Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 21, 2021

Australian agribulk exports in 4Q21 forecast 42% higher year-on-year on bumper harvest

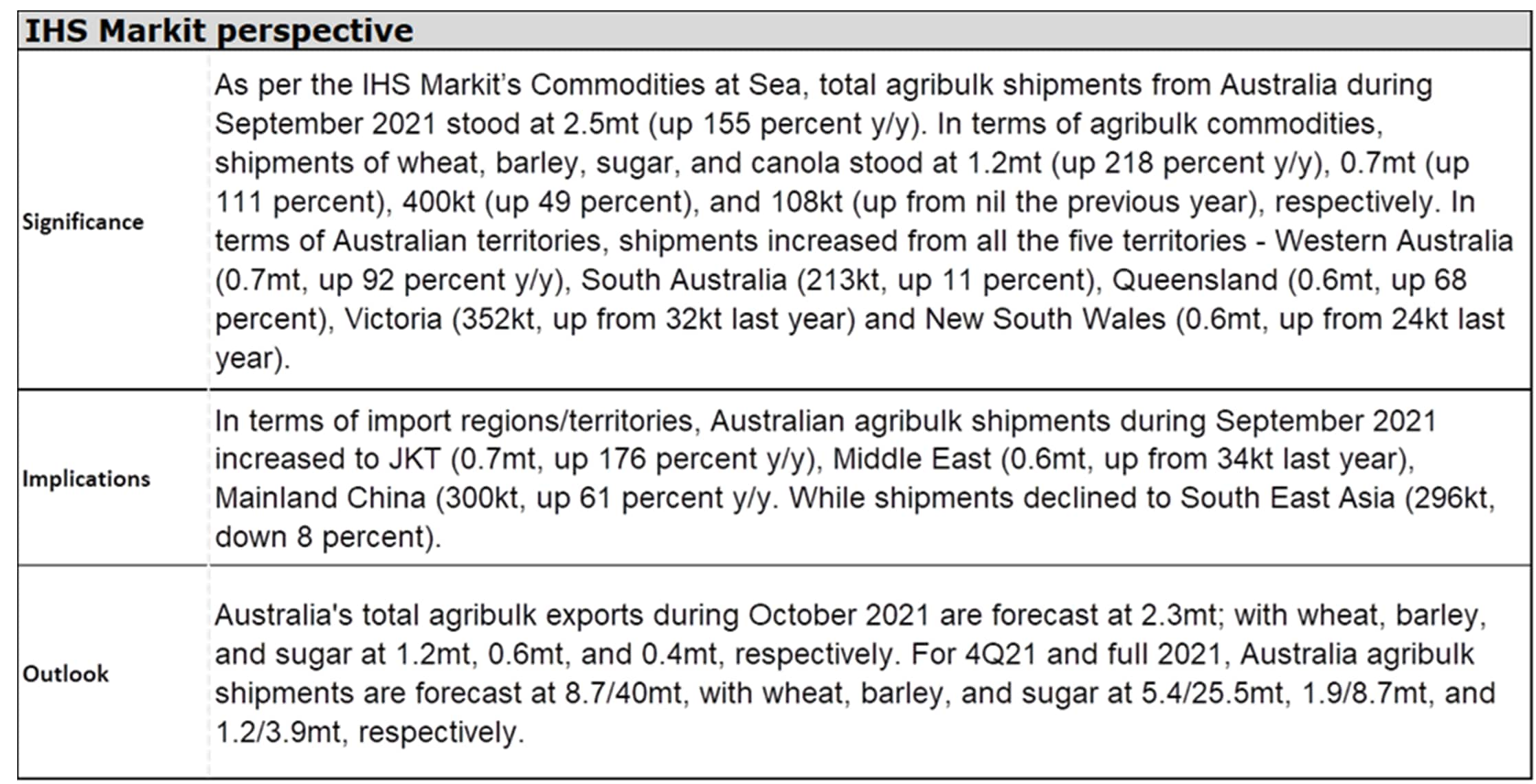

As per the IHS Markit's Commodities at Sea, total agribulk shipments from Australia during September 2021 stood at 2.5mt (up 155 percent year-on-year (y/y)). In terms of agribulk commodities, shipments of wheat, barley, sugar, and canola stood at 1.2mt (up 218 percent y/y), 0.7mt (up 111 percent), 400kt (up 49 percent), and 108kt (up from nil the previous year), respectively.

In terms of Australian territories, shipments increased from all the five territories - Western Australia (0.7mt, up 92 percent y/y), South Australia (213kt, up 11 percent), Queensland (0.6mt, up 68 percent), Victoria (352kt, up from 32kt last year) and New South Wales (0.6mt, up from 24kt last year).

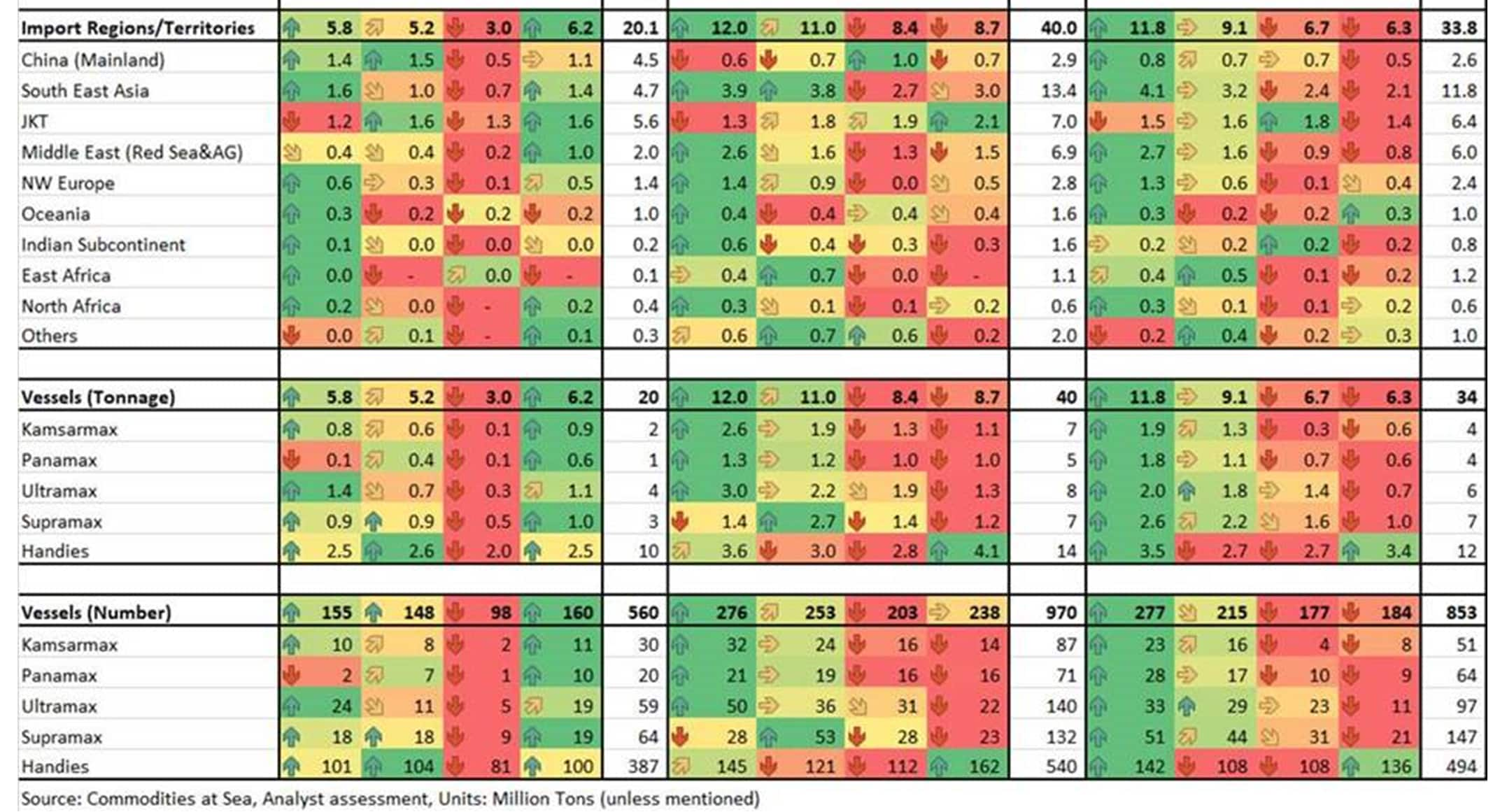

In terms of import regions/territories, Australian agribulk shipments during September 2021 increased to JKT (0.7mt, up 176 percent y/y), Middle East (0.6mt, up from 34kt last year), Mainland China (300kt, up 61 percent y/y. While shipments declined to South East Asia (296kt, down 8 percent).

In terms of vessel segments, during September 2021, shipments increased on Kamsarmax 333kt (up from nil last year), Panamax (431kt, up from 75kt last year), Ultramax (523kt, up from 37kt last year), Supramax (347kt, up 221 percent); while no shipments were seen on Handies (versus 752kt last year).

In the first nine months of 2021, total agribulk shipments from Australia stood at 31.3mt (up 125 percent y/y), with wheat at 20.2mt (up 174 percent), barley at 6.8mt (up 92 percent), sugar (2.8mt, down 2 percent), and canola at 1.3mt (up 433 percent). The growth in agribulk exports is due to recovery in crop production after facing drought conditions in the last couple of years.

In terms of Australian territories, during 9M21, agribulk shipments increased from all the five territories - Western Australia (11.6mt, up 61 percent y/y), South Australia (6.0mt, 119 percent), Queensland (4.2mt, up 39 percent), Victoria (4.4mt, up 577 percent) and New South Wales (5.1mt, from just 316kt a year ago).

In terms of import regions/territories, Australian agribulk shipments during the 9M21 increased to South East Asia (10.4mt, up 216 percent y/y), Middle East (5.4mt, up 474 percent), JKT (4.9mt, up 22 percent), and NW Europe (2.3mt, up 143 percent); while declined to Mainland China (2.3mt, down 31 percent).

In terms of vessel segments, agribulk shipments during the 9M21 period increased across all vessel sizes - on Kamsarmaxes (5.8mt, up from 1.5mt over 9M20), Panamax (3.6mt, up from 0.6mt), Ultramax (7.0mt, up from 2.4mt), Supramax (5.5mt, up from 2.3mt) and Handies (8.6mt, up from 7.2mt).

Short-Medium term outlook

USDA's October WASDE report has the Australian wheat production forecast for 2021/22 has been kept at the previous month estimate of 31.5mt, which will be the third-largest wheat crop on record. The wheat export forecast is raised to 23.5mt against 23mt seen in the previous month.

As per the ABARES September 2021 Crop Report, winter crop production in 2021-22 is projected to be above the average level. The planted area for the winter crop is estimated to reach record highs and average yields are forecast to be above long-term averages in every state, though below the levels achieved in 2020-21. Forecast yields are more than 20 percent above 10-year averages to 2020-21 in New South Wales, Western Australia, and Queensland and around 10 percent higher in Victoria and South Australia. Winter crop production is projected to fall by 2 percent in 2021-22 to 54.8mt, 32 percent above the 10-year average.

For the major winter crops in 2021-22, wheat production is forecast to fall by 2 percent to 32.6mt. The average yield is forecast to fall by 3 percent and the area planted is estimated to have increased by 1 percent. Production of barley is forecast to fall by 5 percent to 12.5mt. The average yield is forecast to fall by 3 percent and the area planted is estimated to have fallen by 2 percent. Production of canola is forecast to increase by 11 percent to a record high of over 5mt. Area planted to canola is estimated to have increased 24 percent to reach the third-highest on record of just over 3 million hectares, boosted by producers responding to favorable world prices and excellent planting conditions in Western Australia and New South Wales. The average yield is forecast to fall by 10 percent from the record high of last season. The estimate of last season's canola production has also been revised upwards by around 500kt. This revision comes as canola exports in New South Wales and Victoria point to higher production than previously estimated.

According to the latest three-month climate outlook (November to January), issued by the Bureau of Meteorology on 21 October 2021, November to January rainfall is likely to be above median for the eastern half of Australia, though below normal in western Tasmania. Maximum temperatures for November to January are likely to be above median for much of the northern half of Australia and Tasmania. Below median daytime temperatures are likely for eastern NSW. Above median minimum temperatures for November to January are very likely for almost all of Australia, with roughly equal chances of warmer or cooler than median nights for south-east WA and south-west SA. The El Niño-Southern Oscillation is neutral, with cooling of the tropical Pacific towards La Niña levels likely in the coming months. This may be increasing the chances of above-average rainfall for much of eastern Australia. The Indian Ocean Dipole is expected to return to neutral in November.

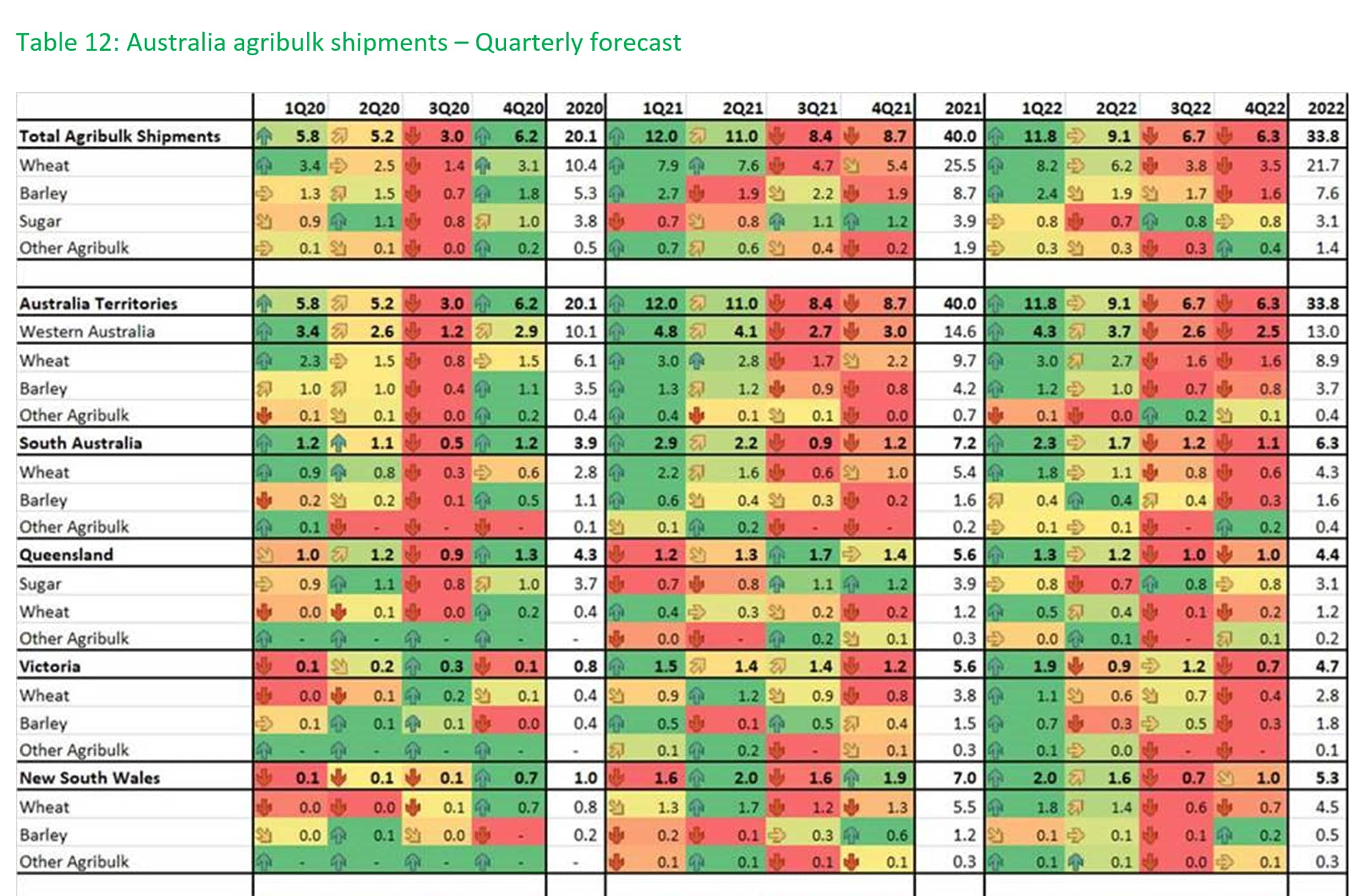

Australia's total agribulk exports during October 2021 are forecast at 2.3mt; with wheat, barley, and sugar at 1.2mt, 0.6mt, and 0.4mt, respectively. For 4Q21 and full 2021, Australia agribulk shipments are forecast at 8.7/40mt, with wheat, barley, and sugar at 5.4/25.5mt, 1.9/8.7mt, and 1.2/3.9mt, respectively.

For more insight subscribe to our complimentary commodity analytics newsletter

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralian-agribulk-exports-in-4q21-forecast-42-higher-yearony.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralian-agribulk-exports-in-4q21-forecast-42-higher-yearony.html&text=Australian+agribulk+exports+in+4Q21+forecast+42%25+higher+year-on-year+on+bumper+harvest+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralian-agribulk-exports-in-4q21-forecast-42-higher-yearony.html","enabled":true},{"name":"email","url":"?subject=Australian agribulk exports in 4Q21 forecast 42% higher year-on-year on bumper harvest | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralian-agribulk-exports-in-4q21-forecast-42-higher-yearony.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australian+agribulk+exports+in+4Q21+forecast+42%25+higher+year-on-year+on+bumper+harvest+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralian-agribulk-exports-in-4q21-forecast-42-higher-yearony.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}