US securities lending revenues see rebound

A resurgence in equities balance has seen US securities lending pickup pace over the last seven months. We reveal the factors driving this trend.

- Equity balances are up by 20% year to date which, along with an increased demand for specials, has seen the aggregate revenues rise by over 3%

- ETFs and ADRs saw large surges in revenue

- Fixed income driving much of the increased revenue as the asset class has seen a 12.6% jump in revenue

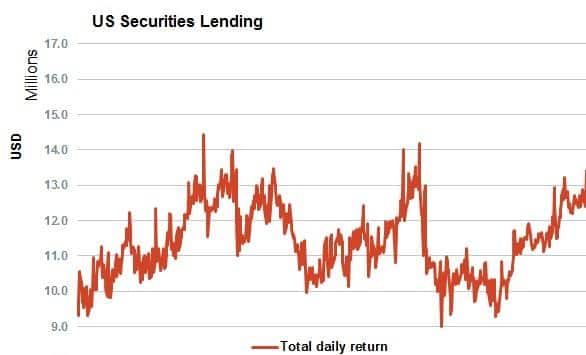

After failing to keep up pace with a rising markets, the US securities lending market looks to have regained some of the ground lost over the last couple of years. Year to date, revenues generated by lending out US assets, which include both corporate and government bonds and equity products such as ADRs and ETFs, are up by 8.9% from the same period a year ago. The aggregate revenue generated by lending out all asset classes comes in just shy of $1.85bn which puts it roughly in line with total seen in 2012.

Helping this drive in revenue has been the fact that fees generated by loan transactions have proven resilient over the last seven months, something which was not seen last year when a flood of new inventory saw the weighted average fee commanded by US stock loan assets fall to all-time low levels in the second half of last year. Interestingly, this surge in fees was seen in spite of the fact that the aggregate value of assets in lending programs, which many fingered as the cause for last years’ collapsing fees, continued its relentless climb to all-time high levels.

Equities drive the rebound

The lion’s share of the extra $151m generated by lending out US securities has come from equities products which have generated just under $90m more revenue over the last seven months than over the previous period last year.

Surprisingly, the majority of the extra revenue generated by loans against equities was generated by lending out non-conventional assets such as ETFs and ADRs. The two assets classes saw a strong demand to borrow as well as resilient fees to post a 37% and 47% jump in revenue since the start of the year.

While conventional equities didn’t see as strong a rise as the rest of the market, the asset class did see a 3% lift in revenue. While this number may seem disappointing at first glance, there are encouraging signs in the fact that lenders seem to be able to command better fees for their loans than they did in the second half of last year. These resilient fees have been seen despite the fact that equity inventories have continued to ever climbing new highs.

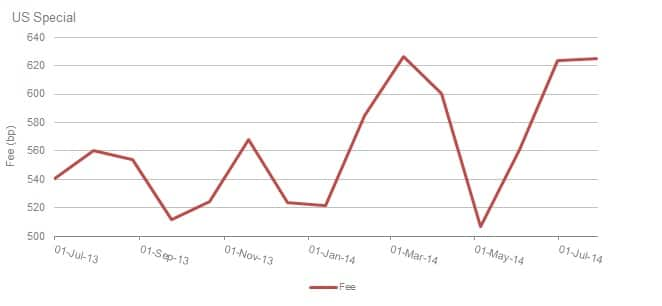

Specials proving resilient

The improving fee picture is also seen in the fee commanded by specials as the weighted average fee of loans for companies whose fee is higher than 1% has jumped from 540 basis points a year ago to 625 as of latest count.

As for the shares making up this high demand group, we continue to see the biotech heavy healthcare systems top the list of specials shares, as the sector makes up just over a quarter of all specials. The likes of Inovio Pharmaceuticals and Organovo are currently amongst the shares commanding the highest fee.

Energy shares also continue to make popular shorts as these shares make up a fifth of all US specials.

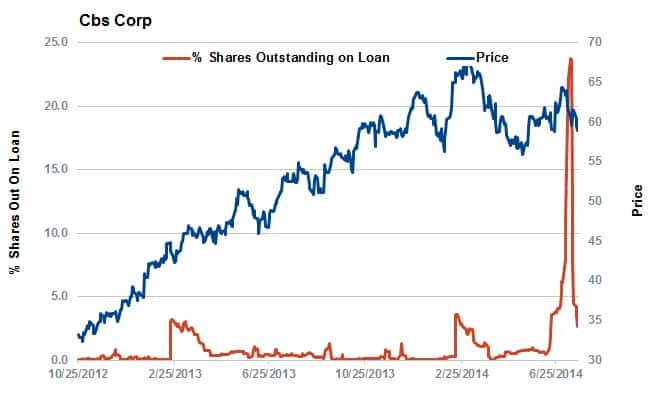

Not all special stories are directionally driven however as demonstrated by the recent CBS spin-off which proved a boon to the industry and lifted the group returns over the last couple of weeks.

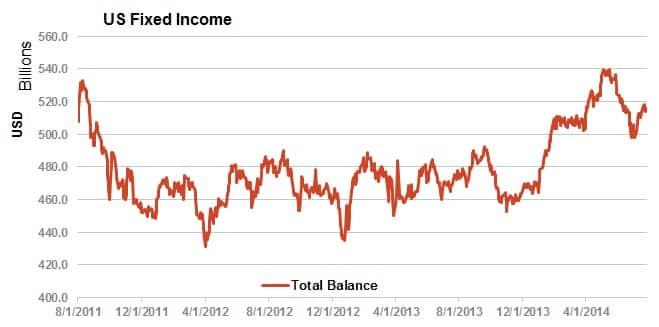

Fixed income also resilient

Fixed income also contributed their share to the bumper revenue figures as the aggregate revenue generated by both corporate and government bonds jumped by 12.6% in the last seven months. This jump in revenue was driven by both a jump in aggregate balances and an improving fee picture.

Unlike their equity peers, fixed income assets did not experience a slump in fees last year so revenues have proven steady over the last three year.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.