enabled":true},{"name":"email","url":"?subject=Bargain shoppers accelerate US retail inventory shift | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbargain-shoppers-accelerate-us-retail-inventory-shift.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bargain+shoppers+accelerate+US+retail+inventory+shift+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbargain-shoppers-accelerate-us-retail-inventory-shift.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}