Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Retailers continue to feature prominently among heavily shorted firms announcing earnings

- Carillion sees twice as much short interest as any of European firm announcing earnings

- Worleyparsons sees large jump in short interest despite recent rebound

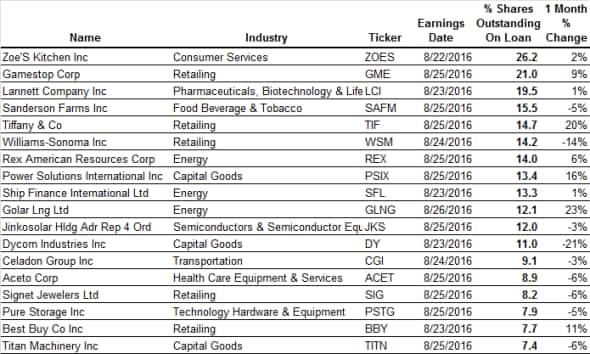

North America

The most shorted company announcing earnings this week is casual dining eatery Zoe's Kitchen which has more than 26% of its shares shorted. Bears have been circling around Zoe's for quite some time and the company had more than 60% of its shares shorted earlier in the year. The company was able to placate some of its doubters in its first quarter earnings however which sent its shares up sharply and prompted short sellers to cover half their positions in the firm. But this covering has stalled in recent weeks and the current borrow is still over ten times the average seen in the rest of the market which indicates that doubts around the company are yet to be fully appeased.

Retailers, which featured heavily in last week's most shorted ahead of earnings report, continue to see heavy short interest with short sellers targeting the jewellery and tech retail space in this week's batch of heavily shorted firms.

Short interest in the jewellery sector is led by Tiffany, which has just under 15% of its shares shorted; three times its January level. The company's disappointing guidance coming out of last year's Q4 results was the catalyst for the recent bear raid and short sellers have continued to add to their positions in the last six months despite the fact that Tiffany shares have recovered most of their lost ground in the last few weeks.

The other heavily shorted jewellery firm announcing earnings this week is Signet Jewelers which has 8% out on loan to short sellers.

In the tech retail space, short sellers are targeting Gamestop which has over 21% of its shares out on loan. Gamestop shares, which have been a very profitable trade for short sellers, have rebounded from their lows after the firm was able to ride the Pok"mon Go craze by attracting food traffic to its stores by making them in game "poke stops". Short sellers haven't been convinced by this recent 20% rebound and have increased their positions by a tenth in the month leading up to earnings.

The other tech retailer seeing heavy short interest, Best Buy, has also seen a pickup in short interest in the last month.

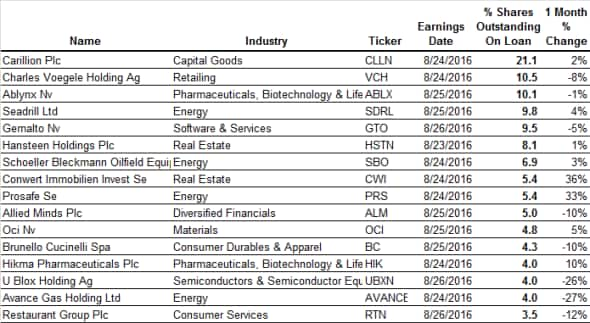

Europe

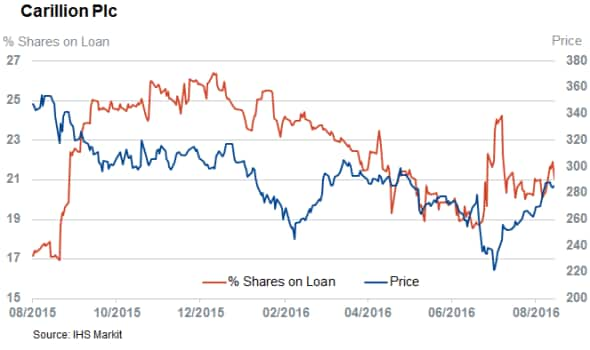

In Europe, Carillion has twice the short interest out of any company announcing earnings this week, with 21% of the UK outsourced service provider's shares out on loan. Carillion shares, which took a battering in the wake of the UK referendum have rebounded strongly in the last few weeks, but short sellers have been willing to stay the course given the proportion of Carillion shares out on loan has stayed roughly flat despite the rebound.

Energy names continue to feature heavily in this earning cycle with short sellers targeting Seadrill, Schoeller Bleckmann and Prosafe among the firms announcing earnings this week.

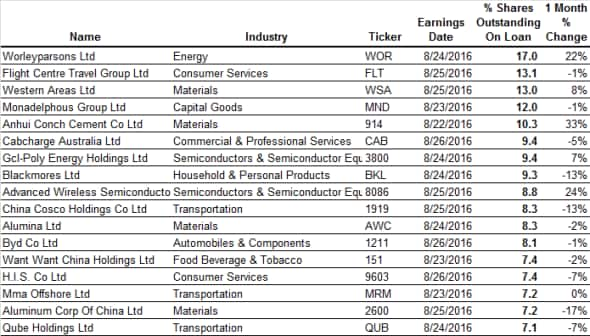

Apac

Energy also features heavily among the Asian companies seeing heavy short interest in the lead-up to earnings, led by Worleyparsons. The Australian engineering services firm has seen its share price double since the start of the year following a stabilisation in oil prices and aggressive cost cutting, but short sellers have been staying the course as the current demand to borrow the firm's shares is 60% higher year to date.

Another firms experiencing a heavy bearish sentiment leading up to earnings this week is Ahui Conch Cement whose short interest has jumped by a third in the last month. This recent bear raid takes the company back over the 10% of shares outstanding mark for the first time so far this year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.