Hong Kong mood lifted by China

After several months of downbeat economic news, the latest HSBC China Manufacturing PMI results signalled a lift in output, reflected in an upturn in Hong Kong investor sentiment.

- Short interest amongst HSI constituents is down significantly from March highs

- Hong Kong tracking ETFs saw their second worst quarterly outflow in Q2, but saw a reversal in the last three weeks

- Dividends paid by HSI companies are set to continue growing in the current year

The start of the year saw Hong Kong equities take a stumble as the pace of China’s growth tapered, prompting many to ask whether the country, for which Hong Kong is the international financial gateway, was due for a hard landing. This in turn saw investor sentiment towards Hong Kong turn bearish as investors pulled funds from products exposed to the county, while short sellers increased their aggregate positions in constituents of the HSI index.

But the last couple of months seem to have proved China’s sceptics wrong, as the HSBC China Manufacturing PMI readings indicated that manufacturing output grew in the country for the first time since last December. This uptick in output has seen a brightening in investor sentiment.

Aggregate short positions falling

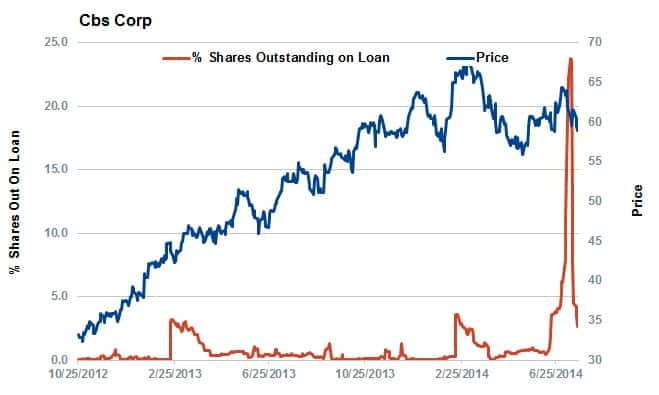

Aggregate short positions in HSI constituents, as measured by the proportion of shares out on loan, surged by over 40% from the start of the year to an 18 month high in March when 1.32% of the index’s shares were out on loan. This development looks to have been well timed, as the week when short interest marked its highest reading coincided with the new yearly low for the index after its level fell by 9.6% from the beginning of 2014.

The subsequent three months have seen equities recover, with the HSBC China PMI readings showing signs of resilience, prompting shorts to cover pretty much across the board and ensuring that aggregate short interest fell back to the level it started the year.

Covering has been almost across the board, with eight of the ten most shorted companies seeing less demand to borrow than they did when short interest measured its highest reading. The largest amount of covering was seen in China Coal which saw demand to borrow fall by a fifth to 12% of shares outstanding.

Interestingly, another energy company has found itself as the firm seeing the largest surge in demand to borrow. China Shenhua Energy has seen demand to borrow nearly triple to 2.27% of shares outstanding, making it the only company to see short interest jump by more than 1% of shares outstanding over this period of sustained short covering.

ETFs also see rebound

ETF investors have also reacted to the recent improvement in economic mood, with Hong Kong focused ETPs seeing strong inflows in the first three weeks of the third quarter as investors piled $689m of new capital into the 20 products that track Hong Kong’s market. The iShares MSCI Hong Kong ETF has led the way with $385m of inflows helping it mirror the string of inflows seen in the opening months of the year.

This surge in new assets is not universal however as the locally listed Tracker Fund of Hong Kong, the largest fund, has continued to see outflows in July compounding its year to date outflow to over $200m.

Dividends set to continue climbing

On the corporate side, the buoyant earnings has Hong Kong companies set to continue to lift their dividend payments in both the current and coming fiscal year according to Markit Dividend Forecasting. Constituents of the HSCI index are set to boost payments by 7.8% in the current fiscal year to HKD 771.4bn. This increase is expected to be fairly consistent, with 16 of the 19 sector set to grow their payments from the previous year.

Telecom and Travel companies are set to be the main lagging sectors, as China Mobile is expected to focus on capital investment tied to rolling out its 4G network and Air China’s currency headwinds has both these firms set to cut payments.

Looking further ahead, the next fiscal year will also see a jump in payments according to Markit’s forecast as HSCI constituents will make just under HKD 800bn in aggregate payments.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.