European luxury dividends keep their shine

European luxury firms are defying global headwinds and mounting bearish investor sentiment and raising their dividends.

- Ordinary dividends across the 15 largest European luxury stocks set to grow by 9% in FY 2016

- Nine of the sector's active dividend payers set to increase payments in the current fiscal year

- Dividend moths beware; the four highest yielding names in the sector see heavy short interest

The European luxury sector has had a torrid time in the last couple of years as the ongoing Chinese corruption crackdown and growth woes in emerging markets dented demand for luxury wares in the sector's main growth markets. While these headwinds have made the sector the target of short sellers European luxury firms have showed no appetite to cut dividend payments in light of the tough operating environment, according to Markit Dividend Forecasting.

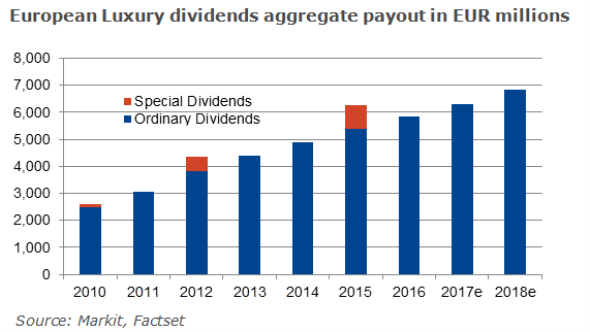

Total aggregate ordinary dividends across the sector's 14 shares have grown by 9% in 2016 and Markit is forecasting payments to grow by a further 8% in 2017 which will take the aggregate payments past the $6bn mark.

While the pace of dividend growth has halved since 2012, the fact that dividends are rising at all shows that firms are willing to ride out the uncertainty in order to sustain payments. This largess does come at a cost however as current fiscal year's forecasted payouts will represent 45% of forecasted earnings, up from 37% back in 2010

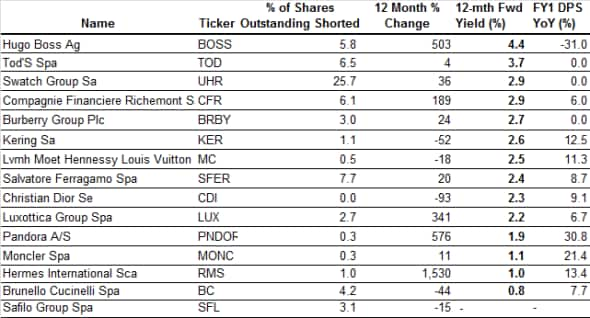

Nine of the sector's 14 dividend paying firms are set to raise payments, but French conglomerate LVMH will be the trend's main growth engine as its forecasted 11.3% payment increase in the current fiscal year will make it responsible for a third of the aggregate payments. French firm are proving to be particularly generous as LVMH compatriots Kering and Hermes are also slated to grow dividends by more than 10% in the coming fiscal year which will make the country responsible for half of all luxury dividends.

Danish jeweller Pandora and Italian apparel firm Moncler round out the lists of companies expected to boost payments by more than 10%.

Bears target high yielders

Investors looking to wade into the sector's highest yielding shares need to beware however as all four companies forecasted to offer the most attractive yield in the coming 12 months have more than 5% of their shares currently shorted.

Hugo Boss, only luxury stock to yield more than 4%, exemplifies this trend as short sellers have increased their positions by more than five-fold in the last year to the current 5.8% of shares outstanding. The attractive forward yield is mainly driven by a 42% fall in its share price which has outpaced the forecasted 31% fall in dividend per share, a phenomenon known as a dividend sump. Even with the reduced forecasted payment, the 2.5 EUR per share payment will represent a 70% payout ratio, so a further deterioration in Hugo Boss's profitability could herald a further cut in payments in order to keep the company within its 60-80% payout ratio range.

Dividend policies of Swiss watch firms Swatch and Richemont are set to defy a 13 months streak of falling overseas demand for Swiss timepieces with Markit expecting the latter to actually grow its per share payment by 6% in the coming fiscal year. Both firms have been favourite targets of short sellers in recent months and the demand to short their shares has shown no signs of slowing down even if their current 2.9% forecasted 12 month yield makes it a relatively expensive trade to keep open.

Simon Colvin, Research Analyst at IHS Markit

Posted 26 August 2016

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.