Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 03, 2021

A new strain on markets

Research Signals - November 2021

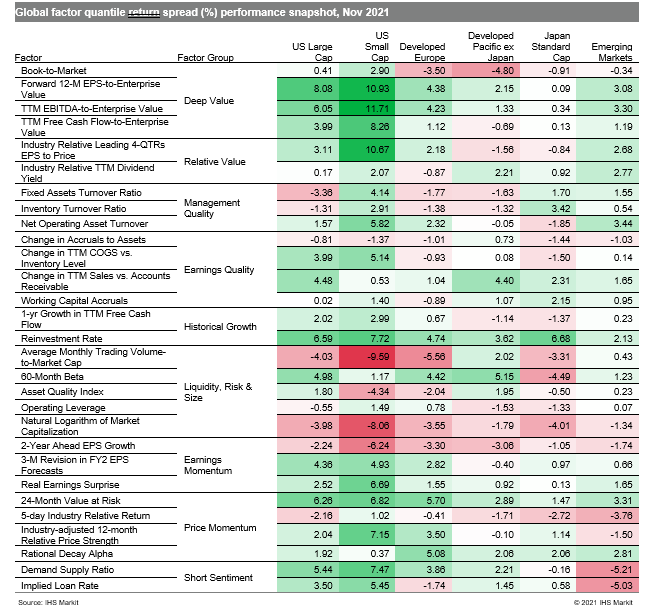

Volatility returned to the several regional equity markets as investors weighed the economic risks posed by the new omicron strain of the COVID-19 virus. Furthermore, price and supply shortage measures remain close to recent highs, according to the J.P.Morgan Global Manufacturing PMI report, amid sharp increases in vendor delivery times given the continued severe strain on global supply chains. In turn, factor performance in November (Table 1) reflects variants across regions as investors await potential changes to the timing of the US Federal Reserve's tapering of bond purchases and pace of interest rate hikes.

- US: Deep Value measures, such as Forward 12-M EPS-to-Enterprise Value, which were strongly favored among small caps in October, gained traction among large caps as well last month

- Developed Europe: High momentum stocks measured by Rational Decay Alpha extended October's outperformance into November

- Developed Pacific: Reinvestment Rate was a strong performer in Japan, while Book-to-Market performance was particularly weak in markets outside Japan

- Emerging markets: Deep Value measures such as TTM EBITDA-to-Enterprise Value continued to be rewarded last month

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-new-strain-on-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-new-strain-on-markets.html&text=A+new+strain+on+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-new-strain-on-markets.html","enabled":true},{"name":"email","url":"?subject=A new strain on markets | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-new-strain-on-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=A+new+strain+on+markets+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-new-strain-on-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}