Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

May 02, 2019

Banking sector dividends keep growing

U.S. and Brazilian banks to carry forward dividend gains in FY19 despite declining sector profits

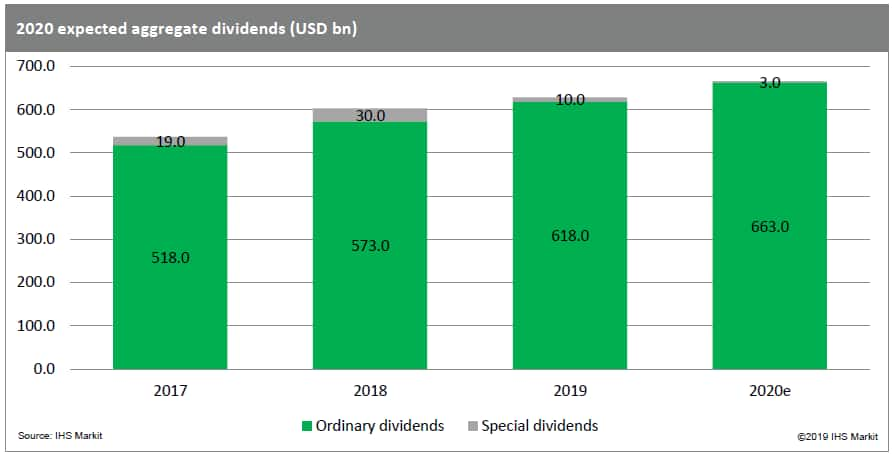

• We expect bank dividends to outperform other sectors as deregulation of the sector continues unabetted

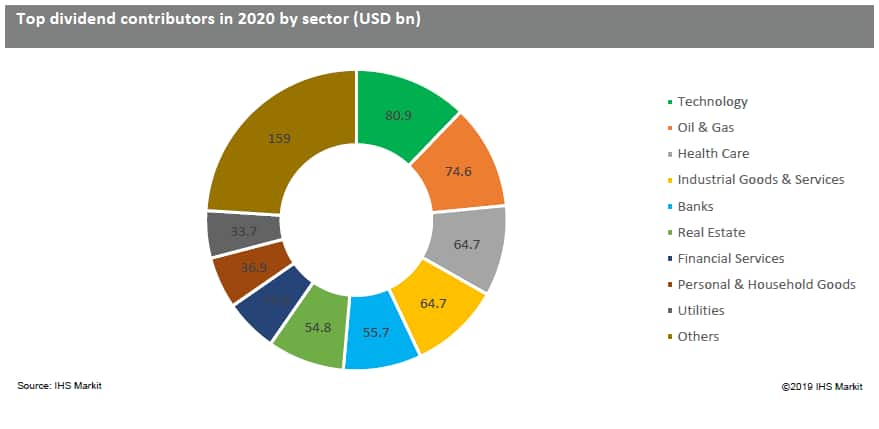

• We are forecasting that U.S. banks will account for 17% of the aggregate global payout from the sector, or $51.2bn

• The combined annual dividend distribution of Brazil's four largest banks is expected to grow 16% to over R$35.4bn in FY19

We examine dividends from banks in the US and Brazil to compare our outlook at either end of the continent. Broad U.S. macroeconomic data indicates the Federal Reserve will take a more dovish stance towards interest rate hikes this year. With this new base case of no rate hikes in FY19 or FY20, net interest margin (NIM) is kept relatively flat through FY21. Furthermore, our economists' projections for a slowdown in GDP to the ~1.5% area. While political and economic uncertainty in Brazil continue to incite nervousness amongst investors, we find that the largest banks continue to deliver positive results, thus positioning their dividends for sustainable growth.

Banking Sector Outlook

Taking into consideration the volatile market conditions in FY18 2H and slightly lower average assets under management at investment managers, gross profits for the U.S. banking and market administration is expected to decline 2.5% in FY19, remarkably different from the rest of the world. Globally, the CAGR for the sector is projected to arrive around ~2.4% in FY19. According to projections from our Economics and Country Risk, U.S. banks represent approximately 75% of the market share in the North American region and 16% worldwide.

Neutral and downside economic risks for U.S banks include: an economic recession in the next two years, mounting deposit betas as the Federal Reserve shrinks its balance sheet, falling mortgage originations and lower home prices. On the other hand, there is upside potential for wider net interest margin, better than expected expense ratio improvement as banks invest in their mobile applications, higher loan growth, stronger capital return and a mollified regulatory environment. Consequently, we expect over 51% of U.S. firms will see dividend increases.

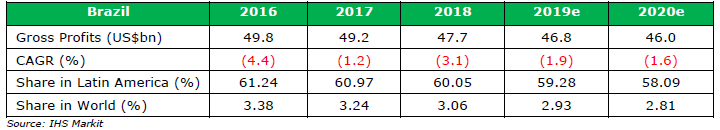

Regarding Brazil, the gross profit for banking and market administration is projected to shrink by 1.9% in 2019. However, the four largest Brazilian banks have exhibited sustainable earnings amidst political and economic instability. These banks now see multiple drivers for FY'19 growth, due to better prospects in the Brazilian economy. As such, we believe these banks are poised for substantial dividend growth buoyed by pick-up in lending and decrease in loan losses.

To access the report please contact dividendsupport@ihsmarkit.com

Dominique DeRubeis Sr. Product Analysis and Design Analyst

Roberto Soares Sr. Research Analyst

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-sector-dividends-keep-growing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-sector-dividends-keep-growing.html&text=Banking+sector+dividends+keep+growing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-sector-dividends-keep-growing.html","enabled":true},{"name":"email","url":"?subject=Banking sector dividends keep growing | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-sector-dividends-keep-growing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+sector+dividends+keep+growing+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-sector-dividends-keep-growing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}